Best South African Brokers

When choosing a broker in South Africa, it's essential to consider factors such as regulatory compliance, trading platforms, customer support, and fees. Some of the top brokers in South Africa include IC Markets, XM, and RoboForex. Researching and comparing different brokers available in South Africa is essential to find the one that best fits your needs.

This South African brokers guide explains what South African brokers are, the risks, and why people use South African Brokers and trading platforms to trade on world financial markets. We describe and compare South African brokers and trading platforms, what to check when signing up with a South African Broker and how to check FSCA financial regulation and range of available financial instruments, trading tools, funding and withdrawal methods available with your South African Brokers trading platform.

Trading platforms allow South Africans to invest in various assets, including stocks, bonds, and cryptocurrencies. Investors can access real-time market data and execute trades quickly and easily using a trading platform. South Africans may use trading platforms to diversify their portfolios and reduce risk. By investing in various assets across different sectors and industries, South African investors can spread their risk and potentially increase their returns. South African brokers give South Africans access to markets and assets that may be difficult or expensive to access through traditional investment channels. For example, some trading platforms offer access to international markets or exotic assets such as commodities and derivatives.

Trading platforms are often accessible online, which means South Africans can trade from anywhere with an internet connection. This convenience makes it easier for busy South African professionals and individuals to manage their investments without visiting a physical trading floor or broker.

Best South African Brokers Table of Contents

- Popular South African Brokers

- Advantages of South African Trading Platforms

- Expertise and knowledge

- Diversification of investment options

- Access to global markets from South Africa

- Professional portfolio management

- Research and analysis

- Disadvantages of South African Brokers

- Cost

- Limited product range

- Risk management

- Regulatory compliance

- Competition

- South African Regulations for Brokers

- Licensing Requirements

- Capital Requirements

- Segregation of Client Funds

- Disclosure Requirements

- Legal Trading Methods in South Africa

- Stock Trading

- Forex Trading

- Commodity Trading

- Bond Trading

- Investing in South Africa as a Non-Citizen

- Requirements for Non-Citizen Investors

- Regulations for Non-Citizen Investors

- Popular Trading Platforms in South Africa

- Features of Popular Trading Platforms in South Africa

- Cheapest Brokers in South Africa

- Factors Affecting the Cost of Trading

- Steps to Start Trading in South Africa

- Important Considerations Before Trading In South Africa

- Is Trading in South Africa Safe?

- Steps to Ensure Safe Trading

- Benefits Of South African brokers and trading platforms

- Weak points of South African brokers

- Trading Opportunities With South African Brokers

- Risks Of South African broker trading platforms

- South African Brokers & Trading Platforms Verdict

- Best South African Brokers List Compared

South Africa is home to a thriving financial market, with a range of brokers and trading platforms for investors to trade various assets, including stocks, bonds, currencies, and commodities. South African brokers and trading platforms offer a range of services, from traditional brokerage services to more sophisticated trading platforms that offer advanced trading tools and features.

Popular South African Brokers

Some of the most popular South African brokers include IC Markets, RoboForex, AvaTrade, Sanlam iTrade, Standard Bank Webtrader, and PSG Online. These brokers offer various services, including online trading platforms, research tools, and educational resources to help investors make informed investment decisions. Many South African brokers also offer mobile trading apps, which allow traders to access their accounts and execute trades on the go.

Advantages of South African Trading Platforms

South African trading platforms offer a range of advantages for investors, including

- Access to a wide range of assets, including stocks, bonds, currencies, and commodities

- Advanced trading tools and features, such as real-time market data, charts, and technical analysis tools

- Convenient and accessible trading, with many platforms offering mobile trading apps and online trading platforms

- Educational resources and research tools to help traders make informed investment decisions

- Competitive fees and commissions, with many platforms offering low or no fees for trading certain assets

South African brokers are an important part of the country's financial system, providing individuals and institutions with access to financial products and markets. While there are some disadvantages to working with South African brokers, there are also many advantages investors should be aware of.

South Africa is home to a thriving financial market, with a range of brokers and trading platforms available for investors to trade various assets. South African brokers and trading platforms offer various services, including online trading platforms, research tools, and educational resources to help investors make informed investment decisions. By choosing a reputable and experienced South African broker or trading platform, investors can access the resources and expertise they need to succeed in the financial markets.

Expertise and knowledge

South African brokers have a wealth of experience and knowledge in the financial industry, which can be invaluable for investors. Brokers can guide and advise on various financial products, such as stocks, bonds, and mutual funds, and help investors make informed investment decisions.

Diversification of investment options

One of the key advantages of working with South African brokers is the ability to diversify investment options. Brokers offer a range of investment products, from stocks and bonds to mutual funds and exchange-traded funds (ETFs), which can help investors achieve a diversified portfolio and manage risk.

Access to global markets from South Africa

South African brokers provide investors access to global financial markets, allowing them to invest in international companies and gain exposure to a wider range of investment opportunities. Global markets can help South African investors diversify their portfolios and potentially increase their returns.

Professional portfolio management

South African brokers can provide professional portfolio management services, which can be especially beneficial for investors with larger portfolios. Brokers can help investors create and manage portfolios tailored to their specific investment goals, risk tolerance, and time horizon, ensuring their investments are well-managed and optimized for growth.

Research and analysis

Brokers also provide research and analysis on financial products and markets, which can be very helpful for investors. Brokers can provide market insights, investment analysis, and financial news and updates, which can help investors stay informed and make better investment decisions.

Disadvantages of South African Brokers

South African brokers are essential to the country's financial system, providing individuals and institutions access to financial products and markets. While there are many benefits to working with South African brokers, there are also several disadvantages that investors should be aware of.

Cost

One of the main disadvantages of South African brokers is the cost. South African brokers can be expensive, with high fees and commissions on trades and other transactions. High brokerage costs in South Africa can make it difficult for some investors, particularly those with smaller portfolios, to afford the services of a broker.

Limited product range

Another disadvantage of South African brokers is that they may have a limited range of financial products. Some brokers may specialize in certain types of investments, such as equities or derivatives, and may not offer clients a full range of options. Few tradable financial instruments on your trading platform in South Africa can limit the investment choices available to investors and may make it difficult to achieve a diversified portfolio.

Risk management

The financial industry in South Africa is subject to several risks, such as market volatility and economic uncertainty. While brokers must have effective risk management practices in place, there is always a risk that investments may lose value or the market may experience a downturn. Investors should be aware of these risks and work closely with their brokers to manage their portfolios and minimize their risk exposure.

Regulatory compliance

South African brokers are subject to strict regulatory requirements, which ensures that they are held accountable for their actions and that clients are protected. However, these regulations can also disadvantage South African brokers, as they must spend time and resources ensuring they comply with all applicable laws and regulations. Complying with South African financial regulations can be time-consuming.

Competition

The South African brokerage market is highly competitive, so brokers must work hard to differentiate themselves. Competition among brokers in South Africa can result in brokers using aggressive marketing tactics or offering incentives that may not be in the best interest of their South African clients. Investors should be wary of South African brokers prioritizing their interests over their SA clients' interests.

South African Regulations for Brokers

The South African financial market is regulated by the Financial Sector Conduct Authority (FSCA) and the Johannesburg Stock Exchange (JSE), which is the largest stock exchange in Africa. The FSCA and the JSE work together to ensure the financial markets' integrity and protect investors from fraudulent activities. The following are some of the regulations that South African brokers must abide by

Licensing Requirements

All South African brokers must be licensed by the FSCA to operate in the country. The license application process involves a review of the broker's financial stability, business practices, and management team. The FSCA also audits licensed brokers regularly to ensure they adhere to regulatory requirements.

Capital Requirements

South African brokers must meet minimum capital requirements set by the FSCA. These capital requirements help ensure that brokers have the financial stability to meet their client obligations and manage market risks.

Segregation of Client Funds

South African brokers must separate client funds from the company's operational funds. Segregation of client funds helps protect client funds in the event of a South African broker's bankruptcy or other financial difficulties.

Disclosure Requirements

South African brokers must provide clients with clear and accurate information about their products and services, including any associated fees or commissions. Brokers must also provide regular reports to clients on their investment performance and portfolio holdings.

Legal Trading Methods in South Africa

South Africa has a well-developed financial market, offering a range of legal trading methods for investors to access the market and trade various assets. The following are some of the most common legal trading methods available in South Africa:

Stock Trading

One of the most popular forms of trading in South Africa is stock trading, where investors can buy and sell shares of publicly traded companies on the Johannesburg Stock Exchange (JSE). The JSE is the largest stock exchange in Africa and offers a range of investment opportunities for investors, including blue-chip companies, small- and mid-cap companies, and exchange-traded funds (ETFs).

Forex Trading

Forex trading, or foreign exchange trading, is exchanging one currency for another. South Africa offers a well-developed forex market, with a range of currency pairs available for trading, including the South African Rand (ZAR) and major international currencies like the US Dollar (USD), Euro (EUR), and British Pound (GBP).

Commodity Trading

Commodity trading involves the buying and selling of commodities, such as precious metals, energy, and agricultural products. South Africa offers a range of commodity trading opportunities, including trading on international commodity exchanges and over-the-counter (OTC) trading through South African brokers.

Bond Trading

Bond trading involves buying and selling debt securities, such as government and corporate bonds. South Africa has a well-developed bond market, with a range of bonds available for trading, including local and international bonds. Bond trading is popular for those seeking a more conservative investment strategy.

Investing in South Africa as a Non-Citizen

Investing in South Africa as a non-citizen is possible, and there are no restrictions on who can invest in the country's financial market. However, certain requirements and regulations must be followed when investing in South Africa as a foreign national.

Requirements for Non-Citizen Investors

Non-citizen investors must meet the following requirements when investing in South Africa:

- Have a valid passport

- Have a tax identification number (TIN) from their country of origin

- Have a bank account in their name

- Open a brokerage account with a South African broker

Regulations for Non-Citizen Investors

In addition to the above requirements, non-citizen investors must also follow the regulations set by the South African Reserve Bank (SARB) and the Financial Services Board (FSB) when investing in South Africa. These regulations include:

- Complying with exchange control regulations

- Filing tax returns and paying taxes in South Africa

- Complying with anti-money laundering (AML) and counter-terrorist financing (CTF) regulations

Investing in South Africa as a non-citizen is possible, and there are no restrictions on who can invest in the country's financial market. However, non-citizen investors must meet certain requirements and follow regulations set by the South African Reserve Bank and the Financial Services Board. Before investing in South Africa, it is recommended to seek the advice of a financial advisor to ensure compliance with all applicable regulations and to make informed investment decisions.

Popular Trading Platforms in South Africa

South Africa has a well-developed financial market, and several trading platforms are available for investors. The most popular trading platforms in South Africa include:

- First National Bank (FNB) Trading

- IC Markets South Africa

- RoboForex

- AvaTrade

- Plus500

- Standard Bank Webtrader

- Easy Equities

Features of Popular Trading Platforms in South Africa

Each of the above trading platforms offers unique features to their users, such as:

- FNB Trading offers online trading in a variety of financial instruments, including equities, exchange-traded funds (ETFs), and bonds

- Standard Bank Webtrader provides access to global markets, including the JSE and international exchanges

- Easy Equities offers commission-free trading and investment in a range of ETFs and equities

- IC Markets South Africa is a CFD and forex trading platform offering a range of trading products, including shares, indices, commodities, and cryptocurrencies

- Plus500 is a CFD trading platform offering access to over 2,000 financial instruments, including equities, indices, commodities, and cryptocurrencies

Several popular trading platforms are available in South Africa, each offering their users a unique range of features. The best trading platform for a particular investor will depend on their specific investment goals and preferences. Before opening an account with any trading platform, it is recommended to research and compare the different platforms to determine the best fit for your needs.

Cheapest Brokers in South Africa

Determining the cheapest broker in South Africa can be challenging as the cost of trading can vary based on several factors, such as the type of financial instruments traded, the frequency of trades, and the size of the trades. Some popular brokers in South Africa that offer competitive pricing include:

- Easy Equities

- Sygnia

- Satrix

Factors Affecting the Cost of Trading

When comparing the cost of trading between different brokers, it is important to consider the following factors:

- Commissions: The fee charged by the broker for executing a trade

- Spread: The difference between the bid and ask price of a financial instrument

- Transaction Fees: A fee charged by the exchange for executing a trade

- Account Maintenance Fees: A fee charged by the broker for maintaining an account

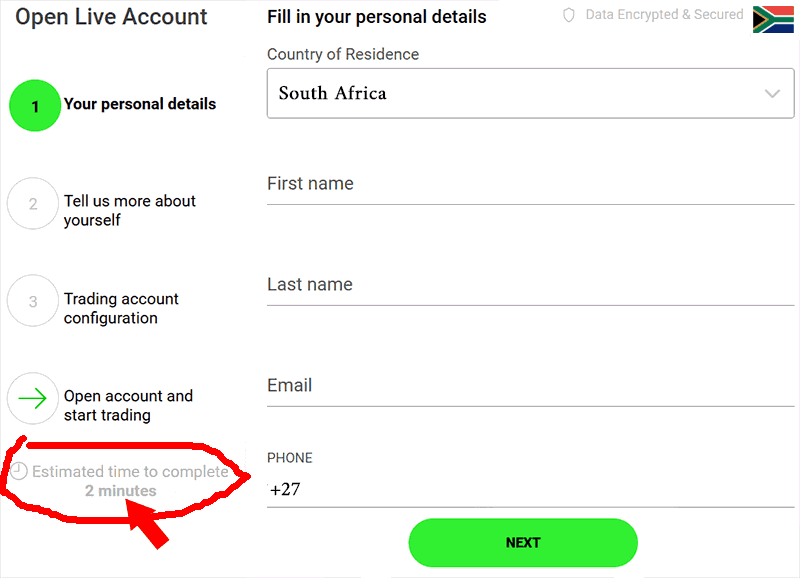

Steps to Start Trading in South Africa

Starting to trade in South Africa requires you to follow a few basic steps:

- Choose a broker: Research and compare different brokers and choose one that meets your trading needs and preferences.

- Open an account: Complete the online application form and submit the required documents to open an account with your chosen broker.

- Fund your account: Transfer funds to your trading account to begin trading.

- Get familiar with the platform: Take the time to familiarize yourself with the trading platform offered by your broker, including its features and tools.

- Start trading: Begin trading by making your first trade and continuously monitoring and adjusting your trading strategy as needed.

Important Considerations Before Trading In South Africa

Before you start trading in South Africa, it is important to consider the following factors:

- Risk Management: Develop and implement a risk management strategy to help you manage the risks associated with trading.

- Education: Invest in your education by learning about different financial instruments and the markets in which they are traded.

- Trading Plan: Develop a comprehensive trading plan that outlines your goals, strategies, and risk management measures.

Starting to trade in South Africa can be a rewarding experience, but it is important to approach it with caution and a well-thought-out plan. By choosing a reputable broker, educating yourself about the markets, and developing a solid risk management strategy, you can increase your chances of success as a trader in South Africa.

Is Trading in South Africa Safe?

Trading in South Africa is generally considered safe if you choose a reputable and regulated broker and follow best practices for managing your risk. The South African financial market is regulated by the Financial Services Board (FSB), which oversees the activities of financial services providers, including brokers, to ensure that they are operating fairly and transparently.

Steps to Ensure Safe Trading

To ensure safe trading in South Africa, you should follow these steps:

- Choose a regulated broker: Only trade with a broker that is registered and regulated by the Financial Services Board (FSB). Regulated South African trading platforms and brokers will ensure your funds are safe, secure, and protected from fraud and other financial crimes.

- Manage your risk: Implement a solid risk management strategy that takes into account your financial goals and risk tolerance. Risk management will help you minimize your exposure to potential losses and increase your chances of success.

- Educate yourself: Stay informed about the markets and financial instruments you are trading. Educating yourself about financial markets will help you make informed trading decisions and understand the risks involved.

- Stay vigilant: Stay alert to any changes in the markets and be aware of any potential risks. Regularly monitor your trades and make adjustments as needed to help minimize your exposure to potential losses.

Trading in South Africa can be safe if you choose a reputable and regulated broker and follow best practices for managing your risk. By educating yourself about the markets and financial instruments you are trading, you can increase your chances of success and minimize your exposure to potential losses.

Benefits Of South African brokers and trading platforms

- Experience: South African brokers have a wealth of experience and knowledge in the financial industry.

- Reputation: Many South African brokers have built up strong reputations for providing quality services to their clients.

- Expertise: Brokers in South Africa have expertise in a range of financial products, including equities, derivatives, commodities, and forex.

- Technology: Many South African brokers have invested heavily in technology, which has allowed them to provide efficient and effective services to their clients.

- Regulatory compliance: South African brokers are subject to strict regulatory requirements, which ensures that they are held accountable for their actions and that clients are protected.

Weak points of South African brokers

- Market saturation: There is a lot of competition in the South African brokerage market, which means that brokers must work hard to stand out.

- Limited product range: Some South African brokers may have a limited range of financial products, which may limit the options available to clients.

- Risk management: The financial industry in South Africa is subject to several risks, such as market volatility and economic uncertainty. Brokers must have effective risk management practices to protect their client's investments.

- Cost: The cost of brokerage services in South Africa may be relatively high compared to other markets, which may make it less accessible for some clients.

- Limited reach: Some South African brokers may have limited reach outside of South Africa, which may make it difficult for clients to access their services if they are located in other countries.

Trading Opportunities With South African Brokers

- Growing market: The financial industry in South Africa is growing, which presents opportunities for brokers to expand their services and reach new clients.

- Diversification: Brokers in South Africa may consider diversifying their product offerings to attract new clients and expand their market share.

- International expansion: Brokers in South Africa may consider expanding their reach beyond South Africa to attract new clients and increase their market share.

- Technology: Continued investment in technology can help South African brokers provide better and more efficient services to their clients.

- Collaboration: Collaboration with other financial institutions, such as banks or asset managers, can help brokers expand their services and reach new clients.

Risks Of South African broker trading platforms

- Economic uncertainty: The South African economy is subject to a range of risks, such as political instability and inflation, which can impact the financial industry.

- Changing regulations: Regulatory requirements in South Africa may change, which can impact the operations and profitability of brokers.

- Cybersecurity threats: Brokers must ensure that their systems and data are secure to prevent cyber attacks and data breaches.

- Competition: The South African brokerage market is highly competitive, which means that brokers must work hard to differentiate themselves from their competitors.

- Market volatility: The financial markets in South Africa are subject to volatility, which can impact the performance of investments and the profitability of brokers.

South African Brokers & Trading Platforms Verdict

While there are many advantages to working with South African brokers, investors should also be aware of the disadvantages. The high cost of brokerage services, limited product range, risk management challenges, regulatory compliance requirements, and competition are all factors that investors should consider when choosing a broker. By working closely with a trusted and experienced broker, investors can navigate these challenges and achieve their financial goals.

South Africa's financial sector has seen a significant rise in the popularity of online trading, and this has led to the emergence of many brokerage firms and trading platforms. The brokers and platforms highlighted in this article offer various trading services, from forex to stocks, and they all have unique features and benefits. When choosing a broker or trading platform, investors should consider factors such as fees, regulations, customer support, and ease of use.

It is worth noting that online trading comes with its risks, and investors should take precautions to protect themselves from fraudulent activities. They should also educate themselves on trading strategies and keep up with market trends to make informed investment decisions.

Overall, the brokers and trading platforms discussed in this article are among the most reputable and reliable in South Africa's financial market. With the right knowledge and strategy, investors can take advantage of the opportunities offered by these platforms to grow their wealth.

Best South African Brokers List Compared

| Featured South African Broker Trading Platform | Account Features | Trading Features |

|---|---|---|

| Used By: 180,000 Instruments Available: 232 Stocks Available: 2100 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 61 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mirror Trader, ZuluTrade, Web Trader, cTrader, Mac Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 53 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 35 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 10 USD / 10 EUR |

Platforms: MT4, MT5, Mac, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 200,000 Instruments Available: 1000 Stocks Available: 99 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 80 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: Web Trader, MT4, MT5, AvaTradeGo, AvaOptions, Mac, Mobile Apps, ZuluTrade, DupliTrade, MQL5 Negative Balance Protection: Inactivity Fee: No 71% of retail CFD accounts lose moneyVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 10000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 60 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, IRESS, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 50 Stocks Available: 0 US Stocks: No UK Stocks: No German Stocks: No Japanese Stocks: No Indices: No Forex Pairs Available: 65 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Minimum Deposit: 10 |

Platforms: MT4, MT5, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 250,000 Instruments Available: 4000 Stocks Available: 1696 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 57 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 0 |

Platforms: MT4, Mirror Trader, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Visit |

|

| Used By: 89,000 Instruments Available: 100 Stocks Available: 60 US Stocks: No UK Stocks: No German Stocks: Yes Japanese Stocks: No Indices: Yes Forex Pairs Available: 70 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mac, ZuluTrade, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your moneyVisit |

|

| Used By: 10,000,000 Instruments Available: 1000 Stocks Available: 160 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 55 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 5 |

Platforms: MT4, MT5, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77.74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.Visit |

|

| Used By: 10,000 Instruments Available: 130 Stocks Available: 60 US Stocks: Yes UK Stocks: Yes German Stocks: No Japanese Stocks: No Indices: Yes Forex Pairs Available: 45 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, Mac, Mirror Trader, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 142,500 Instruments Available: 200 Stocks Available: 52 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 150 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Your capital is at riskVisit |

|

| Used By: 15,000,000 Instruments Available: 10000 Stocks Available: 1731 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 177 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.Visit |

|

| Used By: 10,000 Instruments Available: 148 Stocks Available: 64 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 40 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: $100 |

Platforms: MT4, MT5, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 15000 Stocks Available: 1000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 55 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 10 US Stocks: Yes UK Stocks: No German Stocks: No Japanese Stocks: No Indices: Yes Forex Pairs Available: 40 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes Losses can exceed depositsVisit |

|

| Used By: 300,000 Instruments Available: 100 Stocks Available: 0 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 150 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1000 |

Platforms: MT4, MT5, ZuluTrade, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

Best South African Broker South African Broker Reviews

Read our details broker South African Broker South African Broker reviews, you will find something useful if you are shortlisting a South African Broker South African Broker and trading platform.

- IC Markets Review (read our in depth reviews)

- Roboforex Review (read our in depth reviews)

- AvaTrade Review (read our in depth reviews)

- FP Markets Review (read our in depth reviews)

- NordFX Review (read our in depth reviews)

- XTB Review (read our in depth reviews)

- Pepperstone Review (read our in depth reviews)

- XM Review (read our in depth reviews)

- FXPrimus Review (read our in depth reviews)

- easyMarkets Review (read our in depth reviews)

- Trading 212 Review (read our in depth reviews)

- Admiral Markets Review (read our in depth reviews)

- SpreadEx Review (read our in depth reviews)

- HYCM Review (read our in depth reviews)

- Swissquote Review (read our in depth reviews)

South African Broker South African Broker Alternatives

Read about and compare South African Broker South African Broker alternatives. We have indepth side by side comparisons to help you find South African Broker South African Broker related brokers.

- IC Markets Alternatives

- Roboforex Alternatives

- AvaTrade Alternatives

- FP Markets Alternatives

- NordFX Alternatives

- XTB Alternatives

- Pepperstone Alternatives

- XM Alternatives

- FXPrimus Alternatives

- easyMarkets Alternatives

- Trading 212 Alternatives

- Admiral Markets Alternatives

- SpreadEx Alternatives

- HYCM Alternatives

- Swissquote Alternatives

IC Markets

IC Markets

Roboforex

Roboforex

AvaTrade

AvaTrade

FP Markets

FP Markets

NordFX

NordFX

XTB

XTB

Pepperstone

Pepperstone

XM

XM

FXPrimus

FXPrimus

easyMarkets

easyMarkets

Trading 212

Trading 212

Admiral Markets

Admiral Markets

SpreadEx

SpreadEx

HYCM

HYCM

Swissquote

Swissquote