Best DAX Brokers

When selecting the best DAX brokers, certain crucial aspects demand careful consideration. Firstly, check the broker's reputation and regulatory compliance, ensuring they are overseen by recognized financial authorities for investment security. Secondly, assess the fees and commissions associated with DAX index trading, as lower costs can boost potential returns. Thirdly, a diverse range of indices allows for greater flexibility and portfolio diversification.

Fourthly, prioritize brokers with intuitive and stable trading platforms that offer sophisticated market analysis tools. Additionally, seek brokers with ample educational resources like webinars and articles to improve your trading skills and knowledge. Lastly, evaluate the quality of the broker's customer service, as prompt and effective support is invaluable in resolving issues.

Remember that DAX index trading comes with inherent risks, necessitating a careful strategy and risk management approach. Armed with these considerations, embark on your DAX trading journey and aim for successful and secure investments.

Best DAX Brokers Table of Contents

- Exploring the World of DAX Brokers: Unleashing the Potential of German Markets

- Understanding the DAX Index

- Choosing the Ideal DAX Broker:

- Trading Conditions:

- Market Access and Asset Variety:

- Best DAX Trading Platforms (Germany 40)

- DAX Index Calculation

- What is the difference between GER40 and DAX?

- Factors that influence the overall DAX 30 index price

- Advantages of trading the DAX Index

- How DAX Trading Works for Traders and Brokers

- For Traders and Brokers:

- DAX Index and DAX Brokers

- DAX spread betting

- What Causes The DAX Index's Price To Move?

- The best DAX trading platforms

- Dax Trading versus Dax Investing

- Reputable DAX Index Brokers

- Alternative indices for DAX (Germany 40) traders

- Funding methods

- Account Types

- DAX Brokers Verdict

- Best DAX Brokers List Compared

Exploring the World of DAX Brokers: Unleashing the Potential of German Markets

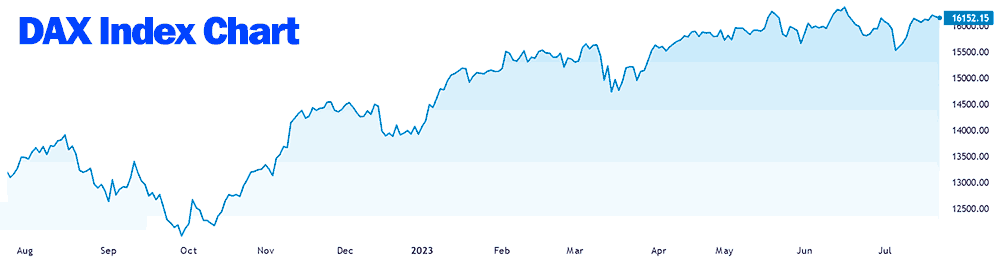

The German stock market index DAX is prominent in the global financial landscape. Choosing the right DAX broker becomes crucial as investors seek opportunities in Germany's robust economy.

In this article, we dive into the realm of DAX brokers, uncovering the key considerations and features of trading brokers that can help you make an informed decision. Trading CFDs with DAX trading brokers is a high risk because of the leverage used. It would help you to understand what you are doing with trading the DAX stock index. When trading the DAX with CFD trading, traders risk losing money rapidly due to high-risk leverage.

Understanding the DAX Index

The DAX Index, also known as the Deutscher Aktienindex, is a benchmark stock market index representing the performance of Germany's 30 most significant and most liquid firms on the Frankfurt Stock Exchange. It includes a diverse range of sectors and is weighted by market capitalization.

The DAX is widely regarded as an essential indicator of the German economy and serves as a reference point for investors and traders looking to gauge the overall performance of the German stock market.

The composition of the DAX index consists of blue-chip companies that have a significant impact on its movements. These include renowned German corporations from various sectors, such as automotive (Volkswagen, BMW) and pharmaceutical companies. (Bayer, Siemens Healthineers), technology (SAP, Infineon), and financial services (Deutsche Bank, Allianz).

The DAX index is calculated using a market capitalization-weighted methodology, where each constituent company's stock prices and the number of shares are considered.

Factors influencing its fluctuations include changes in the companies' market cap and stock prices, corporate earnings reports, macroeconomic data, global market trends, and investor sentiment toward the German economy.

Choosing the Ideal DAX Broker:

Choosing the ideal DAX broker involves considering several factors. Look for a broker that offers direct access to DAX trading, competitive spreads, reliable execution, robust trading platforms, regulatory compliance, strong customer support, and suitable account types. Tailor your choice based on your trading goals, risk tolerance, and preferred features.

Regulatory Compliance: Highlight the importance of selecting brokers regulated by reputable authorities like BaFin or the European Securities and Markets Authority (ESMA).

Selecting brokers regulated by reputable authorities like BaFin or ESMA ensures regulatory compliance and investor protection. These regulatory bodies impose strict standards, including capital requirements for retail investor accounts, client fund segregation for retail investor accounts and fair trading practices

Trading Platforms: Explore the trading platforms offered by DAX brokers, emphasizing the need for user-friendly interfaces, advanced charting tools, high risk, and high risk but reliable order execution.

DAX brokers offer trading platforms that cater to the needs of traders. User-friendly interfaces, advanced charting tools, and reliable order execution are essential features to consider. A well-designed platform enhances the trading experience provides in-depth market analysis and ensures smooth and efficient execution of trades on the DAX index.

Trading Conditions:

Spread and Commissions: Compare DAX brokers' competitive spreads and transparent commission structures.

When choosing a DAX broker, comparing the competitive spreads and transparent commission structures they offer is essential. Low spreads reduce trading costs, while transparent commissions ensure clear pricing. Evaluating these factors helps traders optimize their profitability and cost-efficiency when trading the DAX index.

Leverage and Margin: Discuss the leverage options available, considering your risk tolerance and trading strategy.

DAX brokers provide leverage options that allow traders to amplify their trading positions. It's importConsideringtolerance and trading strategy when utilizing leverage is important. Higher leverage increases potential profits but also magnifies losses. Careful risk management and understanding the potential impact of leverage are crucial for successful DAX trading.

Order Types: Examine the range of order types supported, such as market orders, limit orders, and stop orders.

Order types refer to the various ways in which investors can place trades. Market orders allow buying or selling at the prevailing market price, while limit orders set a specific price for execution. Stop orders trigger a trade when a specific price is reached. Brokers support these and additional order types to cater to different trading strategies and preferences.

Market Access and Asset Variety:

DAX Futures and CFDs: Discuss the availability of DAX futures contracts and Contracts for Difference (CFDs) for trading the index.

DAX futures contracts and Contracts for Difference (CFDs) offer traders the opportunity to trade the DAX index. DAX futures contracts can allow for the purchase or sale of the index at a predetermined price and date in the future. CFDs provide a flexible alternative, enabling traders to speculate on the price movements of the DAX index without owning the underlying asset.

Best DAX Trading Platforms (Germany 40)

Several trading platforms cater to DAX (Germany 40) trading, offering robust features and user-friendly interfaces. The best platforms include MetaTrader 4 and 5, IC Markets, social trading with eToro and XTB. These platforms typically provide access to real-time market data, advanced charting tools, order types, risk management features, and mobile trading options to facilitate efficient DAX trading in Germany.

DAX Index Calculation

The DAX index is calculated using a market capitalization-weighted methodology. It comprises the 30 most significant and liquid companies on the Frankfurt Stock Exchange. Each company's weight in the index is determined by its market capitalization, with higher-weighted companies having a more significant influence on its movements.

To invest in the DAX 40, you can consider purchasing exchange-traded funds (ETFs) or mutual funds that track the index's performance. Alternatively, you may directly invest in individual stocks of DAX-listed companies through a brokerage account, considering your investment goals, risk tolerance, and diversification strategy.

What is the difference between GER40 and DAX?

GER40 and DAX are two different names used to refer to the same index, namely the German stock market index. DAX (Deutscher Aktienindex) is the official name for the index, while GER40 is an alternative name or symbol used by some trading platforms or financial providers to represent the DAX index.

Therefore, there is no actual difference between GER40 and DAX; they both represent the same underlying index tracking the performance of the German stock market.

Factors that influence the overall DAX 30 index price

The overall DAX 30 index price is influenced by several factors, with most indices including:

-

Company Earnings: The financial performance and earnings of the 30 constituent companies impact the index. Positive earnings reports can increase the index, while poor earnings can lead to declines.

-

Macroeconomic Data: Economic indicators such as GDP growth, inflation rates, employment data, and consumer sentiment affect the overall market sentiment and can influence the DAX 30 index.

-

Global Market Trends: Developments in international markets, including geopolitical events, global economic trends, and shifts in investor sentiment, can have an impact on the DAX 30 index.

-

Interest Rates: Changes in interest rates set by central banks can affect borrowing costs, corporate profitability, and investor behaviour, ultimately impacting the DAX 30 index.

-

Currency Fluctuations: As the DAX 30 index is denominated in euros, fluctuations in the euro exchange rate against other currencies can affect the index, particularly for companies with significant foreign operations.

-

Market Sentiment and Investor Confidence: Investor sentiment, market volatility, and overall risk appetite can influence buying and selling decisions, impacting the DAX 30 index.

-

Corporate News and Events: Major announcements, mergers and acquisitions, product launches, or legal issues affecting individual companies within the DAX 30 index can impact the overall price.

It's important to note that these factors interact, and a complex interplay of multiple economic and market variables influences the DAX 30 index.

Advantages of trading the DAX Index

Trading the DAX index offers several advantages:

Broad Market Exposure: The DAX index represents Germany's 30 most significant and liquid companies' performance. By trading the DAX, investors can gain exposure to various industries and sectors within the German economy.

Volatility and Liquidity: The DAX index is known for its volatility, providing opportunities for traders to profit from price fluctuations. Additionally, the index is highly liquid, meaning there is ample trading volume, tight spreads, and ease of executing trades.

Trading Opportunities: The DAX index is influenced by various factors, including economic data, corporate earnings, and global market trends. The DAX creates numerous trading opportunities, particularly for day traders and short-term traders who seek to capitalize on price movements.

Efficient Markett: The DAX is among the most well-regulated and transparent markets globally. It operates on a reliable trading infrastructure, with access to real-time market data and efficient order execution.

Trading Instruments: The DAX index can be done through various financial instruments, such as futures contracts, Contracts for Difference (CFDs), and exchange-traded funds (ETFs).

Diversification: Including the DAX index in a portfolio can help diversify investment holdings. Adding exposure to German equities, traders can reduce risk by spreading investments across different markets and sectors.

How DAX Trading Works for Traders and Brokers

DAX trading involves both traders and brokers in a collaborative process:

For Traders and Brokers:

-

Market Access: Brokers provide traders access to the DAX market by offering DAX CFDs or futures contracts.

-

Trading Platform: Brokers develop and maintain trading platforms that enable traders to access real-time DAX prices, place orders, and manage their positions.

-

Order Execution: Brokers execute traders' orders in the market to achieve the best possible price and efficient order filling.

-

Risk Management and Compliance: Brokers implement risk management systems to ensure the stability of their platforms and adherence to regulatory requirements. They may set leverage limits and margin requirements and monitor trading activities to mitigate risks.

DAX Index and DAX Brokers

The DAX index, also known as the Deutscher Aktienindex, is a benchmark stock market index representing the performance of Germany's 30 most significant and most liquid firms on the Frankfurt Stock Exchange.

DAX brokers are brokerage firms or platforms that provide access to trade the DAX index. These brokers typically offer various financial instruments such as DAX futures contracts, Contracts for Difference (CFDs), or exchange-traded funds (ETFs) linked to the DAX index. They provide traders with the necessary tools, trading platforms, and market access for DAX trading.

DAX spread betting

DAX spread bets, or spread betting, is a financial derivative product that enables traders to speculate on the price movements of the DAX index without owning the underlying assets. It is a form of financial call spread bets or betting where traders can take positions on whether the DAX index will rise or fall.

When spread betting on the DAX, traders place bets on the index's price movement. The spread betting provider quotes a bid and asks price, and traders can choose to go long (buy) if they believe the DAX will rise or go short (sell) if they anticipate a decline. The fluctuation between the opening and closing prices of the position determines the profit or loss.

What Causes The DAX Index's Price To Move?

The DAX Index is a stock market index representing the 30 most significant and actively traded companies and firms listed on the Frankfurt Stock Exchange in Germany. Several factors can affect the DAX Index price, including:

-

Company earnings: The performance and earnings of the individual companies within the DAX Index can significantly influence the index's price. Positive earnings reports or better-than-expected financial results from DAX-listed companies generally increase the index's value, while disappointing earnings can result in a decline.

-

Macroeconomic indicators: Economic data and indicators such as GDP growth, inflation rates, interest rates, and employment figures can impact the DAX Index. Positive economic news often leads to increased investor confidence and higher stock prices, while harmful economic data can cause a decrease in the index.

-

Global market trends: Global market trends and sentiments can influence the DAX Index. Factors such as geopolitical events, trade disputes, changes in global commodity prices, and market reactions to news from other major economies can impact the index.

-

Monetary policy decisions: The actions and statements of central banks, notably the European Central Bank (ECB), can influence the DAX Index. Interest rate changes, quantitative easing measures, or shifts in monetary policy can impact investor sentiment and affect the index's movement.

-

Currency fluctuations: As the DAX Index is denominated in euros, the euro's value against other major currencies can affect the index's price. A weaker euro can boost the competitiveness of DAX-listed companies, potentially leading to higher stock prices.

The best DAX trading platforms

Some popular platforms for DAX trading include MetaTrader, IC Markets, RoboForex, XTB and eToro. These platforms often offer a range of features, including charting tools, real-time market data, and order execution capabilities, to assist traders in making informed decisions.

However, it's essential to thoroughly review and compare platforms based on your specific requirements and preferences before deciding.

Dax Trading versus Dax Investing

DAX Trading: Trading involves actively buying and selling DAX contracts or derivatives within shorter timeframes, aiming to profit from short-term price fluctuations. Traders use technical analysis, chart patterns, and market indicators to make trading decisions.

DAX Investing: on the other hand, investing involves taking a longer-term perspective and buying DAX-related assets to hold them for an extended period. Investors focus on the fundamentals of the DAX constituent companies, economic trends, and long-term growth prospects.

Reputable DAX Index Brokers

When looking for reputable DAX index brokers for trading online, consider the following checklist best broker name:

Regulation: Ensure the financial services provider or is well regulated with multiple international financial regulators, such as financial services authority such as the British FCA or the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) in Germany.

Trading Platforms: Assess the broker's trading platform options. Look for user-friendly interfaces, advanced charting tools, order execution capabilities, and access to real-time market data.

DAX Market Access: Verify that the broker offers direct access to trade DAX CFDs, futures contracts, or DAX-related instruments.

Competitive Spreads and Fees: Compare spreads, commissions, overnight financing costs, and any additional fees charged by the broker to ensure they are competitive and transparent.

DAX Broker Support: Consider customer support availability with your DAX index trading platform. Look for live chat, email, and phone support availablity.

Through this checklist, you can assess and compare different brokers to find a reputable one that meets your specific requirements for trading the DAX index online.

Alternative indices for DAX (Germany 40) traders

Several other major indices and options are available for traders looking for alternative indices to DAX (Germany 40) trading. Here are a few notable other indices that can provide exposure to different financial markets or sectors:

EURO STOXX 50: This index represents the performance of 50 large-cap European companies from 18 Eurozone countries. It includes companies from different sectors and is considered a benchmark for the Eurozone equity market.

S& P 500: The S& P 500 index comprises 500 large-cap companies listed on US stock exchanges. It is a benchmark for the overall US stock market and includes companies from various sectors.

FTSE 100: The FTSE 100 index represents the 100 largest companies on the London Stock Exchange. It exposes the UK equity market and includes companies from diverse sectors.

CAC 40: The CAC 40 index follows the performance of the 40 largest companies listed on Euronext Paris. It represents the French equity market and covers various sectors.

Nikkei 225: The Nikkei 225 index is a primary stock market index for the Tokyo Stock Exchange, representing the performance of 225 large-cap Japanese companies.

NASDAQ 100: The NASDAQ 100 index consists of 100 non-financial companies listed on the NASDAQ stock exchange. It focuses on technology and growth-oriented sectors.

Funding methods

Funding methods for trading accounts vary among brokers but commonly include bank transfers, credit/debit cards, e-wallets like PayPal or Skrill, cryptocurrencies, and local payment methods. When choosing a broker, traders should consider the availability, convenience, high risk, fees, and processing times associated with each funding method.

When it comes to funding your trading broker account to lose money in the account, brokers typically offer various methods for depositing and withdrawing funds from trading accounts lose money broker.

Account Types

Account types offered by brokers vary but commonly include standard, mini/micro, VIP/premium, Islamic (swap-free), demo accounts, and managed accounts. Each account type has specific features, minimum deposit requirements, and benefits tailored to meet traders' diverse needs and preferences. Choose a trading account type that suits your goals and risk tolerance.

Navigating the world of DAX brokers requires careful consideration of factors like regulation, trading platforms, trading conditions, market access, research tools, and customer support.

By selecting a reputable and suitable DAX broker, you can unlock the potential of German markets and seize the opportunities DAX index trading presents.

DAX Brokers Verdict

By choosing a DAX broker, traders gain access to a diverse array of financial instruments, including stocks, indices, commodities, and currencies. This wide range of options allows for greater flexibility in trading strategies and diversifying portfolios. Furthermore, DAX brokers often provide advanced trading platforms with state-of-the-art tools and technologies, enabling traders to execute trades efficiently, access real-time market data, and implement advanced charting and analysis techniques.

DAX brokers serve as essential platforms for traders interested in participating in the German financial market, explicitly trading the DAX index. These brokers offer a range of advantages that cater to individual and institutional traders, allowing them to capitalize on the opportunities presented by one of the world's most influential stock market indices.

The liquidity and stability of the DAX make it an attractive index for both short-term and long-term traders. DAX brokers facilitate swift order execution and competitive spreads, ensuring traders can capitalize on price movements and benefit from intraday volatility. Additionally, trading derivatives and employing leverage allows traders to amplify their exposure and potentially enhance their profitability. However, it's essential to consider the associated risks and exercise prudent risk management.

Furthermore, DAX brokers typically offer comprehensive research and analysis resources, including market news, expert insights, and economic calendars. These tools assist traders in staying informed about market trends, corporate announcements, and macroeconomic events that can impact DAX performance. Such knowledge is invaluable in making well-informed trading decisions and effectively managing risk.

However, traders must consider certain factors when choosing a DAX broker. These include evaluating the broker's regulatory compliance, reputation, customer support, trading costs, and available trading platforms. Additionally, traders should understand the potential risks associated with trading the DAX, such as market volatility, economic uncertainties, and geopolitical events that can significantly impact index performance.

DAX brokers allow traders to access the German financial market and trade the highly influential DAX index. Through their comprehensive offerings, advanced trading platforms, and research resources, DAX brokers empower traders to take advantage of the market's potential and navigate the complexities of trading. By carefully selecting a reputable DAX broker and employing sound trading strategies, traders can capitalize on the opportunities presented by the DAX and potentially achieve their financial goals.

Best DAX Brokers List Compared

| Featured DAX Index Broker Trading Platform | Account Features | Trading Features |

|---|---|---|

| Used By: 180,000 Instruments Available: 232 Stocks Available: 2100 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 61 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mirror Trader, ZuluTrade, Web Trader, cTrader, Mac Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 53 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 35 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 10 USD / 10 EUR |

Platforms: MT4, MT5, Mac, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 200,000 Instruments Available: 1000 Stocks Available: 99 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 80 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: Web Trader, MT4, MT5, AvaTradeGo, AvaOptions, Mac, Mobile Apps, ZuluTrade, DupliTrade, MQL5 Negative Balance Protection: Inactivity Fee: No 71% of retail CFD accounts lose moneyVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 10000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 60 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, IRESS, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 250,000 Instruments Available: 4000 Stocks Available: 1696 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 57 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 0 |

Platforms: MT4, Mirror Trader, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Visit |

|

| Used By: 89,000 Instruments Available: 100 Stocks Available: 60 US Stocks: No UK Stocks: No German Stocks: Yes Japanese Stocks: No Indices: Yes Forex Pairs Available: 70 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mac, ZuluTrade, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your moneyVisit |

|

| Used By: 10,000,000 Instruments Available: 1000 Stocks Available: 160 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 55 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 5 |

Platforms: MT4, MT5, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77.74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.Visit |

|

| Used By: 20,000,000 Instruments Available: 2000 Stocks Available: 2042 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 50 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 50 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 51% of retail investor accounts lose money when trading CFDs with this provider.Visit |

|

| Used By: 15,000,000 Instruments Available: 10000 Stocks Available: 1731 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 177 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.Visit |

|

| Used By: 10,000 Instruments Available: 15000 Stocks Available: 1000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 55 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 1000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: No Forex Pairs Available: 100 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 0 |

Platforms: MT4, Mac, ZuluTrade, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 4,000,000 Instruments Available: 2200 Stocks Available: 2000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: No Indices: Yes Forex Pairs Available: 67 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your moneyVisit |

|

| Used By: 300,000 Instruments Available: 100 Stocks Available: 0 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 150 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1000 |

Platforms: MT4, MT5, ZuluTrade, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 10 US Stocks: Yes UK Stocks: No German Stocks: No Japanese Stocks: No Indices: Yes Forex Pairs Available: 40 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes Losses can exceed depositsVisit |

|

| Used By: 1,866,000 Instruments Available: 430 Stocks Available: 1700 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 70 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 75.78% of retail investor accounts lose money when trading CFDs and Spread Betting with this providerVisit |

Best DAX Index Broker DAX Index Broker Reviews

Read our details broker DAX Index Broker DAX Index Broker reviews, you will find something useful if you are shortlisting a DAX Index Broker DAX Index Broker and trading platform.

- IC Markets Review (read our in depth reviews)

- Roboforex Review (read our in depth reviews)

- AvaTrade Review (read our in depth reviews)

- FP Markets Review (read our in depth reviews)

- XTB Review (read our in depth reviews)

- Pepperstone Review (read our in depth reviews)

- XM Review (read our in depth reviews)

- eToro Review (read our in depth reviews)

- Trading 212 Review (read our in depth reviews)

- SpreadEx Review (read our in depth reviews)

- Axi Review (read our in depth reviews)

- Markets.com Review (read our in depth reviews)

- Swissquote Review (read our in depth reviews)

- HYCM Review (read our in depth reviews)

- FxPro Review (read our in depth reviews)

DAX Index Broker DAX Index Broker Alternatives

Read about and compare DAX Index Broker DAX Index Broker alternatives. We have indepth side by side comparisons to help you find DAX Index Broker DAX Index Broker related brokers.

- IC Markets Alternatives

- Roboforex Alternatives

- AvaTrade Alternatives

- FP Markets Alternatives

- XTB Alternatives

- Pepperstone Alternatives

- XM Alternatives

- eToro Alternatives

- Trading 212 Alternatives

- SpreadEx Alternatives

- Axi Alternatives

- Markets.com Alternatives

- Swissquote Alternatives

- HYCM Alternatives

- FxPro Alternatives

IC Markets

IC Markets

Roboforex

Roboforex

AvaTrade

AvaTrade

FP Markets

FP Markets

XTB

XTB

Pepperstone

Pepperstone

XM

XM

eToro

eToro

Trading 212

Trading 212

SpreadEx

SpreadEx

Axi

Axi

Markets.com

Markets.com

Swissquote

Swissquote

HYCM

HYCM

FxPro

FxPro