Best Trading Platforms New Zealand 2025

Trading platforms have seen huge growth in New Zealand. Thanks mainly to the increased accessibility of the internet and computers and mobile devices all over the New Zealand region over the last 5 to 10 years in New Zealand for New Zealander traders.

A younger generation of New Zealander tech savy traders now see new more modern New Zealand trading platforms that gives the average New Zealander trader access to not only local New Zealand financial markets, but quick easy access to buying and selling of a variety of financial instruments on all major financial markets all over the globe from without leaving their homes in New Zealand. Many trading platforms available to New Zealand traders give New Zealander traders the ability to trade on both mobile and desktop devices. Many modern New Zealand trading platforms just need a web browser and internet connection and offer fast order execution speeds to New Zealander traders.

The financial center of New Zealand is Wellington but many New Zealander traders increasingly have a more global outlook to the financial instruments they want to trade in. Many New Zealander traders now look to New Zealand and global stocks and shares, world fiat currency markets, cryptocurrency trading, commodities trading, ETFs and CFDS.

New Zealand does have the local The NZX Equity Market financial market for New Zealander traders to buy and sell New Zealand securities. Although the Local The NZX Equity Market is there for New Zealander traders, more experienced New Zealander traders are actively looking to add a range of financial instruments to their investment and trading portfolios from financial markets all over the world not just New Zealand.

Although New Zealander traders still use the NZD, more experienced New Zealander traders are intergrating multiple deposit and withdrawal currencies into their New Zealand trading strategies when New Zealander traders compare New Zealand trading platforms.

Choosing The Best Regulated Trading Platform New Zealand

Choosing the best New Zealand trading platform for you can be overwhelming for new investors. The good news is that many New Zealand investment platforms provide education, research, and trading tools to help you get started. We'll show you how to evaluate new New Zealand trading platforms for example checking they are regulated and where you should begin.

All trading platforms in New Zealand need to be regulated by The Financial Markets Authority (FMA), Financial Service Providers Register (FSPR), Financial Services Complaints Limited (FSCL). Its also a good sign if when using an international trading platform that serves New Zealand residents if they are regulated by a major European financial regulator like the UK's Financial Conducat Authority (FCA) and Cysec.

Best Trading Platforms New Zealand 2025 Table of Contents

- Best Trading Platforms New Zealand 2025

- Top New Zealand Trading Platforms Compared

- Best Trading Platforms New Zealand List

- IC Markets

- Roboforex

- NordFX

- XTB

- Pepperstone

- XM

- eToro

- FXPrimus

- easyMarkets

- Trading 212

- Admiral Markets

- SpreadEx

- Swissquote

- HYCM

- Axi

- Best Online Brokers New Zealand Reviewed

- What Can I Trade on New Zealand Trading Platforms

- Stocks And Shares on New Zealand Trading Platforms

- New Zealand Fractional Trading

- Cryptocurrency Trading on New Zealand Trading Platforms

- ETFs on New Zealand Trading Platforms

- Indices on New Zealand Trading Platforms

- Bonds on New Zealand Trading Platforms

- How do New Zealand Bond Trading Platforms Work?

- Commodities on New Zealand Trading Platforms

- Margin Trading on New Zealand Trading Platforms

- Stock CFD Trading on New Zealand Trading Platforms

- ETF CFD trading on New Zealand Trading Platforms

- Commodity CFDs on New Zealand Trading Platforms

- Bond CFDs on New Zealand Trading Platforms

- Futures CFDs on New Zealand Trading Platforms

- Forex Trading on New Zealand Trading Platforms

- Trading Platform New Zealand Features & Tools

- MT4 on New Zealand Trading Platforms

- MT5 on New Zealand Trading Platforms

- cTrader on New Zealand Trading Platforms

- STP Accounts on New Zealand Trading Platforms

- ECN Accounts on New Zealand Trading Platforms

- DMA Accounts on New Zealand Trading Platforms

- Social Trading on New Zealand Trading Platforms

- Copy Trading on New Zealand Trading Platforms

- VIP Trading Account on New Zealand Trading Platforms

- Auto Trading on New Zealand Trading Platforms

- New Zealand Mobile Apps on New Zealand Trading Platforms

- Trade Signals on New Zealand Trading Platforms

- Islamic Accounts on New Zealand Trading Platforms

- Demo accounts on New Zealand Trading Platforms

- Financial Regulation on New Zealand Trading Platforms

- New Zealand Financial Regulation

- New Zealand Trading Platform Customer Service

- Phone Support on New Zealand Trading Platforms

- Live Chat Support on New Zealand Trading Platforms

- New Zealand Trading Platform Minimum Deposits

- Does It Matter How Many Traders My New Zealand Trading Platform Has?

- Educational Resources on New Zealand Trading Platforms

- Trading Platforms New Zealand Trading Fees Explained

- New Zealand Share Dealing Fees

- New Zealand Trading Commission

- New Zealand Spreads

- New Zealand Trading Platform Fees

- New Zealand Overnight Financing Fees

- New Zealand Trading Platform Transaction Fees

- New Zealand Trading Platform Inactivity Fees

- New Zealand Forex Trading Fees

- New Zealand Trading Account Payment Methods

- Popular New Zealand Trading Plaform Payment Methods

- How to Open a New Zealand Trading Account

- Step 1: Open a New Zealand Trading Account

- Step 2: Confirm Your New Zealand Identity

- Step 3: Deposit Funds To Your New Zealand Trading Platform

- Step 4: Research a Financial Instrument To Trade On Your New Zealand Trading Platform

- Step 5: Place a Trade

- Best Trading Platforms New Zealand Verdict

- Best Trading Platforms New Zealand 2025 Frequently Asked Questions

- Related Guides

- Best Trading Platforms New Zealand Reviews

- Best Trading Platforms New Zealand Alternatives

Top New Zealand Trading Platforms Compared

Best Trading Platforms New Zealand List

| Featured New Zealand Trading Platform | Account Features | Trading Features |

|---|---|---|

| Used By: 180,000 Instruments Available: 232 Number Of Shares Available: 2,100 Minimum Deposit: 200 |

Platforms: MT4, MT5, Mirror Trader, ZuluTrade, Web Trader, cTrader, Mac Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsTry Now |

|

| Used By: 10,000 Instruments Available: 100 Number Of Shares Available: 53 Minimum Deposit: 10 USD / 10 EUR |

Platforms: MT4, MT5, Mac, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsTry Now |

|

| Used By: 10,000 Instruments Available: 50 Number Of Shares Available: 0 Minimum Deposit: 10 |

Platforms: MT4, MT5, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsTry Now |

|

| Used By: 250,000 Instruments Available: 4000 Number Of Shares Available: 1,696 Minimum Deposit: 0 |

Platforms: MT4, Mirror Trader, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Try Now |

|

| Used By: 89,000 Instruments Available: 100 Number Of Shares Available: 60 Minimum Deposit: 200 |

Platforms: MT4, MT5, Mac, ZuluTrade, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your moneyTry Now |

|

| Used By: 10,000,000 Instruments Available: 1000 Number Of Shares Available: 160 Minimum Deposit: 5 |

Platforms: MT4, MT5, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77.74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.Try Now |

|

| Used By: 20,000,000 Instruments Available: 2000 Number Of Shares Available: 2,042 Minimum Deposit: 50 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 51% of retail investor accounts lose money when trading CFDs with this provider.Try Now |

|

| Used By: 10,000 Instruments Available: 130 Number Of Shares Available: 60 Minimum Deposit: 100 |

Platforms: MT4, Mac, Mirror Trader, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsTry Now |

|

| Used By: 142,500 Instruments Available: 200 Number Of Shares Available: 52 Minimum Deposit: 100 |

Platforms: MT4, MT5, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Your capital is at riskTry Now |

|

| Used By: 15,000,000 Instruments Available: 10000 Number Of Shares Available: 1,731 Minimum Deposit: 1 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.Try Now |

|

| Used By: 10,000 Instruments Available: 148 Number Of Shares Available: 64 Minimum Deposit: $100 |

Platforms: MT4, MT5, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsTry Now |

|

| Used By: 10,000 Instruments Available: 15000 Number Of Shares Available: 1,000 Minimum Deposit: 1 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsTry Now |

|

| Used By: 300,000 Instruments Available: 100 Number Of Shares Available: 0 Minimum Deposit: 1000 |

Platforms: MT4, MT5, ZuluTrade, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsTry Now |

|

| Used By: 10,000 Instruments Available: 100 Number Of Shares Available: 10 Minimum Deposit: 100 |

Platforms: MT4, MT5, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes Losses can exceed depositsTry Now |

|

| Used By: 10,000 Instruments Available: 100 Number Of Shares Available: 1,000 Minimum Deposit: 0 |

Platforms: MT4, Mac, ZuluTrade, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsTry Now |

Best Online Brokers New Zealand Reviewed

What Can I Trade on New Zealand Trading Platforms

Trading platforms in New Zealand have seen a have seen huge growth in the last 5 years.

Modern New Zealand trading platforms are easy to find, use and install. The internet's expansion in New Zealand and the rest of the world, the improvement in terms of cost in New Zealand and speed has lowered the barrier to entry to New Zealand traders. More people in New Zealand can now access these online New Zealand trading services and begin trading in minutes. Trading has also been revolutionised by the internet for New Zealand people, which has made trading in New Zealand not only more convenient but also real-time.

We list the most popular tradable financial assets available on New Zealand trading platforms below.

Stocks And Shares on New Zealand Trading Platforms

New Zealand Stock market trading is the buying and selling of company stocks and shares, or other securities through a New Zealand stockbroker and trading platform in New Zealand. Trading on the New Zealand or global stock market is accomplished by placing a buy or sell order to your New Zealand trading platform. A buy order is placed when you wish to purchase a security, and a sell order is placed when you wish to sell the security back to your New Zealand trading platform.

Most people trade stocks and shares with New Zealand online trading platforms. New Zealand trading platforms offer more convenience for local New Zealand residents than traditional brokerage firms that used to handle buy and sell financial instrument transactions by phone.

When trading stocks and shares on a New Zealand trading platform, stocks and shares are the primary source of funds for companies listed on New Zealand and global stock exchanges. Investing on a New Zealand trading platform offers investors a stake in listed companies, as well as a share of that companies profits through dividends. The price of stocks and shares can go up or down depending on how the New Zealand financial market perceives their value.

|

|

|

|

| |

| Name | IC Markets | Roboforex | NordFX | XTB | Pepperstone |

| UK Stocks | Yes | Yes | No | Yes | No |

| US Stocks | Yes | Yes | No | Yes | No |

| DE Stocks | Yes | Yes | No | Yes | Yes |

| JP Stocks | Yes | Yes | No | Yes | No |

| Penny Stocks | No | No | No | Yes | No |

| riskwarning | Try Now Losses can exceed deposits | Try Now Losses can exceed deposits | Try Now Losses can exceed deposits | Try Now 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. | Try Now CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money |

New Zealand Fractional Trading

A relatively new trading feature for New Zealand traders that New Zealand trading platforms offer are fractional shares. A fractional share is a fraction of a full share of an equity stock. Stock splits, which don't always result in an even number of shares, frequently result in fractional shares. Fractional shares are not traded on the open market; they can only be sold through a larger New Zealand trading platform brokers. New Zealand trading platforms that offer fractional shares allow New Zealand traders to buy shares with a lower barrier to entry.

|

|

|

|

| |

| Name | IC Markets | Roboforex | NordFX | XTB | Pepperstone |

| Fractional Shares | No | Yes | No | No | No |

| riskwarning | Try Now Losses can exceed deposits | Try Now Losses can exceed deposits | Try Now Losses can exceed deposits | Try Now 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. | Try Now CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money |

Cryptocurrency Trading on New Zealand Trading Platforms

In order to be able to trade cryptocurrency in New Zealand, you need a New Zealand crypto trading account. This is where your New Zealand crypto assets are held and perform a similar function to New Zealand bank accounts used in the real world. You will need to create a crypto New Zealand trading account if you are from the New Zealand, so that you can start buying and selling cryptocurrency with ease.

Cryptocurrency trading is one of the fastest growing financial markets in the world today. It has grown exponentially over the past few years and it shows no signs of slowing down. In fact, there are now more cryptocurrencies than ever before and each exchange has an average daily volume that exceeds $1 million USD.

In order to trade cryptocurrencies from New Zealand, you first need to open a New Zealand cryptocurrency trading account with a New Zealand cryptocurrency exchange or crypto New Zealand trading platform. You can then deposit cash from your New Zealand bank or credit card into a New Zealand trading account in order to buy different cryptocurrencies with USD dollars or other fiat currencies available in New Zealand.

After you have purchased your digital assets on a New Zealand trading platform, you can withdraw your New Zealand crypto assets onto your local computer or store them in another software wallet that you have control of in New Zealand.

Make sure you trade cryptocurrencies with a well regulated and secure trading platform in New Zealand. If you decide to leave crypto on a unregulated unsecure New Zealand exchange, be careful not to keep too much of your digital currency on any one New Zealand trading platform as unregulated New Zealand crypto trading platforms are known for getting hacked.

|

|

|

|

| |

| Name | IC Markets | Roboforex | NordFX | XTB | Pepperstone |

| Crypto | Yes | No | No | Yes | Yes |

| riskwarning | Try Now Losses can exceed deposits | Try Now Losses can exceed deposits | Try Now Losses can exceed deposits | Try Now 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. | Try Now CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money |

ETFs on New Zealand Trading Platforms

Most modern online New Zealand Trading platforms allow trading in ETFs. Exchange-traded Funds (ETFs) in New Zealand are a type of investment that trade on an exchange just like stocks. The value of ETFs is based on the collective value of their underlying assets. Because they trade on an local New Zealand or global financial exchange, ETFs can be bought and sold at any time on a New Zealand ETF trading platform during market hours. New Zealand trading platforms allow New Zealand traders to purchase partial shares or full shares depending on the desired commitment to the investment and ability to pay for it.

Indices on New Zealand Trading Platforms

New Zealand indice trading platforms allow New Zealand traders to invest in local New Zealand Indices and stock indexes as well as indices on financial markets all over the world.

Financial market indices are used to measure changes in the value of a New Zealand or global selection of stocks, bonds, or other financial assets.

The most common Global indices Markets include: the London Stock Exchange, the Dow Jones Industrial Average (DJIA), Standard & Poor's 500 (S&P 500), the NASDAQ Composite, and the Russell 2000.

Financial indices are also referred to as stock market indices or a stock market index. The Dow Jones Industrial Average (DJIA) is often referred to as the “Dow 30” or “the Dow,” while the Nasdaq Composite is also referred to as the “Nasdaq”.

When trading on New Zealand trading platforms, financial indices are designed to show how a group of New Zealand or worldwide stocks performs in relation to other market-traded stocks or indexes. Financial indices can measure stocks on an absolute basis or relative basis.

A benchmark index is a statistical measure of the value of a section of the global or New Zealand stock market. It is computed from the prices of specific selected stocks and reflects changes in their valuations.

Financial indices can help New Zealand investors using New Zealand trading platforms understand how markets have performed over time from month-to-month and year-to-year against local New Zealand financial markets and markets all around the world.

Bonds on New Zealand Trading Platforms

Bonds from New Zealand and all over the world can be actively traded on New Zealand trading platforms.

Bonds are a kind of loan from individuals or institutions to the New Zealand government. They help governments meet their borrowing needs and finance their local New Zealand expenditures. New Zealand Bonds can be issued as either long-term (20 years or more) or short-term (less than three years). These bonds are issued on behalf of the government by its debt manager, the Bank of Canada.

How do New Zealand Bond Trading Platforms Work?

When you buy a bond on a New Zealand trading platform, you're essentially loaning money to the government. When the government receives your loan, it will pay you interest on your investment until its debt is paid off; Usually after 20 years or more. You can choose to hold onto your bonds within your New Zealand trading platform until they mature, sell them before they mature, or put them in a portfolio that automatically re-balances itself by purchasing more bonds when prices fall and selling some when prices rise, an approach called 'rebalancing'.

Commodities on New Zealand Trading Platforms

When trading from New Zealand commodities trading is a way of investing in commodities through contracts. Some of the examples of commodities are gold, silver, oil, stocks and other goods that are traded in the public market. Modern trading platforms allow New Zealand residents to trade commodities not only from New Zealand but also commodity markets all over the world across multiple timezones via commodity futures or commodity CFD trading.

New Zealand investors have a choice to either go for futures or physical commodities. A futures contract is a standardised legal agreement between unrelated parties to buy or sell something at a predetermined price at a predetermined time in the future. Physical options are where you directly acquire some goods as soon as you agree to a deal; however, this requires more funds which is why many people prefer going for futures options.

Margin Trading on New Zealand Trading Platforms

Margin trading on New Zealand trading platforms have a higher profit potential than standard trading, but it also comes with a higher level of risk. The repercussions of losses are amplified when buying stocks on margin. A margin call, which asks you to sell your stock position or front more funds to keep your investment, may also be issued by the broker.

Stock CFD Trading on New Zealand Trading Platforms

Trading traditional stocks and shares are usually better suiting for long term trading. Modern online trading platforms in New Zealand allow CFD stock trading.

CFD stock trading is where more experienced traders can speculate on a stocks up or down price movement using leveraged margin trading which allows a fraction of a traded amount to be placed with a New Zealand CFD stock trading platform.

Stock CFD trading is high risk and you may lose more than your deposited amount with some New Zealand trading platforms. No underlying real company stocks are brought on a CFD stock trade on your New Zealand trading platform. A CFD stock trade is a speculative deal between you and your New Zealand CFD stock broker platform on a stock assets price movement.

ETF CFD trading on New Zealand Trading Platforms

When you trade ETFs as CFDs (Contracts for Difference), you are investing in the price of the ETF rather than the actual ETF. The market value of the financial instrument that a CFD instrument represents is used to calculate its value. Most trading platforms in New Zealand will allow speculative trading in ETFs through CFDs. Check you fully understand what ETF CFDS are as they hold risk and what CFD ETFs your trading platform in New Zealand specfically offers.

Commodity CFDs on New Zealand Trading Platforms

Commodity CFDs although high risk due to their leverage feature, are a versatile tool for experienced New Zealand investors. Trading platforms in New Zealand allow CFD trading in commodity futures at a fraction of the cost of trading tradtional commodities. You can also utilise Stop Loss and Take Profit orders on your New Zealand trading platform to automate trades, leverage to raise your position's exposure, and technical analysis to construct exact strategies. Understand that no underlying commodities are traded on your New Zealand trading platform with a commodity CFD. A commodity CFD is high risk speculation using leverage on up or down price movement on a specific commodity between the trader and the New Zealand trading platform.

Bond CFDs on New Zealand Trading Platforms

Some trading platforms in New Zealand allow New Zealand traders to trade Bond CFDs.

A bond CFD is a form of financial derivative trading. When you trade a bond, you are taking a position on the price of the underlying instrument and not purchasing the instrument itself. Bond CFDs use leverage which is very high risk.

New Zealand trading platforms sell bond CFDs, which are financial instruments. The reference asset for each Bond CFD is a specific New Zealand or global bond financial instrument. The capital return of the instrument is the difference between the open and closing prices of the reference bond, which is what CFDs stand for. When trading CFDs, the difference is settled in cash, and no physical delivery of bonds is required.

Futures CFDs on New Zealand Trading Platforms

Futures CFD trading is available on most trading platforms in New Zealand.

Futures contracts are standardized agreements or contracts with obligations to buy or sell a particular asset at a preset price with a future expiration date. Although CFDs allow investors to trade the price movements of futures, they are not futures contracts by themselves.

Futures CFDs are high risk leveraged trades on speculative Futures price movements up or down with your New Zealand trading platform or broker. With a Futures CFD you are not trading any underlying Futures assets. Futures CFDS although high risk can have a lower barrier of entry than traditional Futures trading.

|

|

|

|

| |

| Name | IC Markets | Roboforex | NordFX | XTB | Pepperstone |

| Stock CFDs | 110 | 8400 | 65 | 1,800 | 253 |

| ETF CFDs | 30 | 50 | 50 | 114 | 250 |

| Commodity CFDs | 20 | 20 | 20 | 22 | 16 |

| riskwarning | Try Now Losses can exceed deposits | Try Now Losses can exceed deposits | Try Now Losses can exceed deposits | Try Now 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. | Try Now CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money |

Forex Trading on New Zealand Trading Platforms

Forex, short for foreign exchange, is the largest financial market in New Zealand and the rest of the world. Trading currencies in New Zealand allows you to take advantage of the swings in values in local New Zealand and global currencies, and the volatility that occurs between different countries currencies. On your New Zealand trading platform, New Zealand residents can trade on these price differences with the goal of making a profit from speculating on price movements, or using currency fluctuations to hedge against losses in another investment position. All of this can be done on modern online New Zealand trading platforms.

Different New Zealand trading platforms offer different currency pairs available. All major currency pairs will be available on your New Zealand trading platform, but if you need some more exotic currency pairs when trading from New Zealand, you will need to check they are available in your New Zealand trading dashboard.

|

|

|

|

| |

| Name | IC Markets | Roboforex | NordFX | XTB | Pepperstone |

| Forex | Yes | Yes | Yes | Yes | Yes |

| Major Pairs | Yes | Yes | Yes | Yes | Yes |

| Exotic Pairs | Yes | Yes | Yes | Yes | |

| riskwarning | Try Now Losses can exceed deposits | Try Now Losses can exceed deposits | Try Now Losses can exceed deposits | Try Now 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. | Try Now CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money |

Trading Platform New Zealand Features & Tools

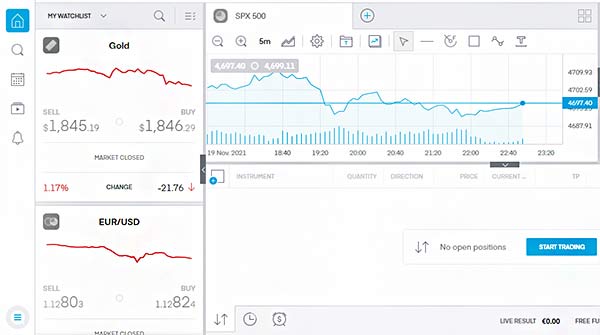

New Zealand trading platforms offer varying features and tools that help New Zealand traders with technical analysis and financial market research. New Zealand trading account tools can include a range of chart types, technical indicators, market news, advanced order types, trading simulators and faster order executions.

MT4 on New Zealand Trading Platforms

MT4 is a Forex and CFD trading platform, which means you can trade Forex online with it. MT4 stands for MetaTrader 4 and it was developed by MetaQuotes Software Corp., a Russian software company that has been in business since 1999.

MetaQuotes is still one of the market leaders when it comes to New Zealand Forex trading platforms, but there are other companies like eToro which also offer their own trading platform solutions.

While the basic features of MT4 and other similar platforms may look quite similar, there are some differences between them that you need to keep in mind before picking one or another. If you have used MT4 before and are happy with it check if your New Zealand trading platform offers MT4.

MT5 on New Zealand Trading Platforms

Unless your New Zealand trading platform have built their own proprietary trading platform, your New Zealand broker is probably using MT5 or MT4 as their trading platform for New Zealand residents.

MT5 is a more modern version of MT4 offering more technical indicators to New Zealand traders. MT5 has more technical analysis tools like depth of market which allows New Zealand traders to view financial instrument bid prices across many global financial markets, not just the New Zealand market. MT5 offers over twice as many timeframes on its charting tools to New Zealand users. MT5 is not just for CFD trading. MT5 is a multiasset trading platform allowing trading stocks, commodities, futures, Forex and cryptocurrencies. MT5 is 64 bit and has been designed for speed. Check if your New Zealand trading platform offers MT5.

cTrader on New Zealand Trading Platforms

cTrader is a full-featured trading platform that Forex and CFD firms can provide to their New Zealand clients. The cTrader platform is jam-packed with features that cater to most New Zealand traders needs. If you are looking for a trading platform in New Zealand that offers automated trading facilities to users in New Zealand. cTrader is known for is popular accessible programming language. Check to see if your New Zealand trading platform offers these features if you need this functionality.

|

|

|

|

| |

| Name | IC Markets | Roboforex | NordFX | XTB | Pepperstone |

| MT4 | Yes | Yes | Yes | Yes | Yes |

| MT5 | Yes | Yes | Yes | No | Yes |

| cTrader | Yes | No | No | No | Yes |

| riskwarning | Try Now Losses can exceed deposits | Try Now Losses can exceed deposits | Try Now Losses can exceed deposits | Try Now 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. | Try Now CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money |

STP Accounts on New Zealand Trading Platforms

A Forex broker that offers Straight Through Processing of trade orders is known as a STP broker. These are brokers who submit the trader's orders directly to liquidity providers (big banks) for processing and fulfilment of trade orders.

STP brokerages can often provide tight spreads and cost of execution without the disadvantage of a dealing desk's higher costs.

ECN Accounts on New Zealand Trading Platforms

A real ECN account is a pure order-matching execution system in which the New Zealand trading platform charges a premium as commission per trade rather than artificially inflating the raw spread that occurs naturally during the order-matching process.

In liquid market situations, New Zealand ECN accounts might offer tighter spreads and a lower overall cost of trading in New Zealand.

DMA Accounts on New Zealand Trading Platforms

Direct market access (DMA) is an electronic trading strategy that allows New Zealand investors to conduct transactions on New Zealand trading platforms by engaging directly with an electronic order book. An order book is a collection of orders listed on New Zealand trading platforms. New Zealand DMA trading platforms displays prices and volumes and is a list of orders that records the orders placed on the stock exchange by buyers and sellers. If you require DMA trading in New Zealand check your New Zealand trading platform offers it.

|

|

|

|

| |

| Name | IC Markets | Roboforex | NordFX | XTB | Pepperstone |

| STP | No | Yes | Yes | Yes | Yes |

| ECN | Yes | Yes | No | No | Yes |

| DMA | Yes | No | Yes | Yes | Yes |

| riskwarning | Try Now Losses can exceed deposits | Try Now Losses can exceed deposits | Try Now Losses can exceed deposits | Try Now 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. | Try Now CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money |

Social Trading on New Zealand Trading Platforms

Social trading is a form of investing in which New Zealand individuals copy or mirror the trades or portfolios of other, more successful investors. Social trading allows you to invest in ways that were previously only available to a select few institutional investors – including hedge fund managers, investment bankers, and venture capitalists.

It can take decades for New Zealand traders to build up the necessary experience and expertise to fully understand risk and make consistent profits on financial markets. With social trading, new traders can research and follow the trades of more successful New Zealand and global traders.

It takes some skill to identify skilled traders whom you should follow closely on New Zealand trading platforms. Fortunately, many New Zealand trading platforms offer New Zealand users trading tools designed specifically for this purpose. A social trading New Zealand portfolio should be well diversified to help mitigate trading risks.

Copy Trading on New Zealand Trading Platforms

Copy trading is a system that allows New Zealand investors to copy the trades of other traders not only in New Zealand but all over the world. New Zealand traders can either trade a specific financial instrument or the market as a whole. While it can be done manually, it is now common for New Zealand trading platforms to offer copy trading on their New Zealand platforms. Copy trading is offered by many New Zealand brokers including eToro, but not all New Zealand copy trading platforms have the same trading features and systems. The best way to find out about the details of how each New Zealand trading platforms offers copytrading is to read each New Zealand copytrading platforms user guides. eToro is the biggest social trading and copytrading platform in the world with over 20 million registered users.

If you do opt in for a New Zealand copy trading platform, then it will generally be up to you which trades you want copied from other New Zealand or worldwide traders and when those copies should be made. You will normally be able to choose between having one-to-one copies of every trade made by another investor on your New Zealand copytrading platform or having automatic 'buy' and 'sell' copies made automatically once per day at a set time so long as there has been activity during that day in that option or market as a whole.

If there hasn't been any activity during the day (or no new positions being opened) then no automatic copies will be made on your New Zealand trading platform until there is some activity again after midnight GMT/UTC time (the default time zone set by most brokers). It really depends on what your New Zealand trading platform offers with their own system so always check first before making any assumptions with your trades.

|

|

|

|

| |

| Name | IC Markets | Roboforex | NordFX | XTB | Pepperstone |

| Copytrading | No | Yes | Yes | No | Yes |

| Social Trading | Yes | No | No | No | Yes |

| riskwarning | Try Now Losses can exceed deposits | Try Now Losses can exceed deposits | Try Now Losses can exceed deposits | Try Now 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. | Try Now CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money |

VIP Trading Account on New Zealand Trading Platforms

Trading with a New Zealand VIP account is similar to trading with a personal market analyst, but with the added benefit of lower New Zealand trading fees and lower latency for faster execution for New Zealand traders.

VIP trading accounts are preferable to normal accounts since they come with a slew of extra features. These accounts are open to both professional and individual traders of any degree who have a big amount of money to trade.

Many New Zealand trading platforms offering VIP accounts offer New Zealand users additional trading features including free VPS trading machines, hosting service, no deposit/withdrawal fees, private consultations with a New Zealand personal account manager, exclusive seminars and events which may be available locally in New Zealand or worldwide. New Zealand VIP trading account features vary between New Zealand trading platforms. Check to see what your VIP New Zealand trading platform offers.

|

|

|

|

| |

| Name | IC Markets | Roboforex | NordFX | XTB | Pepperstone |

| VIP Accounts | No | Yes | Yes | Yes | No |

| riskwarning | Try Now Losses can exceed deposits | Try Now Losses can exceed deposits | Try Now Losses can exceed deposits | Try Now 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. | Try Now CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money |

Auto Trading on New Zealand Trading Platforms

Automated trading in New Zealand is a way of participating in financial markets by executing pre-set procedures for entering and leaving trades on New Zealand trading platforms through a computer programme. As a New Zealand automated trader, you'll combine in-depth technical analysis on global and New Zealand financial instruments, with the creation of position characteristics like open orders, trailing stops, and guaranteed stops.

Many New Zealand trading platforms offer APIs and programming languages allowing traders in New Zealand to make use of and add automation to their investment strategies. MT4, MT5, cTrader all offer New Zealand traders access to automated trading features.

|

|

|

|

| |

| Name | IC Markets | Roboforex | NordFX | XTB | Pepperstone |

| Automated Trading | Yes | Yes | Yes | Yes | Yes |

| riskwarning | Try Now Losses can exceed deposits | Try Now Losses can exceed deposits | Try Now Losses can exceed deposits | Try Now 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. | Try Now CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money |

New Zealand Mobile Apps on New Zealand Trading Platforms

Trading in New Zealand and worldwide financial instruments such as the stock market, cryptocurrencies, Forex, commodities, Indices, ETFs, and CFDs using a smartphone or tablet, such as an Apple or Android device, is known as mobile app trading. New Zealand mobile trading apps have become more advanced as technology, software and the internet has progressed in the last 5 years. Trading in New Zealand a decade ago was previously mostly conducted through desktop trading, which was done using a PC or Apple Mac computer. No mobile app trading in New Zealand on New Zealand trading platforms in now faster and easier. With the help of a variety of New Zealand trading apps, a New Zealand trader can purchase and sell financial instruments as well as manage a portfolio on his or her mobile phone.

|

|

|

|

| |

| Name | IC Markets | Roboforex | NordFX | XTB | Pepperstone |

| Mobile Apps | iOS, Android and Windows | iOS | iOS, Android | iOS, Android and Windows | iOS, Android and Windows |

| riskwarning | Try Now Losses can exceed deposits | Try Now Losses can exceed deposits | Try Now Losses can exceed deposits | Try Now 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. | Try Now CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money |

Trade Signals on New Zealand Trading Platforms

Trading signals are instructions to purchase or sell a security based on a set of pre-defined parameters. New Zealand Traders can develop trading signals on many New Zealand trading platforms based on a range of parameters, ranging from simple ones like earnings reports and volume surges to more complicated signals drawn from previously generated signals and technical data.

If you are looking for a New Zealand trading platform that offers trading signals, make sure you understand that they are very high risk. Check to see if your trading platform in New Zealand is well regulated and able to offer trading signals to traders in New Zealand.

|

|

|

|

| |

| Name | IC Markets | Roboforex | NordFX | XTB | Pepperstone |

| Signal Trading | Yes | Yes | No | Yes | Yes |

| riskwarning | Try Now Losses can exceed deposits | Try Now Losses can exceed deposits | Try Now Losses can exceed deposits | Try Now 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. | Try Now CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money |

Islamic Accounts on New Zealand Trading Platforms

New Zealand Islamic Trading accounts in New Zealand are designed to allow New Zealand traders to trade in accordance with the ethical principles of Islam.

New Zealand Islamic trading accounts reflect the Islamic prohibition against trading (“gambling”) by excluding speculative investments that include buying on margin or borrowing money to trade, and by only allowing certain asset classes such as currencies, commodities and stocks. However it does allow for certain riskier trades including options and derivatives.

New Zealand traders who wish to trade using a Islamic compatible trading platform available in New Zealand should be aware the Shariah rules for Islamic Financial instruments are set out in detail by the Accounting & Auditing Organization for Islamic Financial Institutions (AAOIFI).

The AAOIFI have codified all aspects of these financial instruments including how they should be structured. These rules cover topics such as profit-sharing arrangements which protect returns from being used before earning them; one-year contracts which prevent speculation on short-term price volatility; regular payments on deposits which remove the element of risk from banks depositors; and interest rates which are not excessive. If you are looking for for a New Zealand Islamic trading account check your New Zealand trading platform offers these Islamic compliant trading accounts.

|

|

|

|

| |

| Name | IC Markets | Roboforex | NordFX | XTB | Pepperstone |

| Islamic Accounts | Yes | Yes | Yes | Yes | Yes |

| riskwarning | Try Now Losses can exceed deposits | Try Now Losses can exceed deposits | Try Now Losses can exceed deposits | Try Now 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. | Try Now CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money |

Demo accounts on New Zealand Trading Platforms

A New Zealand demo trading account is a type of account provided by New Zealand trading platforms that are filled with fictitious virtual trading funds raning from 100k USD that allows a potential New Zealand trader to test the New Zealand trading platform and its features before opting to open a real New Zealand trading account.

If you are new to trading it is essential you learn to trade first with a New Zealand trading platform, before risking losing real money on a live New Zealand trading account. Demo accounts are free on most reputable New Zealand trading platforms.

|

|

|

|

| |

| Name | IC Markets | Roboforex | NordFX | XTB | Pepperstone |

| Demo Accounts | Yes | Yes | Yes | Yes | Yes |

| riskwarning | Try Now Losses can exceed deposits | Try Now Losses can exceed deposits | Try Now Losses can exceed deposits | Try Now 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. | Try Now CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money |

Financial Regulation on New Zealand Trading Platforms

Financial regulation in New Zealand is the process of controlling and managing financial services in New Zealand regional area. It combines aspects of New Zealand law, consumer protection and economics. Governments like New Zealand often implement financial regulations to prevent industry abuse, ensure fairness and protect consumers from mismanagement or fraud for New Zealand residents. New Zealand and international financial regulators also control the amounts of risk that New Zealand individual retail trading can take with their investments.

New Zealand Financial Regulation

All trading platforms in New Zealand need to be authorised and overseen New Zealand financial regulators including by The Financial Markets Authority (FMA), Financial Service Providers Register (FSPR), Financial Services Complaints Limited (FSCL). Traders in New Zealand can also use online trading platforms that serve New Zealand residents. Check that any online trading platform you use from New Zealand is regulated by a major European financial regulator like the UKs Financial Conduct Authority (FCA).

|

|

|

|

| |

| Name | IC Markets | Roboforex | NordFX | XTB | Pepperstone |

| Regulated By | Australian Securities and Investments Commission (ASIC), Financial Services Authority (FSA), Cyprus Securities and Exchange Commission (CySEC) | RoboForex Lid is regulated by Belize FSC, License No. 000138/7, reg. number 000001272 | Cyprus Securities and Exchange Commission (CySEC), License No: 209/13 | Financial Conduct Authority (FCA), FCA number FRN 522157, Cyprus Securities and Exchange Commission (CySEC), CySEC Licence Number: 169/12, Comision Nacional del Mercado de Valores, Komisja Nadzoru Finansowego, Belize International Financial Services Commission (IFSC) under license number IFSC/60/413/TS/19, Polish Securities and Exchange Commission (KPWiG), Dubai Financial Services Authority (DFSA), Dubai International Financial Center (DIFC),Financial Sector Conduct Authority (FSCA), XTB AFRICA (PTY) LTD licensed to operate in South Africa | Financial Conduct Authority (FCA), Australian Securities and Investments Commission (ASIC), Cyprus Securities and Exchange Commission (CySEC), Federal Financial Supervisory Authority (BaFin), Dubai Financial Services Authority (DFSA), Capital Markets Authority of Kenya (CMA), Pepperstone Markets Limited is incorporated in The Bahamas (number 177174 B), Licensed by the Securities Commission of the Bahamas (SCB) number SIA-F217 |

| riskwarning | Try Now Losses can exceed deposits | Try Now Losses can exceed deposits | Try Now Losses can exceed deposits | Try Now 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. | Try Now CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money |

New Zealand Trading Platform Customer Service

Phone Support on New Zealand Trading Platforms

For most trading platform users in New Zealand, it's more convenient to call a phone number and speak to an actual New Zealand trading platform support person when we need help. New Zealand trading platform phone support also allows you to ask questions in real time without having to wait for an email response. A real human from New Zealand who is able to talk in your language can answer all of your New Zealand trading platform questions, and if they don't know the answer, they can connect you with someone who does.

A good New Zealand trading platform phone support person will not only answer your New Zealand trading platform questions. A thing to note is that although a New Zealand trading platform support person can help you resolve New Zealand trading platform issues, they cannot and are not allowed to give you financial advice.

Live Chat Support on New Zealand Trading Platforms

Livechat is the most popular method of contacting your New Zealand trading platform. New Zealand trading platforms that offer livechat support are able to offer answers to New Zealand traders queries in often less than 5 minutes. Livechat sometimes is reserved for VIP New Zealand traders trading in higher volumes. Check to see if your New Zealand trading platform offers livechat to New Zealand traders.

|

|

|

|

| |

| Name | IC Markets | Roboforex | NordFX | XTB | Pepperstone |

| Live Chat | Yes | Yes | Yes | Yes | Yes |

| Phone | Yes | Yes | No | Yes | Yes |

| Yes | Yes | Yes | Yes | Yes | |

| riskwarning | Try Now Losses can exceed deposits | Try Now Losses can exceed deposits | Try Now Losses can exceed deposits | Try Now 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. | Try Now CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money |

New Zealand Trading Platform Minimum Deposits

New Zealand trading platform minimum deposits usually range from $0 up to $1000 dollars plus depending on the type of New Zealand trading account (i.e., margin vs non-margin).

New Zealand trading platforms set minimum deposit requirements that vary for each account depending on the type of trading and features you require for your New Zealand trading account. Many New Zealand trading accounts offer low minimum deposits and commission fee trading. If you require margin based trading or more advanced trading tools and features you may need a New Zealand trading platform which requires a greater minimum despost.

|

|

|

|

| |

| Name | IC Markets | Roboforex | NordFX | XTB | Pepperstone |

| Min Deposit | 200 | 10 USD / 10 EUR | 10 | No | 200 |

| riskwarning | Try Now Losses can exceed deposits | Try Now Losses can exceed deposits | Try Now Losses can exceed deposits | Try Now 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. | Try Now CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money |

Does It Matter How Many Traders My New Zealand Trading Platform Has?

One benefit to trading with a large volume New Zealand trading platform with a larger amount of users, is that you have access to more liquidity from other traders on the New Zealand trading platform looking to invest in your chosen financial asset whether is stocks, currency, crypto or commodities. You can buy or sell with greater confidence knowing that there is a great chance there someone else on either side of your trade looking to take advantage of changes in the financial markets. eToro for example has over 20 million registered traders.

In addition, if you want your money quickly, high volume New Zealand trading platforms will offer quick settlement times as well as fast execution speeds on their New Zealand trading platforms. When placing an order with a lower volume New Zealand trading, it may take longer for your transaction to complete since only a handful of people use their New Zealand trading platform leading to an increased risk in the financial markets changing while waiting for confirmation of a buy or sell order on your New Zealand trading platform.

|

|

|

|

| |

| Name | IC Markets | Roboforex | NordFX | XTB | Pepperstone |

| Usedby | 180000 | 10000 | 10000 | 250000 | 89000 |

| riskwarning | Try Now Losses can exceed deposits | Try Now Losses can exceed deposits | Try Now Losses can exceed deposits | Try Now 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. | Try Now CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money |

Educational Resources on New Zealand Trading Platforms

Many of the more established New Zealand trading platforms offer New Zealand traders a range of learning and educational resources that New Zealand traders can use to learn more about New Zealand trading platform trading tools and technical analysis and financial market search. These educational resources on New Zealand trading platforms can range from how to trading videos, market research article guides, trading webinars, free courses and podcasts. See what your shortlisted New Zealand trading platforms are able to offer you.

Trading Platforms New Zealand Trading Fees Explained

Make sure you are fully aware of all the fees and commissions that your short listed New Zealand trading platforms charge. Check and compare the fees that New Zealand trading platforms that you decided upon charge. Some trading platforms in New Zealand may charge monthly fees for having accounts open with them but some are free or charge very little if any at all.

Paying additional fees on your New Zealand trading platform may be necessary in you require some more advanced trading tools. But if you do not require these tools pick a New Zealand trading platform without these fees.

New Zealand Share Dealing Fees

There is a charge for each purchase and sell transaction you make on a New Zealand trading platform for shares on the local New Zealand and global stock markets.

Generally on New Zealand trading platforms, the lesser the cost, the larger the share transaction. A minimal fee is charged by New Zealand trading platforms. Fees of stocks and shares vary from 0.1% to 3%. Depending on your New Zealand trading platform share dealing fees might be as low as 0.1 percent for larger trades.

New Zealand Trading Commission

Trading commission is the amount charged by the New Zealand trading platform to execute a trade. The amount of commission charged by different New Zealand trading platforms varies depending on the asset traded and the type of service provided. Check you understand and are happy with your shortlisted New Zealand trading platform trading commissions before trading.

New Zealand Spreads

When Trading on a New Zealand trading platform the difference between the bid and ask prices for a currency pair is called a spread. In forex, spreads are typically much smaller than in other markets like equities or commodities. If you trade with a more liquid New Zealand trading platform with larger user bases the spreads should generally be better. Check you undertand your New Zealand trading platforms spreads well before trading.

New Zealand Trading Platform Fees

New Zealand Overnight Financing Fees

When trading on a New Zealand trading platform using a leveraged trading you may have to pay an overnight financing fee. Overnight financing is a price you pay to keep a trading position open overnight on leveraged transactions; It's effectively an interest payment to cover the cost of the leverage you're using overnight. Positions with no fixed expiration date are subject to overnight financing charges. Check what overnight fees your New Zealand trading platform charges if you are planning to use leverage trading.

If you're trading CFDs on a New Zealand trading platform, you may have to pay an overnight finance cost if you keep your trade open past a specific period. Because of overnight fees CFDs that are charged by all New Zealand trading platforms, they are better suited for short-term trading strategies.

New Zealand Trading Platform Transaction Fees

Some New Zealand trading platforms allow you to deposit and withdraw funds fee-free, while others will implement a charge. This might be based on your chosen payment method or because you are using a New Zealand trading platform that is denominated in a currency other than the currency of your New Zealand bank account. One currency has to be converted to another which may incur a fee.

New Zealand Trading Platform Inactivity Fees

Certain New Zealand trading platforms may charge a fee if your account remains inactive for a certain amount of time. If you are no longer using your New Zealand trading account or forget about it, check you are not liable for any inactivity fees. If you are no longer using your New Zealand trading account be sure to contact support and close your New Zealand trading platform account.

New Zealand Forex Trading Fees

New Zealand trading platforms do not offer free Forex trading. When you trade Forex, you can expect to pay a fee no matter what your trading strategy is, through spreads. The Forex spreads fees differ with each New Zealand trading platform. Some are more competitive than other New Zealand trading platforms. Some New Zealand trading platforms charge a fixed spread while other New Zealand trading platforms change a variable spread. Fixed spreads are are determined by the New Zealand trading platform and remain constant regardless of market conditions or volatility. Fixed spreads allow you to plan your investment strategy by knowing your spread cost ahead of time. Variable spreads may for experienced traders be beneficial if a financial market is less volatile depending on the investment strategy and goals.

|

|

|

|

| |

| Name | IC Markets | Roboforex | NordFX | XTB | Pepperstone |

| Withdrawal Fee | No | Yes | No | No | No |

| Deposit Fee | Varies | No | No | No | No |

| Inactivity Fees | No | No | No | Yes | Yes |

| riskwarning | Try Now Losses can exceed deposits | Try Now Losses can exceed deposits | Try Now Losses can exceed deposits | Try Now 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. | Try Now CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money |

New Zealand Trading Account Payment Methods

When trading with a New Zealand trading platform online, there are a variety of payment options accessible to New Zealand traders; Depending on which New Zealand trading plaforms you shortlist each will have different deposit and withdrawal methods. Each trade payment option has its own set of benefits and cons in terms of costs, processing times, and limits.

Some traders consider the time it takes to execute a payment to be critical, while others are content to wait a few days. Similarly, transaction costs may be more or less essential depending on whether you will make numerous little transactions or fewer, larger ones.

Popular New Zealand Trading Plaform Payment Methods

The funding and withdrawal methods a New Zealand Trading Plaform offers is very important when trading. The number of payment methods available to New Zealander traders is increasing every month.

Popular payment methods available on New Zealand Trading Plaforms include New Zealand Bank Transfers, New Zealand Debit Cards, New Zealand Credit Cards, PayPal, Neteller, Skrill, Rapid Transfer, iDeal, Klarna and Poli. Funding and withdrawal payment methods differ from broker to broker in New Zealand.

|

|

|

|

| |

| Name | IC Markets | Roboforex | NordFX | XTB | Pepperstone |

| Payment Methods | BPAY, Credit Card, FasaPay, Giropay, Mastercard, Neteller, PayPal, POLi, QIWI, Rapid Transfer, Skrill, UnionPay, Visa, Wire Transfer, Yandex Money | ADVcash, Alipay, Bitcoin Payments, Cashu, FasaPay, Giropay, iDeal, MoneyGram, Neteller, Perfect Money, POLi, QIWI, Rapid Transfer, SafeCharge, Skrill, Sofort, Trustly, Vietcombank Transfer, Visa, Webmoney, WeChat Pay, Wire Transfer, Yandex Money | Cashu, Perfect Money, QIWI, Yandex Money | Credit cards, MasterCard, Maestro, Visa, Debit cards, Bank Transfer, Electronic wallets (eWallets), PayPal, Neteller, Skrill, Poli, Paysafe, Payoneer, | Apple Pay, Credit Card, Debit Card, Mastercard, POLi, QIWI, UnionPay, Visa |

| riskwarning | Try Now Losses can exceed deposits | Try Now Losses can exceed deposits | Try Now Losses can exceed deposits | Try Now 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. | Try Now CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money |

How to Open a New Zealand Trading Account

Step 1: Open a New Zealand Trading Account

When opening a New Zealand trading account. Set up two factor authentication as well as a strong password; we recommend using Google Authenticator for extra security; Make sure that email addresses associated with your New Zealand trading account are verified.

Verifying your New Zealand trading account will you to access your withdrawal history should any issues arise in future;

Step 2: Confirm Your New Zealand Identity

Online trading platforms New Zealand, require a New Zealand resident to have a verified New Zealand account with them before they will let you trade on their New Zealand trading platform.

New Zealand trading accounts will require some form of identify verification such as New Zealand social security number or equivalent, New Zealand drivers license or New Zealand passport. You will not be able to trade on your selected New Zealand trading platform until you have passed verification checks. This is due to the financial regulation New Zealand trading platforms have to adhere too. Verification of your New Zealand trading account may take 2-10 working days but may be faster.

Step 3: Deposit Funds To Your New Zealand Trading Platform

New Zealand trading platforms offer a wide range of deposit funding methods before you begin trading. Pick a deposit method that you are most comfortable with. Remember to keep your New Zealand trading platform minimum deposit requirements in mind when opening your new New Zealand trading account. The minimum deposit requirement amounts may vary depending on the type of New Zealand trading account you decide to open.

Step 4: Research a Financial Instrument To Trade On Your New Zealand Trading Platform

Research financial instrument is one of the most difficult parts of trading on a New Zealand trading platform. Experienced traders have spent years learning how to understand market sentiment using technical analysis and charting tools. To use a New Zealand trading platform effectively you will have to spend time to understand how these tools work.

One of the most important things you can do when researching a financial asset on a New Zealand trading platform, is to look at financial statements, annual reports and historical price data. You need to have a good understanding of how your financial instrument makes money, what they spend their money on, and more importantly, the financial markets sentiment towards the financial instrument. A New Zealand trading platform will offer market research tools but you must use your own judgement and understand what you are doing.

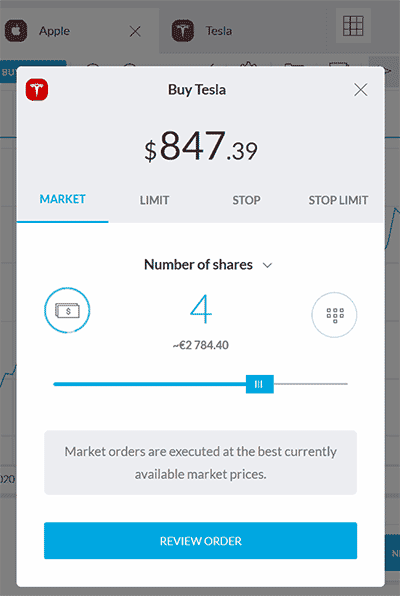

Step 5: Place a Trade

Create a watchlist or browse the financial markets on your chosen New Zealand trading platform.

Open the chart of the financial asset you want to invest in.

Your New Zealand trading platform will have a range of tradable financial instruments available. Whether it's a stock, commodity, currency pair, or crypto asset your have selected on your New Zealand trading platform, click 'Buy' or 'Sell' for the desired financial asset.

Enter the number of units you want to buy or sell. Set up your Take Profit and Stop Loss levels on your New Zealand trading platform. If you do not know what risk management strategies are learn about them before trading on a New Zealand trading platform.

Before you click buy make sure you understand the trading risks and know clearly what you are doing. Do not trade with money you cannot afford to lose. Trading on the financial markets on a New Zealand trading platform holds risks. Click on the Buy Trade button.

On your chosen New Zealand trading platform, your trade will be sent for order execution by your New Zealand trading platform immediately.

Best Trading Platforms New Zealand Verdict

Their has been a huge growth in online trading in New Zealand. New New Zealand trading platforms have seen their user bases see huge spikes in registrations over the last 2 years as new traders embrace trading online in New Zealand.

Modern New Zealand trading platforms are good because they offer both the traditional financial instruments like stocks and shares, Forex and commodities and the futures markets along with new financial markets like cryptocurrencies and higher risk leveraged trading options like CFDs.

Modern online trading platforms in New Zealand offer New Zealand traders access to thousands of tradable financial assets in multiple asset classes on financial markets not just in New Zealand, but all over the world. Modern New Zealand trading platforms offer very advanced trading tools, all available online, through a mobile app or even as downloadable software. Mordern New Zealand traders can easily place buy and sell orders from just there mobile devices anywhere in the world.

Best Trading Platforms New Zealand 2025 Frequently Asked Questions

We answer the most frequently asked New Zealand trading platform questions below.

What is the best trading platform in New Zealand?

The best New Zealand trading platforms is eToro. eToro has the worlds most advanced online social trading platform with 0% commissions charged on real stocks.

What is the best platform for beginners in New Zealand?

Here are some of the best trading platforms for beginners in New Zealand: eToro - best for following more experienced traders. XTB - Low fees, good tools and fast account opening. Avatrade - Great research tools and free withdrawal and deposit options.

What is the safest New Zealand Trading Platform?

eToro is among the safest trading platforms in New Zealand as they are heavily regulated.

What can I trade on New Zealand Trading Platforms?

New Zealand trading platforms allowing trading in stocks, commodities, futures, ETFs, CFDs, Forex and cryptocurrencies.

Related Guides

- Best Trading Platforms New Zealand

- Best Stock Trading Apps New Zealand

- Trade US Stocks in New Zealand

- Best Indices Brokers New Zealand

Best Stock Trading Apps New Zealand Reviews

We also have in depth reviews of each of the best New Zealand trading platform reviews listed below.

Best Trading Platforms New Zealand Reviews

We also have in depth reviews of each of the best New Zealand trading platform reviews listed below.

- IC Markets Review (read our in depth 2025 reviews)

- Roboforex Review (read our in depth 2025 reviews)

- NordFX Review (read our in depth 2025 reviews)

- XTB Review (read our in depth 2025 reviews)

- Pepperstone Review (read our in depth 2025 reviews)

- XM Review (read our in depth 2025 reviews)

- eToro Review (read our in depth 2025 reviews)

- FXPrimus Review (read our in depth 2025 reviews)

- easyMarkets Review (read our in depth 2025 reviews)

- Trading 212 Review (read our in depth 2025 reviews)

- Admiral Markets Review (read our in depth 2025 reviews)

- SpreadEx Review (read our in depth 2025 reviews)

- Swissquote Review (read our in depth 2025 reviews)

- HYCM Review (read our in depth 2025 reviews)

- Axi Review (read our in depth 2025 reviews)

Best Trading Platforms New Zealand Alternatives

We also have in depth guides of the best New Zealand alternative trading platforms for each New Zealand broker below.

- IC Markets Alternatives

- Roboforex Alternatives

- NordFX Alternatives

- XTB Alternatives

- Pepperstone Alternatives

- XM Alternatives

- eToro Alternatives

- FXPrimus Alternatives

- easyMarkets Alternatives

- Trading 212 Alternatives

- Admiral Markets Alternatives

- SpreadEx Alternatives

- Swissquote Alternatives

- HYCM Alternatives

- Axi Alternatives

IC Markets

IC Markets

Roboforex

Roboforex

NordFX

NordFX

XTB

XTB

Pepperstone

Pepperstone

XM

XM

eToro

eToro

FXPrimus

FXPrimus

easyMarkets

easyMarkets

Trading 212

Trading 212

Admiral Markets

Admiral Markets

SpreadEx

SpreadEx

Swissquote

Swissquote

HYCM

HYCM

Axi

Axi