Best Scalping Brokers

When searching for the best scalping brokers, consider low spreads, fast execution speeds, and reliable trading platforms. Look for brokers that allow scalping strategies and have a strong regulatory compliance record.

When selecting a broker for scalping, it is important to consider factors such as reputation, level of regulation, and the range of minor and major currency pairs provided. Scalping trading has gained immense popularity in recent years, attracting many individuals interested in generating extra income. A scalping broker acts as an intermediary between traders and the foreign exchange market. It is crucial to ensure that the chosen broker has the necessary licensing and regulations to protect investors from fraudulent practices when performing scalping trading. However, it is important to remember that trading in volatile Forex markets carries a high degree of potential loss, and not all brokers support scalping trades.

Best Scalping Brokers Table of Contents

- Scalping Brokers

- What Is Scalping In Forex Trading?

- What Is The Difference Between Regular And Scalping Brokers?

- What Features Should I Look For In A Scalping Broker?

- Low Spreads

- Fast Execution Speeds

- Minimal Slippage

- Flexible Lot Sizes

- Support for Automated Trading

- How Do I Know If A Broker Allows Scalping?

- Check the Broker's Website

- Read Reviews and Forums

- Contact Customer Support

- Test the Broker's Platform

- Can Scalping Brokers Be Trusted?

- Regulation

- Reputation

- Trading Conditions

- Customer Support

- Do Scalping Brokers Charge Higher Fees?

- Spreads

- Other Fees

- What Is The Minimum Deposit Requirement For Scalping Brokers?

- Micro Accounts

- Standard Accounts

- ECN Accounts

- Can I Use Automated Trading Strategies With Scalping Brokers?

- Expert Advisors (EAs)

- Algorithmic Trading Systems

- How Can I Find The Best Scalping Broker For Me?

- Regulation and Reputation

- Trading Platform and Tools

- Spreads and Commissions

- Account Types and Minimum Deposit

- Customer Support and Education

- Do Scalping Brokers Offer Demo Accounts?

- Are There Any Risks Associated With Scalping?

- Can Scalping Be Profitable?

- What Is The Maximum Leverage Offered By Scalping Brokers?

- What Types Of Securities Can Be Traded Using The Scalping Strategy?

- How Important Is A Broker's Trading Platform For Scalping?

- Do Scalping Brokers Have Any Restrictions On Trade Duration?

- How Does A Scalping Strategy Differ From Other Trading Strategies?

- Can Scalping Be Used By Beginner Traders?

- Scalping Brokers Verdict

- Best Scalping Brokers List Compared

Scalping Brokers

Scalping is a popular trading strategy that involves buying and selling securities within a very short time frame to profit from small price movements. To execute this strategy effectively, traders need a broker that offers low spreads, fast execution speeds, and minimal slippage. However, not all brokers allow scalping, and those that do may have specific requirements or limitations.

In this article, we'll explore the world of scalping brokers, answering common questions such as what to look for in a scalping broker, how to find the best one for your needs, and what risks and benefits come with using a scalping strategy. Whether you're a seasoned scalper or a beginner trader looking to learn more, this article will provide valuable insights into the world of scalping brokers.

What Is Scalping In Forex Trading?

Scalping is a popular trading strategy in forex trading that involves buying and selling securities within a very short time frame, usually seconds or minutes. Scalping aims to profit from small price movements by quickly entering and exiting the market.

Scalping can be done manually or with the help of automated trading software. It requires a high level of discipline, quick reflexes, and a thorough understanding of the market. Scalping is often used by traders looking to make quick profits, but it can also be used as a supplement to other trading strategies.

Scalping requires a broker that offers low spreads, fast execution speeds, and minimal slippage to execute trades quickly and efficiently. Not all brokers allow scalping, so it's important to research and choose a broker that supports this trading strategy if you plan to use it.

What Is The Difference Between Regular And Scalping Brokers?

The main difference between regular and scalping brokers is the type of trading strategies they support. Regular brokers typically cater to traders using longer-term trading strategies, such as swing or position trading. In contrast, scalping brokers are specifically designed for traders who use the scalping strategy.

Scalping brokers offer features tailored to scalpers' needs, such as low spreads, fast execution speeds, and minimal slippage. These features are necessary for scalping because the strategy requires traders to enter and exit the market quickly to profit from small price movements.

Regular brokers may not have the same level of support for scalping as scalping brokers. They may have higher spreads or longer order execution times, making executing trades quickly and efficiently difficult. Scalpers often prefer to use scalping brokers that are specifically designed for their needs.

Choosing a broker that supports the trading strategy you plan to use is important. If you're a scalper, it's recommended that you choose a scalping broker that offers the features and support you need to execute your trading strategy effectively.

What Features Should I Look For In A Scalping Broker?

When choosing a scalping broker, there are several features you should look for to ensure that the broker is suitable for your trading strategy:

Low Spreads

Scalping involves profiting from small price movements, so choosing a broker that offers low spreads is important. Spreads differ between a currency pair's bid and ask prices or security, representing the cost of trading. The lower the spread, the less cost you'll incur when opening and closing positions.

Fast Execution Speeds

Scalping requires quick reflexes and fast execution speeds. Choosing a broker that can execute trades quickly and efficiently is important. A delay of just a few seconds can result in missed opportunities or losses.

Minimal Slippage

Slippage is the difference between the expected price of a trade and the actual price at which the trade is executed. It can occur when market conditions change rapidly and can result in losses for scalpers. Look for a broker that offers minimal slippage to minimize your trading costs.

Flexible Lot Sizes

Scalping involves trading frequently and in small amounts, so choosing a broker that offers flexible lot sizes is important. Allowing scalpers to adjust your position sizes to suit your trading strategy and risk tolerance.

Support for Automated Trading

Many scalpers use automated trading software to execute trades quickly and efficiently. Look for a broker that supports popular trading platforms and APIs, such as MetaTrader 4 or 5, to ensure compatibility with your trading software.

By choosing a scalping broker that offers these features, you can execute your trading strategy effectively and maximize your profits.

How Do I Know If A Broker Allows Scalping?

Not all brokers allow scalping, so it's important to check if a broker supports this trading strategy before opening an account. Here are a few ways to determine if a broker allows scalping:

Check the Broker's Website

Most brokers will indicate whether they allow scalping on their website. Look for information on their trading conditions, account types, or FAQ sections for details on their scalping policy.

Read Reviews and Forums

Reading reviews and forums can give you insight into a broker's scalping policy. Look for feedback from other traders who have used the broker for scalping and check if they had any issues with their trading activities.

Contact Customer Support

If you're unsure if a broker allows scalping, contact their customer support team for clarification. Send an email, use the live chat feature, or call their support hotline and ask if their platform supports scalping.

Test the Broker's Platform

Another way to determine if a broker allows scalping is to test their platform with a demo account. Open a demo account with the broker and try scalping on their platform. If you experience any issues or notice high spreads, slippage, or execution delays, it may indicate that the broker is unsuitable for scalping.

Using these methods, you can determine if a broker allows scalping and choose the best broker to support your trading strategy.

Can Scalping Brokers Be Trusted?

Scalping brokers can be trusted if they are regulated by reputable authorities and follow strict trading standards. However, not all scalping brokers are trustworthy, and some engage in unethical practices.

Regulation

Regulation is an important factor in determining the trustworthiness of a scalping broker. Regulated brokers must follow strict trading standards and rules designed to protect traders. Look for scalping brokers regulated in multiple European countries, for example, the UK's FCA, the Securities and Exchange Commission (SEC) in the US, or the ASIC in Australia and Cysec in Europe.

Reputation

Research a broker's reputation before opening an account. Look for reviews, ratings, and comments from other traders to understand their experiences with the broker. Check if the broker has any history of fraudulent activities or scams, and avoid brokers with a bad reputation.

Trading Conditions

Scalping brokers should offer low spreads, fast execution speeds, minimal slippage, and flexible lot sizes. Check the broker's trading conditions and compare them to those of other brokers to ensure they are competitive and fair.

Customer Support

Good customer support is essential in building trust between traders and brokers. Check if the broker offers reliable customer support through email, phone, or live chat channels. Test their responsiveness and helpfulness before opening an account.

Scalping brokers can be trusted if they are regulated, have a good reputation, offer competitive trading conditions, and provide reliable customer support. You can find a trustworthy scalping broker to support your trading activities by doing your research and due diligence.

Do Scalping Brokers Charge Higher Fees?

Scalping brokers may charge higher fees than regular brokers due to the nature of the trading strategy. Scalping involves opening and closing multiple positions quickly, which results in higher trading volumes and increased transaction costs for the broker.

Spreads

Scalping brokers offer tight spreads to attract scalpers. However, they may also charge a commission or markup on the spread to offset the higher costs of scalping. Some brokers offer a raw spread or an ECN (Electronic Communication Network) account that allows scalpers to access interbank spreads, but these accounts may come with higher fees.

Other Fees

Scalping brokers may also charge other fees such as deposit and withdrawal, account maintenance, or inactivity fees. Be sure to read the broker's fee schedule carefully to understand all the charges associated with trading.

While higher fees may be a disadvantage of scalping brokers, it's important to consider other factors such as trading conditions, execution speed, and regulation when choosing a broker. A scalping broker that offers competitive spreads, fast execution, and reliable customer support may be worth paying higher fees.

While scalping brokers may charge higher fees, it's essential to weigh the costs against the benefits and choose a broker that provides the best overall value for your trading needs.

What Is The Minimum Deposit Requirement For Scalping Brokers?

The minimum deposit requirement for scalping brokers varies depending on the broker and the type of account. Some brokers offer accounts with no minimum deposit, while others may require a significant deposit to access advanced trading tools and features.

Micro Accounts

Micro accounts are popular for scalpers as they offer low minimum deposits and allow traders to trade in smaller lot sizes. These accounts typically require a minimum deposit of $1 to $50, making them accessible to traders with small budgets. However, they may come with higher spreads or trading costs than other account types.

Standard Accounts

Standard accounts usually require a minimum deposit of $100 to $500 and offer access to more advanced trading tools and features such as expert advisors (EAs), custom indicators, and trading signals. These accounts may have lower spreads and trading costs than micro accounts but may require larger lot sizes, making them less suitable for scalping strategies.

ECN Accounts

ECN (Electronic Communication Network) accounts are popular among scalpers as they offer direct access to interbank liquidity and typically have tight spreads and low trading costs. However, these accounts may require a higher minimum deposit of $500 to $5,000 and may charge a commission or markup on the spread.

While the minimum deposit requirement is important when choosing a scalping broker, it's essential to consider other factors such as trading conditions, regulation, and customer support. A broker that offers competitive spreads, fast execution, and reliable customer support may be worth considering, even if it requires a higher minimum deposit.

Overall, the minimum deposit requirement for scalping brokers varies depending on the type of account and the broker. It's important to compare different brokers and account types to find the best option for your trading needs and budget.

Can I Use Automated Trading Strategies With Scalping Brokers?

Many scalping brokers allow traders to use automated trading strategies, such as expert advisors (EAs) and algorithmic trading systems.

Expert Advisors (EAs)

Expert advisors (EAs) are automated trading systems that can execute trades based on pre-defined rules and algorithms. They can be programmed to enter and exit trades based on technical indicators, price action, and other criteria. Scalping strategies are well-suited for automation as they rely on rapid trade execution and require quick decision-making.

Many scalping brokers offer trading platforms that support using EAs. These platforms may have built-in tools for creating and testing EAs or allow traders to import EAs created using third-party software.

Algorithmic Trading Systems

Algorithmic trading systems are similar to EAs, using pre-defined rules and algorithms to execute trades. However, they may be more complex and sophisticated than EAs, incorporating machine learning and artificial intelligence techniques.

Some scalping brokers offer dedicated platforms for algorithmic trading or allow traders to connect their systems to the broker's trading infrastructure via APIs (Application Programming Interfaces).

While automated trading can effectively implement scalping strategies, it's essential to use caution and proper risk management techniques. Automated systems can execute trades quickly and efficiently but also suffer from technical glitches, connectivity issues, etc. It's important to thoroughly test and optimize your trading system before using it in live trading and monitor its performance closely.

Overall, many scalping brokers allow traders to use automated trading strategies such as EAs and algorithmic systems. It's important to choose a broker that supports your preferred trading platform and offers reliable execution and low latency connectivity.

How Can I Find The Best Scalping Broker For Me?

Finding the best scalping broker for your needs requires careful consideration of several factors, including:

Regulation and Reputation

Choose a scalping broker regulated by a reputable regional financial authority. Regulated brokers are held to high transparency and client protection standards, reducing the risk of fraud and malpractice. Additionally, research the broker's reputation among traders and read reviews from trusted sources to ensure they have a track record of reliable execution and customer service.

Trading Platform and Tools

Choose a scalping broker with a platform suitable for your trading style and preferences. The platform should offer fast, reliable order execution, low latency connectivity, and advanced charting and analysis tools. Additionally, look for features such as one-click trading, the ability to trade directly from charts, and the ability to create and test automated trading strategies.

Spreads and Commissions

Scalping strategies rely on small price movements and require low transaction costs to be profitable. Look for a scalping broker that offers tight spreads, low commissions, and minimal slippage. Additionally, be aware of hidden fees or charges, such as inactivity or withdrawal fees.

Account Types and Minimum Deposit

Choose a scalping broker that offers account types and minimum deposit requirements suitable for your trading needs and budget. Some brokers may offer accounts with low minimum deposits but have limited features or higher transaction costs. Other brokers may offer premium accounts with more features and lower transaction costs but may require a higher minimum deposit.

Customer Support and Education

Choose a scalping broker that offers reliable and responsive customer support, including phone, email, and live chat options. Additionally, look for brokers that offer educational resources and tools to help you improve your trading skills and stay informed about market news and events.

Overall, finding the best scalping broker requires careful research and consideration of multiple factors. Consider your trading style, preferences, and budget, and choose a broker that offers reliable execution, low transaction costs, and excellent customer support and educational resources.

Do Scalping Brokers Offer Demo Accounts?

Many scalping brokers offer demo trading accounts that are not live accounts. Scalping demo accounts can be used to practice. Demo accounts typically use virtual funds and replicate the trading conditions of a live account, including order execution, market conditions, and pricing.

Demo accounts are an essential tool for traders, especially those new to scalping or forex trading in general. They allow traders to test their strategies, familiarize themselves with the trading platform, and gain experience and confidence before trading with real money.

When choosing a scalping broker, looking for one that offers a demo account with realistic trading conditions and no time limit is essential. Some brokers may offer demo accounts with limited features or unrealistic market conditions, which may not accurately reflect real-world trading conditions.

Overall, demo accounts are an important feature to look for when choosing a scalping broker. They can help traders to improve their skills, test their strategies, and gain experience without risking real money.

Are There Any Risks Associated With Scalping?

Several risks are associated with scalping, just like any other trading strategy. Scalping trading opens and exits many trades, usually seconds or minutes, aiming to gain from slight up or down price changes. The main risks associated with scalping include:

- High trading costs: Scalping involves frequent trading, which can result in high trading costs, such as spreads, commissions, and slippage. These costs can eat into profits and make it difficult to achieve consistent profits.

- Market volatility: Scalping relies on small price movements, and sudden market volatility can lead to unexpected losses. Market volatility can be caused by a range of factors, such as news events, economic indicators, or political developments.

- Technical issues: Scalping requires fast and reliable trade execution, and technical issues, such as platform downtime or slow order execution, can result in missed opportunities or losses.

- Emotional stress: Scalping can be a stressful trading strategy that requires discipline, patience, and quick decision-making. The pressure to make quick profits can lead to emotional trading, such as revenge trading or overtrading, which can result in losses.

Despite these risks, scalping can be a profitable trading strategy when executed correctly. Traders should carefully consider their risk tolerance and trading objectives before implementing a scalping strategy and should always use appropriate risk management techniques, such as stop-loss orders and position sizing.

Can Scalping Be Profitable?

Yes, scalping can be a profitable trading strategy. Scalping involves opening and closing multiple trades, usually in seconds or minutes, aiming to gain from trading in volume. The key to profitable scalping is to have a high win rate, which means that most trades are profitable and losses are small.

Successful scalping requires technical analysis, market knowledge, and discipline. Traders should use technical indicators, such as moving averages, support and resistance levels, and chart patterns, to identify short-term trading opportunities. They should also stay updated with market news and events that could impact price movements.

Also, traders should use appropriate risk management techniques, such as setting stop-loss orders and position sizing, to limit risk and protect profits. They should also be disciplined to follow their trading plan and avoid emotional trading, such as revenge trading or overtrading.

Overall, scalping can be a profitable trading strategy for experienced traders with a high-risk tolerance and comfortable with fast-paced trading. However, it is important to note that scalping is unsuitable for all traders and can result in significant losses if not executed correctly.

What Is The Maximum Leverage Offered By Scalping Brokers?

The maximum leverage offered by scalping brokers varies depending on the broker and the jurisdiction in which it operates. In general, scalping brokers offer high leverage to traders to maximize their trading potential. However, high leverage can also increase the risk of losses, so traders should use it cautiously.

In some jurisdictions, such as the European Union and the United States, regulatory authorities have imposed restrictions on the maximum leverage brokers can offer retail traders. For example, in the EU, the maximum leverage for forex trading is limited to 1:30 for major currency pairs and 1:20 for minor and exotic pairs. In the US, the maximum leverage is limited to 1:50 for forex trading.

However, in other jurisdictions, such as Australia and some Asian countries, there are fewer restrictions on leverage, and scalping brokers may offer leverage as high as 1:500 or more.

Traders need to understand the risks and benefits of leverage before trading with a scalping broker. Traders should also carefully review the broker's terms and conditions to understand the leverage offered and any associated fees or charges.

What Types Of Securities Can Be Traded Using The Scalping Strategy?

The scalping strategy can trade various securities, including forex, stocks, and futures. However, it is most commonly used in the forex market due to its high liquidity and volatility. The scalping strategy is based on making multiple trades over a short period, usually seconds or minutes, to profit from small price movements.

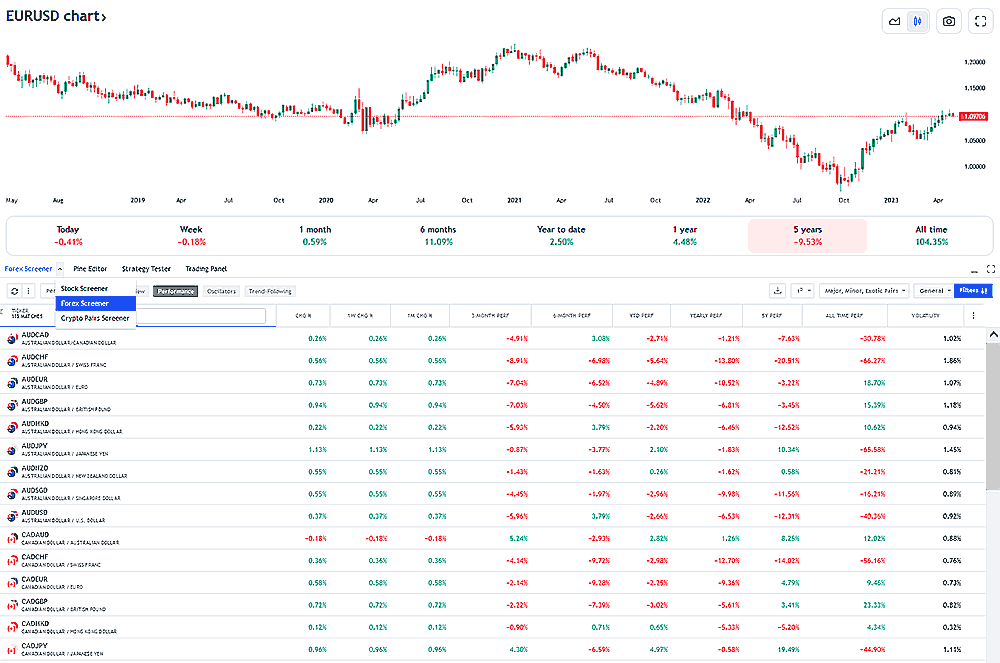

When trading forex using the scalping strategy, traders typically focus on major currency pairs with high liquidity and tight bid-ask spreads, such as EUR/USD, USD/JPY, and GBP/USD. Scalping can also be used in stock trading, particularly with large-cap stocks with high trading volumes and tight spreads. Futures trading can also be suitable for scalping, particularly with contracts with high liquidity and low trading fees.

Traders must choose securities suitable for scalping based on their personal trading style, risk tolerance, and trading goals. Traders should also consider the fees and commissions associated with trading different securities and the availability of trading tools and resources their chosen broker offers.

How Important Is A Broker's Trading Platform For Scalping?

A broker's trading platform is extremely important for scalping, as it is the primary tool traders use to execute trades quickly and efficiently. Scalping involves making multiple trades over a short period, often in just a few seconds or minutes, which requires a platform that can handle a high volume of trades and provide real-time market data.

Some key features to look for in a trading platform for scalping include fast order execution, the ability to place orders directly from charts, real-time market data and news, and customizable charting tools. The platform should be stable and reliable, with minimal downtime and fast trade confirmation times.

Traders should also consider the type of platform the broker offers, as some brokers may offer their proprietary platforms. In contrast, others may provide popular third-party platforms such as MetaTrader 4 or cTrader. Choosing a platform, the trader is comfortable using is important and offers the necessary features and functionality for their scalping strategy.

In summary, a broker's trading platform is crucial when choosing a scalping broker, as it can significantly impact the trader's ability to execute trades quickly and efficiently.

Do Scalping Brokers Have Any Restrictions On Trade Duration?

Scalping brokers do not have any specific restrictions on trade duration, as scalping involves making quick trades that are opened and closed within a short period. However, some brokers may have minimum holding periods for trades, such as a few seconds or minutes, which may not be suitable for scalping strategies.

Traders employing scalping strategies should look for brokers that allow them to open and close trades quickly and without unnecessary restrictions. Including the ability to place orders directly from charts, the availability of fast order execution, and real-time market data and news.

It is important to note that scalping is a high-risk trading strategy requiring skill and experience. Traders should also be aware of the potential risks involved, including the possibility of high volatility and significant losses.

In summary, while scalping brokers generally do not have restrictions on trade duration, traders should choose brokers that allow them to execute trades quickly and efficiently without any unnecessary barriers or delays.

How Does A Scalping Strategy Differ From Other Trading Strategies?

Scalping is a trading strategy focused on making quick profits from small price movements in the market. Scalping is achieved by opening and closing trades within a very short time frame, often just a few seconds or minutes.

Unlike other trading strategies, such as swing or position trading, scalping is not concerned with holding positions for longer to capture larger market movements. Instead, it relies on taking advantage of small price movements in the market, which can be repeated many times throughout a trading session.

Scalping strategies typically involve technical analysis to identify short-term trading opportunities, such as breakouts, trend reversals, or support and resistance levels. Traders may use a variety of indicators and charting tools to help them identify these opportunities, including moving averages, Bollinger Bands, and RSI.

Another key difference between scalping and other trading strategies is the frequency of trades. Scalping involves opening and closing many trades over a short period, which requires a high focus and attention to the market. Both mentally and emotionally challenging and requires a certain level of discipline and risk management skills.

In summary, scalping is a unique trading strategy that differs from other strategies in its focus on quick profits from small price movements, frequent trading, and technical analysis to identify short-term opportunities.

Can Scalping Be Used By Beginner Traders?

Scalping is a trading strategy that requires quick decision-making and the ability to act on market movements in seconds or minutes. As such, it is generally not recommended for beginner traders still learning the basics of trading and market analysis. Scalping requires a high level of skill and experience to be successful.

However, if a beginner trader is determined to use the scalping strategy, it is important first to spend a significant amount of time practicing on a demo account and developing a solid understanding of the market, technical analysis, and risk management strategies. It is also important to choose a reputable scalping broker that offers low spreads, fast execution, and a reliable trading platform.

While scalping can be a highly profitable trading strategy for experienced traders, it is generally not recommended for beginner traders due to the high skill and experience required.

Scalping Brokers Verdict

Scalping can be a highly profitable trading strategy for experienced traders who can make quick decisions and act on market movements in seconds or minutes. However, it is important to choose a reputable scalping broker that offers low spreads, fast execution, and a reliable trading platform. When looking for a scalping broker, traders should consider factors such as regulation, trading fees, leverage, and customer support.

While scalping can be a lucrative trading strategy, it is also associated with higher risks due to the short-term nature of the trades. Traders should also know the potential for slippage and requote when using scalping strategies. It is important to develop a solid understanding of the market, technical analysis, and risk management strategies before using the scalping strategy.

In conclusion, scalping can be a viable trading strategy for experienced traders who can manage the risks and make quick decisions. By choosing a reputable scalping broker and developing a solid understanding of the market and technical analysis, traders can potentially achieve success with this strategy.

Best Scalping Brokers List Compared

| Featured Scalping Broker Trading Platform | Account Features | Trading Features |

|---|---|---|

| Used By: 180,000 Instruments Available: 232 Stocks Available: 2100 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 61 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mirror Trader, ZuluTrade, Web Trader, cTrader, Mac Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 53 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 35 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 10 USD / 10 EUR |

Platforms: MT4, MT5, Mac, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 200,000 Instruments Available: 1000 Stocks Available: 99 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 80 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: Web Trader, MT4, MT5, AvaTradeGo, AvaOptions, Mac, Mobile Apps, ZuluTrade, DupliTrade, MQL5 Negative Balance Protection: Inactivity Fee: No 71% of retail CFD accounts lose moneyVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 10000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 60 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, IRESS, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 50 Stocks Available: 0 US Stocks: No UK Stocks: No German Stocks: No Japanese Stocks: No Indices: No Forex Pairs Available: 65 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Minimum Deposit: 10 |

Platforms: MT4, MT5, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 250,000 Instruments Available: 4000 Stocks Available: 1696 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 57 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 0 |

Platforms: MT4, Mirror Trader, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Visit |

|

| Used By: 89,000 Instruments Available: 100 Stocks Available: 60 US Stocks: No UK Stocks: No German Stocks: Yes Japanese Stocks: No Indices: Yes Forex Pairs Available: 70 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mac, ZuluTrade, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your moneyVisit |

|

| Used By: 10,000,000 Instruments Available: 1000 Stocks Available: 160 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 55 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 5 |

Platforms: MT4, MT5, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77.74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.Visit |

|

| Used By: 10,000 Instruments Available: 130 Stocks Available: 60 US Stocks: Yes UK Stocks: Yes German Stocks: No Japanese Stocks: No Indices: Yes Forex Pairs Available: 45 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, Mac, Mirror Trader, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 142,500 Instruments Available: 200 Stocks Available: 52 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 150 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Your capital is at riskVisit |

|

| Used By: 10,000 Instruments Available: 15000 Stocks Available: 1000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 55 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 148 Stocks Available: 64 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 40 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: $100 |

Platforms: MT4, MT5, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 1000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: No Forex Pairs Available: 100 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 0 |

Platforms: MT4, Mac, ZuluTrade, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 10 US Stocks: Yes UK Stocks: No German Stocks: No Japanese Stocks: No Indices: Yes Forex Pairs Available: 40 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes Losses can exceed depositsVisit |

|

| Used By: 300,000 Instruments Available: 100 Stocks Available: 0 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 150 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1000 |

Platforms: MT4, MT5, ZuluTrade, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

Best Scalping Broker Scalping Broker Reviews

Read our details broker Scalping Broker Scalping Broker reviews, you will find something useful if you are shortlisting a Scalping Broker Scalping Broker and trading platform.

- IC Markets Review (read our in depth reviews)

- Roboforex Review (read our in depth reviews)

- AvaTrade Review (read our in depth reviews)

- FP Markets Review (read our in depth reviews)

- NordFX Review (read our in depth reviews)

- XTB Review (read our in depth reviews)

- Pepperstone Review (read our in depth reviews)

- XM Review (read our in depth reviews)

- FXPrimus Review (read our in depth reviews)

- easyMarkets Review (read our in depth reviews)

- SpreadEx Review (read our in depth reviews)

- Admiral Markets Review (read our in depth reviews)

- Axi Review (read our in depth reviews)

- HYCM Review (read our in depth reviews)

- Swissquote Review (read our in depth reviews)

Scalping Broker Scalping Broker Alternatives

Read about and compare Scalping Broker Scalping Broker alternatives. We have indepth side by side comparisons to help you find Scalping Broker Scalping Broker related brokers.

- IC Markets Alternatives

- Roboforex Alternatives

- AvaTrade Alternatives

- FP Markets Alternatives

- NordFX Alternatives

- XTB Alternatives

- Pepperstone Alternatives

- XM Alternatives

- FXPrimus Alternatives

- easyMarkets Alternatives

- SpreadEx Alternatives

- Admiral Markets Alternatives

- Axi Alternatives

- HYCM Alternatives

- Swissquote Alternatives

IC Markets

IC Markets

Roboforex

Roboforex

AvaTrade

AvaTrade

FP Markets

FP Markets

NordFX

NordFX

XTB

XTB

Pepperstone

Pepperstone

XM

XM

FXPrimus

FXPrimus

easyMarkets

easyMarkets

SpreadEx

SpreadEx

Admiral Markets

Admiral Markets

Axi

Axi

HYCM

HYCM

Swissquote

Swissquote