Best Spread Betting Brokers

When looking for the best spread betting platform, consider fees, range of markets, ease of use, and customer support. Popular options include IC Markets, RoboForex, and eToro. Research and compare platforms before making a decision.

A financial service provider known as a spread betting broker enables traders to place speculative bets on the price fluctuations of a variety of financial assets, including equities, indices, commodities, and currencies, amongst others. Spread-betting brokers, in contrast to typical stockbrokers, do not purchase or sell the underlying assets but rather offer a platform for traders to speculate on price changes. Traditional stockbrokers buy and sell the underlying assets.

In this article, we discuss spread betting brokers, including what they are, the dangers associated with using them, and the reasons why individuals use spread betting brokers to trade using spread betting on financial markets.

In our guide to spread betting brokers, we explain and compare spread betting trading platforms and financial spread betting. We also tell you what to watch out for when registering with a Spread Betting broker and how to check that they are financially regulated, and offer a good range of financial instruments to spread bet on, including stocks, Forex, commodities, cryptocurrency, and indices, as well as spread betting bonds. The spread betting trading tools, financing and withdrawal methods, and inexpensive spread betting trading costs are accessible with the trading platform provided by your spread betting broker.

Best Spread Betting Brokers Table of Contents

- What Can I Spread Bet On With A Spread Betting Broker?

- What Does A Spread Betting Broker Trading Platform Look Like?

- Example Of A Spread Bet Using $1000 With A Leverage Of 10:1

- Advantages of Spread Betting

- Tax Benefits Of Spread Betting

- Spread Betting Taxes In The UK And Ireland

- Spread Betting Taxes In EU

- Spread Betting Taxes In Australia

- Spread Betting Taxes In South Africa

- Spread Betting Taxes In The USA

- Spread Betting Leverage

- Wide Range of Financial Markets To Spread Bet On

- Easy to Use Spread Betting Trading Platforms

- Risks of Spread Betting

- Spread Betting Leverage Risk

- Spread Betting Market Risk

- Spread Betting Credit Risk

- How Do I Sign Up For A Spread Betting Broker?

- How to Choose a Spread Betting Broker

- Best Spread Betting Brokers

- Regulations for Spread Betting Brokers

- UK and Ireland Spread Betting Financial Regulations

- Australia Spread Betting Financial Regulations

- Cyprus Spread Betting Financial Regulations

- Features of a Good Spread Betting Platform

- User-Friendly Interface

- Range of Markets

- Reliable and Fast Execution

- Competitive Spreads

- Excellent Customer Support

- Fees in Spread Betting

- Spread

- Overnight Financing Fees

- Platform Fees

- Deposit and Withdrawal Fees

- Spread Betting Broker Deposit And Withdrawal Methods

- Avoiding Fees in Spread Betting

- Choose a Broker with Competitive Spreads

- Minimize Overnight Financing Fees

- Compare Platform Fees

- Use a Low-Cost Deposit and Withdrawal Method

- Minimum Amount Required for Spread Betting

- Experience Needed for Spread Betting

- Spread Betting Brokers Verdict

- Best Spread Betting Brokers List Compared

What Can I Spread Bet On With A Spread Betting Broker?

- Forex spread betting : (foreign exchange currency market, EURUSD, USD/JPY, GBP/USD)

- Indices spread betting : (e.g. S&P 500, NASDAQ, FTSE 100)

- Commodities spread betting : (e.g. gold, oil, silver, natural gas)

- Stocks and shares spread betting : (individual stocks or shares listed on global stock exchanges)

- Bonds spread betting : (government or corporate debt securities)

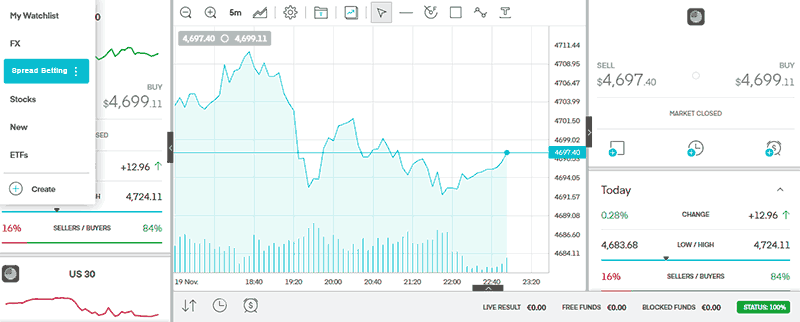

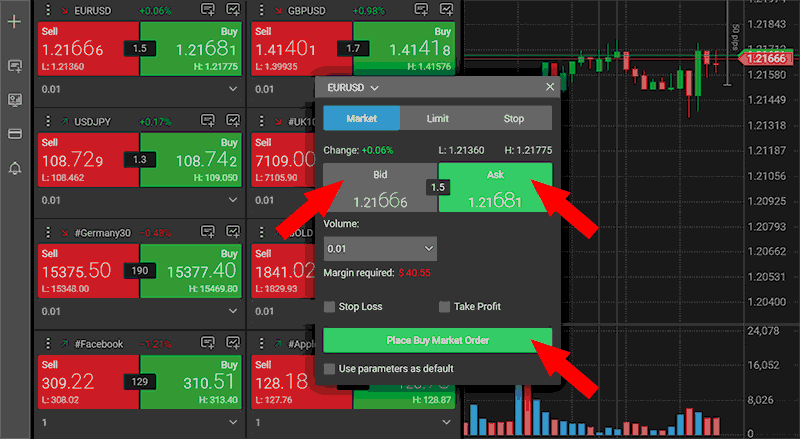

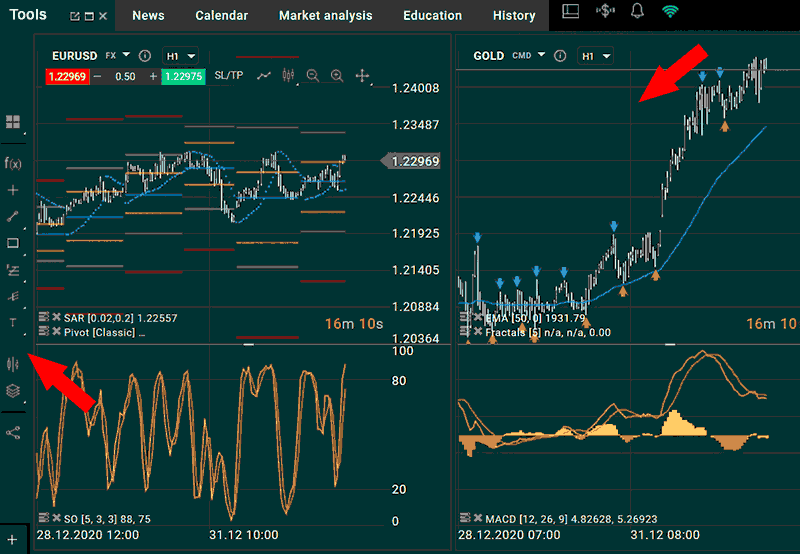

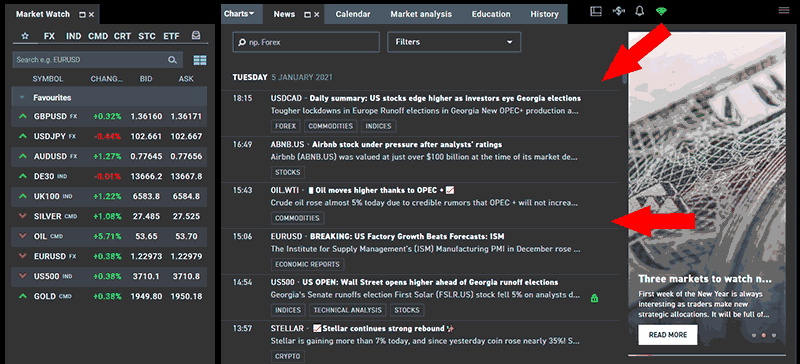

What Does A Spread Betting Broker Trading Platform Look Like?

The design of a spread betting platform can vary between providers, but the basic functionality remains similar. The platform is usually web-based or accessed via a desktop or mobile app. The interface should be user-friendly and intuitive, allowing traders to quickly access the necessary information and tools.

A spread betting trading platform typically includes the following features:

The design, features, range of financial instruments, withdrawal methods and trading tools of a spread betting platform can vary between providers, but the basic functionality remains similar. The platform is usually web-based or accessed via a desktop or mobile app. The interface should be user-friendly and intuitive, allowing traders to quickly access the necessary information and tools.

Market data and charts: The platform provides real-time market data, charts, and technical analysis tools to help traders make informed decisions.

Order execution: Traders can place orders to buy or sell a spread betting instrument, such as a stock, commodity, or currency pair, directly from the platform.

Spread betting trading tools: Spread betting platforms often provide a range of tools to help traders manage their positions, such as stop-loss orders and take-profit orders.

Account management: Traders can view their account balance, open positions, and trade history directly from the platform. They can also deposit and withdraw funds from their account.

News and research: Many spread betting platforms provide access to financial news and research to help traders stay informed about market developments.

Example Of A Spread Bet Using $1000 With A Leverage Of 10:1

Spread betting uses high risk leverage and different spread betting brokers offer different leverage limits. Allowed financial regulators to limit leverage on spread betting. It's important to note that leverage amplifies your potential profits and losses. If the price of gold falls instead of rises, your spread bet will decrease by the same amount, potentially resulting in a significant loss.

Assume you want to place a $1000 spread bet on the price of gold to increase per spread point. You believe that gold will rise in price in the next month.

With leverage of 10:1, you can place a spread bet of $1,000 per point, using a deposit of $100 on gold using borrowed money from your spread betting broker. Spread betting is speculation on price movement between you and your spread betting broker; no real financial assets like gold are brought or sold.

If your speculated gold price prediction comes true and the price of gold rises 1 point, your spread bet will hypothetically increase by $10 ($1000 x 0.01). In our hypothetical example, a gold spread bet results in a profit of $10 on your $100 investment.

If your speculated gold price falls by 1 point, you will lose $10 on your deposit balance of $100. If you use a spread betting broker that is well-regulated in Europe, they will have to offer negative balance protection. Meaning you will not lose more than your deposited spread betting amount. You must check you have negative balance protection, or you may owe more than your initial deposit if your spread bet is a losing trade.

It's important to keep in mind that spread betting is a high-risk investment and can result in substantial losses, so it's important to thoroughly understand the risks involved before engaging in this type of investment.

Advantages of Spread Betting

Spread betting offers several benefits to traders, including

Tax Benefits Of Spread Betting

Spread betting tax laws differ from country to country, but generally, spread betting in most countries is tax-free for most traders. It is important to note that your local tax laws are subject to change regarding spread betting. Consult a tax professional for specific advice on the tax treatment of spread betting in your country.

Spread Betting Taxes In The UK And Ireland

In the UK, spread betting is tax-free for individuals. Profits from spread betting are exempt from income tax, capital gains tax, and stamp duty.

In the UK and Ireland, spread betting profits are tax-free, making it an attractive option for experienced traders. Spread betting is classified as gambling rather than investment and is therefore not subject to capital gains or income tax.

Spread Betting Taxes In EU

In the EU, tax laws for spread betting vary by country. For example, spread betting is taxed in Ireland as betting and gambling winnings are exempt from income tax.

Spread Betting Taxes In Australia

In Australia, spread betting is considered gambling, and profits from it are not taxed. However, in some cases, if the spread betting activity is considered a business, the profits may be subject to income tax.

Spread Betting Taxes In South Africa

In South Africa, spread betting is considered gambling, and any winnings from it are exempt from tax. However, if an individual is considered a professional gambler and derives a significant portion of their income from gambling, their winnings may be subject to tax as income.

Spread Betting Taxes In The USA

In the US, spread betting is not recognised as a form of investing and is considered gambling. As such, any winnings from spread betting are subject to taxation as ordinary income.

Spread Betting Leverage

Spread betting allows traders to access markets with much higher exposure than the capital, increasing their potential profits and risk. Leverage means traders can make a large profit from a small investment, provided they are successful in their trades. Or a large loss if a spread bet loses.

Wide Range of Financial Markets To Spread Bet On

Spread betting brokers offer a variety of markets to trade, including stocks, indices, commodities, and currencies. A wide range of markets allows traders to speculate on various financial instruments, increasing the potential for diversification in their portfolios.

Easy to Use Spread Betting Trading Platforms

Spread betting platforms are user-friendly, and traders can place bets quickly and easily. Spread betting platforms are designed to be intuitive and easy to navigate, allowing traders to focus on their trading strategies rather than on the mechanics of the platform itself.

Risks of Spread Betting

Spread betting is a high-risk form of trading, and investors should be aware of the following risks before deciding to participate:

Spread Betting Leverage Risk

Spread betting allows traders to access markets with much higher exposure than the capital they have. This increased leverage can lead to amplified potential profits, but it also increases the potential for losses. If the trade goes against the trader, their losses can quickly spiral out of control, potentially leading to significant financial losses.

Spread Betting Market Risk

The prices of financial instruments can be unpredictable and volatile, making spread betting a high-risk form of trading. Economic events, natural disasters, and political developments can all impact the price of an asset, leading to sudden and significant losses for traders.

Spread Betting Credit Risk

Traders who use high leverage in spread betting may be required to deposit collateral, or margin, with their broker. If the value of their collateral drops below a certain level, the broker may issue a margin call, requiring the trader to deposit more funds to maintain their position. If the trader read cannot meet the margin call, their positions may be closed and incur significant losses.

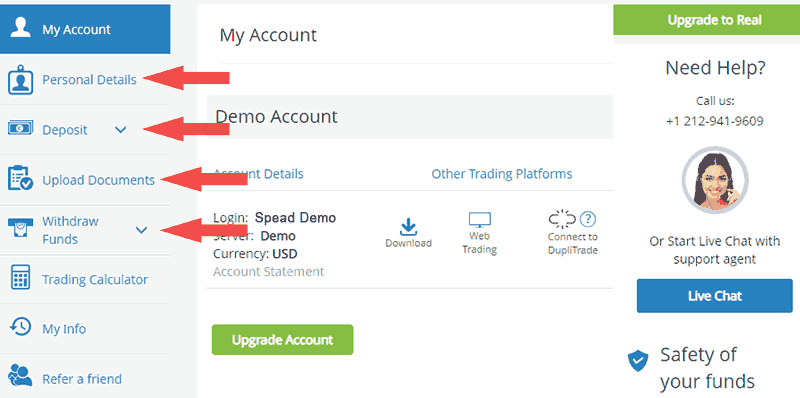

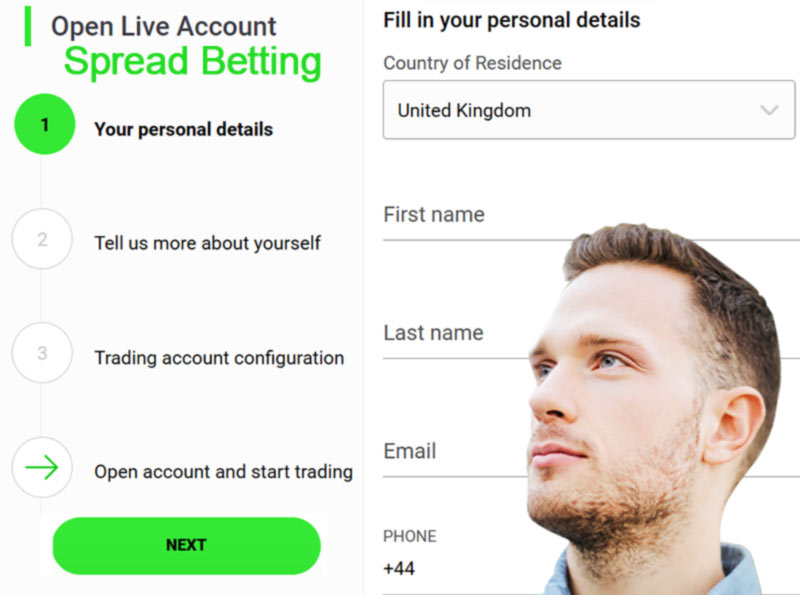

How Do I Sign Up For A Spread Betting Broker?

Before signing up, read and understand the terms and conditions, including the fees and risks associated with spread betting, as it is a high-risk form of investing. The steps to sign up with a spread betting broker may vary slightly depending on the broker, but the general process is as follows:

- Research: Start by researching different spread betting brokers and comparing their features, such as the types of financial instruments they offer, the spread and fees they charge, and the platform they use.

- Shortlist a spread betting broker: Once you have decided on a spread betting broker that meets your needs, visit their website and click on the 'Sign Up' or 'Open an Account' button.

- Fill out the application form: The broker will ask you to provide personal and financial information, such as your name, address, date of birth, and employment information. You will also need to provide proof of identity, such as a passport or driver's license, and proof of address, such as a utility bill.

- Fund your account: Once your application is approved, you will need to fund your spread betting account before you can start placing live spread bets. You can typically do this by debit card, credit card, bank transfer, or electronic payment services like PayPal.

- Verify your identity: Many spread betting brokers require that you verify your identity to comply with KYC anti-money laundering regulations. Verifying your spread betting account will involve uploading a copy of your passport or ID card and a recent utility bill to the spread betting brokers trading platform.

- Start trading spread bets: Once your spread betting account is set up and funded, you can start placing live buy and sell spread bets. The spread betting broker will provide you with access to their spreading betting trading platform and market data, and you can start placing live spread trades.

How to Choose a Spread Betting Broker

When choosing a spread betting broker, traders should consider the following factors:

- Regulation: Spread betting brokers must hold regulation from a reputable financial authority like the UK's FCA (Financial Conduct Authority), Australian Securities and Investments Commission (ASIC) or Cyprus Securities and Exchange Commission (CySEC).

- Spread Betting Trading platform: Check if the spread betting platform is easy to use and has all the features you need.

- Market coverage: Choose a spread betting broker that offers spread betting in the markets you want to trade.

- Customer support: Ensure the spread betting broker provides excellent customer support, including helpful and responsive staff with an answer to your query in 48 hours in a language you understand. Useful spread betting broker support can come from email, live chat and phone support.

- Charges: Compare the spread betting fees and charges of different spread bet brokers to find the most cost-effective option.

Best Spread Betting Brokers

The best-spread betting broker can vary based on geographical location, regulatory environment, and individual trader preferences. Some of the well-known and highly regarded spread betting brokers include:

IC Markets IC Markets is a popular broker that offers its clients the ability to trade in a range of financial markets including spread betting. The reasons you might consider signing up with IC Markets for spread betting include competitive spreads, which can lead to lower trading costs, a wide range of spread betting financial instruments, excellent customer service, and the availability of advanced MT4 / MT5 spread betting trading platforms and high spread betting leverage where available of upto 1:1000.

RoboForex RoboForex are a well-established spread betting trading platform offering leverage upto 1:2000. RoboForex have low spread betting trading costs and a good range of tradable instruments and trading tools.

XTB is very well regulated including by the FCA. XTB offer a feature-rich set of spread betting tools, a wide range of financial instruments and good customer service for spread bettors. XTB also offers useful trading guides and educational resources for spread-betting traders.

XM XM offer Spread Betting leverage upto 1000:1 where available. XM are an up-and-coming spread betting broker offering a good range of spread betting instruments and resources, including a good range of deposit and withdrawal methods when spread betting.

It is important to note that the best spread betting broker for one trader may not be the best for another. When selecting a spread betting broker, traders should carefully consider their investment objectives, risk tolerance, and individual preferences. They should also thoroughly research and compare different brokers' offerings to determine which is the best fit for their needs.

Regulations for Spread Betting Brokers

Spread betting is regulated by financial authorities in the countries it is allowed. Here are some of the regulations that spread betting brokers must comply with:

UK and Ireland Spread Betting Financial Regulations

In the UK and Ireland, spread betting is regulated by the Financial Conduct Authority (FCA). The FCA sets standards for financial markets, including those for spread betting. Spread betting brokers must hold authorisation from the FCA and comply with the FCA's rules and regulations to offer spread betting to customers.

Australia Spread Betting Financial Regulations

In Australia, spread betting is regulated by the Australian Securities and Investments Commission (ASIC). ASIC sets standards for financial services, including those for spread betting. Spread betting brokers in Australia must be authorised by ASIC and comply with ASIC's rules and regulations to offer spread betting to customers.

Cyprus Spread Betting Financial Regulations

In Cyprus, spread betting is regulated by the Cyprus Securities and Exchange Commission (CySEC). CySEC sets standards for financial services, including those for spread betting. Spread betting brokers regulated by CySEC must comply with CySEC's rules and regulations.

Features of a Good Spread Betting Platform

When choosing a spread betting platform, it is important to look for the following features:

User-Friendly Interface

A good spread betting platform should have a user-friendly interface that is easy to navigate and allows traders to place trades quickly and easily. The platform should be designed with the trader in mind and should be intuitive and easy to use.

Range of Markets

The best-spread betting platforms offer a wide range of markets, including stocks, indices, commodities, and currencies. An increased range of markets allows traders to diversify their portfolios and speculate on various financial instruments.

Reliable and Fast Execution

A good spread betting platform should have reliable and fast trade execution, ensuring that trades are placed and executed quickly. Slow trade execution can result in missed opportunities or significant losses, so it is important to choose a platform with fast and reliable trade execution.

Competitive Spreads

Spread betting platforms make their money from the spread, which is the difference between the bid and ask prices of a financial instrument. Choosing a platform with competitive spreads is important, as this will minimise the cost of trading and maximise the potential for profits.

Excellent Customer Support

A good spread betting platform should offer excellent customer support, including 24/7 support, in case of any issues or questions. Customer support can help traders to resolve any problems quickly and effectively, minimising the impact on their trading activities.

Fees in Spread Betting

Spread betting is a form of financial trading speculation that allows trading on price movements against a spread betting broker purely on price and no asset exchange. There are several fees associated with spread betting, including

Spread

The spread is the difference between a financial instrument's bid and ask prices, and it is the main source of revenue for spread betting brokers. The spread is typically a small percentage of the total value of the trade. The spread is one of the main costs of spread betting, and choosing a broker with competitive spreads is important to minimise the cost of trading.

Overnight Financing Fees

When holding spread bet positions overnight, fees incur with most brokers. The calculated fee is the difference between the underlying assets' interest rate and the spread betting broker charges. The overnight financing fee is usually a small percentage of the total value of the trade, and it can be either positive or negative depending on the interest rate differential.

Platform Fees

Some spread betting platforms charge a monthly or annual fee to access their trading platform. This fee can vary depending on the platform and the offered features, and it is important to compare platform fees when choosing a spread betting platform.

Deposit and Withdrawal Fees

Spread betting brokers may also charge fees for depositing or withdrawing funds from a spread betting account. These fees can vary depending on the method of deposit or withdrawal, and it is important to check the fees before depositing or withdrawing funds.

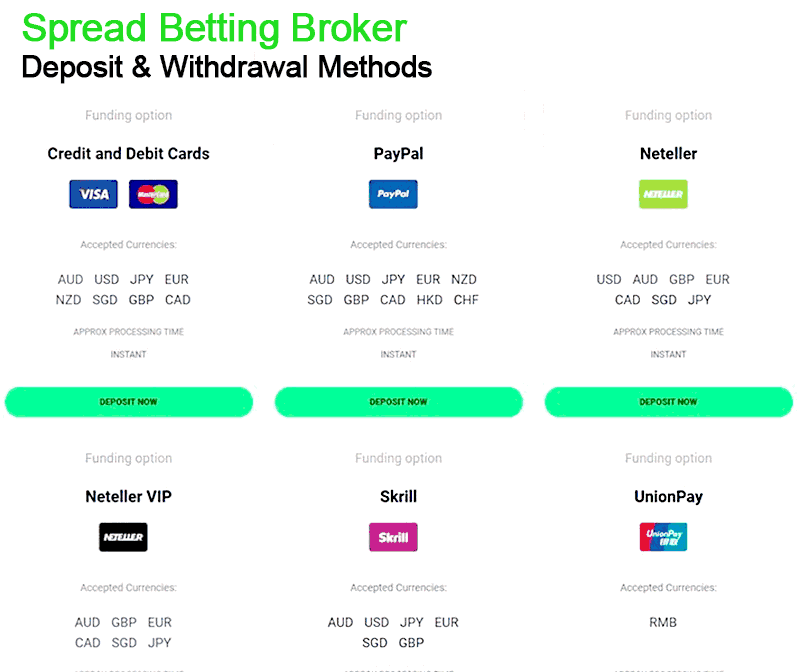

Spread Betting Broker Deposit And Withdrawal Methods

Spread betting brokers and trading platforms typically offer a variety of deposit and withdrawal methods. These deposit and withdrawal methods vary from spread betting broker to spread betting broker and the deposit or withdrawal methods available in your country. Suppose your spread betting account's base fiat currency is different from your withdrawal method. Your payment provider may charge additional fiat currency conversion fees on your withdrawal from your spread betting brokerage firm.

Popular deposit and spread betting deposit and withdrawal methods available can include:

- Bank transfer: clients can transfer funds from their bank account to the trading platform account.

- Credit/debit cards: clients can deposit funds using their credit or debit card.

- E-wallets: popular e-wallets such as PayPal, Skrill, and Neteller are often accepted by trading platforms.

- Cryptocurrencies: clients can deposit funds using cryptocurrencies such as Bitcoin, Ethereum, and Litecoin.

Avoiding Fees in Spread Betting

Spread betting is a form of financial trading involving several fees, including the spread, overnight financing, platform, and deposit and withdrawal fees. However, there are several ways to minimise or avoid these fees:

Choose a Broker with Competitive Spreads

The spread is the main source of revenue for spread betting brokers, and it is the main cost of spread betting. Choosing a broker with competitive spreads is important to minimise the cost of trading. For competitive spreads, compare the spreads offered by different brokers and choose the one with the lowest spreads.

Minimize Overnight Financing Fees

Overnight financing fees can be minimised by closing spread bets before the end of the trading day or by choosing a broker with lower overnight financing fees. Some brokers offer interest-free financing for overnight positions, which can help to reduce the cost of spread betting.

Compare Platform Fees

Some spread betting platforms charge a monthly or annual fee to access their trading platform. It is important to compare platform fees when choosing a spread betting platform and to choose the one with the lowest fees. Some brokers offer free access to their trading platforms, so it is important to check for hidden fees or charges before choosing a platform.

Use a Low-Cost Deposit and Withdrawal Method

Spread betting brokers may charge fees for depositing or withdrawing funds from a spread betting account. It is important to choose a low-cost deposit or withdrawal method to minimise these fees. Some brokers offer free deposit and withdrawal methods, so checking for hidden fees or charges is important before depositing or withdrawing funds.

Minimum Amount Required for Spread Betting

The minimum amount required to start spread betting can vary depending on the platform or broker you choose. Some providers have a minimum deposit of 1 GBP/EUR/USD, while others may require a minimum deposit of 100 GBP/EUR/USD or more. It is important to note that spread betting is a high-risk investment and can result in significant losses, so it is recommended to only invest what you can afford to lose.

Experience Needed for Spread Betting

There is no specific trading experience required to start spread betting; however, you must understand the financial markets and the underlying assets you want to bet on. Spread betting involves taking a position on the price movement of an asset, so a basic understanding of technical or fundamental analysis can help make informed trading decisions.

Spread Betting Brokers Verdict

Spread betting brokers play a crucial role in facilitating access to the financial markets for traders. Choosing the right spread betting broker can have a significant impact on the success of a trader's investment strategy. When selecting a broker, it is important to consider factors such as the broker's reputation, fees, platform reliability, and customer support. Traders should also ensure that the broker they choose is regulated and adheres to industry standards.

In conclusion, spread betting can be a high-risk investment, but with the right knowledge and broker, it can offer the potential for significant profits. As with any investment, it is important to thoroughly research the market and understand the risks before entering into spread betting.

Best Spread Betting Brokers List Compared

| Featured Spread Betting Broker Trading Platform | Account Features | Trading Features |

|---|---|---|

| Used By: 180,000 Instruments Available: 232 Stocks Available: 2100 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 61 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mirror Trader, ZuluTrade, Web Trader, cTrader, Mac Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 200,000 Instruments Available: 1000 Stocks Available: 99 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 80 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: Web Trader, MT4, MT5, AvaTradeGo, AvaOptions, Mac, Mobile Apps, ZuluTrade, DupliTrade, MQL5 Negative Balance Protection: Inactivity Fee: No 71% of retail CFD accounts lose moneyVisit |

|

| Used By: 89,000 Instruments Available: 100 Stocks Available: 60 US Stocks: No UK Stocks: No German Stocks: Yes Japanese Stocks: No Indices: Yes Forex Pairs Available: 70 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mac, ZuluTrade, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your moneyVisit |

|

| Used By: 10,000 Instruments Available: 15000 Stocks Available: 1000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 55 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 4,000,000 Instruments Available: 2200 Stocks Available: 2000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: No Indices: Yes Forex Pairs Available: 67 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your moneyVisit |

|

| Used By: 1,866,000 Instruments Available: 430 Stocks Available: 1700 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 70 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 75.78% of retail investor accounts lose money when trading CFDs and Spread Betting with this providerVisit |

|

| Used By: 10,000 Instruments Available: 150 Stocks Available: 1000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: No Forex Pairs Available: 50 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 215 |

Platforms: MT4,iOS,MacBook,iPhone Negative Balance Protection: Inactivity Fee: Trading leverage products may not be suitable for all traders. 71% of retail CFD accounts lose money.Visit |

|

| Used By: 10,000 Instruments Available: 97 Stocks Available: 379 US Stocks: Yes all Major UK Stocks: Yes all Major German Stocks: Yes all Major Japanese Stocks: No Indices: Yes Forex Pairs Available: 67 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 500 |

Platforms: MT4,mac,Android.iPhone/iPad Negative Balance Protection: Inactivity Fee: Your capital is at riskVisit |

|

| Used By: 10,000 Instruments Available: 97 Stocks Available: US Stocks: No UK Stocks: Yes German Stocks: No Japanese Stocks: No Indices: Yes Forex Pairs Available: Major Forex Pairs: Yes Minor Forex Pairs: No Exotic Forex Pairs: No Minimum Deposit: 500 |

Platforms: MT4,mac,Android.iPhone/iPad Negative Balance Protection: Inactivity Fee: Your capital is at riskVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 0 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 70 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 0 |

Platforms: MT4, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Your capital is at riskVisit |

|

| Used By: 239,000 Instruments Available: 17000 Stocks Available: 8000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 100 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 250 |

Platforms: MT4, Mac, Web Trader, L2 Dealer, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 70% of retail CFD accounts lose moneyVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 300 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 55 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 20 |

Platforms: MT4, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 1605 Stocks Available: 1550 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: No Indices: Yes Forex Pairs Available: 40 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 0 |

Platforms: MT4, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 2000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 15 Major Forex Pairs: Yes Minor Forex Pairs: Exotic Forex Pairs: Minimum Deposit: 200 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 178 Stocks Available: 0 US Stocks: No UK Stocks: Yes German Stocks: No Japanese Stocks: No Indices: Yes Forex Pairs Available: Major Forex Pairs: Yes Minor Forex Pairs: No Exotic Forex Pairs: Yes Minimum Deposit: 10 |

Platforms: Desktop,Android,iPhone,Mac Negative Balance Protection: Inactivity Fee: Your capital is at riskVisit |

Best Spread Betting Broker Spread Betting Broker Reviews

Read our details broker Spread Betting Broker Spread Betting Broker reviews, you will find something useful if you are shortlisting a Spread Betting Broker Spread Betting Broker and trading platform.

- IC Markets Review (read our in depth reviews)

- AvaTrade Review (read our in depth reviews)

- Pepperstone Review (read our in depth reviews)

- SpreadEx Review (read our in depth reviews)

- Markets.com Review (read our in depth reviews)

- FxPro Review (read our in depth reviews)

- ETFinance Review (read our in depth reviews)

- Phoenix Markets Review (read our in depth reviews)

- EZINVEST Review (read our in depth reviews)

- LCG Review (read our in depth reviews)

- IG Review (read our in depth reviews)

- GKFX Review (read our in depth reviews)

- Core Spreads Review (read our in depth reviews)

- Hargreaves Lansdown Review (read our in depth reviews)

- NPBFX Review (read our in depth reviews)

Spread Betting Broker Spread Betting Broker Alternatives

Read about and compare Spread Betting Broker Spread Betting Broker alternatives. We have indepth side by side comparisons to help you find Spread Betting Broker Spread Betting Broker related brokers.

- IC Markets Alternatives

- AvaTrade Alternatives

- Pepperstone Alternatives

- SpreadEx Alternatives

- Markets.com Alternatives

- FxPro Alternatives

- ETFinance Alternatives

- Phoenix Markets Alternatives

- EZINVEST Alternatives

- LCG Alternatives

- IG Alternatives

- GKFX Alternatives

- Core Spreads Alternatives

- Hargreaves Lansdown Alternatives

- NPBFX Alternatives

AvaTrade

AvaTrade

Pepperstone

Pepperstone

SpreadEx

SpreadEx

Markets.com

Markets.com

FxPro

FxPro

ETFinance

ETFinance

Phoenix Markets

Phoenix Markets

EZINVEST

EZINVEST

LCG

LCG

IG

IG

GKFX

GKFX

Core Spreads

Core Spreads

Hargreaves Lansdown

Hargreaves Lansdown

NPBFX

NPBFX