cTrader Vs MT4

cTrader and MT4 are popular trading platforms but differ in several ways. cTrader has a modern, user-friendly interface, while MT4 has a more traditional interface that traders customize with various plugins and add-ons. cTrader does not offer a market depth of display, Multi-terminal trading, while MT4 does. cTrader uses a Straight Through Processing (STP) model, while MT4 uses a dealing desk model.

cTrader Vs MT4 Table of Contents

- What are the key differences between cTrader and MT4?

- How do cTrader and MT4 ensure the security of user data and funds?

- What types of analysis tools are available on cTrader and MT4?

- How do cTrader and MT4 provide market data and news to traders?

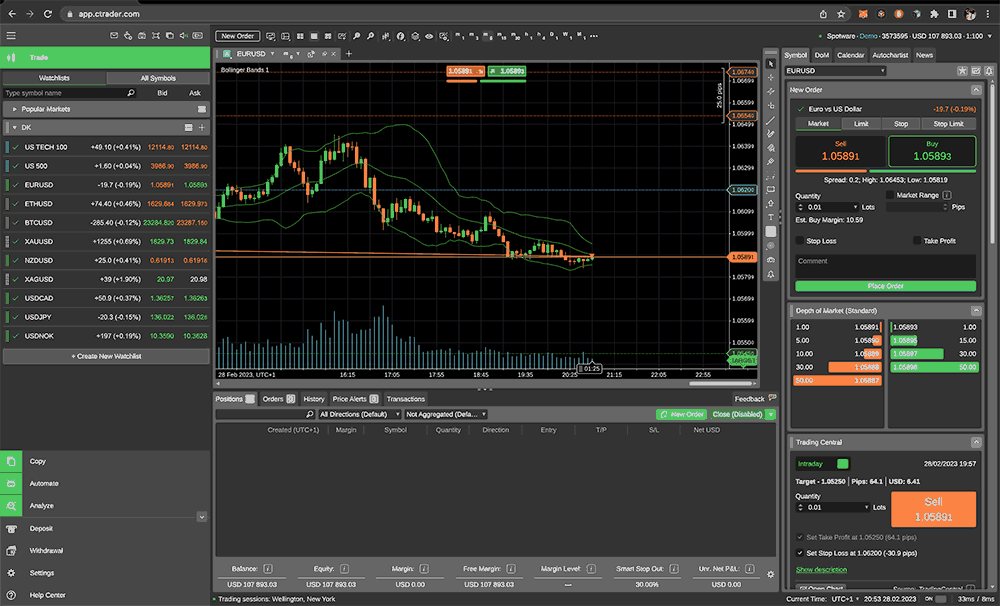

- cTrader Interface & UI

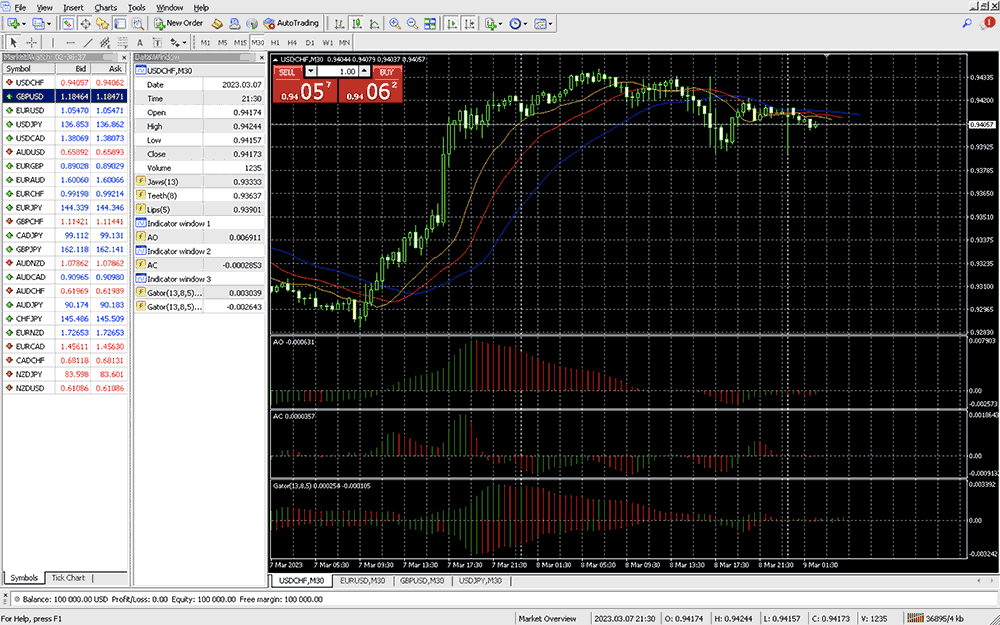

- MT4 Interface & UI

- How do cTrader and MT4 handle order execution and trade settlement?

- How do cTrader and MT4 compare to other trading platforms in terms of pricing and features?

- What is the user interface like for cTrader and MT4?

- How easy is it to learn and use cTrader and MT4 for beginners?

- What customization options are available on cTrader and MT4?

- cTrader:

- MT4:

- Can cTrader and MT4 be used on mobile devices?

- What is the level of automation and algorithmic trading support on cTrader and MT4?

- What is the outlook for the future of cTrader and MT4 in the trading platform market?

- What financial instruments can be traded on cTrader and MT4?

- What are the fees and commissions associated with trading on cTrader and MT4?

- What is the minimum investment required to start trading on cTrader and MT4?

- What are the trading hours for cTrader and MT4?

- Do cTrader and MT4 offer demo accounts or educational resources for new traders?

- How do cTrader and MT4 handle disputes or complaints from traders?

- What are the withdrawal and deposit options for cTrader and MT4?

- What is the customer support like for cTrader and MT4?

- How to do cTrader and MT4 comply with regulatory requirements for financial trading?

- What is the policy on insider trading and other forms of market manipulation for cTrader and MT4?

- cTrader Vs MT4 List Compared

cTrader and MT4 are electronic trading platforms traders use to execute trades in the financial markets. Various brokerage firms provide these platforms to their clients and allow traders to access a range of financial instruments, including currencies, stocks, commodities, and indices.

cTrader is a trading platform developed by Spotware Systems, while MT4 (MetaTrader 4) is a platform developed by MetaQuotes Software. Both platforms offer various tools and features to help traders make informed trading decisions, including charting tools, technical indicators, and news feeds.

| Feature | cTrader | MT4 |

|---|---|---|

| User interface | Modern, user-friendly interface with advanced charting tools and customizable layouts | Traditional customizable interface that with various trading plugins and add-ons |

| Order execution model | Straight-through processing (STP) model | Dealing desk model |

| Order types | Limit orders, stop orders, market orders, and more | Primarily market and pending orders |

| Analysis tools | Advanced charting tools, technical indicators, and news feeds | Charting tools, technical indicators, and news feeds |

| Customization options | Customizable charting tools, order management tools, and layout options | Customizable with various plugins and add-ons |

| Regulatory compliance | Designed to comply with various regulatory requirements for financial trading | Designed to comply with various regulatory requirements for financial trading |

| Customer support | Varies depending on the brokerage firm offering the platform | Varies depending on the brokerage firm offering the platform |

| Market depth display | No | Yes |

| Multi-terminal trading | No | Yes |

| Automated risk management | No | Yes |

| Market depth display | No | Yes |

| Expert Advisors (EAs) | Yes | Yes |

| Custom indicators | Yes | Yes |

| Backtesting | Yes | Yes |

| Hedging | Yes | Yes |

| One-click trading | Yes | Yes |

| Trailing stops | Yes | Yes |

| Multi-currency support | Yes | Yes |

| Advanced charting | Yes | Yes |

| News alerts | Yes | Yes |

| Custom scripts | Yes | Yes |

| Multiple order types | Yes | Yes |

| Time-based trading | Yes | Yes |

| Depth of market (DOM) | Yes | Yes |

| VPS hosting | Yes | Yes |

| Trade copying | Yes | Yes |

| Multiple timeframes | Yes | Yes |

| Strategy tester | Yes | Yes |

What are the key differences between cTrader and MT4?

The user interface is one key difference between cTrader and MT4. cTrader has a more modern and intuitive interface, with features such as advanced charting and order management tools. In contrast, MT4 has a more traditional basic interface that users customize with plugins.

Another difference is the order execution model. cTrader uses a straight-through processing (STP) model, which ensures that orders are executed directly with liquidity providers. In contrast, MT4 uses a dealing desk model, which involves orders being executed through the broker's dealing desk.

cTrader also offers a wider range of order types, including limit orders, stop orders, and market orders, while MT4 primarily offers market and pending orders.

How do cTrader and MT4 ensure the security of user data and funds?

Both cTrader and MT4 take security very seriously and have implemented various measures to ensure the safety of user data and funds.

cTrader uses 128-bit SSL encryption to protect all data transmitted between the platform and users' devices, which helps to prevent unauthorized access to sensitive information. Additionally, cTrader stores user data on secure servers in data centres protected by advanced security measures, including firewalls, intrusion detection systems, and 24/7 monitoring.

MT4 also uses 128-bit SSL encryption to protect all data transmitted between the platform and users' devices. The platform also stores user data on secure servers in data centres protected by advanced security measures, including firewalls, intrusion detection systems, and 24/7 monitoring. Additionally, MT4 offers two-factor authentication (2FA) as an optional security feature, which adds an extra layer of protection to user accounts.

Both cTrader and MT4 are also regulated by reputable financial authorities, which helps ensure they follow strict security and privacy standards. Additionally, brokers offering cTrader and MT4 must comply with various regulatory requirements, including segregating client funds and regular financial reporting.

Overall, both cTrader and MT4 have implemented various security measures to protect user data and funds and are regulated by reputable financial authorities to ensure that they operate following strict security and privacy standards.

What types of analysis tools are available on cTrader and MT4?

cTrader and MT4 offer various analysis tools to help traders make informed decisions.

cTrader offers a comprehensive set of charting tools, including over 70 technical indicators and drawing tools. The platform also offers advanced charting capabilities, such as multiple timeframes, custom timeframes, and the ability to view multiple charts simultaneously. Additionally, cTrader offers a range of chart types, including candlestick, bar, line, and Renko charts.

MT4 also offers a comprehensive set of charting tools, including over 30 built-in technical indicators and drawing tools. The platform also offers advanced charting capabilities, such as multiple timeframes, custom timeframes, and the ability to view multiple charts simultaneously. Additionally, MT4 offers a range of chart types, including candlestick, bar, line, and point and figure charts.

Both cTrader and MT4 offer the ability to use custom indicators and strategies, which can be created using the platforms' respective programming languages (cAlgo for cTrader and MQL4 for MT4). Allowing traders to develop and use their unique trading tools and strategies.

Besides charting and technical analysis tools, both platforms offer a range of fundamental analysis tools, including economic calendars and news feeds, to help traders stay up-to-date with market news and events.

Overall, both cTrader and MT4 offer a comprehensive set of analysis tools to help traders make informed trading decisions, with each platform offering its unique strengths and capabilities.

How do cTrader and MT4 provide market data and news to traders?

cTrader and MT4 offer access to real-time market data and news feeds from various sources. Financial data to inform trading decisions and monitor market conditions.

cTrader and MT4 provide market data and news to traders through various channels.

Both platforms offer real-time quotes and charts, which provide traders with up-to-date information on price movements and market trends. Additionally, both platforms offer a range of technical indicators used to analyze market data and identify potential trading opportunities.

Regarding news and analysis, both cTrader and MT4 offer integrated news feeds and economic calendars, which provide traders with the latest market news and economic data. These features can help traders stay up-to-date with the latest developments in the financial markets and make more informed trading decisions.

Many brokers that offer cTrader and MT4 also provide their client's access to third-party research and analysis tools, including news feeds, research reports, and market analysis tools. Providing traders with additional insights and helping them make more informed trading decisions.

cTrader Interface & UI

MT4 Interface & UI

How do cTrader and MT4 handle order execution and trade settlement?

Both cTrader and MT4 use an Electronic Communication Network (ECN) to execute trades and settle transactions. An ECN is a computerized system that automatically matches buy and sell orders for financial instruments in real time without needing a centralized exchange.

In cTrader, orders are executed and settled directly with liquidity providers, which ensures fast and reliable order execution. The platform also offers a range of order types, including market, limit, stop, and trailing stop orders, as well as the ability to set take profit and stop loss levels. Trades are settled in real-time, with funds and securities exchanged between counterparties.

MT4 also uses an ECN to execute trades and settle transactions, with orders routed directly to liquidity providers for execution. The platform offers a range of order types, including market, limit, stop, and trailing stop orders, and the ability to set take profit and stop loss levels. Trades are settled in real-time, with funds and securities exchanged between counterparties.

Both cTrader and MT4 use a Straight Through Processing (STP) system, which ensures that orders are processed quickly and accurately, with minimal delays or errors. Helping to ensure that traders receive fair prices and that trades are executed at the best available prices in the market.

Both cTrader and MT4 offer reliable and efficient order execution and trade settlement processes, which helps to ensure that traders can execute their trades quickly and accurately without experiencing delays or errors.

How do cTrader and MT4 compare to other trading platforms in terms of pricing and features?

Regarding pricing, both cTrader and MT4 offer similar pricing structures, with many brokers offering the platforms for free or with a small monthly fee. Some brokers may also offer discounted pricing for traders who meet certain trading volumes or deposit requirements.

Regarding features, cTrader and MT4 offers a comprehensive set of tools and features that make them popular choices for traders. However, each platform has its strengths and weaknesses.

cTrader is known for its advanced charting capabilities and user-friendly interface. The platform also offers advanced order types, algorithmic trading options, and the ability to trade various asset classes. Additionally, cTrader offers an extensive library of custom indicators and trading robots that can be created using its cAlgo programming language.

MT4, on the other hand, is known for its wide range of third-party plugins and tools, including custom indicators, EAs, and risk management tools. The platform also offers advanced charting capabilities, algorithmic trading options, and the ability to trade various asset classes. MT4 offers a built-in strategy tester that allows traders to backtest their EAs and optimize their performance.

Compared to other trading platforms, cTrader and MT4 are among the most comprehensive and feature-rich platforms available. However, other platforms, such as MetaTrader 5, TradingView, and NinjaTrader, also offer a range of advanced features and tools that may be better suited to certain traders' needs. It ultimately depends on each trader's preferences and style to determine which platform fits best.

What is the user interface like for cTrader and MT4?

cTrader and MT4 have different user interfaces. cTrader's modern, user-friendly interface offers advanced charting tools, order management, and customizable layouts. MT4, on the other hand, has a more traditional interface that can be customized with various plugins and add-ons to suit the trader's preferences.

How easy is it to learn and use cTrader and MT4 for beginners?

The ease of learning and using cTrader and MT4 will depend on the individual trader's experience and knowledge of the financial markets. Both platforms offer a range of educational resources and tutorials to help new traders learn the basics of trading and familiarize themselves with the platform.

Learning to use cTrader and MT4 for beginners can be challenging, as both platforms offer a wide range of features and tools that can take some time to fully understand. However, with some practice and dedication, beginners can use these platforms proficiently.

cTrader's user-friendly interface and intuitive design make it relatively easy for beginners to navigate the platform and execute trades. The platform also offers a range of educational resources, including video tutorials, user guides, and webinars, that can help beginners learn how to use the platform effectively.

MT4, on the other hand, has a steeper learning curve, as the platform offers a more complex set of tools and features. However, the platform also offers a range of educational resources, including a user guide, video tutorials, and online courses, that can help beginners learn how to use the platform effectively.

To make it easier for beginners, many brokers have practise demo accounts on cTrader and MT4. These demo accounts can be a useful tool for beginners to familiarize themselves with the platforms and develop their trading skills before trading with real money.

Overall, while learning to use cTrader and MT4 for beginners can be challenging, with some practice and dedication, beginners can become proficient in using these platforms and develop their trading skills over time.

What customization options are available on cTrader and MT4?

cTrader and MT4 offer a range of customization options to allow traders to personalize their trading experience. These may include customizable charting tools, order management tools, and layout options.

Both cTrader and MT4 offer customization. Here are some of the customization options available on each platform:

cTrader:

- Customizable workspace layout, allowing traders to move and resize panels, charts, and indicators

- Advanced charting capabilities, with over 70 built-in technical indicators and drawing tools

- Custom indicators can be created using cTrader's cAlgo coding language

- Advanced order types, including market, limit, stop, and trailing stop orders

- Algorithmic trading options, with cTrader's cAlgo platform offering an extensive library of pre-built algorithms, as well as the ability to create custom trading robots

- Multiple timeframes for charts, including tick, minute, hourly, daily, and weekly timeframes

- Ability to trade a wide range of asset classes, including forex, stocks, indices, and commodities

MT4:

- Customizable workspace layout, with the ability to create multiple charts and workspaces

- Wide range of built-in technical indicators and drawing tools, with the ability to add custom indicators and scripts

- Expert Advisors (EAs) allow traders to automate their trading strategies, with the ability to create custom EAs using the MQL4 programming language

- Advanced order types, including market, limit, stop, and trailing stop orders, as well as the ability to set price alerts and receive notifications via email or mobile push notifications

- Multiple timeframes for charts, including tick, minute, hourly, daily, and weekly timeframes

- Ability to trade a wide range of asset classes, including forex, stocks, indices, and commodities

- Access a vast library of third-party plugins and tools, including custom indicators, EAs, and risk management tools.

Can cTrader and MT4 be used on mobile devices?

Yes, both cTrader and MT4 offer mobile applications that allow traders to access the platforms on-the-go.

cTrader's mobile app is available for iOS and Android devices. It provides access to all the same features as the desktop platform, including advanced charting tools, multiple timeframes, custom indicators, and algorithmic trading options.

MT4's mobile app is also available for iOS and Android devices. It provides access to all the same features as the desktop platform, including custom indicators, Expert Advisors (EAs), and advanced order types.

Both mobile apps offer a user-friendly interface optimized for mobile devices, making it easy for traders to monitor their positions, execute trades, and manage their accounts from anywhere at any time.

What is the level of automation and algorithmic trading support on cTrader and MT4?

Both cTrader and MT4 offer a high level of automation and algorithmic trading support, making them popular choices for traders who prefer to use automated trading strategies.

cTrader offers an advanced algorithmic trading platform called cAlgo, which allows traders to create and backtest custom trading robots using the C# programming language. cAlgo offers an extensive library of pre-built algorithms and the ability to create custom indicators and trading robots from scratch.

MT4 offers a robust automated trading platform through its Expert Advisors (EAs) feature. EAs are automated trading robots that execute trades based on pre-set criteria, such as technical indicators, chart patterns, and price action signals. MT4 also offers a built-in strategy tester that allows traders to backtest their EAs and optimize their performance.

Both cTrader and MT4 offer support for copy trading, which allows traders to automatically replicate the trades of other successful traders. It is a useful tool for novice traders looking to learn from more experienced traders and busy traders who don't have the time to monitor the markets themselves.

Both cTrader and MT4 offer a high level of automation and algorithmic trading support, making them popular choices for traders who prefer to use automated trading strategies.

What is the outlook for the future of cTrader and MT4 in the trading platform market?

The trading platform market is constantly evolving, with new platforms and technologies being developed to meet the needs of traders. However, cTrader and MT4 are established platforms that have proven popular and reliable choices for traders. Both platforms will likely continue to be widely used, especially as more traders embrace electronic trading and automated trading systems.

Regarding the outlook for the future of these platforms in the trading platform market, it isn't easy to make a definite prediction. However, Schrader has gained market share in recent years and aggressively promoted its platform to attract new traders. Additionally, many brokers are now offering cTrader as an alternative to MT4, indicating its growing popularity.

MT4, on the other hand, still maintains a large market share due to its long-standing presence and the vast number of third-party plugins and custom indicators available. However, its successor, MT5, which offers more advanced features, has not gained as much popularity as MT4.

Both cTrader and MT4 will continue to be popular trading platforms in the future. While cTrader is gaining ground and attracting new users, MT4 still has a significant user base. It will continue to be used by traders who value the vast number of plugins and custom indicators available for the platform.

What financial instruments can be traded on cTrader and MT4?

cTrader and MT4 offer access to various financial instruments, including currencies, stocks, commodities, and indices. Including major currency pairs, such as EUR/USD and GBP/USD, as well as minor and exotic currency pairs. In addition, traders can access stocks from major global exchanges, such as the New York Stock Exchange (NYSE) and the London Stock Exchange (LSE), as well as commodities such as gold, silver, and crude oil and indices can also be traded on MT4 and cTrader platforms. The specific instruments available to trade will depend on the brokerage firm offering the platform, as well as the regulations governing financial trading in the trader's jurisdiction.

What are the fees and commissions associated with trading on cTrader and MT4?

The fees and commissions associated with trading on cTrader and MT4 will vary depending on the brokerage firm offering the platform. Some firms may charge a commission on each trade, while others may offer a spread-based pricing model.

What is the minimum investment required to start trading on cTrader and MT4?

The minimum investment required to start trading on cTrader and MT4 will vary depending on the brokerage firm offering the platform. Some firms may have no minimum investment requirements, while others may require a minimum deposit of several thousand dollars.

What are the trading hours for cTrader and MT4?

The trading hours for cTrader and MT4 will vary depending on the financial instrument being traded and the exchange on which it is listed. However, most platforms allow trading 24 hours a day, five days a week.

Do cTrader and MT4 offer demo accounts or educational resources for new traders?

Many brokerage firms that offer cTrader and MT4 will provide access to demo accounts and educational resources for new traders. These resources may include tutorials, webinars, and other materials designed to help traders learn the basics of trading and familiarize themselves with the platform.

How do cTrader and MT4 handle disputes or complaints from traders?

cTrader and MT4 may have different procedures for handling disputes and complaints from traders. However, these platforms will generally encourage traders to contact their brokerage firm's customer support team in the first instance and may escalate complaints to a regulatory authority if necessary.

What are the withdrawal and deposit options for cTrader and MT4?

The withdrawal and deposit options available for cTrader and MT4 will depend on the brokerage firm offering the platform. However, most firms will support a range of payment methods, including bank transfers, credit and debit cards, and online payment systems such as PayPal and Skrill.

What is the customer support like for cTrader and MT4?

The quality of customer support offered for cTrader and MT4 will vary depending on the brokerage firm offering the platform. Some firms may offer extensive customer support services, including phone and email support, while others may have limited support options.

How to do cTrader and MT4 comply with regulatory requirements for financial trading?

cTrader and MT4 are designed to comply with various regulatory requirements for financial trading, including those set forth by regulatory bodies such as the Financial Conduct Authority (FCA) and the Securities and Exchange Commission (SEC). These platforms may also have additional security features to protect against fraudulent activity and market manipulation.

What is the policy on insider trading and other forms of market manipulation for cTrader and MT4?

cTrader and MT4 have strict policies to prevent insider trading and other forms of market manipulation. These policies may include measures such as monitoring user activity for suspicious behaviour and implementing strict penalties for those found to be engaging in fraudulent activity.

cTrader Vs MT4 List Compared

| Featured cTrader Vs MT4 Trading Platform | Account Features | Trading Features |

|---|---|---|

| Used By: 180,000 Instruments Available: 232 Stocks Available: 2100 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 61 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mirror Trader, ZuluTrade, Web Trader, cTrader, Mac Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 10000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 60 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, IRESS, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 89,000 Instruments Available: 100 Stocks Available: 60 US Stocks: No UK Stocks: No German Stocks: Yes Japanese Stocks: No Indices: Yes Forex Pairs Available: 70 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mac, ZuluTrade, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your moneyVisit |

|

| Used By: 1,866,000 Instruments Available: 430 Stocks Available: 1700 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 70 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 75.78% of retail investor accounts lose money when trading CFDs and Spread Betting with this providerVisit |

|

| Used By: 10,000 Instruments Available: 57 Stocks Available: 0 US Stocks: Yes UK Stocks: No German Stocks: No Japanese Stocks: No Indices: No Forex Pairs Available: Major Forex Pairs: Yes Minor Forex Pairs: No Exotic Forex Pairs: No Minimum Deposit: 100 |

Platforms: MetaTrader 4, cTrader Platform Negative Balance Protection: Inactivity Fee: Your capital is at riskVisit |

|

| Used By: 10,000 Instruments Available: 73 Stocks Available: 200 US Stocks: NO UK Stocks: No German Stocks: No Japanese Stocks: No Indices: No Forex Pairs Available: Major Forex Pairs: No Minor Forex Pairs: No Exotic Forex Pairs: No Minimum Deposit: 100 |

Platforms: cTrader, SocialTrading, copyTrading, webPlatform, DesktopPlatform, Proprietary . Negative Balance Protection: Inactivity Fee: Yes Your capital is at riskVisit |

|

| Used By: 30,000 Instruments Available: 50 Stocks Available: 0 US Stocks: No UK Stocks: No German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: Major Forex Pairs: Yes Minor Forex Pairs: Exotic Forex Pairs: Minimum Deposit: 100 |

Platforms: MT4, MT5, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 231 Stocks Available: 0 US Stocks: No UK Stocks: Yes German Stocks: No Japanese Stocks: No Indices: Yes Forex Pairs Available: Major Forex Pairs: Yes Minor Forex Pairs: No Exotic Forex Pairs: Yes Minimum Deposit: 10 |

Platforms: MT4,iOS,MacBook,iPhone Negative Balance Protection: Inactivity Fee: Your capital is at riskVisit |

|

| Used By: 10,000 Instruments Available: 234 Stocks Available: 1000 US Stocks: NO UK Stocks: Yes German Stocks: No Japanese Stocks: No Indices: Yes Forex Pairs Available: Major Forex Pairs: Yes Minor Forex Pairs: No Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: Android Apps,iPhone/iPad,Desktop Negative Balance Protection: Inactivity Fee: Yes Your capital is at riskVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 0 US Stocks: UK Stocks: German Stocks: Japanese Stocks: Indices: Forex Pairs Available: Major Forex Pairs: Minor Forex Pairs: Exotic Forex Pairs: Minimum Deposit: $50 |

Platforms: Negative Balance Protection: Inactivity Fee: Your capital is at riskVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 0 US Stocks: UK Stocks: German Stocks: Japanese Stocks: Indices: Forex Pairs Available: Major Forex Pairs: Minor Forex Pairs: Exotic Forex Pairs: Minimum Deposit: $200 |

Platforms: Negative Balance Protection: Inactivity Fee: Your capital is at riskVisit |

Best cTrader Vs MT4 cTrader Vs MT4 Reviews

Read our details broker cTrader Vs MT4 cTrader Vs MT4 reviews, you will find something useful if you are shortlisting a cTrader Vs MT4 cTrader Vs MT4 and trading platform.

- IC Markets Review (read our in depth reviews)

- FP Markets Review (read our in depth reviews)

- Pepperstone Review (read our in depth reviews)

- FxPro Review (read our in depth reviews)

- Bittrex Review (read our in depth reviews)

- ChoiceTrade Review (read our in depth reviews)

- OctaFX Review (read our in depth reviews)

- Traders Way Review (read our in depth reviews)

- Tradeview Review (read our in depth reviews)

- Fibo Group Review (read our in depth reviews)

- FXPIG Review (read our in depth reviews)

cTrader Vs MT4 cTrader Vs MT4 Alternatives

Read about and compare cTrader Vs MT4 cTrader Vs MT4 alternatives. We have indepth side by side comparisons to help you find cTrader Vs MT4 cTrader Vs MT4 related brokers.

IC Markets

IC Markets

FP Markets

FP Markets

Pepperstone

Pepperstone

FxPro

FxPro

Bittrex

Bittrex

ChoiceTrade

ChoiceTrade

OctaFX

OctaFX

Traders Way

Traders Way

Tradeview

Tradeview

Fibo Group

Fibo Group

FXPIG

FXPIG