Best New Zealand Brokers

If you're seeking reliable brokers in New Zealand, assessing trading fees, regulatory compliance, customer support, and available investment options is crucial. Notable choices include IC Markets, eToro, and Pepperstone. Thoroughly researching and comparing their features is vital to discover the perfect fit for your trading requirements.

If you're an investor looking for a New Zealand brokerage to facilitate your investment activities, it's imperative to thoroughly research and compare different brokers to identify the one that aligns best with your needs. When shortlisting brokers in New Zealand, factors to research their fee structures and commissions, the range of financial instruments available for trading, tools for trading analysis, methods for funding and withdrawal, and compliance with regulations set by the Financial Markets Authority (FMA). By investing time in researching and evaluating New Zealand brokers, you can make well-informed investment decisions.

This guide is designed for New Zealand traders seeking information about brokers and trading platforms in New Zealand. New Zealand-based brokers provide access to the global financial markets, enabling investors to trade various financial instruments, including stocks, bonds, and cryptocurrencies. Through portfolio diversification, New Zealand traders can mitigate risk and potentially enhance their returns.

Trading platforms are often available online, enabling busy professionals and individuals in New Zealand to manage their investments from anywhere with an internet connection conveniently. This user-friendly accessibility empowers traders to execute trades efficiently and swiftly.

Before registering with a New Zealand broker, it is essential to verify their compliance with FMA financial regulations to ensure they hold the necessary licenses and adhere to regulatory standards. Additionally, comparing different New Zealand brokers and trading platforms is crucial to discover the one that caters to your specific requirements. Explore the assortment of available financial instruments, trading tools, funding and withdrawal methods, and access to real-time market data to enable better-informed investment decisions. Some New Zealand trading platforms even offer access to international markets or unique assets such as commodities and derivatives, which we elaborate on in this comprehensive guide to New Zealand brokers.

Best New Zealand Brokers Table of Contents

- New Zealand Brokers: A Comprehensive Guide to Trading and Investing

- What are New Zealand brokers?

- What is a trading platform?

- What is a trading account?

- How do trading fees work?

- What should I look for in an online broker?

- What is the Financial Markets Authority (FMA)?

- What are retail investor accounts?

- What are exchange-traded funds (ETFs)?

- Can New Zealand brokers facilitate forex trading?

- How do I deposit money into a trading account?

- What are financial markets?

- Can New Zealand brokers offer retail CFD accounts?

- Are there New Zealand forex brokers?

- Can I trade stocks with New Zealand brokers?

- Do New Zealand brokers charge low trading fees?

- How can I develop effective trading strategies?

- What are leveraged products in trading?

- Can I trade with international brokers from New Zealand?

- How do I choose the right stock broker?

- What is the role of online brokers?

- Are all online brokers the same?

- How can I ensure the safety of my funds with online brokers?

- Can I trade cryptocurrencies with New Zealand brokers?

- What are the advantages of using New Zealand brokers?

- Do New Zealand brokers offer educational resources for traders?

- Can I open multiple trading accounts with different brokers?

- How can I stay updated on global market trends and news?

- Can I trade on the go with New Zealand brokers?

- New Zealand Brokers Verdict

- Best New Zealand Brokers List Compared

New Zealand Brokers: A Comprehensive Guide to Trading and Investing

New Zealand brokers play a crucial role in facilitating access to global financial markets for retail investors. For new and experienced traders, understanding the role of brokers, trading platforms, and various trading accounts is essential. This guide addresses the most frequently asked questions concerning New Zealand brokers, equipping you with valuable insights to facilitate well-informed decision-making.

What are New Zealand brokers?

New Zealand brokers are financial intermediaries that enable individuals to trade and invest in various financial instruments, such as stocks, currencies, commodities, and more. They provide the necessary infrastructure to access global markets, including trading platforms and accounts.

What is a trading platform?

A trading platform is online software brokers provide that allows users to execute trades, monitor their investments, and access market data. It serves as a bridge between the trader and the financial markets, providing real-time information and order execution capabilities.

What is a trading account?

A trading account is provided by a broker that allows individuals to deposit money and engage in trading activities. It acts as a repository for funds for buying and selling financial instruments.

How do trading fees work?

Trading fees are charges imposed by brokers for executing trades on their platforms. These fees can vary, including commissions, spreads, and other transaction-related costs. Considering trading fees when choosing an online broker is important, as they can impact profitability.

What should I look for in an online broker?

When selecting an online broker, consider factors such as reputation, regulatory compliance, trading fees, available markets, customer support, and the quality of their trading platform. Seek independent financial advice if needed to make an informed decision.

What is the Financial Markets Authority (FMA)?

The Financial Markets Authority (FMA) is the regulatory body in New Zealand responsible for overseeing and regulating financial markets and services. They aim to promote fair and transparent financial markets and protect the interests of investors.

What are retail investor accounts?

Retail investor accounts are trading accounts designed for individual rather than institutional investors. These accounts often have lower minimum deposit requirements and cater to individuals with less investment capital.

What are exchange-traded funds (ETFs)?

Exchange-traded funds (ETFs) are funds traded on stock exchanges, similar to individual stocks. Through a single trade, ETFs enable investors to access a diversified portfolio of assets, including stocks, bonds, or commodities.

Why is independent financial advice important?

Seeking independent financial advice is crucial when making investment decisions. Independent advisors can provide unbiased recommendations tailored to your goals, risk tolerance, and investment horizon.

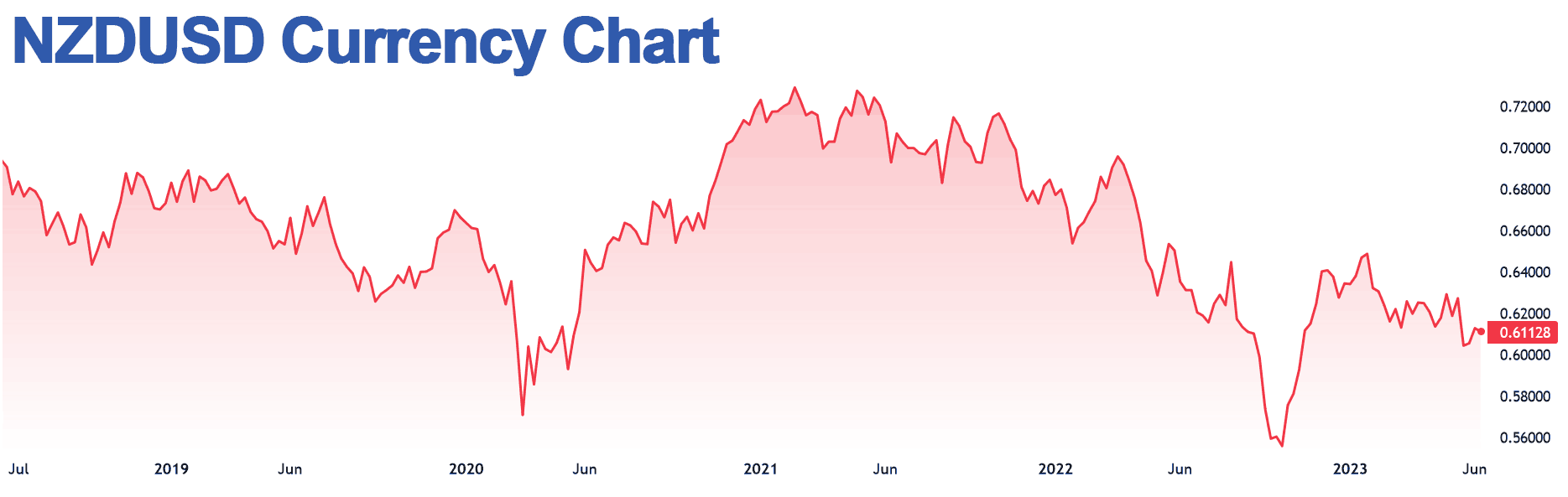

Can New Zealand brokers facilitate forex trading?

Yes, New Zealand brokers often provide access to the foreign exchange (forex) market, allowing individuals to trade currencies. Forex trading offers opportunities to profit from fluctuations in exchange rates between different currency pairs.

How do I deposit money into a trading account?

Depositing money into a trading account is typically done through various methods, such as bank transfers, credit/debit cards, or electronic payment systems. Brokers usually provide multiple options to accommodate different preferences.

What are financial markets?

Financial markets refer to platforms where buyers and sellers trade financial instruments. These instruments include stocks, bonds, commodities, currencies, and derivatives. Financial markets provide liquidity and facilitate capital allocation.

Can New Zealand brokers offer retail CFD accounts?

New Zealand brokers often provide retail contracts for difference (CFD) accounts. CFDs trading is price speculation upwards or downwards with no real ownership of what you are trading. However, trading CFDs involves risks, including potential losses exceeding the initial investment.

Are there New Zealand forex brokers?

Several New Zealand forex brokers offer trading services specifically focused on the foreign exchange market. These brokers cater to forex traders' needs, providing them access to currency pairs and related trading tools.

Can I trade stocks with New Zealand brokers?

Absolutely! New Zealand brokers enable individuals to trade stocks listed on various domestic and international stock exchanges. By opening a trading account, you gain the opportunity to engage in the stock market and capitalize on the performance of individual companies.

Do New Zealand brokers charge low trading fees?

Trading fees vary among brokers. While some brokers may offer competitive and low trading fees, others may have higher fees but provide additional services or features. It's important to compare fees across brokers to find the best for your trading style and investment objectives.

How can I develop effective trading strategies?

Developing effective trading strategies involves research, analysis, and experience. Traders use technical analysis, fundamental analysis, and risk management techniques to formulate strategies that align with their trading goals.

What are leveraged products in trading?

Leveraged products like CFDs allow traders to have large exposure to financial instruments using monies from your NZ broker . While leverage can enhance potential profits, it also magnifies losses. It's important to fully understand the risks associated with trading leveraged products.

Can I trade with international brokers from New Zealand?

Yes, individuals in New Zealand can trade with international brokers that accept clients from the country. However, it's essential to ensure that the chosen broker is reputable and regulated and provides access to the markets and financial instruments you desire.

How do I choose the right stock broker?

When selecting a stock broker, consider factors such as commission fees, account types offered, research and analysis tools, customer support, and user experience. It's also important to review the broker's reputation and regulatory compliance.

What is the role of online brokers?

Online brokers are pivotal in enabling individuals to trade and invest in financial instruments through their online platforms. They provide a user-friendly interface, real-time market data, order execution capabilities, and access to various markets and instruments.

Are all online brokers the same?

No, online brokers can vary in terms of the services they offer, the markets they provide access to, the trading platforms they utilize, and their fee structures. Researching and comparing different online brokers is important to find the one best for your trading preferences and goals.

How can I ensure the safety of my funds with online brokers?

To ensure the safety of your funds, it is crucial to choose online brokers regulated by reputable financial authorities. Regulatory bodies, such as the Financial Markets Authority (FMA) in New Zealand, oversee brokers to ensure they adhere to strict financial standards and client fund segregation.

Can I trade cryptocurrencies with New Zealand brokers?

Yes, many New Zealand brokers offer cryptocurrency trading services. Cryptocurrency trading allows individuals to speculate on the price movements of digital currencies. It's important to note that cryptocurrencies are highly volatile and carry additional risks.

What are the advantages of using New Zealand brokers?

Using New Zealand brokers can provide several advantages, including localized customer support, compliance with local regulations, familiarity with the New Zealand market, and potential tax benefits. Additionally, trading with New Zealand brokers may offer easier fund transfers within the local banking system.

Do New Zealand brokers offer educational resources for traders?

Many New Zealand brokers provide educational resources to help traders enhance their knowledge and skills. These resources can include webinars, tutorials, e-books, and market analysis tools. Such resources can empower traders to make more informed trading decisions.

Can I open multiple trading accounts with different brokers?

Yes, you can open multiple trading accounts with different brokers. Numerous trading accounts offer several advantages as it enables you to diversify your trading strategies, gain access to foreign markets, and capitalize on the distinct offerings provided by each broker. However, managing your accounts effectively and considering any associated fees is essential.

How can I stay updated on global market trends and news?

Staying updated on global market trends and news is essential for successful trading. You can utilize various sources, including financial news websites, market analysis reports, economic calendars, and social media platforms. Following reputable financial analysts and subscribing to newsletters can also provide valuable insights.

Can I trade on the go with New Zealand brokers?

Yes, many New Zealand brokers offer mobile trading platforms on the go using your smartphone or tablet. Mobile trading apps provide convenience and flexibility, enabling you to monitor your positions, execute trades, and access market data from anywhere at any time.

New Zealand Brokers Verdict

In conclusion, New Zealand brokers allow individuals to participate in global markets through their online platforms. Choosing regulated brokers, considering the range of markets and instruments available, and leveraging educational resources to enhance your trading knowledge are important. By staying informed and utilizing the tools brokers provide, you can confidently navigate the trading world and aim for success.

Best New Zealand Brokers List Compared

| Featured New Zealand Broker Trading Platform | Account Features | Trading Features |

|---|---|---|

| Used By: 180,000 Instruments Available: 232 Stocks Available: 2100 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 61 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mirror Trader, ZuluTrade, Web Trader, cTrader, Mac Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 53 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 35 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 10 USD / 10 EUR |

Platforms: MT4, MT5, Mac, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 50 Stocks Available: 0 US Stocks: No UK Stocks: No German Stocks: No Japanese Stocks: No Indices: No Forex Pairs Available: 65 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Minimum Deposit: 10 |

Platforms: MT4, MT5, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 250,000 Instruments Available: 4000 Stocks Available: 1696 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 57 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 0 |

Platforms: MT4, Mirror Trader, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Visit |

|

| Used By: 89,000 Instruments Available: 100 Stocks Available: 60 US Stocks: No UK Stocks: No German Stocks: Yes Japanese Stocks: No Indices: Yes Forex Pairs Available: 70 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mac, ZuluTrade, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your moneyVisit |

|

| Used By: 10,000,000 Instruments Available: 1000 Stocks Available: 160 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 55 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 5 |

Platforms: MT4, MT5, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77.74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.Visit |

|

| Used By: 20,000,000 Instruments Available: 2000 Stocks Available: 2042 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 50 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 50 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 51% of retail investor accounts lose money when trading CFDs with this provider.Visit |

|

| Used By: 10,000 Instruments Available: 130 Stocks Available: 60 US Stocks: Yes UK Stocks: Yes German Stocks: No Japanese Stocks: No Indices: Yes Forex Pairs Available: 45 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, Mac, Mirror Trader, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 142,500 Instruments Available: 200 Stocks Available: 52 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 150 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Your capital is at riskVisit |

|

| Used By: 15,000,000 Instruments Available: 10000 Stocks Available: 1731 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 177 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.Visit |

|

| Used By: 10,000 Instruments Available: 148 Stocks Available: 64 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 40 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: $100 |

Platforms: MT4, MT5, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 15000 Stocks Available: 1000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 55 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 10 US Stocks: Yes UK Stocks: No German Stocks: No Japanese Stocks: No Indices: Yes Forex Pairs Available: 40 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 1000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: No Forex Pairs Available: 100 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 0 |

Platforms: MT4, Mac, ZuluTrade, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 300,000 Instruments Available: 100 Stocks Available: 0 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 150 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1000 |

Platforms: MT4, MT5, ZuluTrade, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

Best New Zealand Broker New Zealand Broker Reviews

Read our details broker New Zealand Broker New Zealand Broker reviews, you will find something useful if you are shortlisting a New Zealand Broker New Zealand Broker and trading platform.

- IC Markets Review (read our in depth reviews)

- Roboforex Review (read our in depth reviews)

- NordFX Review (read our in depth reviews)

- XTB Review (read our in depth reviews)

- Pepperstone Review (read our in depth reviews)

- XM Review (read our in depth reviews)

- eToro Review (read our in depth reviews)

- FXPrimus Review (read our in depth reviews)

- easyMarkets Review (read our in depth reviews)

- Trading 212 Review (read our in depth reviews)

- Admiral Markets Review (read our in depth reviews)

- SpreadEx Review (read our in depth reviews)

- HYCM Review (read our in depth reviews)

- Axi Review (read our in depth reviews)

- Swissquote Review (read our in depth reviews)

New Zealand Broker New Zealand Broker Alternatives

Read about and compare New Zealand Broker New Zealand Broker alternatives. We have indepth side by side comparisons to help you find New Zealand Broker New Zealand Broker related brokers.

- IC Markets Alternatives

- Roboforex Alternatives

- NordFX Alternatives

- XTB Alternatives

- Pepperstone Alternatives

- XM Alternatives

- eToro Alternatives

- FXPrimus Alternatives

- easyMarkets Alternatives

- Trading 212 Alternatives

- Admiral Markets Alternatives

- SpreadEx Alternatives

- HYCM Alternatives

- Axi Alternatives

- Swissquote Alternatives

IC Markets

IC Markets

Roboforex

Roboforex

NordFX

NordFX

XTB

XTB

Pepperstone

Pepperstone

XM

XM

eToro

eToro

FXPrimus

FXPrimus

easyMarkets

easyMarkets

Trading 212

Trading 212

Admiral Markets

Admiral Markets

SpreadEx

SpreadEx

HYCM

HYCM

Axi

Axi

Swissquote

Swissquote