Best Margin Trading Brokers

Margin trading involves risks, so it is crucial to select a reliable broker. When searching for margin trading brokers, there are specific factors to consider. These include:

- Reputation: Look for brokers with a solid reputation in the industry. Their track record and customer reviews can provide insights into their reliability and trustworthiness.

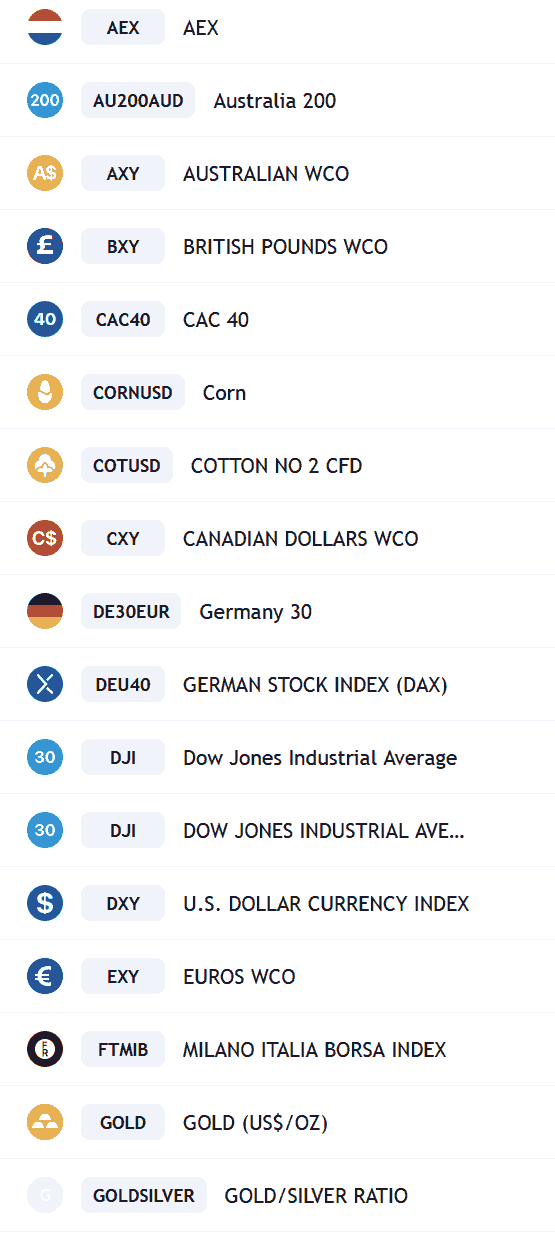

- Available Markets: Check if the broker offers a diverse range of markets to trade, such as stocks, Forex, cryptocurrencies, commodities, and indices. This ensures you have various options to explore.

- Competitive Spreads: Low spreads can significantly impact your trading costs. Look for brokers that offer competitive spreads to maximize your potential profits.

- User-Friendly Platforms: A user-friendly trading platform is essential for smooth trading experiences. Consider brokers that provide intuitive and feature-rich platforms to execute your trades efficiently.

- Regulations and Compliance: Research the broker's regulatory status and ensure they adhere to financial regulations. This helps protect your funds and ensures the broker operates in a transparent and accountable manner.

- Fees and Charges: Examine the fee structure of the broker, including commission rates, overnight fees, and other charges. Look for brokers with reasonable and transparent fee policies.

- Financial Instruments: Ensure the broker offers a wide selection of tradable financial instruments, giving you the flexibility to diversify your investment portfolio.

- Margin Trading Tools: Evaluate the margin trading tools and features provided by the broker. Advanced tools like leverage options, stop-loss orders, and risk management features can enhance your trading strategies.

- Funding and Withdrawal Methods: Check the available options for depositing and withdrawing funds from your trading account. Look for brokers that offer convenient and secure payment methods that suit your preferences.

By considering these factors and conducting thorough research, you can make an informed decision when selecting a margin trading broker that aligns with your trading goals and preferences.

Best Margin Trading Brokers Table of Contents

- What are margin trading brokers?

- What is margin trading?

- What is a margin account?

- What is the margin account used for?

- What is the initial margin?

- What happens during a margin call?

- How do margin traders manage the margin call?

- What is a margin trading account?

- What is the initial margin requirement?

- What is the maintenance margin?

- Can margin trading be done on all financial instruments?

- What are the risks of commodities margin trading?

- How do margin loans work?

- What is margin balance?

- Is US commodities margin trading different from other forms?

- How can I get started with securities margin trading?

- What are USD margin loan balances?

- What does margin trading refer to?

- What is a trading account?

- What are the margin requirements?

- What does margin mean in trading?

- What is buying power in margin trading?

- What is the role of the Financial Industry Regulatory Authority (FINRA)?

- How do risk-based margin systems work?

- Is there a minimum account balance for margin trading?

- Margin Trading Brokers: Verdict

- Best Margin Trading Brokers List Compared

Margin trading brokers, which specialize in providing advanced trading services, offer investors a unique opportunity to optimize their trading potential. By engaging in margin trading, investors can leverage their initial investment and access additional funds to enter larger positions in the financial markets. In this comprehensive article, we will address the top questions that frequently arise when discussing margin trading brokers. By covering various aspects such as margin accounts, initial margin requirements, margin calls, and more, we aim to provide a thorough understanding of this intricate trading method.

What are margin trading brokers?

Margin trading brokers are financial intermediaries that allow investors to trade on margin. These brokers facilitate the borrowing of funds to investors, allowing them to increase their buying power and engage in larger trades. They act as a bridge between investors and the financial markets, offering specialized services tailored to margin trading.

What is margin trading?

Margin trading involves the act of engaging in buying and selling financial instruments by utilizing borrowed funds. It enables traders to amplify their potential profits or losses by leveraging their initial investment. Investors can access additional funds beyond their capital through margin trading, significantly enhancing their trading capabilities.

What is a margin account?

A margin account allows traders to borrow funds from the broker to invest in securities or other financial instruments. This borrowed money serves as collateral for the trades conducted within the account. These accounts provide traders with increased flexibility and the chance for higher returns but also carry additional risks.

What is the margin account used for?

The margin account is primarily used for trading on margin, where traders can access additional funds to increase their trading positions and potential returns. The margin account empowers experienced traders seeking higher leverage and greater market exposure. Margin accounts enable traders to take advantage of market opportunities that may not be feasible with their capital alone.

What is the initial margin?

Initial margin refers to the minimum amount of funds required by a margin trading broker for a trader to open a margin account. It acts as a collateral deposit to cover potential losses from leveraged investments. This margin requirement varies based on the financial instrument being traded and the broker's specific policies.

What happens during a margin call?

A margin call occurs when the margin balance in a trader's account falls below a certain threshold, typically determined by the broker's maintenance margin requirements. When this happens, the broker may request the trader to deposit additional funds or liquidate some of their positions to restore the required margin level. The margin call is essential to risk management mechanisms that protect the trader and the broker from excessive losses.

How do margin traders manage the margin call?

Margin traders must closely monitor their positions and account balances to avoid margin calls. By maintaining sufficient margin levels and being aware of market fluctuations, traders can effectively mitigate the risk of margin calls. Margin requires prudent risk management practices, such as setting stop-loss orders, diversifying their portfolio, and keeping track of their margin requirements.

What is a margin trading account?

A margin trading account is a specialized brokerage account that allows traders to engage in margin trading. It provides traders with the necessary infrastructure, tools, and access to leverage for executing trades on margin. Margin trading accounts differ from regular trading accounts as they involve borrowing funds and require traders to adhere to specific margin requirements and risk management guidelines.

What is the initial margin requirement?

The initial margin requires the percentage of the total trade value traders must contribute as collateral when opening a position. It represents the initial deposit required by the broker to secure the trade and manage potential risks. This margin requirement varies depending on the financial instrument being traded, market conditions, and the broker's risk management policies.

What is the maintenance margin?

Maintenance margin refers to the minimum account equity that traders must maintain to avoid a margin call. It is typically expressed as a percentage of the total trade value and is set by the broker to ensure that traders have sufficient collateral to cover potential losses. Maintaining the required maintenance margin is crucial to sustaining open positions and continuing trading without disruptions.

Can margin trading be done on all financial instruments?

While trading on margin is commonly associated with securities, it can also be applied to other financial instruments, such as commodities. Commodities' margin trading involves putting up a margin deposit to trade commodity contracts on margin. However, it's important to note that the availability of margin trading for specific financial instruments may vary across brokers and jurisdictions.

What are the risks of commodities margin trading?

Trading commodities on margin carries certain risks due to the inherent volatility of commodity markets. These risks include the potential for losses exceeding the initial investment, rapid price fluctuations, and market-specific factors such as geopolitical events or supply-demand dynamics. Traders engaging in commodities margin trading must exercise caution, conduct thorough market analysis, and employ effective risk management strategies to mitigate these risks. Commodities margin involves putting up collateral to facilitate leveraged trading in the commodities market.

How do margin loans work?

Margin loans are loans provided by margin trading brokers to traders, allowing them to borrow funds to invest. The trader's margin account balance secures these loans and must be repaid with interest. Margin loans enable traders to access additional capital, which can be used to enter larger positions or explore new investment opportunities. Traders must understand the terms and conditions of margin loans, including interest rates, repayment schedules, and potential risks.

What is margin balance?

Margin balance refers to the net value of funds in a trader's margin account, considering both the borrowed money and the trader's equity. It represents the total amount available for trading and is collateral for the borrowed funds. Margin balance is a key indicator of a trader's financial position and determines their buying power and ability to open and maintain positions.

Is US commodities margin trading different from other forms?

Yes, US commodities margin trading may have specific regulations imposed by regulatory authorities, such as FINRA and the Securities and Exchange Commission (SEC). These regulatory bodies oversee commodities margin trading activities to ensure fair and transparent markets and protect investors. Traders in US commodities margin trading should know these regulations and comply with the applicable rules and guidelines.

How can I get started with securities margin trading?

To get started with securities trading on margin, you need to open a trading account with a qualified broker. The process typically involves submitting an application, providing the necessary documentation, and meeting the broker's eligibility criteria. Once your margin trading account is approved and funded, you can begin trading on margin. Choosing a reputable broker with a robust trading platform, competitive margin rates, and reliable customer support is essential.

What are USD margin loan balances?

USD margin loan balances refer to the outstanding amounts of money traders borrowed in US dollars to fund their margin trading activities. These balances represent the loans the broker provides and must be repaid by the trader according to the agreed-upon terms. The USD margin loan balances are subject to interest charges, which accrue based on the interest rates set by the broker.

What does margin trading refer to?

Margin trading refers to trading financial instruments using borrowed money. By leveraging their initial investment, traders can amplify their profits or losses. Margin trading allows investors to access additional capital beyond their resources, increasing their trading capacity and potential returns. It's important to note that margin trading involves higher risk than trading with only the trader's capital.

What is a trading account?

A trading account is a platform or service brokers provide that enables investors to buy and sell financial instruments. It is a gateway to the financial markets, allowing traders to execute trades, monitor their positions, and manage their portfolios. Trading accounts can be tailored to various trading methods, including margin trading, and offer access to various financial instruments across different markets.

What are the margin requirements?

Margin requirements are the rules and criteria set by margin trading brokers regarding the amount of collateral required for different financial instruments. The purpose of these requirements is to guarantee the security and reliability of margin trading operations. Margin requirements may vary depending on factors such as the type of financial instrument, market conditions, and the broker's risk management policies. Traders must adhere to these requirements to maintain active margin positions and avoid margin calls.

What does margin mean in trading?

In trading, margin refers to borrowing money from a broker to invest in financial instruments. By utilizing margin, traders can access additional capital beyond their resources, increasing their buying power and potential returns. However, the margin also introduces additional risk, as losses can exceed the initial investment. Margin trading requires careful risk management and an understanding the associated obligations and potential rewards.

What is buying power in margin trading?

Buying power in margin trading represents the total funds available to a trader for executing trades. It is influenced by the trader's equity and the leverage provided by the broker. Buying power determines the maximum size of positions a trader can enter and affects the trades' potential profitability and risk exposure. Traders must manage their buying power effectively and consider risk management strategies to protect their capital.

What is the role of the Financial Industry Regulatory Authority (FINRA)?

The Financial Industry Regulatory Authority (FINRA) monitors brokerage firms and their registered representatives in the United States. FINRA sets rules and standards to protect investors and ensure fair and transparent financial markets. It establishes guidelines for margin trading practices, including initial margin requirements, maintenance margin levels, and risk management protocols. Traders should know FINRA regulations and seek brokers who adhere to these standards to ensure a secure and regulated trading environment.

How do risk-based margin systems work?

Risk-based margin systems assess the potential risk and volatility associated with specific financial instruments. These systems evaluate factors such as historical price fluctuations, market liquidity, and the correlations between

different instruments. Based on this assessment, margin trading brokers determine the margin requirements for each instrument. Risk-based margin systems aim to align the required collateral with the potential risks involved in trading specific financial instruments.

Is there a minimum account balance for margin trading?

Yes, margin trading brokers often impose a minimum account balance requirement to open and maintain a margin trading account. This balance is a safeguard to ensure traders have sufficient funds to cover potential losses and meet margin calls if necessary. The minimum account balance requirement may vary among brokers and depend on the trading platform, the trader's experience level, and the specific financial instruments being traded.

Margin Trading Brokers: Verdict

To understand margin trading and its intricacies, traders should seek margin education courses or educational resources from reputable brokers. Margin education courses cover risk management, leverage utilization, margin calculations, and effective trading strategies. By acquiring the necessary knowledge, traders can confidently navigate the world of margin trading, make informed investment decisions, and effectively manage their margin positions.

In conclusion, margin trading brokers enable traders to leverage their initial investments and access additional funds for increased market exposure. By understanding the concepts of margin accounts, initial margin requirements, margin calls, and other relevant aspects, traders can effectively utilize margin trading to their advantage while managing the associated risks.

Best Margin Trading Brokers List Compared

| Featured Margin trading Broker Trading Platform | Account Features | Trading Features |

|---|---|---|

| Used By: 180,000 Instruments Available: 232 Stocks Available: 2100 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 61 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mirror Trader, ZuluTrade, Web Trader, cTrader, Mac Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 53 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 35 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 10 USD / 10 EUR |

Platforms: MT4, MT5, Mac, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 200,000 Instruments Available: 1000 Stocks Available: 99 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 80 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: Web Trader, MT4, MT5, AvaTradeGo, AvaOptions, Mac, Mobile Apps, ZuluTrade, DupliTrade, MQL5 Negative Balance Protection: Inactivity Fee: No 71% of retail CFD accounts lose moneyVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 10000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 60 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, IRESS, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 50 Stocks Available: 0 US Stocks: No UK Stocks: No German Stocks: No Japanese Stocks: No Indices: No Forex Pairs Available: 65 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Minimum Deposit: 10 |

Platforms: MT4, MT5, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 250,000 Instruments Available: 4000 Stocks Available: 1696 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 57 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 0 |

Platforms: MT4, Mirror Trader, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Visit |

|

| Used By: 89,000 Instruments Available: 100 Stocks Available: 60 US Stocks: No UK Stocks: No German Stocks: Yes Japanese Stocks: No Indices: Yes Forex Pairs Available: 70 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mac, ZuluTrade, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your moneyVisit |

|

| Used By: 10,000,000 Instruments Available: 1000 Stocks Available: 160 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 55 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 5 |

Platforms: MT4, MT5, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77.74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.Visit |

|

| Used By: 20,000,000 Instruments Available: 2000 Stocks Available: 2042 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 50 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 50 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 51% of retail investor accounts lose money when trading CFDs with this provider.Visit |

|

| Used By: 10,000 Instruments Available: 130 Stocks Available: 60 US Stocks: Yes UK Stocks: Yes German Stocks: No Japanese Stocks: No Indices: Yes Forex Pairs Available: 45 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, Mac, Mirror Trader, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 142,500 Instruments Available: 200 Stocks Available: 52 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 150 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Your capital is at riskVisit |

|

| Used By: 15,000,000 Instruments Available: 10000 Stocks Available: 1731 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 177 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.Visit |

|

| Used By: 10,000 Instruments Available: 148 Stocks Available: 64 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 40 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: $100 |

Platforms: MT4, MT5, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 15000 Stocks Available: 1000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 55 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 300,000 Instruments Available: 100 Stocks Available: 0 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 150 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1000 |

Platforms: MT4, MT5, ZuluTrade, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

Best Margin trading Broker Margin trading Broker Reviews

Read our details broker Margin trading Broker Margin trading Broker reviews, you will find something useful if you are shortlisting a Margin trading Broker Margin trading Broker and trading platform.

- IC Markets Review (read our in depth reviews)

- Roboforex Review (read our in depth reviews)

- AvaTrade Review (read our in depth reviews)

- FP Markets Review (read our in depth reviews)

- NordFX Review (read our in depth reviews)

- XTB Review (read our in depth reviews)

- Pepperstone Review (read our in depth reviews)

- XM Review (read our in depth reviews)

- eToro Review (read our in depth reviews)

- FXPrimus Review (read our in depth reviews)

- easyMarkets Review (read our in depth reviews)

- Trading 212 Review (read our in depth reviews)

- Admiral Markets Review (read our in depth reviews)

- SpreadEx Review (read our in depth reviews)

- Swissquote Review (read our in depth reviews)

Margin trading Broker Margin trading Broker Alternatives

Read about and compare Margin trading Broker Margin trading Broker alternatives. We have indepth side by side comparisons to help you find Margin trading Broker Margin trading Broker related brokers.

- IC Markets Alternatives

- Roboforex Alternatives

- AvaTrade Alternatives

- FP Markets Alternatives

- NordFX Alternatives

- XTB Alternatives

- Pepperstone Alternatives

- XM Alternatives

- eToro Alternatives

- FXPrimus Alternatives

- easyMarkets Alternatives

- Trading 212 Alternatives

- Admiral Markets Alternatives

- SpreadEx Alternatives

- Swissquote Alternatives

IC Markets

IC Markets

Roboforex

Roboforex

AvaTrade

AvaTrade

FP Markets

FP Markets

NordFX

NordFX

XTB

XTB

Pepperstone

Pepperstone

XM

XM

eToro

eToro

FXPrimus

FXPrimus

easyMarkets

easyMarkets

Trading 212

Trading 212

Admiral Markets

Admiral Markets

SpreadEx

SpreadEx

Swissquote

Swissquote