Zero Spread Forex Brokers

The best zero spread forex brokers include IC Markets, RoboForex, and XM. These brokers offer no spread or low spread trading with commission-based pricing models. It's important to note that these brokers may have other charges, so traders should carefully review their fee structure before choosing a broker.

Finding the right zero-spread forex broker requires careful consideration and analysis. Look for brokers that offer low or no spreads, reliable trading platforms, and robust regulatory compliance. Top zero spread forex brokers also provide educational resources and excellent customer support. When selecting a zero spread forex broker, it's important to consider your trading goals and preferences and be aware trading commissions and other fees still exist.

When searching for a zero spread forex broker, it's crucial to consider several factors, such as reputation, regulatory compliance, and the range of services provided, including the availability of minor, major and exotic currency pairs with liquidity.

To protect investors from fraudulent activities, ensuring that the forex broker has the appropriate licensing and regulation is essential. Forex trading involves a high potential reward and a high degree of potential loss.

Zero Spread Forex Brokers Table of Contents

- What are zero-spread forex brokers?

- Zero Spread Forex Brokers Vs Low Spread Forex Brokers

- How do zero-spread Forex brokers differ from regular Forex brokers?

- How zero spread forex brokers make money

- What are the advantages of trading with a zero-spread forex broker?

- Are zero spread forex brokers regulated?

- What types of accounts do zero-spread forex brokers offer?

- What trading platforms do zero-spread forex brokers offer?

- Choosing a zero spread forex broker?

- What minimum deposit is required to open an account with a zero spread forex broker?

- Do zero-spread forex brokers offer demo accounts?

- What trading instruments are offered by zero-spread forex brokers?

- Currency Pairs:

- Zero Spread Major Currency Pairs

- Zero Spread Minor Currency Pairs

- Zero Spread Exotic Currency Pairs

- Commodities

- Indices

- Cryptocurrencies

- Do zero-spread forex brokers charge commissions or fees?

- Zero spread forex brokers orders and executions?

- Do zero-spread forex brokers offer leverage?

- What are the margin requirements with zero-spread forex brokers?

- Do zero-spread forex brokers offer customer support?

- What are the deposit and withdrawal options with zero-spread forex brokers?

- What are the deposit and withdrawal fees with zero spread forex brokers?

- Zero Spread Forex Broker Deposit Fees

- Zero Spread Forex Broker Withdrawal Fees

- Do zero-spread forex brokers offer bonuses or promotions?

- Zero Spread Forex Broker Bonuses

- Zero Spread Forex Broker Promotions

- How do zero-spread forex brokers ensure the safety of client funds?

- Regulation and Licensing

- Segregated Accounts

- Insurance Coverage

- What is the average spread with zero-spread forex brokers?

- Understanding Zero Spread Forex Brokers

- Commission Rates

- Impact on Trading Costs

- Are there any limitations on trading with zero-spread forex brokers?

- Are There Any Limitations on Trading with Zero Spread Forex Brokers?

- Limited Currency Pairs

- Higher Minimum Deposit Requirements

- Higher Commission Charges

- What is the trading volume requirement with zero spread forex brokers?

- What are Trading Volume Requirements?

- Do Zero Spread Forex Brokers Have Trading Volume Requirements?

- Impact of Trading Volume Requirements on Traders

- Do zero-spread forex brokers offer educational resources?

- The Importance of Education in Forex Trading

- Types of Educational Resources Offered by Zero Spread Forex Brokers

- Benefits of Using Educational Resources

- How do zero-spread forex brokers compare to ECN brokers?

- What Are Zero Spread Forex Brokers?

- What Are ECN Brokers?

- Comparison of Zero Spread Forex Brokers and ECN Brokers

- What risks are involved in trading with zero-spread forex brokers?

- Market Volatility Risk

- Slippage Risk

- Broker Risk

- High Leverage Risk

- Can I trade with zero-spread forex brokers from any country?

- Regulatory Environment

- Payment and Withdrawal Options

- Language and Customer Support

- Are there any restrictions on trading strategies with zero-spread forex brokers?

- What are the trading hours with zero-spread forex brokers?

- 24-Hour Trading

- Limited Trading Hours for Certain Markets

- Weekend Trading

- Zero-spread forex broker managed accounts

- Managed Account Basics

- Managed Accounts with Zero Spread Forex Brokers

- Benefits of Managed Accounts with Zero Spread Forex Brokers

- Zero Spread Forex Brokers Verdict

- Zero Spread Forex Brokers List Compared

What are zero-spread forex brokers?

Forex trading platforms that offer zero spreads when trading currency pairs. A spread is a the bid and asking price difference of a currency pair.

Zero Spread Forex Brokers Vs Low Spread Forex Brokers

Zero spread forex brokers and low spread forex brokers are two different types of forex brokers, but they share some similarities in their approach to pricing.

Zero-spread forex brokers offer forex trading with no or very low spreads. Spreads are usually how forex brokers make money. With zero-spread forex brokers, the bid and ask prices are the same, so there is no spread. Instead, zero-spread brokers may charge a commission on each trade, a fixed fee or a percentage of the trade value. On the other hand,

Low-spread forex brokers offer forex trading with lower spreads than the industry average. These brokers still profit from the spread but aim to offer more competitive pricing to attract traders. Low-spread forex brokers may offer fixed or variable spreads and charge commissions on each trade.

Generally, both zero-spread and low-spread forex brokers can be attractive to traders who want to minimise their trading costs. Zero-spread brokers may be better for traders who trade frequently or use scalping strategies. In comparison, low-spread brokers may be better for traders who hold positions longer and are more concerned with overall trading costs than the spread for each trade.

Both zero-spread and low-spread forex brokers may have other fees, such as deposit and withdrawal, inactivity, or account maintenance fees. Traders should carefully review the fee structure of any broker they are considering to ensure they understand all the costs involved in trading.

How do zero-spread Forex brokers differ from regular Forex brokers?

A forex trading platform or broker that offers no trading spreads varies from a regular forex broker by providing trading instruments without any spread. Essentially, this means that there is no difference in the bid and asking price of a currency pair, and instead, the broker only imposes a commission on the trade. In contrast, a regular forex broker charges a spread that is the gap between the bid and ask price of a currency pair.

Trading with a zero-spread forex broker can result in several benefits, such as reduced transaction costs, no hidden charges, improved transparency, faster trade execution, and decreased slippage risk. However, it's worth noting that zero-spread forex brokers might not be the best option for all traders, particularly if they execute multiple trades, as the broker's commission may accumulate over time. Additionally, the lack of a spread might make it challenging to anticipate trade expenses, which could affect risk management strategies.

How zero spread forex brokers make money

Zero spread forex brokers generate revenue by levying a commission on each trade their clients execute. These brokers do not impose any spread on trading instruments but impose a fixed commission that is generally a percentage of the trade size or a flat fee per trade. Therefore, the more trades a client executes, the more commission the broker earns.

It is worth noting that the commission charged by zero-spread forex brokers may vary depending on several factors, including the trading instrument, the account type, and the trading volume. Some brokers may also provide tiered commission structures where the commission percentage reduces as the trading volume increases.

In addition to commissions, some zero-spread forex brokers may earn interest from holding their clients' funds in their accounts. Nonetheless, this revenue stream is generally insignificant compared to the commission earned from trades.

What are the advantages of trading with a zero-spread forex broker?

The main advantage of trading with a zero-spread forex broker is that it can lower trading costs. Because there is no spread to pay, traders can enter and exit trades at the same price, saving them money over time. Zero-spread forex brokers may offer faster trade execution and more transparent pricing.

A zero spread forex broker facilitates trading forex currencies with no spread fees, only a commission is charged on Forex transactions.

Trading Forex with zero spreads can offer several benefits:

- Lower transaction costs: Transactions with a zero spread broker are only charged a commission on trades, which could be less than the spread imposed by other brokers. Traders who trade more frequently may find zero spreads help reduce costs.

- No hidden fees: With a zero-spread forex broker, traders have visibility on what they are paying for each transaction.

- Better transparency: A zero-spread forex broker can provide greater transparency since there is no difference between the bid and ask price. Traders can be certain they are receiving the best price for their trades.

- Fast order execution: Trades can be executed more quickly with a zero-spread forex broker since there is no spread to consider. Faster forex orders can be particularly beneficial for traders who use scalping or other short-term trading strategies.

- Reduced risk of slippage: Slippage occurs when the price of an order is executed at a different price than anticipated. With a zero spread forex broker, there is less slippage risk because there is no spread to factor in.

It is essential to consider that zero-spread forex brokers may not suit all traders. The broker's commission could accumulate over time, particularly if many trades exist. Additionally, the lack of spread could make it challenging to anticipate trade expenses, which could affect risk management strategies. As a result, it is critical to weigh the advantages and disadvantages of trading with a zero-spread forex broker and assess if it is the right fit for your trading style and goals.

Are zero spread forex brokers regulated?

Zero spread forex brokers are subject to the same regulatory requirements and standards as regular forex brokers. These brokers must follow the regulations and guidelines established by the regulatory authorities in their countries. Including complying with the regulations on client fund segregation, financial reporting, anti-money laundering, and investor protection.

It is essential to confirm whether a reputable regulatory authority regulates a zero-spread forex broker before selecting one. Regulatory oversight ensures your funds are safe and the broker complies with all necessary regulations.

What types of accounts do zero-spread forex brokers offer?

Zero-spread forex brokers typically offer a range of account types to suit different trading needs. These may include standard accounts, mini-accounts, and micro-accounts. Some brokers may also offer Islamic accounts that are compliant with Sharia law.

Zero spread forex brokers offer various account types with different features and benefits, depending on their business model and target market. Although there is no standard account type, some of the common ones include:

- Standard account: It is the most basic account type offered by zero-spread forex brokers. This account typically has a minimum deposit requirement, and traders can trade a range of currency pairs and other instruments with no spread.

- ECN Account: This account type provides traders with direct access to the interbank market, enabling them to trade with other traders and institutions. ECN accounts usually have a commission-based fee structure and a higher minimum deposit requirement.

- VIP Account: A VIP account is designed for high-net-worth individuals or experienced traders who require additional benefits, such as lower commission rates, personalised support, and exclusive trading tools.

- Islamic account: This account is also known as a swap-free account and is designed for traders who follow Islamic finance principles that prohibit earning or paying interest. Islamic accounts do not charge swap fees but may have other fees or charges.

Traders should carefully consider the features and benefits of each account type before selecting one that suits their trading needs and objectives, as brokers may have different names and features for their account types.

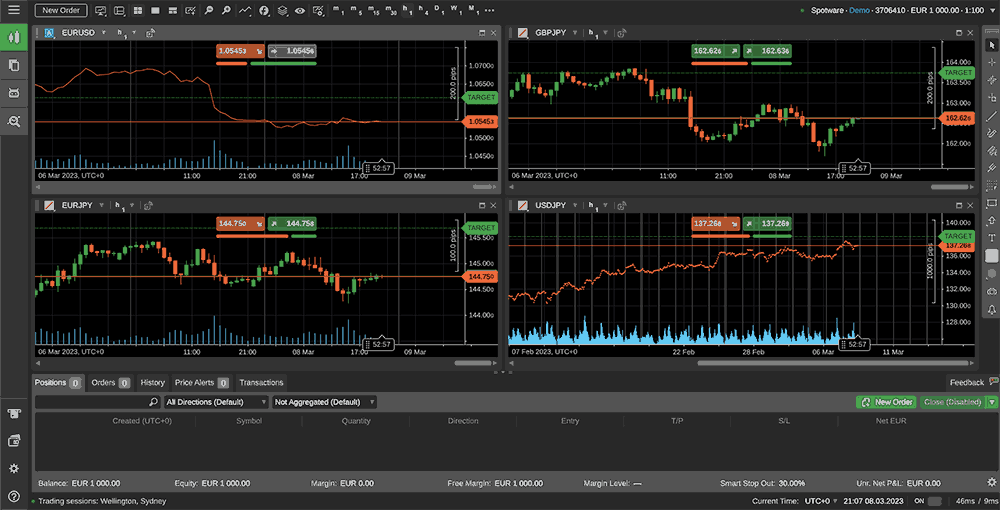

What trading platforms do zero-spread forex brokers offer?

Zero-spread forex brokers typically offer a range of trading platforms, including popular options such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Some brokers may also offer their proprietary trading platform.

Zero spread forex brokers provide a variety of trading platforms for traders to execute trades. Although the specific platforms offered may differ among brokers, several popular trading platforms include:

- MetaTrader 4 (MT4): This platform is widely used in the forex industry, known for its user-friendly interface, advanced charting capabilities, and a variety of technical indicators and tools.

- MetaTrader 5 (MT5): This platform is an upgraded version of MT4 that offers enhanced features and improved performance, including additional asset classes such as stocks and commodities and advanced hedging capabilities.

- cTrader: Known for its fast order execution speed and deep market features, cTrader includes a range of technical indicators, charting tools, and advanced risk management features.

- JForex: Dukascopy, a forex broker, developed this trading platform. JForex includes advanced features like customisable trading algorithms, backtesting tools, and social trading capabilities.

Aside from these platforms, some brokers may offer proprietary trading platforms designed to cater to their client's needs. Traders should carefully consider the trading platform's features, functionalities, and compatibility with their trading strategy before selecting a broker.

Choosing a zero spread forex broker?

When choosing a zero-spread forex broker, several factors must be considered, including regulation, trading platforms, account types, trading instruments, customer support, and deposit and withdrawal options. Researching and choosing a broker that meets your trading needs and preferences is important.

Short listing zero spread forex broker should be carefully researched as it can impact traders' success in the forex market. Here are some important factors when shortlisting forex brokers with zero spreads:

- Regulation: Ensure that the broker is regulated by reputable authorities to guarantee the safety of your funds and adherence to necessary regulations.

- Trading Conditions: Consider the broker's trading conditions, including minimum deposit requirements, leverage, and account types, to see if they align with your trading needs and goals.

- Trading Platforms: Evaluate the trading platform offered by the broker, its features, functionalities, and compatibility with your trading strategy.

- Customer Support: Choose a broker that provides reliable and efficient customer support, especially for new traders who may need assistance.

- Reputation and Reviews: Research the broker's reputation and reviews online to get an idea of other traders' experiences with the broker and its services.

By considering these factors, traders can select a zero-spread forex broker that suits their trading needs and preferences. Testing the broker's services by opening a demo account before committing to a live account is also recommended.

What minimum deposit is required to open an account with a zero spread forex broker?

The minimum deposit requirement to open an live trading account with a zero spread forex broker depends on the type of account you sign up for and the trading tools you require. Generally, zero-spread forex brokers offer account types with varying minimum deposit requirements, ranging from as low as $1 to as high as $10,000 or more. Some brokers may also offer micro or nano accounts allowing traders to start with a smaller deposit, which can benefit those new to forex trading or with limited funds. It's important for traders to carefully consider the minimum deposit requirement and other trading conditions the broker offers before choosing an account type.

Do zero-spread forex brokers offer demo accounts?

Yes, many zero-spread forex brokers offer demo accounts that allow traders to practice trading. Demo accounts can be a valuable tool for new traders who want to learn the basics, without using real money.

Zero-spread forex brokers have been gaining popularity among traders due to their competitive pricing and fee structure. One of the significant benefits of trading with zero-spread brokers is the opportunity to trade without paying any spread, which can lead to considerable cost savings.

Moreover, zero-spread forex brokers also offer demo accounts to their clients. A demo account allows traders to practice in a risk-free environment using virtual funds. It is a crucial tool for traders to test their trading strategies, learn the platform's features and functionalities, and get familiar with the trading conditions before committing to a live account.

Most zero spread forex brokers offer demo accounts replicating the live trading environment, including the same platforms and tools available in the live account. Demo accounts come with a virtual balance that traders can use to place trades without risking any real money. However, traders should note that the trading environment may differ from the live account due to market liquidity, slippage, and order execution speed.

To open a demo account with a zero-spread forex broker, traders usually need to provide basic personal information and agree to the broker's terms and conditions. The process is generally simple and can be completed within a few minutes. Traders can access the demo account through the broker's trading platform or a login portal.

Although demo accounts are an excellent way for traders to practice trading, it is crucial to understand their limitations. For example, demo accounts cannot replicate the emotional impact of trading with real money, affecting a trader's decision-making process. Additionally, traders may not experience the same market conditions and order execution speed in a demo account as in a live account.

In conclusion, zero-spread forex brokers offer demo accounts to their clients to provide them with a risk-free environment to practice trading and test their trading strategies. Demo accounts are a valuable tool for traders to familiarise themselves with the platform's features, functionalities, and trading conditions before committing to a live account. However, traders should be aware of the limitations of demo accounts and take the time to learn about the risks involved in trading before opening a live account.

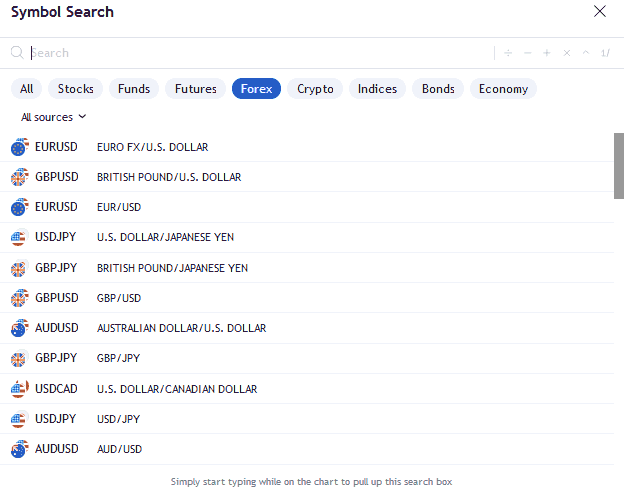

What trading instruments are offered by zero-spread forex brokers?

Zero-spread forex brokers typically offer various trading instruments, including currency pairs, commodities, indices, and cryptocurrencies. The exact trading instruments offered can vary between brokers, so it's important to check which instruments are available before opening an account.

Zero-spread forex brokers have become increasingly popular among traders due to their competitive pricing and transparent fee structure. These brokers offer traders a range of trading instruments, including currency pairs, commodities, indices, and cryptocurrencies. This article will examine the trading instruments offered by zero-spread forex brokers.

Currency Pairs:

The primary trading instruments zero-spread forex brokers offer are currency pairs. Traders can trade major, minor, and exotic currency pairs. Major currency pairs include EUR/USD, GBP/USD, and USD/JPY, while minor forex pairs can include USD/CHF and AUD/NZD. Exotic forex pairs involve a currency from a emerging economy, such as USD/TRY or USD/BRL.

The specific currency pairs offered by zero spread forex brokers will differ, but generally, the following major, minor, and exotic currency pairs are available:

Zero Spread Major Currency Pairs

- (Euro - US Dollar) EURUSD

- (US Dollar - Japanese Yen) USDJPY

- (British Pound - US Dollar) GBPUSD

- (US Dollar - Swiss Franc) USDCHF

- (Australian Dollar - US Dollar) AUDUSD

- (US Dollar - Canadian Dollar) USDCAD

- (New Zealand Dollar - US Dollar) NZDUSD

Zero Spread Minor Currency Pairs

- (Euro - British Pound) EURGBP

- (Euro - Japanese Yen) EURJPY

- (British Pound - Japanese Yen) GBPJPY

- (Australian Dollar - New Zealand Dollar) AUDNZD

- (Australian Dollar - Japanese Yen) AUDJPY

- (Canadian Dollar - Japanese Yen) CADJPY

- (Swiss Franc - Japanese Yen) CHFJPY

- (New Zealand Dollar - Japanese Yen) NZDJPY

- (Euro - Swiss Franc) EUR/CHF

- (British Pound - Swiss Franc) GBPCHF

Zero Spread Exotic Currency Pairs

- USDHKD (Hong Kong Dollar)

- USDSGD (Singapore Dollar)

- USDTRY (Turkish Lira)

- USDBRL (Brazilian Real)

- USDZAR (South African Rand)

- USDMXN (Mexican Peso)

- USDCNH (Chinese Yuan)

- USDINR (Indian Rupee)

- USDRUB (Russian Ruble)

- USDIDR (Indonesian Rupiah)

It's important to note that the availability of specific currency pairs may vary between brokers and may be subject to change.

Commodities

Zero spread forex brokers also offer to trade in commodities such as gold, silver, oil, and natural gas. Trading commodities can be an attractive option for diversifying portfolios or hedging against inflation. Commodities are traded as futures contracts, representing an agreement to buy or sell a commodity at a predetermined price and date.

Indices

Indices represent a basket of stocks that track the performance of a particular market or sector. Zero-spread forex brokers offer trading in various indices, including the S&P 500, NASDAQ, and FTSE 100. Trading in indices can be a popular choice for traders looking to speculate on the stock market's overall performance.

Cryptocurrencies

Zero spread forex brokers also offer trading in cryptocurrencies such as Bitcoin, Ethereum, and Litecoin. Cryptocurrency trading has become increasingly popular in recent years, with traders attracted by the volatility and potential for significant gains. However, it's important to note that cryptocurrency trading can be highly speculative and carries a high level of risk.

Do zero-spread forex brokers charge commissions or fees?

Yes, zero-spread forex brokers typically charge a commission on each trade. Commissions are charged on both the sale and purchange or a forex currency pair trade. Some brokers may also charge deposits, withdrawals, or other service fees.

Zero or low-spread forex brokers have become increasingly popular among traders due to their competitive pricing and transparent fee structure. As the name suggests, zero-spread forex brokers offer traders the benefit of trading without any spread, which is the difference between a currency pair's bid and ask price. Traders can enter and exit trades at the same price, maximising their profits and minimising their losses.

So, if zero spread forex brokers don't charge a spread, do they charge any other fees or commissions? The answer is yes, they do. While zero-spread forex brokers don't charge a spread, they may charge a commission or a fee for each trade. This commission or fee can vary depending on the broker and the trading instrument being traded.

For example, some zero-spread forex brokers may charge a commission based on the trade volume. The larger the trade, the higher the commission. Other brokers may charge a flat fee for each trade, regardless of the size. It's important to note that the commission or fee charged by the broker can significantly impact a trader's overall profitability.

Zero spread forex brokers may charge withdrawal, inactivity, or deposit fees. Traders should carefully review a broker's fee structure before opening an account to fully understand the costs involved.

It's important to note that while zero-spread forex brokers may charge fees, they generally have a much lower fee structure than traditional forex brokers. Zero spread brokers operate on a different business model that allows them to offer competitive pricing to their clients.

In conclusion, while zero-spread forex brokers don't charge a spread, they may charge commissions or fees for each trade. Traders should carefully review a broker's fee structure before opening an account to fully understand the costs involved. By doing so, traders can make informed decisions and choose a broker that best meets their needs.

Zero spread forex brokers orders and executions?

Zero-spread forex brokers typically offer fast and efficient order execution, with orders processed in milliseconds. Brokers may use various execution methods, including market execution, instant execution, and request for quote (RFQ) execution.

Zero-spread forex brokers are known for their competitive pricing and transparent fee structure. But how do they handle orders and executions? In this article, we'll look at the order execution process of zero-spread forex brokers.

When a trader places an order with a zero spread forex broker, the broker will typically send the order to a liquidity provider, usually a large financial institution or a group of financial institutions. The liquidity provider then matches the order with another order from another trader or with its inventory of currencies.

Once the order is matched, the liquidity provider sends a confirmation to the broker, who then sends a confirmation to the trader. The process typically takes a few milliseconds, meaning orders are executed quickly and efficiently.

It's important to note that zero-spread forex brokers use electronic communication networks (ECNs) to match orders with liquidity providers. The broker doesn't act as the counterparty to the trade, which can help eliminate potential conflicts of interest.

Besides ECNs, zero-spread forex brokers may also use straight-through processing (STP) to handle orders and executions. STP is an automated process that allows orders to be executed without manual intervention. Orders are executed quickly and accurately and can help to eliminate the potential for human error.

Overall, zero-spread forex brokers typically use a combination of ECNs and STP to handle orders and executions. Allowing for fast and efficient execution of trades while also helping to eliminate potential conflicts of interest. Traders can benefit from the quick execution times and competitive pricing offered by zero-spread forex brokers, making them an attractive option for many traders in the forex market.

Do zero-spread forex brokers offer leverage?

Zero-spread forex brokers typically offer leverage, allowing traders to control larger positions with less capital. The amount of leverage offered can vary between brokers and account types.

Forex trading platforms offer leverage to their clients, which facilitates forex pair price speculation with a larger position in the market than their account balance would otherwise allow. Leverage is a powerful tool that can increase potential profits but also amplifies potential losses.

The leverage offered by a zero spread forex broker varies depending on the broker and the trading instrument being traded. For example, some brokers may offer leverage of up to 1:500 for major currency pairs. In contrast, others may offer lower leverage, such as 1:100 or 1:50. The leverage offered for exotic currency pairs may be even lower due to their higher volatility and risk.

Traders should be aware that leverage may increase potential profits, potential losses are very high. If a forex trade moves against your position, losses may be greater than the initial investment, resulting in a margin call or a complete loss of funds. As such, it's important for traders to carefully manage their risk using limit orders and stop-loss orders and position sizing.

It's important to note that some regulatory bodies limit the leverage brokers can offer their clients. For example, in the United States, the maximum leverage for forex trading is 1:50, while in Europe, the maximum leverage is typically 1:30. Traders should check the regulatory requirements in their jurisdiction to ensure that they are trading with a regulated and compliant broker.

Zero spread forex brokers typically offer leverage to their clients, allowing them to control larger positions in the market than their account balance would otherwise allow. However, traders should be aware of the risks when using leverage and use risk management tools.

What are the margin requirements with zero-spread forex brokers?

The margin requirements with zero-spread forex brokers can vary depending on the broker and the account type. The margin is the funding requirement to place a open leveraged forex position. Margins are a percentage your forex position size.

Margin requirements are important to trading with zero-spread forex brokers. To open and maintain positions in the forex market, traders must have sufficient margin in their trading account.

Margin is essentially a deposit that the broker requires to cover any potential losses on a trade. The amount of margin required by a zero-spread forex broker will vary depending on the trading instrument being traded and the leverage being used.

For example, if a trader wants to open a position in a major currency pair with leverage of 1:100, the broker may require a margin of 1% of the position's notional value. So, if the position's notional value is $100,000, the margin required would be $1,000.

Traders must understand that margin requirements can change depending on market conditions. If volatility increases or market conditions become more uncertain, the broker may increase margin requirements to protect itself and its clients from potential losses.

Traders should also know the potential for margin calls. Suppose the losses on a position exceed the available margin in the trader's account. In that case, the broker may issue a margin call, which requires the trader to deposit additional funds to maintain the position. The broker may close out the position if the trader cannot meet the margin call.

Overall, margin requirements are important for traders trading with zero-spread forex brokers. Traders should ensure sufficient margin in their trading account and use appropriate risk management strategies, such as stop-loss orders, to protect their capital.

Do zero-spread forex brokers offer customer support?

Yes, zero-spread forex brokers typically offer customer support in various languages. Support may be available through phone, email, or live chat. Some brokers may also offer educational resources to help traders improve their skills and knowledge.

Zero-spread forex brokers typically offer customer support through various channels, including phone, email, live chat, and social media. Some brokers may offer additional support options such as online forums, FAQs, and educational resources such as webinars, trading guides, and market analysis. The availability and quality of customer support can vary among brokers, so traders must research and choose a broker with good customer service. Some brokers may also offer specialised support for certain traders, such as high-volume or institutional traders, including dedicated account managers, customised trading solutions, and other premium services.

Zero spread forex brokers typically offer customer support to their clients, including a range of services to help traders with their accounts and trading activities.

Customer support can be provided through various phone, email, live chat, and social media channels. The availability of support channels and the support quality vary among brokers, so it's important to research and chooses a broker with good customer service.

Common services offered by zero-spread forex brokers include account setup and management, assistance with trading platforms and tools, and help with deposits and withdrawals. Some brokers may also offer educational resources such as webinars, trading guides, and market analysis to help traders make informed decisions.

Besides general customer support, some brokers may offer specialised support for certain traders, such as high-volume or institutional traders. Including dedicated account managers, customised trading solutions, and other premium services.

Traders should also consider the availability and quality of customer support when choosing a broker. It can be critical during technical difficulties or other issues impacting their trading activities. A broker with responsive and knowledgeable customer support can help to resolve issues quickly and minimise any negative impact on the trader's account.

In conclusion, zero-spread forex brokers typically offer customer support to their clients, including a range of services to assist traders with their accounts and trading activities. Traders should research and choose a broker with good customer service to ensure they receive timely and effective support when needed.

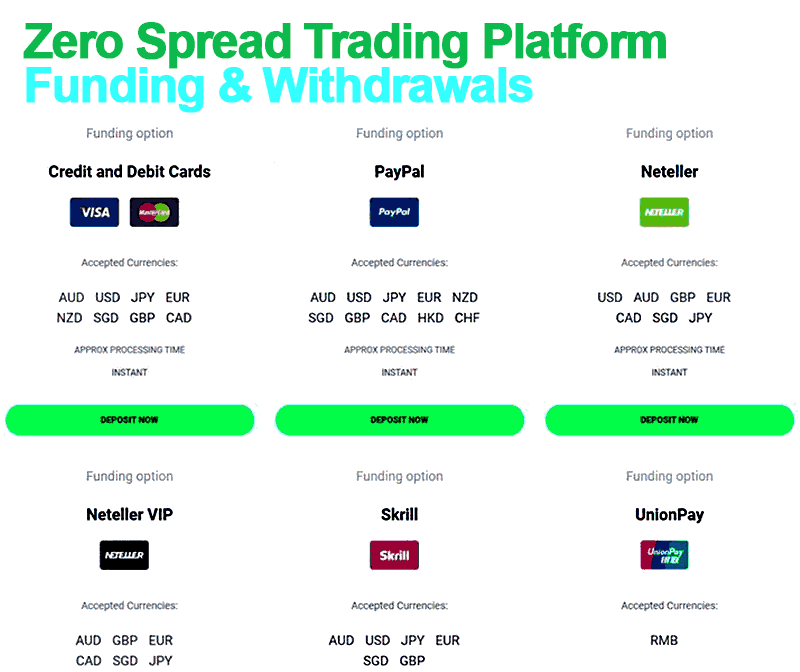

What are the deposit and withdrawal options with zero-spread forex brokers?

Zero spread forex brokers typically offer a range of deposit and withdrawal options, including bank wire transfer, credit card, and e-wallets such as Skrill and Neteller. The availability of deposit and withdrawal options can vary between brokers and countries.

Zero spread forex brokers typically offer their clients various local deposit and withdrawal methods for live forex trading accounts, so any profits or gains can be easily withdrawn. These options include bank transfers, credit and debit cards, e-wallets, and other payment methods.

Bank transfers are a common deposit and withdrawal option offered by most brokers, allowing traders to transfer funds directly from their bank accounts to their trading accounts. Credit and debit cards, such as Visa and Mastercard, are also popular for depositing funds as they offer quick and convenient transactions.

E-wallets, such as PayPal, Skrill, and Neteller, have become increasingly popular among traders as they offer fast and secure transactions, often with lower fees than other options. Some zero-spread forex brokers may also offer cryptocurrencies as a deposit and withdrawal option, such as Bitcoin or Ethereum.

Traders need to check the fees and processing times for each deposit and withdrawal option their broker offers, as these can vary depending on the payment method. Some brokers may impose minimum and maximum deposit and withdrawal limits, which vary based on the account type and trading instrument.

Traders should also consider the security and reliability of their broker's deposit and withdrawal options and any additional verification or authentication requirements necessary to complete the transactions.

Zero spread forex brokers typically offer clients various deposit and withdrawal options, including bank transfers, credit and debit cards, e-wallets, and cryptocurrencies. Traders should review the fees, processing times, and security of each option their broker offers to choose the most suitable option for their needs.

What are the deposit and withdrawal fees with zero spread forex brokers?

The deposit and withdrawal fees with zero spread forex brokers can vary depending on the broker and the payment method. Some brokers may charge fees for deposits or withdrawals, while others offer free ones.

Regarding trading forex, one of the most important things to consider is the fees charged by the broker. Zero-spread forex brokers are becoming increasingly popular because they do not charge a trade spread. However, it is still important to understand the deposit and withdrawal fees that these brokers may charge.

Zero Spread Forex Broker Deposit Fees

Most zero-spread forex brokers do not charge deposit fees. You can fund your trading account without having to pay any additional fees. However, it is important to check with the broker to ensure no hidden fees or charges.

Zero Spread Forex Broker Withdrawal Fees

Withdrawal fees can vary depending on the broker and your chosen payment method. Some zero spread forex brokers charge set withdrawal fees. Checking with the broker to understand their specific withdrawal fees is important.

Additionally, some payment methods may incur additional fees. For example, if you withdraw funds using a bank wire transfer, your bank may charge you a fee for the transaction.

Do zero-spread forex brokers offer bonuses or promotions?

Some zero-spread forex brokers may offer bonuses or promotions to attract new clients or reward existing clients. These may include deposit bonuses, no-deposit bonuses, or cashback promotions. It's important to read the terms and conditions of any bonus or promotion before accepting it.

Zero-spread forex brokers are popular with more active traders due to their competitive pricing and low transaction costs. However, many traders may wonder if these brokers offer bonuses or promotions to attract or retain new clients. Let's take a closer look at whether zero-spread forex brokers offer such incentives.

Zero Spread Forex Broker Bonuses

Unlike traditional forex brokers, most zero spread forex brokers do not offer bonuses to their clients. They primarily focus on offering low transaction costs and competitive pricing rather than attracting clients through bonus schemes. Additionally, many regulatory authorities have restricted using bonuses by forex brokers to protect clients from excessive trading or taking on too much risk.

Zero Spread Forex Broker Promotions

While zero-spread forex brokers may not offer bonuses, they may offer promotions occasionally. These promotions may include reduced transaction costs or cashback offers for certain trading volumes. However, it is important to note that these promotions are typically not as common or extensive as traditional forex brokers offer.

How do zero-spread forex brokers ensure the safety of client funds?

Zero-spread forex brokers are regulated by financial regulatory bodies in the countries where they operate. These regulatory bodies ensure that client funds are held in segregated accounts, separate from the broker's funds. Helping to protect client funds if the broker experiences financial difficulties.

Zero-spread forex brokers have become increasingly popular due to their low transaction costs and competitive pricing. However, ensuring that your funds are safe when trading with any broker is important. Let's take a closer look at how zero-spread forex brokers ensure the safety of client funds.

Regulation and Licensing

Zero spread forex brokers are typically licensed and regulated by major european and international regulatory bodies such as the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), and the Cyprus Securities and Exchange Commission (CySEC). Financial regulators have established rules and regulations that brokers must follow to ensure the safety of client funds.

Segregated Accounts

Zero-spread forex brokers typically hold client funds in segregated accounts. Client funds are kept separate from the broker's operating funds. In the event of the broker experiencing financial difficulties, client funds will remain untouched and can be returned to clients. The use of segregated accounts is a regulatory requirement for many regulatory authorities.

Insurance Coverage

Some zero-spread forex brokers may offer insurance coverage for client funds in the event of the broker experiencing financial difficulties. A third-party insurer may provide this insurance coverage and can provide additional protection for client funds.

What is the average spread with zero-spread forex brokers?

As the name suggests, zero-spread forex brokers offer trading with no spread. However, these brokers may charge a commission on each trade, which can vary depending on the broker and the account type.

Zero-spread forex brokers have become popular among traders due to their low transaction costs. But if they don't charge spreads, what is the average spread with zero-spread forex brokers?

Understanding Zero Spread Forex Brokers

Zero-spread forex brokers do not charge spreads on trades. Instead, they may charge a commission on each trade. This commission is typically a fixed amount per lot traded rather than a percentage of the trade value. The cost of trading with a zero-spread forex broker can be calculated more easily and is more transparent than trading with a traditional forex broker.

Commission Rates

The commission rates charged by zero spread forex brokers can vary depending on the broker, the trading platform used, and the currency pair being traded. Typically, commission rates range from $2 to $7 per lot traded. Some brokers may offer volume discounts for higher trading volumes or account balances.

Impact on Trading Costs

While zero spread forex brokers do not charge spreads, they charge commissions on each trade. The impact of these commissions on trading costs can vary depending on the trading style and frequency of the trader. For example, a high-frequency trader who executes many trades may find that the commissions charged by a zero-spread forex broker add up quickly and significantly impact their profitability.

Zero-spread forex brokers do not charge spreads on trades, but they do charge commissions. The commission rates can vary depending on the broker and the trading platform used and typically range from $2 to $7 per lot traded. It is important to carefully review the commission rates and other trading costs of any zero-spread forex broker you are considering trading with to understand the overall cost of trading and how it impacts your profitability.

Are there any limitations on trading with zero-spread forex brokers?

There may be some limitations on trading with zero-spread forex brokers, such as the minimum and maximum position sizes or the maximum number of open trades that can be held at any one time. These limitations can vary between brokers and account types, so checking the terms and conditions before opening an account is important.

Are There Any Limitations on Trading with Zero Spread Forex Brokers?

Zero-spread forex brokers have become popular among traders due to their low transaction costs and competitive pricing. However, there are some limitations that traders should be aware of when trading with zero-spread forex brokers.

Limited Currency Pairs

One of the limitations of trading with zero-spread forex brokers is that they may offer a limited range of currency pairs compared to traditional forex brokers. The most popular and liquid currency pairs that can be traded with tight spreads and high liquidity. As a result, traders who require access to a wider range of currency pairs may find zero-spread forex brokers unsuitable for their needs.

Higher Minimum Deposit Requirements

Zero-spread forex brokers may have higher minimum deposit requirements than traditional ones. Low-spread forex brokers typically cater to more experienced traders who can trade with larger account balances. As a result, traders who are just starting or do not have a large trading capital may find that zero-spread forex brokers are unsuitable for their needs.

Higher Commission Charges

Zero-spread forex brokers do not charge spreads on trades, but they do charge commissions. The commission rates can vary depending on the broker and the trading platform used and typically range from $2 to $7 per lot traded. Traders who execute many trades may find that the commissions charged by zero-spread forex brokers add up quickly and significantly impact their profitability.

What is the trading volume requirement with zero spread forex brokers?

The trading volume requirement with zero-spread forex brokers can vary depending on the broker and the account type. Some brokers may require a certain level of trading activity before allowing withdrawals, while others may have no such requirements.

Zero-spread forex brokers have become increasingly popular among traders due to their low transaction costs and transparent pricing structure. However, some brokers may impose trading volume requirements on their clients. Here's what you need to know about trading volume requirements with zero-spread forex brokers.

What are Trading Volume Requirements?

Trading volume requirements are minimum trading volumes that traders must meet to qualify for certain benefits or avoid certain fees. For example, a broker may require traders to trade several lots monthly to avoid inactivity fees or qualify for a bonus or promotion.

Do Zero Spread Forex Brokers Have Trading Volume Requirements?

Some zero-spread forex brokers may impose trading volume requirements on their clients, but not all do. It is important to carefully review the terms and conditions of any broker you are considering trading with to determine whether they have trading volume requirements and, if so, what those requirements are.

Impact of Trading Volume Requirements on Traders

Trading volume requirements can significantly impact traders, particularly those just starting out or with limited trading capital. Meeting minimum trading volume requirements may require traders to execute more trades than they are comfortable with or to take on more risks than they are comfortable with to meet those requirements. On the other hand, traders who can meet the trading volume requirements may benefit from reduced fees or other benefits offered by the broker.

Do zero-spread forex brokers offer educational resources?

Some zero-spread forex brokers may offer educational resources to help traders improve their skills and knowledge. These may include webinars, video tutorials, trading guides, and other educational materials.

Zero-spread forex brokers are known for their low transaction costs and transparent pricing structure. But do they offer educational resources to help traders learn about the forex market and improve their trading skills? Here's what you need to know.

The Importance of Education in Forex Trading

Forex trading is a complex and fast-moving market. It requires a deep understanding of economic principles, technical analysis, and risk management strategies. For traders to succeed in the forex market, they must continually improve their knowledge and skills. Educational resources become crucial.

Types of Educational Resources Offered by Zero Spread Forex Brokers

Zero-spread forex brokers understand the importance of education in forex trading, and many offer their clients a range of educational resources. These resources can include:

- Online courses

- Video tutorials

- Webinars

- E-books

- Trading guides

- Market analysis and commentary

Demo forex trading accounts could also be considered an educational resource.

Benefits of Using Educational Resources

Using educational resources provided by zero spread forex brokers can have several benefits for traders, including:

- Improved knowledge and understanding of the forex market.

- Enhanced trading skills and strategies.

- Increased confidence in trading decisions.

- Access to expert analysis and commentary on the market.

- The ability to practice trading in a simulated environment without risking real money.

How do zero-spread forex brokers compare to ECN brokers?

Zero-spread forex and ECN brokers offer trading with no spread but operate differently. ECN brokers typically offer a transparent trading environment where traders can see the bids and offers of other market participants and can trade with them directly. On the other hand, zero-spread forex brokers typically act as market makers and offer fixed spreads but charge a commission on each trade.

Both zero spread forex and ECN brokers have advantages and disadvantages. Zero-spread forex brokers can trade without spreads but charge a commission on trades. ECN brokers offer tighter spreads and more transparent pricing but may require a higher minimum deposit. Ultimately, the choice between the two will depend on the trader's needs and preferences.

What Are Zero Spread Forex Brokers?

Zero-spread forex brokers allow traders to trade without paying a spread. Instead, they make their money by charging a commission on trades. Resulting in lower overall transaction costs for traders.

What Are ECN Brokers?

ECN stands for Electronic Communication Network. ECN brokers use electronic communication networks to match buyers and sellers in the forex market. Allowing traders to trade directly with other market participants can result in tighter spreads and more transparent pricing.

Comparison of Zero Spread Forex Brokers and ECN Brokers

Here are some of the key differences between zero spread forex brokers and ECN brokers:

| Factor | Zero Spread Forex Brokers | ECN Brokers |

|---|---|---|

| Spreads | No spreads, but a commission is charged on trades | Variable spreads, but typically tighter than other types of brokers |

| Pricing | Transparent pricing structure | Transparent pricing structure |

| Order Execution | Instant execution, but slippage may occur during high volatility | Market execution, but slippage may occur during high volatility |

| Liquidity | May have access to multiple liquidity providers | Access to multiple liquidity providers |

| Minimum Deposit | May have lower minimum deposit requirements | May have higher minimum deposit requirements |

What risks are involved in trading with zero-spread forex brokers?

Trading with zero-spread forex brokers involves risks, as with any form of trading. These risks include market volatility, price fluctuations, and loss potential. Traders must have a solid understanding of the markets and risk management strategies before trading with any broker.

Zero-spread forex brokers can offer many benefits to traders, such as lower transaction costs and increased transparency. However, like any type of investment, there are also risks involved. Here are some of the risks to consider when trading with zero-spread forex brokers:

Market Volatility Risk

Zero spread forex brokers typically charge a commission on trades instead of a spread. While this can result in lower overall transaction costs, it also means that traders are more exposed to market volatility. During times of high volatility, the commission charged by the broker may increase, resulting in higher transaction costs for traders.

Slippage Risk

Slippage is a common issue when trading with any broker. With zero-spread forex brokers, When currency market conditions change rapidly or when there is a lack of liquidity, slippage may arise. Resulting in trades being executed at a less favourable price than anticipated, which can impact overall profitability.

Broker Risk

When trading with zero-spread forex brokers, traders rely on the broker to execute trades and handle their funds. If the broker is not reputable or financially stable, there is a risk that the trader's funds could be lost or mismanaged. Researching any broker thoroughly before depositing funds and only trading with brokers regulated by a reputable financial authority is important.

High Leverage Risk

Many zero spread forex brokers offer high leverage ratios, which can increase the potential for profits but also the potential for losses. High leverage can magnify even small price movements, resulting in significant gains or losses. Traders should always use caution when trading with high leverage and only use it if they fully understand the risks.

Can I trade with zero-spread forex brokers from any country?

Zero-spread forex brokers may restrict who they can accept as clients, depending on the regulations in their countries. Traders should check with the broker to see if they can open an account.

Zero-spread forex brokers have become increasingly popular due to their transparent pricing model and lower transaction costs. However, the availability of these brokers can vary depending on your location. Here are some factors to consider when determining whether you can trade with zero-spread forex brokers from your country:

Regulatory Environment

The regulatory environment in your country can impact whether zero-spread forex brokers are available to you. Some countries highly regulate forex trading, and brokers must meet strict operating requirements. In other countries, forex trading may be less regulated, making it easier for brokers to offer their services. It is important to research the regulatory environment in your country and ensure that any broker you consider is properly licensed and regulated.

Payment and Withdrawal Options

The availability of payment and withdrawal options can also impact whether you can trade with zero-spread forex brokers from your country. Some brokers may only offer certain payment methods, such as credit cards or bank transfers, which may not be available in all countries. Additionally, the availability of local currency options can vary, impacting the ease and cost of making deposits and withdrawals.

Language and Customer Support

The language and customer support options offered by zero-spread forex brokers can also impact whether you can trade with them from your country. If a broker only offers customer support in a language you do not speak, getting the assistance you need may be difficult. Similarly, if customer support is only available during certain hours or through limited channels, it may be challenging to get help when you need it.

Are there any restrictions on trading strategies with zero-spread forex brokers?

There may be restrictions on the trading strategies that can be used with zero-spread forex brokers, such as scalping or hedging. These restrictions can vary between brokers and account types, so checking the terms and conditions before opening an account is important.

Zero-spread forex brokers are popular among traders because they offer competitive pricing and low transaction costs. These brokers generally do not charge a spread, which allows traders to benefit from tight bid-ask spreads. However, there may be restrictions on the trading strategies that can be used with these brokers. Here are some important considerations to keep in mind:

- Scalping:Scalping is a popular trading strategy that involves opening and closing trades quickly to capture small price movements. Some zero-spread forex brokers may restrict scalping or impose additional fees for scalping trades. It is important to review the broker's trading terms and conditions to determine whether scalping is allowed and whether any additional fees or restrictions apply.

- News Trading:News trading is another popular strategy that involves taking advantage of market-moving news events. Some zero-spread forex brokers may restrict news trading or impose additional fees for news trading trades. It is important to review the broker's trading terms and conditions to determine whether news trading is allowed and whether any additional fees or restrictions apply.

- Hedging:Hedging is a risk management strategy that involves opening multiple positions to offset potential losses. Some zero-spread forex brokers may restrict hedging or impose additional fees for hedging trades. It is important to review the broker's trading terms and conditions to determine whether hedging is allowed and whether any additional fees or restrictions apply.

What are the trading hours with zero-spread forex brokers?

The trading hours with zero-spread forex brokers can vary depending on the traded markets. Forex markets are open 24 hours a day, five days a week, so traders can typically trade with zero-spread forex brokers during these hours. Other markets may have specific trading hours.

Zero spread forex brokers offer traders competitive pricing and low transaction costs. However, it's important to understand the trading hours offered by these brokers. Here are some important considerations to keep in mind:

24-Hour Trading

Most zero spread forex brokers offer 24-hour trading from Sunday evening to Friday evening. Traders can trade currencies around the clock, regardless of their time zone. The advantage of 24-hour trading is that it allows traders to take advantage of opportunities outside regular business hours.

Limited Trading Hours for Certain Markets

Many zero-spread forex brokers offer 24-hour trading, but certain markets may have restrictions. For example, some brokers may limit trading hours for less liquid currency pairs or markets closed due to holidays or other events. It's important to review the trading hours for each market the broker offers to ensure you can trade the currencies you want during the hours you prefer.

Weekend Trading

Some zero-spread forex brokers also offer weekend trading for select currency pairs. Allowing traders to take advantage of market movements over the weekend when traditional markets are closed. However, weekend trading is generally less liquid than weekday trading, so traders should be cautious when trading during these hours.

Zero-spread forex broker managed accounts

Some zero-spread forex brokers may offer managed accounts, where an experienced trader manages the account on behalf of the client. Managed accounts can offer a passive investment option for those who do not have the time or expertise to trade themselves. However, choosing a trustworthy and trustworthy manager is important before investing in a managed account.

Managed accounts are investment accounts where an experienced trader manages the account on behalf of the investor. The goal of a managed account is to generate returns for the investor while minimising risk. Here's what you need to know about managed accounts with zero spread forex brokers:

Managed Account Basics

Managed accounts are popular with investors who want to invest in the forex market but don't have the time, knowledge, or experience to trade independently. With a managed account, the investor typically opens an account with a broker and then delegates trading authority to a professional trader who makes trading decisions on their behalf. The trader is compensated through a performance fee, which is a percentage of the profits generated.

Managed Accounts with Zero Spread Forex Brokers

Some zero-spread forex brokers offer managed accounts to investors. These brokers typically have a team of experienced traders who manage the accounts on behalf of the investors. The traders use their knowledge and experience to generate returns while minimising risk. Managed accounts with zero-spread forex brokers may offer various investment options, including currency pairs, strategies, and risk levels. The performance fee charged by the broker for managing the account may vary depending on the level of risk involved.

Benefits of Managed Accounts with Zero Spread Forex Brokers

Managed accounts with zero spread forex brokers offer several benefits to investors. First, they provide a way for investors to invest in the forex market without having to trade independently. Useful for investors who are new to forex trading or don't have the time to dedicate to trading. Second, managed accounts allow investors to benefit from the expertise of professional traders. The traders use their knowledge and experience to generate returns while minimising risk. Finally, managed accounts with zero spread forex brokers offer transparency that is not available with traditional investment accounts. Investors can monitor the performance of their accounts in real-time and make adjustments as needed.

Zero Spread Forex Brokers Verdict

Zero-spread forex brokers offer trading with no spread but charge a commission on each trade. These brokers can offer advantages such as fast order execution, tight spreads, and low trading costs. However, traders should know the risks involved in trading and choose a reputable and trustworthy broker that meets their trading needs.

Zero Spread Forex Brokers List Compared

| Featured Zero Spread Forex Brokers Trading Platform | Account Features | Trading Features |

|---|---|---|

| Used By: 180,000 Instruments Available: 232 Stocks Available: 2100 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 61 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mirror Trader, ZuluTrade, Web Trader, cTrader, Mac Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 53 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 35 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 10 USD / 10 EUR |

Platforms: MT4, MT5, Mac, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 200,000 Instruments Available: 1000 Stocks Available: 99 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 80 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: Web Trader, MT4, MT5, AvaTradeGo, AvaOptions, Mac, Mobile Apps, ZuluTrade, DupliTrade, MQL5 Negative Balance Protection: Inactivity Fee: No 71% of retail CFD accounts lose moneyVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 10000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 60 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, IRESS, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 50 Stocks Available: 0 US Stocks: No UK Stocks: No German Stocks: No Japanese Stocks: No Indices: No Forex Pairs Available: 65 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Minimum Deposit: 10 |

Platforms: MT4, MT5, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 250,000 Instruments Available: 4000 Stocks Available: 1696 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 57 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 0 |

Platforms: MT4, Mirror Trader, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Visit |

|

| Used By: 89,000 Instruments Available: 100 Stocks Available: 60 US Stocks: No UK Stocks: No German Stocks: Yes Japanese Stocks: No Indices: Yes Forex Pairs Available: 70 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mac, ZuluTrade, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your moneyVisit |

|

| Used By: 10,000,000 Instruments Available: 1000 Stocks Available: 160 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 55 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 5 |

Platforms: MT4, MT5, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77.74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.Visit |

|

| Used By: 20,000,000 Instruments Available: 2000 Stocks Available: 2042 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 50 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 50 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 51% of retail investor accounts lose money when trading CFDs with this provider.Visit |

|

| Used By: 10,000 Instruments Available: 130 Stocks Available: 60 US Stocks: Yes UK Stocks: Yes German Stocks: No Japanese Stocks: No Indices: Yes Forex Pairs Available: 45 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, Mac, Mirror Trader, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 142,500 Instruments Available: 200 Stocks Available: 52 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 150 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Your capital is at riskVisit |

|

| Used By: 15,000,000 Instruments Available: 10000 Stocks Available: 1731 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 177 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.Visit |

|

| Used By: 10,000 Instruments Available: 15000 Stocks Available: 1000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 55 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 148 Stocks Available: 64 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 40 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: $100 |

Platforms: MT4, MT5, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 4,000,000 Instruments Available: 2200 Stocks Available: 2000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: No Indices: Yes Forex Pairs Available: 67 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your moneyVisit |

Best Zero Spread Forex Brokers Zero Spread Forex Brokers Reviews

Read our details broker Zero Spread Forex Brokers Zero Spread Forex Brokers reviews, you will find something useful if you are shortlisting a Zero Spread Forex Brokers Zero Spread Forex Brokers and trading platform.

- IC Markets Review (read our in depth reviews)

- Roboforex Review (read our in depth reviews)

- AvaTrade Review (read our in depth reviews)

- FP Markets Review (read our in depth reviews)

- NordFX Review (read our in depth reviews)

- XTB Review (read our in depth reviews)

- Pepperstone Review (read our in depth reviews)

- XM Review (read our in depth reviews)

- eToro Review (read our in depth reviews)

- FXPrimus Review (read our in depth reviews)

- easyMarkets Review (read our in depth reviews)

- Trading 212 Review (read our in depth reviews)

- SpreadEx Review (read our in depth reviews)

- Admiral Markets Review (read our in depth reviews)

- Markets.com Review (read our in depth reviews)

Zero Spread Forex Brokers Zero Spread Forex Brokers Alternatives

Read about and compare Zero Spread Forex Brokers Zero Spread Forex Brokers alternatives. We have indepth side by side comparisons to help you find Zero Spread Forex Brokers Zero Spread Forex Brokers related brokers.

- IC Markets Alternatives

- Roboforex Alternatives

- AvaTrade Alternatives

- FP Markets Alternatives

- NordFX Alternatives

- XTB Alternatives

- Pepperstone Alternatives

- XM Alternatives

- eToro Alternatives

- FXPrimus Alternatives

- easyMarkets Alternatives

- Trading 212 Alternatives

- SpreadEx Alternatives

- Admiral Markets Alternatives

- Markets.com Alternatives

IC Markets

IC Markets

Roboforex

Roboforex

AvaTrade

AvaTrade

FP Markets

FP Markets

NordFX

NordFX

XTB

XTB

Pepperstone

Pepperstone

XM

XM

eToro

eToro

FXPrimus

FXPrimus

easyMarkets

easyMarkets

Trading 212

Trading 212

SpreadEx

SpreadEx

Admiral Markets

Admiral Markets

Markets.com

Markets.com