Best NASDAQ Brokers

When looking for a broker for NASDAQ trading, consider factors such as fees, trading platform, research tools, and customer support. Some top brokers for NASDAQ trading include IC Markets, eToro, and XTB. Research and compare options to find the best fit for your trading needs.

NASDAQ brokers enable traders to place speculative buy or sell trades on the price fluctuations of the NASDAQ stock index.

NASDAQ brokers facilitate trading the NASDAQ through a variety of financial instruments, including trading the NASDAQ indices, trading NASDAQ CFDs using leverage, buying and selling individual NASDAQ stocks, NASDAQ futures contracts and NASDAQ options trading.

In our guide to NASDAQ brokers, we explain and compare NASDAQ trading platforms and financial instruments related to the NASDAQ. We explain what to check when shortlisting NASDAQ brokers. We explain and compare the NASDAQ trading tools, NASDAQ broker funding and withdrawal methods, and NASDAQ trading costs involved when using a NASDAQ brokerage firm or NASDAQ trading platform.

Best NASDAQ Brokers Table of Contents

- NASDAQ Brokers

- What NASDAQ Indices Are Available To Trade?

- What Ways Can I Trade The NASDAQ?

- Ways to trade the NASDAQ

- Trading NASDAQ Stocks?

- What stocks are in the NASDAQ 100?

- Example Of A NASDAQ Stock Trade

- Trading NASDAQ ETFs?

- Example Of NASDAQ ETF Trading

- Trading NASDAQ Futures Contracts?

- Example Of A NASDAQ Future Contract Trade

- What Are NASDAQ Options?

- Example Of NASDAQ Options Trading

- What Is NASDAQ CFD Trading?

- Example Of A NASDAQ CFD Trade

- Features of a NASDAQ Broker

- Authorization to operate on the NASDAQ

- Low fees and commissions

- Platform and tools

- Investment products and services

- Customer support

- Research and educational resources

- Starting to Trade with a NASDAQ Broker

- Step 1: Choose a NASDAQ broker

- Step 2: Open an account

- Step 3: Fund your account

- Step 4: Learn about the market and tools

- Step 5: Place your first trade

- Minimum to Start Trading with a NASDAQ Broker

- Account minimums

- Initial deposit

- Trading minimums

- NASDAQ Broker Deposit And Withdrawal Methods

- Advantages of Trading Stocks on the NASDAQ Market

- Electronic trading platform Software

- Wide range of stocks

- High liquidity

- Transparency

- Reduced Costs

- Risks of Trading Stocks on the NASDAQ Market

- Market risk

- NASDAQ listed company risk

- NASDAQ price volatility risks

- Liquidity risk

- Leverage risk

- Trader Experience Required to Start Trading on the NASDAQ Market

- Day trading

- Swing trading

- Long-term investing

- Broker requirements

- How Can I Choose the Most Reliable NASDAQ Broker?

- Regulation and oversight

- Financial stability

- Reputation

- Range of services

- How Volatile Is The NASDAQ?

- NASDAQ Long Term Vs Short Term Trading

- NASDAQ Brokers Verdict

- Best NASDAQ Brokers List Compared

NASDAQ Brokers

NASDAQ, or the National Association of Securities Dealers Automated Quotations, is a stock exchange known for its electronic trading platform. It is the second-largest stock exchange in the world by market capitalisation, behind only the New York Stock Exchange (NYSE).

The NASDAQ is one of the largest stock exchanges in the world. The NASDAQ has over 3,000 companies listed on the exchange. These companies represent various industries, including technology, healthcare, consumer goods, and financial services. Some of the largest and most well-known companies listed on the NASDAQ include Apple, Amazon, Microsoft, Tesla, and Facebook.

To trade the NASDAQ, you can do so via a few financial instrument types. Many brokers offer access to the NASDAQ, including online and traditional brick-and-mortar firms. Some of the most popular NASDAQ brokers include IC Markets, RoboForex, XTB, AvaTrade.

When choosing a NASDAQ broker, it's important to consider factors such as fees, account minimums, and the range of investment products and services offered. Additionally, many online brokers offer tools and resources such as market research, educational resources, and trading platforms to help you make informed investment decisions.

It's also important to note that while some brokers may have a physical presence, they may not be able to trade in NASDAQ as they may be authorised only to trade in other exchanges. Therefore, it's always wise to check the authorisations of the broker before opening an account.

What NASDAQ Indices Are Available To Trade?

- NASDAQ Composite - A weighted index of all the common stocks listed on the NASDAQ stock exchange by capitalisation.

- NASDAQ 100 - includes some of the top 100 NASDAQ companies that are not financial companies, weighted by capitalisation.

- NASDAQ Biotechnology Index (NBI) - composed of NASDAQ listed biotech and pharma companies, weighted by capitalisation.

- NASDAQ Computer Index - A NASDAQ index composed of computer hardware and software, weighted by capitalisation.

- NASDAQ Financial 100 Index - highest volume traded financial related NASDAQ listed companies, weighted by capitalisation.

- NASDAQ Internet Index - composed of the largest NASDAQ internet listed companies.

- NASDAQ Telecommunications Index - made up of NASDAQ telecommunications companies, weighted by capitalisation.

What Ways Can I Trade The NASDAQ?

You can trade the NASDAQ index using a variety of financial instrument types using a NASDAQ broker trading platform. It's important to carefully consider the risks involved in trading the NASDAQ in the financial instrument form your choose, as well as your investment goals, experience, and risk tolerance before making NASDAQ investment decisions.

Ways to trade the NASDAQ

- NASDAQ Stocks - You can purchase individual stocks listed on the NASDAQ exchange.

- NASDAQ Exchange-Traded Funds (ETFs) - You can buy ETFs that track the performance of the NASDAQ composite index.

- NASDAQ Futures Contracts - You can trade futures contracts based on the NASDAQ index.

- NASDAQ Options - You can trade options on individual NASDAQ-listed stocks or the NASDAQ index.

- NASDAQ CFDs (Contracts for Difference) - You can trade NASDAQ through CFDs offered by some NASDAQ brokers. NASDAQ CFDs use high-risk leverage to speculate on up or down NASDAQ index price movement, requiring a lower deposit amount than your exposure to your NASDAQ brokerage firm.

Trading NASDAQ Stocks?

NASDAQ stocks are shares of publicly traded companies listed on the NASDAQ (National Association of Securities Dealers Automated Quotations) stock exchange. The NASDAQ is one of the largest stock exchanges in the world, and it primarily lists technology and growth-oriented companies. However, it does include companies from other industries as well. When you purchase a NASDAQ stock, you own a small part of that company and are entitled to a portion of its profits through dividends or an increase in the stock price.

Investing in NASDAQ stocks carries risks, as stock prices can be volatile, and there's no return guarantee. It's important to research and consider the potential risks and rewards before making investment decisions.

What stocks are in the NASDAQ 100?

- Activision Blizzard - Gaming

- Adobe - Software

- Alphabet (A) - Technology

- Alphabet (C) - Technology

- Amazon - E-commerce

- AMD - Semiconductors

- American Electric Power - Energy

- Amgen - Biotechnology

- Apple - Technology

- Applied Materials - Manufacturing

- ASML - Manufacturing

- Autodesk - Software

- Automatic Data Processing - Business Process Services

- Baker Hughes - Energy

- Biogen - Biotechnology

- Booking Holdings - Online Travel

- Broadcom - Semiconductors

- Cadence Design Systems - Software

- Charte a - Retail

- Cintas - Business Services

- Cisco - Technology

- Cognizant - Business Process Services

- Comcast - Telecommunications

- Copart - Online Auction

- CoStar Group - Commercial Real Estate Information

- Costco Wholesale - Retail

- CrowdStrike - Cybersecurity

- CSX - Transportation

- DexCom - Medical Devices

- Diamondback Energy - Oil & Gas

- Dollar Tree - Retail

- eBay - E-commerce

- Electronic Arts - Gaming

- Exelon - Energy

- Fiserv - Financial Technology

- Gilead Sciences - Biotechnology

- GLOBALFOUNDRIES - Manufacturing

- Honeywell - Conglomerate

- IDEXX Laboratories - Healthcare

- Illumina - Life Sciences

- Intel - Semiconductors

- Intuit - Software

- Intuitive Surgical - Medical Devices

- JD.com - E-commerce

- Keurig Dr Pepper - Beverages

- KLA-Tencor - Manufacturing

- Lam Research - Manufacturing

- Lululemon Athletica - Apparel

- Marriott - Hospitality

- Marvell Technology - Semiconductors

- MercadoLibre - E-commerce

- Meta Platforms - Technology

- Microchip Technology - Semiconductors

- Micron Technology - Semiconductors

- Microsoft - Technology

- Moderna - Biotechnology

- Mondelez - Snacks & Confectionery

- Monster Beverage - Beverages

- Netflix - Streaming Video

- NVIDIA - Graphics Processing Units

- NXP Semiconductors - Semiconductors

- O'Reilly Automotive - Retail

- Old Dominion Freight Line - Transportation

- Paccar - Manufacturing

- Paychex - Business Process Services

- PayPal - Financial Technology

- PepsiCo - Beverages & Snacks

- Pinduoduo - E-commerce

- QUALCOMM - Semiconductors

- Regeneron Pharmaceuticals - Biotechnology

- Rivian Automotive - Automotive

- Ross Stores - Retail

- Seagen - Biotechnology

- Sirius XM - Satellite Radio

- Starbucks - Coffeehouse

- Synopsys - Software

- Tesla - Automotive

- Texas Instruments - Semiconductors

- The Kraft Heinz Company - Food & Beverage

- T-Mobile US - Telecommunications

- Verisk Analytics - Risk Management

- Vertex Pharmaceuticals - Biotechnology

- Walgreens Boots Alliance - Retail Pharmacy

- Warner Bros. Discovery - Entertainment

- Xcel Energy - Energy

- Zoom Video Communications - Video Conferencing

Example Of A NASDAQ Stock Trade

Suppose a NASDAQ trader wants to purchase shares of Apple Inc. (AAPL), listed on the NASDAQ stock exchange. The individual opens a brokerage account and transfers funds into the account for trading the NASDAQ.

The individual then logs into the brokerage account and places a 'buy' order for 100 shares of Apple Inc. at an example price of $130 per share. The brokerage matches the individual's order with a 'sell' order from another party.

The trade is executed, the individual now owns 100 shares of Apple Inc., and the brokerage has debited the individual's account for the total cost of the shares, which in this example would be $13,000 (100 shares x $130 per share).

The individual now holds a position in Apple Inc. and can hold onto the shares as a long-term investment or sell them at any time if they believe the price will decrease.

It's important to remember that this is a simplified example and that actual stock trades can be more complex. Additionally, stock trading involves significant risk, and individual investors should thoroughly research a company and consult with a financial advisor before investing.

Trading NASDAQ ETFs?

NASDAQ ETFs (Exchange-Traded Funds) are investment funds designed to track the performance of a specific index, commodity, or basket of assets listed on the NASDAQ stock exchange. NASDAQ ETFs provide investors with a convenient and cost-effective way to gain exposure to a diverse range of assets listed on the Nasdaq, including stocks, bonds, commodities, and other financial instruments.

NASDAQ ETFs are traded on stock exchanges, just like individual stocks, and can be bought and sold throughout the trading day. NASDAQ ETFs are an accessible and flexible investment option for individual and institutional investors.

The underlying assets in NASDAQ ETFs can vary widely, from broad-based market indices such as the NASDAQ Composite Index to more specialised indices that track specific sectors, such as technology or healthcare. NASDAQ ETFs allow investors to easily diversify their portfolios and achieve specific investment goals, such as income generation or capital appreciation.

It's important to note that while ETFs provide a convenient and cost-effective way to gain exposure to a diverse range of assets, they carry their risks, such as market risk and tracking error. Before investing in NASDAQ ETFs, it's important to understand the underlying assets, investment objectives, and potential risks involved.

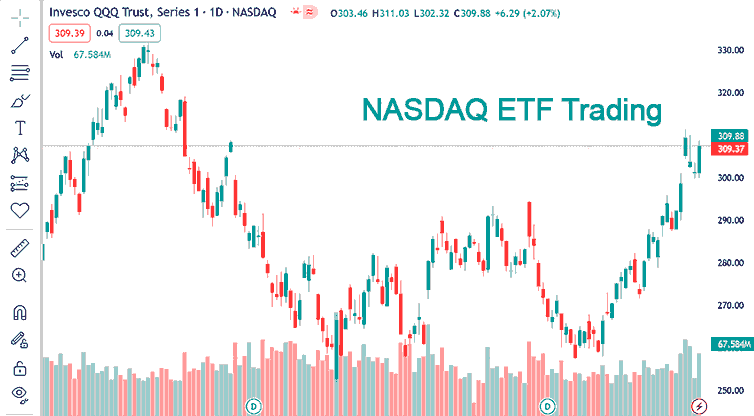

Example Of NASDAQ ETF Trading

If a NASDAQ ETF investor is interested in gaining exposure to the technology sector and decides to invest in the Technology Select Sector SPDR Fund (XLK), which tracks the performance of technology companies listed on the NASDAQ and other major stock exchanges.

The investor decides to purchase 100 shares of XLK at $100 per share. Execute live trades through a brokerage account, like buying an individual stock.

A few months later, the price of XLK increased to $110 per share. The investor decides to sell their shares and realises a profit of $100 (100 x ($110 - $100)).

It's important to note that while ETFs provide a convenient and cost-effective way to gain exposure to a specific market or sector, they carry their risks, such as market risk and tracking error. Before investing in NASDAQ ETFs, it's important to understand the underlying assets, investment objectives, and potential risks involved.

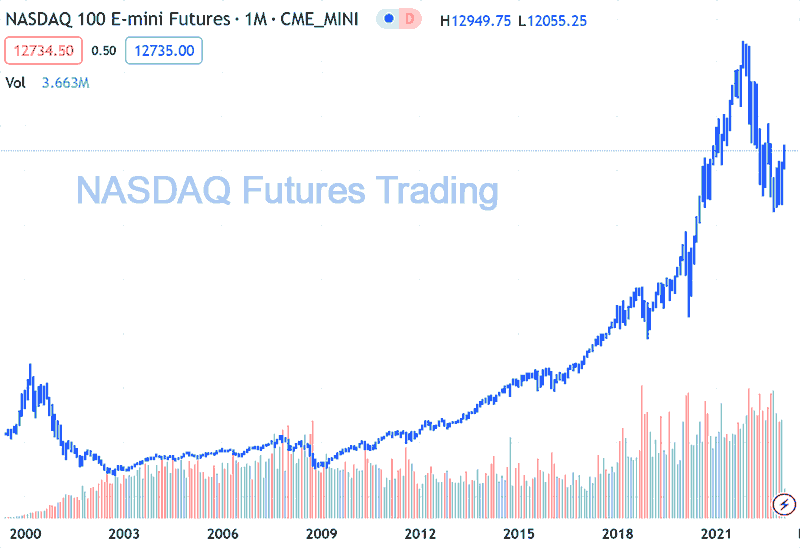

Trading NASDAQ Futures Contracts?

NASDAQ Futures contracts are financial derivatives that allow traders to speculate on the future price of the NASDAQ stock market index. They are standardised agreements that give the buyer the obligation to purchase the underlying asset (in this case, the NASDAQ index) at a specified price on a specified date in the future. NASDAQ Futures contracts are available on the Chicago Mercantile Exchange (CME). Traders can use them to hedge their positions or speculate on the future price movements of the NASDAQ stock market index.

By trading NASDAQ Futures contracts, traders can take advantage of the market's perceived direction without buying and selling individual stocks. Futures contracts offer a convenient way for traders to gain exposure to the NASDAQ index and can be an effective tool for managing market risk or taking advantage of market opportunities.

It's important to remember that trading in futures contracts is a complex, risky activity and unsuitable for all investors. Before trading in NASDAQ Futures contracts, it's important to understand the risks and consult a financial advisor.

Example Of A NASDAQ Future Contract Trade

Suppose a trader believes that the NASDAQ index will increase in value over the next few months. The trader could purchase a NASDAQ Futures contract with the following terms:

- Underlying asset: The NASDAQ index

- Contract size: One NASDAQ Futures contract is equivalent to a certain amount of the NASDAQ index (e.g., $100 x the NASDAQ index)

- Delivery date: Three months from the date of the contract

- Contract price: The price of the NASDAQ index at the time the contract is purchased, let's say it's 10,000

In this scenario, the trader has entered into a contract to purchase the NASDAQ index at 10,000 three months from now. If the NASDAQ index does increase in value over the next three months, the trader could sell the contract for a profit. If the NASDAQ index decreases in value, the trader would be obligated to purchase the NASDAQ index at the agreed-upon price of 10,000, which would result in a loss.

It's important to remember that this is a simplified example and that actual NASDAQ Futures contracts can be more complex. Additionally, trading in futures contracts is a complex and risky activity and unsuitable for all investors. Before trading in NASDAQ Futures contracts, it's important to understand the risks and consult a financial advisor.

What Are NASDAQ Options?

NASDAQ options are financial contracts that give the holder the right, but not the obligation, to buy or sell a specific underlying asset at a predetermined price (strike price) on or before a specified expiration date. The underlying asset in NASDAQ options is typically a stock listed on the NASDAQ stock exchange. Options trading allows investors to hedge against potential losses, generate income, and speculate on the price movements of the underlying security.

Example Of NASDAQ Options Trading

Let's say that an investor believes that the stock price of a certain company listed on the NASDAQ exchange will increase shortly. The investor can purchase a call option on the stock with a strike price of $100 and an expiration date of 3 months.

If the stock price of the company indeed increases to $110 by the expiration date, the investor can exercise their option and buy the stock at the strike price of $100 and then immediately sell it on the market for $110, realising a profit of $10 per share.

On the other hand, if the stock price does not increase and remains at $100 or decreases, the investor can choose not to exercise the option, and the option will expire worthless, resulting in a loss of the premium paid to purchase the option.

This is a basic example of how options trading works using NASDAQ options. Options can be complex financial instruments, and it's important to understand the potential risks and rewards before trading options.

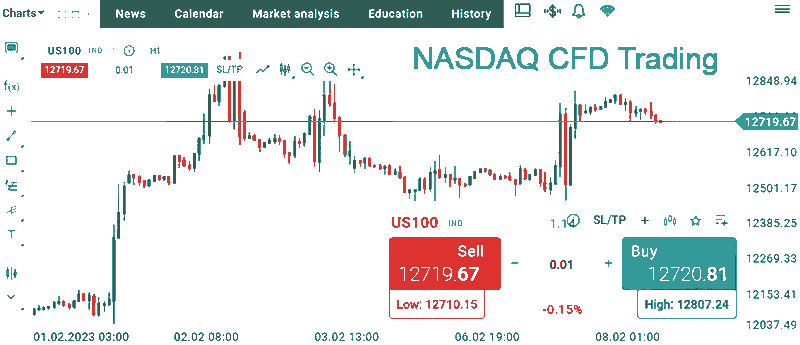

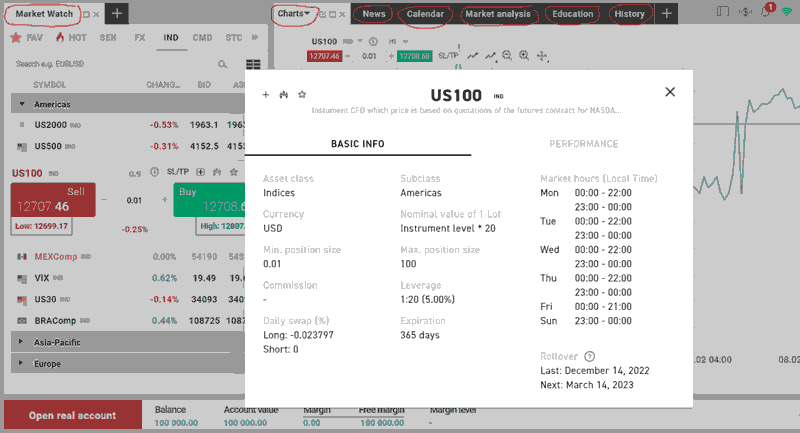

What Is NASDAQ CFD Trading?

NASDAQ CFD trading or NASDAQ contract for difference trading is high-risk leveraged trading on up or down price speculation only (no real NASDAQ assets exchanged). In NASDAQ CFD trading, investors enter into a contract with a broker to exchange the difference in the price of an underlying asset, such as a stock listed on the NASDAQ exchange, between the time entering the contract is entered into and the time it is closed.

For example, if an investor believes that the price of a certain NASDAQ-listed stock will increase, they can enter into a NASDAQ CFD trade with a broker. If the stock price increases, the investor will make a profit based on the difference between the opening and closing prices of the stock. If the stock price decreases, the investor will incur a loss.

CFD trading provides a flexible and cost-effective way for investors to trade financial markets, including the NASDAQ stock exchange, as it requires only a small initial deposit and allows for leverage to trade larger positions. However, it's important to understand the risks associated with CFD trading, as the potential for losses can be substantial.

Example Of A NASDAQ CFD Trade

Suppose an investor believes that the price of Apple Inc. (AAPL), listed on the Nasdaq exchange, will increase soon. The current price of AAPL is $120 per share. The investor decides to enter into a NASDAQ CFD trade by buying ten shares of AAPL through a CFD broker with a margin requirement of 5%.

The margin requirement means that the NASDAQ CFD investor only needs to deposit 5% of the total trade value, or $60 ($120 x 10 x 5%), as collateral with the broker. The broker provides the remaining 95% of the trade value, or $1140, as leverage.

A few days later, the price of AAPL increased to $130 per share. The investor decides to close the NASDAQ CFD trade. The calculated profit from the trade is as follows:

($130 - $120) x 10 shares = $100

The NASDAQ CFD investor makes a profit of $100, and the broker collects the margin deposit of $60 as collateral.

It's important to note that while CFD trading can generate significant profits, it also carries a high level of risk, as the potential for losses is equal to the potential for gains. It's essential to fully understand the mechanics and risks involved in NASDAQ CFD trading before engaging in it.

Features of a NASDAQ Broker

When it comes to trading on the NASDAQ, there are certain features that you should look for in a broker. These features include:

Authorization to operate on the NASDAQ

Not all brokers operate on the NASDAQ, so it's important to ensure that the broker you choose is authorised to trade on the exchange.

Low fees and commissions

Many NASDAQ brokers charge fees and commissions on trades, so it's important to compare the costs of different brokers and choose one that offers low fees and commissions.

Platform and tools

A good NASDAQ broker should offer a robust trading platform that is easy to use and provides access to real-time market data and other tools to help you make informed investment decisions.

Investment products and services

Many NASDAQ brokers offer a wide range of investment products and services, including stocks, options, ETFs, mutual funds, and more. Look for a broker that offers investment products and services that align with your investment goals.

Customer support

Good customer support is essential for any NASDAQ broker. Look for a broker that offers multiple channels for customer support, such as phone, email, and live chat, and is available during market hours.

Research and educational resources

Many NASDAQ brokers offer research and educational resources such as market analysis, news, and educational articles to help you make informed investment decisions.

It's always wise to compare the features of different NASDAQ brokers before opening an account and choose one that best aligns with your investment goals and preferences.

Starting to Trade with a NASDAQ Broker

Here are the general steps you can follow to start trading with a NASDAQ broker:

Step 1: Choose a NASDAQ broker

The first step in trading on the NASDAQ is choosing a broker authorised to operate on the exchange. Compare the fees, account minimums, and the range of investment products and services offered by different brokers, and choose one that aligns with your investment goals and preferences.

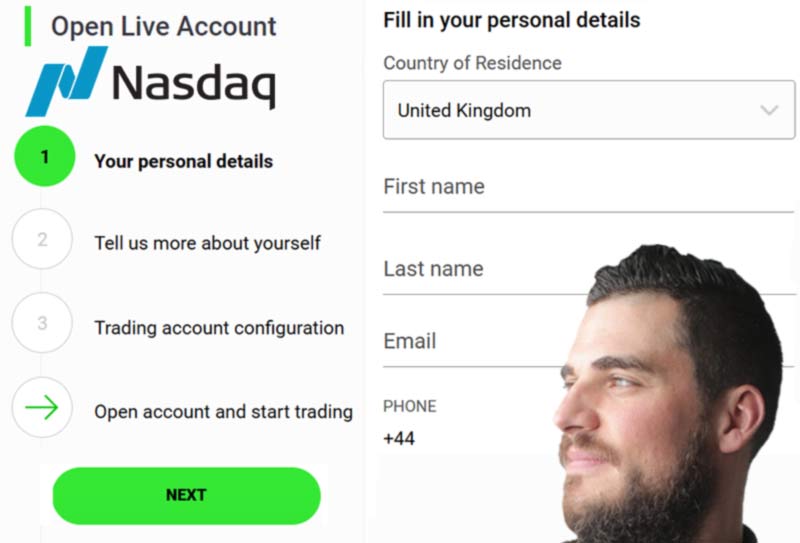

Step 2: Open an account

Once you have chosen a NASDAQ broker, you must open an account. This process typically involves filling out an application and providing documentation such as your ID and proof of residence. Some brokers may also require you to provide information about your financial situation and investment experience.

Step 3: Fund your account

After opening your account, you need to fund it to start trading. Funding a live NASDAQ broker account can typically be done via bank transfer, credit or debit card, Sofort, PayPal, Skrill, or check.

Step 4: Learn about the market and tools

Before you start trading on the NASDAQ, it's important to understand how the market works and to familiarise yourself with the tools and resources offered by your broker. Many brokers offer research, educational resources, and trading platforms to help you make informed investment decisions.

Step 5: Place your first trade

Once you understand the market and the tools available, you can start placing trades. Placing live NASDAQ trades is done via the broker's trading platform. Remember to always consider the risks involved in any trade, and never invest more than you can afford to lose.

Minimum to Start Trading with a NASDAQ Broker

NASDAQ broker minimum deposits range from 0 - 2000 USD. The minimum amount required to start trading with a NASDAQ broker can vary depending on the broker and the type of account and trading features you require. Here are a few things to consider:

Account minimums

Some NASDAQ brokers have account minimums, meaning you need a certain amount of money to open an account. This minimum can vary depending on the broker, but it can range from a few hundred to several thousand dollars.

Initial deposit

Some NASDAQ brokers require an initial deposit when you open an account. This deposit can range from a few hundred dollars to several thousand dollars.

Trading minimums

Some NASDAQ brokers have trading minimums, meaning that you need a certain amount of money to place a trade. This minimum can vary depending on the broker, but it can range from a few to several hundred dollars.

NASDAQ Broker Deposit And Withdrawal Methods

The specific payment methods available on your NASDAQ broker may vary between trading platforms and your country. Some 3rd party payment providers may not be available in your country, so they may not be available with your shortlisted NASDAQ broker trading platform.

NASDAQ broker trading platforms can offer a range of deposit and withdrawal methods, including

- Credit/debit cards (e.g. Visa, Mastercard)

- Bank transfers (e.g. wire transfers)

- E-wallets (e.g. PayPal, Skrill, Neteller)

- Cryptocurrencies (e.g. Bitcoin, Ethereum, Litecoin)

- Prepaid cards (e.g. Visa gift cards)

- Electronic checks (e.g. e-checks)

- Mobile payment methods (e.g. Apple Pay, Google Pay)

Advantages of Trading Stocks on the NASDAQ Market

The NASDAQ is one of the world's most popular stock exchanges, and trading stocks on the NASDAQ market can offer several advantages, including

Electronic trading platform Software

The NASDAQ is available on a range of trading platform software, including MT4, MT5, cTrader and bespoke online trading platforms, which allows for fast and efficient execution of NASDAQ trades. Advanced trading software can be especially beneficial for NASDAQ day traders and other traders who need to make rapid trades.

Wide range of stocks

The NASDAQ offers a wide range of stocks to trade, including companies from various sectors such as technology, healthcare, and consumer goods. A wide range of NASDAQ stocks and indices allows traders to diversify their portfolios and access a wide range of investment opportunities.

High liquidity

The NASDAQ has a high level of liquidity, which means it is easy to buy and sell stocks without significantly affecting their price. High liquidity can be especially beneficial for traders who need to make large trades or who are looking to enter or exit a position quickly.

Transparency

The NASDAQ provides real-time market data, which means traders can see the latest prices and trading activity for stocks. This transparency can help traders make informed investment decisions and can also help to prevent market manipulation.

Reduced Costs

Trading on the NASDAQ market can be less expensive than trading on other markets because the NASDAQ uses an electronic trading system, which eliminates the need for intermediaries such as market makers and specialist firms. Reduced costs can lead to lower trading costs for traders.

Risks of Trading Stocks on the NASDAQ Market

Trading stocks on the NASDAQ market carries certain risks. Here are a few things to consider:

Market risk

Market risk refers to the risk that the overall stock market will decline, which can affect the value of individual stocks. The NASDAQ is a global market and can be affected by various factors such as economic conditions, political events, and natural disasters, which can lead to volatility in the market and can cause individual stocks to lose value.

NASDAQ listed company risk

Specific NASDAQ company risk refers to the risk that a specific NASDAQ-listed company stock may fall for several reasons, including performance, management changes, or company competition. Generally, this risk is higher for individual NASDAQ stocks than for the diversified NASDAQ stock market index.

NASDAQ price volatility risks

NASDAQ price volatility may cause constituent NASDAQ stocks to rise and fall unpredictably, which can cause significant losses for traders who do not prepare for such fluctuations. The NASDAQ is known for its high volatility level, meaning traders must be prepared for rapid price movements and manage risk effectively.

Liquidity risk

Liquidity risk refers to the risk that it will be difficult to buy or sell stock due to a lack of buyers or sellers. Liquidity risk can occur when there is a lack of interest in a particular stock or when there is a sudden increase in the number of traders looking to buy or sell a stock.

Leverage risk

Leverage risk refers to the risk that traders will use leverage to magnify their potential gains and losses. Leverage can benefit traders who use it carefully but can also lead to significant losses if not used properly.

Trader Experience Required to Start Trading on the NASDAQ Market

The trader experience required to start trading on the NASDAQ market can vary depending on the type of trading you plan to do and the broker you choose. Here are a few things to consider:

Day trading

Day trading on the NASDAQ market typically requires a higher level of trader experience due to the fast-paced nature of the market and the need to make rapid trades. Day traders need to have a good understanding of the market, be able to read and interpret market data and be able to make quick decisions.

Swing trading

Swing trading, which involves holding positions for a few days to a few weeks, typically requires less trader experience than day trading. Swing traders need to have a good understanding of the market and be able to read and interpret market data, but they do not need to make quick decisions like day traders.

Long-term investing

Long-term investing on the NASDAQ market typically requires less trader experience than day trading or swing trading. Long-term investors need to have a good understanding of the market, be able to read and interpret market data, and have a long-term investment strategy.

Broker requirements

NASDAQ brokers may have different requirements regarding trader experience. Some brokers may require that traders have a certain level of experience or knowledge before opening an account, while others may have no requirements. It's always wise to check the broker's website and read their terms and conditions before opening an account and starting to trade.

How Can I Choose the Most Reliable NASDAQ Broker?

Determining the most reliable NASDAQ broker can be subjective as it depends on the individual trader's preference and priorities. Some factors in evaluating the reliability of a broker are:

Regulation and oversight

A reliable NASDAQ broker should be regulated and overseen by a reputable financial regulatory agency such as the Securities and Exchange Commission (SEC) in the United States, the Financial Conduct Authority (FCA) in the UK, Cyprus Securities and Exchange Commission (CySEC) in Cyprus, Markets In Financial Instruments Directive (MiFID) in Europe, and the Australian Securities and Investments Commission (ASIC). NASDAQ broker financial regulation ensures that the broker operates legally and adheres to certain standards of conduct.

Financial stability

A reliable NASDAQ broker should have a strong financial position and should be able to withstand market fluctuations. Checking the broker's balance sheet and financial statements indicates the financial stability of a NASDAQ brokerage firm.

Reputation

A reliable NASDAQ broker should have a good industry reputation and be well-respected by other market participants. Check the broker's customer reviews, testimonials and ratings by different rating agencies to indicate reputation.

Range of services

A reliable NASDAQ broker should offer clients a wide range of services, including trading platforms, research and educational resources, and customer support.

How Volatile Is The NASDAQ?

The NASDAQ, like any stock market, can be volatile, so stock prices can fluctuate rapidly and unpredictably. The level of volatility can vary depending on several factors, including global economic conditions, changes in interest rates, and the market's overall sentiment. During periods of market uncertainty or economic turmoil, the NASDAQ and other stock markets can experience significant fluctuations in stock prices. On the other hand, during periods of economic stability and growth, stock prices may be more stable and show less volatility.

It's important to remember that past performance is not a guarantee of future results and that investing in the stock market always carries some risk. Before making investment decisions, it's a good idea to consult with a financial advisor and consider your investment goals, risk tolerance, and other factors.

NASDAQ Long Term Vs Short Term Trading

The NASDAQ can be a good investment for long-term and short-term traders, depending on an individual's investment goals, risk tolerance, and market outlook.

For long-term investors, the NASDAQ can be a good investment due to its historical track record of strong returns over time and its reputation as a leading exchange for technology and growth-oriented companies. Investing in the NASDAQ long-term can provide exposure to some of the world's leading companies and help build wealth over time.

For short-term traders, the NASDAQ can also offer opportunities for quick profits based on short-term price movements and market trends. However, short-term trading can also be riskier, as stock prices can be more volatile and unpredictable in the short term.

Ultimately, whether the NASDAQ is a good investment depends on several factors, including your investment goals, risk tolerance, and market outlook. Before making investment decisions, it's important to carefully consider these factors and consult with a financial advisor.

NASDAQ Brokers Verdict

The NASDAQ is one of the world's most popular stock exchanges, with many reputable NASDAQ brokers to choose from. When selecting a NASDAQ broker, it's important to consider factors such as fees, account minimums, and the range of investment products and services offered. Additionally, traders should also consider the level of experience required, the trading style they plan to use and the level of regulation and oversight of the broker.

When trading stocks on the NASDAQ market, it's important to understand that inherent risks are involved. Day trading and swing trading typically require more experience than long-term investing. Still, regardless of the trading style, it's important to be well-informed about the market and to have a good understanding of the risks involved.

In conclusion, the NASDAQ is a popular and reliable stock exchange with a wide range of investment opportunities, and there are many reputable NASDAQ brokers to choose from. However, it's important to carefully evaluate your options, choose a broker that aligns with your investment goals and preferences, and always be aware of the risks involved in trading stocks.

Best NASDAQ Brokers List Compared

| Featured NASDAQ Broker Trading Platform | Account Features | Trading Features |

|---|---|---|

| Used By: 180,000 Instruments Available: 232 Stocks Available: 2100 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 61 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mirror Trader, ZuluTrade, Web Trader, cTrader, Mac Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 53 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 35 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 10 USD / 10 EUR |

Platforms: MT4, MT5, Mac, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 200,000 Instruments Available: 1000 Stocks Available: 99 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 80 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: Web Trader, MT4, MT5, AvaTradeGo, AvaOptions, Mac, Mobile Apps, ZuluTrade, DupliTrade, MQL5 Negative Balance Protection: Inactivity Fee: No 71% of retail CFD accounts lose moneyVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 10000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 60 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, IRESS, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 250,000 Instruments Available: 4000 Stocks Available: 1696 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 57 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 0 |

Platforms: MT4, Mirror Trader, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Visit |

|

| Used By: 89,000 Instruments Available: 100 Stocks Available: 60 US Stocks: No UK Stocks: No German Stocks: Yes Japanese Stocks: No Indices: Yes Forex Pairs Available: 70 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mac, ZuluTrade, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your moneyVisit |

|

| Used By: 10,000,000 Instruments Available: 1000 Stocks Available: 160 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 55 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 5 |

Platforms: MT4, MT5, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77.74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.Visit |

|

| Used By: 20,000,000 Instruments Available: 2000 Stocks Available: 2042 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 50 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 50 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 51% of retail investor accounts lose money when trading CFDs with this provider.Visit |

|

| Used By: 15,000,000 Instruments Available: 10000 Stocks Available: 1731 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 177 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.Visit |

|

| Used By: 10,000 Instruments Available: 15000 Stocks Available: 1000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 55 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 1000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: No Forex Pairs Available: 100 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 0 |

Platforms: MT4, Mac, ZuluTrade, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 4,000,000 Instruments Available: 2200 Stocks Available: 2000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: No Indices: Yes Forex Pairs Available: 67 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your moneyVisit |

|

| Used By: 300,000 Instruments Available: 100 Stocks Available: 0 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 150 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1000 |

Platforms: MT4, MT5, ZuluTrade, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 10 US Stocks: Yes UK Stocks: No German Stocks: No Japanese Stocks: No Indices: Yes Forex Pairs Available: 40 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes Losses can exceed depositsVisit |

|

| Used By: 1,866,000 Instruments Available: 430 Stocks Available: 1700 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 70 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 75.78% of retail investor accounts lose money when trading CFDs and Spread Betting with this providerVisit |

Best NASDAQ Broker NASDAQ Broker Reviews

Read our details broker NASDAQ Broker NASDAQ Broker reviews, you will find something useful if you are shortlisting a NASDAQ Broker NASDAQ Broker and trading platform.

- IC Markets Review (read our in depth reviews)

- Roboforex Review (read our in depth reviews)

- AvaTrade Review (read our in depth reviews)

- FP Markets Review (read our in depth reviews)

- XTB Review (read our in depth reviews)

- Pepperstone Review (read our in depth reviews)

- XM Review (read our in depth reviews)

- eToro Review (read our in depth reviews)

- Trading 212 Review (read our in depth reviews)

- SpreadEx Review (read our in depth reviews)

- Axi Review (read our in depth reviews)

- Markets.com Review (read our in depth reviews)

- Swissquote Review (read our in depth reviews)

- HYCM Review (read our in depth reviews)

- FxPro Review (read our in depth reviews)

NASDAQ Broker NASDAQ Broker Alternatives

Read about and compare NASDAQ Broker NASDAQ Broker alternatives. We have indepth side by side comparisons to help you find NASDAQ Broker NASDAQ Broker related brokers.

- IC Markets Alternatives

- Roboforex Alternatives

- AvaTrade Alternatives

- FP Markets Alternatives

- XTB Alternatives

- Pepperstone Alternatives

- XM Alternatives

- eToro Alternatives

- Trading 212 Alternatives

- SpreadEx Alternatives

- Axi Alternatives

- Markets.com Alternatives

- Swissquote Alternatives

- HYCM Alternatives

- FxPro Alternatives

IC Markets

IC Markets

Roboforex

Roboforex

AvaTrade

AvaTrade

FP Markets

FP Markets

XTB

XTB

Pepperstone

Pepperstone

XM

XM

eToro

eToro

Trading 212

Trading 212

SpreadEx

SpreadEx

Axi

Axi

Markets.com

Markets.com

Swissquote

Swissquote

HYCM

HYCM

FxPro

FxPro