Best Netherlands Brokers & Netherland Trading Platforms

When searching for the best Netherlands brokers, consider factors such as reputation, regulatory compliance, range of tradable assets, trading platforms, research and analysis tools, and associated fees. Conduct thorough research to find brokers that align with your trading needs and provide a reliable and transparent trading experience.

Netherlands brokers play a vital role as intermediaries, granting traders access to a diverse range of markets, including EU and international stock exchanges. These brokers adhere to stringent regulations imposed by bodies like BaFin and GDPR, ensuring transparency and investor protection. Alongside facilitating the buying and selling of financial assets, Netherlands brokers offer comprehensive services such as trading platforms, research and analysis, financial services, and portfolio management. Fees and commissions vary across brokers and services provided. For an extensive overview of Netherlands brokers and trading platforms, our guide offers valuable insights. It covers comparisons of Netherlands trading platforms, selecting the right broker, features of Netherlands trading tools, funding options, withdrawal methods, and associated costs. Make informed decisions and optimize your trading experience with our informative guide.

Best Netherlands Brokers & Netherland Trading Platforms Table of Contents

- Top Brokerage Firms in the Netherlands: A Comprehensive Guide

- How do I choose the right broker in the Netherlands?

- What are the fees and commissions associated with Netherlands brokers?

- What investment products can I trade with Netherlands brokers?

- Are Netherlands brokers regulated by any financial authorities?

- What is the minimum deposit required to open an account with a Netherlands broker?

- How can I compare the trading platforms offered by Netherlands brokers?

- Are there any restrictions on non-residents opening brokerage accounts in the Netherlands?

- What are the tax implications of trading with a Netherlands broker?

- How do Netherlands brokers handle client funds and securities?

- Can I trade international stocks with a Netherlands broker?

- Are there any specific trading strategies or tools Netherlands brokers offer?

- What is the level of customer service provided by Netherlands brokers?

- Can I open a margin or options trading account with a Netherlands broker?

- How can I conduct research and analysis using the resources provided by Netherlands brokers?

- Do Netherlands brokers offer any educational resources or training programs?

- What is the process for opening an account with a Netherlands broker?

- Can I transfer my existing brokerage account to a Netherlands broker?

- Do Netherlands brokers offer mobile trading apps?

- What are the pros and cons of using Netherlands brokers compared to international brokers?

- Pros of Netherlands Brokers:

- Cons of Netherlands Brokers:

- Brokers and Trading Platforms in Netherlands Verdict

- Empowering Retail Investor Accounts in the Netherlands

- Best Netherlands Brokers & Netherland Trading Platforms List Compared

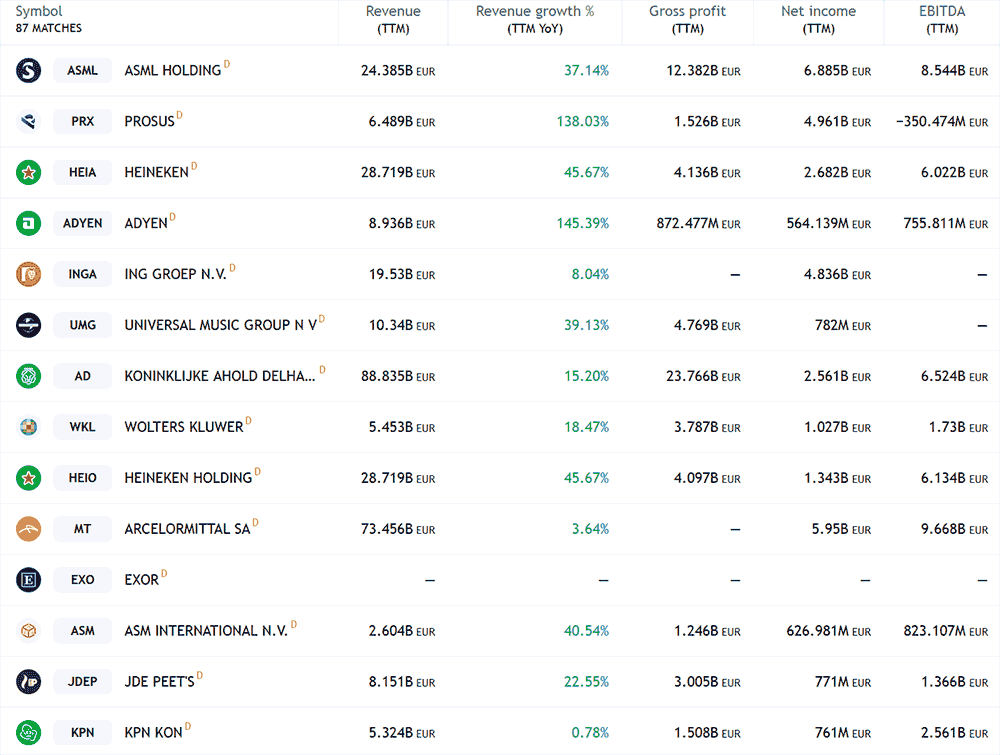

Top Brokerage Firms in the Netherlands: A Comprehensive Guide

The Netherlands boasts a thriving financial market with many online brokers. Some of the best online brokers in the country include brokerage firms like IC Markets, RoboForex, XTB, AvaTrade and XM, all of which are available in the Netherlands. These brokers offer a wide range of services, competitive fees, and innovative platforms to meet the needs of both novice and experienced traders.

These brokers are crucial in facilitating financial transactions, providing investment advice, and offering trading platforms for individuals and businesses. Here are a few unique texts explaining some of the top brokers in the Netherlands:

-

IC Markets: Experience Seamless Trading IC Markets stands out as one of the best brokers in the Netherlands, offering a seamless trading experience. With their user-friendly platform and advanced tools, investors can easily navigate the financial markets. Whether a beginner or an experienced trader, IC Markets provides educational resources and personalized support to help you make informed investment decisions. With a strong focus on security and reliability, IC Markets ensures that your funds and personal information are safeguarded, allowing you to trade with peace of mind.

-

RoboForex: Your Gateway to Diverse Investments RoboForex is widely recognized as a leading broker in the Netherlands, offering a wide range of investment opportunities. Their platform provides access to global markets, allowing investors to diversify their portfolios across various asset classes, including stocks, bonds, commodities, and cryptocurrencies. With RoboForex's comprehensive research tools and expert analysis, you can stay ahead of market trends and make well-informed investment choices. Furthermore, their intuitive interface and responsive customer support make it easy for investors of all levels to engage in successful trading.

-

XTB: Empowering Traders with Knowledge XTB is a brokerage firm in the Netherlands that focuses on empowering traders through knowledge and education. They go beyond just providing a trading platform and offer many educational resources, including webinars, tutorials, and market insights. By equipping traders with the necessary skills and understanding, XTB aims to enhance their clients' trading capabilities and increase their chances of success. With a strong emphasis on continuous learning, XTB cultivates a community of informed traders who can navigate the financial markets confidently.

-

XM : Streamlined Trading for Busy Individuals XM caters to busy individuals who seek a straightforward and efficient trading experience. Their platform is designed to be intuitive and user-friendly, ensuring that even those with limited trading knowledge can easily engage in the financial markets. XM provides a range of features, such as automated trading, real-time market data, and customizable dashboards, allowing investors to trade conveniently and efficiently. Additionally, their responsive customer support team can readily assist clients with queries or concerns, ensuring a smooth trading experience.

CFDs are complex instruments with a high risk of losing money rapidly due to leverage. 70 - 88% of retail investor accounts lose money when trading CFDs with these providers. You should consider whether you understand how CFDs work and whether you can afford to risk losing your money. Losses can exceed deposits.

How do I choose the right broker in the Netherlands?

Choosing the right broker in the Netherlands is a crucial decision that can significantly impact your trading and investment experience. Here are some key considerations to help you select the right broker:

-

Regulation: Ensure that the broker is regulated by reputable financial authorities such as the Dutch Authority (AFM) and operates within the framework of top-tier regulators like the European Securities and Markets Authority (ESMA). The regulation provides a level of security and investor protection.

-

Fees and Commissions: Compare the fee structures of different brokers, including trading fees, spreads, and any additional charges. Look for brokers with competitive and transparent pricing to minimize your trading costs.

-

Trading Platforms: Evaluate the trading platforms offered by brokers. Look for user-friendly interfaces, advanced charting tools, real-time market data, and reliable order execution. The platform should align with your trading style and provide a seamless experience.

-

Product Range: Consider the variety of investment products available through the broker. Ensure they offer access to the specific asset classes, such as stocks, ETFs, forex, and commodities, that you intend to trade.

-

Customer Service: Assess the level of customer service provided by the broker. Prompt and knowledgeable support is essential, especially when you need assistance with account-related matters or technical issues.

-

Research and Analysis Tools: Look for brokers that offer comprehensive research and analysis tools. Access to market news, research reports, technical analysis indicators, and educational resources can enhance your decision-making process.

-

Account Types and Minimum Deposit: Consider the types of accounts offered by the broker and their minimum deposit requirements. Choose a broker that aligns with your budget and investment goals.

-

Security and Fund Protection: Ensure that the broker maintains segregated client accounts and provides additional security measures, such as negative balance protection, to safeguard your funds and assets.

-

Reputation and Reviews: Research the broker's reputation and read user reviews to gauge customer satisfaction and reliability. Look for brokers with a positive track record and a strong reputation within the industry.

-

Personal Preferences: Consider your individual preferences and trading style. Factors such as available trading tools, educational resources, and access to specific markets may vary among brokers. Choose a broker that aligns with your specific needs and preferences.

What are the fees and commissions associated with Netherlands brokers?

Regarding fees and commissions associated with Netherlands brokers, it's important to understand the various charges you may encounter while trading. While the specific fee structure may vary from broker to broker, some common elements must be considered.

-

Trading Fees: One of the primary fees you'll come across is the trading fee, which is charged when you execute a trade. This fee can be a fixed amount or a percentage of the trade value. Some brokers may offer tiered fee structures where the fee decreases as your trade value increases.

-

Spread: The spread refers to the difference between the buying and selling prices of an asset. It represents the broker's profit. Brokers may charge a wider spread, especially for more illiquid assets, which can affect your overall trading costs.

-

Commissions: In addition to trading fees, brokers may charge commissions on certain types of trades or specific products. For example, if you engage in options trading, there may be a separate commission for each option contract you buy or sell.

-

Withdrawal Fees: Some brokers may impose withdrawal fees when you transfer funds from your trading account to your bank account. These fees can vary depending on the withdrawal method, such as wire transfers or electronic payment systems.

-

Inactivity Fees: Inactivity fees are charged when there is no trading activity in your account over a specific period. If you are a less frequent trader, be aware of any potential inactivity fees and their conditions.

-

Other Fees: It's essential to carefully review the broker's fee schedule for any additional charges that may apply. These could include account maintenance fees, currency conversion fees, or fees related to specific services like accessing real-time market data or using advanced trading tools.

What investment products can I trade with Netherlands brokers?

Netherlands brokers provide a diverse range of investment products to cater to the needs and preferences of different traders and investors. You can access various asset classes and financial instruments when trading with Netherlands brokers. Here are some of the common types of investment products you can trade:

-

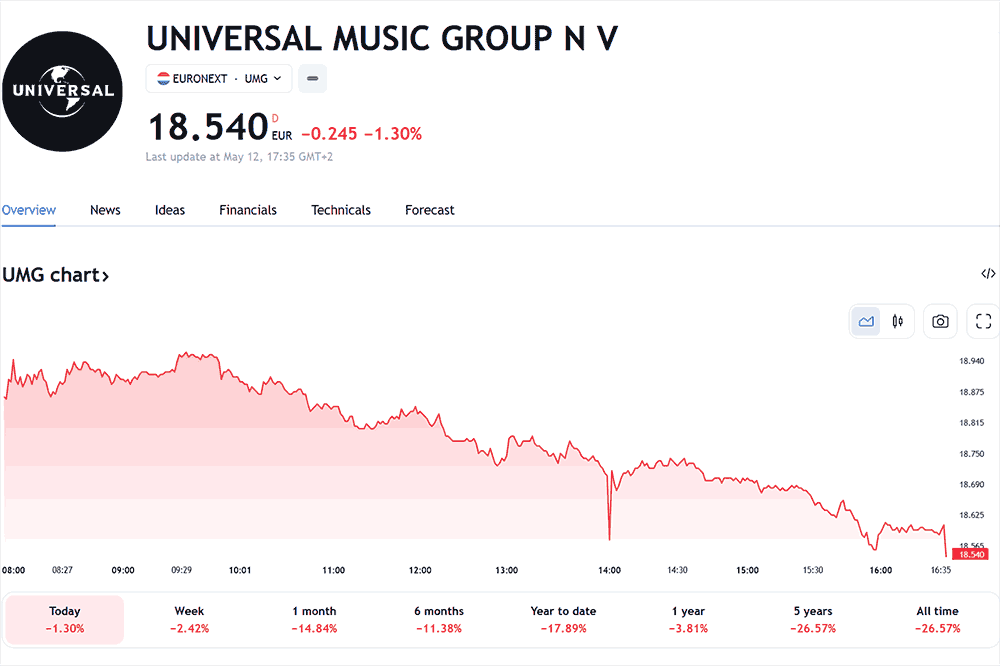

Stocks: Netherlands brokers offer the opportunity to trade stocks listed on major stock exchanges (real stocks), including domestic exchanges such as the Amsterdam Stock Exchange (AEX) and international exchanges worldwide. You can invest in individual equities of companies and potentially benefit from capital appreciation and dividends.

-

Exchange-Traded Funds (ETFs): ETFs are investment funds that trade on stock exchanges, mirroring the performance of a specific index, sector, or asset class. Netherlands brokers provide access to a wide range of ETFs, allowing you to diversify your portfolio across different markets and investment themes.

-

Mutual Funds: Netherlands brokers offer access to a variety of mutual funds, which pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. Professional fund managers manage mutual funds and provide an opportunity to invest in a broad range of securities.

-

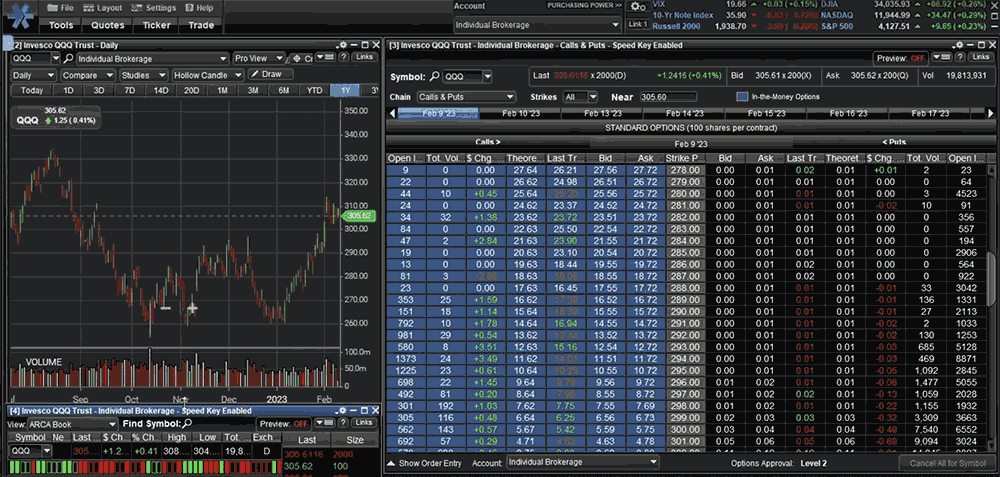

Options and Futures: Options and futures are derivative instruments that enable traders to speculate on the price movements of underlying assets without owning them directly. Netherlands brokers provide the infrastructure for trade options and futures contracts, allowing you to use more advanced trading strategies.

-

Forex (Foreign Exchange): The forex market is the largest and most liquid financial market globally. You can trade currency pairs with Netherlands brokers, speculating on the exchange rate fluctuations between different currencies. Forex trading offers opportunities for both short-term speculation and long-term investment strategies.

Speaking of forex trading, the Netherlands brokers excel in providing comprehensive trading services in this area. They collaborate with the best forex brokers in the industry to ensure that retail investors have access to a diverse range of currency pairs and competitive pricing. With their user-friendly trading platforms, investors can easily execute trades and monitor their positions, all from the comfort of their homes.

-

Bonds and Fixed Income Securities: Netherlands brokers provide access to bonds and fixed income securities, allowing you to invest in government bonds, corporate bonds, and other fixed income instruments. These investments provide regular interest payments and are often less volatile than equities.

-

Commodities: With Netherlands brokers, you can trade commodities such as gold, silver, oil, natural gas, agricultural products, and more. Commodities offer a way to diversify your portfolio and potentially benefit from price movements in these tangible assets.

-

CFD Trading in the Netherlands: CFD trading has revolutionized the investment landscape in the Netherlands, offering a unique avenue for Dutch traders to unlock new opportunities. By trading Contracts for Difference (CFDs), investors can speculate on price movements of diverse financial instruments without owning the underlying assets using very high-risk leverage (borrowed money from the Netherlands brokerage firm).

-

Trading CFDs can be exciting and potentially profitable, but it's important to understand that it also carries risks. For retail investors, the allure of quickly making money can overshadow the fact that losing money is a real possibility. However, these risks can be mitigated with the right tools and knowledge. Netherlands brokers and trading platforms come into play, offering a wide range of services tailored to the needs of retail investors.

-

Cryptocurrencies: The popularity of cryptocurrencies has grown significantly in recent years. Many Netherlands brokers now offer the opportunity to trade popular cryptocurrencies like Bitcoin, Ethereum, and others, providing exposure to the digital currency market.

Are Netherlands brokers regulated by any financial authorities?

Yes, Netherlands brokers are regulated by financial authorities to ensure the integrity and transparency of their operations. The financial regulatory framework in the Netherlands aims to protect investors, promote fair and efficient markets, and maintain the financial system's stability. Here are some key points regarding the regulation of Netherlands brokers:

-

Dutch Authority: The primary regulatory body overseeing financial markets in the Netherlands is the Dutch Authority (De Autoriteit Financiële Markten or AFM). AFM is an independent supervisory authority responsible for regulating and overseeing the conduct of financial institutions, including brokers, investment firms, and banks.

-

European Union Regulations: As a member state of the European Union (EU), the Netherlands also adheres to EU regulations and directives related to financial services. EU regulations establish a harmonized framework for financial markets across member countries, ensuring consistent standards and investor protection.

-

Top-Tier Regulators: The Netherlands, as part of the EU, benefits from the oversight of top-tier regulators such as the European Securities and Markets Authority (ESMA). ESMA provides guidelines, policies, and regulations that impact the operations of Netherlands brokers, further enhancing investor protection and market integrity.

-

Investor Protection: The regulatory framework in the Netherlands focuses on safeguarding the interests of investors. Netherlands brokers must comply with strict rules regarding client fund segregation, disclosure requirements, transparency, and fair treatment of customers.

-

Licensing and Authorization: To operate legally, Netherlands brokers must obtain the necessary licenses and authorizations from regulatory bodies. These licenses ensure that brokers meet certain financial and operational standards, including capital adequacy, risk management, and compliance with regulatory obligations.

-

Compliance and Enforcement: The regulatory authorities in the Netherlands actively monitor and enforce compliance by conducting regular inspections, audits, and investigations. They have the power to impose fines, penalties, and other disciplinary measures for violations of regulations, ensuring that brokers adhere to the prescribed standards.

What is the minimum deposit required to open an account with a Netherlands broker?

Generally, some Netherlands brokers may offer basic or standard account types that require a relatively low minimum deposit, typically ranging from around €100 to €500. These accounts are often designed for retail investors or those starting with smaller capital amounts.

Conversely, some brokers may offer premium or VIP account types with additional features and benefits, but these may require a higher minimum deposit. The minimum deposit for such accounts can range from a few thousand euros to tens of thousands.

How can I compare the trading platforms offered by Netherlands brokers?

When choosing brokers and trading platforms in the Netherlands, you must compare various factors to ensure you select the right one for your needs. Here are the key things to consider and compare:

-

Regulation: Verify that a reputable financial authority, such as the Dutch Authority or top-tier regulators within the European Union, regulates the broker. There are many benefits to regulatory oversight from your local regulator provides security and investor protection.

-

Trading Costs: Compare the fees and commissions charged by different brokers, including trading fees, spreads, withdrawal fees, and any other applicable charges. Look for brokers with competitive and transparent pricing structures. Check inactivity fee charges, initial deposit requirements, and additional fees apply from your 3rd party payment provider when withdrawing to 3rd party payment systems and currency conversion is involved, for example, broker to PayPal or broker to central bank withdrawals in EU countries. Find a broker in the Netherlands with the lowest fees per account basis.

-

Product Range: Assess the range of investment products offered by brokers. Look for access to stocks, ETFs, mutual funds, options, futures, forex, and other instruments you wish to trade.

-

Trading Platforms: Evaluate the trading platforms provided by brokers. Look for user-friendly interfaces, advanced charting tools, real-time market data, order execution speed, and compatibility with desktop and mobile devices.

-

Market Access: Consider the availability of domestic and international markets. Ensure the broker offers access to the desired exchanges and markets where you intend to trade.

-

Research and Analysis Tools: Assess the availability of research and analysis tools. Look for features such as market news, fundamental data, technical analysis indicators, research reports, and educational resources to support your trading decisions.

-

Customer Service: Evaluate the level of customer service provided by brokers. Look for responsive and knowledgeable support through various phone, email, and live chat channels. Consider their availability during trading hours.

-

Account Types and Minimum Deposit: Compare the types of accounts offered by brokers, including standard accounts, margin accounts, and options trading accounts. Check the minimum deposit requirements for account opening.

-

Security and Fund Protection: Assess how brokers handle client funds and securities. Look for brokers maintaining segregated accounts and providing additional security measures, such as negative balance protection.

-

Trading Tools and Features: Consider the availability of advanced trading tools and features, such as social trading, demo accounts, algorithmic trading options, and access to third-party software.

-

Mobile Trading: Evaluate whether brokers offer mobile trading platforms or apps that allow you to trade and monitor your investments on the go.

-

Educational Resources: Assess the availability of educational resources, webinars, tutorials, and training programs offered by brokers to enhance your trading knowledge and skills.

-

User Reviews and Reputation: Research user reviews, ratings, and the overall reputation of the broker to gauge customer satisfaction and reliability.

-

Additional Services: Consider any additional services offered by brokers, such as retirement accounts, robo-advisory services, or access to initial public offerings (IPOs).

Are there any restrictions on non-residents opening brokerage accounts in the Netherlands?

Netherlands brokers generally do not have restrictions on non-resident opening accounts. Dutch retail traders can enjoy seamless account opening, trading complex instruments, low trading costs, access to high-risk financial instruments, commission-free trading a demo account in Dutch using virtual money, access to modern investment platforms and a trading app, financial institution-level trading speed, access to a range of financial products like stocks, crypto trading, ETF trading, commodity trading, major indices trading, access to free stock news on an innovative platform, access to a range of deposit and withdrawal methods including bank transfer, PayPal, Skrill and Apple Pay, Dutch customers can access customer support and live chat in Dutch. They welcome investors from around the world, allowing individuals to access the Dutch financial markets and take advantage of the opportunities available.

What are the tax implications of trading with a Netherlands broker?

Tax implications for trading with a Netherlands broker depend on various factors, including your country of residence and the specific tax laws in place. It is advisable to consult with a tax professional or accountant familiar with your local tax regulations and the taxation policies related to international investments in the Netherlands.

How do Netherlands brokers handle client funds and securities?

Netherlands brokers must adhere to strict regulations regarding handling client funds and securities. They typically maintain segregated accounts to keep client funds separate from the broker's operational funds. This segregation provides an additional layer of security and helps protect client assets during the broker's insolvency.

Can I trade international stocks with a Netherlands broker?

Many Netherlands brokers offer access to international stock exchanges, allowing you to trade a wide range of international stocks. You can diversify your portfolio with a Netherlands broker by investing in individual equities from various global markets.

Are there any specific trading strategies or tools Netherlands brokers offer?

Netherlands brokers often provide a range of trading tools and resources to assist investors in executing their trading strategies. These may include real-time market data, charting tools, technical analysis indicators, educational materials, and research reports. Some brokers even offer advanced trading platforms with customizable features to accommodate various trading strategies.

What is the level of customer service provided by Netherlands brokers?

The level of customer service offered by Netherlands brokers can vary. However, many brokers strive to provide excellent customer support through multiple phones, email, and live chat channels. They aim to assist clients with inquiries, technical issues, and account-related matters promptly and efficiently.

Can I open a margin or options trading account with a Netherlands broker?

Netherlands brokers often offer margin trading and options trading facilities. However, it's important to note that these trading activities involve additional risks and may require meeting certain criteria or fulfilling specific margin requirements set by the broker.

How can I conduct research and analysis using the resources provided by Netherlands brokers?

Netherlands brokers typically provide various resources for conducting research and analysis. These include fundamental data, company reports, analyst recommendations, economic calendars, and market insights. Additionally, some brokers offer educational resources such as webinars, tutorials, and investment guides to help clients enhance their trading knowledge and skills.

Do Netherlands brokers offer any educational resources or training programs?

Many Netherlands brokers understand the importance of investor education and provide educational resources and training programs. These resources include online courses, educational articles, video tutorials, and webinars. By utilizing these materials, investors can deepen their understanding of the financial markets and improve their trading strategies.

What is the process for opening an account with a Netherlands broker?

The process for opening an account with a Netherlands broker is typically straightforward. It usually involves completing an online application form, providing identification documents, and verifying your identity. Once your application is approved and the necessary documentation is submitted, you can fund your account and start trading.

Can I transfer my existing brokerage account to a Netherlands broker?

Transferring your existing brokerage account to a Netherlands broker is often possible. Many brokers offer a seamless account transfer process, allowing you to consolidate your investments and enjoy the services the new broker provides. However, it is advisable to check with your current broker and the Netherlands broker to understand the specific requirements and procedures involved in the account transfer.

Do Netherlands brokers offer mobile trading apps?

Yes, most Netherlands brokers recognize the importance of mobile accessibility and offer mobile trading apps. These apps enable clients to trade, monitor their investments, access real-time market data, and manage their accounts conveniently from their smartphones or tablets.

What are the pros and cons of using Netherlands brokers compared to international brokers?

Using Netherlands brokers compared to international brokers has its own set of advantages and considerations. Let's explore some of the pros and cons:

Pros of Netherlands Brokers:

One of the key advantages of the Netherlands brokers is their low trading fees. These online brokers understand that cost-effectiveness is crucial for retail investors, especially those starting with limited capital. By offering competitive and transparent pricing structures, they make it more accessible for individuals to participate in the financial markets.

-

Local Expertise: Netherlands brokers have an in-depth understanding of the Dutch financial markets, including specific regulations, local investment opportunities, and market dynamics.

-

Regulatory Oversight: Netherlands brokers operate under the supervision of top-tier regulators within the European Union. The regulation provides a certain level of security and investor protection for residents in the Netherlands.

-

Language and Cultural Alignment: Engaging with a Netherlands broker can offer language support and cultural familiarity, making it easier to communicate and access customer service.

-

Knowledge of Local Taxation: Netherlands brokers are well-versed in local tax laws and can guide you on tax implications related to your investments.

Cons of Netherlands Brokers:

-

Limited International Market Coverage: While Netherlands brokers do offer access to international markets, their focus may primarily be on the Dutch and European markets. If you are interested in non-European markets, you might find a broader range of options with international brokers.

-

Potential Lack of Global Research Coverage: Netherlands brokers may prioritize local research and analysis, which might be less comprehensive for international markets. International brokers could be more suitable if you heavily rely on extensive global research coverage.

-

Language Limitations: While Netherlands brokers provide services in multiple languages, their primary focus is often Dutch or English. International brokers might offer more language options if you prefer trading in a different language.

-

Availability of Specialized Products: International brokers might have a wider range of specialized products or investment opportunities that may not be as readily available with Netherlands brokers. If you have specific requirements, it's worth comparing the offerings of international brokers.

Brokers and Trading Platforms in Netherlands Verdict

Empowering Retail Investor Accounts in the Netherlands

Regarding online brokers in the Netherlands, choosing the best one for your needs is essential. The best online brokers offer low fees and a mobile trading platform that allows investors to trade on the go. This flexibility ensures that investors can seize opportunities whenever they arise, regardless of their physical location. Moreover, the best brokers offer broad market access, enabling investors to trade various financial instruments such as trading forex, retail CFD accounts, ETFs, and investment funds using an online broker investment platform.

Social trading is another innovative feature offered by Netherlands brokers. By integrating social trading platforms into their services, investors can learn from experienced traders and copy their trades. This form of collaborative investing creates a community-driven environment where retail investors can benefit from the expertise of others.

Best Netherlands Brokers & Netherland Trading Platforms List Compared

| Featured Netherlands Broker Trading Platform | Account Features | Trading Features |

|---|---|---|

| Used By: 180,000 Instruments Available: 232 Stocks Available: 2100 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 61 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mirror Trader, ZuluTrade, Web Trader, cTrader, Mac Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 53 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 35 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 10 USD / 10 EUR |

Platforms: MT4, MT5, Mac, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 200,000 Instruments Available: 1000 Stocks Available: 99 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 80 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: Web Trader, MT4, MT5, AvaTradeGo, AvaOptions, Mac, Mobile Apps, ZuluTrade, DupliTrade, MQL5 Negative Balance Protection: Inactivity Fee: No 71% of retail CFD accounts lose moneyVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 10000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 60 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, IRESS, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 250,000 Instruments Available: 4000 Stocks Available: 1696 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 57 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 0 |

Platforms: MT4, Mirror Trader, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Visit |

|

| Used By: 89,000 Instruments Available: 100 Stocks Available: 60 US Stocks: No UK Stocks: No German Stocks: Yes Japanese Stocks: No Indices: Yes Forex Pairs Available: 70 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mac, ZuluTrade, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your moneyVisit |

|

| Used By: 10,000,000 Instruments Available: 1000 Stocks Available: 160 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 55 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 5 |

Platforms: MT4, MT5, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77.74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.Visit |

|

| Used By: 20,000,000 Instruments Available: 2000 Stocks Available: 2042 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 50 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 50 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 51% of retail investor accounts lose money when trading CFDs with this provider.Visit |

|

| Used By: 15,000,000 Instruments Available: 10000 Stocks Available: 1731 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 177 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.Visit |

|

| Used By: 10,000 Instruments Available: 15000 Stocks Available: 1000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 55 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 10 US Stocks: Yes UK Stocks: No German Stocks: No Japanese Stocks: No Indices: Yes Forex Pairs Available: 40 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes Losses can exceed depositsVisit |

|

| Used By: 300,000 Instruments Available: 100 Stocks Available: 0 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 150 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1000 |

Platforms: MT4, MT5, ZuluTrade, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 1000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: No Forex Pairs Available: 100 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 0 |

Platforms: MT4, Mac, ZuluTrade, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 4,000,000 Instruments Available: 2200 Stocks Available: 2000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: No Indices: Yes Forex Pairs Available: 67 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your moneyVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 0 US Stocks: No UK Stocks: No German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 45 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

Best Netherlands Broker Netherlands Broker Reviews

Read our details broker Netherlands Broker Netherlands Broker reviews, you will find something useful if you are shortlisting a Netherlands Broker Netherlands Broker and trading platform.

- IC Markets Review (read our in depth reviews)

- Roboforex Review (read our in depth reviews)

- AvaTrade Review (read our in depth reviews)

- FP Markets Review (read our in depth reviews)

- XTB Review (read our in depth reviews)

- Pepperstone Review (read our in depth reviews)

- XM Review (read our in depth reviews)

- eToro Review (read our in depth reviews)

- Trading 212 Review (read our in depth reviews)

- SpreadEx Review (read our in depth reviews)

- HYCM Review (read our in depth reviews)

- Swissquote Review (read our in depth reviews)

- Axi Review (read our in depth reviews)

- Markets.com Review (read our in depth reviews)

- Eightcap Review (read our in depth reviews)

Netherlands Broker Netherlands Broker Alternatives

Read about and compare Netherlands Broker Netherlands Broker alternatives. We have indepth side by side comparisons to help you find Netherlands Broker Netherlands Broker related brokers.

- IC Markets Alternatives

- Roboforex Alternatives

- AvaTrade Alternatives

- FP Markets Alternatives

- XTB Alternatives

- Pepperstone Alternatives

- XM Alternatives

- eToro Alternatives

- Trading 212 Alternatives

- SpreadEx Alternatives

- HYCM Alternatives

- Swissquote Alternatives

- Axi Alternatives

- Markets.com Alternatives

- Eightcap Alternatives

IC Markets

IC Markets

Roboforex

Roboforex

AvaTrade

AvaTrade

FP Markets

FP Markets

XTB

XTB

Pepperstone

Pepperstone

XM

XM

eToro

eToro

Trading 212

Trading 212

SpreadEx

SpreadEx

HYCM

HYCM

Swissquote

Swissquote

Axi

Axi

Markets.com

Markets.com

Eightcap

Eightcap