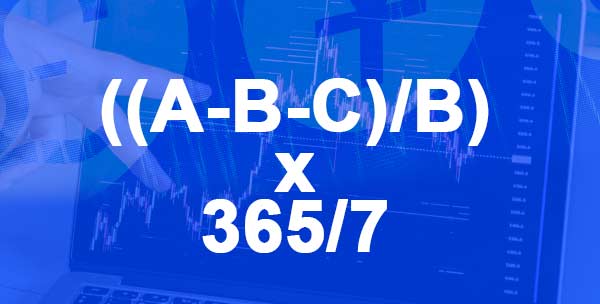

The 7-day SEC yield is a method for estimating the likely return on investment. It is calculated by deducting the acquisition price of the investment from its current value. The 7-day SEC yield is the annual return that an investor receives based on the difference between the purchase price and the sale price. The 7-day SEC yield is a measurement of a security's yield that takes into account major short-term price movements when evaluating how much should be paid for securities. It can help investors decide intelligently whether to acquire or sell specific investments.

The SEC yield is calculated by dividing the net investment income by the fair market value of each asset and annualizing the result. It shows the profit that would be realized if the shares were sold on a particular day. It is calculated by multiplying the price difference between the buy and sale by 7. For instance, if 100 shares of the corporation were purchased for $10 each and were worth $15 each after 7 days, the SEC yield would be ($15-$10)/7 or.285714286 (or 28.57%). For a seven-day period, the SEC yield is calculated as ( investment income/current market value) times 365.

Investors use the 7-day SEC yield as a tool to assess a security's profitability. Despite being created in the 1930s, it has changed since then. Seven days are divided by the difference between the buying price and the sale price (the number of days from when bought the stock). It gives an estimate of the amount that would be left over if the shares were sold at that time after paying for all expenditures. This amount is known as 'yield' since it shows how much interest would be generated on the investment over time. The formula for calculating the 7-day SEC Yield is (Net investment income / Current market value) x 365.

SEC yield is a measure used to determine the overall return on investment. It is calculated by subtracting any dividend payments received over this period from the annualized total return and dividing the result by the current market value. According to this formula, the SEC yield is determined: Annualized Return*(1/PPS)+Dividends Paid-Current Price*Total Shares Held = Annualized Return + Dividends Paid, where% Change - Current Price The original price per share (PPS) for Apple Inc., Inc., in this case, is $100, and dividend payments were made at some point while the investment was held. Shares Held * Current Price = Annualized Return + Dividends Paid

The 7-day SEC yield is used to calculate a security's annualized yield. It is calculated by dividing the sum of the annual interest by the price of the current market, taking into account both long-term and short-term investments.

The amount displayed in the brokerage account represents an average over this period; as a result, if looking at recent data (for example, when evaluating options), it should look for '30-day' or '60-day' periods, which take into account all three-quarters of trading activity to reflect price changes over a given month or year. Investors can estimate how much money they will get from a mutual fund over seven days using the 7-day SEC yield. It can be used to forecast how investments will perform in the future and are extremely simple to calculate.

Similar to the 30-day and 60-day yields, the 7-day SEC yield tracks the cash flow from dividends, interest payments, and other sources of income. The 60-day and 90-day yields consider all other funds, regardless of whether they distribute dividends on a monthly or quarterly basis, whereas the 30-day yield solely considers funds that do so (like equities). Therefore, since this information is already provided on each fund's profile page on Investopedia, no additional calculations are required.

The 7-day SEC yield is calculated by dividing the fund's total cash dividends over the previous seven days by its net asset value (NAV). This can be accomplished by using the formula below: 100 times (Cash Distributions/NAV); 7-day SEC Yield

The 7-day yield is a good predictor of the number of money investors will make from their mutual fund investments over a week. It is easy to compute and can be used to forecast future fund performance. The total cash distributions made by the fund over 30 days are divided by the fund's net asset value to provide the 30-day yield, which is the average annualized return (NAV). The formula for calculating the 30-day yield is as follows: 30-day SEC Yield = ((Cash Distributions/NAV) x 365)/100. It acts as a useful guide to how much money investors can expect to make from their mutual fund investments over 30 days. It can be used to predict future fund performance and is simple to calculate.

The average annualized return can be calculated by taking the 180-day SEC return, which is the 180-day cash dividend total for the fund, and dividing it by the fund's net asset value (NAV). The 180-day yield can be calculated using the following formula: 180-day SEC Yield = ((Cash Distributions/NAV) x 1820)/100 It is simple to calculate and can be used to predict future fund performance. The 180-day yield is a useful indicator of how much money investors will receive from their mutual fund investments over 180 days.

The 7-day SEC yield is a crucial measure for investors to employ in the realm of investing. It can be computed by dividing the security's price by its annualized return. As a result, we can contrast the performance of the assets with that of stocks or bonds of a similar size. If want to know the kind of return on investment should be looking at before making any decisions, you can also use this number to determine when it's time to sell or buy an investment. The 7-day SEC yield helps keep an investment portfolio liquid by allowing owners who need to sell their shares right away but lack the funds (or don't want to pay commissions) to do so without having to wait for another buyer to come along (like when buying during market dips).

By dividing the annualized return by the security's price, the 7-day SEC yield is determined. This makes it possible for us to compare the performance of the investments to that of stocks or bonds of comparable size. If want to know what type of return on the investment looking at before making any decisions, use this number to decide if it's time to sell or buy an investment.