Best MT4 Brokers

When looking for a broker for MT4 trading, consider factors such as fees, trading platform, research tools, and customer support. Some top brokers for MT4 trading include IC Markets, Pepperstone, and XM. Research and compare options to find the best fit for your trading needs.

This MT4 brokers guide explains what MT4 Brokers are, the risks, and why people use MT4 Brokers and trading platforms to trade on world financial markets. The MT4 trading platform is widely available from a variety of brokers, making it accessible to traders around the world. We explain and compare MT4 Brokers and trading platforms, check MT4 Broker regulation and tradable financial instruments, MT4 trading tools, funding and withdrawal methods available with your MT4 Brokers trading platform.

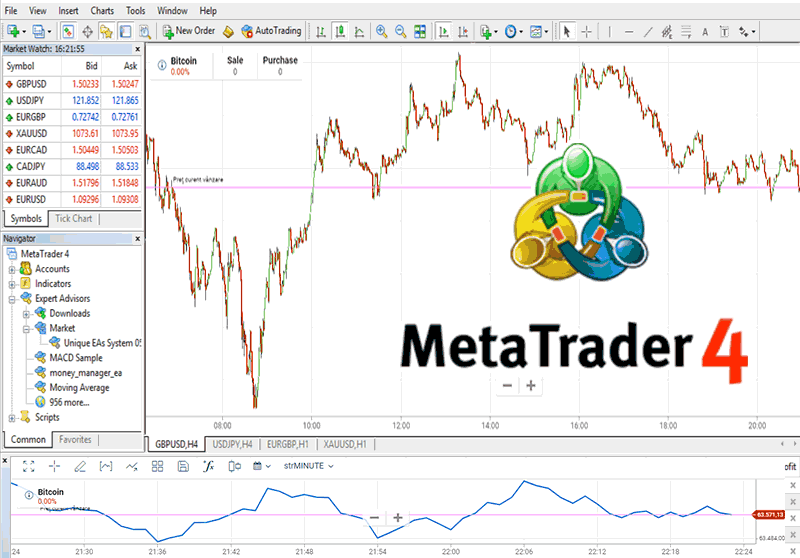

The MetaTrader 4 trading platform is known for its user-friendly interface, which is easy to navigate even for beginners. The MT4 platform offers customizable charts that allow traders to analyze market data and make informed trading decisions. MT4 allows automated trading through expert advisors (EAs), custom scripts that execute trades based on specific criteria or conditions. MT4 also allows traders to backtest their trading strategies using historical market data, which can help them refine their approach and increase their chances of success.

MT4 is available for mobile devices, allowing traders to stay connected to the markets and manage their trades. The MT4 platform has a large and active community of users who share strategies, tips, and advice, making it easier for traders to learn and improve their skills.

Best MT4 Brokers Table of Contents

- Features of MT4

- Choosing an MT4 Broker

- Pros and Cons of Using an MT4 Broker

- MT4 Broker Pros:

- MT4 Broker Cons:

- MT4 Broker Minimum Deposit Requirements

- How can I deposit and withdraw funds with an MT4 broker?

- What is the spread with MT4 brokers?

- What is the leverage with MT4 brokers?

- How can I deposit and withdraw funds with an MT4 broker?

- What is the spread with MT4 brokers?

- What is the leverage with MT4 brokers?

- Deposits and Withdrawals

- MT4 Brokers Spread, Leverage, and Commission

- What are the analytical tools available with MT4 brokers?

- What are the trading strategies supported by MT4 brokers?

- What is the security of funds with MT4 brokers?

- Devices that Support MT4

- Windows and Mac Computers

- Mobile Devices

- WebTrader

- VPS

- What is an MT4 broker?

- How To Choose an MT4 Broker?

- Are MT4 brokers regulated?

- What is the reputation of MT4 brokers?

- What is the trading experience like with MT4 brokers?

- Trading Costs

- Platform Features

- What is the customer support with MT4 brokers?

- What types of accounts are available with MT4 brokers?

- What is the educational material available with MT4 brokers?

- Top MT4 Brokers

- Minimum deposit for MT4 trading

- Why a minimum deposit is required?

- How can I open an account with an MT4 broker?

- Starting to Trade on MT4

- Choose a Broker:

- Open an MT4 Account:

- Download and Install MT4:

- Fund Your Account:

- Place Your First Trade:

- How can I download and install the MT4 trading platform?

- Is MT4 Ideal for Beginner Traders?

- Advantages for Beginners:

- Disadvantages for Beginners:

- Strengths Of MT4 Brokers

- Weaknesses Of MT4 Brokers And MT4 Trading Platforms

- Opportunities Of MT4 brokers and trading platforms

- Risks Of MT4 brokers and trading platforms

- MT4 vs MT5

- MT4

- MT5

- Trading Assets on MT4

- How can I customize the MT4 trading platform?

- MT4 Brokers Verdict

- Best MT4 Brokers List Compared

MT4 stands for MetaTrader 4, a widely-used electronic trading platform for retail forex, developed by the Russian software company MetaQuotes Software Corp, released in 2005. MetaQuotes licenses its MetaTrader 4 (MT4) software to forex brokers, who then provide it to their clients.

MT4, short for MetaTrader 4, is a popular trading platform forex and CFD traders use. An MT4 broker is a brokerage firm that provides access to the MT4 platform and allows traders to place trades on various financial instruments, including currencies, stocks, and commodities.

Features of MT4

Some of the key features of the MT4 platform include:

- Advanced charting capabilities

- Support for custom indicators and automated trading strategies (Expert Advisors or EAs)

- The ability to backtest trading strategies using historical data

- A wide range of technical indicators and charting tools

Choosing an MT4 Broker

When choosing an MT4 broker, there are several factors to consider, such as regulatory compliance, trading conditions, fees, and customer support. Traders should ensure a reputable regulatory body, such as the FCA or CySEC, license the broker. They should also compare trading conditions, such as spreads, commissions, and leverage, to find the best deal for their trading strategy. Additionally, it is important to check the reputation of the broker and the quality of their customer support.

Pros and Cons of Using an MT4 Broker

MT4 Broker Pros:

- User-friendly interface and advanced charting tools

- Supports automated trading and custom indicators

- Wide range of trading instruments

- Ability to use various trading strategies

- Access to advanced trading tools and features

- Real-time market quotes

- Customizable trading interface

MT4 Broker Cons:

- Some MT4 brokers may charge high fees and spread or have unfavourable trading conditions

- MT4 can be resource-intensive and may require a powerful computer or VPS

- Automated trading strategies may be complex to set up and maintain

- Limited range of trading instruments

- Potentially complex for novice traders

MT4 Broker Minimum Deposit Requirements

MT4 brokers typically offer several types of accounts, such as standard, mini, micro, and Islamic accounts. Minimum deposit requirements vary depending on the broker and the account type but typically range from $50 to $5000. Minimum deposit requirements vary by broker and account type.

How can I deposit and withdraw funds with an MT4 broker?

MT4 brokers typically offer a range of deposit and withdrawal methods, including bank transfers, credit/debit cards, and e-wallets. The specific methods available may vary by broker.

What is the spread with MT4 brokers?

The spread is the difference between a currency pair's bid and ask price. MT4 brokers typically charge a spread on each trade. Spreads can vary widely depending on the broker and the trading instrument.

What is the leverage with MT4 brokers?

Leverage is a trading mechanism allowing traders to control larger positions with less capital. MT4 brokers typically offer leverage of up to 1:500, although the available leverage may vary by broker and account type.

How can I deposit and withdraw funds with an MT4 broker?

MT4 brokers typically offer a range of deposit and withdrawal methods, including bank transfers, credit/debit cards, and e-wallets. The specific methods available may vary by broker.

What is the spread with MT4 brokers?

The spread is the difference between a currency pair's bid and ask price. MT4 brokers typically charge a spread on each trade. Spreads can vary widely depending on the broker and the trading instrument.

What is the leverage with MT4 brokers?

Leverage is a trading mechanism allowing traders to control more significant positions with less capital. MT4 brokers typically offer leverage of up to 1:500, although the specific leverage available may vary by broker and account type.

Deposits and Withdrawals

MT4 brokers offer various payment methods for deposits and withdrawals, such as bank transfers, credit/debit cards, and e-wallets. Some brokers may also offer additional payment methods, such as Bitcoin. Withdrawal processing times and fees vary depending on the payment method and the broker.

MT4 Brokers Spread, Leverage, and Commission

The spread is the difference between a financial instrument's bid and ask price and how the broker makes money. Leverage allows traders to control a larger position than their account balance would allow but also increases the risk of losses. Some brokers may charge the commission on top of the spread or in place of it. Trading conditions and fees vary between brokers, so comparing them before choosing a broker is important.

What are the analytical tools available with MT4 brokers?

Analytical tools are essential for successful trading, and the best MT4 brokers offer a range of tools to help traders analyze the markets. These tools may include technical analysis indicators, charting tools, and news feeds.

What are the trading strategies supported by MT4 brokers?

Different traders have different trading styles and strategies, and the best MT4 brokers offer a range of tools and features to support a variety of trading strategies. These features may include automated trading, hedging, scalping, and other advanced trading techniques.

What is the security of funds with MT4 brokers?

Security is a top priority for any trader, and the best MT4 brokers take the security of their client's funds seriously. They should use the latest encryption and security technologies to protect their clients' personal and financial information. Additionally, regulated brokers are required to keep their clients' funds in segregated accounts, which helps to protect the funds from any financial difficulties the broker may encounter.

Devices that Support MT4

MetaTrader 4 (MT4) is a popular platform for forex and CFD trading, and it is available on a wide range of devices, including

Windows and Mac Computers

The MT4 platform can be downloaded and installed on Windows and Mac computers, requiring a minimum of Windows 7 or Mac OS X 10.8. This platform version offers all the features and tools traders need to analyze the markets, execute trades, and manage their accounts.

Mobile Devices

MT4 is available on mobile devices, including smartphones and tablets. The platform's mobile version offers many of the same features as the desktop version and is available for download from the App Store or Google Play. The mobile version allows traders to access their accounts, view real-time charts, and execute trades from anywhere.

WebTrader

Many brokers offer a web-based version of MT4, also known as WebTrader, accessible from any device with an internet connection. This version requires no software download and can be accessed directly from the browser. It offers the same features as the desktop version, but it can be a little less responsive.

VPS

Another option is to use Virtual Private Server (VPS) hosting, which allows you to run the MT4 platform on a remote server. MT4 VPS systems are useful for traders using automated trading strategies, as they allow the platform to run 24 hours a day without interruption.

It's important to check with your broker which versions of MT4 they offer and which one fits your needs.What is an MT4 broker?

An MT4 (MetaTrader 4) broker is a forex broker using the popular MetaTrader 4 trading platform as their primary platform. This platform is known for its advanced charting capabilities, as well as its ability to support automated trading strategies through the use of expert advisors (EAs).

How To Choose an MT4 Broker?

When choosing an MT4 broker, research some important factors. Here are a few key things to keep in mind:

- Regulation and licensing

- Trading conditions and fees

- Range of trading instruments

- Quality of customer support

- User reviews and reputation

Are MT4 brokers regulated?

It's essential to choose a broker regulated by a reputable agency, such as the FCA in the UK or the NFA in the US. MT4 broker regulation must ensure that your funds are in a segregated account and that your MT4 broker trades are fair.

Regulation is a crucial factor to consider when choosing an MT4 broker. Regulated brokers are subject to strict rules and regulations set by regulatory bodies, which helps to ensure that they operate fairly and transparently. The most reputable MT4 brokers hold financial regulation by well-respected regulatory bodies, such as the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), and the Cyprus Securities and Exchange Commission (CySEC).

What is the reputation of MT4 brokers?

The reputation of an MT4 broker is another essential factor to consider. It would be best if you did your research to find out what other traders are saying about the broker. Look for reviews and ratings from independent websites like Trustpilot and Forex Peace Army to get an idea of the broker's reputation. A broker with a good reputation will have positive reviews and ratings from their clients.

What is the trading experience like with MT4 brokers?

The trading experience with MT4 brokers can vary significantly. Some brokers offer a simple, user-friendly trading platform that is easy to navigate, while others have more complex platforms with advanced features. When choosing an MT4 broker, it's essential to consider the trading platform, as it will be the primary tool you use to execute your trades.

Trading Costs

Be sure to compare the trading costs of different MT4 brokers, including spreads, commissions, and overnight swap rates. These costs can significantly impact your trading performance, so it's important to choose a broker that offers competitive prices.

Platform Features

Check the features offered by the MT4 platform, such as the number of technical indicators and available automated trading strategies. Also, consider if the platform has a mobile app and if it offers an option for VPS hosting.

What is the customer support with MT4 brokers?

Customer support is essential to any trading experience and choosing an MT4 broker that provides excellent customer service is crucial. The best MT4 brokers offer multiple customer support channels, including phone, email, and live chat. Their website should also have a comprehensive knowledge base or FAQ section.

Ensure the broker offers good customer support, including 24-hour assistance and multiple contact methods. Also, check if they offer educational resources like webinars, tutorials, and market analysis.

What types of accounts are available with MT4 brokers?

Be sure to choose a broker that offers the type of account that best suits your needs. For example, if you're a beginner trader, choose a broker that offers a small minimum deposit and a micro account. If you're an experienced trader, choose a broker offering higher leverage and a professional account. MT4 brokers typically offer a range of account types to suit different trading needs. Common account types include:

- Standard accounts

- Mini accounts

- Micro accounts

- Islamic accounts

- Managed accounts

What is the educational material available with MT4 brokers?

Education is a vital component of successful trading, and the best MT4 brokers offer a range of educational resources to help traders improve their skills and knowledge. These resources may include webinars, video tutorials, trading guides, and other educational materials.

Top MT4 Brokers

There are many MT4 brokers, and knowing which one to choose is challenging. Some of the top MT4 brokers include:

IC Markets is a popular broker offering its clients the MetaTrader 4 (MT4) trading platform with some of the fastest order execution speeds available. MT4 is a well-known and widely used platform in the trading industry, and it provides a range of features that make it attractive to traders of all levels. With IC Markets, traders can access the full suite of MT4 tools, including customizable charts, a user-friendly interface, and automated trading capabilities through expert advisors (EAs). IC Markets also offers fast execution speeds and low spreads, which can help traders maximize their profits. Additionally, IC Markets provides 24/7 customer support and educational resources to help traders improve their skills and stay up-to-date with market trends. Overall, the MT4 platform and IC Markets' competitive pricing and support make it a popular choice for traders worldwide.

RoboForex is a global broker offering its clients the popular MetaTrader 4 (MT4) trading platform with high available leverage. MT4 is a versatile platform that allows traders to access a wide range of trading instruments, including forex, stocks, and commodities. RoboForex provides its clients with the full suite of MT4 tools, including customizable charts, advanced technical analysis indicators, and a user-friendly interface. The broker also offers automated trading capabilities through expert advisors (EAs), which can help traders execute trades quickly and efficiently. Additionally, RoboForex provides its clients with various educational resources, including webinars and video tutorials, to help traders improve their skills and stay up-to-date with market trends. With competitive pricing, fast execution speeds, and 24/7 customer support, RoboForex is a popular choice for traders looking to trade on the MT4 platform.

XTB provides its clients with the full suite of MT4 tools, including customizable charts, advanced technical analysis indicators, and a user-friendly interface. The platform also offers automated trading capabilities through expert advisors (EAs), which can help traders execute trades quickly and efficiently. Additionally, XTB provides its clients with various educational resources, including webinars and video tutorials, to help traders improve their skills and stay current with market trends. With competitive pricing, fast execution speeds, and 24/5 customer support, XTB is a popular choice for traders looking to trade on the MT4 platform.

XM provides its clients with various educational resources, including webinars and video tutorials, to help traders improve their skills and stay up-to-date with market trends. With competitive pricing, fast execution speeds, and 24/5 customer support, XM is a popular choice for traders looking to trade on the MT4 platform.

With competitive pricing, fast execution speeds, and 24/5 customer support, a wide range of expert advisors and competitive spreads, Pepperstone is a popular choice for traders looking to trade on the MT4 platform.

It's important to note that different traders have different needs, preferences and priorities. Therefore, the best MT4 broker for one trader might not be the best choice for another trader. It is important to check if the broker is regulated, their account type, spreads and commissions, and customer support.

Minimum deposit for MT4 trading

The minimum deposit required to start trading with an MT4 broker varies from one broker to another. Some brokers may require a higher minimum deposit, while others may have a lower minimum deposit.

It's common for MT4 brokers to require a minimum deposit of $100 or $200, although some may require as little as $5 or $10. However, it's important to remember that a higher minimum deposit may be required for certain account types or to access certain features or services.

Why a minimum deposit is required?

The minimum deposit is a way for the broker to ensure that the trader has enough capital to open and maintain trades and cover potential losses. It also helps to prevent traders from overleveraging their accounts and risking more than they can afford to lose.

It's important to remember that the minimum deposit is not the only cost associated with trading. Other costs, such as spreads, commissions, and overnight financing, should also be considered when planning your trading budget.

It's recommended to check the terms and conditions of the broker you're interested in to confirm the minimum deposit requirement and any other associated costs before starting to trade with them.

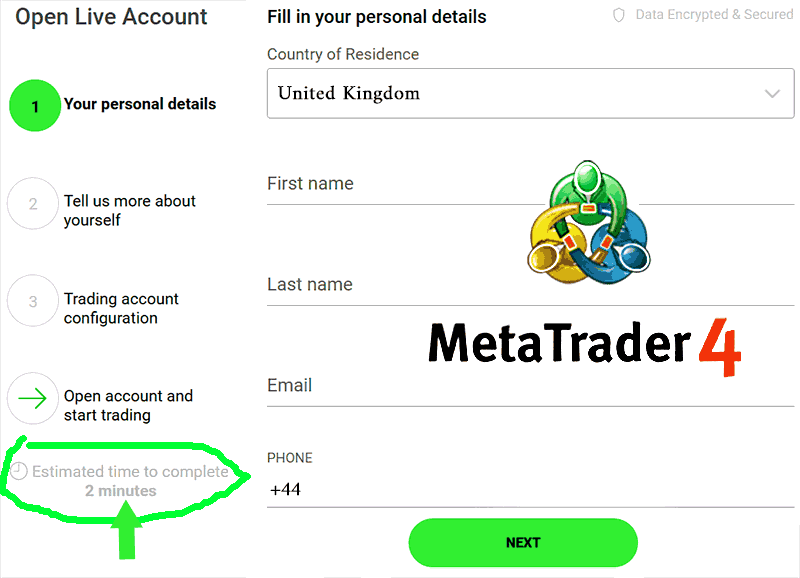

How can I open an account with an MT4 broker?

Opening an account with an MT4 broker is usually a straightforward process. You must provide some personal information and documentation to verify your identity. The exact requirements may vary depending on the broker and the regulatory body they are registered with.

Starting to Trade on MT4

Here are the general steps to start trading on an MT4 platform:

Choose a Broker:

The first step in trading on MT4 is to choose a broker that offers the platform. Many online brokers offer MT4, so it's important to research and compare the different options to find one that is reputable and fits your trading needs.

Open an MT4 Account:

Once you have chosen an MT4 broker, you must open an account. Opening a live MT4 broker account typically involves filling out an online application and providing personal and financial information.

Download and Install MT4:

After you have opened an account, you can download and install the MT4 software. The broker will usually provide instructions on how to do this.

Fund Your Account:

To start trading, you must fund your account. Most brokers accept various funding methods, such as credit/debit cards and bank transfers.

Place Your First Trade:

Once your MT4 account has available funds, you can start placing trades on the MT4 platform. The platform will offer different order types and tools to help you make your trade. Start with a small trade size and practice with a demo account before moving to live to trade.

How can I download and install the MT4 trading platform?

To download and install the MT4 trading platform, you must visit the broker's website and follow the instructions provided. The process is usually straightforward, and the broker should provide detailed instructions on downloading and installing the platform.

Is MT4 Ideal for Beginner Traders?

MT4, or MetaTrader 4, is a popular trading platform widely used by traders of all experience levels. It offers a wide range of features and tools that can be helpful for beginner traders.

Advantages for Beginners:

- Ease of use: The platform has a user-friendly interface and is easy to navigate, making it accessible for beginners.

- Widely available: MT4 is offered by many online brokers, making it easy for beginners to find a broker that fits their needs.

- Customizable: The platform allows for the customization of charts and indicators, allowing beginners to personalize their trading experience.

- Automated trading: The platform offers the ability to use automated trading strategies, which can be useful for beginners still learning the ropes.

Disadvantages for Beginners:

- Learning curve: Although the platform is easy to use, mastering all of its features and tools is still a learning curve. Beginners may need time and effort to use the platform effectively.

- Overwhelming: Beginners may find the platform overwhelming, as many different indicators and tools are available.

- Risk of losing money: As with any form of trading, there is a risk of losing money. Beginners may be more vulnerable to making costly mistakes if not educated on the risks involved.

Strengths Of MT4 Brokers

- Established brand: MT4 is a well-known and trusted trading platform which can help brokers to attract and retain clients.

- User-friendly interface: The MT4 platform is easy to use and navigate, making it accessible to traders of all experience levels.

- Robust analytical tools: MT4 offers a range of powerful analytical tools that can help traders to make informed trading decisions.

- Wide range of asset classes: MT4 brokers can offer a diverse range of assets for trading, including forex, commodities, stocks, and indices.

- High level of customization: The MT4 platform is often customized to meet the specific needs and preferences of individual traders.

Weaknesses Of MT4 Brokers And MT4 Trading Platforms

- Limited product offerings: While MT4 brokers can offer a wide range of asset classes, they are limited to the products available on the MT4 platform.

- High competition: The popularity of the MT4 platform has led to a high level of competition among brokers, making it difficult for new brokers to gain market share.

- Limited integration with other platforms: MT4 has limited integration with other trading platforms and technologies, which can be a disadvantage for traders who use multiple platforms or tools.

Opportunities Of MT4 brokers and trading platforms

- Expansion into new markets: MT4 brokers can expand into new geographical markets to attract a wider range of clients.

- Development of new trading products: MT4 brokers can develop and offer new trading products and features to attract clients and differentiate themselves from competitors.

- Investment in technology: MT4 brokers can invest in new technologies and tools to improve their trading platforms and attract more clients.

Risks Of MT4 brokers and trading platforms

- Changes in regulatory environment: Regulatory changes can impact the operations and profitability of MT4 brokers.

- Market volatility: The forex and other markets can be highly volatile, which can impact the performance of MT4 brokers and their clients.

- Cybersecurity risks: MT4 brokers are vulnerable to cyber attacks, which can compromise the security and confidentiality of their clients' trading data.

MT4 vs MT5

Both MT4 and MT5 are popular electronic trading platforms developed by MetaQuotes Software Corp. However, there are some key differences between the two platforms:

MT4

- primarily used for forex and CFD trading

- limited support for exchange-traded instruments

- limited built-in market depth

- advanced charting capabilities

- support for custom indicators and automated trading strategies (Expert Advisors or EAs)

MT5

- designed for a wider range of financial instruments, including stocks and futures

- built-in market depth

- more advanced order management and economic calendar

- more advanced algorithmic trading options

It's also worth noting that MT4 has been around longer than MT5 and has a larger user base and a more established ecosystem of third-party indicators and EAs. However, MT5 is gradually gaining popularity among traders, and many brokers now offer both platforms to their clients.

Ultimately, the choice between MT4 and MT5 will depend on the trader's needs and preferences. Both platforms have their strengths and weaknesses, and it's important to assess which one best fits your specific trading needs and goals.

Trading Assets on MT4

MT4, or MetaTrader 4, is a popular trading platform that offers a wide range of assets for traders to trade. The following are some of the most common assets that are available on MT4:

- Forex currencies: The platform offers a variety of currency pairs for traders to trade, such as EUR/USD, GBP/USD, and USD/JPY.

- Commodities: MT4 offers to trade in popular commodities such as gold, silver, and oil.

- Indices: The platform also offers trading in various stock markets indices, such as the S&P 500 and the NASDAQ.

- Stocks: MT4 also offers to trade in individual stocks, although the selection may vary depending on the broker.

How can I customize the MT4 trading platform?

The MT4 trading platform is highly customizable, and you can tailor it to suit your trading style and preferences. You can add or remove indicators, change the colour scheme, and customize the layout to suit your trading requirements.

MT4 Brokers Verdict

while MT4 brokers have several strengths that make them attractive to traders, several weaknesses and threats should be considered when evaluating their business models. By taking advantage of opportunities and mitigating threats, MT4 brokers can enhance their competitive position and achieve long-term success in online trading.

MetaTrader 4 (MT4) is a widely used platform for forex trading, and many brokers offer it as an option to their clients. One of the main benefits of MT4 is its user-friendly interface and advanced charting capabilities, which can help traders make informed decisions. Additionally, the platform offers a wide range of technical indicators, automated trading strategies, and custom scripts, which creates a personalized trading experience. However, it's important to note that not all MT4 brokers are created equal, and traders should do their due diligence when choosing a broker to ensure that they are reputable and regulated.

Best MT4 Brokers List Compared

| Featured MT4 Broker Trading Platform | Account Features | Trading Features |

|---|---|---|

| Used By: 180,000 Instruments Available: 232 Stocks Available: 2100 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 61 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mirror Trader, ZuluTrade, Web Trader, cTrader, Mac Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 53 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 35 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 10 USD / 10 EUR |

Platforms: MT4, MT5, Mac, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 200,000 Instruments Available: 1000 Stocks Available: 99 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 80 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: Web Trader, MT4, MT5, AvaTradeGo, AvaOptions, Mac, Mobile Apps, ZuluTrade, DupliTrade, MQL5 Negative Balance Protection: Inactivity Fee: No 71% of retail CFD accounts lose moneyVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 10000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 60 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, IRESS, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 50 Stocks Available: 0 US Stocks: No UK Stocks: No German Stocks: No Japanese Stocks: No Indices: No Forex Pairs Available: 65 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Minimum Deposit: 10 |

Platforms: MT4, MT5, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 250,000 Instruments Available: 4000 Stocks Available: 1696 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 57 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 0 |

Platforms: MT4, Mirror Trader, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Visit |

|

| Used By: 89,000 Instruments Available: 100 Stocks Available: 60 US Stocks: No UK Stocks: No German Stocks: Yes Japanese Stocks: No Indices: Yes Forex Pairs Available: 70 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mac, ZuluTrade, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your moneyVisit |

|

| Used By: 10,000,000 Instruments Available: 1000 Stocks Available: 160 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 55 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 5 |

Platforms: MT4, MT5, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77.74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.Visit |

|

| Used By: 10,000 Instruments Available: 130 Stocks Available: 60 US Stocks: Yes UK Stocks: Yes German Stocks: No Japanese Stocks: No Indices: Yes Forex Pairs Available: 45 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, Mac, Mirror Trader, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 142,500 Instruments Available: 200 Stocks Available: 52 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 150 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Your capital is at riskVisit |

|

| Used By: 10,000 Instruments Available: 148 Stocks Available: 64 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 40 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: $100 |

Platforms: MT4, MT5, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 1000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: No Forex Pairs Available: 100 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 0 |

Platforms: MT4, Mac, ZuluTrade, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 10 US Stocks: Yes UK Stocks: No German Stocks: No Japanese Stocks: No Indices: Yes Forex Pairs Available: 40 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes Losses can exceed depositsVisit |

|

| Used By: 500,000 Instruments Available: 1500 Stocks Available: 1500 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: No Indices: Yes Forex Pairs Available: 40 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 0 |

Platforms: ThinkTrader, MT4, MT5, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71.89% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your moneyVisit |

|

| Used By: 300,000 Instruments Available: 100 Stocks Available: 0 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 150 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1000 |

Platforms: MT4, MT5, ZuluTrade, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

Best MT4 Broker MT4 Broker Reviews

Read our details broker MT4 Broker MT4 Broker reviews, you will find something useful if you are shortlisting a MT4 Broker MT4 Broker and trading platform.

- IC Markets Review (read our in depth reviews)

- Roboforex Review (read our in depth reviews)

- AvaTrade Review (read our in depth reviews)

- FP Markets Review (read our in depth reviews)

- NordFX Review (read our in depth reviews)

- XTB Review (read our in depth reviews)

- Pepperstone Review (read our in depth reviews)

- XM Review (read our in depth reviews)

- FXPrimus Review (read our in depth reviews)

- easyMarkets Review (read our in depth reviews)

- Admiral Markets Review (read our in depth reviews)

- Axi Review (read our in depth reviews)

- HYCM Review (read our in depth reviews)

- ThinkMarkets Review (read our in depth reviews)

- Swissquote Review (read our in depth reviews)

MT4 Broker MT4 Broker Alternatives

Read about and compare MT4 Broker MT4 Broker alternatives. We have indepth side by side comparisons to help you find MT4 Broker MT4 Broker related brokers.

- IC Markets Alternatives

- Roboforex Alternatives

- AvaTrade Alternatives

- FP Markets Alternatives

- NordFX Alternatives

- XTB Alternatives

- Pepperstone Alternatives

- XM Alternatives

- FXPrimus Alternatives

- easyMarkets Alternatives

- Admiral Markets Alternatives

- Axi Alternatives

- HYCM Alternatives

- ThinkMarkets Alternatives

- Swissquote Alternatives

AvaTrade

AvaTrade

FP Markets

FP Markets

NordFX

NordFX

FXPrimus

FXPrimus

easyMarkets

easyMarkets

Admiral Markets

Admiral Markets

Axi

Axi

HYCM

HYCM

ThinkMarkets

ThinkMarkets

Swissquote

Swissquote