Best European Brokers

Finding the best European broker depends on regulations, fees, and trading platforms. Some top options include IC Markets, eToro, and RoboForex. Doing your research and comparing different brokers before making a decision is recommended.

A European broker is a financial intermediary based in Europe that helps facilitate buying and selling of various financial assets, such as stocks, bonds, currencies, commodities, and derivatives. European brokers can provide access to multiple markets, including the European Union's stock exchanges and international exchanges.

Generally, European brokers must comply with regulations set by the European Securities and Markets Authority (ESMA) and other regulatory bodies in their countries. These regulations protect investors and ensure fair and transparent trading practices. Some key regulations that European brokers must comply with include MiFID II (Markets in Financial Instruments Directive II) and the GDPR (General Data Protection Regulation).

European brokers can offer various services, such as trading platforms, research and analysis, financial services, and portfolio management. They may charge fees or commissions for their services, which can vary depending on the broker and the type of service provided.

Our comprehensive guide to European brokers covers a range of topics, including a detailed comparison of European trading platforms and financial services. We also provide useful information on narrowing down your choices when selecting a European broker.

In addition to discussing the features of European trading tools and funding and withdrawal methods offered by European brokers, we also delve into the costs associated with using a European brokerage firm or trading platform. Our guide provides a clear and informative overview of the factors investors should consider when choosing a European broker.

Best European Brokers Table of Contents

- Understanding European Brokers: A Comprehensive Guide

- What is a European broker?

- How do European brokers differ from brokers in other regions?

- What regulatory bodies oversee European brokers?

- What are the advantages of using a European broker?

- What are the risks associated with using a European broker?

- How do I choose a reputable European broker?

- Benefits of European brokers

- Limits of European brokers

- Opportunities of trading with European brokers

- Things to monitor with European brokers

- What is the process for opening an account with a European broker?

- What do European brokers charge the fees and commissions?

- What types of assets can I trade with a European broker?

- What are the margin requirements for trading with a European broker?

- What are the trading hours for European brokers?

- What minimum deposit is required to open an account with a European broker?

- What types of trading platforms do European brokers offer?

- Can I trade with a European broker if I am not a resident of Europe?

- What are the funding options for my European broker account?

- Are there any restrictions on trading with European brokers?

- How do European brokers handle customer support?

- What is the process for withdrawing funds from a European broker account?

- Do European brokers offer demo accounts for practice trading?

- What are the tax implications of trading with a European broker?

- Are European brokers subject to any other regulations or laws?

- How do I stay informed about changes or regulation updates affecting my trading with a European broker?

- Are European brokers insured against financial losses?

- What is the level of transparency European brokers provide regarding their financial health?

- Can I transfer my account from one European broker to another?

- European brokers verdict

- Best European Brokers List Compared

Understanding European Brokers: A Comprehensive Guide

What is a European broker?

A European broker is a financial intermediary that facilitates the buying and selling various financial assets, such as stocks, bonds, currencies, commodities, and derivatives. European brokers operate in Europe and are regulated by European regulatory bodies.

How do European brokers differ from brokers in other regions?

European brokers differ from brokers in other regions regarding their regulatory frameworks, trading platforms, and asset offerings. For example, European brokers are subject to more stringent regulations than brokers in other regions, which provides greater protection to investors and imposes more restrictions on brokers' activities. Additionally, European brokers typically offer trading platforms that are designed to meet the specific needs of European investors, and they may offer a different range of assets than brokers in other regions.

What regulatory bodies oversee European brokers?

European brokers are overseen by various regulatory bodies, depending on the country in which they are based. Some of the most prominent regulatory bodies include the European Securities and Markets Authority (ESMA), the Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), and the German Federal Financial Supervisory Authority (BaFin).

What are the advantages of using a European broker?

There are several advantages to using a European broker, including

- Greater protection for investors due to stringent regulations

- Access to a wide range of financial instruments

- Advanced trading platforms that cater to the needs of European investors

- Competitive pricing and low fees

- Excellent customer service and support

What are the risks associated with using a European broker?

Although there are many advantages to using a European broker, there are also some risks you must research and understand. These may include:

- The possibility of losing money due to market volatility or trading errors

- The risk of fraud or theft by unscrupulous brokers or hackers

- The risk of account hacking or other security breaches

How do I choose a reputable European broker?

Choosing a reputable European broker can be daunting, but there are several factors to consider when making your decision. Some important considerations include:

- The broker's regulatory status and compliance record

- The range of financial instruments and trading platforms offered

- The broker's pricing structure and fees

- The quality of customer service and support

- The broker's reputation among other investors

Benefits of European brokers

- Strict Regulations: European brokers are subject to strict regulations enforced by the European Securities and Markets Authority (ESMA) and national regulators. European financial regulation ensures that clients' funds are safe and that brokers operate fairly and transparently.

- Strong Infrastructure: European brokers have access to a well-developed financial infrastructure that includes advanced trading platforms, reliable market data, and efficient settlement systems. A strong trading infrastructure allows European brokers to offer their clients a wide range of financial instruments and execute trades quickly and accurately.

- Skilled Workforce: European brokers employ highly skilled professionals, including traders, analysts, and customer service representatives. Skilled customer service ensures that clients receive expert advice and support when needed.

- Diversified Products: European brokers offer a wide range of financial products, including CFDs, ETFs, forex, stocks, and commodities. Great financial instrument selection enables clients to diversify their portfolios and manage risks more effectively.

Limits of European brokers

- Limited Market Access: European brokers are restricted from providing services to clients in certain regions due to regulatory limitations. Certain financial products are limited from some European customer bases and revenue streams due to financial regulations in Europe.

- High Operating Costs: European brokers must comply with strict regulatory requirements and maintain advanced trading technology, which can result in high operating costs. The high costs of highly regulated European brokers can impact their profitability and ability to compete with lower-cost brokers in Europe.

- Complex Compliance: European brokers must comply with a complex web of regulations, including anti-money laundering (AML) and know-your-customer (KYC) requirements. Complex European regulatory compliance can be time-consuming and expensive, requiring significant resources to maintain compliance.

Opportunities of trading with European brokers

- Expansion into Emerging Markets: European brokers can expand their reach by targeting emerging markets in Asia, Africa, and South America. Emerging markets could provide significant growth opportunities for European traders, as these regions have a large and growing population of potential clients.

- Digital Transformation: European brokers can leverage new technologies, such as blockchain and artificial intelligence, to reduce costs, increase efficiency, and improve customer experience. New digital financial products and online trading platforms in Europe could help bring financial trading to newer, tech-driven retail traders.

- Increased Client Demand: The rise of online trading and the growing popularity of cryptocurrencies have created a surge in demand for trading services. European brokers can capitalize on this trend by offering innovative products and services that meet clients' evolving needs.

Things to monitor with European brokers

- Intense competition : European brokers face intense competition from both traditional and newer, tech-driven brokers. Intense competition can result in price pressures and lower profit margins for European traders and trading platforms.

- Regulatory Changes: Changes to regulatory frameworks could impact European brokers' ability to operate and offer certain products and services. Changes in financial regulation could result in significant costs and disruptions to their business operations.

- Cybersecurity Risks: European brokers face the risk of cyberattacks and data breaches, which could result in financial losses and damage to their reputation. Cybersecurity highlights the need for strong cybersecurity measures and risk management practices.

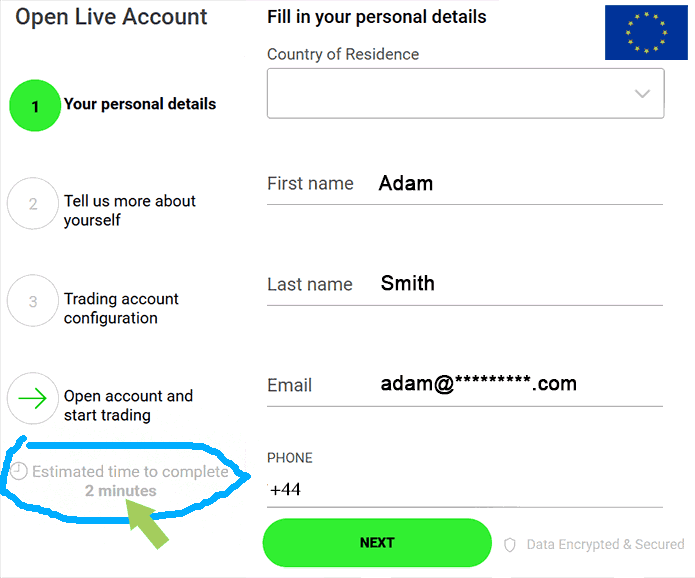

What is the process for opening an account with a European broker?

The process for opening an account with a European broker varies depending on the broker and the type of account you wish to open. However, in general, you will need to provide personal information such as your name, address, contact details, proof of identity, and residency. You may also need to provide information about your financial situation and trading experience. Once you have provided this information and your account has been approved, you will typically need to fund your account before you can start trading.

What do European brokers charge the fees and commissions?

The fees and commissions charged by European brokers vary depending on the broker and your account type. Some brokers may charge a fixed fee per trade, while others charge a percentage of the trade value. Additionally, brokers may charge other fees such as account maintenance, withdrawal, and inactivity fees. It is important to carefully review the broker's fee structure before opening an account to ensure it is competitive and affordable.

What types of assets can I trade with a European broker?

European brokers typically offer a wide range of financial assets for trading, including stocks, bonds, currencies, commodities, and derivatives such as futures and options. Some brokers may specialize in particular asset classes, while others may offer a more diverse range of instruments.

What are the margin requirements for trading with a European broker?

The margin requirements for trading with a European broker will vary depending on the broker, the asset being traded, and the trade size. Margin requirements may be expressed as a percentage of the trade value and are typically higher for more volatile assets. It is important to be aware of margin requirements when trading with a European broker, as failing to maintain sufficient margin may result in the closure of your positions.

What are the trading hours for European brokers?

The trading hours for European brokers will vary depending on the asset being traded and the exchange on which it is listed. However, most European brokers will offer trading during the normal business hours of the major exchanges and pre-market and after-hours trading in some cases.

What minimum deposit is required to open an account with a European broker?

The minimum deposit required to open an account with a European broker will vary depending on the broker and the type of account you wish to open. Some brokers may require a minimum deposit of just a few hundred euros, while others may require a larger deposit of several thousand euros.

What types of trading platforms do European brokers offer?

European brokers typically offer a range of trading platforms to suit the needs of different types of traders. Some of the most popular platforms include MetaTrader 4 and 5, cTrader, and proprietary platforms developed by the broker. These platforms may be available in desktop, web, and mobile versions and may offer a range of tools and features such as charting, technical analysis, and automated trading.

Can I trade with a European broker if I am not a resident of Europe?

Yes, you can trade with a European broker even if you are not a resident of Europe. However, you may need to provide additional documentation to prove your identity and residency, and you may be subject to different tax and regulatory requirements than European residents.

What are the funding options for my European broker account?

European brokers typically offer a range of funding options for your account, including bank transfers, credit and debit cards, and e-wallets like PayPal and Skrill. The availability of funding options may vary depending

Are there any restrictions on trading with European brokers?

There may be certain restrictions on trading with European brokers depending on your location and the regulations in your country. For example, some countries may prohibit trading certain assets, such as derivatives, or require special licenses or permits to trade. It is important to check your country's regulations and ensure that you comply with all applicable laws and regulations.

How do European brokers handle customer support?

European brokers typically offer a range of customer support options, including phone, email, and live chat. Some brokers may offer support in multiple languages to cater to traders from different countries. It is important to check the quality and availability of customer support before choosing a broker, as this can be critical in resolving any issues or questions that may arise.

What is the process for withdrawing funds from a European broker account?

The withdrawal process from a European broker account will vary depending on the broker and the funding method used. You must log in to your account and follow the instructions to initiate a withdrawal. You may be required to provide additional documentation to verify your identity before processing the withdrawal. Withdrawals may be subject to fees and processing times, so it is important to check the terms and conditions of your broker before requesting a withdrawal.

Do European brokers offer demo accounts for practice trading?

Many European brokers offer demo accounts that allow you to practice trading with virtual funds before risking your capital. Demo accounts can be a valuable tool for testing trading strategies and familiarizing yourself with the broker's platform and features.

What are the tax implications of trading with a European broker?

The tax implications of trading with a European broker will depend on your location and the regulations in your country. In general, you may be subject to taxes on any profits earned from trading and may be required to report these profits on your tax return. It is important to consult with a tax professional to understand the tax implications of trading in your country.

Are European brokers subject to any other regulations or laws?

Yes, European brokers are subject to a range of regulations and laws designed to protect traders and ensure the integrity of the financial markets. Some of the key regulatory bodies overseeing European brokers include the European Securities and Markets Authority (ESMA), the Financial Conduct Authority (FCA), and the Cyprus Securities and Exchange Commission (CySEC).

How do I stay informed about changes or regulation updates affecting my trading with a European broker?

It is important to stay informed about changes or updates to regulations that may affect your trading with a European broker. Checking changes in European regulatory law can be done by regularly checking the websites of regulatory bodies such as the ESMA and the FCA and following industry news and developments. Your broker may also provide updates and notifications regarding regulatory changes affecting your trading.

Are European brokers insured against financial losses?

Some European brokers may be insured against financial losses through client fund segregation and compensation schemes. These schemes protect traders if the broker becomes insolvent or cannot fulfil its financial obligations. It is important to check whether your broker offers these protections and to understand the scope and limitations of the coverage before opening an account.

What is the level of transparency European brokers provide regarding their financial health?

European brokers are generally required to provide high transparency regarding their financial health and operations. Broker transparency in Europe may include regular financial reporting, audits by independent accounting firms, and disclosures regarding any conflicts of interest or potential risks to traders. It is important to review this information and understand your broker's financial health before depositing funds or placing trades.

Can I transfer my account from one European broker to another?

It is generally possible to transfer your account from one European broker to another. The process for doing so will vary depending on the brokers involved and the types of accounts being transferred. In general, you will need to provide some basic information about your account and follow the instructions provided by the new broker. It is important to review any fees or charges associated with transferring your account before initiating the transfer.

European brokers verdict

European brokers operate in a highly regulated and competitive environment, which presents opportunities and challenges. To succeed in this market, they must stay up-to-date with regulatory requirements, invest in advanced technology, and provide exceptional customer service.

European brokers offer a wide range of advantages for traders, including access to diverse assets and markets, strong regulatory oversight, and robust customer support options. However, risks are also associated with trading with European brokers, including potential regulatory changes, fees and commissions, and the risks inherent in trading. By conducting thorough research, choosing a reputable broker, and staying informed about regulatory changes, traders can minimize these risks and take advantage of the opportunities offered by European brokers.

Ultimately, the decision to trade with a European broker should be based on a careful evaluation of your trading needs and goals and the specific risks and opportunities associated with trading in the European market. With the right approach and mindset, trading with a European broker can be a rewarding and profitable experience.

Best European Brokers List Compared

| Featured European Broker Trading Platform | Account Features | Trading Features |

|---|---|---|

| Used By: 180,000 Instruments Available: 232 Stocks Available: 2100 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 61 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mirror Trader, ZuluTrade, Web Trader, cTrader, Mac Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 200,000 Instruments Available: 1000 Stocks Available: 99 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 80 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: Web Trader, MT4, MT5, AvaTradeGo, AvaOptions, Mac, Mobile Apps, ZuluTrade, DupliTrade, MQL5 Negative Balance Protection: Inactivity Fee: No 71% of retail CFD accounts lose moneyVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 10000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 60 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, IRESS, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 250,000 Instruments Available: 4000 Stocks Available: 1696 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 57 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 0 |

Platforms: MT4, Mirror Trader, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Visit |

|

| Used By: 89,000 Instruments Available: 100 Stocks Available: 60 US Stocks: No UK Stocks: No German Stocks: Yes Japanese Stocks: No Indices: Yes Forex Pairs Available: 70 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mac, ZuluTrade, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your moneyVisit |

|

| Used By: 10,000,000 Instruments Available: 1000 Stocks Available: 160 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 55 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 5 |

Platforms: MT4, MT5, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77.74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.Visit |

|

| Used By: 20,000,000 Instruments Available: 2000 Stocks Available: 2042 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 50 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 50 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 51% of retail investor accounts lose money when trading CFDs with this provider.Visit |

|

| Used By: 15,000,000 Instruments Available: 10000 Stocks Available: 1731 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 177 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.Visit |

|

| Used By: 10,000 Instruments Available: 15000 Stocks Available: 1000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 55 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 10 US Stocks: Yes UK Stocks: No German Stocks: No Japanese Stocks: No Indices: Yes Forex Pairs Available: 40 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes Losses can exceed depositsVisit |

|

| Used By: 300,000 Instruments Available: 100 Stocks Available: 0 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 150 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1000 |

Platforms: MT4, MT5, ZuluTrade, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 4,000,000 Instruments Available: 2200 Stocks Available: 2000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: No Indices: Yes Forex Pairs Available: 67 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your moneyVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 1000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: No Forex Pairs Available: 100 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 0 |

Platforms: MT4, Mac, ZuluTrade, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 1,866,000 Instruments Available: 430 Stocks Available: 1700 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 70 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 75.78% of retail investor accounts lose money when trading CFDs and Spread Betting with this providerVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 0 US Stocks: No UK Stocks: No German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 45 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

Best European Broker European Broker Reviews

Read our details broker European Broker European Broker reviews, you will find something useful if you are shortlisting a European Broker European Broker and trading platform.

- IC Markets Review (read our in depth reviews)

- AvaTrade Review (read our in depth reviews)

- FP Markets Review (read our in depth reviews)

- XTB Review (read our in depth reviews)

- Pepperstone Review (read our in depth reviews)

- XM Review (read our in depth reviews)

- eToro Review (read our in depth reviews)

- Trading 212 Review (read our in depth reviews)

- SpreadEx Review (read our in depth reviews)

- HYCM Review (read our in depth reviews)

- Swissquote Review (read our in depth reviews)

- Markets.com Review (read our in depth reviews)

- Axi Review (read our in depth reviews)

- FxPro Review (read our in depth reviews)

- Eightcap Review (read our in depth reviews)

European Broker European Broker Alternatives

Read about and compare European Broker European Broker alternatives. We have indepth side by side comparisons to help you find European Broker European Broker related brokers.

- IC Markets Alternatives

- AvaTrade Alternatives

- FP Markets Alternatives

- XTB Alternatives

- Pepperstone Alternatives

- XM Alternatives

- eToro Alternatives

- Trading 212 Alternatives

- SpreadEx Alternatives

- HYCM Alternatives

- Swissquote Alternatives

- Markets.com Alternatives

- Axi Alternatives

- FxPro Alternatives

- Eightcap Alternatives

IC Markets

IC Markets

AvaTrade

AvaTrade

FP Markets

FP Markets

XTB

XTB

Pepperstone

Pepperstone

XM

XM

eToro

eToro

Trading 212

Trading 212

SpreadEx

SpreadEx

HYCM

HYCM

Swissquote

Swissquote

Markets.com

Markets.com

Axi

Axi

FxPro

FxPro

Eightcap

Eightcap