Best United Kingdom Brokers

When searching for brokers in the United Kingdom, consider those regulated by the Financial Conduct Authority (FCA). Look for brokers with competitive fees, reliable platforms, and strong customer support. Research the broker's reputation and track record before making a decision.

A United Kingdom broker is a financial intermediary that specializes in helping traders in the UK buy and sell a range of financial assets, such as stocks, bonds, currencies, commodities, and derivatives. These brokers can provide access to multiple markets, including the United Kingdom Union's stock exchanges and international exchanges, making it easier for traders to invest and trade globally.

United Kingdom brokers must comply with regulations set by the United Kingdom Financial Conduct Authority (FCA) and other regulatory bodies in their countries. These regulations aim to protect investors and ensure that trading practices are fair and transparent. Some key regulations that United Kingdom brokers must comply with include the FCA (Financial Conduct Authority) and the GDPR (General Data Protection Regulation). UK financial regulation ensures that investors have confidence in their broker and their services.

In addition to helping traders buy and sell financial assets, United Kingdom brokers can offer a range of other services, such as trading platforms, research and analysis, financial services, and portfolio management. The fees and commissions charged for these services can vary depending on the broker and the type of service provided. Our comprehensive guide to United Kingdom brokers covers a range of topics, including a detailed comparison of United Kingdom trading platforms and financial services. We provide useful information on narrowing down your choices when selecting a United Kingdom broker. Our guide also delves into the features of United Kingdom trading tools, funding and withdrawal methods offered by United Kingdom brokers, and the costs associated with using a United Kingdom brokerage firm or trading platform. Our guide provides a clear and informative overview of the factors investors should consider when choosing a United Kingdom broker and how to make the most of their trading experience.

Best United Kingdom Brokers Table of Contents

- United Kingdom Brokers

- How to Choose the Right UK Broker for Your Investment Needs

- Licensing and Regulation

- UK Trading Platforms

- Investment Products Available To UK Traders

- Customer Service In English

- Commission and fees

- What is the Minimum Deposit Required to Open an Account with a UK Broker?

- How Do I Fund My Account with a UK Broker?

- What Are The Deposit And Withdrawal Options Available With UK Brokers?

- Education and research

- How Can I Compare The Different UK Brokers Available?

- What are the Risks of Trading with a UK Broker?

- What Are The Advantages of a UK Broker?

- What Are The Best UK Brokers For Trading Stocks And Shares?

- What Are The Fees And Commissions Associated With Trading With UK Brokers?

- How Do I Withdraw My Funds from a UK Broker?

- How Do UK Brokers Handle Disputes or Complaints?

- Can I Trade Internationally with a UK Broker?

- Which UK Brokers Offer The Best Customer Support And Service?

- Are UK Brokers Regulated By Any Financial Regulatory Body?

- What Trading Platforms Do UK Brokers Offer?

- How Much Capital Is Required To Open An Account With UK Brokers?

- What types of investment products do UK brokers offer?

- Are UK Brokers Suitable For Beginner Traders?

- What Is The Minimum Trade Size With UK Brokers?

- Are UK Brokers Suitable For High-frequency Trading?

- What Are The Margin Requirements With UK Brokers?

- Are UK Brokers Suitable For Trading Forex And Other Derivatives?

- What Is The Process For Opening An Account With UK Brokers?

- What Educational And Research Resources Are Available With UK Brokers?

- Trading guides and tutorials

- Market analysis and commentary

- Trading platforms and tools

- UK Demo accounts for practice trading

- How Do UK Brokers Handle Client Funds And Ensure Security Of Personal And Financial Information?

- Segregated accounts

- Financial Services Compensation Scheme (FSCS)

- Anti-money laundering (AML) and Know Your Customer (KYC) policies

- Regulation by financial regulatory bodies

- Secure technology

- What Are The Tax Implications Of Trading With UK Brokers?

- Capital gains tax (CGT)

- Income tax

- Stamp duty

- ISA and SIPP accounts

- Seek professional advice

- How Do UK Brokers Differ From Brokers In Other Countries?

- Are UK Brokers Suitable For Long-term Investing Or Only For Short-term Trading?

- What is the History of the UK Brokerage Industry?

- How Have UK Brokers Adapted to Technological Advancements in Recent Years?

- United Kingdom Brokers Verdict

- Best United Kingdom Brokers List Compared

United Kingdom Brokers

Choosing the right UK broker for your investment needs is crucial in your journey as an investor. By considering factors such as licensing and regulation, trading platform, investment products, and customer service, you can find a broker that meets your needs and provides the security and support you need to succeed. Remember to be aware of the risks involved in trading and to carefully consider your investment goals and risk tolerance before making any trades or investments. By working with a reputable UK broker and staying informed about market conditions and industry trends, you can achieve your investment goals and grow your wealth over time.

How to Choose the Right UK Broker for Your Investment Needs

Choosing the right UK broker for your investment needs can be daunting. With so many brokers to choose from, it cannot be easy to know where to start. Here are some factors to consider when selecting a UK broker:

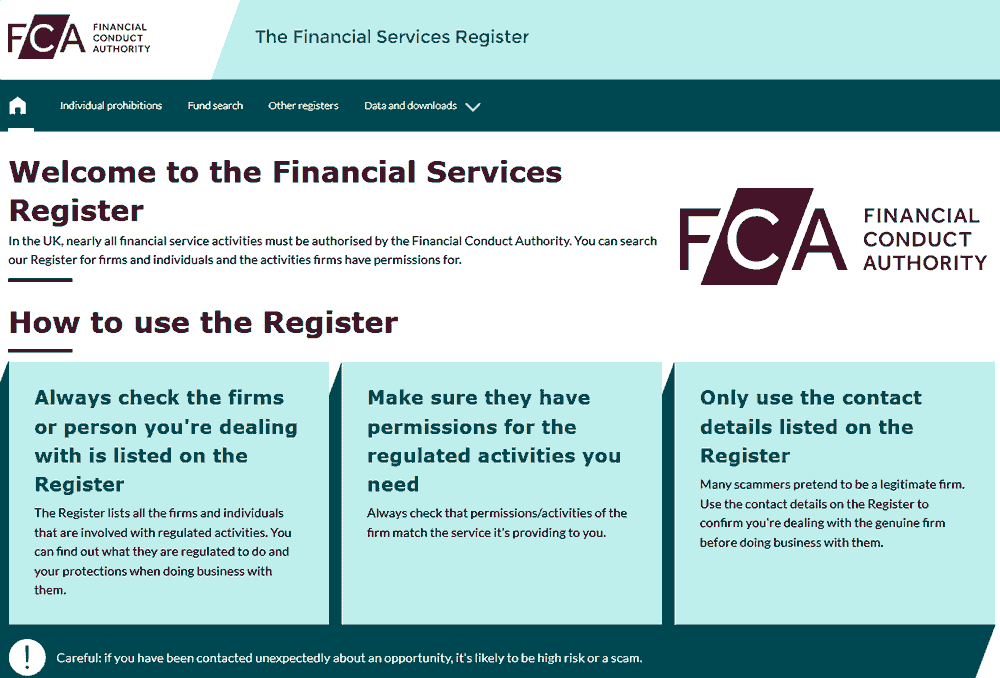

Licensing and Regulation

The first thing you should check when considering a UK broker is whether they are licensed and regulated by the Financial Conduct Authority (FCA). The FCA is the regulatory body that oversees financial services firms in the UK, including brokers. A broker licensed and regulated by the FCA must adhere to strict rules and regulations designed to protect investors. Financial regulation in the United Kingdom provides extra security for your investments.

Check if the broker is regulated by the Financial Conduct Authority (FCA) or another reputable regulatory body. Strong regulation can help ensure that your funds are safe and that the broker operates according to industry standards.

UK Trading Platforms

Look at the broker's trading platform and make sure it is user-friendly and meets your needs. Some brokers offer multiple platforms, while others have a proprietary platform.

The trading platform is the software that allows you to access the financial markets and execute trades. You should choose a UK broker offering a trading platform that is easy to use, reliable, and has all the necessary features. Some brokers offer their proprietary trading platform, while others use third-party platforms such as MetaTrader 4 or 5.

Investment Products Available To UK Traders

Another important factor to consider when selecting a UK broker is their range of investment products. Some brokers specialize in a particular asset class, such as stocks, while others offer a wider range of investment products, including forex, commodities, and cryptocurrencies. Choose a broker that offers the investment products you are interested in trading.

Customer Service In English

Good customer service is essential when selecting a UK broker. Look for a broker that offers responsive and helpful customer service. Ideally, you should be able to reach customer service 24/7 via phone, email, or live chat.

Commission and fees

Look at the UK broker's commission and fee structure, including account maintenance fees, inactivity fees, and trading fees. Compare the fees with other brokers to ensure you get a competitive deal.

What is the Minimum Deposit Required to Open an Account with a UK Broker?

The minimum deposit required to open an account with a UK broker can vary widely depending on the broker and the type of account you want to open. Some brokers require a minimum deposit of just £50, while others require several thousand pounds. Generally, the minimum deposit required to open an account with a UK broker varies depending on the trading features your trading account offers.

How Do I Fund My Account with a UK Broker?

Once you have opened an account with a UK broker, you must fund your account to start trading. Most UK brokers offer several funding options, including:

- Bank transfer

- Credit/debit card

- E-wallets such as PayPal, Neteller, and Skrill

When funding your account, be aware that some funding methods may incur fees, and some brokers may require a minimum deposit for certain funding methods.

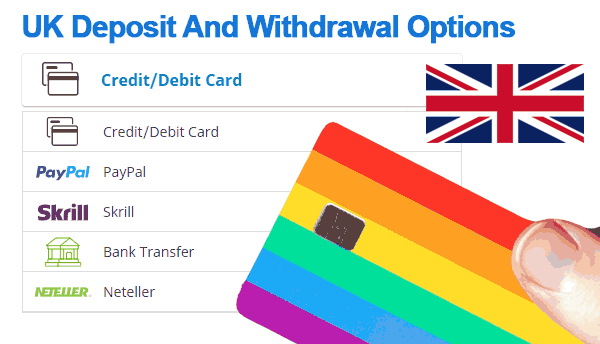

What Are The Deposit And Withdrawal Options Available With UK Brokers?

Check the broker's deposit and withdrawal options, including bank transfers, credit/debit cards, e-wallets, and cryptocurrencies. Look for a brokerin the UK that offers a variety of options that suit your needs.

UK brokers offer various deposit and withdrawal options to accommodate the needs of their clients. Here are some of the most common options:

- Bank transfers: Many UK brokers allow clients to deposit and withdraw funds via bank transfer, which is a secure and reliable method of transferring funds.

- Debit and credit cards: Some UK brokers accept debit and credit cards for deposits and withdrawals, although this may be subject to certain restrictions and fees.

- E-wallets: Some UK brokers accept e-wallets such as PayPal, Skrill, and Neteller for deposits and withdrawals, which can be a convenient option for clients who prefer to use electronic payment methods.

- Cryptocurrencies: Some UK brokers also accept cryptocurrencies such as Bitcoin and Ethereum for deposits and withdrawals, although this is less common.

It's important to note that deposit and withdrawal options may vary between brokers, and some brokers may charge fees or have minimum deposit and withdrawal requirements. Traders should check with their chosen broker to see what options are available and what fees may apply.

Also, brokers may have specific requirements for verifying client identity and preventing fraud, which may impact the withdrawal process. Clients should be prepared to provide identification documents and comply with any verification procedures their broker requires.

Education and research

Check if the broker offers educational resources and research tools, such as webinars, trading guides, and market analysis. Trading educational resources and guides can be especially helpful for beginner traders in the United Kingdom.

How Can I Compare The Different UK Brokers Available?

When comparing brokers, it's important to consider your individual trading needs and priorities. Consider what assets you want to trade, how much you plan to invest, and what level of support and education you need.

You can also read reviews and ratings from other traders to understand the broker's reputation and track record. However, it's important to approach reviews critically and consider multiple sources to get a well-rounded view of the broker.

Overall, by considering these factors and researching, you can find a UK broker that meets your needs and helps you achieve your trading goals.

What are the Risks of Trading with a UK Broker?

While trading with a UK broker can offer many advantages, risks are also involved. Some of the risks of trading with a UK broker include:

- Market risk: The value of your investments can go down and up, depending on market conditions.

- Leverage risk: Trading with leverage can amplify your gains, but it can also amplify your losses.

- Counterparty risk: If the broker goes bankrupt or cannot meet its obligations, you may lose some or all of your investments.

What Are The Advantages of a UK Broker?

There are several advantages to trading with a UK broker, including:

- Regulation: UK brokers are regulated by the FCA, which provides an extra layer of security for your investments.

- Access to a wide range of investment products: UK brokers offer access to a wide range of investment products, including stocks, forex, commodities, and cryptocurrencies.

- Competitive pricing: UK brokers often offer competitive pricing and low fees, making trading and investing easier.

- Good customer service: UK brokers are known for their responsive and helpful customer service.

It's important to be aware of these risks and to carefully consider your investment goals and risk tolerance before trading with a UK broker or any other financial institution.

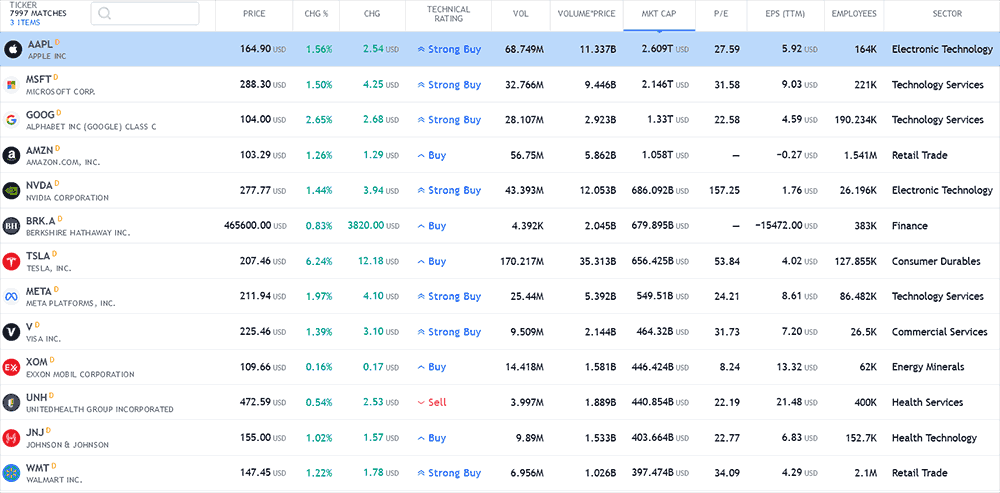

What Are The Best UK Brokers For Trading Stocks And Shares?

several UK brokers offer excellent services for trading stocks and shares. Here are some of the top UK brokers:

| Broker Name | Description |

|---|---|

IC Markets IC Markets |

This is one of the largest UK brokers and offers a wide range of trading instruments, including stocks and shares, forex, and commodities. It has a user-friendly trading platform and competitive fees. |

AvaTrade AvaTrade |

This is a popular UK broker that offers a comprehensive trading platform with access to UK and international markets. It also offers a range of research and educational resources. |

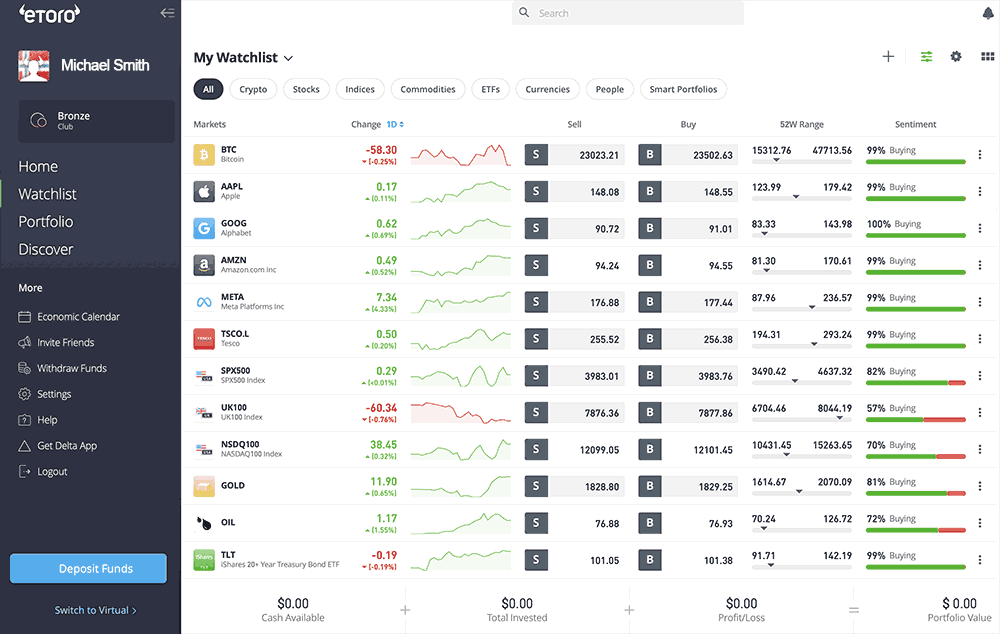

eToro eToro |

This is a popular social trading platform that allows users to follow and copy the trades of successful traders. It also offers commission-free trading on stocks and shares. |

Roboforex Roboforex |

This is a global broker that offers access to UK and international markets with competitive fees and a range of trading platforms. |

XM XM |

This is a low-cost broker that offers access to UK and international markets with competitive fees and a user-friendly trading platform. |

It's important to research and compares the different brokers to find the one that best meets your needs and preferences.

What Are The Fees And Commissions Associated With Trading With UK Brokers?

The fees and commissions associated with trading with UK brokers vary depending on the broker and the trading instrument. Here are some common fees and commissions to be aware of:

- Trading fees: These are fees charged by the broker for each trade you make. They can be charged as a flat fee or as a percentage of the trade value.

- Commission: This is a fee charged by the broker for executing a trade on your behalf. Some UK brokers have a flat commission per trade, other UK brokerages may charge a per cent of the total trades value.

- Spread: This is the difference between the bid and ask price of an instrument. Brokers may charge a spread instead of a commission for some trading instruments.

- Inactivity fees: Some brokers may charge a fee if your account is inactive for a certain period.

- Withdrawal fees: Some brokers may charge a fee for withdrawing funds from your account.

- Exchange fees: Some brokers may pass on exchange fees charged by the stock exchange or other trading venues.

It's important to review a broker's fee schedule before opening an account to understand the costs associated with trading. Some brokers may also offer discounts or promotions that can help lower the cost of trading.

How Do I Withdraw My Funds from a UK Broker?

Withdrawing funds from a UK broker is typically straightforward. Most UK brokers offer withdrawal options, including bank transfers, credit/debit cards, and e-wallets. To withdraw your funds, simply login to your account, navigate to the withdrawal section, and follow the instructions provided by the broker. Be aware that some brokers may require you to verify your identity before allowing you to withdraw funds.

How Do UK Brokers Handle Disputes or Complaints?

If you have a dispute or complaint with a UK broker, the first step is to try to resolve the issue directly with the UK broker via their available support methods like phone, email and live chat. Suppose you are unable to resolve the issue. In that case, you can escalate it to the Financial Ombudsman Service (FOS), an independent organization that provides dispute resolution services for financial services firms in the UK. The FOS can investigate your complaint and help to resolve the issue with the broker.

Can I Trade Internationally with a UK Broker?

Yes, you can trade internationally with a UK broker. Many UK brokers offer access to international markets, including the US, Europe, Asia, and Australia. However, be aware that some brokers may have restrictions on trading certain markets or may require additional documentation to trade internationally.

Which UK Brokers Offer The Best Customer Support And Service?

Customer support and service are important factors when choosing a UK broker. Here are some brokers are known for offering excellent customer support:

| Broker | Customer Support Options | Online Resources and Educational Materials |

|---|---|---|

IC Markets IC Markets |

Phone, email, and live chat | Comprehensive help centre and educational resources |

AvaTrade AvaTrade |

24/7 customer support via phone and email | Range of online resources and educational materials |

eToro eToro |

Phone, email, and live chat | Extensive range of educational materials and resources |

Roboforex Roboforex |

Phone and email | Comprehensive help centre and social trading community |

XM XM |

Phone and email | Extensive help centre and educational resources |

When choosing a broker, it's important to consider your own customer support needs and preferences. Some brokers may offer more personalized support, while others may have a more self-service model with online resources and tools.

Are UK Brokers Regulated By Any Financial Regulatory Body?

Yes, UK brokers are regulated by the Financial Conduct Authority (FCA), the financial regulatory body in the UK. The FCA regulates financial firms and protects consumers in the UK. The FCA sets rules and standards for financial firms to ensure they operate fairly and transparently, and it also has the power to take enforcement action against firms that fail to meet its standards.

Brokers regulated by the FCA must meet certain requirements, such as maintaining minimum capital levels, segregating client funds from company funds, and implementing risk management procedures. The FCA also requires brokers to provide clear and transparent information to clients about their services, fees, and risks associated with trading.

It's important to choose a broker regulated by a reputable financial regulatory body like the FCA to protect your funds and investments.

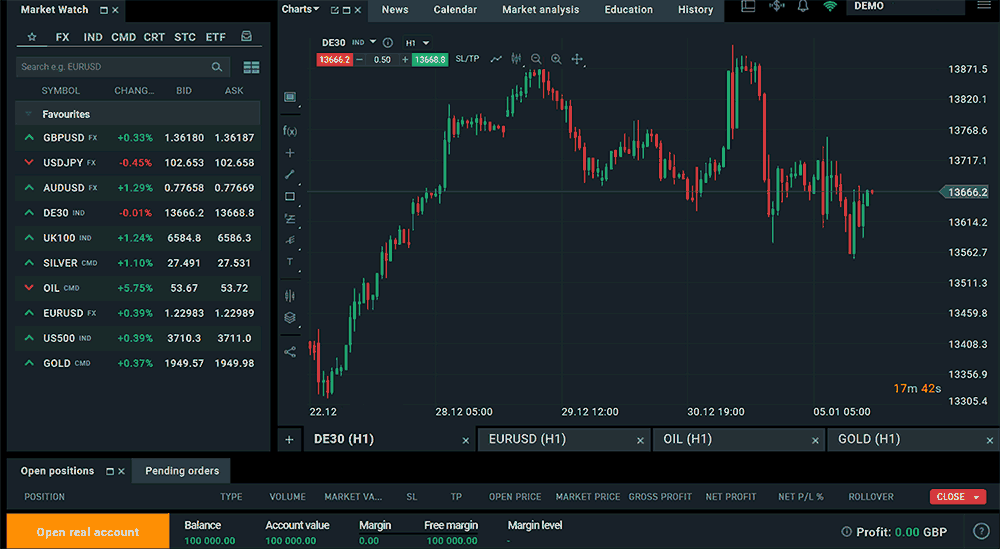

What Trading Platforms Do UK Brokers Offer?

UK brokers offer a variety of trading platforms, ranging from proprietary platforms developed in-house to third-party platforms widely used in the industry. Here are some of the most popular trading platforms offered by UK brokers:

- MetaTrader 4 (MT4): This is a popular third-party trading platform used by many brokers around the world. It is known for its user-friendly interface and advanced charting tools.

- MetaTrader 5 (MT5): This is the newer version of the MT4 platform and offers additional features such as more advanced order types and more timeframes.

- cTrader: This is another third-party trading platform that is gaining popularity among traders. It offers advanced charting and order management tools.

- Proprietary platforms: Some brokers offer their own trading platforms developed in-house. These platforms may offer unique features and tools that are not available on third-party platforms.

- Web-based platforms: Some brokers offer web-based trading platforms that can be accessed through a web browser without the need to download any software.

- Mobile platforms: Many brokers also offer mobile trading platforms that can be downloaded as apps on smartphones and tablets.

It's important to consider the trading platform a broker offers when choosing a broker. The platform should be user-friendly and offer the tools and features you need to trade effectively.

How Much Capital Is Required To Open An Account With UK Brokers?

The capital required to open an account with a UK broker varies depending on the broker and the type of account you wish to open. Here are some general guidelines:

- Stocks and shares ISA accounts: Many UK brokers offer stocks and shares ISA accounts, which allow investors to invest up to a certain amount tax-free each year. The amount required to open an account varies, but it is typically in the range of £50 to £1,000.

- Cash trading accounts: Cash trading accounts allow investors to buy and sell shares without using leverage. The amount required to open a cash trading account varies, but it is typically in the range of £200 to £5,000.

- Margined trading accounts: Margined trading accounts allow investors to trade with leverage, meaning they can take larger positions than their account balance would allow. The amount required to open a margined trading account varies, but it is typically in the range of £200 to £10,000.

It's important to note that some brokers may also have minimum trade sizes or other requirements that must be met to open an account. When choosing a broker, carefully read the account opening requirements to ensure you meet them.

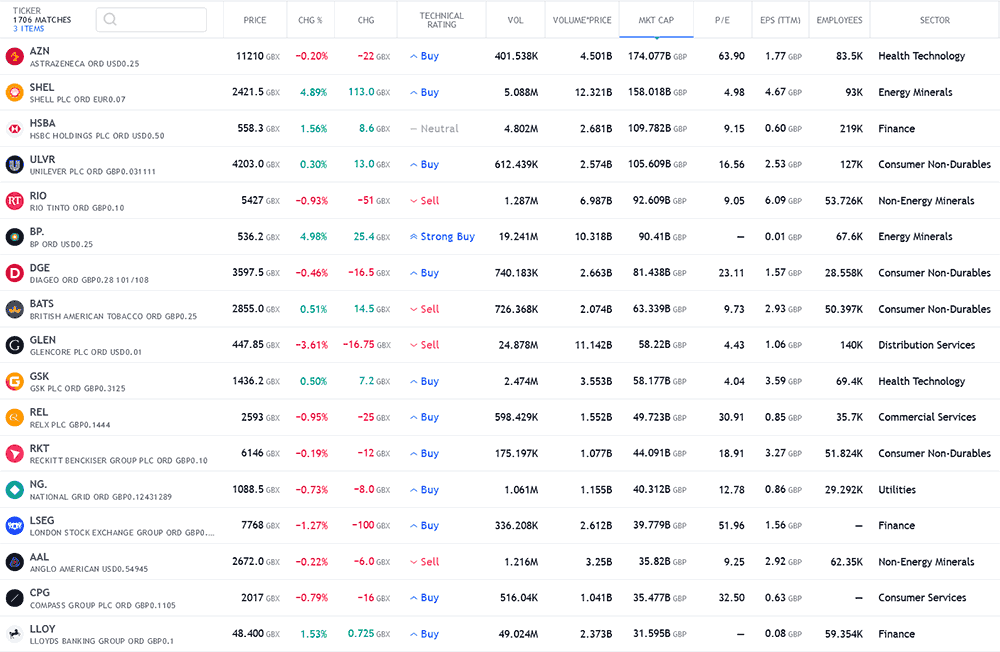

What types of investment products do UK brokers offer?

UK brokers offer various trading instruments, allowing investors to trade in various financial markets. Here are some of the most common instruments available:

- Stocks: UK brokers allow investors to trade in stocks listed on various stock exchanges, including the London Stock Exchange (LSE) and international exchanges such as the New York Stock Exchange (NYSE).

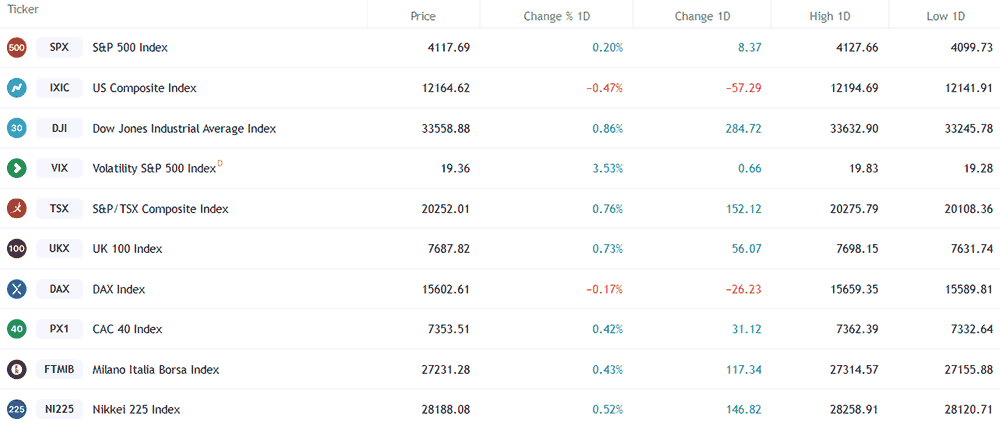

- Indices Trading: Indice trading in the UK involves buying and selling financial instruments based on the performance of a specific stock market index, such as the FTSE 100 or the S&P 500.

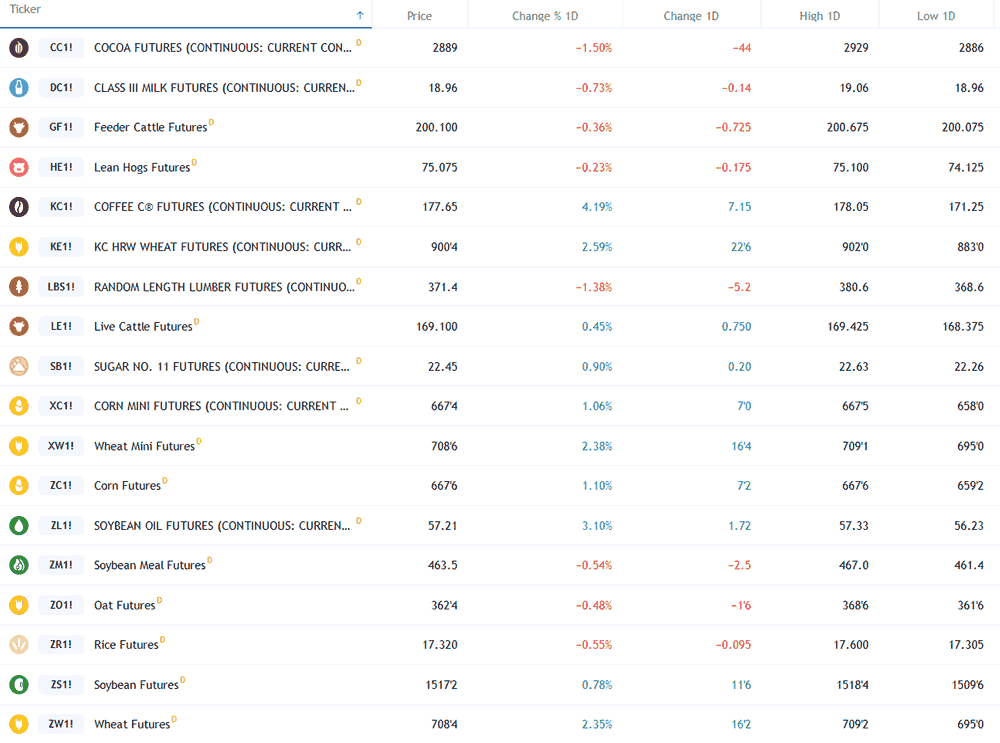

- Commodities Trading: Commodity trading in the UK involves buying and selling physical or virtual commodities, such as gold, oil, wheat, or coffee, with the aim of profiting from the fluctuations in their prices in the global markets.

- Exchange-Traded Funds (ETFs): ETFs are funds that track the performance of an underlying index or asset and trade like a stock on an exchange. Many UK brokers offer a wide range of ETFs, allowing investors to gain exposure to various markets and asset classes.

- Contracts for Difference (CFDs): If you're a trader in the UK, you may want to consider Contracts for Difference (CFDs) as an investment opportunity. CFDs allow traders to benefit from price fluctuations of financial instruments, even if they don't own the underlying asset. The UK offers CFDs on a diverse range of financial instruments, including stocks, indices, commodities, and currencies. By investing in CFDs, traders can potentially profit from the direction of the market, whether it's bullish or bearish, and access multiple markets to diversify their portfolio and reduce overall risk. One advantage of CFDs is that they offer leverage, which allows traders to control larger positions with less capital. However, it's crucial to understand the risks associated with leveraged trading, including the possibility of losing more than your initial investment. It's essential to conduct thorough research and understand the high risks involved before investing in CFDs in the UK or any other financial market.

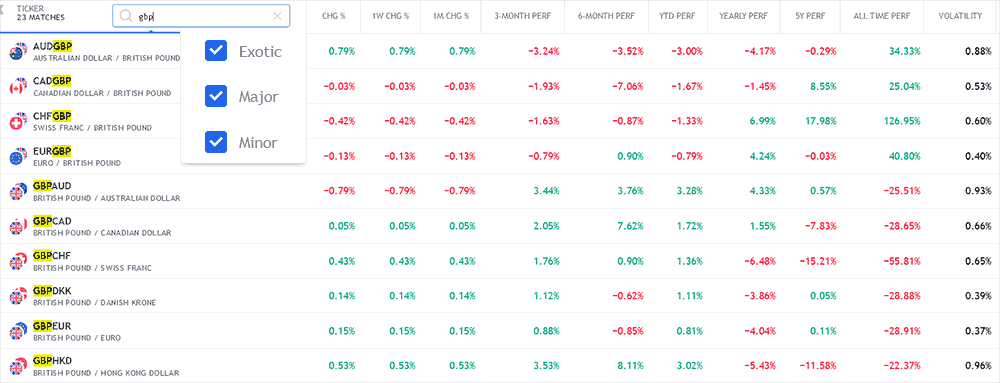

- Foreign Exchange (Forex): UK brokers offer forex trading, allowing investors to trade in various currency pairs.

- Options and Futures: Some UK brokers also offer options and futures trading, which allow investors to speculate on the future price movements of an underlying asset.

- Cryptocurrencies: Many UK brokers also offer trading in cryptocurrencies, such as Bitcoin, Ethereum, Dogecoin and Litecoin.

It's important to note that the availability of trading instruments may vary between brokers, so choosing a broker that offers the instruments you are interested in trading is important.

Are UK Brokers Suitable For Beginner Traders?

UK brokers can be suitable for beginner traders, but it depends on the specific broker and the individual trader's needs. Here are some factors to consider:

- User-friendly platforms: Many UK brokers offer user-friendly trading platforms and educational resources that can be helpful for beginner traders who are still learning how to trade.

- Low minimum deposits: Some UK brokers offer low minimum deposit requirements, which can be beneficial for beginner traders who may not have a lot of capital to start with.

- Regulation: UK brokers are regulated by the Financial Conduct Authority (FCA), which is known for its strict regulatory standards. FCA regulation can provide some reassurance to beginner traders concerned about their funds' safety.

- Customer support: Many UK brokers offer good customer support, which can be important for beginner traders who may have questions or need help with their accounts.

- Risk management tools: Some UK brokers offer risk management tools, such as stop-loss orders and negative balance protection, which can help beginner traders manage their risk.

However, it's important to note that trading can be risky, and beginner traders should take the time to educate themselves about trading and the risks involved before investing their money. Additionally, beginner traders may want to start with a demo account or a small amount of capital to practice trading before investing larger amounts.

Overall, UK brokers can be suitable for beginner traders, but choosing a broker that fits your specific needs and offers the resources and support, you need to succeed as a trader is important.

What Is The Minimum Trade Size With UK Brokers?

The minimum trade size with UK brokers can vary depending on the broker and your account type. Generally, the minimum trade size can range from as low as £1 to as high as £10,000 or more. Some brokers may also have different minimum trade sizes for asset classes, such as stocks, forex, and commodities.

It's important to check with the broker to see their minimum trade size before opening an account. Ensure you have enough capital to make trades and meet the broker's account requirements.

Additionally, it's important to note that some brokers may also have maximum trade sizes or position sizes. Maximum trading limits are set to help manage risk and ensure traders do not make overly large trades that could potentially harm their account balance.

If you are a beginner trader, starting with smaller trade sizes and gradually increasing as you gain more experience and confidence in your trading strategy is recommended. Smaller positions can help you manage your risk and avoid large losses in your account.

Are UK Brokers Suitable For High-frequency Trading?

Some UK brokers may be suitable for high-frequency trading (HFT), but it depends on several factors, including the broker's trading platform, execution speed, and fees.

HFT is a type of trading that involves making large numbers of trades in a short period. High-frequency trading requires fast execution speeds and low-latency connections to the broker's servers. Some brokers offer dedicated HFT platforms and infrastructure to accommodate this type of trading.

However, it's important to note that HFT can be risky and generally unsuitable for beginner traders. It requires significant capital and a sophisticated trading strategy to be profitable. Additionally, HFT can also be controversial, as some traders may use techniques such as order spoofing or front-running to gain an advantage over other traders.

Overall, if you are interested in HFT, it's important to research different UK brokers and their HFT capabilities before choosing a broker. You should also consult with a financial advisor or other professional to ensure that HFT is an appropriate trading strategy for your situation and risk tolerance.

What Are The Margin Requirements With UK Brokers?

Margin requirements with UK brokers can vary depending on the broker and your account type. Margin is collateral traders must deposit with the broker to open and maintain trading positions.

Margin requirements are typically expressed as a percentage of the total trade value and can range from 0.5% to 25% or more, depending on the asset class and the volatility of the underlying market.

For example, if a broker requires a margin of 5% for a particular trade and the total trade value is £10,000, then the trader would need to deposit £500 as collateral with the broker.

It's important to note that margin trading can be risky, as traders can potentially lose more than their initial deposit if the market moves against their position. Traders should consider their risk tolerance and trading strategy before engaging in margin trading.

If you are interested in margin trading, it's important to research different UK brokers and their margin requirements before choosing a broker. You should also consult with a financial advisor or other professional to ensure that margin trading is an appropriate trading strategy for your situation and risk tolerance.

Are UK Brokers Suitable For Trading Forex And Other Derivatives?

UK brokers are suitable for trading forex and other derivatives such as CFDs, options, and futures. Many UK brokers specialize in forex and derivatives trading and offer a wide range of instruments to trade.

Forex trading involves buying and selling currencies in the foreign exchange market. Forex trading is popular because it allows traders to trade 24 hours a day, 5 days a week, and provides high leverage and liquidity.

Derivatives trading involves financial instruments that derive value from an underlying asset, such as stocks, commodities, or currencies. CFDs, options, and futures are common derivatives traded by UK brokers.

It's important to note that trading forex and derivatives can be risky and complex and may not be suitable for all traders. Traders should consider their risk tolerance and trading strategy before engaging in trading for forex and derivatives.

If you are interested in trading forex and derivatives, it's important to research different UK brokers and their offerings before choosing a broker. You should also consult with a financial advisor or other professional to ensure that forex and derivatives trading is an appropriate trading strategy for your situation and risk tolerance.

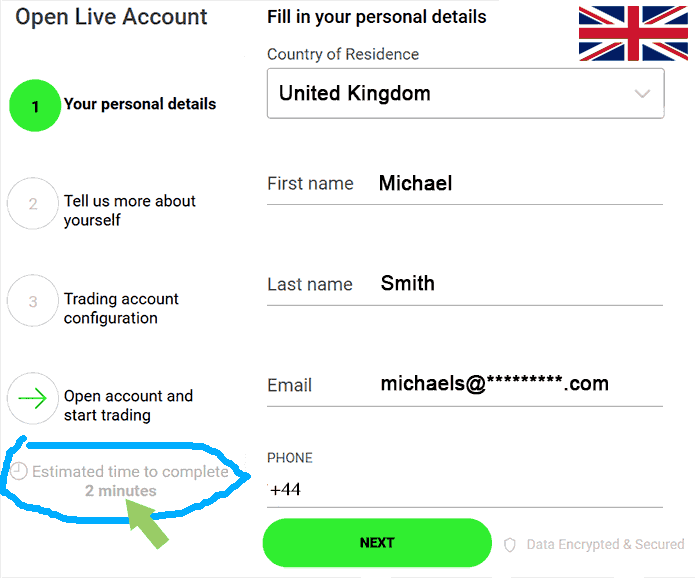

What Is The Process For Opening An Account With UK Brokers?

The process for opening an account with UK brokers can vary depending on the broker but typically involves the following steps:

- Research and choose a broker: The first step is to research different UK brokers and choose one that best meets your trading needs and preferences.

- Visit the broker's website: Once you've chosen a broker, visit their website and navigate to the account opening section.

- Provide personal information: You'll need to provide personal information such as your name, address, and contact details.

- Verify your identity: To comply with regulations, brokers must verify their clients' identities. You may need to provide a copy of your ID or passport and, in some cases, proof of address.

- Choose an account type: Brokers typically offer different accounts with varying features and minimum deposit requirements. Choose an account type that best suits your trading needs and budget.

- Fund your account: Once approved, you can fund it with the minimum deposit required by the broker. Most UK brokers offer a range of funding options, including bank transfers, credit/debit cards, and e-wallets.

- Download and set up trading platform: Depending on the broker, you may need to download and set up a trading platform to start trading.

- Start trading: Once your account is funded and the trading platform is set up, you can start trading the markets.

It's important to read and understand the terms and conditions of the broker before opening an account to ensure you are comfortable with their policies and fees.

Additionally, some UK brokers may require additional steps, such as completing a suitability assessment or providing trading experience information before approving your account.

What Educational And Research Resources Are Available With UK Brokers?

Many UK brokers offer a variety of educational and research resources to help traders stay informed and make better trading decisions. Here are some of the common resources that may be available:

Trading guides and tutorials

UK brokers may offer guides and tutorials on various trading topics, such as technical analysis, fundamental analysis, and risk management. These resources may be available through written articles, videos, or webinars.

Market analysis and commentary

Many brokers provide daily or weekly market analysis and commentary, which can help traders stay up-to-date on market news, events, and trends. Some brokers in the United Kingdom may provide research reports, market summaries, and economic calendars.

Trading platforms and tools

Some UK brokers offer proprietary trading platforms and tools, including educational resources, such as trading manuals, user guides, and video tutorials. These resources can help traders learn how to use the platform's features and tools effectively.

UK Demo accounts for practice trading

Most UK brokers offer demo accounts, which allow traders to practice trading with virtual funds in a risk-free environment. Demo trading accounts can be a valuable resource for beginner traders in the United Kingdom who want to gain experience without risking real money.

The availability and quality of educational and research resources can vary between UK brokers, so research is important. It compares different brokers to find one that offers the resources and tools that best meet your trading needs.

How Do UK Brokers Handle Client Funds And Ensure Security Of Personal And Financial Information?

UK brokers must adhere to strict regulations and guidelines to ensure the safety and security of client funds. Here are some of the common practices that UK brokers use to handle client funds:

Segregated accounts

UK brokers must hold client funds in segregated accounts, separate from the broker's accounts. The use of segregated accounts helps to ensure that client funds are not used for any other purpose than to execute trades on behalf of clients.

Financial Services Compensation Scheme (FSCS)

The FSCS is a UK government-backed scheme that compensates clients if a broker cannot meet its financial obligations. The FSCS provides £85,000 of compensation per person, per firm.

Anti-money laundering (AML) and Know Your Customer (KYC) policies

UK brokers must implement AML and KYC policies to prevent money laundering and ensure that clients are who they say they are. KYC may involve verifying client identities and monitoring transactions for suspicious activity.

Regulation by financial regulatory bodies

UK brokers are regulated by financial regulatory bodies such as the Financial Conduct Authority (FCA), which sets standards for financial services firms and ensures compliance with regulations.

Secure technology

UK brokers use secure technology to protect client funds and data. UK broker security may include firewalls, encryption, and other security measures to prevent unauthorized access to client accounts and information.

Overall, UK brokers take client fund security very seriously and must follow strict regulations and guidelines to ensure the safety of client funds. Traders can check a broker's regulatory status and security measures before opening an account to ensure their funds are protected.

What Are The Tax Implications Of Trading With UK Brokers?

Trading with UK brokers can have tax implications, and traders are responsible for understanding and fulfilling their tax obligations. Here are some key points to consider:

Capital gains tax (CGT)

As a trader in the UK, it's crucial to understand how Capital Gains Tax (CGT) works. CGT is a tax on the profits made from selling assets, including stocks or shares. The current CGT rates in the UK are 10% or 20%, depending on the individual's income and the amount of the gain. To comply with tax regulations, traders must keep track of their trades and report any gains to HM Revenue & Customs (HMRC) when filing their tax returns. CGT allowance is also available, which means that you can make gains of up to a certain amount before having to pay any tax. As of the 2022/23 tax year, the CGT allowance in the UK is £12,300. It's essential to stay up-to-date with changes to tax regulations and seek professional advice if needed to ensure you comply with CGT rules and regulations. By doing so, you can avoid penalties or fines and continue trading with peace of mind.

Income tax

Traders in the United Kingdom trading as a business or profession may be subject to income tax on their profits. The tax rate for income tax depends on the individual's income level and tax bracket.

Stamp duty

Stamp duty is a tax on the purchase of shares and is currently charged at a rate of 0.5% in the UK. The buyer usually pays this tax, and it is the responsibility of the broker to collect and pay the tax to HMRC.

ISA and SIPP accounts

Individual Savings Account (ISA) and Self-Invested Personal Pension (SIPP) accounts are tax-efficient investment accounts that offer tax benefits to UK residents. Capital gains and dividends earned in these accounts are generally tax-free.

Seek professional advice

Traders should seek professional advice from a UK-qualified tax accountant or financial advisor to understand their tax obligations and how to fulfil them. UK tax professionals can help ensure compliance with tax laws and avoid potential penalties or fines.

Overall, trading with UK brokers can have tax implications, and traders should understand their tax obligations and seek professional advice to ensure compliance with tax laws.

How Do UK Brokers Differ From Brokers In Other Countries?

UK brokers differ from brokers in other countries in several ways:

- Regulation: UK brokers are regulated by the Financial Conduct Authority (FCA), which is known for its strict regulatory standards. Other countries may have different regulatory bodies with different levels of oversight.

- Taxation: Taxation laws for trading profits and losses may differ in different countries, and traders should be aware of the tax implications of trading in their country of residence.

- Trading instruments: The range of trading instruments available with UK brokers may differ from those available with brokers in other countries. For example, some countries may not allow the trading of certain instruments such as CFDs.

- Trading platforms: UK brokers may offer different trading platforms compared to brokers in other countries. Some trading platforms may be more popular in certain regions than others.

- Customer support: The quality of customer support offered by brokers may vary across different countries.

- Deposit and withdrawal options: Deposit and withdrawal options may differ between UK brokers and brokers in other countries. Differing deposit and withdrawal methods available in the United Kingdom may affect the convenience and cost of transferring funds.

It is important for traders to understand the differences between brokers in different countries and to choose a broker suitable for their needs and preferences.

Are UK Brokers Suitable For Long-term Investing Or Only For Short-term Trading?

UK brokers can be suitable for both long-term investing and short-term trading, depending on the individual trader's investment objectives and trading style.

- Long-term investing: UK brokers may offer a range of investment products, such as stocks, ETFs, mutual funds, and bonds, which can be suitable for long-term investing. These products can offer stable returns over a longer period.

- Short-term trading: UK brokers may also offer a range of trading products, such as forex, CFDs, and options, which can be suitable for short-term trading. These products can allow traders to make quick profits from market volatility.

traders must choose a broker that offers the products and services suitable for their investment objectives and trading style. Additionally, traders should consider fees, commissions, and regulatory oversight when choosing a UK broker.

What is the History of the UK Brokerage Industry?

The UK brokerage industry has a long and storied history. The first stock exchange in the UK was established in 1773, and over the years, the industry has evolved to meet the changing needs of investors. Today, the UK brokerage industry is known for its high levels of regulation, competitive pricing, and wide range of investment products.

How Have UK Brokers Adapted to Technological Advancements in Recent Years?

UK brokers have recently been at the forefront of technological advancements in the financial industry. Many brokers now offer advanced trading platforms that allow investors to trade on the go using mobile devices. Some brokers also offer automated trading systems that use artificial intelligence and machine learning algorithms to analyze market data and execute trades. Additionally, UK brokers have embraced blockchain technology and are now offering cryptocurrencies as an investment product. UK brokers constantly adapt to new technologies and innovations to provide their clients with the best possible trading experience.

United Kingdom Brokers Verdict

The UK is home to many reputable brokers that offer a wide range of investment products and services. Traders can choose from various trading platforms and tools and use educational resources to improve their trading skills.

When selecting a UK broker, traders should consider important factors such as fees and commissions, regulatory oversight, customer support, and the range of products and services offered. It is also important to clearly understand your investment objectives and trading style to choose the broker that best meets your needs.

By conducting thorough research and carefully selecting a reputable UK broker, traders can increase their chances of success in the competitive world of online trading and investing.

Best United Kingdom Brokers List Compared

| Featured United Kingdom Broker Trading Platform | Account Features | Trading Features |

|---|---|---|

| Used By: 180,000 Instruments Available: 232 Stocks Available: 2100 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 61 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mirror Trader, ZuluTrade, Web Trader, cTrader, Mac Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 53 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 35 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 10 USD / 10 EUR |

Platforms: MT4, MT5, Mac, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 200,000 Instruments Available: 1000 Stocks Available: 99 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 80 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: Web Trader, MT4, MT5, AvaTradeGo, AvaOptions, Mac, Mobile Apps, ZuluTrade, DupliTrade, MQL5 Negative Balance Protection: Inactivity Fee: No 71% of retail CFD accounts lose moneyVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 10000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 60 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, IRESS, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 250,000 Instruments Available: 4000 Stocks Available: 1696 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 57 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 0 |

Platforms: MT4, Mirror Trader, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Visit |

|

| Used By: 89,000 Instruments Available: 100 Stocks Available: 60 US Stocks: No UK Stocks: No German Stocks: Yes Japanese Stocks: No Indices: Yes Forex Pairs Available: 70 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mac, ZuluTrade, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your moneyVisit |

|

| Used By: 10,000,000 Instruments Available: 1000 Stocks Available: 160 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 55 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 5 |

Platforms: MT4, MT5, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77.74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.Visit |

|

| Used By: 20,000,000 Instruments Available: 2000 Stocks Available: 2042 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 50 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 50 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 51% of retail investor accounts lose money when trading CFDs with this provider.Visit |

|

| Used By: 15,000,000 Instruments Available: 10000 Stocks Available: 1731 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 177 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.Visit |

|

| Used By: 10,000 Instruments Available: 15000 Stocks Available: 1000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 55 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 10 US Stocks: Yes UK Stocks: No German Stocks: No Japanese Stocks: No Indices: Yes Forex Pairs Available: 40 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes Losses can exceed depositsVisit |

|

| Used By: 300,000 Instruments Available: 100 Stocks Available: 0 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 150 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1000 |

Platforms: MT4, MT5, ZuluTrade, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 1000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: No Forex Pairs Available: 100 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 0 |

Platforms: MT4, Mac, ZuluTrade, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 4,000,000 Instruments Available: 2200 Stocks Available: 2000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: No Indices: Yes Forex Pairs Available: 67 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your moneyVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 0 US Stocks: No UK Stocks: No German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 45 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

Best United Kingdom Broker United Kingdom Broker Reviews

Read our details broker United Kingdom Broker United Kingdom Broker reviews, you will find something useful if you are shortlisting a United Kingdom Broker United Kingdom Broker and trading platform.

- IC Markets Review (read our in depth reviews)

- Roboforex Review (read our in depth reviews)

- AvaTrade Review (read our in depth reviews)

- FP Markets Review (read our in depth reviews)

- XTB Review (read our in depth reviews)

- Pepperstone Review (read our in depth reviews)

- XM Review (read our in depth reviews)

- eToro Review (read our in depth reviews)

- Trading 212 Review (read our in depth reviews)

- SpreadEx Review (read our in depth reviews)

- HYCM Review (read our in depth reviews)

- Swissquote Review (read our in depth reviews)

- Axi Review (read our in depth reviews)

- Markets.com Review (read our in depth reviews)

- Eightcap Review (read our in depth reviews)

United Kingdom Broker United Kingdom Broker Alternatives

Read about and compare United Kingdom Broker United Kingdom Broker alternatives. We have indepth side by side comparisons to help you find United Kingdom Broker United Kingdom Broker related brokers.

- IC Markets Alternatives

- Roboforex Alternatives

- AvaTrade Alternatives

- FP Markets Alternatives

- XTB Alternatives

- Pepperstone Alternatives

- XM Alternatives

- eToro Alternatives

- Trading 212 Alternatives

- SpreadEx Alternatives

- HYCM Alternatives

- Swissquote Alternatives

- Axi Alternatives

- Markets.com Alternatives

- Eightcap Alternatives

FP Markets

FP Markets

XTB

XTB

Pepperstone

Pepperstone

Trading 212

Trading 212

SpreadEx

SpreadEx

HYCM

HYCM

Swissquote

Swissquote

Axi

Axi

Markets.com

Markets.com

Eightcap

Eightcap