Investment strategies that are competitive against any constant rebalanced portfolio (CRP) can be discovered by algorithms for each and every market sequence. This research investigates the issue of competitiveness over a subset of realistic market sequences that are not pathological and are observed in a variety of contexts, such as high-frequency trading. A constant rebalanced portfolio, also known as a CRP, is a type of investment strategy that maintains a constant wealth distribution across a group of stocks from one trading day to the next. Recent research has focused on developing strategies that can compete favourably with the CRP that was determined to be the best after the fact.

Would you be able to travel back in time to invest in the stock market of the future or find the company that will become the next Apple? Modern researchers are building universal portfolio automated trading algorithms so that maybe you might be able to statistically do that.

Universal portfolio algorithms are a type of algorithmic trading. Using computer algorithms to trade big blocks of stocks or other financial assets is known as algorithmic trading. Algorithm trading is placing deals in accordance with predetermined criteria and dividing these trades into smaller lots to minimize the influence on the stock's or asset's price.

The objective is to turn a little profit on each trade, frequently by profiting from price differences for the same stock or item in various marketplaces. Due to the confluence of a number of variables, including the expanding significance of technology and the growing complexity of financial instruments and products, HFT has become a crucial component of the financial markets.

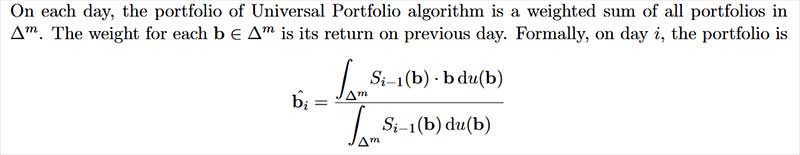

Universal portfolio algorithm is a broad algorithm of prediction with expert guidance, is applied to two different idealized stock markets (or other markets, such the currency markets) in today's financial market algorithms. . Both of these idealizations are considered to be high risk and do have a risk of financial loss, and are only as good as their training sets and input data. Additionally, when investors speculate and apply it to the innumerable family of 'constant rebalanced portfolios' risks must be taken into consideration. The new universal investor imitates the buy order of a multitude of investors by utilising all 'constant rebalanced' strategies, in which the amount of money invested in each stock or financial asset is varied on a daily basis. This allows the investor to maintain a in theory stable portfolio, using universal portfolio methodology based on algorithmic conditional math. It does not make any attempt to model the real world market as an autonomous, unchanging trading entity that is immune to the effects of declared wars, oil volatility, and competing economical and environmental factors that occur in the real world.

The universal portfolio algorithm that was developed by Thomas Cover makes investments in a standardised manner across all constantly rebalanced portfolio strategies. The strategy that proves to be the most successful over time will eventually rise to the top of the financial food chain. In the long run, the compound growth rate attained by utilising this tactic is comparable to that of the most successful constantly rebalanced portfolio.

Thomas M. Cover was a professor of statistics and electrical engineering at Stanford University. He was an American information theorist. One of his most notable works is on the Universal Portfolio Algorithm He worked on improving the connection between information theory and statistics for virtually his whole professional life. Thomas graduated from MIT with a B.S. in Physics in 1960 and Stanford University with a Ph.D. in electrical engineering in 1964.

He was a Fellow of the Institute of Mathematical Statistics and the President of the IEEE Information Theory Society. His 1972 paper, 'Broadcast Channels,' won the Outstanding Paper Award in Information Theory. He was chosen to join the American Academy of Arts and Sciences in 2003.

Professor of electrical engineering and statistics at Stanford University, who collaborated with Joy A. Thomas to write the textbook Elements of Information Theory, passed away at the age of 84. In the 48 years of his career, he graduated 64 PhD candidates and published more than 120 journal articles in the fields of learning and information theory.

Instead of attempting to forecast stock prices or individual winners, one strategy that shows promise is to take advantage of the inherent volatility of the market and to profit from the straightforward and enduring statistical relations that exist between individual stocks. If you use the universal portfolio algorithm, your profits will increase at an exponential rate, and the average growth rate of exponential growth rates will be the same as the maximum growth rate.

Author Thomas Cover says that algorithmic investing is 'guiding thinking', but that it has not yet produced profitable results. It does not take into account the brokerage fees that are attached to each stock trade, which can quickly eat away at an investor's capital.

Although algorithms like universal portfolio algorithms have been used for a long time, the necessity to critically assess them for biases and a lack of rigor has only recently become apparent.

The portfolio selection (PS) problem is a challenging problem for machine learning, online algorithms, and of course computational finance. Specifically, the problem involves selecting investments from a pool of potential investments. Instead of trying to forecast stock prices or identify 'winners', it may be more fruitful to take advantage of the inherent volatility of the market and to profit from the straightforward and consistent statistical relations that exist between different stocks.

Algorithms can quickly transmit shocks from one market to the next, increasing the risk of a major crash. One incorrect or flawed algorithm can cause millions of dollars in losses in a very short amount of time because most algorithmic trading, particularly universal portfolio algorithmic trading, happens at millisecond speed.

Investors who set stop-loss orders on their stock holdings at levels that are 5% off of current trading prices run the risk of suffering significant losses as a result of algorithmic trading. Investors would have suffered trading losses and lost their shares even if equities quickly recovered. During extreme market volatility, such as the Flash Crash, some trades were reversed or canceled, but most trades were not. The Commodity Futures Trading Commission put regulations in place for companies employing algorithmic trading in derivatives in January 2021. Such firms would be required by these requirements to have pre-trade risk controls.

Inadequate sample size and sampling methodologies, incomplete, outdated, or irrelevant data, and a discrepancy between the data used to train the algorithm and the actual input data are risk factors for poor data quality.

Factors including biased logic, erroneous assumptions, bad judgment, unsuitable modeling, coding flaws, and missing data can all have an impact on algorithm design.

Decisions based on the result of a universal portfolio algorithm are susceptible to hazards like inaccurate output interpretation, unsuitable output use, and disregard for the underlying assumptions.

An algorithm's output may be wrong if it wasn't developed, trained, tested, or validated with sufficient rigor or soundness. Inappropriate decision-making can also result from flaws in the implementation, integration, or use by end users.