Best PayPal Brokers

When looking for a broker that accepts PayPal, consider factors such as fees, security, customer support, and trading platform. Some top brokers that accept PayPal include eToro, IC Markets, and RoboForex. Research and compare options to find the best fit for your trading needs.

Within our guide on PayPal brokers, we extensively researched several of the most well-known PayPal brokers available. It is essential to take into consideration several key factors before choosing a PayPal broker that is reputable and reliable and can offer you the PayPal trading platform that meets your trading needs.

We conduct a thorough examination and comparison of the various features offered by PayPal brokers, including regulation, tradable financial instruments with PayPal, available PayPal funding and withdrawal methods, customer support, and educational resources for traders interested in using PayPal brokers.

It is crucial to ensure that when researching PayPal brokers, you select a trustworthy and dependable PayPal broker that is capable of meeting your trading requirements. Use our guide to make an informed decision when selecting your PayPal broker.

Best PayPal Brokers Table of Contents

- PayPal Brokers

- What is PayPal?

- How Do PayPal Brokers Work?

- Brokers that Accept PayPal

- Use PayPal with IC Markets

- Cons of using IC Markets with PayPal:

- Use PayPal with eToro

- Pros of using eToro with PayPal:

- Cons of using eToro with PayPal:

- Use PayPal with RoboForex

- Pros of using RoboForex with PayPal:

- Cons of using RoboForex with PayPal:

- Use PayPal with XM

- Advantages of Using PayPal for Trading

- Disadvantages of Using PayPal for Trading

- How to Open a Broker Account with PayPal Funding

- How does PayPal compare to other payment methods for online trading?

- PayPal Vs Other Payment Methods For Trading

- Credit/Debit Cards:

- Bank Transfer:

- E-wallets:

- Cryptocurrency:

- Prepaid Cards:

- What are the fees associated with using PayPal brokers and trading platforms?

- Regulations for PayPal Brokers

- What to Look for When Choosing a PayPal Broker

- Is PayPal a safe and secure payment method for online trading?

- What types of trading instruments are available through PayPal brokers and trading platforms?

- Can I use PayPal to withdraw funds from my trading account?

- Are there any limitations to using PayPal for online trading?

- Are there any restrictions on which countries can use PayPal for online trading?

- How do I find a reputable PayPal broker or trading platform?

- Can I use PayPal for margin trading?

- What are the minimum and maximum deposit amounts when using PayPal for trading?

- How long does it take to transfer funds through PayPal when using it for trading?

- What are the customer support options for PayPal brokers and trading platforms?

- Are there any bonus offers or promotions available for using PayPal with certain brokers or trading platforms?

- Can I use PayPal for automated trading systems?

- How does PayPal compare to other payment methods for online trading?

- What are some of the success stories and cautionary tales of traders who have used PayPal brokers or trading platforms, and what can we learn from them?

- Compare PayPal Brokers

- Best PayPal Brokers List Compared

PayPal Brokers

A PayPal broker is a financial service provider that allows traders to use their PayPal account for depositing and withdrawing funds from their trading account. This type of broker enables traders to fund their trading account directly from their PayPal account without transferring funds through other payment methods such as bank transfer or credit card.

Also, PayPal brokers provide a secure and reliable payment method for traders who prefer to use it for their financial transactions. Using PayPal has become increasingly popular among traders prioritising convenience, speed, and security online trading. Overall, a PayPal broker can be a valuable resource for traders who want to simplify their financial transactions and streamline their trading process.

Choosing a reputable and licensed PayPal broker or trading platform that complies with local laws and regulations is important. Traders should also be aware of any fees or limitations associated with using PayPal for trading and the risks associated with trading financial instruments.

Overall, PayPal brokers and trading platforms can be a convenient and secure way to trade financial instruments. However, conducting proper research and due diligence before choosing a PayPal broker or trading platform is important to ensure that it meets your trading needs and is a reputable and reliable option.

What is PayPal?

PayPal is an online payment system that allows individuals and businesses to make and receive payments electronically. It is one of the world's most popular online payment systems. It is used by millions of people for various purposes, including online shopping, peer-to-peer payments, and online trading.

To use PayPal, individuals must create an account and link it to a credit card, debit card, or bank account. Once the account is set up, users can send and receive money, make online purchases, and manage their account balance. For added security, PayPal also offers a range of features, such as buyer protection and dispute resolution.

PayPal is widely accepted by many merchants and businesses, making it a convenient option for individuals who wish to make online payments without entering their credit card or bank account information each time. Additionally, PayPal allows for easy and secure money transfers between people, making it also a popular option for P2P transactions.

How Do PayPal Brokers Work?

PayPal brokers are online trading platforms that accept PayPal as a payment method for trading activities. Using their PayPal accounts, these brokers enable traders to buy and sell various financial instruments, such as forex, stocks, cryptocurrencies, and commodities.

To start trading with a PayPal broker, traders first need to register an account with the broker and then link their PayPal account to it. Once their PayPal account is linked, they can deposit funds into their trading account directly from their PayPal balance or linked bank account.

When traders execute trades on a PayPal broker platform, their profits or losses are credited or debited to their trading account. They can then withdraw their funds back to their PayPal and bank accounts.

PayPal brokers typically offer a range of trading tools and features, such as real-time market data, charting and technical analysis tools, risk management tools, and educational resources to help traders make informed trading decisions.

PayPal brokers provide a convenient and secure way for traders to access the financial markets and manage their trading accounts, all through the trusted PayPal payment system.

Brokers that Accept PayPal

Several trading platforms accept PayPal as a payment method. PayPal is a widely accepted payment method that is used by millions of people around the world. It is convenient and secure, making it an ideal payment method for trading platforms.

Some popular trading platforms that accept PayPal include eToro, Plus500, AvaTrade, IG Markets, and XM. These platforms allow traders to fund their accounts using PayPal, a fast and easy way to start trading.

When using PayPal to fund a trading account, it is important to ensure that the platform is reputable and regulated. Financial regulation will help protect your funds and ensure the trading platform operates transparently and fairly.

Overall, trading platforms that accept PayPal offer a convenient and secure way for traders to fund their accounts and start trading quickly and easily.

PayPal is a widely accepted and popular payment method for online transactions and is also accepted by many online brokers for funding trading accounts. Some of the most popular brokers that accept PayPal include:

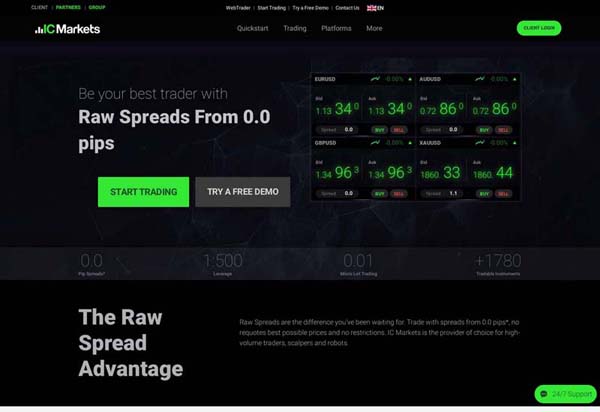

Use PayPal with IC Markets

Losses can exceed deposits. Upto 88% of retail CFD accounts lose money.

IC Markets is a well-known online broker that accepts PayPal for deposits and withdrawals. They are regulated by multiple regulatory bodies such as the FSA, CySEC, and ASIC.

IC Markets is a well-known and reputable online forex and CFD broker that allows traders to use PayPal as a payment method. Using PayPal with IC Markets is a relatively straightforward process that involves linking your PayPal account with your IC Markets account.

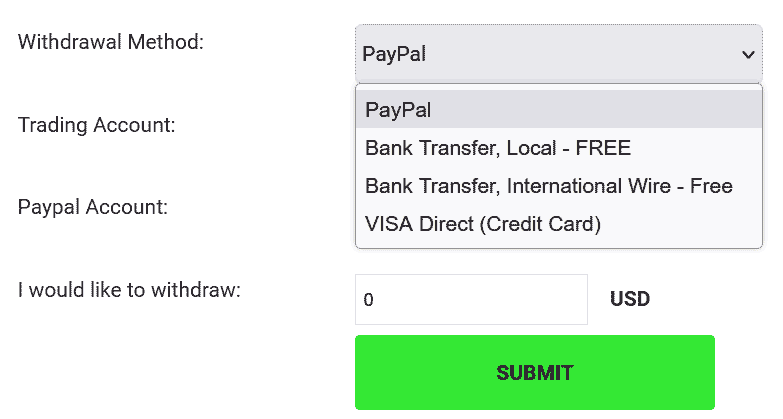

To use PayPal with IC Markets, open an IC Markets trading account and log in to the IC Markets client portal. From there, select the 'Deposit Funds' option and choose PayPal as your payment method. Enter the amount you wish to deposit, and you will be redirected to the PayPal website to complete the transaction. Once the transaction is complete, the funds will be immediately available in your IC Markets trading account.

Using PayPal with IC Markets is a convenient and secure way to deposit and withdraw funds from your trading account. However, it's important to note that PayPal may not be available in all countries and that fees may apply. Before using PayPal with IC Markets, read and understand both services' terms and conditions.

- Quick and easy deposit process: Deposits using PayPal are almost instant, so you can start trading right away.

- Secure payment method: PayPal is a secure and trusted payment method, and your personal and financial information is kept confidential.

- No deposit fees: IC Markets does not charge any deposit fees when using PayPal. Fast withdrawal process: Withdrawals using PayPal are processed quickly, usually within 24 hours.

Cons of using IC Markets with PayPal:

- Limited payment options: IC Markets only supports a few payment options, and PayPal may not be available in all countries.

- PayPal fees: Although IC Markets does not charge any deposit fees when using PayPal, PayPal may charge a transaction fee, depending on your location and the currency used.

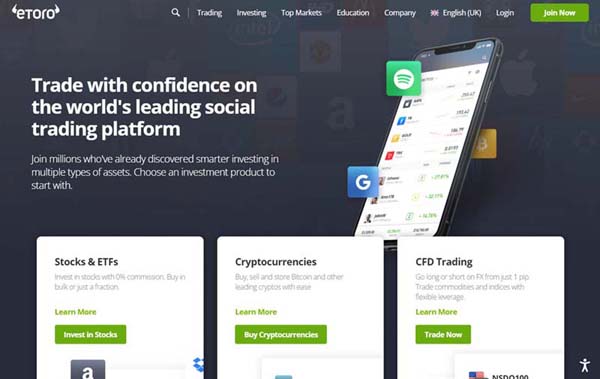

Use PayPal with eToro

Losses can exceed deposits. Upto 88% of retail CFD accounts lose money.

eToro is a social trading platform that accepts PayPal for deposits and withdrawals. They are regulated by multiple regulatory bodies such as the FCA, and CySEC.

We found that eToro, a popular online trading platform, offers PayPal as a payment method for both deposits and withdrawals. eToro provides traders with an added level of convenience and security when it comes to managing their trading funds.

To use PayPal with eToro, users must log in to their eToro account, select their preferred payment method, and follow the prompts to complete the transaction. The process is quick and easy, allowing users to start trading almost instantly.

The availability of PayPal with eToro provides traders with added convenience and security when managing their trading funds. However, it's important to consider the potential fees and limitations of both services before using them.

Pros of using eToro with PayPal:

- Convenience: Using PayPal with eToro is a convenient way to manage trading funds, as it allows for fast and easy deposits and withdrawals.

- Security: PayPal is a secure payment method, and its integration with eToro provides an added level of security for users.

- No Deposit Fees: eToro does not charge any deposit fees when using PayPal. Fast Withdrawal Process: Withdrawals using PayPal are usually processed within 24 hours.

Cons of using eToro with PayPal:

- Limited Payment Options: eToro only supports a few payment options, and PayPal may not be available in all countries.

- PayPal Fees: Although eToro does not charge any deposit fees when using PayPal, PayPal may charge a transaction fee, depending on your location and the currency used.

- Inactivity Fees: eToro charges an inactivity fee of $10 per month if you don't log in to your account for 12 months.

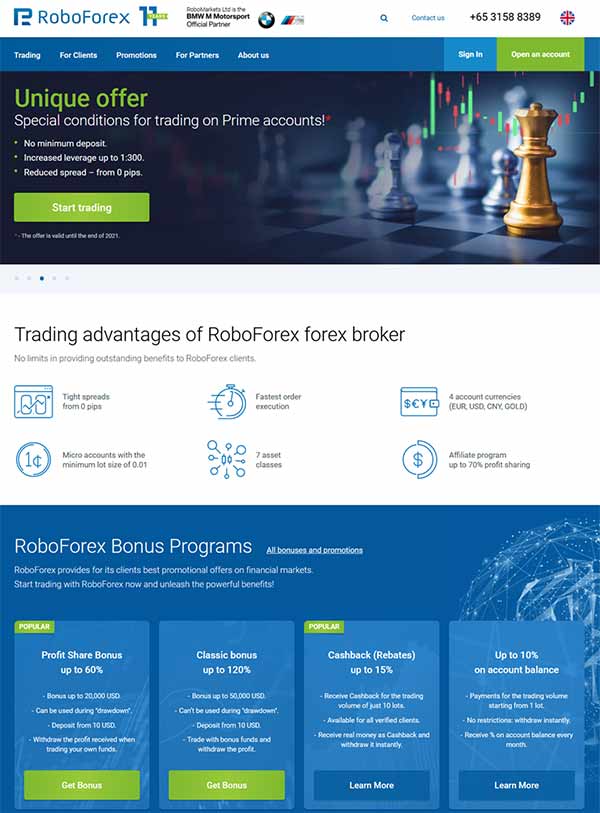

Use PayPal with RoboForex

Losses can exceed deposits. Upto 88% of retail CFD accounts lose money.

RoboForex is a leading online broker that accepts PayPal for deposits and withdrawals. They are regulated by multiple regulatory bodies and allow leveraged trading.

We found that RoboForex, an online Forex and CFD broker, offers PayPal as a payment method for both deposits and withdrawals. RoboForex provides traders with added convenience and flexibility when managing their trading funds.

To use PayPal with RoboForex, users must log in to their account, select PayPal as their preferred payment method, and follow the prompts to complete the transaction. The process is quick and easy, allowing users to start trading almost instantly.

Pros of using RoboForex with PayPal:

- Convenience: Using PayPal with RoboForex is a convenient way to manage trading funds, as it allows for fast and easy deposits and withdrawals.

- Security: PayPal is a secure payment method, and its integration with RoboForex provides an added level of security for users.

- No Deposit Fees: RoboForex does not charge any deposit fees when using PayPal. Fast Withdrawal Process: Withdrawals using PayPal are usually processed within 24 hours.

Cons of using RoboForex with PayPal:

- Limited Payment Options: RoboForex only supports a few payment options, and PayPal may not be available in all countries.

- PayPal Fees: Although RoboForex does not charge any deposit fees when using PayPal, PayPal may charge a transaction fee, depending on your location and the currency used.

- Trading Fees: RoboForex charges trading fees that can be higher than some other brokers. But RoboForex also allows high-leverage trading not easily available elsewhere.

Use PayPal with XM

Losses can exceed deposits. Upto 88% of retail CFD accounts lose money.

XM is a globally recognised online broker that accepts PayPal for deposits and withdrawals. They are regulated by multiple regulatory bodies such as the FCA, ASIC, and CySEC.

We would like to highlight the availability of PayPal as a payment method with XM, a popular online trading platform. PayPal is a widely recognised and trusted payment method globally, and its integration with XM provides users with a convenient and secure way to fund their trading accounts.

One of the key advantages of using PayPal with XM is that it allows for fast and easy deposits and withdrawals. Users can fund their accounts instantly using PayPal, and withdrawals are processed quickly. PayPal also offers advanced security features such as two-factor authentication, which helps to protect users' accounts from unauthorised access.

Another advantage of using PayPal with XM is that it offers users an additional layer of protection. In a dispute with XM, PayPal offers a dispute resolution process that can help resolve the issue quickly and fairly. PayPal provides users with added peace of mind when trading online.

However, using PayPal with XM also has some potential drawbacks. For example, some users may find that PayPal charges higher fees than other payment methods. Additionally, PayPal may not be available in all countries, which could limit the accessibility of XM to some users.

It's worth noting that some brokers may have certain restrictions for PayPal acceptance, such as country restrictions or deposit limits. It's always best to check with the broker and read their terms and conditions before depositing or withdrawing.

PayPal is a widely accepted payment method by many online brokers, allowing traders to easily fund their trading accounts and make transactions. Choosing a broker that accepts PayPal can make the funding process more convenient and efficient. As always, it's important to do proper research and due diligence before choosing a broker and to fully understand the terms and conditions of the account.

Advantages of Using PayPal for Trading

PayPal offers a safe, convenient, and cost-effective way to conduct online trading transactions.

Using PayPal for online trading offers several advantages:

- Security: PayPal uses state-of-the-art security measures to protect your financial information, reducing the risk of fraud and identity theft.

- Convenience: PayPal provides a fast and convenient way to deposit and withdraw funds from your trading account. You can easily transfer funds to and from your bank account or credit/debit card.

- Speed: PayPal transactions are processed instantly, allowing you to make quick trades and take advantage of market opportunities.

- Accessibility: PayPal is a widely accepted payment method, meaning that many trading platforms and brokers offer it as an option. Accessibility makes it easier for traders to find a platform that suits their needs and preferences.

- Low fees: PayPal charges lower transaction fees compared to traditional banking methods, making it a cost-effective option for traders.

- International transactions: PayPal enables traders to transact in multiple currencies, making it easier to trade in international markets.

- Mobile compatibility: PayPal is compatible with mobile devices, allowing traders to manage their accounts and make transactions on the go.

Disadvantages of Using PayPal for Trading

- Limited Availability: PayPal may not be accepted by all online brokers and may not be available in all countries. The lack of availability of PayPal in your region can limit a trader's options when choosing a broker or making deposits and withdrawals.

- Withdrawal Limits: PayPal may have withdrawal limits in place, which can be a disadvantage for traders who wish to withdraw large amounts of money at once.

- Fees: PayPal may charge fees for certain transactions, such as currency conversion fees or withdrawal fees. These fees can add up over time and may be higher than fees charged by other online payment methods.

- Account Restrictions: PayPal may place restrictions on certain types of accounts or transactions, such as those related to online trading or gambling. PayPal account restrictions can limit a trader's ability to use PayPal for certain trading activities or financial instruments.

- Holding Funds: PayPal may hold funds in certain circumstances, such as when a dispute is being resolved. Holding funding can disadvantage traders needing immediate access to their funds.

- Risk of Fraud: PayPal, like any other online payment method, is vulnerable to fraud and scams. Traders should always be cautious when using PayPal and should not share their account information with anyone.

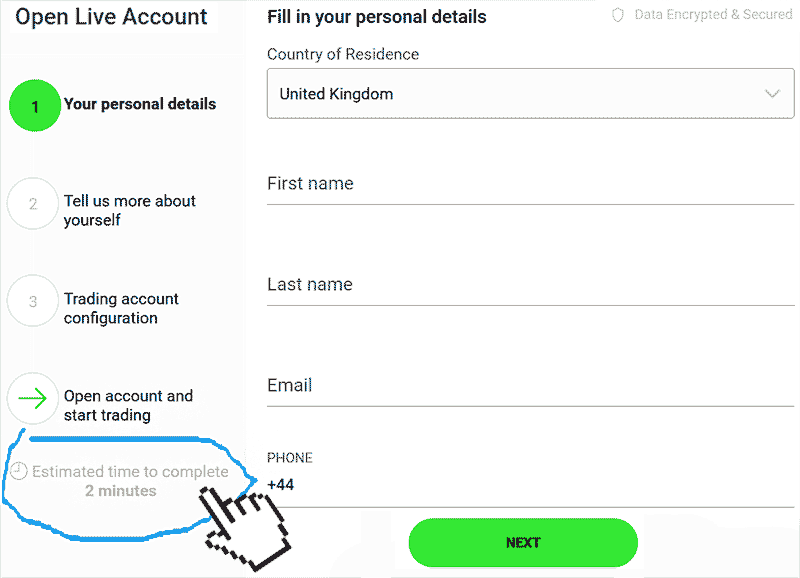

How to Open a Broker Account with PayPal Funding

- Choose a broker that accepts PayPal: First, you will need to find a broker that accepts PayPal for deposits and withdrawals. Many reputable brokers accept PayPal, but it's best to check with the broker directly to ensure they accept it and to familiarise yourself with any restrictions or limits.

- Create a PayPal account: If you don't already have a PayPal account, you will need to create one. You must provide your personal information and link your account to a credit card, debit card, or bank account.

- Register with the broker: Once you have chosen a broker and set up a PayPal account, you will need to register with the broker. PayPay broker registration typically involves filling out an online application form and providing your personal information.

- Verify your identity: Most brokers will require you to verify your identity before you can start trading. Verifying your PayPal trading account may involve providing a copy of your ID or passport and proof of address.

- Fund your account: Once your account is set up and verified, you can fund your account using PayPal. You can typically do this by logging into your account, navigating to the deposit section and selecting PayPal as your funding method.

How does PayPal compare to other payment methods for online trading?

PayPal is one of the most popular payment methods for online trading, but it's not the only one. Other common payment methods include credit/debit cards, bank transfers, and e-wallets like Skrill and Neteller.

Compared to credit/debit cards, PayPal offers several advantages. Firstly, it's a more secure payment method that doesn't require traders to enter their card details directly into the trading platform. Secondly, PayPal transactions are faster and more reliable than credit/debit card payments. Finally, PayPal has a reputation for excellent customer service and dispute resolution, which can be important for traders.

Compared to bank transfers, PayPal is generally faster and more convenient. Bank transfers can take several business days, while PayPal transactions are typically completed within minutes. Additionally, PayPal offers a more user-friendly interface, making it easier for traders to manage their funds and make payments.

Compared to other e-wallets like Skrill and Neteller, PayPal has a larger user base and wider acceptance among online brokers and trading platforms. However, some brokers may offer better fees or incentives for using other e-wallets, so it's important to research and compare different payment methods before choosing one.

PayPal Vs Other Payment Methods For Trading

| Payment Method | Advantages | Disadvantages |

|---|---|---|

| PayPal | Fast and secure transactions, buyer protection, widely accepted, easy to use | High fees for currency conversion, potential account freezes or limitations |

| Credit/Debit Cards | Widely accepted, easy to use, buyer protection | High transaction fees, potential for fraud or chargebacks |

| Bank/Wire Transfers | Low transaction fees, secure | Slow processing time, potential for errors or delays, limited availability in some countries |

| Cryptocurrencies | Low transaction fees, decentralised and secure | Volatility, limited acceptance by merchants, potential for hacking or scams |

| E-wallets (Skrill, Neteller, etc.) | Fast and secure transactions, widely accepted | High fees, potential account freezes or limitations, limited availability in some countries |

It's important to note that the advantages and disadvantages of each payment method may vary depending on the specific broker or trading platform being used. It's recommended to do thorough research and compare the fees and features of each payment method before deciding on one.

Credit/Debit Cards:

Credit and debit cards are among the most common and widely accepted forms of payment for online trading. They are easy to use and offer fast funding options.

Bank Transfer:

Bank transfer is a traditional method of funding trading accounts. It is widely accepted by brokers and can be used for deposits and withdrawals, but it may take longer than other methods for the funds to be credited to the account.

E-wallets:

E-wallets such as Skrill and Neteller are becoming increasingly popular for online trading. They offer fast and secure funding options and are widely accepted by brokers.

Cryptocurrency:

Some brokers accept cryptocurrencies such as Bitcoin, Ethereum, and Litecoin for deposits and withdrawals. This method is becoming increasingly popular as it offers fast, secure, low-cost transactions.

Prepaid Cards:

Prepaid cards such as Paysafecard can be used to fund trading accounts. They are widely accepted and offer a secure and anonymous way to fund accounts.

What are the fees associated with using PayPal brokers and trading platforms?

It's important to note that PayPal's fees may change from time to time and may vary depending on the country, it's always best to check with PayPal directly for the most current fees, and it's also important to note that some broker may have additional fees or commissions that are applied to PayPal transactions.

Using PayPal brokers and trading platforms may incur certain fees. These fees can vary depending on the broker or platform and the type of transaction being made.

When using PayPal to deposit or withdraw funds, the broker or platform may charge a percentage-based or flat fee. PayPal payment fees can range from 1-5% of the transaction amount or a fixed amount such as $1-$5. Additionally, PayPal may charge fees for certain transactions, such as currency conversions or withdrawals to a bank account. Something to note: when your trading account currency differs from your PayPal account currency, currency conversion fees from PayPal will occur.

It is important to thoroughly research the fees associated with using PayPal for trading before choosing a broker or platform. Some brokers or platforms may offer lower fees for using PayPal than other payment methods, while others may charge higher fees.

It is also important to consider the potential impact of fees on overall profitability when trading. High fees can eat into profits and should be factored into a trader's risk management plan.

PayPal charges fees for certain transactions, including those related to online trading. These fees may include:

- Transaction Fees: PayPal charges a fee for each transaction, which is a percentage of the total amount of the transaction. The exact fee varies depending on the country and the type of transaction, but it typically ranges from 1.9% to 3.9%.

- Currency Conversion Fees: PayPal charges a currency conversion fee when you make a transaction in a currency other than the one your account is set up in. The exact fee varies, but it typically ranges from 2.5% to 4%.

- Withdrawal Fees: PayPal may charge a fee for withdrawing funds from your account. The exact fee varies depending on the country and the method of withdrawal, but it typically ranges from $0.25 to $1.99.

- Monthly or Annual Fees: some PayPal accounts may have monthly or annual fees for certain services or features.

Regulations for PayPal Brokers

PayPal is a widely accepted and popular payment method for online transactions and is also accepted by many online brokers for funding trading accounts. However, PayPal is primarily a payment processor and not a financial institution. It's not subject to the same regulatory oversight as traditional financial institutions.

Regulation of online brokers that accept PayPal as a funding method varies depending on the country and the broker. In general, online brokers are subject to regulation by financial regulatory bodies in their countries.

For example, in the United States, online brokers must be registered with the National Futures Association (NFA) and the Commodity Futures Trading Commission (CFTC), which are responsible for regulating the online trading industry. In the European Union, online brokers are subject to regulation by the Cyprus Securities and Exchange Commission (CySEC) and the Financial Conduct Authority (FCA) in the UK.

It's worth noting that PayPal has its terms and conditions and regulatory compliance. For example, PayPal is subject to the Consumer Financial Protection Bureau (CFPB) oversight in the United States and the Financial Conduct Authority (FCA) in the UK.

What to Look for When Choosing a PayPal Broker

Regulation: Choosing a broker regulated by a reputable financial regulatory body is important. PayPal broker regulation can provide added security and assurance that the broker is operating in compliance with the laws and regulations of the country in which they operate.

Security: Ensure that the broker has robust security measures in place to protect your personal and financial information. Strong PayPal broker security includes SSL encryption, two-factor authentication, and a secure login process.

Payment Methods: Make sure that the broker accepts PayPal as a funding method and that it's available in your country. Also, check if the broker has any additional payment methods available and if there are any deposit or withdrawal limits.

Trading Platform: Evaluate the broker's trading platform to see if it's user-friendly and offers the features and tools that you need for your trading style.

Fees: Look at the fees the broker charges for transactions, such as spreads, commissions, and overnight fees. Compare the fees to other brokers to see if they are competitive.

Customer Service: Check if the broker offers customer service and support through different channels, such as email, phone and chat. Also, check the hours of availability and the quality of service.

Research and Education: Check if the broker offers research and education resources such as market analysis, webinars, and e-books. Financial market research and education resources like podcasts and guides from PayPal brokers can be valuable tools for learning and improving

Is PayPal a safe and secure payment method for online trading?

PayPal is considered a safe and secure payment method for online trading. It offers multiple layers of protection to both buyers and sellers, including advanced encryption technology and fraud monitoring. PayPal also has a dispute resolution process in place to resolve any issues that may arise between buyers and sellers. Additionally, PayPal is regulated by various financial authorities in different countries, which adds an extra layer of security and accountability.

However, it's important to note that while PayPal itself is secure, not all brokers or trading platforms accepting it as a payment method may be equally secure. Doing your research and due diligence on any broker or platform before using them is important to ensure they are legitimate and trustworthy. It's also important to take necessary precautions, such as using strong passwords and enabling two-factor authentication on your PayPal account.

Trading with PayPal can be safe if you choose a reputable and regulated broker and take the necessary precautions to protect your personal and financial information. PayPal offers a range of security features to protect against fraud and unauthorised transactions, such as buyer protection and dispute resolution.

As with any online payment method, fraud or scams are always risky. Therefore, it's important to take the following steps to ensure the safety of your PayPal account:

- Use a strong and unique password for your PayPal account and enable two-factor authentication.

- Keep your computer and mobile device secure with updated antivirus software.

- Be cautious of phishing scams and never click links in emails or text messages asking for your PayPal account information.

- Review your account activity regularly and immediately report any suspicious activity to PayPal.

- Choose a reputable, regulated broker with robust security measures.

What types of trading instruments are available through PayPal brokers and trading platforms?

PayPal brokers and trading platforms offer a range of trading instruments that can be bought and sold using PayPal as a payment method. Some of the most common trading instruments available through PayPal brokers and trading platforms include stocks, bonds, currencies, commodities, indices, and cryptocurrencies.

Stocks are shares of ownership in a particular company and can be bought and sold on a stock exchange using PayPal. Bonds are a form of debt issued by companies or governments, and their value can be traded on bond markets with PayPal. Currencies are bought and sold on foreign exchange markets with PayPal, with traders speculating on changes in exchange rates. Commodities such as gold, oil, and wheat can be bought and sold as trading instruments with PayPal. Indices are baskets of stocks or other assets that can be bought and sold as a single unit with PayPal, allowing traders to gain exposure to a broader market or sector. Finally, cryptocurrencies such as Bitcoin and Ethereum can be bought and sold through certain PayPal brokers and trading platforms.

It's important for traders to understand the risks and benefits of each type of trading instrument and choose a reputable and licensed PayPal broker or trading platform that offers transparent and fair trading terms. Traders should also consider diversifying their portfolios and managing risk appropriately by setting stop-loss orders and using other risk management tools.

Can I use PayPal to withdraw funds from my trading account?

Yes, many PayPal brokers and trading platforms allow users to withdraw funds from their trading accounts using PayPal.

Are there any limitations to using PayPal for online trading?

Yes, there may be certain limitations when using PayPal for online trading, such as transaction fees, withdrawal limits, and restrictions on certain countries or regions.

When it comes to transferring funds from PayPal to a bank account, there are limits to how much can be transferred in a single transaction. PayPal's Instant Transfer service allows users to transfer funds instantly to their linked bank account for a fee, with a maximum transaction limit of $25,000 and a minimum transfer of $1.00.

It's important to note that this transaction limit is higher than the limits typically imposed on debit card transactions. However, additional fees may be associated with transferring larger amounts of money using PayPal's Instant Transfer service.

Traders should also be aware that other factors may impact the speed and availability of funds when using PayPal for online trading, such as processing times and bank policies. It's always a good idea to check with your PayPal broker or trading platform to understand any fees or limitations associated with using PayPal for online trading.

Are there any restrictions on which countries can use PayPal for online trading?

Yes, there are restrictions on which countries can use PayPal for online trading. PayPal is not available in all countries, and its availability for online trading may vary by region.

For example, PayPal is available for online trading in countries such as the United States, United Kingdom, Canada, Australia, and many European countries. However, PayPal is not available for online trading in countries such as India, Pakistan, Bangladesh, and several African countries.

traders need to check with their PayPal broker or trading platform to see if PayPal is available in their country for online trading. Even if PayPal is available, there may be additional restrictions or fees associated with using PayPal for online trading.

Traders should also be aware that regulations around online trading can vary by country and region, and it's important to choose a reputable and licensed broker or trading platform that complies with local laws and regulations.

How do I find a reputable PayPal broker or trading platform?

Users can find reputable PayPal brokers and trading platforms by researching, reading reviews, and checking regulatory bodies to ensure they are licensed and regulated, such as the FCA or ASIC.

Can I use PayPal for margin trading?

Yes, some PayPal brokers and trading platforms offer margin trading using PayPal.

Using PayPal for margin trading with certain brokers and trading platforms is possible. Margin trading allows traders to invest with borrowed funds, amplifying potential profits and increasing risk.

When using PayPal for margin trading, traders may be required to link their PayPal account to their trading account and provide additional documentation or verification. Additionally, certain limitations or fees may be associated with using PayPal for margin trading, such as higher transaction fees or restrictions on borrowing amounts.

It's important for traders to carefully consider the risks and benefits of margin trading before using PayPal or any other payment method. Choosing a reputable and licensed broker or trading platform that offers transparent and fair margin trading terms is also recommended. As with all investments, it's important to manage risk appropriately and to only invest what you can afford to lose.

What are the minimum and maximum deposit amounts when using PayPal for trading?

The minimum and maximum deposit amounts vary depending on the PayPal broker or trading platform. Still, they typically range from $10 to $10,000 or more, depending on your trading account's features.

How long does it take to transfer funds through PayPal when using it for trading?

The transfer time for PayPal funds can vary, but it typically takes a few minutes to a few hours for funds to be transferred when using PayPal for trading.

What are the customer support options for PayPal brokers and trading platforms?

Customer support options for PayPal brokers and trading platforms include email, phone, live chat, and online support forums.

Are there any bonus offers or promotions available for using PayPal with certain brokers or trading platforms?

Yes, some PayPal brokers and trading platforms offer bonus offers and promotions for using PayPal, such as deposit bonuses or reduced transaction fees.

Can I use PayPal for automated trading systems?

Yes, many PayPal brokers and trading platforms offer automated trading systems that can be used with PayPal.

How does PayPal compare to other payment methods for online trading?

PayPal is a popular payment method for online trading due to its ease of use and widespread acceptance. Still, it may have higher transaction fees and withdrawal limits than other payment methods.

What are some of the success stories and cautionary tales of traders who have used PayPal brokers or trading platforms, and what can we learn from them?

There are many success stories and cautionary tales of traders who have used PayPal brokers or trading platforms. Some key takeaways include the importance of doing research and due diligence before investing, managing risk appropriately, and being aware of any fees or limitations associated with using PayPal for trading.

Compare PayPal Brokers

PayPal is a widely accepted and popular payment method for online transactions and is also accepted by many online brokers for funding trading accounts. However, it's important to choose a reputable and regulated broker with robust security measures and a good industry reputation.

When choosing a PayPal broker, it's important to consider factors such as regulation, security, payment methods, trading platform, fees, customer service, and research and education resources.

It's also important to take the necessary precautions to protect your personal and financial information and be aware of the potential risks of trading and fraud. While PayPal can be a convenient and secure option for funding trading accounts, traders should always do their own research and due diligence before opening an account with a broker that accepts PayPal.

PayPal is a widely accepted and popular payment method for online transactions, including online trading. However, when using PayPal for trading, it's important to choose a reputable and regulated broker, be aware of the fees and regulations and take the necessary precautions to protect your personal and financial information.

Best PayPal Brokers List Compared

| Featured PayPal Broker Trading Platform | Account Features | Trading Features |

|---|---|---|

| Used By: 180,000 Instruments Available: 232 Stocks Available: 2100 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 61 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mirror Trader, ZuluTrade, Web Trader, cTrader, Mac Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 200,000 Instruments Available: 1000 Stocks Available: 99 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 80 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: Web Trader, MT4, MT5, AvaTradeGo, AvaOptions, Mac, Mobile Apps, ZuluTrade, DupliTrade, MQL5 Negative Balance Protection: Inactivity Fee: No 71% of retail CFD accounts lose moneyVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 10000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 60 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, IRESS, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 250,000 Instruments Available: 4000 Stocks Available: 1696 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 57 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 0 |

Platforms: MT4, Mirror Trader, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Visit |

|

| Used By: 89,000 Instruments Available: 100 Stocks Available: 60 US Stocks: No UK Stocks: No German Stocks: Yes Japanese Stocks: No Indices: Yes Forex Pairs Available: 70 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mac, ZuluTrade, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your moneyVisit |

|

| Used By: 20,000,000 Instruments Available: 2000 Stocks Available: 2042 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 50 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 50 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 51% of retail investor accounts lose money when trading CFDs with this provider.Visit |

|

| Used By: 15,000,000 Instruments Available: 10000 Stocks Available: 1731 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 177 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.Visit |

|

| Used By: 10,000 Instruments Available: 148 Stocks Available: 64 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 40 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: $100 |

Platforms: MT4, MT5, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 4,000,000 Instruments Available: 2200 Stocks Available: 2000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: No Indices: Yes Forex Pairs Available: 67 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your moneyVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 10 US Stocks: Yes UK Stocks: No German Stocks: No Japanese Stocks: No Indices: Yes Forex Pairs Available: 40 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes Losses can exceed depositsVisit |

|

| Used By: 1,000,000 Instruments Available: 100 Stocks Available: 190 US Stocks: No UK Stocks: No German Stocks: No Japanese Stocks: Yes Indices: Forex Pairs Available: 70 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, Binary, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Your capital is at riskVisit |

|

| Used By: 1,866,000 Instruments Available: 430 Stocks Available: 1700 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 70 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 75.78% of retail investor accounts lose money when trading CFDs and Spread Betting with this providerVisit |

|

| Used By: 22,000,000 CFD Instruments Available: 2500 CFD Stocks Available: 1,900 CFD US Stocks: Yes CFD UK Stocks: Yes CFD German Stocks: Yes CFD Japanese Stocks: Yes CFD Indices: Yes CFD Forex Pairs Available: 65 CFD Major Forex Pairs: Yes CFD Minor Forex Pairs: Yes CFD Exotic Forex Pairs: Yes Minimum Deposit: £$€100 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.Visit |

|

| Used By: 239,000 Instruments Available: 17000 Stocks Available: 8000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 100 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 250 |

Platforms: MT4, Mac, Web Trader, L2 Dealer, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 70% of retail CFD accounts lose moneyVisit |

|

| Used By: 10,000 Instruments Available: 195 Stocks Available: 0 US Stocks: No UK Stocks: Yes German Stocks: No Japanese Stocks: No Indices: Yes Forex Pairs Available: Major Forex Pairs: Yes Minor Forex Pairs: No Exotic Forex Pairs: No Minimum Deposit: 20 |

Platforms: WEB,Desktop,Mac,Android Negative Balance Protection: Inactivity Fee: Your capital is at riskVisit |

Best PayPal Broker PayPal Broker Reviews

Read our details broker PayPal Broker PayPal Broker reviews, you will find something useful if you are shortlisting a PayPal Broker PayPal Broker and trading platform.

- IC Markets Review (read our in depth reviews)

- AvaTrade Review (read our in depth reviews)

- FP Markets Review (read our in depth reviews)

- XTB Review (read our in depth reviews)

- Pepperstone Review (read our in depth reviews)

- eToro Review (read our in depth reviews)

- Trading 212 Review (read our in depth reviews)

- Admiral Markets Review (read our in depth reviews)

- Markets.com Review (read our in depth reviews)

- HYCM Review (read our in depth reviews)

- ForTrade Review (read our in depth reviews)

- FxPro Review (read our in depth reviews)

- Plus500 Review (read our in depth reviews)

- IG Review (read our in depth reviews)

- Real Trade Group Review (read our in depth reviews)

PayPal Broker PayPal Broker Alternatives

Read about and compare PayPal Broker PayPal Broker alternatives. We have indepth side by side comparisons to help you find PayPal Broker PayPal Broker related brokers.

- IC Markets Alternatives

- AvaTrade Alternatives

- FP Markets Alternatives

- XTB Alternatives

- Pepperstone Alternatives

- eToro Alternatives

- Trading 212 Alternatives

- Admiral Markets Alternatives

- Markets.com Alternatives

- HYCM Alternatives

- ForTrade Alternatives

- FxPro Alternatives

- Plus500 Alternatives

- IG Alternatives

- Real Trade Group Alternatives

AvaTrade

AvaTrade

FP Markets

FP Markets

XTB

XTB

Pepperstone

Pepperstone

Trading 212

Trading 212

Admiral Markets

Admiral Markets

Markets.com

Markets.com

HYCM

HYCM

ForTrade

ForTrade

FxPro

FxPro

Plus500

Plus500

IG

IG

Real Trade Group

Real Trade Group