Best Trading Demo Accounts

Trading demo accounts have truly changed the game in how we approach the financial markets. These fantastic demo accounts offer virtual funds, giving us a risk-free space to hone our trading skills. Whether you're into forex trading, spread bets, or trading stocks, demo accounts are like a secret weapon for both rookies and seasoned pros like us. Let me break it down for you in this article, covering all the key info about trading demo accounts.

Aimed For new beginner traders a trading demo account, also referred to as a demo trading account or virtual account, is like a practice field provided by online trading platforms. It's where we can sharpen our trading strategies using virtual cash, without putting our real money on the line.

Best Trading Demo Accounts Table of Contents

- How does a demo account work?

- Why should I use a demo account?

- Can I open a free demo account?

- What are the benefits of using a demo account?

- Risk-Free Environment:

- Learning the Trading Platform:

- Testing Trading Strategies:

- Understanding Market Dynamics:

- Developing Confidence:

- Exploring Different Markets and Instruments:

- Testing New Trading Tools and Indicators:

- Building Discipline and Emotional Control:

- Are demo accounts limited to trading forex?

- Can I open multiple demo accounts?

- How long can I use a demo account?

- Can I transfer my trading skills from a demo to a live account?

- Are demo accounts the same as live accounts?

- Switching from a Demo to a Live Account

- Exploring Demo Account Features

- Getting Hands-On with the Trading Simulator

- How can a demo account help me develop trading strategies?

- Are all trading platforms suitable for demo trading?

- What are the risks of trading demo accounts?

- Is there a risk of losing money rapidly after practising on a demo account?

- Can I use a demo account for spread betting?

- How can I choose the right trading platform for demo trading?

- What should I do after mastering demo trading?

- Can I trade Forex with a demo account?

- Are demo accounts completely free?

- Trading Demo Accounts Verdict

- Best Trading Demo Accounts List Compared

How does a demo account work?

When you open a demo account, you gain access to a trading platform replicating the experience of real trading. You can execute trades, utilize various trading tools, and test different trading strategies. However, all transactions are conducted using virtual funds, ensuring zero risk.

Why should I use a demo account?

Demo accounts enable you to familiarize yourself with the trading platform and its features before starting real trading. They allow you to practice different trading methods, understand the behaviour of financial markets, and gain confidence in your trading abilities.

Can I open a free demo account?

Yes, most trading platforms offer free demo accounts to their users. These accounts provide all the functionality of a live trading account but operate solely with virtual funds.

What are the benefits of using a demo account?

Using a demo account before real trading offers multiple benefits that can significantly enhance your overall trading experience. Here are some key advantages of utilizing a demo account:

Risk-Free Environment:

One of the primary benefits of a demo account is the ability to trade with virtual funds. It eliminates the risk of losing money while learning and refining your trading skills. It provides a safe space to practice without fearing financial losses; you can gain confidence and build competence.

Learning the Trading Platform:

Demo accounts enable you to familiarize yourself with the trading platform your chosen broker offers. You can explore the platform's features, functionalities, and tools without the pressure of making live trades. It allows you to understand how to execute trades, analyze charts, set stop-loss and take-profit levels, and use technical indicators effectively.

Testing Trading Strategies:

Demo accounts provide an opportunity to test and refine your trading strategies. You can experiment with different approaches, indicators, timeframes, and risk management techniques to see how they perform in various market conditions. This trial-and-error process allows you to fine-tune your strategies and identify what works best for your trading style.

Understanding Market Dynamics:

Demo accounts allow you to observe and analyze the behaviour of financial markets in real time. You can monitor price movements, identify trends, and practice reading and interpreting market charts and patterns. This hands-on experience enhances your understanding of market dynamics and helps you make more informed trading decisions.

Developing Confidence:

Practise trading can be an emotional endeavour, and a lack of confidence can hinder decision-making. Using a demo account enables you to develop confidence in your abilities without the pressure of real money on the line. As you witness your strategies yield positive results and gain consistency, you'll gain the confidence necessary to tackle live trading with a more evident mindset.

Exploring Different Markets and Instruments:

Demo accounts are not limited to a specific market or financial instrument. You can use them to explore asset classes such as Forex, stocks, commodities, indices, etc. It broadens your trading horizons and helps you identify which markets and instruments align with your trading goals and preferences.

Testing New Trading Tools and Indicators:

Demo accounts provide access to a range of trading tools and technical indicators. You can experiment with different tools to analyze market trends, apply indicators to your charts, and evaluate their effectiveness in generating trading signals. It lets you determine which tools and indicators suit your trading style and improve your decision-making process.

Building Discipline and Emotional Control:

Trading requires discipline and emotional control. Demo accounts offer an opportunity to practice and develop these essential skills. By experiencing simulated wins and losses, you can learn to manage your emotions, stick to your trading plan, and avoid impulsive decisions that can lead to losses in real trading.

Are demo accounts limited to trading forex?

No, demo accounts are available for various financial markets, including Forex, stocks, spread betting, and more. They provide a comprehensive platform for traders to explore different asset classes and styles.

Can I open multiple demo accounts?

Many trading platforms allow users to open multiple demo accounts. This feature is handy to try different trading strategies simultaneously or focus on specific markets.

How long can I use a demo account?

The duration of demo account availability varies between trading platforms. Some platforms offer unlimited access to demo accounts, while others have time restrictions. Checking with the specific platform for their demo account policy is recommended.

Can I transfer my trading skills from a demo to a live account?

While demo trading cannot fully replicate the psychological aspects of real trading, it provides an excellent foundation for building trading skills. The knowledge and experience gained from a demo account can be applied to real trading, helping you make more informed decisions.

Are demo accounts the same as live accounts?

Switching from a Demo to a Live Account

When you've got a good grasp of the trading game and you're feeling confident, it's time to make the move from playing in the sandbox (demo account) to the real deal (live trading account). This is where the rubber meets the road, and you start trading with your hard-earned cash, aiming to stack up those profits.

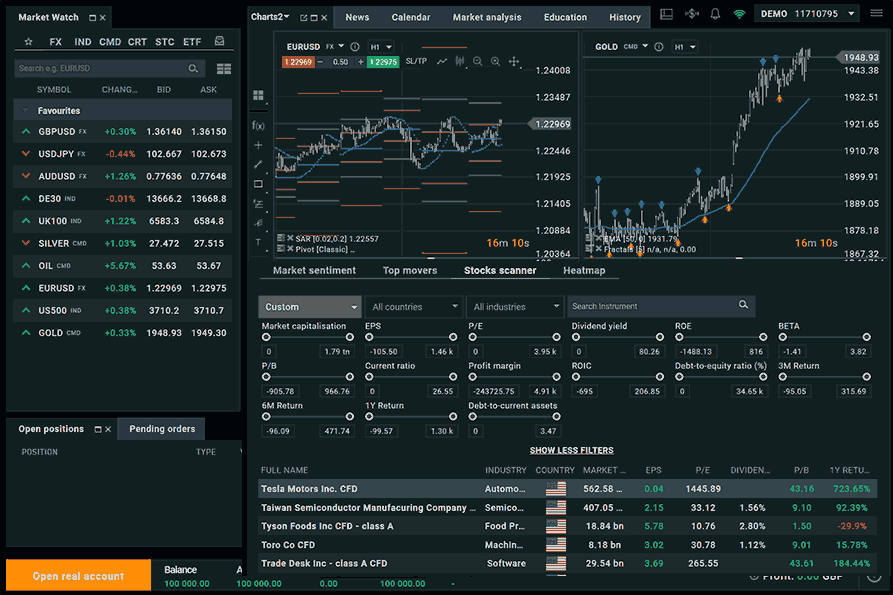

Exploring Demo Account Features

So, in the world of demo accounts, you get some nifty features to sharpen your trading skills. Picture this: real-time market data, nifty charting tools, technical indicators, and various order types. These goodies are your tools of the trade, helping you analyze the market and craft those winning trading strategies.

Getting Hands-On with the Trading Simulator

Guess what? Demo accounts are like your own personal trading playground, complete with a trading simulator feature. It's like honing your skills in a flight simulator before taking off in a real plane. This simulator lets you practice your trading moves and techniques without risking a single dime of your actual money. Pretty sweet, right?

Demo accounts and live accounts differ in terms of risk and capital. Demo accounts operate with virtual funds and pose no financial risk, whereas live accounts involve real money and actual market conditions. However, the trading platform and tools used are generally the same for both account types.

How can a demo account help me develop trading strategies?

Demo accounts offer a risk-free environment to test and refine trading strategies. By experimenting with different approaches, analyzing market patterns, and tracking performance, traders can develop strategies that align with their trading goals.

Are all trading platforms suitable for demo trading?

Most trading platforms offer demo account features open to all users. However, it is advisable to research and choose an online trading site with a user-friendly interface, extensive educational resources, and reliable customer support.

What are the risks of trading demo accounts?

The primary risk of trading demo accounts is the false sense of safety they can create. Since no real money is at stake, traders may not experience the same emotional reactions as live trading. It is important to transition to live trading cautiously and manage risks accordingly.

Is there a risk of losing money rapidly after practising on a demo account?

No, there is no risk of losing real money rapidly after practising on a demo account. Demo accounts operate with virtual funds, meaning any losses incurred during simulated trading do not financially impact your funds or investments.

The purpose of a demo account is to offer a risk-free environment for traders to practice and learn without the fear of financial losses. While the trading conditions and market data in a demo account mirror real trading, the funds used are entirely virtual, and any profits or losses are purely simulated.

However, it's important to note that transitioning from a demo account to live trading involves real money and actual market conditions. While practising on a demo account can help you develop trading skills and strategies, it doesn't guarantee success or eliminate the risk of losses when trading with real funds.

Can I use a demo account for spread betting?

Yes, demo accounts are suitable for spread betting, a form of speculation on the price movements of financial instruments. Using a demo account, you can practice spread betting strategies and familiarize yourself with the mechanics of this trading method.

How can I choose the right trading platform for demo trading?

When selecting a trading platform for demo trading, consider factors such as the range of financial instruments offered, the availability of educational resources, the reputation of the platform, and user reviews. Opting for an award-winning trading platform can also provide added credibility and reliability.

What should I do after mastering demo trading?

After mastering demo trading, opening a live trading account to apply your skills in a real market environment is recommended. However, continue learning and refining your trading strategies to adapt to the dynamic nature of the financial markets.

Can I trade Forex with a demo account?

The Forex demo account is designed for individuals interested in trading currency markets. These accounts allow traders to practice forex trading strategies, analyze currency pairs, and develop a deep understanding of the forex market.

Are demo accounts completely free?

Yes, demo accounts are typically provided free of charge by trading platforms. However, it is essential to review the terms and conditions of each platform to ensure there are no hidden costs or limitations associated with their free demo trading account offering.

Trading Demo Accounts Verdict

Trading demo accounts are powerful tools that enable traders to gain practical experience and refine their strategies in a risk-free environment. Whether you're a beginner looking to learn the ropes or an experienced trader testing new techniques, demo accounts offer many opportunities. By utilizing the features and resources available on various trading platforms, you can enhance your trading skills, explore different markets, and ultimately improve your chances of success in the financial markets. So, open a demo account today and unlock the potential that awaits you in the trading world.

Best Trading Demo Accounts List Compared

| Featured Trading Demo Account Trading Platform | Account Features | Trading Features |

|---|---|---|

| Used By: 180,000 Instruments Available: 232 Stocks Available: 2100 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 61 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mirror Trader, ZuluTrade, Web Trader, cTrader, Mac Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 53 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 35 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 10 USD / 10 EUR |

Platforms: MT4, MT5, Mac, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 200,000 Instruments Available: 1000 Stocks Available: 99 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 80 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: Web Trader, MT4, MT5, AvaTradeGo, AvaOptions, Mac, Mobile Apps, ZuluTrade, DupliTrade, MQL5 Negative Balance Protection: Inactivity Fee: No 71% of retail CFD accounts lose moneyVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 10000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 60 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, IRESS, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 50 Stocks Available: 0 US Stocks: No UK Stocks: No German Stocks: No Japanese Stocks: No Indices: No Forex Pairs Available: 65 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Minimum Deposit: 10 |

Platforms: MT4, MT5, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 250,000 Instruments Available: 4000 Stocks Available: 1696 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 57 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 0 |

Platforms: MT4, Mirror Trader, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Visit |

|

| Used By: 89,000 Instruments Available: 100 Stocks Available: 60 US Stocks: No UK Stocks: No German Stocks: Yes Japanese Stocks: No Indices: Yes Forex Pairs Available: 70 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mac, ZuluTrade, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your moneyVisit |

|

| Used By: 10,000,000 Instruments Available: 1000 Stocks Available: 160 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 55 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 5 |

Platforms: MT4, MT5, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77.74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.Visit |

|

| Used By: 20,000,000 Instruments Available: 2000 Stocks Available: 2042 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 50 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 50 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 51% of retail investor accounts lose money when trading CFDs with this provider.Visit |

|

| Used By: 10,000 Instruments Available: 130 Stocks Available: 60 US Stocks: Yes UK Stocks: Yes German Stocks: No Japanese Stocks: No Indices: Yes Forex Pairs Available: 45 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, Mac, Mirror Trader, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 142,500 Instruments Available: 200 Stocks Available: 52 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 150 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Your capital is at riskVisit |

|

| Used By: 15,000,000 Instruments Available: 10000 Stocks Available: 1731 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 177 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.Visit |

|

| Used By: 10,000 Instruments Available: 148 Stocks Available: 64 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 40 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: $100 |

Platforms: MT4, MT5, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 15000 Stocks Available: 1000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 55 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 10 US Stocks: Yes UK Stocks: No German Stocks: No Japanese Stocks: No Indices: Yes Forex Pairs Available: 40 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes Losses can exceed depositsVisit |

Best Trading Demo Account Trading Demo Account Reviews

Read our details broker Trading Demo Account Trading Demo Account reviews, you will find something useful if you are shortlisting a Trading Demo Account Trading Demo Account and trading platform.

- IC Markets Review (read our in depth reviews)

- Roboforex Review (read our in depth reviews)

- AvaTrade Review (read our in depth reviews)

- FP Markets Review (read our in depth reviews)

- NordFX Review (read our in depth reviews)

- XTB Review (read our in depth reviews)

- Pepperstone Review (read our in depth reviews)

- XM Review (read our in depth reviews)

- eToro Review (read our in depth reviews)

- FXPrimus Review (read our in depth reviews)

- easyMarkets Review (read our in depth reviews)

- Trading 212 Review (read our in depth reviews)

- Admiral Markets Review (read our in depth reviews)

- SpreadEx Review (read our in depth reviews)

- HYCM Review (read our in depth reviews)

Trading Demo Account Trading Demo Account Alternatives

Read about and compare Trading Demo Account Trading Demo Account alternatives. We have indepth side by side comparisons to help you find Trading Demo Account Trading Demo Account related brokers.

- IC Markets Alternatives

- Roboforex Alternatives

- AvaTrade Alternatives

- FP Markets Alternatives

- NordFX Alternatives

- XTB Alternatives

- Pepperstone Alternatives

- XM Alternatives

- eToro Alternatives

- FXPrimus Alternatives

- easyMarkets Alternatives

- Trading 212 Alternatives

- Admiral Markets Alternatives

- SpreadEx Alternatives

- HYCM Alternatives

IC Markets

IC Markets

Roboforex

Roboforex

AvaTrade

AvaTrade

FP Markets

FP Markets

NordFX

NordFX

XTB

XTB

Pepperstone

Pepperstone

XM

XM

eToro

eToro

FXPrimus

FXPrimus

easyMarkets

easyMarkets

Trading 212

Trading 212

Admiral Markets

Admiral Markets

SpreadEx

SpreadEx

HYCM

HYCM