Best cTrader Brokers

When looking for the best cTrader brokers, it's essential to consider factors such as regulation, fees, and trading conditions. Some top options include Pepperstone, IC Markets, and RoboForex. It's recommended to compare different brokers and read reviews before deciding.

In our cTrader brokers guide, we researched several of the most popular cTrader brokers. We found several key factors that you should consider to ensure that you choose a reputable and reliable broker offering the cTrader trading platform that meets your trading needs.

We examine and compare cTrader broker features, regulation, tradable financial instruments with cTrader, available cTrader funding and withdrawal methods, customer support and educational resources available to traders looking to use cTrader brokers. When researching cTrader brokers, you should ensure that you choose a reputable and reliable cTrader broker that meets your trading needs.

Best cTrader Brokers Table of Contents

- What is cTrader, and how does it work?

- Top cTrader Brokers

- RoboForex cTrader

- RoboForex cTrader Account Types

- IC Markets cTrader

- IC Markets cTrader Account Types

- Pepperstone cTrader

- What makes cTrader different from other trading platforms?

- Regulations for cTrader Brokers

- How to Start Trading with a cTrader Broker

- What is the process of opening an account on cTrader?

- Trading Assets Available with a cTrader Broker

- Minimum Deposit for cTrader Brokers

- What Does the cTrader trading platform look like?

- Is cTrader Suitable for Beginners?

- How do cTrader brokers differ from other types of brokers?

- How can one find the best cTrader broker?

- What are the advantages of using a cTrader broker?

- What types of assets can be traded on cTrader?

- What are the fees and commissions associated with trading on cTrader?

- How do cTrader brokers ensure the security and safety of funds?

- What are the deposit and withdrawal options available on cTrader?

- How long does it take for deposits and withdrawals to be processed on cTrader?

- Is cTrader available on mobile devices?

- What do cTrader brokers support the trading platforms?

- What minimum deposit is required to start trading on cTrader?

- What do cTrader brokers offer the maximum leverage?

- What types of accounts are offered by cTrader brokers?

- How can one access customer support on cTrader?

- What are the educational resources available on cTrader?

- Are there any restrictions on trading on cTrader?

- What are the risks associated with trading on cTrader?

- What is the difference between cTrader and other trading platforms?

- Can one use cTrader for automated trading?

- What are the trading hours on cTrader?

- What types of accounts are offered by cTrader brokers?

- What is the process of opening an account on cTrader?

- How can one access customer support on cTrader?

- What are the educational resources available on cTrader?

- How can one develop a profitable trading strategy on cTrader?

- cTrader Brokers Verdict

- Best cTrader Brokers List Compared

What is cTrader, and how does it work?

cTrader is a mature trading platform designed for online Forex and CFD trading. It is a popular choice among traders due to its intuitive user interface and advanced trading features. The cTrader platform operates on a direct market access (DMA) model, which means that traders can access prices from various liquidity providers and trade with low latency.

It is important to note that trading, like any other type of trading, also carries risk. It is important to thoroughly understand the markets and the risks involved before starting to trade.

Top cTrader Brokers

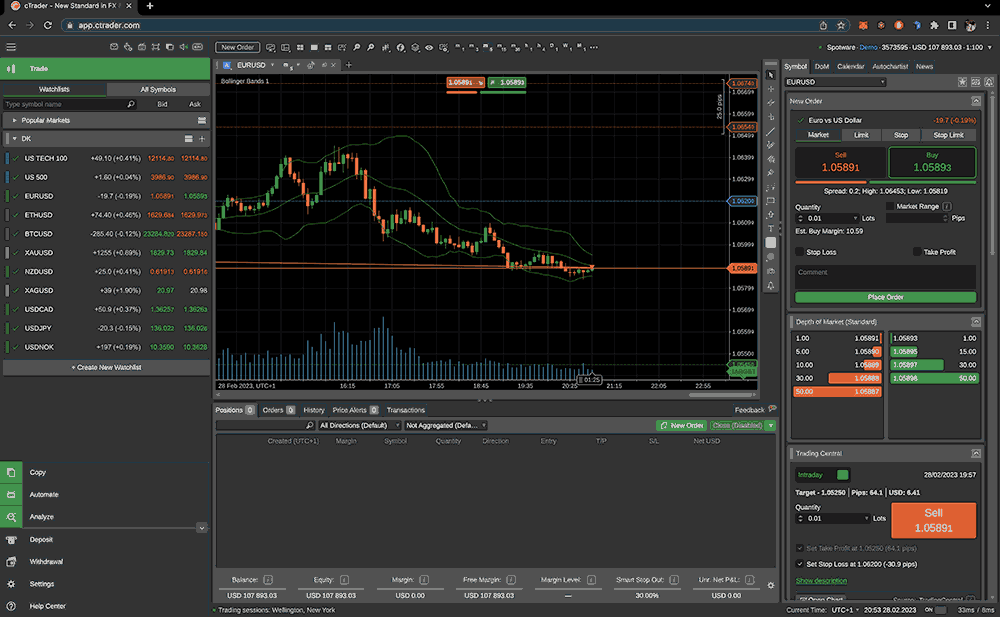

cTrader is a trading platform widely used by forex and CFD brokers worldwide. It is known for its advanced charting capabilities and customisable user interface. cTrader also supports automated trading strategies, known as expert advisors (EAs), which can be used to execute trades automatically based on certain conditions.

Some of the most popular cTrader brokers include:

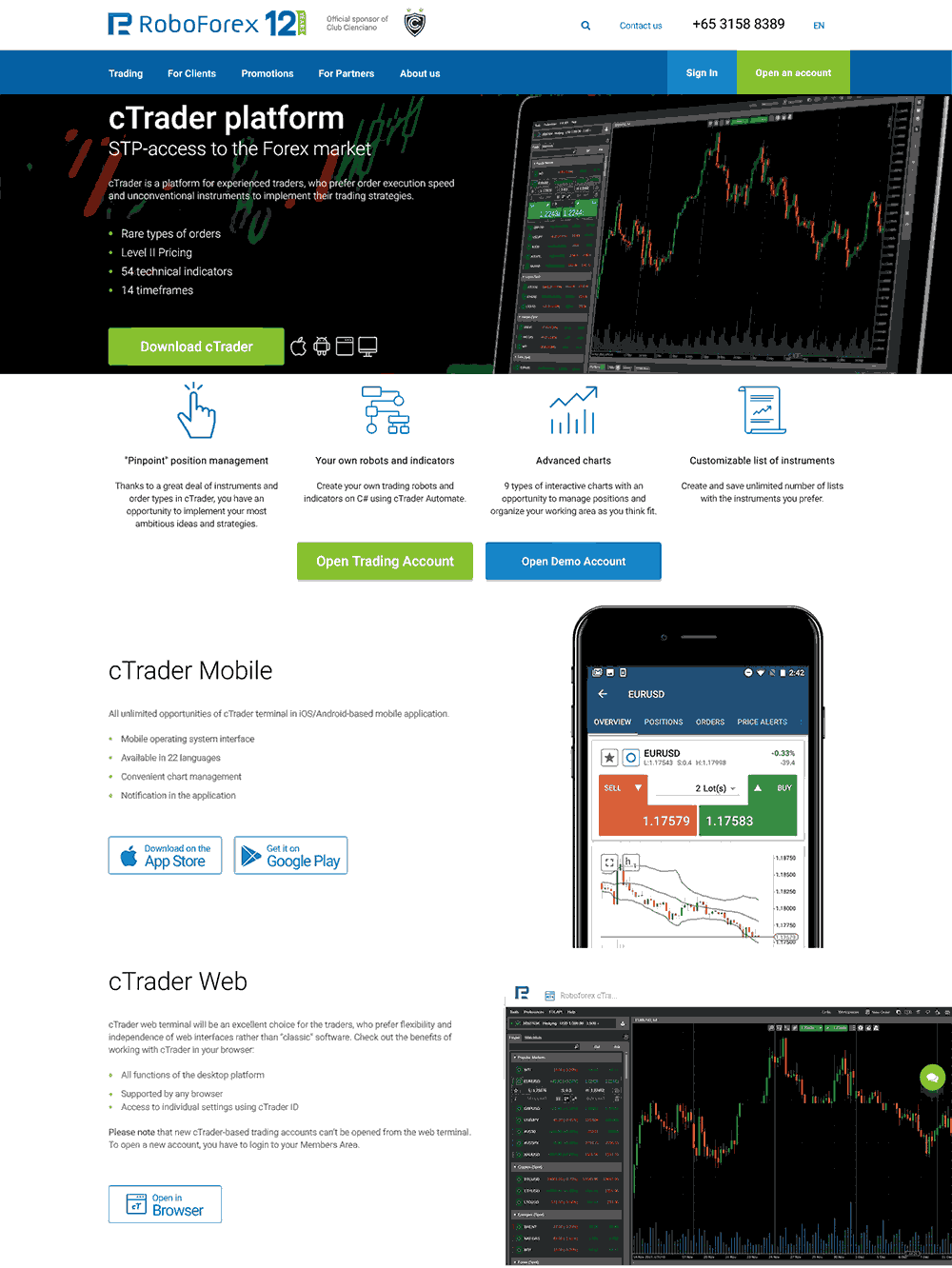

RoboForex cTrader

RoboForex is a global forex and CFD broker offering cTrader as a trading platform. It is regulated and offers a wide range of markets for trading, including Forex, indices, commodities, and shares. RoboForex is known for offering high leverage on CFD financial instruments, competitive spreads and a good selection of deposit and withdrawal methods for traders.

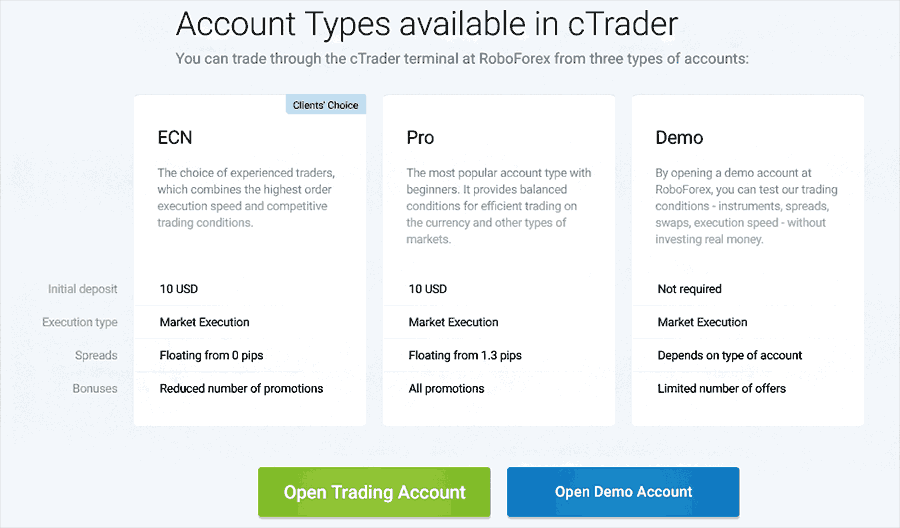

RoboForex cTrader Account Types

RoboForex is a forex and CFD broker that offers several account types for traders, including cTrader accounts. RoboForex offers a range of cTrader account types to suit different trading styles and preferences, with competitive pricing and access to advanced trading tools and features.

Here's a breakdown of the cTrader account types offered by RoboForex:

- Pro-Standard cTrader Account: This account is designed for traders who prefer to trade with floating spreads and market execution. It requires a minimum deposit of $1,000 and offers leverage of up to 1:500. The commission fee for this account is $7 per lot.

- ECN-Pro cTrader Account: This account is designed for traders who prefer to trade with the lowest possible spreads and faster execution. It requires a minimum deposit of $1,000 and offers leverage of up to 1:500. The commission fee for this account is $6 per lot.

- Prime cTrader Account: This account is designed for professional traders and institutions who require access to deep liquidity from top-tier banks and ECN networks. It requires a minimum deposit of $5,000 and offers leverage of up to 1:100. The commission fee for this account is negotiable and based on the trader's trading volume.

All cTrader accounts offered by RoboForex come with the following features:

- Access to the cTrader trading platform, a powerful and user-friendly platform with advanced charting and trading tools.

- Ability to trade forex, commodities, indices, and cryptocurrencies.

- Negative balance protection ensures that traders cannot lose more than their account balance.

- 24/7 customer support and access to educational resources.

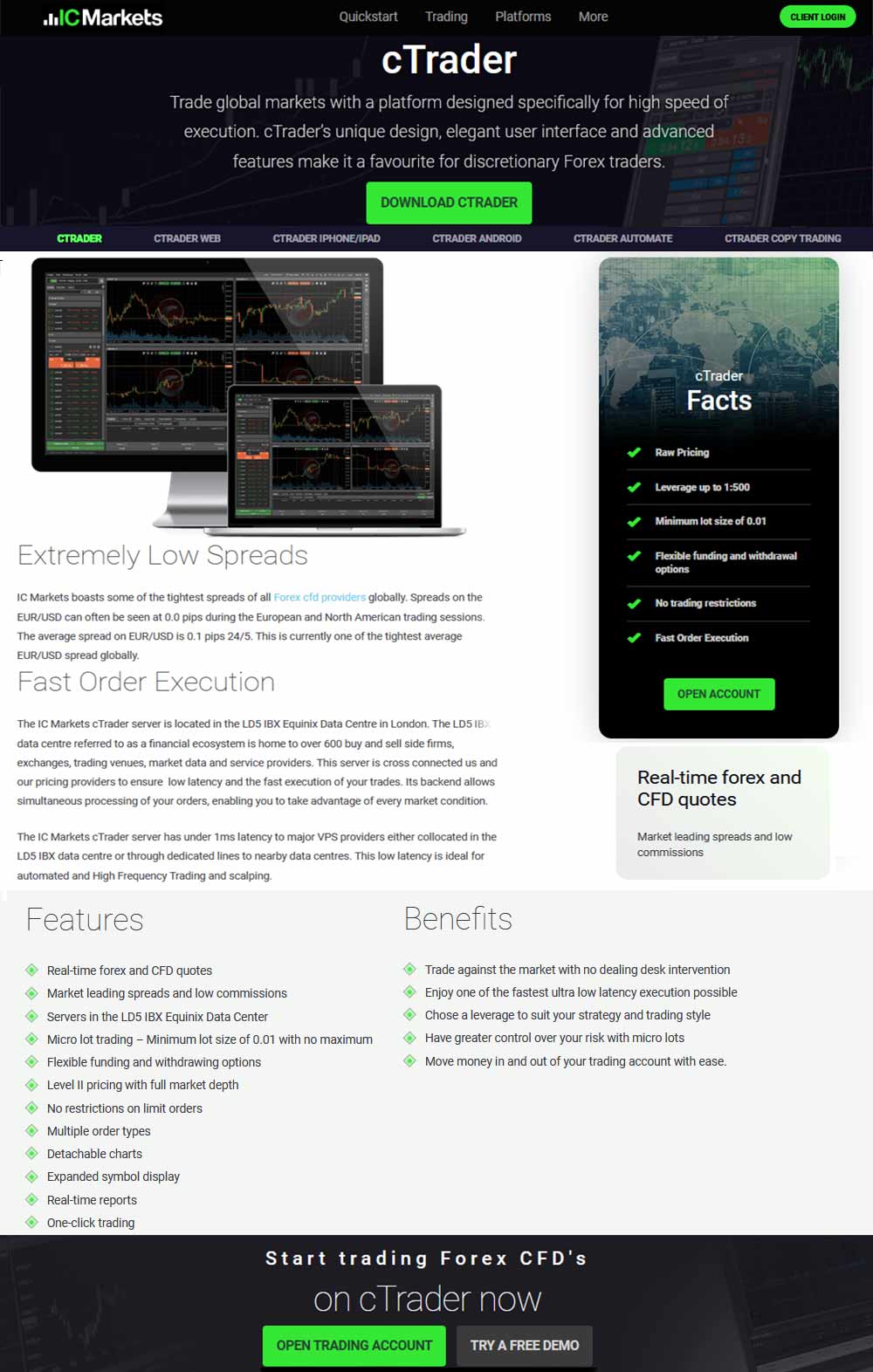

IC Markets cTrader

IC Markets cTrader is an advanced trading platform offered by IC Markets, a popular Australian-based online forex and CFD broker. The cTrader platform is designed specifically for forex and CFD traders and provides various tools and features for advanced charting, trading automation, and order management.

IC Markets is an Australian-based forex and CFD broker offering cTrader as a trading platform. It is regulated by the Australian Securities and Investment Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC). IC Markets offers a wide range of markets for trading, including Forex, indices, commodities, and shares.

IC Markets cTrader is a powerful trading platform that provides forex and CFD traders with advanced charting, trading automation, and order management features.

Some of the key features of the IC Markets cTrader platform include:

- Advanced charting: The platform offers advanced charting tools with over 70 technical indicators, multiple timeframes, and chart types. It also supports custom indicators, which allows traders to create and use their indicators for analysis.

- Trading Automation: The cTrader platform supports algorithmic trading through the use of cAlgo, which is a coding platform that enables traders to create and backtest automated trading strategies.

- Order Management: The platform offers a range of order types, including market, limit, stop-loss, and trailing stop orders. Traders can also set up multiple take-profit and stop-loss levels for each trade.

- Depth of Market (DOM): The platform provides access to the Depth of Market (DOM), which shows the current bid and ask prices for a particular currency pair. This feature enables traders to view the market liquidity and place trades directly from the DOM.

- Mobile Trading: The cTrader platform is available on both desktop and mobile devices, making it easy for traders to access their accounts and trade from anywhere.

IC Markets cTrader Account Types

IC Markets offers three types of cTrader accounts, each designed to cater to the needs of different traders.

All three IC Markets cTrader account types offer access to the full range of features and tools available on the cTrader platform, including advanced charting, trading automation, and order management. Traders can also access the platform on both desktop and mobile devices. Additionally, IC Markets offers a demo account for each of these account types.

The cTrader account types IC Markets offers are:

- cTrader Raw Account: This account type is designed for professional and high-volume traders who require raw spreads with low commissions. The account offers spreads from 0.0 pips, with a commission of $3 per 100,000 traded. The minimum deposit required to open a cTrader Raw Account is $1,000.

- cTrader True ECN Account: This account type is designed for traders who require raw spreads with no dealing desk intervention. The account offers spreads from 0.0 pips, with a commission of $3 per 100,000 traded. The minimum deposit required to open a cTrader True ECN Account is $200.

- cTrader Standard Account: This account type is designed for traders who require standard market execution with no commissions. The account offers spreads from 1.0 pip with no commission charged. The minimum deposit required to open a cTrader Standard Account is $200.

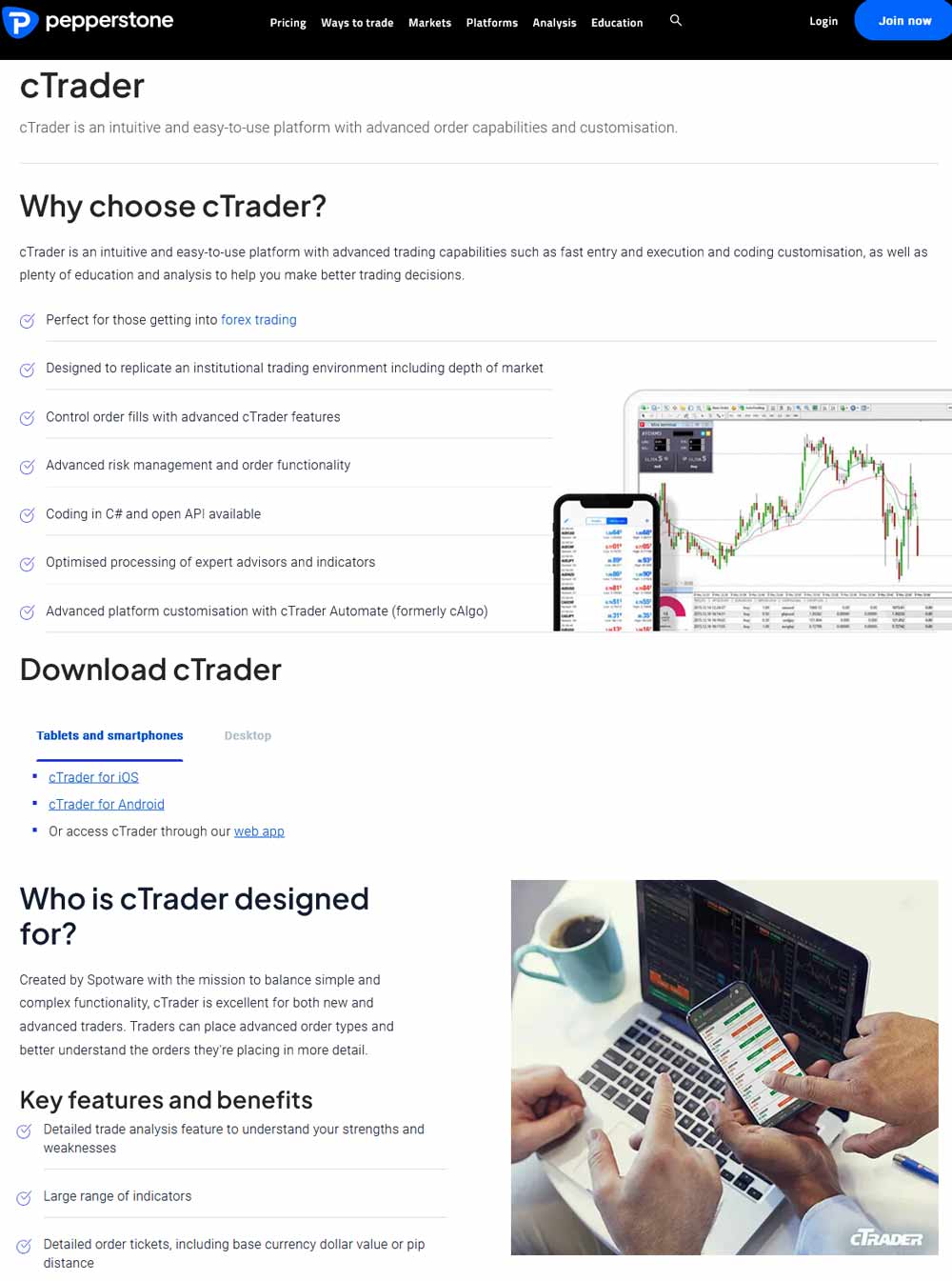

Pepperstone cTrader

Pepperstone is a forex and CFD broker offering various trading accounts on the cTrader platform. Pepperstone's cTrader accounts provide access to various trading instruments, including Forex, indices, commodities, and cryptocurrencies. The cTrader platform offers advanced charting, technical analysis tools, and a customizable interface.

Pepperstone is regulated by the Australian Securities and Investment Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC). Pepperstone offers a wide range of markets for trading, including Forex, indices, commodities, and shares.

Here are the account types offered by Pepperstone on cTrader:

- cTrader Razor Account: This account type offers tight spreads starting from 0 pips, low commissions of $3.5 per 100,000 traded, and deep liquidity from multiple liquidity providers. The minimum deposit required to open a Razor account is $200.

- cTrader Standard Account: This account type offers variable spreads starting from 1 pip and no commissions. The minimum deposit required to open a Standard account is also $200.

- cTrader Islamic Account: This account type is designed for Muslim traders who follow the Shariah law, which prohibits the payment or receipt of interest. The Islamic account is a swap-free account that complies with Shariah law.

- cTrader Demo Account: This account type is a practice account that allows traders to test the cTrader platform and their trading strategies without risking real money. The demo account comes with virtual funds and real-time market data.

The Pepperstone cTrader platform offers advanced charting, algorithmic trading, a range of order types, mobile trading, competitive fees and a good range of tradable financial instruments.

What makes cTrader different from other trading platforms?

cTrader is a trading platform designed specifically for Forex and CFD trading. It offers a range of advanced features and tools that are not typically found on other platforms.

One of the main differences between cTrader and other trading platforms is its use of a 'depth of market' (DOM) feature. cTrader depth of the market allows traders to see the full range of buy and sell orders for a particular instrument rather than just the best bid and ask prices. Market depth can provide a more detailed and accurate view of market liquidity and can be particularly useful for traders using scalping or other short-term trading strategies.

Another key difference is the cTrader's Algo Trading, which allows traders to create and use custom automated trading strategies using a wide range of built-in indicators and order types. Algorithmic trading gives traders more flexibility and control over their trading and can help to reduce the time and effort required to execute trades.

cTrader also has a user-friendly interface, and it's easy to customise. It provides various charting options and offers a fast, reliable execution with low latency.

Overall, cTrader is a great choice for traders looking for advanced trading tools and a high level of customisation in their trading platform.

Regulations for cTrader Brokers

Regulation and safety are important considerations when choosing a cTrader broker. Traders should look for brokers regulated by reputable regulatory bodies, such as the UK's Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC) in Australia. Additionally, traders should ensure their funds are held in segregated accounts to protect against broker insolvency.

The regulations for cTrader brokers vary depending on the country or region where the broker is based. Some of the main regulatory bodies for cTrader brokers include:

- The Financial Conduct Authority (FCA) in the United Kingdom.

- The Australian Securities and Investments Commission (ASIC) in Australia.

- The Cyprus Securities and Exchange Commission (CySEC) in Cyprus.

- The National Futures Association (NFA) and the Commodity Futures Trading Commission (CFTC) in the United States.

- The Monetary Authority of Singapore (MAS) in Singapore.

Each regulatory body has rules and regulations that cTrader brokers must comply with to operate legally within their jurisdiction. These regulations cover various areas, such as financial reporting, risk management, and client protection.

cTrader is a trading platform that is legal to use worldwide, as long as the broker offering it is properly licensed and regulated in the country or region where it operates.

However, it's important to note that the legality and regulation of your cTrader brokerage can vary depending on the country or region. Some countries may have stricter regulations or outright ban certain trading or financial products.

traders need to check the regulations and laws in their country or region to ensure they can legally use cTrader and trade through a cTrader broker.

It's also important to note that trading, in general, carries a high level of risk, and it's not suitable for all investors. Traders should consider their investment objectives, experience level, and risk appetite before trading.

In any case, traders should always make sure to use a properly regulated broker, follow the regulations and laws of their country, and always make informed decisions before engaging in any trading activity.

How to Start Trading with a cTrader Broker

Here are the general steps to start trading with a cTrader broker:

- Research and compare different cTrader brokers to find one that meets your needs and is properly regulated in your country or region.

- Open an account with the broker of your choice. Opening a cTrader account will typically involve providing some personal and financial information and may require you to pass a Know Your Customer (KYC) verification process.

- Fund your account with the initial deposit required by the broker. Funding your cTrader account can be done by credit card, bank transfer, or e-wallet.

- Download and install the cTrader trading platform on your computer or mobile device. The broker should provide instructions for this process.

- Log in to the cTrader platform with your account information.

- Familiarise yourself with the cTrader platform's features and tools through tutorials and demo trading.

- Use a risk management strategy to minimise risk and maximise profits.

- You are now ready to start trading with cTrader. Remember that trading carries a high level of risk, and it's not suitable for all investors, so it's important to make informed decisions based on your research and analysis.

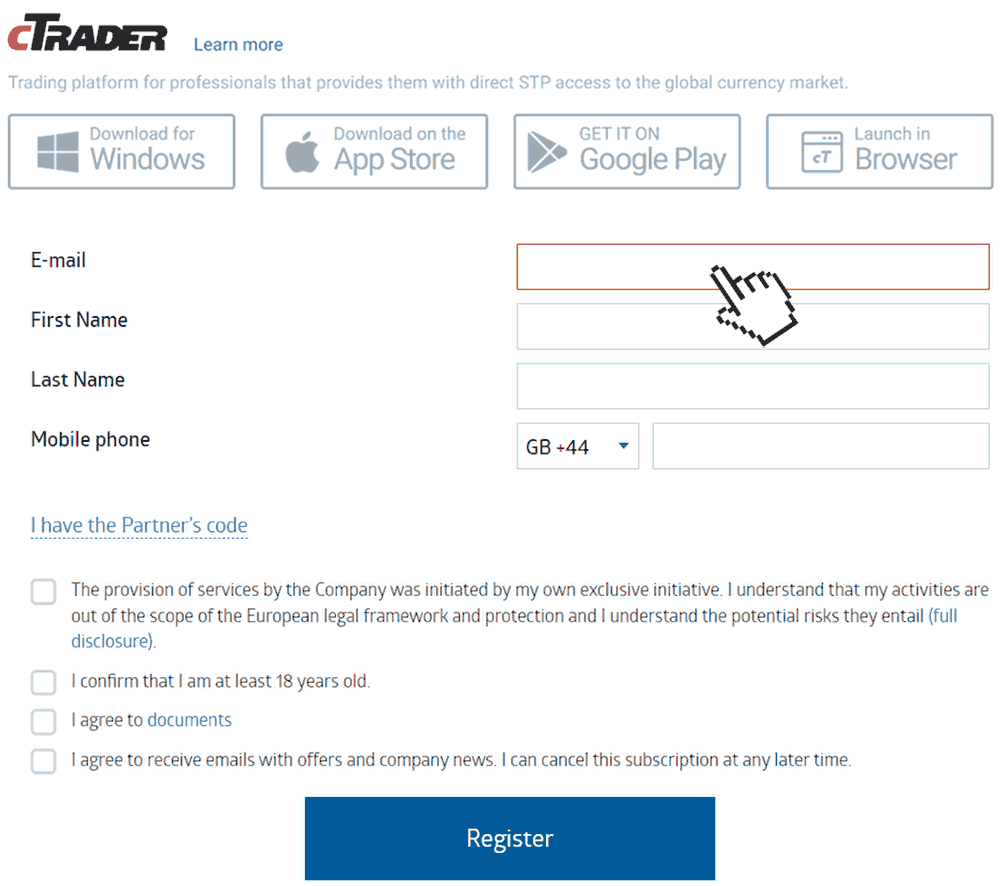

What is the process of opening an account on cTrader?

Opening an account with a cTrader broker is a straightforward process that involves the following steps:

- Choose a cTrader broker: Do some research to find a reputable cTrader broker that meets your trading needs.

- Register an account: Visit the broker's website and click on the 'Open Account' or 'Register' button. You will be asked to provide personal and financial information, such as your name, email address, phone number, and proof of identity.

- Verify your account: After submitting your registration details, you will need to verify your account by providing additional information, such as a copy of your ID, proof of address, and financial information.

- Fund your account: Once your account is verified, you can fund it by selecting a payment method, such as a bank transfer, credit card, or e-wallet. Some cTrader brokers may require a minimum deposit to activate your account.

- Download cTrader: After funding your account, you can download the cTrader platform and start trading.

Trading Assets Available with a cTrader Broker

cTrader brokers typically offer a wide range of assets for trading, including Forex, commodities, indices, and cryptocurrencies. Some brokers may offer a more limited selection of assets, so it is important to research the broker's asset selection before opening an account.

cTrader brokers typically offer a wide range of assets for trading, including

- Forex: The largest financial market in the world, where different currencies are traded.

- CFDs: Contracts for difference, which are derivatives that allow traders to speculate on the price movements of various financial instruments, including stocks, commodities, indices, and cryptocurrencies.

- Indices: A basket of stocks representing a particular market or sector, such as the S&P 500 or the FTSE 100.

- Commodities: Raw materials, such as gold, oil, or agricultural products, trading on financial markets.

- Cryptocurrencies: Digital or virtual currencies like Bitcoin and Ethereum are created and exchanged using advanced encryption techniques.

Minimum Deposit for cTrader Brokers

The minimum deposit required to open an account with a cTrader broker can vary depending on the broker. Some brokers may require a relatively low minimum deposit of $100 or less, while others may require a minimum deposit of $500 or more.

It's important to note that the minimum deposit required to open an account does not necessarily reflect the amount of capital required to start trading. Opening the account is only the initial deposit, and traders can deposit more funds as needed.

It's also important to check the broker's deposit and withdrawal methods as they vary. Some of them can accept only wire transfers, while others can accept debit/credit cards, e-wallets and other methods.

Additionally, it's important to keep in mind that the amount of money you deposit should be based on your financial situation and should not be higher than what you can afford to lose.

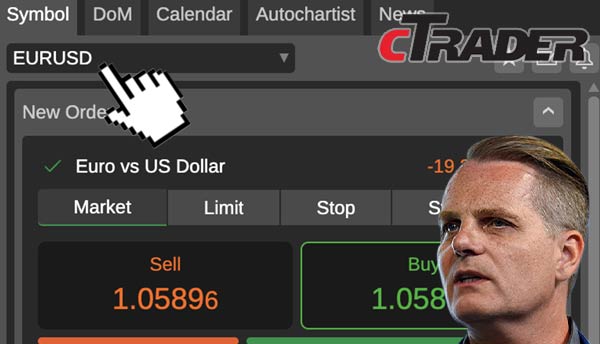

What Does the cTrader trading platform look like?

the cTrader trading platform has a distinct look compared to other trading software like MetaTrader 4 and 5. cTrader has a fully customisable layout, allowing for multiple screens, advanced charting and light and dark themes. cTrader is designed to be used by experienced traders, which is why the default theme is a dark high, contrasting theme for traders looking at screens for long periods.

Is cTrader Suitable for Beginners?

cTrader is a popular trading platform that offers a wide range of tools and features for traders of all skill levels, including beginners. It has a user-friendly interface, and it is easy to navigate, which makes it accessible for beginners.

Many cTrader brokers also offer a wide range of educational resources, such as tutorials, webinars, and e-books, to help beginners learn the basics of trading and how to use the cTrader platform.

Additionally, cTrader offers a demo account, allowing beginners to practice trading with virtual money in a risk-free environment. cTrader demo accounts can help beginners to learn how to use the platform and develop their trading strategies before risking their own money.

However, it's important to note that trading, in general, carries a high level of risk, and it's not suitable for all investors. Therefore, beginners must educate themselves before trading thoroughly and always use a proper risk management strategy to minimise risk and maximise profits.

It's also important for beginners to start trading with a small amount of money and gradually increase it as they gain more experience and confidence.

How do cTrader brokers differ from other types of brokers?

cTrader brokers differ from other brokers in providing traders with access to the cTrader platform. This platform offers advanced trading features, including level II pricing, charting, and technical indicators. Additionally, cTrader brokers typically offer low spreads and fast execution speeds.

How can one find the best cTrader broker?

Finding the best cTrader broker can be daunting, but choosing the right broker for your trading needs is essential. Here are some factors to consider when selecting a cTrader broker:

- Regulation: Choose a cTrader broker that is regulated by a reputable authority, such as the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), or the Cyprus Securities and Exchange Commission (CySEC). Strict regulation will ensure that your funds are protected and that the broker adheres to industry standards.

- Trading conditions: Look for a cTrader broker that offers competitive spreads, low commissions, and a wide range of trading instruments. Also, consider the minimum deposit required, the maximum leverage available, and any other trading conditions that may affect your trading strategy.

- Platform features: Check out the cTrader platform features offered by the broker, such as advanced charting tools, order types, and risk management tools. Make sure that the platform is user-friendly and easy to navigate.

- Customer support: Choose a cTrader broker that provides excellent customer support, with multiple channels of communication available, such as email, phone, and live chat. Also, look for brokers that offer educational resources and market analysis tools to help you improve your trading skills.

- Reputation: Look for reviews and testimonials from other traders to see what their experiences have been with the broker. Choose a broker with a good reputation for reliability and transparency.

What are the advantages of using a cTrader broker?

Some advantages of using a cTrader broker include fast order execution, a wide range of trading tools and indicators, access to level II pricing, and low spreads. Additionally, cTrader brokers are known for their transparent pricing and user-friendly interface.

What types of assets can be traded on cTrader?

cTrader allows traders to trade a wide range of assets, including Forex, indices, commodities, and cryptocurrencies.

What are the fees and commissions associated with trading on cTrader?

Fees and commissions can also vary among cTrader brokers. Some brokers may charge higher fees and commissions, while others offer more competitive pricing. It is important for traders to understand the fees and commissions associated with trading on a particular platform and to factor these costs into their trading plan.

The fees and commissions associated with trading on cTrader vary depending on the broker. Typically, cTrader brokers charge a small commission on trades in addition to the spread.

How do cTrader brokers ensure the security and safety of funds?

cTrader brokers ensure the security and safety of funds by using SSL encryption to protect user data and segregate client funds from company funds. Additionally, reputable cTrader brokers are regulated by financial authorities to ensure compliance with industry standards and best practices.

What are the deposit and withdrawal options available on cTrader?

cTrader brokers typically offer a wide range of deposit and withdrawal options, including bank transfer, credit/debit card, and e-wallets such as PayPal and Skrill.

How long does it take for deposits and withdrawals to be processed on cTrader?

The time it takes for deposits and withdrawals to be processed on cTrader varies depending on the payment method. Typically, e-wallets and credit/debit cards offer the fastest processing times, while bank transfers may take several days.

Is cTrader available on mobile devices?

Yes, cTrader is available on mobile devices, including iOS and Android.

What do cTrader brokers support the trading platforms?

cTrader brokers typically support the cTrader platform, as well as other popular trading platforms such as MetaTrader 4 and MetaTrader 5.

What minimum deposit is required to start trading on cTrader?

The minimum deposit required to start trading on cTrader varies depending on the broker. Typically, the minimum deposit is between $100 and $500.

What do cTrader brokers offer the maximum leverage?

Leverage and spreads can vary among cTrader brokers. Some brokers may offer higher leverage and tighter spreads, while others may have more conservative and wider spreads. It is important for traders to understand the impact of leverage and spreads on their trading performance and to choose a broker that offers suitable conditions for their trading style.

The maximum leverage offered by cTrader brokers varies depending on the broker, the asset being traded and the financial regulator by which your cTrader account is regulated. Typically, the maximum leverage for forex trading is 1:500, depending on your country.

What types of accounts are offered by cTrader brokers?

cTrader brokers typically offer different types of accounts to cater to the needs of various traders. The most common types of trading accounts provided by cTrader brokers are:

- cTrader Demo accounts: These accounts allow traders to practice trading in a risk-free environment using virtual funds.

- cTrader Live accounts: These accounts require traders to deposit real funds and enable them to trade with real money. Live accounts are further subdivided into different account types depending on the minimum deposit required, the level of leverage offered, and the trading conditions.

- cTrader Islamic accounts: These accounts are designed for Muslim traders who follow Shariah law, which prohibits the payment or receipt of interest. Islamic accounts offer swap-free trading, meaning traders do not pay or receive interest on positions held overnight.

- cTrader VIP accounts: These accounts are designed for high-net-worth individuals and professional traders who require personalised services, such as dedicated account managers, faster withdrawal processing, and access to exclusive trading tools.

How can one access customer support on cTrader?

Most cTrader brokers provide customer support through various channels like phone, email, live chat, and social media. Traders can access customer support by

- Checking the broker's website: Most cTrader brokers provide detailed information about their customer support services on their website, including their contact details, support hours, and frequently asked questions.

- Contacting the support team: Traders can contact the support team by phone, email, or live chat, depending on the broker's preferred communication channels.

- Using social media: Some cTrader brokers also offer customer support through social media platforms such as Twitter and Facebook.

What are the educational resources available on cTrader?

cTrader brokers typically offer a range of educational resources to help traders improve their trading skills and knowledge. These resources may include:

- Trading guides: cTrader brokers often provide detailed trading guides that cover various topics, such as technical analysis, fundamental analysis, risk management, and trading psychology.

- Webinars: Many cTrader brokers organise webinars with expert traders and analysts sharing their insights and strategies on various markets.

- Video tutorials: cTrader brokers also provide video tutorials that cover various aspects of trading, such as how to use the platform, how to place orders, and how to analyse the markets.

- Trading tools: Some cTrader brokers offer trading tools such as economic calendars, market news, and trading signals, which can help traders make more informed trading decisions.

Are there any restrictions on trading on cTrader?

The restrictions on trading on cTrader vary depending on the broker and the regulatory environment. Some cTrader brokers may impose trading restrictions on certain assets or limit the maximum.

What are the risks associated with trading on cTrader?

Like any other form of trading,Trading on cTrader involves risks. Here are some of the leading trading risks to be aware of:

- Market risk: The risk that market conditions may change rapidly and unpredictably, causing losses on your trades.

- Leverage risk: The risk that leverage may amplify your losses, as well as your profits.

- Liquidity risk: The risk that there may not be enough liquidity in the market to execute your trades at your desired price.

- Operational risk: The risk that there may be technical issues with the trading platform or that the broker may experience financial difficulties.

- Regulatory risk: The risk that changes in regulatory requirements or laws may affect your trading activities.

To manage these risks, it is important to have a solid trading strategy, use risk management tools such as stop-loss orders, and only trade with funds you can afford to lose. It is also important to choose a reputable cTrader broker regulated by a reputable authority.

What is the difference between cTrader and other trading platforms?

cTrader is a platform that provides a streamlined trading experience with advanced features and functionality. One of the main differences between cTrader and other trading platforms is its user interface, which is intuitive and user-friendly. The platform offers various tools and indicators, allowing traders to perform in-depth technical analysis and make informed trading decisions.

cTrader also supports algorithmic trading, allowing users to automate their trading strategies using cAlgo, the platform's programming language. In addition, the platform offers a transparent pricing model with no hidden fees or commissions.

Another key difference between cTrader and other trading platforms is the range of assets available for trading. cTrader supports trading in Forex, commodities, indices, and cryptocurrencies, giving traders access to various financial instruments.

Can one use cTrader for automated trading?

Yes, cTrader supports automated trading through its cAlgo platform, a programming language allowing users to create and test their own trading algorithms. The platform provides users with comprehensive tools and indicators, making it easy to create and backtest trading strategies.

Automated trading can help traders to reduce emotional bias, execute trades with greater accuracy and speed, and make more informed trading decisions. With cTrader's advanced algorithmic trading features, users can develop, test, and deploy their automated trading strategies.

What are the trading hours on cTrader?

The trading hours on cTrader depend on the asset being traded. For example, Forex markets are open 24 hours a day, five days a week, while the stock market has specific trading hours. The platform provides users access to live market data and real-time quotes, keeping them updated with the latest market conditions.

What types of accounts are offered by cTrader brokers?

cTrader brokers offer a range of different account types to suit the needs of other traders. These may include demo accounts for users who want to practice trading without risking real money, as well as live trading accounts with varying levels of deposit requirements, leverage, and other features.

Some cTrader brokers also offer Islamic accounts that comply with Sharia law and do not charge interest or rollover fees. Additionally, some brokers may offer VIP or premium accounts with additional features such as lower spreads, dedicated account managers, and other benefits.

What is the process of opening an account on cTrader?

The process of opening an account on cTrader may vary depending on the broker. Users must visit the broker's website and complete an online registration form. cTrader registration may involve providing personal information such as their name, address, and contact details, as well as proof of identity and residency.

Users can fund the account and start trading on the platform once the account is approved. Many brokers offer a range of deposit options, including credit cards, bank transfers, and e-wallets.

How can one access customer support on cTrader?

cTrader brokers typically offer a range of customer support options to help users with any issues or questions. These may include live chat, email support, phone support, and a comprehensive FAQ section on their website.

Also, some brokers may offer dedicated account managers or personal customer support representatives to help users with queries or concerns.

What are the educational resources available on cTrader?

Many cTrader brokers offer a range of educational resources to help traders improve their knowledge and skills. These may include webinars, video tutorials, e-books, and other educational materials.

Also, some brokers may offer demo accounts or trading simulators, allowing users to practice trading in a risk-free environment. Demo accounts can be a useful tool for novice cTrader traders.

How can one develop a profitable trading strategy on cTrader?

Developing a profitable trading strategy on cTrader requires time, patience, and discipline. Here are some tips to help you get started:

- Set realistic goals: Define your trading goals and develop a plan to achieve them. Set realistic profit targets and risk management rules to help you stay on track.

- Analyse the market: Use the tools available on cTrader, such as advanced charting tools, economic calendars, and news feeds, to analyse the market and identify trading opportunities.

- Choose your trading style: Decide on your trading style, whether it is scalping, day trading, swing trading, or long-term investing. Choose a style that suits your personality and trading preferences.

- Test your strategy: Use cTrader's demo account feature to test your trading strategy in a risk-free environment. Testing a trading strategy will help refine your strategy and identify any weaknesses.

- Monitor your performance: Keep a trading journal to track your performance and identify areas for improvement. Review your trades regularly and adjust your strategy as necessary.

- Be disciplined: Stick to your trading plan and avoid making emotional decisions. Maintain a strict risk management strategy to protect your capital.

cTrader Brokers Verdict

Overall, cTrader brokers offer a range of benefits for traders, including access to a powerful trading platform, a wide selection of assets, and competitive pricing. However, traders should carefully research and compare cTrader brokers to find the one that best meets their needs regarding leverage, spreads, fees, regulation, safety, and customer support.

cTrader is a popular trading platform that offers a wide range of features and tools for traders of all skill levels. Many cTrader brokers offer a wide range of assets for trading, including Forex, CFDs, Indices, Commodities, and Cryptocurrencies. The minimum deposit required to open an account with a cTrader broker can vary, but it's usually around $100 to $500, and traders can deposit more funds as needed.

cTrader is considered user-friendly and accessible for beginners. Many brokers also offer educational resources such as tutorials, webinars, and e-books to help beginners learn the basics of trading and how to use the cTrader platform. Additionally, cTrader also offers a demo account which allows beginners to practice trading with virtual money in a risk-free environment.

However, it's important to remember that trading is high-risk and unsuitable for all investors. Hence, beginners must educate themselves before trading thoroughly and always use a proper risk management strategy to minimise risk and maximise profits. Additionally, using a properly regulated broker and consulting with a professional financial advisor before making any investment decisions is important.

Overall, cTrader is a powerful and versatile trading platform that traders of all skill levels can use, and it offers a range of features and tools to help traders achieve their goals.

Best cTrader Brokers List Compared

| Featured cTrader Broker Trading Platform | Account Features | Trading Features |

|---|---|---|

| Used By: 180,000 Instruments Available: 232 Stocks Available: 2100 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 61 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mirror Trader, ZuluTrade, Web Trader, cTrader, Mac Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 10000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 60 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, IRESS, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 89,000 Instruments Available: 100 Stocks Available: 60 US Stocks: No UK Stocks: No German Stocks: Yes Japanese Stocks: No Indices: Yes Forex Pairs Available: 70 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mac, ZuluTrade, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your moneyVisit |

|

| Used By: 1,866,000 Instruments Available: 430 Stocks Available: 1700 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 70 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 75.78% of retail investor accounts lose money when trading CFDs and Spread Betting with this providerVisit |

|

| Used By: 10,000 Instruments Available: 57 Stocks Available: 0 US Stocks: Yes UK Stocks: No German Stocks: No Japanese Stocks: No Indices: No Forex Pairs Available: Major Forex Pairs: Yes Minor Forex Pairs: No Exotic Forex Pairs: No Minimum Deposit: 100 |

Platforms: MetaTrader 4, cTrader Platform Negative Balance Protection: Inactivity Fee: Your capital is at riskVisit |

|

| Used By: 10,000 Instruments Available: 73 Stocks Available: 200 US Stocks: NO UK Stocks: No German Stocks: No Japanese Stocks: No Indices: No Forex Pairs Available: Major Forex Pairs: No Minor Forex Pairs: No Exotic Forex Pairs: No Minimum Deposit: 100 |

Platforms: cTrader, SocialTrading, copyTrading, webPlatform, DesktopPlatform, Proprietary . Negative Balance Protection: Inactivity Fee: Yes Your capital is at riskVisit |

|

| Used By: 10,000 Instruments Available: 87 Stocks Available: 5000 US Stocks: No UK Stocks: Yes German Stocks: No Japanese Stocks: No Indices: No Forex Pairs Available: Major Forex Pairs: Yes Minor Forex Pairs: No Exotic Forex Pairs: No Minimum Deposit: 0 |

Platforms: cTrader, SocialTrading, webPlatform, DesktopPlatform, Proprietary . Negative Balance Protection: Inactivity Fee: No Your capital is at riskVisit |

|

| Used By: 30,000 Instruments Available: 50 Stocks Available: 0 US Stocks: No UK Stocks: No German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: Major Forex Pairs: Yes Minor Forex Pairs: Exotic Forex Pairs: Minimum Deposit: 100 |

Platforms: MT4, MT5, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 183 Stocks Available: 0 US Stocks: No UK Stocks: Yes German Stocks: No Japanese Stocks: No Indices: No Forex Pairs Available: Major Forex Pairs: No Minor Forex Pairs: No Exotic Forex Pairs: No Minimum Deposit: 0 |

Platforms: cTrader, SocialTrading, copyTrading, webPlatform, DesktopPlatform, Proprietary . Negative Balance Protection: Inactivity Fee: Your capital is at riskVisit |

|

| Used By: 10,000 Instruments Available: 232 Stocks Available: 0 US Stocks: No UK Stocks: Yes German Stocks: No Japanese Stocks: No Indices: Yes Forex Pairs Available: Major Forex Pairs: Yes Minor Forex Pairs: No Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: cTrader, SocialTrading, copyTrading, webPlatform, DesktopPlatform, Proprietary . Negative Balance Protection: Inactivity Fee: Your capital is at riskVisit |

|

| Used By: 10,000 Instruments Available: 231 Stocks Available: 0 US Stocks: No UK Stocks: Yes German Stocks: No Japanese Stocks: No Indices: Yes Forex Pairs Available: Major Forex Pairs: Yes Minor Forex Pairs: No Exotic Forex Pairs: Yes Minimum Deposit: 10 |

Platforms: MT4,iOS,MacBook,iPhone Negative Balance Protection: Inactivity Fee: Your capital is at riskVisit |

|

| Used By: 10,000 Instruments Available: 234 Stocks Available: 1000 US Stocks: NO UK Stocks: Yes German Stocks: No Japanese Stocks: No Indices: Yes Forex Pairs Available: Major Forex Pairs: Yes Minor Forex Pairs: No Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: Android Apps,iPhone/iPad,Desktop Negative Balance Protection: Inactivity Fee: Yes Your capital is at riskVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 0 US Stocks: UK Stocks: German Stocks: Japanese Stocks: Indices: Forex Pairs Available: Major Forex Pairs: Minor Forex Pairs: Exotic Forex Pairs: Minimum Deposit: $50 |

Platforms: Negative Balance Protection: Inactivity Fee: Your capital is at riskVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 0 US Stocks: UK Stocks: German Stocks: Japanese Stocks: Indices: Forex Pairs Available: Major Forex Pairs: Minor Forex Pairs: Exotic Forex Pairs: Minimum Deposit: $200 |

Platforms: Negative Balance Protection: Inactivity Fee: Your capital is at riskVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 0 US Stocks: UK Stocks: German Stocks: Japanese Stocks: Indices: Forex Pairs Available: Major Forex Pairs: Minor Forex Pairs: Exotic Forex Pairs: Minimum Deposit: $0 |

Platforms: MT4, Web Trader, Tablet & Mobile apps

Negative Balance Protection: Inactivity Fee: Your capital is at riskVisit |

Best cTrader Broker cTrader Broker Reviews

Read our details broker cTrader Broker cTrader Broker reviews, you will find something useful if you are shortlisting a cTrader Broker cTrader Broker and trading platform.

- IC Markets Review (read our in depth reviews)

- FP Markets Review (read our in depth reviews)

- Pepperstone Review (read our in depth reviews)

- FxPro Review (read our in depth reviews)

- Bittrex Review (read our in depth reviews)

- ChoiceTrade Review (read our in depth reviews)

- E*Trade Review (read our in depth reviews)

- OctaFX Review (read our in depth reviews)

- OptionsHouse Review (read our in depth reviews)

- TradersHome Review (read our in depth reviews)

- Traders Way Review (read our in depth reviews)

- Tradeview Review (read our in depth reviews)

- Fibo Group Review (read our in depth reviews)

- FXPIG Review (read our in depth reviews)

- SmartFX Review (read our in depth reviews)

cTrader Broker cTrader Broker Alternatives

Read about and compare cTrader Broker cTrader Broker alternatives. We have indepth side by side comparisons to help you find cTrader Broker cTrader Broker related brokers.

- IC Markets Alternatives

- FP Markets Alternatives

- Pepperstone Alternatives

- FxPro Alternatives

- Bittrex Alternatives

- ChoiceTrade Alternatives

- E*Trade Alternatives

- OctaFX Alternatives

- OptionsHouse Alternatives

- TradersHome Alternatives

- Traders Way Alternatives

- Tradeview Alternatives

- Fibo Group Alternatives

- FXPIG Alternatives

- SmartFX Alternatives

FP Markets

FP Markets

FxPro

FxPro

Bittrex

Bittrex

ChoiceTrade

ChoiceTrade

E*Trade

E*Trade

OctaFX

OctaFX

OptionsHouse

OptionsHouse

TradersHome

TradersHome

Traders Way

Traders Way

Tradeview

Tradeview

Fibo Group

Fibo Group

FXPIG

FXPIG

SmartFX

SmartFX