Best Islamic Forex Brokers

Islamic Forex brokers comply with Sharia law, which prohibits usury and speculation. They offer swap-free accounts and adhere to other Islamic principles. Some of the top Islamic forex brokers include IC Markets, XM, RoboForex, and XTB. Do your research to find the best fit for your trading needs.

Suppose you are a Muslim investor looking for an Islamic forex broker to manage your investments. In that case, it's important to research and compare Islamic brokers to find the one that aligns with your religious beliefs and suits your Islamic needs. Islamic forex brokers offer Shariah-compliant accounts that adhere to Islamic principles, such as no interest-based transactions or excessive speculation.

When researching Islamic forex brokers, factors include compliance with Islamic finance principles, fees and commissions, available financial instruments, trading tools, and regulatory compliance. By taking the time to research and compare Islamic brokers, you can make informed investment decisions that align with your religious beliefs and maximize your returns.

Our Islamic forex brokers guide explains and compares Islamic brokers. We compare fees, withdrawal methods and available tradable forex instruments compliant with the Islamic faith.

Best Islamic Forex Brokers Table of Contents

- Islamic Forex Brokers: Detailed Guide

- What is an Islamic Forex Broker, and how does it differ from a regular forex broker?

- Are there any specific regulations or guidelines that Islamic brokers must follow?

- What are the key features of an Islamic forex account?

- Regulations of Islamic Forex Trading

- Advantages of Islamic Forex Trading

- Is it permissible to trade forex in Islam, and what are the conditions for doing so?

- What is the riba (interest)concept in Islam, and how does it relate to forex trading?

- What types of accounts do Islamic forex brokers offer?

- How do Islamic forex brokers ensure compliance with Shariah law?

- Are there any additional fees or charges associated with Islamic forex accounts?

- How do Islamic forex brokers handle overnight swaps or rollovers?

- Can non-Muslims also use Islamic forex accounts?

- What is the process for opening an Islamic forex account?

- How do Islamic forex brokers ensure the transparency of their operations?

- Do Islamic forex brokers offer Leverage, and how is it calculated?

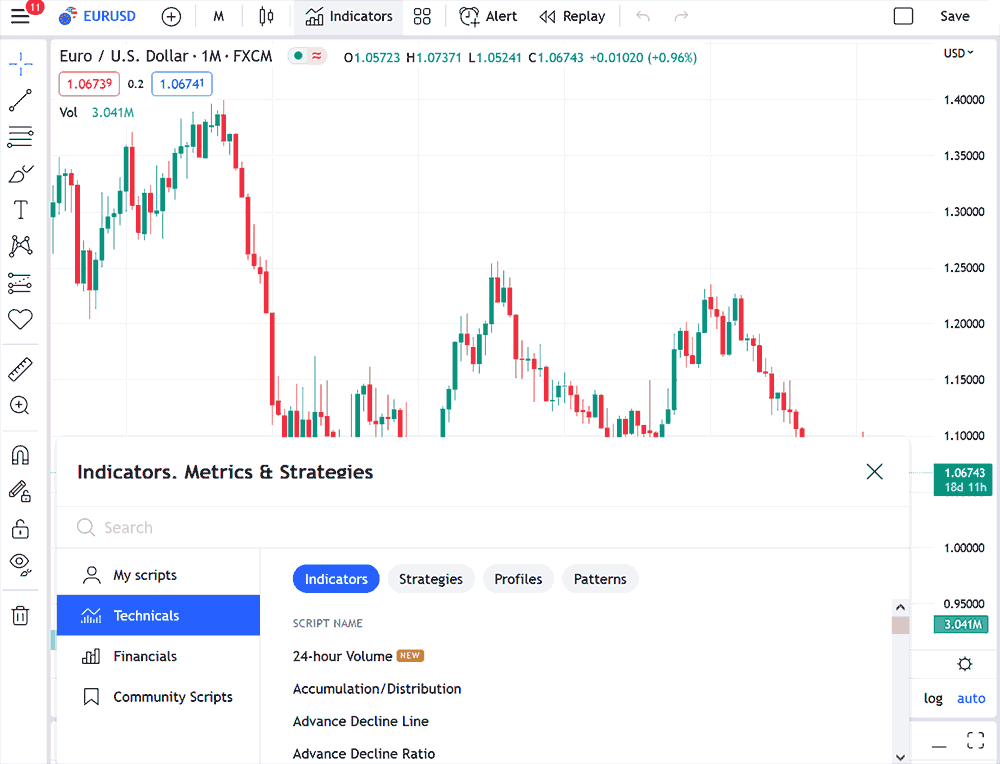

- What does a Islamic Forex trading account look like?

- What is the difference between Islamic and conventional forex trading platforms?

- How can I determine whether an Islamic forex broker is legitimate and trustworthy?

- Do Islamic forex brokers offer demo accounts for practice trading?

- Can I withdraw my profits from an Islamic forex account at any time?

- What risks are involved in trading with Islamic forex brokers?

- Are there any restrictions on the maximum or minimum capital required to open an Islamic forex account?

- How can I learn more about Islamic forex trading and its principles?

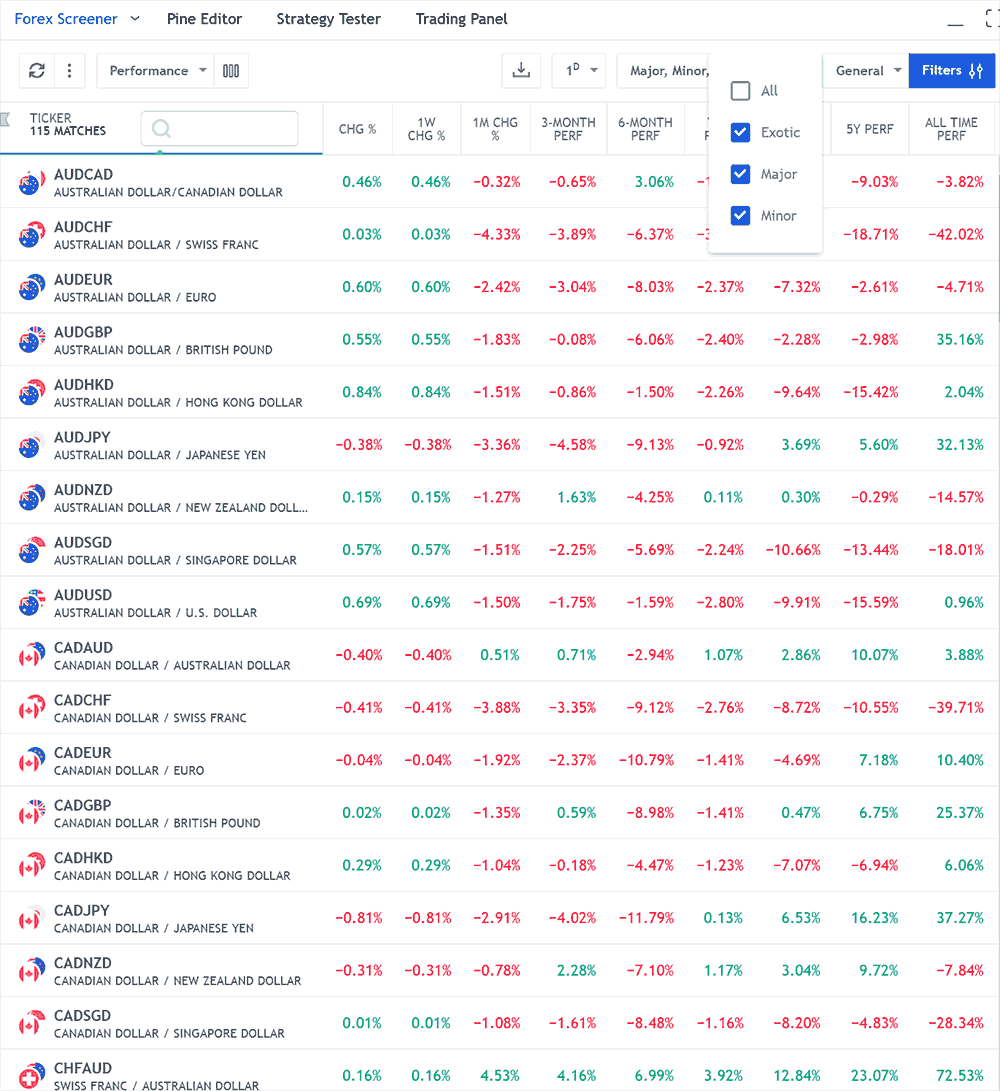

- What currencies are available for trading with Islamic forex brokers?

- Can I trade in other financial instruments besides forex with an Islamic forex broker?

- What are the advantages of trading with an Islamic forex broker?

- Are there any disadvantages of trading with an Islamic forex broker?

- How can I compare Islamic forex brokers to choose the best one for my needs?

- Islamic Forex Brokers Verdict

- Best Islamic Forex Brokers List Compared

Islamic Forex Brokers: Detailed Guide

Forex trading has become a popular investment option for people worldwide, including Muslims. However, due to the Islamic law of Shariah, which prohibits riba (interest), Muslims must use specific forex brokers that comply with Islamic principles. These forex brokers are known as Islamic and differ from regular forex brokers in various ways.

The Muslim population represents a significant portion of the world's population, estimated at around 1.8 billion people. This large demographic has a growing interest in financial products that align with their religious and ethical beliefs, including Islamic forex trading. This interest is likely since Islamic forex trading allows Muslim investors to participate in the global currency markets while adhering to the principles of Shariah law.

Islamic forex trading allows traders to invest in the currency markets without incurring interest or riba, which Islam prohibits. by replacing interest-based transactions with fees or commissions, Muslim traders can trade forex. This approach has gained popularity among Muslim traders seeking investment opportunities that align with their faith.

What is an Islamic Forex Broker, and how does it differ from a regular forex broker?

An Islamic forex broker is a forex broker that follows Islamic principles and provides forex accounts that comply with Shariah law. These brokers offer interest-free trading accounts and do not charge swap or rollover fees, which are considered riba in Islam.

In contrast, regular forex brokers offer standard trading accounts that charge swap or rollover fees for positions held overnight. Forex fees are on the interest rate differential between the two currencies involved in the trade.

Are there any specific regulations or guidelines that Islamic brokers must follow?

Islamic forex brokers must follow specific regulations and guidelines to comply with Shariah law. Some of the key principles that they must follow include:

- Prohibiting riba (interest) in all forms of trading activities.

- Avoiding speculative trading and promoting fair and ethical trading practices.

- Transparency in all their operations, including fees, charges, and commissions.

- Ensuring that their trading platforms and services comply with Shariah principles.

What are the key features of an Islamic forex account?

Islamic forex trading, also known as swap-free forex trading, is a type of forex trading that conforms to the principles of Shariah law. It allows Muslim investors to participate in the global currency markets while adhering to their religious and ethical beliefs. In this analysis, we will provide a detailed spot analysis of Islamic forex trading, including its principles, regulations, and advantages.

Islamic forex trading is based on the principles of Shariah law, which prohibits riba or interest-based transactions. In Islamic finance, money is a medium of exchange, and Muslims must not use it to generate profits. Therefore, Islamic forex trading operates without interest; Islamic forex brokers will charge fees or commissions for holding positions overnight.

Islamic forex trading has several key features that differentiate it from conventional. One of the most important features is the absence of interest-based transactions, which fees or commissions replace. Lack of interest allows Muslim traders to participate in the currency markets without contradicting the principles of Shariah law.

Another key feature of Islamic forex trading is that it allows traders to hold positions indefinitely without incurring interest charges. A rollover mechanism, where a position is closed at the end of the day and reopened at the beginning of the next day, effectively resetting the trading cycle without incurring interest charges.

The key features of an Islamic forex account include:

- No swap or rollover fees are charged.

- Commission-based trading.

- Halal trading environment that complies with Islamic principles.

- No hidden fees or charges.

Regulations of Islamic Forex Trading

Islamic forex trading is regulated by the Islamic finance industry, which sets out strict guidelines and principles to ensure that trading practices conform to the principles of Shariah law. Islamic forex brokers must adhere to these guidelines and principles, and their operations are subject to scrutiny by Islamic scholars and regulatory bodies.

you can learn more about Islamic financial on the Bank of England website here

Advantages of Islamic Forex Trading

Islamic forex trading offers several advantages over conventional forex trading, especially for Muslim traders seeking investment opportunities that align with their faith. One of the key advantages is the absence of interest-based transactions, which is not allowed in Islam. With this, Muslim traders to invest in the currency markets without compromising their religious and ethical beliefs.

Another advantage of Islamic forex trading is that it gives traders greater flexibility in holding positions without incurring interest charges. Muslim traders can take a long-term view of the market and hold positions for as long as necessary.

Is it permissible to trade forex in Islam, and what are the conditions for doing so?

It is permissible to trade forex in Islam, provided that it complies with Shariah principles. The conditions for doing so include:

- Avoiding riba (interest) in all forms of trading activities.

- Trading fairly and ethically.

- Ensuring transparency in all trading operations.

What is the riba (interest)concept in Islam, and how does it relate to forex trading?

Riba (interest) is defined as the increase in loan or debt without any valid reason. Riba is frowned upon in Islam, and Muslims must avoid it in all financial transactions, including forex trading. In forex trading, riba comes in the form of swap or rollover fees, which regular forex brokers charge for positions held overnight. These fees are considered riba and are not allowed in Islam.

What types of accounts do Islamic forex brokers offer?

Islamic forex brokers offer two types of accounts: Standard and ECN (Electronic Communication Network) accounts. Standard accounts have fixed spreads and charge a commission for each trade, while ECN accounts charge variable spreads and a commission per lot traded. Both types of accounts do not charge swap or rollover fees, which are not allowed in Islam.

How do Islamic forex brokers ensure compliance with Shariah law?

Islamic forex brokers ensure compliance with Shariah law by implementing specific rules and regulations, including

- Offering interest-free trading accounts.

- Avoiding speculative trading and promoting fair and ethical trading practices.

- Providing a halal trading environment that complies with Islamic principles.

- Ensuring transparency in all their operations, including fees, charges, and commissions.

- Having a Shariah advisory board that oversees their operations and ensures compliance with Islamic principles.

Are there any additional fees or charges associated with Islamic forex accounts?

Islamic forex accounts do not charge swap or rollover fees but may charge commission-based fees or spreads slightly higher than regular forex accounts. However, these fees are usually transparent, with no hidden charges or fees.

How do Islamic forex brokers handle overnight swaps or rollovers?

Islamic forex brokers do not charge overnight swaps or rollovers; these fees are considered riba and forbidden in Islam. Instead, they may charge a small commission fee or adjust the spread to cover costs.

Can non-Muslims also use Islamic forex accounts?

Yes, non-Muslims can also use Islamic forex accounts, as these accounts offer interest-free trading and fair trading practices. However, they may not be suitable for traders who prefer variable spreads or Leverage, as Islamic forex accounts generally have fixed spreads and limited leverage options.

What is the process for opening an Islamic forex account?

The process for opening an Islamic forex account is similar to opening a regular forex account. Traders must choose a reputable Islamic forex broker, provide their personal information and trading experience, and complete the account registration process. They may also need to provide additional documentation to verify their identity and address.

How do Islamic forex brokers ensure the transparency of their operations?

Islamic forex brokers ensure transparency in their operations by providing detailed information about their fees, charges, commissions, and spreads. They also offer real-time market data and trading reports to help traders make informed decisions. Additionally, they may have a Shariah advisory board that oversees their operations and ensures compliance with Islamic principles.

Do Islamic forex brokers offer Leverage, and how is it calculated?

Islamic forex brokers offer limited leverage options, as excessive Leverage is considered gambling and not allowed in Islam. The maximum Leverage most Islamic forex brokers offer is 1:100. Leverage is calculated based on the margin requirements and the trader's equity.

What does a Islamic Forex trading account look like?

Islamic forex trading software is essentially the same as conventional forex trading software but with certain modifications to cater to the needs of Muslim traders who wish to adhere to the principles of Islamic finance.

Another important feature of Islamic forex trading software is the ability to filter out certain trades prohibited under Islamic finance principles. For example, the software may limit trading to certain currency pairs or require trades to be made immediately without delay.

In addition, Islamic forex trading software may offer educational resources and tools to help traders understand the principles of Islamic finance and how they can apply them to their trading strategies. Islamic forex trading software may include access to Shariah-compliant investment options and advice on ethical investment practices.

What is the difference between Islamic and conventional forex trading platforms?

Islamic and conventional forex trading platforms have similar functionality and features. However, Islamic forex trading platforms may have additional features that ensure compliance with Shariah law, such as interest-free accounts, swap-free trading, and a Shariah advisory board.

How can I determine whether an Islamic forex broker is legitimate and trustworthy?

Traders can determine whether an Islamic forex broker is legitimate and trustworthy by checking their regulatory status, reputation, and track record. They should ensure that the broker is licensed and regulated by a reputable regulatory authority, such as the UK Financial Conduct Authority (FCA) or the US National Futures Association (NFAS. They can also read reviews and feedback from other traders to gauge the broker's reliability and customer service.

Do Islamic forex brokers offer demo accounts for practice trading?

Yes, most Islamic forex brokers offer demo accounts for practice trading, which allow traders to test their trading strategies and get familiar with the broker's trading platform without risking real money. Demo accounts are also useful for new traders who want to learn about forex trading and its principles.

Can I withdraw my profits from an Islamic forex account at any time?

Yes, traders can withdraw their profits from an Islamic forex account at any time, subject to the broker's withdrawal policy and procedures. For easy and convenient withdrawal, most brokers offer multiple payment options, including bank transfers, credit/debit cards, and e-wallets.

What risks are involved in trading with Islamic forex brokers?

Forex trading involves various risks, including market volatility, liquidity, credit, and operational risks. Islamic forex brokers are not exempt from these risks but may offer additional protections and safeguards to ensure compliance with Shariah law. Traders should always understand the risks involved in forex trading and manage their risks accordingly.

Are there any restrictions on the maximum or minimum capital required to open an Islamic forex account?

There are no specific restrictions on the maximum or minimum capital required to open an Islamic forex account. Islamic forex broker minimum deposit requirements may vary depending on the broker's policies and procedures. However, traders should ensure sufficient capital to cover their trading costs and risk management strategies.

How can I learn more about Islamic forex trading and its principles?

Traders can learn more about Islamic forex trading and its principles by reading relevant books, articles, and websites, attending webinars and seminars, and seeking guidance from qualified Shariah scholars and advisors. They can also consult with their broker's Shariah advisory board to ensure compliance with Islamic principles.

What currencies are available for trading with Islamic forex brokers?

*please note forex prices are subject to change.

Islamic forex brokers offer a wide range of currency pairs for trading, including major, minor, and exotic teams. However, they may not provide some currency pairs involving currencies from politically or economically instability countries.

Can I trade in other financial instruments besides forex with an Islamic forex broker?

Some Islamic forex brokers offer other financial instruments for trading, including commodities, indices, and stocks. However, traders should check with their broker to ensure that these instruments comply with Shariah law and do not involve haram activities or transactions.

What are the advantages of trading with an Islamic forex broker?

Islamic forex trading offers several advantages for Muslim traders who wish to invest in the global currency markets while adhering to their religious and ethical beliefs.

The advantages of trading with an Islamic forex broker include:

- Compliance with Shariah law: Islamic forex trading operates under the principles of Shariah law, which prohibits interest-based transactions (riba) and other unethical business practices. Shariah law compliance means traders can invest in the markets while adhering to their religious and ethical beliefs. A Shariah advisory board that oversees the broker's operations and ensures compliance with Islamic principles.

- Transparency: Islamic forex brokers are required to disclose all fees associated with their services upfront, which ensures transparency in the trading process. Transparency helps Muslim traders make informed decisions and avoid hidden charges affecting their profitability. Fair and ethical trading practices that promote transparency and honesty.

- No interest-based transactions: Islamic forex trading does not involve any interest-based transactions, such as rollovers or swaps, which are common in conventional forex trading. Islamic-compliant forex trading means traders can hold positions indefinitely without incurring interest charges, increasing their profitability.

- Risk management: Islamic forex trading encourages risk management and responsible trading practices, which can help traders minimize their losses and maximize their profits. Including strategies such as stop-loss orders, which can automatically close positions when a certain level of loss is reached.

- Diversification: Islamic forex trading allows traders to diversify their portfolios and invest in different currency pairs and markets, which can help spread the risk and increase potential profits. Access to a wide range of currency pairs and other financial instruments for trading.

- Education and support: Islamic forex brokers often provide educational resources and support to traders, which can help them develop their trading skills and strategies. Educational resources can include access to webinars, tutorials, and market analysis.

Are there any disadvantages of trading with an Islamic forex broker?

Muslim traders considering trading with an Islamic Forex broker should consider potential disadvantages before engaging in this type of trading.

The disadvantages of trading with an Islamic forex broker include:

- Limited availability: Islamic forex trading is still a relative niche market, and therefore, there may be fewer brokers offering this service compared to conventional forex trading. Islamic-compliant forex brokers may limit the options available to traders, and they may have to settle for a broker that may not offer the best terms or conditions.

- Shariar law restrictions: Certain trading strategies or products that may be restricted by Shariah law, such as margin trading or short selling.

- Higher transaction costs: Since Islamic forex trading does not allow interest-based transactions, brokers may charge higher fees or commissions to cover their costs. Higher Islamic-compliant trading rules may increase the overall transaction costs, reducing the profitability of trades.

- Limited trading options: Some Islamic forex brokers may limit the trading options available to traders, particularly in terms of the currency pairs available to trade. Limited trading options with Islamic brokers may limit the trading opportunities available to traders, and they may miss out on potential profits.

- Rollover fees: While Islamic forex trading uses a rollover mechanism to avoid interest charges, traders may still incur rollover fees when holding positions overnight. These fees may vary from broker to broker and affect the trades' profitability.

- Lack of Leverage: Islamic forex trading does not allow the use of Leverage, which is a common feature in conventional forex trading. Traders may be unable to take advantage of larger market movements and may have to rely on smaller gains.

How can I compare Islamic forex brokers to choose the best one for my needs?

Traders can compare different Islamic forex brokers based on several factors, including:

- Regulatory status and reputation.

- Trading conditions, such as spreads, commissions, and Leverage.

- Availability of Islamic trading accounts and features.

- Range of currency pairs and other financial instruments for trading.

- Customer service and support.

- Education and research resources.

- Withdrawal and deposit options and fees.

By comparing these factors and assessing their own trading needs and preferences, traders can choose the best Islamic forex broker for their requirements.

Islamic Forex Brokers Verdict

Islamic forex trading is a growing forex market segment. It offers several advantages for Muslim investors seeking investment opportunities that conform to the principles of Shariah law. Islamic forex trading operates without interest-based transactions, which has restrictions under the Islamic faith, and it allows traders to hold positions indefinitely without incurring interest charges. The Islamic finance industry regulates Islamic forex trading, and it is subject to strict guidelines and principles to ensure compliance with Shariah law.

While Islamic forex trading offers several advantages, you must consider some potential disadvantages before engaging in this type. Traders should carefully evaluate the terms and conditions of Islamic forex brokers and compare them with conventional forex brokers to determine which option best suits their needs.

Islamic forex trading offers an interest-free alternative for traders who wish to comply with Shariah law and ethical principles. Islamic forex brokers offer various features and accounts designed to meet Muslim traders' needs while providing access to a wide range of currency pairs and financial instruments. By understanding the principles and regulations of Islamic forex trading, traders can make informed decisions and trade confidently.

Traders should carefully evaluate the terms and conditions of Islamic forex brokers to determine if this type of trading suits their needs.

Best Islamic Forex Brokers List Compared

| Featured Islamic Forex Broker Trading Platform | Account Features | Trading Features |

|---|---|---|

| Used By: 180,000 Instruments Available: 232 Stocks Available: 2100 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 61 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mirror Trader, ZuluTrade, Web Trader, cTrader, Mac Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 53 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 35 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 10 USD / 10 EUR |

Platforms: MT4, MT5, Mac, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 200,000 Instruments Available: 1000 Stocks Available: 99 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 80 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: Web Trader, MT4, MT5, AvaTradeGo, AvaOptions, Mac, Mobile Apps, ZuluTrade, DupliTrade, MQL5 Negative Balance Protection: Inactivity Fee: No 71% of retail CFD accounts lose moneyVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 10000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 60 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, IRESS, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 50 Stocks Available: 0 US Stocks: No UK Stocks: No German Stocks: No Japanese Stocks: No Indices: No Forex Pairs Available: 65 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Minimum Deposit: 10 |

Platforms: MT4, MT5, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 250,000 Instruments Available: 4000 Stocks Available: 1696 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 57 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 0 |

Platforms: MT4, Mirror Trader, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Visit |

|

| Used By: 89,000 Instruments Available: 100 Stocks Available: 60 US Stocks: No UK Stocks: No German Stocks: Yes Japanese Stocks: No Indices: Yes Forex Pairs Available: 70 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mac, ZuluTrade, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your moneyVisit |

|

| Used By: 10,000,000 Instruments Available: 1000 Stocks Available: 160 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 55 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 5 |

Platforms: MT4, MT5, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77.74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.Visit |

|

| Used By: 20,000,000 Instruments Available: 2000 Stocks Available: 2042 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 50 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 50 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 51% of retail investor accounts lose money when trading CFDs with this provider.Visit |

|

| Used By: 10,000 Instruments Available: 130 Stocks Available: 60 US Stocks: Yes UK Stocks: Yes German Stocks: No Japanese Stocks: No Indices: Yes Forex Pairs Available: 45 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, Mac, Mirror Trader, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 142,500 Instruments Available: 200 Stocks Available: 52 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 150 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Your capital is at riskVisit |

|

| Used By: 500,000 Instruments Available: 1500 Stocks Available: 1500 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: No Indices: Yes Forex Pairs Available: 40 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 0 |

Platforms: ThinkTrader, MT4, MT5, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71.89% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your moneyVisit |

|

| Used By: 4,000,000 Instruments Available: 2200 Stocks Available: 2000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: No Indices: Yes Forex Pairs Available: 67 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your moneyVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 1000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: No Forex Pairs Available: 100 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 0 |

Platforms: MT4, Mac, ZuluTrade, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 10 US Stocks: Yes UK Stocks: No German Stocks: No Japanese Stocks: No Indices: Yes Forex Pairs Available: 40 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes Losses can exceed depositsVisit |

Best Islamic Forex Broker Islamic Forex Broker Reviews

Read our details broker Islamic Forex Broker Islamic Forex Broker reviews, you will find something useful if you are shortlisting a Islamic Forex Broker Islamic Forex Broker and trading platform.

- IC Markets Review (read our in depth reviews)

- Roboforex Review (read our in depth reviews)

- AvaTrade Review (read our in depth reviews)

- FP Markets Review (read our in depth reviews)

- NordFX Review (read our in depth reviews)

- XTB Review (read our in depth reviews)

- Pepperstone Review (read our in depth reviews)

- XM Review (read our in depth reviews)

- eToro Review (read our in depth reviews)

- FXPrimus Review (read our in depth reviews)

- easyMarkets Review (read our in depth reviews)

- ThinkMarkets Review (read our in depth reviews)

- Markets.com Review (read our in depth reviews)

- Axi Review (read our in depth reviews)

- HYCM Review (read our in depth reviews)

Islamic Forex Broker Islamic Forex Broker Alternatives

Read about and compare Islamic Forex Broker Islamic Forex Broker alternatives. We have indepth side by side comparisons to help you find Islamic Forex Broker Islamic Forex Broker related brokers.

- IC Markets Alternatives

- Roboforex Alternatives

- AvaTrade Alternatives

- FP Markets Alternatives

- NordFX Alternatives

- XTB Alternatives

- Pepperstone Alternatives

- XM Alternatives

- eToro Alternatives

- FXPrimus Alternatives

- easyMarkets Alternatives

- ThinkMarkets Alternatives

- Markets.com Alternatives

- Axi Alternatives

- HYCM Alternatives

IC Markets

IC Markets

Roboforex

Roboforex

AvaTrade

AvaTrade

FP Markets

FP Markets

NordFX

NordFX

XTB

XTB

Pepperstone

Pepperstone

XM

XM

eToro

eToro

FXPrimus

FXPrimus

easyMarkets

easyMarkets

ThinkMarkets

ThinkMarkets

Markets.com

Markets.com

Axi

Axi

HYCM

HYCM