Best Negative Balance Protection Brokers

In the intricate world of online trading, safeguarding one's investments is paramount. Negative Balance Protection is a crucial shield against the volatile tide of the markets, ensuring traders cannot lose more money than they have deposited in their accounts. A dependable well financially regulated broker offering this protection is not just a preference, but a necessity. In this definitive guide, we sieve through the myriad of brokers to identify those that stand tall with a reliable negative balance protection policy.

Best Negative Balance Protection Brokers Table of Contents

- Negative balance protection brokers

- What is Negative Balance Protection (NBP), and how does it work for brokers and traders?

- How does Negative Balance Protection prevent traders from incurring losses beyond their initial investment?

- What are the key features and benefits of using brokers that offer Negative Balance Protection?

- How do brokers implement Negative Balance Protection in their trading platforms?

- What happens when a trader's account balance falls below zero, and how does NBP come into play?

- Are there any limitations or exceptions to Negative Balance Protection policies?

- How do brokers calculate and enforce margin requirements to ensure NBP effectiveness?

- What are the differences between NBP offered by different brokers, and how should traders choose the right one?

- What risks or challenges do brokers face when offering Negative Balance Protection?

- How does NBP impact traders' risk management strategies and overall trading experience?

- Do brokers charge additional fees or adjust trading conditions to provide Negative Balance Protection?

- How do NBP compliance and regulation vary across jurisdictions and financial markets?

- Can traders still trade on leverage while benefiting from Negative Balance Protection?

- What happens in extreme market conditions where significant price gaps occur and NBP is in effect?

- How do brokers handle situations where multiple positions contribute to a negative account balance?

- Before choosing a broker, what steps should traders take to understand the NBP policies and implications?

- Negative Balance Protection Brokers Verdict

- Best Negative Balance Protection Brokers List Compared

Negative balance protection brokers

In the world of forex trading, protecting traders from potential losses beyond their deposited amount is a critical concern. It is where Negative Balance Protection comes into play, providing a safety net against adverse market conditions. For forex traders, Negative Balance Protection guarantees that their account balance cannot fall below zero, ensuring peace of mind and risk management.

We investigate how Negative Balance Protection works, its benefits for traders, and its implications in the forex market. We will explore how it protects traders per account and why many brokers offer this feature. Additionally, we'll discuss how professional traders and even those with brokerage firms can benefit from Negative Balance Protection. By understanding this risk management tool and comparing fees, traders can make informed decisions and choose the best brokers with user-friendly platforms, low spreads, and fast execution to safeguard against significant losses. Let's delve into Negative Balance Protection and its significance in forex trading.

What is Negative Balance Protection (NBP), and how does it work for brokers and traders?

Negative Balance Protection (NBP) is a must have risk tool regulated forex brokers and trading platforms offer to protect traders from incurring losses beyond their initial investment. NBP makes sure a retail traders funed account never goes under zero and you end up in dept to your broker. Here's how NBP works for brokers and traders:

-

Safety Net: NBP acts as a safety net for traders, preventing them from facing debt obligations to brokers in case of significant market volatility or unexpected price gaps.

-

Automatic Protection: When a trader's account balance falls into negative territory due to losses on open positions, the broker automatically covers the negative balance, ensuring traders do not owe additional money.

-

Protection Mechanism: NBP is a standard feature for many regulated forex brokers, protecting retail clients, especially new traders, from significant losses during highly volatile market conditions.

-

Prospective Firms: Traders should research prospective firms carefully and choose brokers with negative balance protection to safeguard their trading capital.

How does Negative Balance Protection prevent traders from incurring losses beyond their initial investment?

Negative Balance Protection limits a trader's potential losses to the amount initially deposited in their trading account. Here's how it prevents traders from incurring losses beyond their initial investment:

-

Margin Calls: When a trader's losses on open positions approach the total account balance, the broker issues a margin call, requesting the trader to deposit additional money to maintain their positions.

-

Automatically Closing Positions: If the market moves quickly and drastically against a trader's position, and their account balance cannot cover the losses, the broker will automatically close the open positions to prevent the account from going into a negative balance.

-

NBP Guarantee: Guaranteed Negative Balance Protection ensures that traders are not liable for losses exceeding their account balance, protecting them from potential debt.

-

Protection Level: The level of protection varies among brokers, but the NBP feature generally provides traders with peace of mind, knowing that their losses will be limited to the amount they have deposited in their trading account.

What are the key features and benefits of using brokers that offer Negative Balance Protection?

Brokers that offer Negative Balance Protection provide traders with several key features and benefits that enhance their trading experience and risk management strategies:

-

Limited Losses: Traders can be assured that their losses will never exceed the amount initially deposited in their account, providing a safety net during volatile market conditions.

-

No Debt Obligations: Negative Balance Protection ensures traders are not responsible for covering negative balances caused by significant market movements.

-

Risk Management Tool: NBP is an essential risk management tool, especially for retail traders and beginners exposed to high market volatility.

-

Regulatory Compliance: Brokers offering NBP are often regulated and adhere to strict financial standards, providing higher trust and transparency.

-

Peace of Mind: Traders gain peace of mind knowing that their account balance is protected, allowing them to focus on implementing their trading strategies without fearing substantial losses.

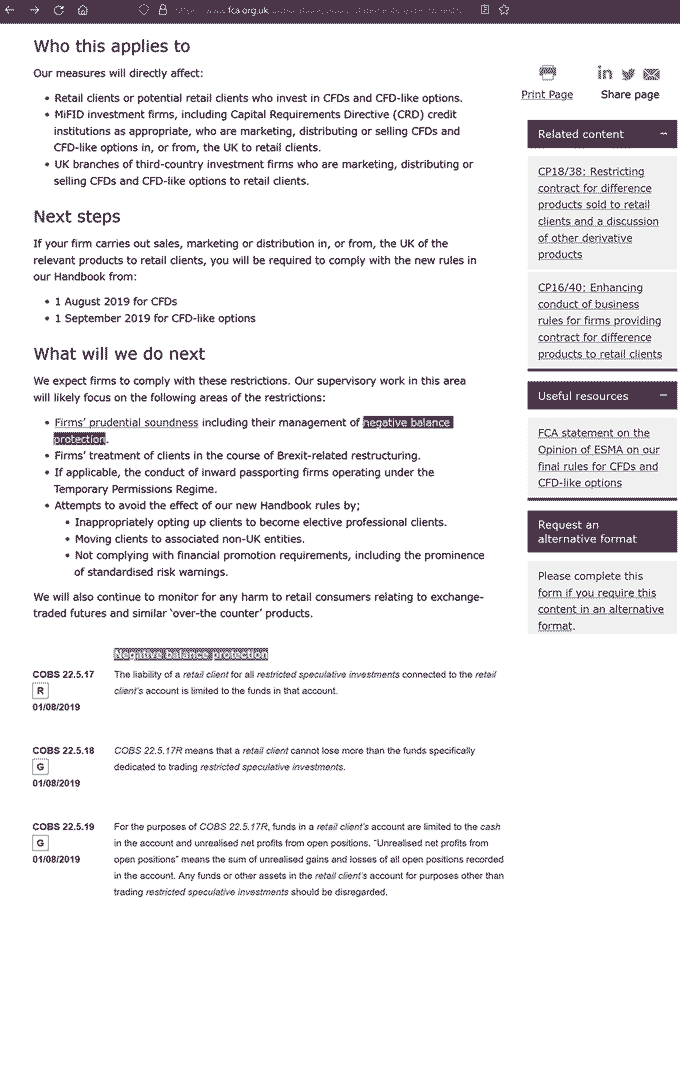

You can see the UK Financial Conduct Authorities negative balance protection requirement for brokers in the UK here and here.

How do brokers implement Negative Balance Protection in their trading platforms?

Brokers implement Negative Balance Protection in their trading platforms through several mechanisms and policies:

-

Account Monitoring: The trading platform continuously monitors each trader's real-time account balance and open positions.

-

Margin Call Notifications: When the account balance approaches zero or falls into a negative balance due to losses on open positions, the broker issues a margin call notification to the trader, requesting additional funds.

-

Automatic Position Closure: If the trader does not deposit additional funds to cover the losses after receiving the margin call, the broker automatically closes open positions to prevent the account from going further into a negative balance.

-

NBP Policy Disclosure: Brokers disclose their Negative Balance Protection policies in their terms and conditions to ensure transparency and to provide traders with a clear understanding of how the feature works.

What happens when a trader's account balance falls below zero, and how does NBP come into play?

When a trader's account balance falls below zero, NBP comes into play to protect the trader from incurring additional losses beyond their initial investment:

-

Automatic Protection: With NBP in place, the broker automatically covers the negative balance in the trader's account.

-

Absorption of Losses: The broker absorbs the losses generated from open positions, preventing the trader from facing debt obligations to the broker.

-

Balance Correction: The trader's account balance is corrected to zero or a positive balance, ensuring they do not owe any additional money to the broker.

-

Peace of Mind: NBP provides traders with peace of mind, knowing they will not face excessive losses beyond their account balance in highly volatile market conditions.

Are there any limitations or exceptions to Negative Balance Protection policies?

While Negative Balance Protection offers significant benefits, there are certain limitations and exceptions that traders should be aware of:

-

Guaranteed NBP: Some brokers may offer guaranteed Negative Balance Protection, which ensures that traders never owe more money than they initially deposited, even during extreme market conditions.

-

NBP Limited: However, the level of NBP protection can vary among brokers, and some may provide partial NBP, which means that traders may still face losses exceeding their deposited amount but not to the extent of unlimited negative balances.

-

Market Gaps: Extreme market conditions, such as price gaps due to news announcements or economic events, can result in temporary slippage, and NBP may not fully protect traders from these occurrences.

-

High Leverage: Utilizing high leverage can increase the risk of losses, and NBP may not wholly shield traders from the impact of highly leveraged trades.

How do brokers calculate and enforce margin requirements to ensure NBP effectiveness?

Brokers calculate and enforce margin requirements as a critical component of Negative Balance Protection to safeguard both traders' and the broker's financial stability:

-

Leverage Ratios: Brokers set specific leverage ratios for different currency pairs and financial instruments, determining the required margin for each trade.

-

Initial Margin: The initial margin is the minimum amount required as collateral to open a position, calculated based on the leverage ratio and trade size.

-

Maintenance Margin: Brokers enforce maintenance margin requirements to ensure traders maintain sufficient funds in their accounts to support open positions.

-

Margin Calls: Your broker can at any time send you a margin call, requesting additional funding to maintain your open postions.

-

Automatic Closure: Should the investor be unable to meet the margin call, the broker will automatically liquidate open positions to avert additional losses and potential negative balances.

What are the differences between NBP offered by different brokers, and how should traders choose the right one?

The level of Negative Balance Protection offered by brokers can vary, and traders should carefully consider the following factors when choosing the right broker:

-

Full Protection: Some brokers offer guaranteed Negative Balance Protection, ensuring that traders' losses are limited to their deposited amount, even in extreme market conditions.

-

Partial NBP: Other brokers may provide partial Negative Balance Protection, limiting the extent of negative balances but not guaranteeing full protection.

-

Leverage Limits: Consider brokers that impose reasonable leverage limits, as excessively high leverage can increase the risk of negative balances.

-

Regulation: Choose regulated forex brokers, as they are more likely to adhere to stringent NBP policies and financial standards.

-

Terms and Conditions: Review the broker's terms and conditions thoroughly to understand the extent of their Negative Balance Protection and any exceptions or limitations.

What risks or challenges do brokers face when offering Negative Balance Protection?

Brokers offering Negative Balance Protection may encounter certain risks and challenges:

-

Market Gaps: Extreme market conditions with rapid price movements or price gaps can create temporary slippage, making it challenging for brokers to protect traders from negative balances fully.

-

Capital Adequacy: Brokers must maintain sufficient capital reserves to cover potential losses from clients' negative balances, ensuring financial stability.

-

Margin Call Delays: Market volatility may result in delays in executing margin calls, leaving brokers vulnerable to potential losses between the margin call and closing positions.

-

Regulatory Compliance: Offering NBP requires brokers to comply with strict regulatory requirements and ensure transparency in risk management practices.

How does NBP impact traders' risk management strategies and overall trading experience?

Negative Balance Protection significantly impacts traders' risk management strategies and overall trading experience in the following ways:

-

Reduced Risk: NBP provides an extra layer of protection, minimizing the risk of incurring substantial losses beyond traders' deposited amount.

-

Peace of Mind: Traders can focus on implementing their trading strategies without the constant fear of encountering negative balances or debt obligations.

-

Confidence: NBP boosts traders' confidence, especially during high market volatility, allowing them to make more informed trading decisions.

-

Beginner-Friendly: Negative Balance Protection acts as a safety net for novice traders, enabling them to gain trading experience without excessive risk exposure.

Do brokers charge additional fees or adjust trading conditions to provide Negative Balance Protection?

Most brokers do not charge additional fees for offering Negative Balance Protection as it is a standard feature provided for the safety of their clients. However, traders should carefully review the broker's fee structure to understand if any fees or commissions are associated with their trading activities.

How do NBP compliance and regulation vary across jurisdictions and financial markets?

NBP compliance and regulation can vary significantly across different jurisdictions and financial markets:

-

Regulatory Standards: Regulated brokers in different jurisdictions may be subject to specific guidelines and standards concerning Negative Balance Protection.

-

Local Laws: Each country may have regulations governing NBP and how brokers must implement and disclose the feature.

-

Client Protections: Regulatory bodies prioritize client protection, and NBP is often seen as a critical measure to safeguard traders' interests.

-

Transparency: Brokers must be transparent in their NBP policies, ensuring that clients understand the level of protection they will receive.

Can traders still trade on leverage while benefiting from Negative Balance Protection?

Traders can still trade on leverage while benefiting from Negative Balance Protection. However, traders need to use leverage responsibly and be aware that higher leverage increases the risk of losses.

What happens in extreme market conditions where significant price gaps occur and NBP is in effect?

Negative Balance Protection may not fully protect traders from temporary slippage in extreme market conditions with significant price gaps. The following may occur:

-

Temporary Slippage: Traders may experience temporary slippage, where the execution of stop-loss orders may not occur precisely at the pre-set price due to rapid price movements.

-

Partial NBP: Brokers offering partial NBP may limit the extent of negative balances, but traders may still experience some losses beyond their account balance during extreme events.

How do brokers handle situations where multiple positions contribute to a negative account balance?

In situations where multiple positions contribute to a negative account balance, brokers follow specific protocols to protect traders:

-

Position Prioritization: Brokers prioritize closing positions based on their margin utilization and potential impact on the account balance.

-

Partial Closure: If the trader's negative balance is due to multiple positions, the broker may partially close some positions to reduce the negative balance.

-

Margin Call and Closure: Brokers may issue a margin call requesting additional funds to cover the negative balance. If the trader does not respond, the broker automatically closes positions to prevent further losses.

Before choosing a broker, what steps should traders take to understand the NBP policies and implications?

Traders should take the following steps to understand NBP policies and implications before choosing a broker:

-

Read Terms and Conditions: Thoroughly read the broker's terms and conditions to understand the extent of Negative Balance Protection offered.

-

Compare Brokers: To make an informed decision, compare different brokers' NBP policies, leverage limits, and regulatory compliance.

-

Seek regulation : Choose regulated forex brokers with a strong reputation for client protection and financial stability.

-

Ask Questions: Reach out to the broker's customer support team to ask any questions or seek clarification on NBP policies.

-

Risk Assessment: Assess your risk tolerance and trading strategies to determine if NBP is a critical feature for your trading activities.

Negative Balance Protection Brokers Verdict

Negative Balance Protection is a crucial risk management tool brokers provide to protect traders from incurring losses beyond their initial investment. Traders should carefully review brokers' NBP policies, leverage limits, and regulatory compliance to choose the right broker that aligns with their risk tolerance and trading preferences. By understanding how NBP works and its impact on trading activities, traders can benefit from a safer and more secure trading experience in the forex market.

Best Negative Balance Protection Brokers List Compared

| Featured Negative Balance Protection Broker Trading Platform | Account Features | Trading Features |

|---|---|---|

| Used By: 180,000 Instruments Available: 232 Stocks Available: 2100 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 61 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mirror Trader, ZuluTrade, Web Trader, cTrader, Mac Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 53 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 35 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 10 USD / 10 EUR |

Platforms: MT4, MT5, Mac, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 200,000 Instruments Available: 1000 Stocks Available: 99 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 80 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: Web Trader, MT4, MT5, AvaTradeGo, AvaOptions, Mac, Mobile Apps, ZuluTrade, DupliTrade, MQL5 Negative Balance Protection: Inactivity Fee: No 71% of retail CFD accounts lose moneyVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 10000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 60 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, IRESS, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 50 Stocks Available: 0 US Stocks: No UK Stocks: No German Stocks: No Japanese Stocks: No Indices: No Forex Pairs Available: 65 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Minimum Deposit: 10 |

Platforms: MT4, MT5, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 250,000 Instruments Available: 4000 Stocks Available: 1696 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 57 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 0 |

Platforms: MT4, Mirror Trader, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Visit |

|

| Used By: 89,000 Instruments Available: 100 Stocks Available: 60 US Stocks: No UK Stocks: No German Stocks: Yes Japanese Stocks: No Indices: Yes Forex Pairs Available: 70 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mac, ZuluTrade, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your moneyVisit |

|

| Used By: 10,000,000 Instruments Available: 1000 Stocks Available: 160 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 55 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 5 |

Platforms: MT4, MT5, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77.74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.Visit |

|

| Used By: 20,000,000 Instruments Available: 2000 Stocks Available: 2042 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 50 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 50 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 51% of retail investor accounts lose money when trading CFDs with this provider.Visit |

|

| Used By: 10,000 Instruments Available: 130 Stocks Available: 60 US Stocks: Yes UK Stocks: Yes German Stocks: No Japanese Stocks: No Indices: Yes Forex Pairs Available: 45 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, Mac, Mirror Trader, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 142,500 Instruments Available: 200 Stocks Available: 52 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 150 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Your capital is at riskVisit |

|

| Used By: 15,000,000 Instruments Available: 10000 Stocks Available: 1731 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 177 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.Visit |

|

| Used By: 10,000 Instruments Available: 148 Stocks Available: 64 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 40 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: $100 |

Platforms: MT4, MT5, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 15000 Stocks Available: 1000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 55 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 10 US Stocks: Yes UK Stocks: No German Stocks: No Japanese Stocks: No Indices: Yes Forex Pairs Available: 40 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes Losses can exceed depositsVisit |

Best Negative Balance Protection Broker Negative Balance Protection Broker Reviews

Read our details broker Negative Balance Protection Broker Negative Balance Protection Broker reviews, you will find something useful if you are shortlisting a Negative Balance Protection Broker Negative Balance Protection Broker and trading platform.

- IC Markets Review (read our in depth reviews)

- Roboforex Review (read our in depth reviews)

- AvaTrade Review (read our in depth reviews)

- FP Markets Review (read our in depth reviews)

- NordFX Review (read our in depth reviews)

- XTB Review (read our in depth reviews)

- Pepperstone Review (read our in depth reviews)

- XM Review (read our in depth reviews)

- eToro Review (read our in depth reviews)

- FXPrimus Review (read our in depth reviews)

- easyMarkets Review (read our in depth reviews)

- Trading 212 Review (read our in depth reviews)

- Admiral Markets Review (read our in depth reviews)

- SpreadEx Review (read our in depth reviews)

- HYCM Review (read our in depth reviews)

Negative Balance Protection Broker Negative Balance Protection Broker Alternatives

Read about and compare Negative Balance Protection Broker Negative Balance Protection Broker alternatives. We have indepth side by side comparisons to help you find Negative Balance Protection Broker Negative Balance Protection Broker related brokers.

- IC Markets Alternatives

- Roboforex Alternatives

- AvaTrade Alternatives

- FP Markets Alternatives

- NordFX Alternatives

- XTB Alternatives

- Pepperstone Alternatives

- XM Alternatives

- eToro Alternatives

- FXPrimus Alternatives

- easyMarkets Alternatives

- Trading 212 Alternatives

- Admiral Markets Alternatives

- SpreadEx Alternatives

- HYCM Alternatives

IC Markets

IC Markets

Roboforex

Roboforex

AvaTrade

AvaTrade

FP Markets

FP Markets

NordFX

NordFX

XTB

XTB

Pepperstone

Pepperstone

XM

XM

eToro

eToro

FXPrimus

FXPrimus

easyMarkets

easyMarkets

Trading 212

Trading 212

Admiral Markets

Admiral Markets

SpreadEx

SpreadEx

HYCM

HYCM