A method of investing that targets the short-term mispricing of a diverse range of assets across the world in order to generate profits. The performance of individual securities is not the primary concern of this strategy; rather, the focus is on how the market as a whole is moving. A top-down approach to investing is known as Global Tactical Asset Allocation, or GTAA for short.

It is believed that GTAA was derived from global macro hedge funds and tactical asset allocation (TAA) strategies, and it shares some characteristics with these other two types of investment vehicles. It is the goal of TAA decisions to improve the results of investments by overweighting or underweighting different asset classes according to how well those classes are expected to perform over relatively short time periods.

Investors can gain exposures that might not otherwise be present in their portfolios by utilising GTAA strategies, which can be beneficial. There is a significant gap in performance between the various asset classes, and the costs of transactions are relatively low. Comparisons between different markets, rather than those between individual securities within the same market, are the primary focus of analysis and decision making.

What is a Tactical Asset Allocation (TAA), and how does it differ from passive management investing in the sense that it actively manages the risk-adjusted returns of a portfolio? Passive management investing seeks to minimise risk while passive management investing seeks to maximise return. The returns on investments that can be obtained through passive management strategies are the benchmark against which a TAA strategy is measured.

GTAA strategies can either be based on discretion or on a systematic approach.

An investor uses a strategy known as discretionary asset allocation when he or she modifies their asset allocation based on the valuation of the markets in which they are invested. Tactical asset allocation, in contrast to stock picking, which involves the investor selecting individual stocks with the expectation that they will perform well, entails only making judgments about the future return of complete markets or sectors.

During the 1980s and 1990s, pension funds allocated an excessive amount of risk to simple equity investments. These days, GTAA can be purchased from a select few exquisite brands in a wide variety of forms and shapes. A typical GTAA process is made up of primarily four sub-processes, or four different sources of alpha that are independent from one another.

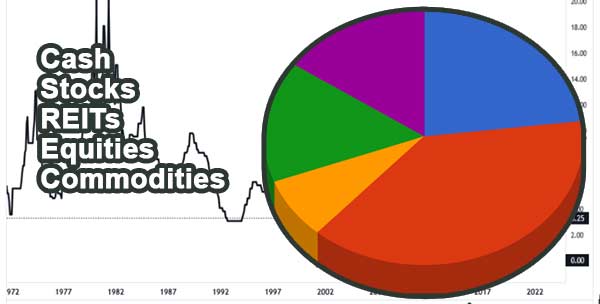

Without putting too much of a strain on capacity, it is possible to trade on up to 13 developed equity markets, 7-8 bond markets, and 9-10 currency pairs. Commodities and curve plays are examples of some products, but these types of products frequently run into capacity problems. Investors receive GTAA in the form of funds, each of which has a unique portfolio of underlying assets (but still chiefly with cash).

In addition to this, GTAA optimizers are typically constructed in such a shrewd way that it is possible to fulfil the specific risk requirements of each client.

The creation of a portfolio involves comparing the expected returns of various asset classes and the various markets that fall under each asset class. In today's modern GTAA products, risk is dynamically re-allocated between different sub-processes and between different markets.

The products offered by GTAA are frequently marketed as hedge funds. When it comes to the fee structure, similar to managers of hedge funds, GTAA managers typically favour receiving a management fee in addition to a performance related fee. In both the case of GTAA and many hedge funds that are permitted to trade derivatives, the instruments that are traded are not cash equities or bonds.

Returns on hedge funds can, to approximately half their extent, be explained by beta exposure. Because hedge fund returns contain a significant amount of beta, some companies have started selling products that attempt to mimic those returns. It would be very difficult to categorise the returns from a GTAA product as beta if the product did not have an inherent bias toward equities or bonds.

The alpha that is delivered is not factored into the performance fees that GTAA managers charge. When investing in a hedge fund, an investor will typically be required to pay additional fees for both alpha and beta. It's possible that this is an extremely rare beta that's extremely difficult to get your hands on. But is that the kind of beta that a typical hedge fund would sell to a typical investor?

The managers of GTAA do not pursue the same opportunities, which is typically the case in many of the strategies used by hedge funds. Therefore, their alpha is not nearly as hard to come by and is not contested with the same ferocity. They are probably more immune to crowding as a result of there being less crowding, and in some cases, this is also due to the contrarian nature of some of their models.

The majority of hedge fund strategies have extremely restricted capacities. The money can still be contributed to funds that have not yet reached the individual capacity ceiling for those accounts. There is a possibility that macro-level events will influence seemingly distinct strategies at the same time. The GTAA will typically conduct an analysis of at least 30 markets while accepting independent bets whose sizes may change over time.

There are a lot of similarities between the correlations that exist between hedge fund managers and the strategies that they use and the correlations that exist between traditional asset classes and other asset classes. However, there is a growing correlation between GTAA managers and their strategies, which suggests that the correlation between the two may not be as strong as was previously believed.

The GTAA was initially provided as a product for discretionary accounts, and the packaging of hedge funds did not come into existence until more recently. When investors look to incorporate GTAA into their portfolio, one of the characteristics that can make a difference is the asset's flexibility. It would be just as simple to design the product to deliver 30% volatility as it would be to design it to deliver 1%, which is a very convenient building block.

Although GTAA and hedge funds share a lot of similarities, there are also key distinctions between the two types of investments. The distinctions that are inherently associated with GTAA will be around for many years to come.

The goal of the GTAA strategy is to reduce the overall exposure to market risk while still generating a real return that is greater than the rate of inflation plus three percent. The asset allocations in the portfolio are designed to be rapidly and actively rebalanced in response to shifts in the market outlook. This allows the portfolio to potentially reduce risk exposure in declining markets while simultaneously maximising returns in expanding markets.

The Berunda-GTAA strategy is predominately a long portfolio strategy, with only a ten to twenty percent allocation to shorting in order to reduce the portfolio's exposure to potential losses. The actual ratio of long positions to short positions is dependent on our forecast for the macroeconomic environment as well as the likelihood of a bear market. The actual performance of the GTAA strategy on a year-to-date basis is displayed in the table below (as of July 31st, 2022).

The performance of the hypothetical fund is compared with that of major benchmarks from March 1, 2004 through July 31, 2022 and is displayed in the chart below. Assumptions regarding performance take into account margin and borrowing rates that are higher than the risk-free rate by a total of 150 basis points. Both the S&P 500 Total Return (SP500TR) and the MSCI All Country World Index are considered to be major benchmarks (ACWI).

Investors try to increase the value of their money, which would otherwise likely remain relatively unchanged in a savings account, by either lending it out (using bonds) or investing it (using stocks). When we invest in a company by purchasing bonds, we are effectively lending that company our money. Because there is a possibility that the company will not repay us for this loan, we anticipate receiving a return on our investment.

Active investors have traditionally held the belief that it is possible to identify opportunities for outsized returns in the market place through the application of disciplined security analysis. As an allegory for this perspective on the market, Benjamin Graham and Warren Buffett are credited with popularising the character of Mr. Market. Investors who exercise sound judgement should take advantage of this opportunity.

Investment decisions are made by global tactical asset allocators based on the asset class, geographic location, and sector or industry. Then, some people will use these perspectives as a guide to help them determine where they should conduct additional research on the subject of security. Others may choose to simply express their opinion by purchasing a diverse portfolio of securities.

The things that actually occur and the things that we anticipate will not, however, always be the same. In general, stocks carry a higher level of risk than bonds do, and they are susceptible to prolonged periods of significant loss. It's possible that a global tactical allocator will try to take advantage of this by switching their holdings from bonds to stocks.

The 'dot-com bubble' that occurred in the late 1990s and 'the Great Financial Crisis' that occurred between 2007 and 2009 are two examples that may be more fresh in the minds of investors in the United States. The high degree to which U.S. equity markets were exposed to the companies that were affected by these events had a significant bearing on the magnitude of the impact that these events had on U.S. equity returns. Following is a sector-by-sector analysis of the components that make up the S&P 500 index. The Financial sector can be recognised as the white region with black dots, whereas the Technology sector is represented by the black region with white dots. Calculations were done by Newfound Research, according to the CSI.

This is the most recent example in a series that demonstrates how a global tactical asset allocator might search for opportunities in various markets around the world. The views may be much more moderate, such as anticipating that returns on U.S. equities will be lower than they have historically been or anticipating that the performance of emerging market sovereign debt will be superior to that of Treasuries.

Value investing, momentum investing, carry investing, defensive investing, and trend investing are the five most common types of systematic investment styles. Each one produces a premium (additional return) that is statistically reliable and can be earned by investors over the course of time. These approaches to global tactical asset allocation are by no means the only ones that can be taken into consideration.

We believe that the methodical approach of the primary investment styles makes it possible to establish performance expectations in a manner that is significantly more open and honest. For instance, in the early 1990s, George Soros's Quantum Fund is credited with bringing down the value of the British pound by placing bets against the United Kingdom's membership in the European Exchange Rate Mechanism (ERM).

Absolute calls and relative calls are the two primary varieties of judgement calls that are utilised by global tactical asset allocators. Absolute calls are judgments made about the potential return on an investment opportunity without taking into account the performance of any other investments in the market. On the other hand, relative calls compare and contrast the various investment opportunities head-on against one another in an explicit manner.

We have been discussing the concept that higher risk investments ought to be accompanied by a greater anticipated return on the investment. For instance, in the long run, it is commonly anticipated that the performance of stocks will be superior to that of cash. The additional return that investors anticipate receiving from their stock investments is referred to as the equity risk premium.

Timing the market is a contentious business strategy. When it comes to making absolute calls, we believe the evidence supports the utilisation of value, defensive, and trend styles. The ad hoc prediction of market tops and bottoms, which has little supporting evidence, and the systematic implementation of investment styles are two very different things. There is a significant difference between the two.

It is referred to as the trend style when used as an absolute, and later on in this piece, we will examine how this fares in comparison to other investment styles in greater detail.

No matter what happens to interest rates, if we purchase a bond that has a yield-to-maturity of 3%, we will always receive a 3% yield on our investment. However, not all assets have a positive carry: if I buy a barrel of oil, there is a physical cost associated with storing that oil. Not all assets have a positive carry.

Essentially, investors can time their interest rate exposure risk by choosing to take on additional risk during periods in which the premium is high and avoiding risk during periods in which the premium is low.

Volatility is a statistical measurement that captures the extent to which returns can vary from one period to the next. Low volatility indicates only slight shifts in price, while high volatility indicates the possibility of significant price increases. The goal of a volatility targeting approach is to dynamically allocate capital in such a way that the risk characteristics of a given asset class are maintained over the course of the strategy's execution.

Within the framework of a trend-following strategy, a global tactical asset allocator evaluates the most recent return on an investment in relation to a threshold rate (often cash). If that return is positive, then we infer that there is a positive trend; if it is negative, then we infer that there is a negative trend. We implement this straightforward strategy in our approach to U.S. equities by making investments during periods of positive trends and selling off our holdings during periods of negative trends.

For the purpose of identifying the trend, the Trend Timing Strategy makes use of a rolling 12-month return. When the return is positive, it is assumed that there is a positive trend, and a position of 150% is maintained. Managed Futures strategies utilise trend-following across a diverse range of asset classes located all over the world.

Managed Futures is one of the few strategies that has consistently demonstrated strong excess risk-adjusted returns. This has made it a popular choice among investors. The extreme discomfort that these strategies can cause when they underperform is hidden by backtests. In the graph that follows, we compare the relative performance of all three strategies to that of U.S. stocks.

It's highly likely that the majority of investors would have given up on these strategies at some point along the way. In order for these kinds of tactics to be successful, they have to be extremely unpleasant. More will be said about that at a later time.

There is a wide range of flexibility in the manner in which one can put into practise global tactical asset allocation strategies. If shorting is permitted, there will be more room for manoeuvrability in the system. Betting in the opposite direction of the movement of an asset's price can result in a profit. Mutual funds, exchange-traded funds, and individual securities all make it possible to achieve relative styles in a more straightforward manner.

The more complex an approach is, the more likely it is that it will begin to include derivatives, such as futures, swaps, and options. This may be done out of necessity (for example, managed futures), to gain leverage, or simply because it may be the most cost-effective way to place a trade. When conducting an analysis of a global tactical strategy, it is important to take into consideration, in general, the following questions:

In order to properly set expectations for how an approach will function, it is essential to not only understand which management styles a manager is incorporating, but also how they are incorporating those styles.

Each of these trading strategies value, momentum, carry, defensive, and trend has a lengthy body of academic and empirical support behind it. However, the excess returns that they have historically generated have not been provided without cost. We are of the opinion that in order for these strategies to be effective going forward, they will need to be challenging enough to adhere to.

When it comes to investing in styles, diversification is the key to success, and combining these approaches can help smooth out the ride and increase the likelihood of success. However, investors who are interested in putting these strategies into action and reaping the benefits they offer should think of them not as a trade but rather as a long-term allocation to their portfolio.

A Global Tactical Asset Allocation strategy, or GTAA for short, is a type of strategy that can be implemented anywhere in the world and gives investors access to a variety of asset classes through tactical allocations. By taking advantage of inefficiencies in the pricing of global and regional macro variables, the plan hopes to achieve its goal of producing positive returns.