Best Swing Trading Brokers

When searching for the ideal swing trading broker, it is crucial to conduct thorough research and consider various factors. Here's what you should look for:

- Competitive Spreads: Opt for brokers that offer competitive spreads, as this can impact your trading costs and potential profits.

- Reliable Platforms: Look for brokers that provide robust and dependable trading platforms. A stable platform ensures smooth execution of trades and access to necessary tools.

- Regulatory Compliance: Ensure that the swing trading broker operates within the confines of relevant regulations. This helps protect your investments and guarantees a certain level of transparency.

- Educational Resources: Top swing trading brokers often provide educational materials to assist traders in improving their skills and knowledge. Look for brokers that offer resources such as tutorials, webinars, and market analysis.

- Customer Support: Excellent customer support is crucial when dealing with a swing trading broker. Consider brokers that offer responsive and helpful support to address any queries or issues promptly.

- Reputation: Research the broker's reputation and track record within the industry. Look for reviews and feedback from other traders to gauge their reliability and trustworthiness.

- Regulation and Licensing: Ensure that the swing trading broker holds the necessary licenses and adheres to regulatory requirements. This protects you from potential fraudulent activities and ensures the broker's legitimacy.

- Range of Currency Pairs: Consider the breadth of services provided by the broker, particularly the range of minor and major currency pairs available for trading. This allows you to diversify your portfolio and explore various opportunities.

- Risk and Reward: Keep in mind that swing trading in the foreign exchange market (Forex) involves both potential rewards and risks. Assess your risk tolerance and ensure you are aware of the potential losses associated with this type of trading.

Best Swing Trading Brokers Table of Contents

- What are swing trading brokers?

- What is swing trading?

- How do swing traders choose trading platforms?

- Can swing traders trade stocks?

- What are the best swing trading platforms?

- How do swing trading platforms differ from other trading platforms?

- What are the best trading platforms for swing traders?

- What trading strategies do swing traders use?

- What are the best swing trading platforms for beginners?

- How can swing traders manage risk?

- What is paper trading, and how does it benefit swing traders?

- What are swing trading stocks?

- What is the best swing trading platform for online brokers?

- What are the advantages of using online trading platforms for swing trading?

- Which advanced trading platform is best for swing traders?

- How important is technical analysis for swing traders?

- What are the best swing trading brokers?

- What trading tools do swing traders need?

- Can swing traders use mutual funds?

- What is a demo account, and why is it important for swing traders?

- Which stock trading platform is best for swing traders?

- What are the best swing trading platforms for technical analysis?

- What educational resources are available for swing traders?

- How can swing traders start to swing trading?

- How important is extensive research for swing traders?

- What is a multi-asset investment platform, and can swing traders benefit from it?

- Can swing traders be successful in global markets?

- How can swing traders optimise their trading decisions?

- What are the key factors when choosing a swing trading broker?

- Can swing traders use advanced trading platform features?

- How do swing traders develop their trading style?

- What role does risk management play in swing trading?

- What are the benefits of using technical analysis tools for swing trading?

- How can swing traders utilise demo accounts effectively?

- What advantages do swing traders have over other types of traders?

- Can swing trading be profitable for beginner investors?

- Can swing traders access educational resources on trading platforms?

- How does swing trading differ from day trading?

- Can swing traders use fundamental analysis alongside technical analysis?

- What are the advantages of using Interactive brokers for swing trading?

- How do swing traders adapt to changing market conditions?

- Can swing traders trade cryptocurrencies?

- How can swing traders benefit from advanced order types?

- Can swing traders use artificial intelligence (AI) in their trading strategies?

- What are the best swing trading brokers for institutional traders?

- Can swing traders trade during the weekend?

- How can swing traders avoid emotional trading decisions?

- Can swing traders use automated trading systems?

- Can swing traders trade options?

- How do swing traders stay updated with market news and events?

- Swing Trading Brokers: Verdict

- Best Swing Trading Brokers List Compared

In the fast-paced world of financial markets, swing trading has emerged as a popular trading style for active and advanced traders. With its focus on capturing short to medium-term price swings, swing trading requires reliable trading platforms and brokers that cater to the unique needs of swing traders. This comprehensive guide answer the most asked questions about weekend trading brokers, swing trading, and everything in between.

What are swing trading brokers?

Swing trading brokers are brokerage firms that provide services and tools tailored to swing traders. These brokers understand the specific needs of swing traders and offer features such as advanced technical analysis tools, risk management features, and fast execution speeds.

What is swing trading?

Swing trading aims to capture short to medium-term price swings in financial markets. Active traders typically hold positions for a few days to weeks, taking advantage of market fluctuations.

How do swing traders choose trading platforms?

Swing traders prioritise trading platforms that offer advanced charting and technical analysis tools. These platforms should provide real-time market data, customisable indicators, and drawing tools to help swing traders analyse and make informed trading decisions.

Can swing traders trade stocks?

Yes, swing traders can trade stocks. Swing trading is commonly used in stock trading. By analysing price patterns and trends, swing traders can realise potential entry and exit points for profitable trades.

What are the best swing trading platforms?

The best swing trading platforms combine user-friendly interfaces with robust technical analysis tools. Some popular swing trading platforms include MetaTrader, eSignal, and TradeStation.

How do swing trading platforms differ from other trading platforms?

Swing trading platforms focus on providing features and tools specifically designed for swing traders. These platforms offer advanced charting, scanning capabilities, and order types that cater to the needs of swing traders.

What are the best trading platforms for swing traders?

The best trading platforms for swing traders offer a combination of advanced technical analysis tools, reliable execution speeds, and comprehensive research resources. Interactive Brokers, TD Ameritrade, and E*TRADE are among the top choices for swing traders.

What trading strategies do swing traders use?

Swing traders employ various strategies, including trend following, breakouts, and reversals. These strategies rely on technical analysis and aim to capture short-term price movements.

What are the best swing trading platforms for beginners?

For beginner investors interested in the swing trade, platforms that provide educational resources and user-friendly interfaces are ideal. eToro, Robinhood, and Fidelity are popular choices for novice swing traders.

How can swing traders manage risk?

Risk management is crucial for swing traders. They can employ risk managing strategie to diversify trades, and using limited positions to ilmit potential losses.

What is paper trading, and how does it benefit swing traders?

Paper trading allows swing traders to practice their strategies without risking real money. Swing traders can test their ideas and gain confidence before executing trades with real capital using a demo account or virtual trading platform.

What are swing trading stocks?

Swing trading stocks refer to buying and selling stocks within a short to medium-term time frame. Swing traders look for stocks with potential price swings and aim to profit from these movements.

What is the best swing trading platform for online brokers?

Online brokers such as Charles Schwab, Interactive Brokers, and TD Ameritrade offer robust platforms that cater to swing traders. These platforms provide advanced order types, customisable charting tools, and access to multiple markets.

What are the advantages of using online trading platforms for swing trading?

Online trading platforms offer convenience, speed, and accessibility for swing traders. They allow traders to access global markets, monitor their positions in real-time, and execute trades swiftly.

Which advanced trading platform is best for swing traders?

Advanced swing traders often require sophisticated platforms with advanced charting, backtesting capabilities, and algorithmic trading functionalities. Platforms like NinjaTrader and TradeStation are popular choices for experienced swing traders.

How important is technical analysis for swing traders?

Technical analysis plays a vital role in swing trading. Swing traders use chart patterns, indicators, and other technical tools to identify their trades' potential entry and exit points.

What are the best swing trading brokers?

The best swing trading brokers offer competitive pricing, a wide range of tradable assets, reliable execution speeds, and comprehensive research resources. Some top choices include Interactive Brokers, TD Ameritrade, and Charles Schwab.

What trading tools do swing traders need?

Swing traders rely on various trading tools, including real-time market data, charting software, scanning tools, and order types, to facilitate trading strategies. These tools assist swing traders in making informed trading decisions.

Can swing traders use mutual funds?

While swing trading is more commonly associated with individual stocks, swing traders can also apply their strategies to select mutual funds. They can analyse fund performance and look for potential price swings to trade.

What is a demo account, and why is it important for swing traders?

A swing trading demo account allows swing traders to use non live trading to use swing trading strategies without using real money. It provides a no risk swing trading environment for swing traders to test their ideas and gain experience.

Which stock trading platform is best for swing traders?

The best stock trading platforms for swing traders offer comprehensive charting tools, real-time market data, and a wide range of tradable stocks. Platforms like TradeStation and MetaTrader are popular among swing traders.

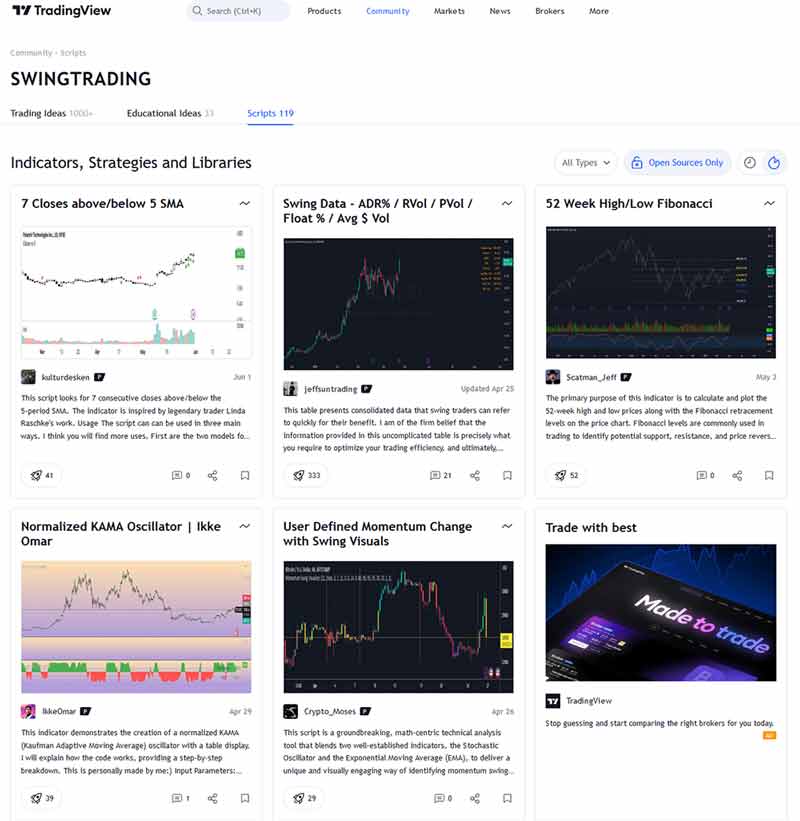

What are the best swing trading platforms for technical analysis?

Swing traders relying heavily on technical analysis require platforms offering advanced charting capabilities, multiple indicators, and drawing tools. eSignal, TradingView, and TC2000 are among the top choices for swing traders focused on technical analysis.

What educational resources are available for swing traders?

Many brokers and trading platforms provide educational resources for swing traders, including tutorials, webinars, and articles. These resources help swing traders enhance their knowledge and develop their trading skills.

How can swing traders start to swing trading?

To start swing trading, individuals can follow these steps: educate themselves about swing trading strategies, choose a suitable broker and trading platform, conduct extensive research on potential stocks or markets, and develop a disciplined trading plan.

How important is extensive research for swing traders?

Extensive research is paramount for swing traders. They must analyse historical price data, track market trends, and stay updated with relevant news and events that may impact their trades. Thorough research enhances the probability of making successful trades.

What is a multi-asset investment platform, and can swing traders benefit from it?

A multi-asset investment platform is a trading platform that allows traders to trade various asset classes, including stocks, forex, commodities, and more, from a single account. Swing traders can benefit from multi-asset platforms as they offer diversification opportunities and access to different markets.

Can swing traders be successful in global markets?

Yes, swing traders can be successful in global markets. With the right tools, access to international markets, and a solid understanding of global trends, swing traders can identify profitable trading opportunities across borders.

How can swing traders optimise their trading decisions?

Swing traders can optimise their trading decisions by combining technical and fundamental analyses. They can analyse price patterns alongside company news, earnings reports, and economic indicators to make well-informed trading decisions.

What are the key factors when choosing a swing trading broker?

When choosing a swing trading broker, consider factors such as commission rates, trading platform features, customer support, available markets, and the broker's reputation for reliability and transparency.

Can swing traders use advanced trading platform features?

Swing traders can benefit from advanced platform features such as algorithmic trading, backtesting capabilities, and customisable indicators. These features can enhance their trading strategies and efficiency.

How do swing traders develop their trading style?

Swing traders develop their trading style through experience and experimentation. By analysing their trades, evaluating their performance, and refining their strategies over time, swing traders can establish a style that suits their preferences and objectives.

What role does risk management play in swing trading?

Risk management is crucial in swing trading as it helps protect capital and minimise losses. Swing traders can utilise techniques such as setting stop-loss orders, diversifying their portfolios, and implementing position-sizing strategies to manage risk effectively.

What are the benefits of using technical analysis tools for swing trading?

Technical analysis tools give swing traders insights into market trends, price patterns, and potential entry and exit points. These tools help traders make objective decisions based on historical price data and market indicators.

How can swing traders utilise demo accounts effectively?

Swing traders can effectively utilise demo accounts by treating them like real ones. They can test different strategies, evaluate their performance, and gain confidence in executing trades without risking real money.

What advantages do swing traders have over other types of traders?

Swing traders benefit from the flexibility of holding positions for a few days to weeks, allowing them to capture larger price moves than day traders. They also have the opportunity to analyse trends and market patterns more thoroughly.

Can swing trading be profitable for beginner investors?

Yes, swing trading can be profitable for beginner investors. With proper education, risk management, and discipline, beginners can develop their swing trading skills and achieve consistent profits.

Can swing traders access educational resources on trading platforms?

Many trading platforms provide educational resources such as video tutorials, webinars, and articles on various trading topics. These resources can help swing traders enhance their knowledge and trading strategies.

How does swing trading differ from day trading?

Swing and day trading differ regarding time horizon and frequency. While swing traders hold positions for days to weeks, day traders open and close positions within the same trading day.

Can swing traders use fundamental analysis alongside technical analysis?

Swing traders can combine fundamental and technical analysis to understand their trade markets comprehensively. Fundamental analysis helps swing traders assess the underlying value of a security, while technical analysis aids in identifying optimal entry and exit points.

What are the advantages of using Interactive brokers for swing trading?

Interactive Brokers is a popular choice for swing traders due to its low commissions, wide range of tradable assets, advanced trading platform, and access to global markets. It provides swing traders with the tools and features necessary to execute their strategies effectively.

How do swing traders adapt to changing market conditions?

Swing traders adapt to changing market conditions by regularly monitoring their positions, staying updated with market news, adjusting their strategies accordingly, and implementing risk management techniques to protect their capital.

Can swing traders trade cryptocurrencies?

Yes, swing traders can trade cryptocurrencies. Many online brokers and trading platforms now offer cryptocurrency trading alongside traditional assets, allowing swing traders to take advantage of price swings in the crypto market.

How can swing traders benefit from advanced order types?

Advanced order types such as trailing stops, OCO (one cancels the other), and limit orders can be valuable tools for swing traders. These orders help automate trade management, protect profits, or limit losses based on predefined parameters.

Can swing traders use artificial intelligence (AI) in their trading strategies?

Swing traders can incorporate AI and machine learning algorithms into their trading strategies. AI can assist in analysing large amounts of data, identifying patterns, and generating trading signals, providing an additional layer of analysis for swing traders.

What are the best swing trading brokers for institutional traders?

Institutional traders often require specialised services and high-level trading platforms. Brokers like Goldman Sachs, J.P. Morgan, and Morgan Stanley are renowned choices for institutional swing traders.

Can swing traders trade during the weekend?

Yes, swing traders can trade during the weekend, although trading volumes and liquidity tend to be lower. Some brokers offer extended trading hours or access to international markets, allowing swing traders to execute trades outside regular market hours.

How can swing traders avoid emotional trading decisions?

Swing traders can avoid emotional trading decisions by sticking to their predefined trading plan, practising discipline, and using technical analysis tools to make objective decisions based on data rather than emotions.

Can swing traders use automated trading systems?

Yes, swing traders can utilise automated trading systems or algorithmic trading strategies. These systems execute trades based on predefined rules and algorithms, removing the emotional aspect of trading and providing increased efficiency.

Can swing traders trade options?

Yes, swing traders can trade options. Options provide additional flexibility and potential profit opportunities for swing traders who can accurately predict price swings and utilise options strategies to their advantage.

How do swing traders stay updated with market news and events?

Swing traders stay updated with market news and events by following financial news outlets, subscribing to market newsletters, utilising economic calendars, and participating in online trading communities where ideas and information are shared.

Swing Trading Brokers: Verdict

Swing is a popular style that appeals to active and advanced traders seeking to capture short to medium-term price swings in financial markets. To effectively engage in swing trading, it is essential to choose the right trading platform and broker that cater to the unique needs of swing traders.

Swing trading brokers offer a range of features and tools specifically designed to support swing traders. These include advanced technical analysis tools, comprehensive research resources, fast execution speeds, and risk management features. By selecting the best swing trading platform, traders can enhance their ability to analyse market trends, make informed trading decisions, and execute trades efficiently.

The choice of a swing trading platform depends on various factors, such as the availability of advanced charting capabilities, customisable indicators, scanning tools, and access to global markets. Additionally, educational resources provided by brokers and platforms can greatly benefit swing traders, especially beginners looking to develop their trading skills and strategies.

Risk management plays a crucial role in swing trading, and swing traders must employ effective risk management techniques such as setting stop-loss orders, diversifying their portfolio, and utilising proper position sizing. Using demo accounts for practice and paper trading can also improve skills and confidence before trading with real capital.

While swing trading primarily focuses on stocks, swing traders can explore other tradable assets, such as mutual funds and cryptocurrencies. Furthermore, swing traders can benefit from incorporating fundamental analysis alongside technical analysis, utilising advanced order types, and even exploring the potential of AI and automated trading systems.

Swing traders can successfully navigate the dynamic financial markets by staying updated with market news, monitoring changing market conditions, and adapting strategies accordingly. Ultimately, the journey of a swing trader is characterised by continuous learning, disciplined execution, and the ability to adapt to evolving market dynamics.

With the right blend of knowledge, skill, and the support of reliable swing trading brokers and platforms, swing traders can strive towards achieving their financial goals and participating actively in the exciting world of swing trading.

Best Swing Trading Brokers List Compared

| Featured Swing trading Broker Trading Platform | Account Features | Trading Features |

|---|---|---|

| Used By: 180,000 Instruments Available: 232 Stocks Available: 2100 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 61 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mirror Trader, ZuluTrade, Web Trader, cTrader, Mac Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 53 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 35 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 10 USD / 10 EUR |

Platforms: MT4, MT5, Mac, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 200,000 Instruments Available: 1000 Stocks Available: 99 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 80 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: Web Trader, MT4, MT5, AvaTradeGo, AvaOptions, Mac, Mobile Apps, ZuluTrade, DupliTrade, MQL5 Negative Balance Protection: Inactivity Fee: No 71% of retail CFD accounts lose moneyVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 10000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 60 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, IRESS, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 50 Stocks Available: 0 US Stocks: No UK Stocks: No German Stocks: No Japanese Stocks: No Indices: No Forex Pairs Available: 65 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Minimum Deposit: 10 |

Platforms: MT4, MT5, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 250,000 Instruments Available: 4000 Stocks Available: 1696 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 57 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 0 |

Platforms: MT4, Mirror Trader, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Visit |

|

| Used By: 89,000 Instruments Available: 100 Stocks Available: 60 US Stocks: No UK Stocks: No German Stocks: Yes Japanese Stocks: No Indices: Yes Forex Pairs Available: 70 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mac, ZuluTrade, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your moneyVisit |

|

| Used By: 10,000,000 Instruments Available: 1000 Stocks Available: 160 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 55 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 5 |

Platforms: MT4, MT5, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77.74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.Visit |

|

| Used By: 20,000,000 Instruments Available: 2000 Stocks Available: 2042 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 50 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 50 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 51% of retail investor accounts lose money when trading CFDs with this provider.Visit |

|

| Used By: 10,000 Instruments Available: 130 Stocks Available: 60 US Stocks: Yes UK Stocks: Yes German Stocks: No Japanese Stocks: No Indices: Yes Forex Pairs Available: 45 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, Mac, Mirror Trader, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 142,500 Instruments Available: 200 Stocks Available: 52 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 150 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Your capital is at riskVisit |

|

| Used By: 15,000,000 Instruments Available: 10000 Stocks Available: 1731 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 177 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.Visit |

|

| Used By: 10,000 Instruments Available: 15000 Stocks Available: 1000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 55 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 148 Stocks Available: 64 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 40 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: $100 |

Platforms: MT4, MT5, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 4,000,000 Instruments Available: 2200 Stocks Available: 2000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: No Indices: Yes Forex Pairs Available: 67 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your moneyVisit |

Best Swing trading Broker Swing trading Broker Reviews

Read our details broker Swing trading Broker Swing trading Broker reviews, you will find something useful if you are shortlisting a Swing trading Broker Swing trading Broker and trading platform.

- IC Markets Review (read our in depth reviews)

- Roboforex Review (read our in depth reviews)

- AvaTrade Review (read our in depth reviews)

- FP Markets Review (read our in depth reviews)

- NordFX Review (read our in depth reviews)

- XTB Review (read our in depth reviews)

- Pepperstone Review (read our in depth reviews)

- XM Review (read our in depth reviews)

- eToro Review (read our in depth reviews)

- FXPrimus Review (read our in depth reviews)

- easyMarkets Review (read our in depth reviews)

- Trading 212 Review (read our in depth reviews)

- SpreadEx Review (read our in depth reviews)

- Admiral Markets Review (read our in depth reviews)

- Markets.com Review (read our in depth reviews)

Swing trading Broker Swing trading Broker Alternatives

Read about and compare Swing trading Broker Swing trading Broker alternatives. We have indepth side by side comparisons to help you find Swing trading Broker Swing trading Broker related brokers.

- IC Markets Alternatives

- Roboforex Alternatives

- AvaTrade Alternatives

- FP Markets Alternatives

- NordFX Alternatives

- XTB Alternatives

- Pepperstone Alternatives

- XM Alternatives

- eToro Alternatives

- FXPrimus Alternatives

- easyMarkets Alternatives

- Trading 212 Alternatives

- SpreadEx Alternatives

- Admiral Markets Alternatives

- Markets.com Alternatives

IC Markets

IC Markets

Roboforex

Roboforex

AvaTrade

AvaTrade

FP Markets

FP Markets

NordFX

NordFX

XTB

XTB

Pepperstone

Pepperstone

XM

XM

eToro

eToro

FXPrimus

FXPrimus

easyMarkets

easyMarkets

Trading 212

Trading 212

SpreadEx

SpreadEx

Admiral Markets

Admiral Markets

Markets.com

Markets.com