Best Trading Platforms Russian 2026

Trading platforms have seen huge growth in Russian. Thanks mainly to the increased accessibility of the internet and computers and mobile devices all over the Russian region over the last 5 to 10 years in Russian for Russians traders.

A younger generation of Russians tech savy traders now see new more modern Russian trading platforms that gives the average Russians trader access to not only local Russian financial markets, but quick easy access to buying and selling of a variety of financial instruments on all major financial markets all over the globe from without leaving their homes in Russian. Many trading platforms available to Russian traders give Russians traders the ability to trade on both mobile and desktop devices. Many modern Russian trading platforms just need a web browser and internet connection and offer fast order execution speeds to Russians traders.

The financial center of Russian is Moscow but many Russians traders increasingly have a more global outlook to the financial instruments they want to trade in. Many Russians traders now look to Russian and global stocks and shares, world fiat currency markets, cryptocurrency trading, commodities trading, ETFs and CFDS.

Russian does have the local Moscow Exchange financial market for Russians traders to buy and sell Russian securities. Although the Local Moscow Exchange is there for Russians traders, more experienced Russians traders are actively looking to add a range of financial instruments to their investment and trading portfolios from financial markets all over the world not just Russian.

Although Russians traders still use the RUB, more experienced Russians traders are intergrating multiple deposit and withdrawal currencies into their Russian trading strategies when Russians traders compare Russian trading platforms.

Choosing The Best Regulated Trading Platform Russian

Choosing the best Russian trading platform for you can be overwhelming for new investors. The good news is that many Russian investment platforms provide education, research, and trading tools to help you get started. We'll show you how to evaluate new Russian trading platforms for example checking they are regulated and where you should begin.

All trading platforms in Russian need to be regulated by The FFMS in Russia (FCFR), Centre for Regulation of Off-Exchange Financial Instruments and Technologies (CRFIN). Its also a good sign if when using an international trading platform that serves Russian residents if they are regulated by a major European financial regulator like the UK's Financial Conducat Authority (FCA) and Cysec.

Best Trading Platforms Russian 2026 Table of Contents

- Best Trading Platforms Russian 2026

- Top Russian Trading Platforms Compared

- Best Trading Platforms Russian List

- IC Markets

- AvaTrade

- FP Markets

- XTB

- Pepperstone

- XM

- eToro

- FXPrimus

- Trading 212

- SpreadEx

- Admiral Markets

- Axi

- HYCM

- Swissquote

- FxPro

- Best Online Brokers Russian Reviewed

- What Can I Trade on Russian Trading Platforms

- Stocks And Shares on Russian Trading Platforms

- Russian Fractional Trading

- Cryptocurrency Trading on Russian Trading Platforms

- ETFs on Russian Trading Platforms

- Indices on Russian Trading Platforms

- Bonds on Russian Trading Platforms

- How do Russian Bond Trading Platforms Work?

- Commodities on Russian Trading Platforms

- Margin Trading on Russian Trading Platforms

- Stock CFD Trading on Russian Trading Platforms

- ETF CFD trading on Russian Trading Platforms

- Commodity CFDs on Russian Trading Platforms

- Bond CFDs on Russian Trading Platforms

- Futures CFDs on Russian Trading Platforms

- Forex Trading on Russian Trading Platforms

- Trading Platform Russian Features & Tools

- MT4 on Russian Trading Platforms

- MT5 on Russian Trading Platforms

- cTrader on Russian Trading Platforms

- STP Accounts on Russian Trading Platforms

- ECN Accounts on Russian Trading Platforms

- DMA Accounts on Russian Trading Platforms

- Social Trading on Russian Trading Platforms

- Copy Trading on Russian Trading Platforms

- VIP Trading Account on Russian Trading Platforms

- Auto Trading on Russian Trading Platforms

- Russian Mobile Apps on Russian Trading Platforms

- Trade Signals on Russian Trading Platforms

- Islamic Accounts on Russian Trading Platforms

- Demo accounts on Russian Trading Platforms

- Financial Regulation on Russian Trading Platforms

- Russian Financial Regulation

- Russian Trading Platform Customer Service

- Phone Support on Russian Trading Platforms

- Live Chat Support on Russian Trading Platforms

- Russian Trading Platform Minimum Deposits

- Does It Matter How Many Traders My Russian Trading Platform Has?

- Educational Resources on Russian Trading Platforms

- Trading Platforms Russian Trading Fees Explained

- Russian Share Dealing Fees

- Russian Trading Commission

- Russian Spreads

- Russian Trading Platform Fees

- Russian Overnight Financing Fees

- Russian Trading Platform Transaction Fees

- Russian Trading Platform Inactivity Fees

- Russian Forex Trading Fees

- Russian Trading Account Payment Methods

- Popular Russian Trading Plaform Payment Methods

- How to Open a Russian Trading Account

- Step 1: Open a Russian Trading Account

- Step 2: Confirm Your Russian Identity

- Step 3: Deposit Funds To Your Russian Trading Platform

- Step 4: Research a Financial Instrument To Trade On Your Russian Trading Platform

- Step 5: Place a Trade

- Best Trading Platforms Russian Verdict

- Best Trading Platforms Russian 2026 Frequently Asked Questions

- Related Guides

- Best Trading Platforms Russian Reviews

- Best Trading Platforms Russian Alternatives

Top Russian Trading Platforms Compared

Best Trading Platforms Russian List

| Featured Russian Trading Platform | Account Features | Trading Features |

|---|---|---|

| Used By: 180,000 Instruments Available: 232 Number Of Shares Available: 2,100 Minimum Deposit: 200 |

Platforms: MT4, MT5, Mirror Trader, ZuluTrade, Web Trader, cTrader, Mac Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsTry Now |

|

| Used By: 200,000 Instruments Available: 1000 Number Of Shares Available: 99 Minimum Deposit: 100 |

Platforms: Web Trader, MT4, MT5, AvaTradeGo, AvaOptions, Mac, Mobile Apps, ZuluTrade, DupliTrade, MQL5 Negative Balance Protection: Inactivity Fee: No 71% of retail CFD accounts lose moneyTry Now |

|

| Used By: 10,000 Instruments Available: 100 Number Of Shares Available: 10,000 Minimum Deposit: 100 |

Platforms: MT4, MT5, IRESS, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsTry Now |

|

| Used By: 250,000 Instruments Available: 4000 Number Of Shares Available: 1,696 Minimum Deposit: 0 |

Platforms: MT4, Mirror Trader, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Try Now |

|

| Used By: 89,000 Instruments Available: 100 Number Of Shares Available: 60 Minimum Deposit: 200 |

Platforms: MT4, MT5, Mac, ZuluTrade, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your moneyTry Now |

|

| Used By: 10,000,000 Instruments Available: 1000 Number Of Shares Available: 160 Minimum Deposit: 5 |

Platforms: MT4, MT5, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77.74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.Try Now |

|

| Used By: 20,000,000 Instruments Available: 2000 Number Of Shares Available: 2,042 Minimum Deposit: 50 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 51% of retail investor accounts lose money when trading CFDs with this provider.Try Now |

|

| Used By: 10,000 Instruments Available: 130 Number Of Shares Available: 60 Minimum Deposit: 100 |

Platforms: MT4, Mac, Mirror Trader, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsTry Now |

|

| Used By: 15,000,000 Instruments Available: 10000 Number Of Shares Available: 1,731 Minimum Deposit: 1 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.Try Now |

|

| Used By: 10,000 Instruments Available: 15000 Number Of Shares Available: 1,000 Minimum Deposit: 1 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsTry Now |

|

| Used By: 10,000 Instruments Available: 148 Number Of Shares Available: 64 Minimum Deposit: $100 |

Platforms: MT4, MT5, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsTry Now |

|

| Used By: 10,000 Instruments Available: 100 Number Of Shares Available: 1,000 Minimum Deposit: 0 |

Platforms: MT4, Mac, ZuluTrade, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsTry Now |

|

| Used By: 10,000 Instruments Available: 100 Number Of Shares Available: 10 Minimum Deposit: 100 |

Platforms: MT4, MT5, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes Losses can exceed depositsTry Now |

|

| Used By: 300,000 Instruments Available: 100 Number Of Shares Available: 0 Minimum Deposit: 1000 |

Platforms: MT4, MT5, ZuluTrade, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsTry Now |

|

| Used By: 1,866,000 Instruments Available: 430 Number Of Shares Available: 1,700 Minimum Deposit: 100 |

Platforms: MT4, MT5, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 75.78% of retail investor accounts lose money when trading CFDs and Spread Betting with this providerTry Now |

Best Online Brokers Russian Reviewed

What Can I Trade on Russian Trading Platforms

Trading platforms in Russian have seen a have seen huge growth in the last 5 years.

Modern Russian trading platforms are easy to find, use and install. The internet's expansion in Russian and the rest of the world, the improvement in terms of cost in Russian and speed has lowered the barrier to entry to Russian traders. More people in Russian can now access these online Russian trading services and begin trading in minutes. Trading has also been revolutionised by the internet for Russian people, which has made trading in Russian not only more convenient but also real-time.

We list the most popular tradable financial assets available on Russian trading platforms below.

Stocks And Shares on Russian Trading Platforms

Russian Stock market trading is the buying and selling of company stocks and shares, or other securities through a Russian stockbroker and trading platform in Russian. Trading on the Russian or global stock market is accomplished by placing a buy or sell order to your Russian trading platform. A buy order is placed when you wish to purchase a security, and a sell order is placed when you wish to sell the security back to your Russian trading platform.

Most people trade stocks and shares with Russian online trading platforms. Russian trading platforms offer more convenience for local Russian residents than traditional brokerage firms that used to handle buy and sell financial instrument transactions by phone.

When trading stocks and shares on a Russian trading platform, stocks and shares are the primary source of funds for companies listed on Russian and global stock exchanges. Investing on a Russian trading platform offers investors a stake in listed companies, as well as a share of that companies profits through dividends. The price of stocks and shares can go up or down depending on how the Russian financial market perceives their value.

|

|

|

|

| |

| Name | IC Markets | AvaTrade | FP Markets | XTB | Pepperstone |

| UK Stocks | Yes | Yes | Yes | Yes | No |

| US Stocks | Yes | Yes | Yes | Yes | No |

| DE Stocks | Yes | Yes | Yes | Yes | Yes |

| JP Stocks | Yes | Yes | Yes | Yes | No |

| Penny Stocks | No | Yes | No | Yes | No |

| riskwarning | Try Now Losses can exceed deposits | Try Now 71% of retail CFD accounts lose money | Try Now Losses can exceed deposits | Try Now 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. | Try Now CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money |

Russian Fractional Trading

A relatively new trading feature for Russian traders that Russian trading platforms offer are fractional shares. A fractional share is a fraction of a full share of an equity stock. Stock splits, which don't always result in an even number of shares, frequently result in fractional shares. Fractional shares are not traded on the open market; they can only be sold through a larger Russian trading platform brokers. Russian trading platforms that offer fractional shares allow Russian traders to buy shares with a lower barrier to entry.

|

|

|

|

| |

| Name | IC Markets | AvaTrade | FP Markets | XTB | Pepperstone |

| Fractional Shares | No | No | No | No | No |

| riskwarning | Try Now Losses can exceed deposits | Try Now 71% of retail CFD accounts lose money | Try Now Losses can exceed deposits | Try Now 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. | Try Now CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money |

Cryptocurrency Trading on Russian Trading Platforms

In order to be able to trade cryptocurrency in Russian, you need a Russian crypto trading account. This is where your Russian crypto assets are held and perform a similar function to Russian bank accounts used in the real world. You will need to create a crypto Russian trading account if you are from the Russian, so that you can start buying and selling cryptocurrency with ease.

Cryptocurrency trading is one of the fastest growing financial markets in the world today. It has grown exponentially over the past few years and it shows no signs of slowing down. In fact, there are now more cryptocurrencies than ever before and each exchange has an average daily volume that exceeds $1 million USD.

In order to trade cryptocurrencies from Russian, you first need to open a Russian cryptocurrency trading account with a Russian cryptocurrency exchange or crypto Russian trading platform. You can then deposit cash from your Russian bank or credit card into a Russian trading account in order to buy different cryptocurrencies with USD dollars or other fiat currencies available in Russian.

After you have purchased your digital assets on a Russian trading platform, you can withdraw your Russian crypto assets onto your local computer or store them in another software wallet that you have control of in Russian.

Make sure you trade cryptocurrencies with a well regulated and secure trading platform in Russian. If you decide to leave crypto on a unregulated unsecure Russian exchange, be careful not to keep too much of your digital currency on any one Russian trading platform as unregulated Russian crypto trading platforms are known for getting hacked.

|

|

|

|

| |

| Name | IC Markets | AvaTrade | FP Markets | XTB | Pepperstone |

| Crypto | Yes | Yes | Yes | Yes | Yes |

| riskwarning | Try Now Losses can exceed deposits | Try Now 71% of retail CFD accounts lose money | Try Now Losses can exceed deposits | Try Now 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. | Try Now CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money |

ETFs on Russian Trading Platforms

Most modern online Russian Trading platforms allow trading in ETFs. Exchange-traded Funds (ETFs) in Russian are a type of investment that trade on an exchange just like stocks. The value of ETFs is based on the collective value of their underlying assets. Because they trade on an local Russian or global financial exchange, ETFs can be bought and sold at any time on a Russian ETF trading platform during market hours. Russian trading platforms allow Russian traders to purchase partial shares or full shares depending on the desired commitment to the investment and ability to pay for it.

Indices on Russian Trading Platforms

Russian indice trading platforms allow Russian traders to invest in local Russian Indices and stock indexes as well as indices on financial markets all over the world.

Financial market indices are used to measure changes in the value of a Russian or global selection of stocks, bonds, or other financial assets.

The most common Global indices Markets include: the London Stock Exchange, the Dow Jones Industrial Average (DJIA), Standard & Poor's 500 (S&P 500), the NASDAQ Composite, and the Russell 2000.

Financial indices are also referred to as stock market indices or a stock market index. The Dow Jones Industrial Average (DJIA) is often referred to as the “Dow 30” or “the Dow,” while the Nasdaq Composite is also referred to as the “Nasdaq”.

When trading on Russian trading platforms, financial indices are designed to show how a group of Russian or worldwide stocks performs in relation to other market-traded stocks or indexes. Financial indices can measure stocks on an absolute basis or relative basis.

A benchmark index is a statistical measure of the value of a section of the global or Russian stock market. It is computed from the prices of specific selected stocks and reflects changes in their valuations.

Financial indices can help Russian investors using Russian trading platforms understand how markets have performed over time from month-to-month and year-to-year against local Russian financial markets and markets all around the world.

Bonds on Russian Trading Platforms

Bonds from Russian and all over the world can be actively traded on Russian trading platforms.

Bonds are a kind of loan from individuals or institutions to the Russian government. They help governments meet their borrowing needs and finance their local Russian expenditures. Russian Bonds can be issued as either long-term (20 years or more) or short-term (less than three years). These bonds are issued on behalf of the government by its debt manager, the Bank of Canada.

How do Russian Bond Trading Platforms Work?

When you buy a bond on a Russian trading platform, you're essentially loaning money to the government. When the government receives your loan, it will pay you interest on your investment until its debt is paid off; Usually after 20 years or more. You can choose to hold onto your bonds within your Russian trading platform until they mature, sell them before they mature, or put them in a portfolio that automatically re-balances itself by purchasing more bonds when prices fall and selling some when prices rise, an approach called 'rebalancing'.

Commodities on Russian Trading Platforms

When trading from Russian commodities trading is a way of investing in commodities through contracts. Some of the examples of commodities are gold, silver, oil, stocks and other goods that are traded in the public market. Modern trading platforms allow Russian residents to trade commodities not only from Russian but also commodity markets all over the world across multiple timezones via commodity futures or commodity CFD trading.

Russian investors have a choice to either go for futures or physical commodities. A futures contract is a standardised legal agreement between unrelated parties to buy or sell something at a predetermined price at a predetermined time in the future. Physical options are where you directly acquire some goods as soon as you agree to a deal; however, this requires more funds which is why many people prefer going for futures options.

Margin Trading on Russian Trading Platforms

Margin trading on Russian trading platforms have a higher profit potential than standard trading, but it also comes with a higher level of risk. The repercussions of losses are amplified when buying stocks on margin. A margin call, which asks you to sell your stock position or front more funds to keep your investment, may also be issued by the broker.

Stock CFD Trading on Russian Trading Platforms

Trading traditional stocks and shares are usually better suiting for long term trading. Modern online trading platforms in Russian allow CFD stock trading.

CFD stock trading is where more experienced traders can speculate on a stocks up or down price movement using leveraged margin trading which allows a fraction of a traded amount to be placed with a Russian CFD stock trading platform.

Stock CFD trading is high risk and you may lose more than your deposited amount with some Russian trading platforms. No underlying real company stocks are brought on a CFD stock trade on your Russian trading platform. A CFD stock trade is a speculative deal between you and your Russian CFD stock broker platform on a stock assets price movement.

ETF CFD trading on Russian Trading Platforms

When you trade ETFs as CFDs (Contracts for Difference), you are investing in the price of the ETF rather than the actual ETF. The market value of the financial instrument that a CFD instrument represents is used to calculate its value. Most trading platforms in Russian will allow speculative trading in ETFs through CFDs. Check you fully understand what ETF CFDS are as they hold risk and what CFD ETFs your trading platform in Russian specfically offers.

Commodity CFDs on Russian Trading Platforms

Commodity CFDs although high risk due to their leverage feature, are a versatile tool for experienced Russian investors. Trading platforms in Russian allow CFD trading in commodity futures at a fraction of the cost of trading tradtional commodities. You can also utilise Stop Loss and Take Profit orders on your Russian trading platform to automate trades, leverage to raise your position's exposure, and technical analysis to construct exact strategies. Understand that no underlying commodities are traded on your Russian trading platform with a commodity CFD. A commodity CFD is high risk speculation using leverage on up or down price movement on a specific commodity between the trader and the Russian trading platform.

Bond CFDs on Russian Trading Platforms

Some trading platforms in Russian allow Russian traders to trade Bond CFDs.

A bond CFD is a form of financial derivative trading. When you trade a bond, you are taking a position on the price of the underlying instrument and not purchasing the instrument itself. Bond CFDs use leverage which is very high risk.

Russian trading platforms sell bond CFDs, which are financial instruments. The reference asset for each Bond CFD is a specific Russian or global bond financial instrument. The capital return of the instrument is the difference between the open and closing prices of the reference bond, which is what CFDs stand for. When trading CFDs, the difference is settled in cash, and no physical delivery of bonds is required.

Futures CFDs on Russian Trading Platforms

Futures CFD trading is available on most trading platforms in Russian.

Futures contracts are standardized agreements or contracts with obligations to buy or sell a particular asset at a preset price with a future expiration date. Although CFDs allow investors to trade the price movements of futures, they are not futures contracts by themselves.

Futures CFDs are high risk leveraged trades on speculative Futures price movements up or down with your Russian trading platform or broker. With a Futures CFD you are not trading any underlying Futures assets. Futures CFDS although high risk can have a lower barrier of entry than traditional Futures trading.

|

|

|

|

| |

| Name | IC Markets | AvaTrade | FP Markets | XTB | Pepperstone |

| Stock CFDs | 110 | 625 | 9,000 | 1,800 | 253 |

| ETF CFDs | 30 | 59 | 250 | 114 | 250 |

| Commodity CFDs | 20 | 27 | 6 | 22 | 16 |

| riskwarning | Try Now Losses can exceed deposits | Try Now 71% of retail CFD accounts lose money | Try Now Losses can exceed deposits | Try Now 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. | Try Now CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money |

Forex Trading on Russian Trading Platforms

Forex, short for foreign exchange, is the largest financial market in Russian and the rest of the world. Trading currencies in Russian allows you to take advantage of the swings in values in local Russian and global currencies, and the volatility that occurs between different countries currencies. On your Russian trading platform, Russian residents can trade on these price differences with the goal of making a profit from speculating on price movements, or using currency fluctuations to hedge against losses in another investment position. All of this can be done on modern online Russian trading platforms.

Different Russian trading platforms offer different currency pairs available. All major currency pairs will be available on your Russian trading platform, but if you need some more exotic currency pairs when trading from Russian, you will need to check they are available in your Russian trading dashboard.

|

|

|

|

| |

| Name | IC Markets | AvaTrade | FP Markets | XTB | Pepperstone |

| Forex | Yes | Yes | Yes | Yes | Yes |

| Major Pairs | Yes | Yes | Yes | Yes | Yes |

| Exotic Pairs | Yes | Yes | Yes | Yes | Yes |

| riskwarning | Try Now Losses can exceed deposits | Try Now 71% of retail CFD accounts lose money | Try Now Losses can exceed deposits | Try Now 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. | Try Now CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money |

Trading Platform Russian Features & Tools

Russian trading platforms offer varying features and tools that help Russian traders with technical analysis and financial market research. Russian trading account tools can include a range of chart types, technical indicators, market news, advanced order types, trading simulators and faster order executions.

MT4 on Russian Trading Platforms

MT4 is a Forex and CFD trading platform, which means you can trade Forex online with it. MT4 stands for MetaTrader 4 and it was developed by MetaQuotes Software Corp., a Russian software company that has been in business since 1999.

MetaQuotes is still one of the market leaders when it comes to Russian Forex trading platforms, but there are other companies like eToro which also offer their own trading platform solutions.

While the basic features of MT4 and other similar platforms may look quite similar, there are some differences between them that you need to keep in mind before picking one or another. If you have used MT4 before and are happy with it check if your Russian trading platform offers MT4.

MT5 on Russian Trading Platforms

Unless your Russian trading platform have built their own proprietary trading platform, your Russian broker is probably using MT5 or MT4 as their trading platform for Russian residents.

MT5 is a more modern version of MT4 offering more technical indicators to Russian traders. MT5 has more technical analysis tools like depth of market which allows Russian traders to view financial instrument bid prices across many global financial markets, not just the Russian market. MT5 offers over twice as many timeframes on its charting tools to Russian users. MT5 is not just for CFD trading. MT5 is a multiasset trading platform allowing trading stocks, commodities, futures, Forex and cryptocurrencies. MT5 is 64 bit and has been designed for speed. Check if your Russian trading platform offers MT5.

cTrader on Russian Trading Platforms

cTrader is a full-featured trading platform that Forex and CFD firms can provide to their Russian clients. The cTrader platform is jam-packed with features that cater to most Russian traders needs. If you are looking for a trading platform in Russian that offers automated trading facilities to users in Russian. cTrader is known for is popular accessible programming language. Check to see if your Russian trading platform offers these features if you need this functionality.

|

|

|

|

| |

| Name | IC Markets | AvaTrade | FP Markets | XTB | Pepperstone |

| MT4 | Yes | Yes | Yes | Yes | Yes |

| MT5 | Yes | Yes | Yes | No | Yes |

| cTrader | Yes | No | Yes | No | Yes |

| riskwarning | Try Now Losses can exceed deposits | Try Now 71% of retail CFD accounts lose money | Try Now Losses can exceed deposits | Try Now 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. | Try Now CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money |

STP Accounts on Russian Trading Platforms

A Forex broker that offers Straight Through Processing of trade orders is known as a STP broker. These are brokers who submit the trader's orders directly to liquidity providers (big banks) for processing and fulfilment of trade orders.

STP brokerages can often provide tight spreads and cost of execution without the disadvantage of a dealing desk's higher costs.

ECN Accounts on Russian Trading Platforms

A real ECN account is a pure order-matching execution system in which the Russian trading platform charges a premium as commission per trade rather than artificially inflating the raw spread that occurs naturally during the order-matching process.

In liquid market situations, Russian ECN accounts might offer tighter spreads and a lower overall cost of trading in Russian.

DMA Accounts on Russian Trading Platforms

Direct market access (DMA) is an electronic trading strategy that allows Russian investors to conduct transactions on Russian trading platforms by engaging directly with an electronic order book. An order book is a collection of orders listed on Russian trading platforms. Russian DMA trading platforms displays prices and volumes and is a list of orders that records the orders placed on the stock exchange by buyers and sellers. If you require DMA trading in Russian check your Russian trading platform offers it.

|

|

|

|

| |

| Name | IC Markets | AvaTrade | FP Markets | XTB | Pepperstone |

| STP | No | No | Yes | Yes | Yes |

| ECN | Yes | No | Yes | No | Yes |

| DMA | Yes | No | Yes | Yes | Yes |

| riskwarning | Try Now Losses can exceed deposits | Try Now 71% of retail CFD accounts lose money | Try Now Losses can exceed deposits | Try Now 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. | Try Now CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money |

Social Trading on Russian Trading Platforms

Social trading is a form of investing in which Russian individuals copy or mirror the trades or portfolios of other, more successful investors. Social trading allows you to invest in ways that were previously only available to a select few institutional investors – including hedge fund managers, investment bankers, and venture capitalists.

It can take decades for Russian traders to build up the necessary experience and expertise to fully understand risk and make consistent profits on financial markets. With social trading, new traders can research and follow the trades of more successful Russian and global traders.

It takes some skill to identify skilled traders whom you should follow closely on Russian trading platforms. Fortunately, many Russian trading platforms offer Russian users trading tools designed specifically for this purpose. A social trading Russian portfolio should be well diversified to help mitigate trading risks.

Copy Trading on Russian Trading Platforms

Copy trading is a system that allows Russian investors to copy the trades of other traders not only in Russian but all over the world. Russian traders can either trade a specific financial instrument or the market as a whole. While it can be done manually, it is now common for Russian trading platforms to offer copy trading on their Russian platforms. Copy trading is offered by many Russian brokers including eToro, but not all Russian copy trading platforms have the same trading features and systems. The best way to find out about the details of how each Russian trading platforms offers copytrading is to read each Russian copytrading platforms user guides. eToro is the biggest social trading and copytrading platform in the world with over 20 million registered users.

If you do opt in for a Russian copy trading platform, then it will generally be up to you which trades you want copied from other Russian or worldwide traders and when those copies should be made. You will normally be able to choose between having one-to-one copies of every trade made by another investor on your Russian copytrading platform or having automatic 'buy' and 'sell' copies made automatically once per day at a set time so long as there has been activity during that day in that option or market as a whole.

If there hasn't been any activity during the day (or no new positions being opened) then no automatic copies will be made on your Russian trading platform until there is some activity again after midnight GMT/UTC time (the default time zone set by most brokers). It really depends on what your Russian trading platform offers with their own system so always check first before making any assumptions with your trades.

|

|

|

|

| |

| Name | IC Markets | AvaTrade | FP Markets | XTB | Pepperstone |

| Copytrading | No | Yes | Yes | No | Yes |

| Social Trading | Yes | Yes | No | No | Yes |

| riskwarning | Try Now Losses can exceed deposits | Try Now 71% of retail CFD accounts lose money | Try Now Losses can exceed deposits | Try Now 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. | Try Now CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money |

VIP Trading Account on Russian Trading Platforms

Trading with a Russian VIP account is similar to trading with a personal market analyst, but with the added benefit of lower Russian trading fees and lower latency for faster execution for Russian traders.

VIP trading accounts are preferable to normal accounts since they come with a slew of extra features. These accounts are open to both professional and individual traders of any degree who have a big amount of money to trade.

Many Russian trading platforms offering VIP accounts offer Russian users additional trading features including free VPS trading machines, hosting service, no deposit/withdrawal fees, private consultations with a Russian personal account manager, exclusive seminars and events which may be available locally in Russian or worldwide. Russian VIP trading account features vary between Russian trading platforms. Check to see what your VIP Russian trading platform offers.

|

|

|

|

| |

| Name | IC Markets | AvaTrade | FP Markets | XTB | Pepperstone |

| VIP Accounts | No | Yes | No | Yes | No |

| riskwarning | Try Now Losses can exceed deposits | Try Now 71% of retail CFD accounts lose money | Try Now Losses can exceed deposits | Try Now 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. | Try Now CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money |

Auto Trading on Russian Trading Platforms

Automated trading in Russian is a way of participating in financial markets by executing pre-set procedures for entering and leaving trades on Russian trading platforms through a computer programme. As a Russian automated trader, you'll combine in-depth technical analysis on global and Russian financial instruments, with the creation of position characteristics like open orders, trailing stops, and guaranteed stops.

Many Russian trading platforms offer APIs and programming languages allowing traders in Russian to make use of and add automation to their investment strategies. MT4, MT5, cTrader all offer Russian traders access to automated trading features.

|

|

|

|

| |

| Name | IC Markets | AvaTrade | FP Markets | XTB | Pepperstone |

| Automated Trading | Yes | Yes | Yes | Yes | Yes |

| riskwarning | Try Now Losses can exceed deposits | Try Now 71% of retail CFD accounts lose money | Try Now Losses can exceed deposits | Try Now 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. | Try Now CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money |

Russian Mobile Apps on Russian Trading Platforms

Trading in Russian and worldwide financial instruments such as the stock market, cryptocurrencies, Forex, commodities, Indices, ETFs, and CFDs using a smartphone or tablet, such as an Apple or Android device, is known as mobile app trading. Russian mobile trading apps have become more advanced as technology, software and the internet has progressed in the last 5 years. Trading in Russian a decade ago was previously mostly conducted through desktop trading, which was done using a PC or Apple Mac computer. No mobile app trading in Russian on Russian trading platforms in now faster and easier. With the help of a variety of Russian trading apps, a Russian trader can purchase and sell financial instruments as well as manage a portfolio on his or her mobile phone.

|

|

|

|

| |

| Name | IC Markets | AvaTrade | FP Markets | XTB | Pepperstone |

| Mobile Apps | iOS, Android and Windows | iOS and Android | iOS, Android | iOS, Android and Windows | iOS, Android and Windows |

| riskwarning | Try Now Losses can exceed deposits | Try Now 71% of retail CFD accounts lose money | Try Now Losses can exceed deposits | Try Now 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. | Try Now CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money |

Trade Signals on Russian Trading Platforms

Trading signals are instructions to purchase or sell a security based on a set of pre-defined parameters. Russian Traders can develop trading signals on many Russian trading platforms based on a range of parameters, ranging from simple ones like earnings reports and volume surges to more complicated signals drawn from previously generated signals and technical data.

If you are looking for a Russian trading platform that offers trading signals, make sure you understand that they are very high risk. Check to see if your trading platform in Russian is well regulated and able to offer trading signals to traders in Russian.

|

|

|

|

| |

| Name | IC Markets | AvaTrade | FP Markets | XTB | Pepperstone |

| Signal Trading | Yes | Yes | Yes | Yes | Yes |

| riskwarning | Try Now Losses can exceed deposits | Try Now 71% of retail CFD accounts lose money | Try Now Losses can exceed deposits | Try Now 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. | Try Now CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money |

Islamic Accounts on Russian Trading Platforms

Russian Islamic Trading accounts in Russian are designed to allow Russian traders to trade in accordance with the ethical principles of Islam.

Russian Islamic trading accounts reflect the Islamic prohibition against trading (“gambling”) by excluding speculative investments that include buying on margin or borrowing money to trade, and by only allowing certain asset classes such as currencies, commodities and stocks. However it does allow for certain riskier trades including options and derivatives.

Russian traders who wish to trade using a Islamic compatible trading platform available in Russian should be aware the Shariah rules for Islamic Financial instruments are set out in detail by the Accounting & Auditing Organization for Islamic Financial Institutions (AAOIFI).

The AAOIFI have codified all aspects of these financial instruments including how they should be structured. These rules cover topics such as profit-sharing arrangements which protect returns from being used before earning them; one-year contracts which prevent speculation on short-term price volatility; regular payments on deposits which remove the element of risk from banks depositors; and interest rates which are not excessive. If you are looking for for a Russian Islamic trading account check your Russian trading platform offers these Islamic compliant trading accounts.

|

|

|

|

| |

| Name | IC Markets | AvaTrade | FP Markets | XTB | Pepperstone |

| Islamic Accounts | Yes | Yes | Yes | Yes | Yes |

| riskwarning | Try Now Losses can exceed deposits | Try Now 71% of retail CFD accounts lose money | Try Now Losses can exceed deposits | Try Now 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. | Try Now CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money |

Demo accounts on Russian Trading Platforms

A Russian demo trading account is a type of account provided by Russian trading platforms that are filled with fictitious virtual trading funds raning from 100k USD that allows a potential Russian trader to test the Russian trading platform and its features before opting to open a real Russian trading account.

If you are new to trading it is essential you learn to trade first with a Russian trading platform, before risking losing real money on a live Russian trading account. Demo accounts are free on most reputable Russian trading platforms.

|

|

|

|

| |

| Name | IC Markets | AvaTrade | FP Markets | XTB | Pepperstone |

| Demo Accounts | Yes | Yes | Yes | Yes | Yes |

| riskwarning | Try Now Losses can exceed deposits | Try Now 71% of retail CFD accounts lose money | Try Now Losses can exceed deposits | Try Now 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. | Try Now CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money |

Financial Regulation on Russian Trading Platforms

Financial regulation in Russian is the process of controlling and managing financial services in Russian regional area. It combines aspects of Russian law, consumer protection and economics. Governments like Russian often implement financial regulations to prevent industry abuse, ensure fairness and protect consumers from mismanagement or fraud for Russian residents. Russian and international financial regulators also control the amounts of risk that Russian individual retail trading can take with their investments.

Russian Financial Regulation

All trading platforms in Russian need to be authorised and overseen Russian financial regulators including by The FFMS in Russia (FCFR), Centre for Regulation of Off-Exchange Financial Instruments and Technologies (CRFIN). Traders in Russian can also use online trading platforms that serve Russian residents. Check that any online trading platform you use from Russian is regulated by a major European financial regulator like the UKs Financial Conduct Authority (FCA).

|

|

|

|

| |

| Name | IC Markets | AvaTrade | FP Markets | XTB | Pepperstone |

| Regulated By | Australian Securities and Investments Commission (ASIC), Financial Services Authority (FSA), Cyprus Securities and Exchange Commission (CySEC) | Central Bank of Ireland, Australian Securities and Investments Commission (ASIC), Financial Services Authority (FSA), South African Financial Sector Conduct Authority (FSCA), Financial Stability Board (FSB), Abu Dhabi Global Markets (ADGM), Financial Regulatory Services Authority (FRSA), British Virgin Islands Financial Services Commission (BVI) | Australian Securities and Investments Commission (ASIC), Cyprus Securities and Exchange Commission (CySEC), Financial Services Authority (St. Vincent and the Grenadines) | Financial Conduct Authority (FCA), FCA number FRN 522157, Cyprus Securities and Exchange Commission (CySEC), CySEC Licence Number: 169/12, Comision Nacional del Mercado de Valores, Komisja Nadzoru Finansowego, Belize International Financial Services Commission (IFSC) under license number IFSC/60/413/TS/19, Polish Securities and Exchange Commission (KPWiG), Dubai Financial Services Authority (DFSA), Dubai International Financial Center (DIFC),Financial Sector Conduct Authority (FSCA), XTB AFRICA (PTY) LTD licensed to operate in South Africa | Financial Conduct Authority (FCA), Australian Securities and Investments Commission (ASIC), Cyprus Securities and Exchange Commission (CySEC), Federal Financial Supervisory Authority (BaFin), Dubai Financial Services Authority (DFSA), Capital Markets Authority of Kenya (CMA), Pepperstone Markets Limited is incorporated in The Bahamas (number 177174 B), Licensed by the Securities Commission of the Bahamas (SCB) number SIA-F217 |

| riskwarning | Try Now Losses can exceed deposits | Try Now 71% of retail CFD accounts lose money | Try Now Losses can exceed deposits | Try Now 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. | Try Now CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money |

Russian Trading Platform Customer Service

Phone Support on Russian Trading Platforms

For most trading platform users in Russian, it's more convenient to call a phone number and speak to an actual Russian trading platform support person when we need help. Russian trading platform phone support also allows you to ask questions in real time without having to wait for an email response. A real human from Russian who is able to talk in your language can answer all of your Russian trading platform questions, and if they don't know the answer, they can connect you with someone who does.

A good Russian trading platform phone support person will not only answer your Russian trading platform questions. A thing to note is that although a Russian trading platform support person can help you resolve Russian trading platform issues, they cannot and are not allowed to give you financial advice.

Live Chat Support on Russian Trading Platforms

Livechat is the most popular method of contacting your Russian trading platform. Russian trading platforms that offer livechat support are able to offer answers to Russian traders queries in often less than 5 minutes. Livechat sometimes is reserved for VIP Russian traders trading in higher volumes. Check to see if your Russian trading platform offers livechat to Russian traders.

|

|

|

|

| |

| Name | IC Markets | AvaTrade | FP Markets | XTB | Pepperstone |

| Live Chat | Yes | Yes | Yes | Yes | Yes |

| Phone | Yes | Yes | Yes | Yes | Yes |

| Yes | Yes | Yes | Yes | Yes | |

| riskwarning | Try Now Losses can exceed deposits | Try Now 71% of retail CFD accounts lose money | Try Now Losses can exceed deposits | Try Now 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. | Try Now CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money |

Russian Trading Platform Minimum Deposits

Russian trading platform minimum deposits usually range from $0 up to $1000 dollars plus depending on the type of Russian trading account (i.e., margin vs non-margin).

Russian trading platforms set minimum deposit requirements that vary for each account depending on the type of trading and features you require for your Russian trading account. Many Russian trading accounts offer low minimum deposits and commission fee trading. If you require margin based trading or more advanced trading tools and features you may need a Russian trading platform which requires a greater minimum despost.

|

|

|

|

| |

| Name | IC Markets | AvaTrade | FP Markets | XTB | Pepperstone |

| Min Deposit | 200 | 100 | 100 | No | 200 |

| riskwarning | Try Now Losses can exceed deposits | Try Now 71% of retail CFD accounts lose money | Try Now Losses can exceed deposits | Try Now 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. | Try Now CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money |

Does It Matter How Many Traders My Russian Trading Platform Has?

One benefit to trading with a large volume Russian trading platform with a larger amount of users, is that you have access to more liquidity from other traders on the Russian trading platform looking to invest in your chosen financial asset whether is stocks, currency, crypto or commodities. You can buy or sell with greater confidence knowing that there is a great chance there someone else on either side of your trade looking to take advantage of changes in the financial markets. eToro for example has over 20 million registered traders.

In addition, if you want your money quickly, high volume Russian trading platforms will offer quick settlement times as well as fast execution speeds on their Russian trading platforms. When placing an order with a lower volume Russian trading, it may take longer for your transaction to complete since only a handful of people use their Russian trading platform leading to an increased risk in the financial markets changing while waiting for confirmation of a buy or sell order on your Russian trading platform.

|

|

|

|

| |

| Name | IC Markets | AvaTrade | FP Markets | XTB | Pepperstone |

| Usedby | 180000 | 200000 | 10000 | 250000 | 89000 |

| riskwarning | Try Now Losses can exceed deposits | Try Now 71% of retail CFD accounts lose money | Try Now Losses can exceed deposits | Try Now 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. | Try Now CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money |

Educational Resources on Russian Trading Platforms

Many of the more established Russian trading platforms offer Russian traders a range of learning and educational resources that Russian traders can use to learn more about Russian trading platform trading tools and technical analysis and financial market search. These educational resources on Russian trading platforms can range from how to trading videos, market research article guides, trading webinars, free courses and podcasts. See what your shortlisted Russian trading platforms are able to offer you.

Trading Platforms Russian Trading Fees Explained

Make sure you are fully aware of all the fees and commissions that your short listed Russian trading platforms charge. Check and compare the fees that Russian trading platforms that you decided upon charge. Some trading platforms in Russian may charge monthly fees for having accounts open with them but some are free or charge very little if any at all.

Paying additional fees on your Russian trading platform may be necessary in you require some more advanced trading tools. But if you do not require these tools pick a Russian trading platform without these fees.

Russian Share Dealing Fees

There is a charge for each purchase and sell transaction you make on a Russian trading platform for shares on the local Russian and global stock markets.

Generally on Russian trading platforms, the lesser the cost, the larger the share transaction. A minimal fee is charged by Russian trading platforms. Fees of stocks and shares vary from 0.1% to 3%. Depending on your Russian trading platform share dealing fees might be as low as 0.1 percent for larger trades.

Russian Trading Commission

Trading commission is the amount charged by the Russian trading platform to execute a trade. The amount of commission charged by different Russian trading platforms varies depending on the asset traded and the type of service provided. Check you understand and are happy with your shortlisted Russian trading platform trading commissions before trading.

Russian Spreads

When Trading on a Russian trading platform the difference between the bid and ask prices for a currency pair is called a spread. In forex, spreads are typically much smaller than in other markets like equities or commodities. If you trade with a more liquid Russian trading platform with larger user bases the spreads should generally be better. Check you undertand your Russian trading platforms spreads well before trading.

Russian Trading Platform Fees

Russian Overnight Financing Fees

When trading on a Russian trading platform using a leveraged trading you may have to pay an overnight financing fee. Overnight financing is a price you pay to keep a trading position open overnight on leveraged transactions; It's effectively an interest payment to cover the cost of the leverage you're using overnight. Positions with no fixed expiration date are subject to overnight financing charges. Check what overnight fees your Russian trading platform charges if you are planning to use leverage trading.

If you're trading CFDs on a Russian trading platform, you may have to pay an overnight finance cost if you keep your trade open past a specific period. Because of overnight fees CFDs that are charged by all Russian trading platforms, they are better suited for short-term trading strategies.

Russian Trading Platform Transaction Fees

Some Russian trading platforms allow you to deposit and withdraw funds fee-free, while others will implement a charge. This might be based on your chosen payment method or because you are using a Russian trading platform that is denominated in a currency other than the currency of your Russian bank account. One currency has to be converted to another which may incur a fee.

Russian Trading Platform Inactivity Fees

Certain Russian trading platforms may charge a fee if your account remains inactive for a certain amount of time. If you are no longer using your Russian trading account or forget about it, check you are not liable for any inactivity fees. If you are no longer using your Russian trading account be sure to contact support and close your Russian trading platform account.

Russian Forex Trading Fees

Russian trading platforms do not offer free Forex trading. When you trade Forex, you can expect to pay a fee no matter what your trading strategy is, through spreads. The Forex spreads fees differ with each Russian trading platform. Some are more competitive than other Russian trading platforms. Some Russian trading platforms charge a fixed spread while other Russian trading platforms change a variable spread. Fixed spreads are are determined by the Russian trading platform and remain constant regardless of market conditions or volatility. Fixed spreads allow you to plan your investment strategy by knowing your spread cost ahead of time. Variable spreads may for experienced traders be beneficial if a financial market is less volatile depending on the investment strategy and goals.

|

|

|

|

| |

| Name | IC Markets | AvaTrade | FP Markets | XTB | Pepperstone |

| Withdrawal Fee | No | No | No | No | No |

| Deposit Fee | Varies | No | Yes | No | No |

| Inactivity Fees | No | No | No | Yes | Yes |

| riskwarning | Try Now Losses can exceed deposits | Try Now 71% of retail CFD accounts lose money | Try Now Losses can exceed deposits | Try Now 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. | Try Now CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money |

Russian Trading Account Payment Methods

When trading with a Russian trading platform online, there are a variety of payment options accessible to Russian traders; Depending on which Russian trading plaforms you shortlist each will have different deposit and withdrawal methods. Each trade payment option has its own set of benefits and cons in terms of costs, processing times, and limits.

Some traders consider the time it takes to execute a payment to be critical, while others are content to wait a few days. Similarly, transaction costs may be more or less essential depending on whether you will make numerous little transactions or fewer, larger ones.

Popular Russian Trading Plaform Payment Methods

The funding and withdrawal methods a Russian Trading Plaform offers is very important when trading. The number of payment methods available to Russians traders is increasing every month.

Popular payment methods available on Russian Trading Plaforms include Russian Bank Transfers, Russian Debit Cards, Russian Credit Cards, PayPal, Neteller, Skrill, Rapid Transfer, iDeal, Klarna and Poli. Funding and withdrawal payment methods differ from broker to broker in Russian.

|

|

|

|

| |

| Name | IC Markets | AvaTrade | FP Markets | XTB | Pepperstone |

| Payment Methods | BPAY, Credit Card, FasaPay, Giropay, Mastercard, Neteller, PayPal, POLi, QIWI, Rapid Transfer, Skrill, UnionPay, Visa, Wire Transfer, Yandex Money | Bitcoin Payments, Credit Card, Debit Card, FasaPay, JCB Card, Mastercard, MoneyGram, Perfect Money, Skrill, Swift, Webmoney, Western Union, Wire Transfer | BPAY, Credit Card, FasaPay, Neteller, PayPal, POLi, Skrill, Visa, Wire Transfer | Credit cards, MasterCard, Maestro, Visa, Debit cards, Bank Transfer, Electronic wallets (eWallets), PayPal, Neteller, Skrill, Poli, Paysafe, Payoneer, | Apple Pay, Credit Card, Debit Card, Mastercard, POLi, QIWI, UnionPay, Visa |

| riskwarning | Try Now Losses can exceed deposits | Try Now 71% of retail CFD accounts lose money | Try Now Losses can exceed deposits | Try Now 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. | Try Now CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money |

How to Open a Russian Trading Account

Step 1: Open a Russian Trading Account

When opening a Russian trading account. Set up two factor authentication as well as a strong password; we recommend using Google Authenticator for extra security; Make sure that email addresses associated with your Russian trading account are verified.

Verifying your Russian trading account will you to access your withdrawal history should any issues arise in future;

Step 2: Confirm Your Russian Identity

Online trading platforms Russian, require a Russian resident to have a verified Russian account with them before they will let you trade on their Russian trading platform.

Russian trading accounts will require some form of identify verification such as Russian social security number or equivalent, Russian drivers license or Russian passport. You will not be able to trade on your selected Russian trading platform until you have passed verification checks. This is due to the financial regulation Russian trading platforms have to adhere too. Verification of your Russian trading account may take 2-10 working days but may be faster.

Step 3: Deposit Funds To Your Russian Trading Platform

Russian trading platforms offer a wide range of deposit funding methods before you begin trading. Pick a deposit method that you are most comfortable with. Remember to keep your Russian trading platform minimum deposit requirements in mind when opening your new Russian trading account. The minimum deposit requirement amounts may vary depending on the type of Russian trading account you decide to open.

Step 4: Research a Financial Instrument To Trade On Your Russian Trading Platform

Research financial instrument is one of the most difficult parts of trading on a Russian trading platform. Experienced traders have spent years learning how to understand market sentiment using technical analysis and charting tools. To use a Russian trading platform effectively you will have to spend time to understand how these tools work.

One of the most important things you can do when researching a financial asset on a Russian trading platform, is to look at financial statements, annual reports and historical price data. You need to have a good understanding of how your financial instrument makes money, what they spend their money on, and more importantly, the financial markets sentiment towards the financial instrument. A Russian trading platform will offer market research tools but you must use your own judgement and understand what you are doing.

Step 5: Place a Trade

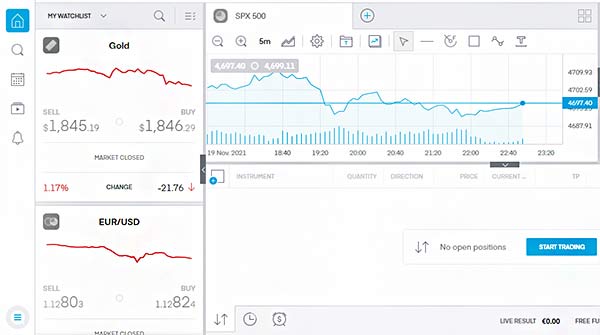

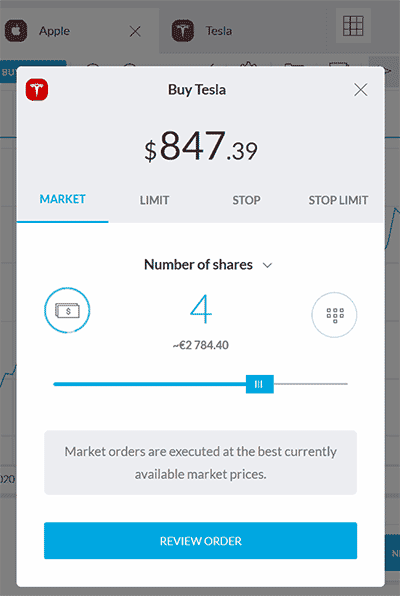

Create a watchlist or browse the financial markets on your chosen Russian trading platform.

Open the chart of the financial asset you want to invest in.

Your Russian trading platform will have a range of tradable financial instruments available. Whether it's a stock, commodity, currency pair, or crypto asset your have selected on your Russian trading platform, click 'Buy' or 'Sell' for the desired financial asset.

Enter the number of units you want to buy or sell. Set up your Take Profit and Stop Loss levels on your Russian trading platform. If you do not know what risk management strategies are learn about them before trading on a Russian trading platform.

Before you click buy make sure you understand the trading risks and know clearly what you are doing. Do not trade with money you cannot afford to lose. Trading on the financial markets on a Russian trading platform holds risks. Click on the Buy Trade button.

On your chosen Russian trading platform, your trade will be sent for order execution by your Russian trading platform immediately.

Best Trading Platforms Russian Verdict

Their has been a huge growth in online trading in Russian. New Russian trading platforms have seen their user bases see huge spikes in registrations over the last 2 years as new traders embrace trading online in Russian.

Modern Russian trading platforms are good because they offer both the traditional financial instruments like stocks and shares, Forex and commodities and the futures markets along with new financial markets like cryptocurrencies and higher risk leveraged trading options like CFDs.

Modern online trading platforms in Russian offer Russian traders access to thousands of tradable financial assets in multiple asset classes on financial markets not just in Russian, but all over the world. Modern Russian trading platforms offer very advanced trading tools, all available online, through a mobile app or even as downloadable software. Mordern Russian traders can easily place buy and sell orders from just there mobile devices anywhere in the world.

Best Trading Platforms Russian 2026 Frequently Asked Questions

We answer the most frequently asked Russian trading platform questions below.

What is the best trading platform in Russian?

The best Russian trading platforms is eToro. eToro has the worlds most advanced online social trading platform with 0% commissions charged on real stocks.

What is the best platform for beginners in Russian?

Here are some of the best trading platforms for beginners in Russian: eToro - best for following more experienced traders. XTB - Low fees, good tools and fast account opening. Avatrade - Great research tools and free withdrawal and deposit options.

What is the safest Russian Trading Platform?

eToro is among the safest trading platforms in Russian as they are heavily regulated.

What can I trade on Russian Trading Platforms?

Russian trading platforms allowing trading in stocks, commodities, futures, ETFs, CFDs, Forex and cryptocurrencies.

Related Guides

- Best Trading Platforms Russian

- Best Stock Trading Apps Russian

- Trade US Stocks in Russian

- Best Indices Brokers Russian

Best Stock Trading Apps Russian Reviews

We also have in depth reviews of each of the best Russian trading platform reviews listed below.

Best Trading Platforms Russian Reviews

We also have in depth reviews of each of the best Russian trading platform reviews listed below.

- IC Markets Review (read our in depth 2026 reviews)

- AvaTrade Review (read our in depth 2026 reviews)

- FP Markets Review (read our in depth 2026 reviews)

- XTB Review (read our in depth 2026 reviews)

- Pepperstone Review (read our in depth 2026 reviews)

- XM Review (read our in depth 2026 reviews)

- eToro Review (read our in depth 2026 reviews)

- FXPrimus Review (read our in depth 2026 reviews)

- Trading 212 Review (read our in depth 2026 reviews)

- SpreadEx Review (read our in depth 2026 reviews)

- Admiral Markets Review (read our in depth 2026 reviews)

- Axi Review (read our in depth 2026 reviews)

- HYCM Review (read our in depth 2026 reviews)

- Swissquote Review (read our in depth 2026 reviews)

- FxPro Review (read our in depth 2026 reviews)

Best Trading Platforms Russian Alternatives

We also have in depth guides of the best Russian alternative trading platforms for each Russian broker below.

- IC Markets Alternatives

- AvaTrade Alternatives

- FP Markets Alternatives

- XTB Alternatives

- Pepperstone Alternatives

- XM Alternatives

- eToro Alternatives

- FXPrimus Alternatives

- Trading 212 Alternatives

- SpreadEx Alternatives

- Admiral Markets Alternatives

- Axi Alternatives

- HYCM Alternatives

- Swissquote Alternatives

- FxPro Alternatives

IC Markets

IC Markets

AvaTrade

AvaTrade

FP Markets

FP Markets

XTB

XTB

Pepperstone

Pepperstone

XM

XM

eToro

eToro

FXPrimus

FXPrimus

Trading 212

Trading 212

SpreadEx

SpreadEx

Admiral Markets

Admiral Markets

Axi

Axi

HYCM

HYCM

Swissquote

Swissquote

FxPro

FxPro