Best Index Brokers For Trading Indices

The best index brokers provide investors access to various global indices and low-cost trading options. Look for a broker with a strong reputation, competitive fees, and a user-friendly trading platform. It's also important to consider the specific indices you want to trade and ensure they are available through your chosen broker.

This indices brokers guide explains what index brokers are, the risks, and why people use index brokers and trading platforms to trade indices on global financial markets. We explain and compare index brokers and indices trading platforms, and financial indexes and tell you what to look out for when registering with an index broker and how to check they are financially regulated and offer a good range of major and minor financial indices, indices trading tools, funding and withdrawal methods available with your index broker trading platform and low indices trading fees.

Best Index Brokers For Trading Indices Table of Contents

- Trading Indices With Index Brokers

- How to Trade Indices

- Index Exchange-Traded Funds (ETFs)

- Index Futures Contracts

- Indices CFDs

- How to Start Trading Indices Step-by-Step With Index Brokers

- Step 1: Research Indices

- Step 2: Choose an Indices Broker

- Step 3: Open a Demo Or Live Indices Trading Account

- Step 4: Fund Your Index Broker Account

- Step 5: Research Indices Using Trading Tools And Indices Market Data

- Step 6: Start Trading Indices

- The Most Valuable Index on the Market

- S&P 500

- NASDAQ Composite

- Dow Jones Industrial Average

- Most Popular Indices By Market Cap

- Where to Start Trading Indices

- Brokerage Firms That Offer Index Financial Instruments

- Exchange-Traded Funds (ETFs)

- Futures and Options

- Is Trading Indices Profitable?

- Market conditions

- Specific index

- Investment strategy and risk management

- Advantages Of Trading Indices

- Risks Of Trading Indices

- Is Trading Indices Safe?

- Diversification

- Liquidity

- Low cost

- Is Trading Indices Ideal for Beginners?

- Simplicity

- Ease of access

- Index Brokers For Trading Indices On Global Markets Verdict

- Best Index Brokers For Trading Indices List Compared

Trading Indices With Index Brokers

An index is a statistical measure of the performance of a group of stocks, typically representing a market or a sector of the market. Indices are used as a benchmark for the performance of a particular market or sector, and indices track changes in the stock market over time.

Indices are created by selecting a group of stocks representing a particular market or sector and then calculating a value for the index based on the prices or performance of those stocks. Commonly used indices include the S&P 500 and the Dow Jones Industrial Average in the United States, and the FTSE 100 in the United Kingdom and the Nikkei 225 in Japan.

There are many different indices, including market capitalization-weighted, equal-weighted, and sector-specific indices. Indices can be used as a tool for investment and trading, as well as for measuring the performance of an investment portfolio.

How to Trade Indices

There are several ways to trade indices, including:

Index Exchange-Traded Funds (ETFs)

ETFs are investment vehicles that track the performance of a particular index and can be bought and sold on a stock exchange, similar to stocks. ETFs can be bought and sold at any time during market hours, held for the long term, or traded for shorter-term gains. ETFs are a popular way for investors to gain exposure to the broader market or a specific market sector without buying and selling individual stocks.

-

Index Futures Contracts

Futures contracts are agreements to buy or sell an index at a specific price on a specific date in the future. Index futures contracts are available on exchanges such as the Chicago Mercantile Exchange (CME) and the Intercontinental Exchange (ICE). Trading index futures allow investors to make directional bets on the market and are a tool for hedging. However, it requires a higher level of knowledge and experience and a margin account to trade futures.

-

Indices CFDs

CFDs (contracts for difference) are derivatives products that allow traders to speculate on the price movements of an index without buying the underlying index. Indice CFDs are leveraged trades, which allow traders to deposit a smaller deposit on a stock index trade than their exposure to the market. This leverage can amplify potential gains from trading indices trading, but also potential losses. It's important to have a good understanding of the risks before trading indices as CFDs.

How to Start Trading Indices Step-by-Step With Index Brokers

Step 1: Research Indices

Before you start trading indices, it's important to research and understand the different indices available to trade. Researching indices trading includes learning about the underlying assets that make up the index and the index's historical performance and volatility. Some popular indices to trade include the S&P 500, NASDAQ, and the Dow Jones Industrial Average.

Step 2: Choose an Indices Broker

Next, you will need to choose a broker that offers index trading. Look for an Index broker that is regulated and has a good reputation. Compare fees, platforms, and other features to find the best option for you.

Step 3: Open a Demo Or Live Indices Trading Account

Once you have chosen a broker, you will need to open an account. You will typically need to provide personal information, such as your name and address, and may be required to complete a form of identification.

Step 4: Fund Your Index Broker Account

Before starting trading indices, you must fund your account. Funding your live index broker trading account can typically be done via a bank transfer, debit card, or an e-wallet like PayPal.

Step 5: Research Indices Using Trading Tools And Indices Market Data

Carefully research the index you are considering trading using live charting tools, market data and risk management tools.

Step 6: Start Trading Indices

You can start trading indices once you fund your live trading account. You can place buy or sell orders on the index, and you will typically pay a spread or commission to your broker for each trade. Make sure you use and understand risk management strategies, like stop loss and limit orders, when trading indices on live financial markets.

The Most Valuable Index on the Market

The most valuable index on the market can vary depending on the specific metrics used to measure value. However, some of the most widely-known and highly-valued indices include:

S&P 500

The S&P 500 is considered one of the world's most important stock market indices. It is a market capitalization-weighted index that comprises 500 of the largest publicly traded companies in the United States. The S&P 500 is a benchmark for the overall performance of the US stock market.

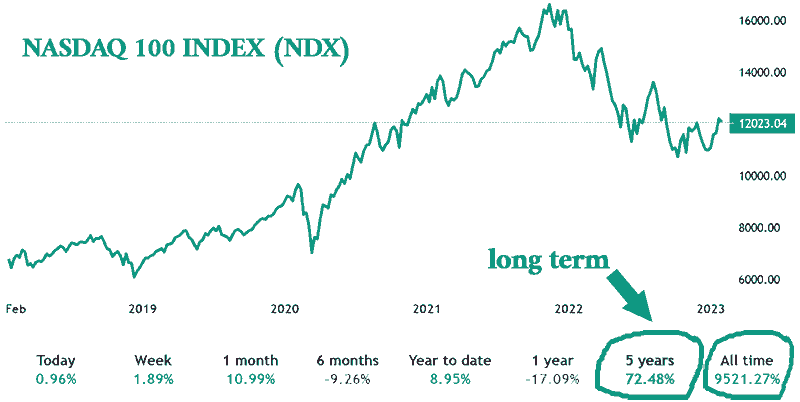

NASDAQ Composite

The NASDAQ composite is another important stock market index that investors widely follow. It is a market capitalization-weighted index that comprises all the common stocks listed on the NASDAQ stock exchange. The NASDAQ composite is a benchmark for the performance of technology and growth-oriented companies.

Dow Jones Industrial Average

The Dow Jones Industrial Average (DJIA) is one of the world's oldest and most well-known stock market indices. It is a price-weighted index that comprises 30 of the largest publicly traded companies in the United States. The DJIA is a benchmark for the performance of blue-chip stocks.

Most Popular Indices By Market Cap

Indice market cap data was last updated in DEC 2024 and may not represent the latest values.

| Index Name | Symbol | Operator | Marketcap | Country | Year Founded | Constituents | Weighting Method | Website URL |

|---|---|---|---|---|---|---|---|---|

| S&P 500 | S&P 500 | S&P Dow Jones Indices | $50.777T | USA | 1957 | 500 large publicly traded companies | Market capitalization-weighted average | https://us.spindices.com/indices/equity/sp-500 |

| NYSE Composite | NYA | New York Stock Exchange (NYSE) | $26.2T | United States | 1907 | 2,400+ common stocks | Market capitalization | https://www.nyse.com/indices/nya |

| NASDAQ-100 | NDX | NASDAQ | $16.9T | USA | 1985 | 100 of the largest non-financial companies listed on the NASDAQ stock exchange | Market capitalization-weighted average | https://indexes.nasdaqomx.com/Index/Overview/NDX |

| Dow Jones Industrial Average | DJIA | S&P Dow Jones Indices | $9.67T | USA | 1896 | 30 large publicly traded companies | Price-weighted average | https://us.spindices.com/indices/equity/dow-jones-industrial-average |

| FTSE 100 | FTSE 100 | FTSE Russell | £1.996T | UK | 1984 | 100 largest companies listed on the London Stock Exchange by market capitalization | Market capitalization-weighted average | https://www.ftse.com/indices/uk-indices/ftse-100 |

| DAX | DAX | Deutsche Börse | €1,245B | Germany | 1988 | 30 largest companies traded on the Frankfurt Stock Exchange | Free float market capitalization-weighted average | https://deutsche-boerse.com/dbg-en/market-data/indices/dax-30 |

| CAC 40 | CAC 40 | Euronext | €2.386T | France | 1987 | 40 largest companies listed on the Euronext Paris exchange by market capitalization | Free float market capitalization-weighted average | https://www.euronext.com/en/products/indices/FR0003500008-XPAR |

| Euro Stoxx 50 | SX5E | STOXX Limited | €3.698T | Europe | 1998 | 50 largest companies listed in the European Union | Free float market capitalization-weighted average | https://www.stoxx.com/indices/index-details/SX5E |

| Hang Seng Index | HSI | Hang Seng Indexes Company Limited | HKD 35.581T | Hong Kong | 1969 | 50 largest companies listed on the Stock Exchange of Hong Kong | Free float market capitalization-weighted average | https://www.hsi.com.hk/eng/indexes/index-detail?index_code=HSI |

| Nikkei 225 | N225 | Japan Exchange Group | $5.67T | Japan | 1949 | 225 largest companies listed on the Tokyo Stock Exchange | Price-weighted average | https://indexes.nikkei.co.jp/en/nkave/index/nikkei-stock-average-225 |

| ASX 200 | XJO | ASX Limited | $8.71B | Australia | 2000 | 200 largest companies listed on the Australian Securities Exchange by market capitalization | Market capitalization-weighted average | https://www.asx.com.au/asx/research/ASx200.html |

| Shanghai Composite | SHCOMP | Shanghai Stock Exchange | $7.62T | China | 1991 | All the stocks listed on the Shanghai Stock Exchange | Market capitalization-weighted average | http://www.sse.com.cn/market/stockdata/overview/index/shanghai/ |

| Taiwan Weighted | TWI | Taiwan Stock Exchange Corporation | $1.4405T | Taiwan | 1962 | Companies listed on the Taiwan Stock Exchange | Market capitalization-weighted average | http://www.tse.com.tw/en/trading/index/taiwan-weighted-index |

| SET Index | SET | The Stock Exchange of Thailand | 19.035T baht | Thailand | 1983 | 50 largest companies listed on the Stock Exchange of Thailand by market capitalization | Market capitalization-weighted average | http://www.set.or.th/set/staticpage.do?lang=en&page=SET50Index |

| KOSPI | KOSPI | Korea Exchange (KRX) | ₩2,254T | South Korea | 1983 | 200 largest companies listed on the Korea Exchange by market capitalization | Market capitalization-weighted average | http://global.krx.co.kr/contents/GLB/02/0202/02020200/GLB02020200.jsp |

| BSE Sensex 30 | BSE30 | Bombay Stock Exchange | $3.5T (₹276.713 lakh crore) | India | 1986 | 30 largest and most actively traded companies listed on the Bombay Stock Exchange | Market capitalization-weighted average | https://www.bseindia.com/indices/IndexArchiveData.html?Expandable=7 |

| JSE All Share Index | J203 | Johannesburg Stock Exchange (JSE) | $1.36T | South Africa | 1887 | All the companies listed on the JSE | Market capitalization | https://www.jse.co.za/indices/all-share-index-asi |

Where to Start Trading Indices

Brokerage Firms That Offer Index Financial Instruments

One of the most common ways to start trading indices is through a brokerage firm. Brokerage firms, such as E-Trade, TD Ameritrade, and Charles Schwab, offer index trading as part of their platform. They provide the necessary tools and resources to research and trade indices. You can open an account with a brokerage firm and fund it with your funds. Then, you can place buy or sell orders on indices through the firm's trading platform.

Exchange-Traded Funds (ETFs)

Another way to start trading indices is through exchange-traded funds (ETFs). ETFs are investment funds that track the performance of a specific index, such as the S&P 500 or NASDAQ. ETFs are traded on stock exchanges, just like stocks, and can be bought and sold throughout the trading day. ETFs can provide a convenient way to gain exposure to an index without buying the underlying stocks directly.

Futures and Options

Traders can also trade indices through futures and options contracts. Futures contracts allow traders to buy or sell an index at a specific price and date in the future. On the other hand, options contracts give traders the right but not the obligation to buy or sell an index at a specific price and date in the future. These methods of trading indices can be complex and require a significant amount of knowledge and experience.

Is Trading Indices Profitable?

Trading indices can be profitable, but it also carries risk. The profitability of trading indices depends on various factors, including market conditions, the specific index traded, and the trader's investment strategy and risk management. Here are some things to consider:

Market conditions

The stock market's overall performance can impact the profitability of trading indices. Generally, a rising stock market tends to be more conducive to profitable index trading, while a falling market can make it more challenging to turn a profit.

Specific index

The specific index traded can also impact profitability. Some indices may be more volatile than others, which can create more profit opportunities and increase risk. Additionally, some indices may have a higher correlation to certain sectors or industries, affecting profitability.

Investment strategy and risk management

A trader's investment strategy and risk management can also play a key role in determining the profitability of trading indices. A well-designed strategy that incorporates a solid risk management plan can help increase the chances of profitability, while a poorly designed strategy can increase the risk of losses.

Advantages Of Trading Indices

- Diversification: Trading indices allow investors to gain exposure to a diverse group of companies rather than just a single stock. Diversification can help spread risk and potentially increase returns.

- Liquidity: Indices are typically highly liquid, meaning they can be easily bought and sold in the market. Liquidity can make it easier to enter and exit trades and can help reduce the impact of slippage.

- Low cost: Compared to actively managed funds, index funds typically have lower expense ratios, making them a cost-effective option for investors.

- Transparency: Indices are generally well-established and have a transparent methodology for determining which included stocks and how they are weighted. Transparency can make it easier for investors to understand and predict the index's performance.

- Ease of access: Many online brokerage firms offer index trading as part of their platform, which can make it easy for investors to trade indices.

Risks Of Trading Indices

- Market risk: Indices are subject to the same market risks as individual stocks. Market risk means that the value of an index can decrease due to general market conditions or macroeconomic factors, such as a recession.

- Correlation risk: Indices correlate to the broader market, which means that they may move in the same direction as the market as a whole. Correlation risk can limit the diversification benefits of trading indices.

- Passive management: Indices are typically passively managed to take advantage of market opportunities or reduce risk. Passive management can lead to underperformance during certain market conditions.

- Limited control: Indices are composed of a basket of stocks, which means that investors have limited control over the specific stocks. Limited control can make it more challenging to control risk or take advantage of specific market opportunities.

- Costs: Trading indices may still involve paying transaction costs and other fees, which can eat into returns.

Is Trading Indices Safe?

Trading indices, like any investment, carry a degree of risk. However, many experts consider indices relatively safe investments over the long term compared to individual stocks or more speculative investments. Here are some reasons why:

Diversification

Trading indices allow investors to gain exposure to a diverse group of companies rather than just a single stock. Diversification can help spread risk and potentially reduce overall portfolio volatility.

Liquidity

Indices are typically highly liquid, meaning they can be easily bought and sold in the market. Liquidity can make it easier to enter and exit trades and can help reduce the impact of slippage.

Low cost

Compared to actively managed funds, index funds typically have lower expense ratios, making them a cost-effective option for investors.

However, it's important to note that no investment is completely safe, and the value of any index can change over time. And differing indices will have different volatility and risk levels. It's essential to consult with a financial advisor before making any investment decisions and also to consider your financial situation, investment goals, and risk tolerance.

Is Trading Indices Ideal for Beginners?

Trading indices can be a good option for beginners as it is relatively easy to understand and access. Here are some reasons why:

Simplicity

Indices are composed of a basket of stocks, which means that investors don't have to pick individual stocks to invest in. Simplicity can make it easier for beginners to navigate the stock market and understand how their investments perform.

Ease of access

Many online brokerage firms offer index trading as part of their platform, which can make it easy for beginners to trade indices.

Index Brokers For Trading Indices On Global Markets Verdict

Trading indices can be a viable option for investors looking to gain exposure to the stock market. Indices provide a way to access a diverse group of companies, which can help spread risk and potentially increase returns. Additionally, indices are typically highly liquid and have low costs, making them accessible to many investors. However, it's important to note that trading in any market carries risk, and past performance does not guarantee future results. It's essential to consult with a financial advisor before making any investment decisions and also to consider your financial situation, investment goals, and risk tolerance.

In conclusion, trading indices can be a good option for beginners and experienced investors. Still, it's important to have a good understanding of the market, the indices you plan to trade, and a well-designed strategy. Investors should also be aware of the risks associated with trading indices and take steps to manage those risks effectively. With proper research, education and risk management, trading indices can be a profitable and safe way to participate in the stock market.

Best Index Brokers For Trading Indices List Compared

| Featured Index Broker Trading Platform | Account Features | Trading Features |

|---|---|---|

| Used By: 180,000 Instruments Available: 232 Stocks Available: 2100 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 61 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mirror Trader, ZuluTrade, Web Trader, cTrader, Mac Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 53 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 35 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 10 USD / 10 EUR |

Platforms: MT4, MT5, Mac, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 200,000 Instruments Available: 1000 Stocks Available: 99 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 80 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: Web Trader, MT4, MT5, AvaTradeGo, AvaOptions, Mac, Mobile Apps, ZuluTrade, DupliTrade, MQL5 Negative Balance Protection: Inactivity Fee: No 71% of retail CFD accounts lose moneyVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 10000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 60 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, IRESS, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 250,000 Instruments Available: 4000 Stocks Available: 1696 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 57 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 0 |

Platforms: MT4, Mirror Trader, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Visit |

|

| Used By: 89,000 Instruments Available: 100 Stocks Available: 60 US Stocks: No UK Stocks: No German Stocks: Yes Japanese Stocks: No Indices: Yes Forex Pairs Available: 70 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mac, ZuluTrade, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your moneyVisit |

|

| Used By: 10,000,000 Instruments Available: 1000 Stocks Available: 160 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 55 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 5 |

Platforms: MT4, MT5, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77.74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.Visit |

|

| Used By: 20,000,000 Instruments Available: 2000 Stocks Available: 2042 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 50 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 50 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 51% of retail investor accounts lose money when trading CFDs with this provider.Visit |

|

| Used By: 10,000 Instruments Available: 130 Stocks Available: 60 US Stocks: Yes UK Stocks: Yes German Stocks: No Japanese Stocks: No Indices: Yes Forex Pairs Available: 45 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, Mac, Mirror Trader, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 142,500 Instruments Available: 200 Stocks Available: 52 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 150 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Your capital is at riskVisit |

|

| Used By: 15,000,000 Instruments Available: 10000 Stocks Available: 1731 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 177 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.Visit |

|

| Used By: 10,000 Instruments Available: 148 Stocks Available: 64 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 40 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: $100 |

Platforms: MT4, MT5, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 15000 Stocks Available: 1000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 55 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 300,000 Instruments Available: 100 Stocks Available: 0 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 150 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1000 |

Platforms: MT4, MT5, ZuluTrade, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 10 US Stocks: Yes UK Stocks: No German Stocks: No Japanese Stocks: No Indices: Yes Forex Pairs Available: 40 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes Losses can exceed depositsVisit |

Best Index Broker Index Broker Reviews

Read our details broker Index Broker Index Broker reviews, you will find something useful if you are shortlisting a Index Broker Index Broker and trading platform.

- IC Markets Review (read our in depth reviews)

- Roboforex Review (read our in depth reviews)

- AvaTrade Review (read our in depth reviews)

- FP Markets Review (read our in depth reviews)

- XTB Review (read our in depth reviews)

- Pepperstone Review (read our in depth reviews)

- XM Review (read our in depth reviews)

- eToro Review (read our in depth reviews)

- FXPrimus Review (read our in depth reviews)

- easyMarkets Review (read our in depth reviews)

- Trading 212 Review (read our in depth reviews)

- Admiral Markets Review (read our in depth reviews)

- SpreadEx Review (read our in depth reviews)

- Swissquote Review (read our in depth reviews)

- HYCM Review (read our in depth reviews)

Index Broker Index Broker Alternatives

Read about and compare Index Broker Index Broker alternatives. We have indepth side by side comparisons to help you find Index Broker Index Broker related brokers.

- IC Markets Alternatives

- Roboforex Alternatives

- AvaTrade Alternatives

- FP Markets Alternatives

- XTB Alternatives

- Pepperstone Alternatives

- XM Alternatives

- eToro Alternatives

- FXPrimus Alternatives

- easyMarkets Alternatives

- Trading 212 Alternatives

- Admiral Markets Alternatives

- SpreadEx Alternatives

- Swissquote Alternatives

- HYCM Alternatives

IC Markets

IC Markets

Roboforex

Roboforex

AvaTrade

AvaTrade

FP Markets

FP Markets

XTB

XTB

Pepperstone

Pepperstone

XM

XM

eToro

eToro

FXPrimus

FXPrimus

easyMarkets

easyMarkets

Trading 212

Trading 212

Admiral Markets

Admiral Markets

SpreadEx

SpreadEx

Swissquote

Swissquote

HYCM

HYCM