Best Germany Brokers & German Trading Platforms

When searching for the best German brokers, it's important to consider their regulation by the Federal Financial Supervisory Authority (BaFin), competitive fees, reliable platforms, and strong customer support. Research the broker's reputation in Germany and track record before making a decision.

German brokers act as intermediaries, providing traders with access to multiple markets, including the stock exchanges of the European Union and international exchanges. They specialize in facilitating the buying and selling various financial assets, such as stocks, bonds, currencies, commodities, and derivatives.

Compliance with regulations set by the BaFin and other regulatory bodies is crucial for German brokers, and investors can have confidence in their services as a result. To protect investors and ensure fair and transparent trading practices, German brokers must comply with regulations such as the BaFin (Federal Financial Supervisory Authority) and the GDPR (General Data Protection Regulation).

In addition to buying and selling financial assets, German brokers offer other services such as trading platforms, research and analysis, financial services, and portfolio management. Fees and commissions for these services can vary depending on the broker and the type of service provided.

If you're looking for a comprehensive guide to German brokers and trading platforms, we've got you covered. Our guide provides a detailed comparison of German trading platforms, narrowing down your choices when selecting a German broker, features of German trading tools, funding and withdrawal methods offered by German brokers, and the costs associated with using a German brokerage firm or trading platform. Our guide offers a clear and informative overview of the factors to consider when choosing a German broker and how to make the most of your trading experience.

Best Germany Brokers & German Trading Platforms Table of Contents

- Germany Brokers: Everything You Need to Know

- What are the most reputable German brokers in the financial market?

- What regulatory body oversees German brokers and ensures their compliance with laws and regulations?

- How Do You Check A German Broker Is Regulated By BaFin?

- What types of financial products and services do German brokers offer to investors?

- Advantages Of German Brokers

- German Broker Deposit And Withdrawal Methods

- German Broker Deposit Methods

- German Broker Withdrawal Methods

- How do German brokers differ from other brokers operating in the global market?

- What is the minimum deposit required to open an account with a German broker?

- What fees and commissions do German brokers charge for their services?

- How do German brokers ensure the safety and security of their client's funds and personal information?

- What trading platforms do German brokers use to execute client trades?

- What educational resources and tools do German brokers offer their clients to help them make informed investment decisions?

- What are the typical account types and leverage options offered by German brokers?

- How do German brokers handle customer support and resolve client issues or disputes?

- What is the average execution speed for trades placed with German brokers?

- What are the margin requirements for trading with German brokers?

- How do German brokers compare in terms of spreads and trading costs to other brokers in the market?

- What are the restrictions and regulations that German brokers must adhere to when serving clients in other countries?

- What risks are associated with trading with German brokers, and how can investors mitigate these risks?

- What is the process for opening an account with a German broker, and how long does it typically take?

- What are the minimum and maximum trading sizes allowed by German brokers?

- How do German brokers comply with anti-money laundering and anti-fraud regulations?

- What is the process for withdrawing funds from a German broker account, and what fees or restrictions apply?

- German Brokers Verdict

- Best Germany Brokers & German Trading Platforms List Compared

Germany Brokers: Everything You Need to Know

Germany has a thriving financial market, with numerous brokers operating there. Suppose you're looking to invest in Germany. In that case, it's important to know about the top brokers, regulatory bodies, financial products and services, fees, security measures, trading platforms, educational resources, account types, customer support, execution speed, margin requirements, trading costs, restrictions and regulations, risks, account opening process, and fund withdrawal procedures. In this article, we will cover each of these topics in detail.

What are the most reputable German brokers in the financial market?

Germany has several reputable brokers in the financial market, including Deutsche Bank, Commerzbank, DekaBank, and Allianz Global Investors. These brokers have a long-standing history of providing top-notch financial services to their clients and are regulated by the Federal Financial Supervisory Authority (BaFin).

What regulatory body oversees German brokers and ensures their compliance with laws and regulations?

BaFin is the primary regulatory body in Germany that oversees brokers operating in the country. BaFin ensures brokers comply with various laws and regulations, including MiFID II, MAR, and AML/CFT regulations. Brokers must be licensed and registered with BaFin before offering their services to investors.

German brokers are regulated by the Federal Financial Supervisory Authority (BaFin), Germany's financial regulatory agency. BaFin oversees and regulates banks, insurance companies, financial services providers, and other institutions operating in the financial markets.

BaFin's mission is to ensure the stability, integrity, and transparency of the financial markets in Germany. The agency supervises and monitors financial institutions to ensure compliance with laws and regulations and takes enforcement actions when necessary to protect consumers and investors.

To become a licensed Germany broker, a company must meet BaFin's requirements, which include:

- Having a physical presence in Germany.

- Having adequate financial resources and capitalization.

- Having sufficient organizational and risk management controls.

- Providing accurate and timely disclosure of information to clients.

- Complying with anti-money laundering and anti-fraud regulations.

BaFin also requires German brokers to participate in an investor compensation scheme, which protects clients in case of the broker's insolvency or bankruptcy.

By regulating German brokers, BaFin aims to promote a fair, transparent, and stable financial market in Germany and to protect the interests of investors and consumers.

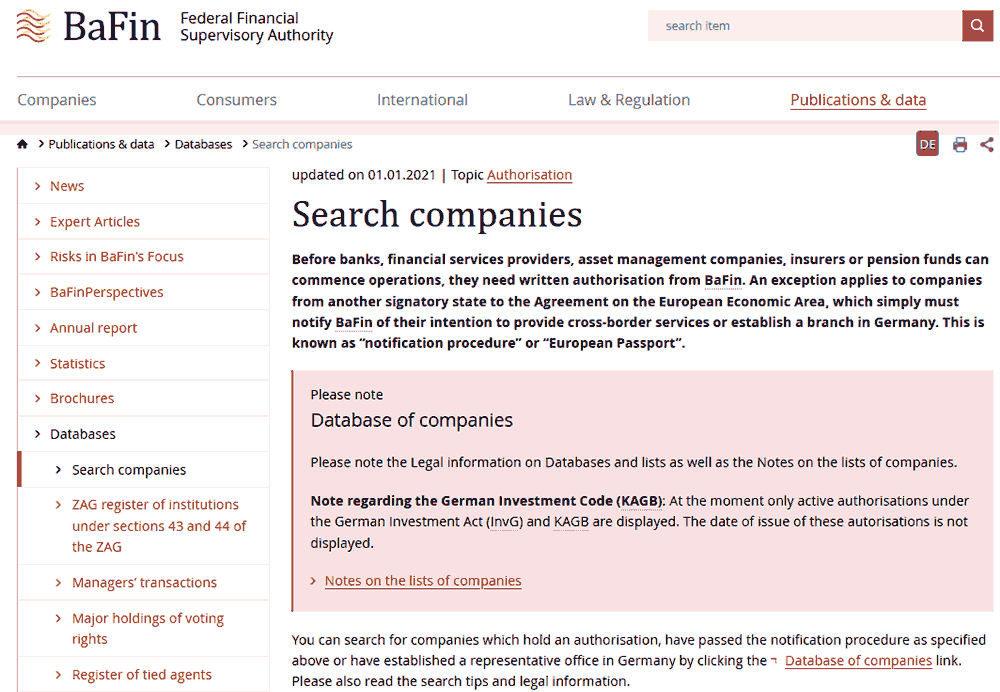

How Do You Check A German Broker Is Regulated By BaFin?

If you are considering using a German broker, it is important to ensure BaFin regulates the broker. Here are the steps you can take to check a German broker's BaFin regulation:

- Visit BaFin's website at www.bafin.de.

- Click on the 'Search' tab in the top menu, and then select 'Directories'.

- Under the 'Directories' section, select 'Institutions and companies'.

- Select the type of institution or company you want to search for, such as 'Investment firms' for German brokers.

- You can search for a specific German broker by entering its name or BaFin registration number if you have it.

- Alternatively, you can use the search filters to narrow down your results by location, type of business, and other criteria.

- Once you have found the German broker you are interested in, you can click on its name to view its details and BaFin registration status.

If a German broker is not listed in BaFin's directory or its registration status is unclear, you should be cautious and consider contacting BaFin directly for more information.

It is important to remember that BaFin's regulation of German brokers does not guarantee the safety or profitability of your investments. Still, it does provide some assurance that the broker is operating legally and under the supervision of a reputable regulatory agency.

What types of financial products and services do German brokers offer to investors?

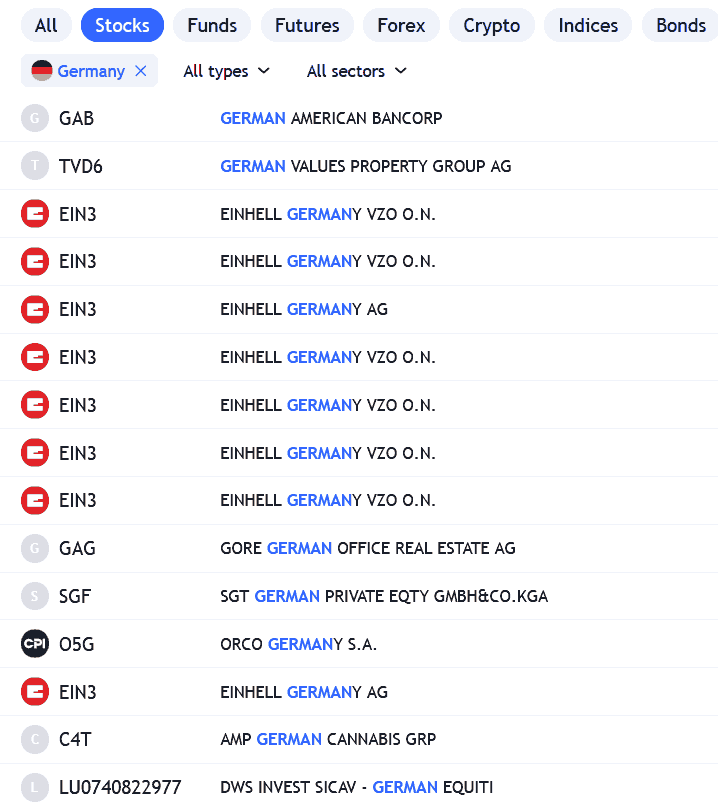

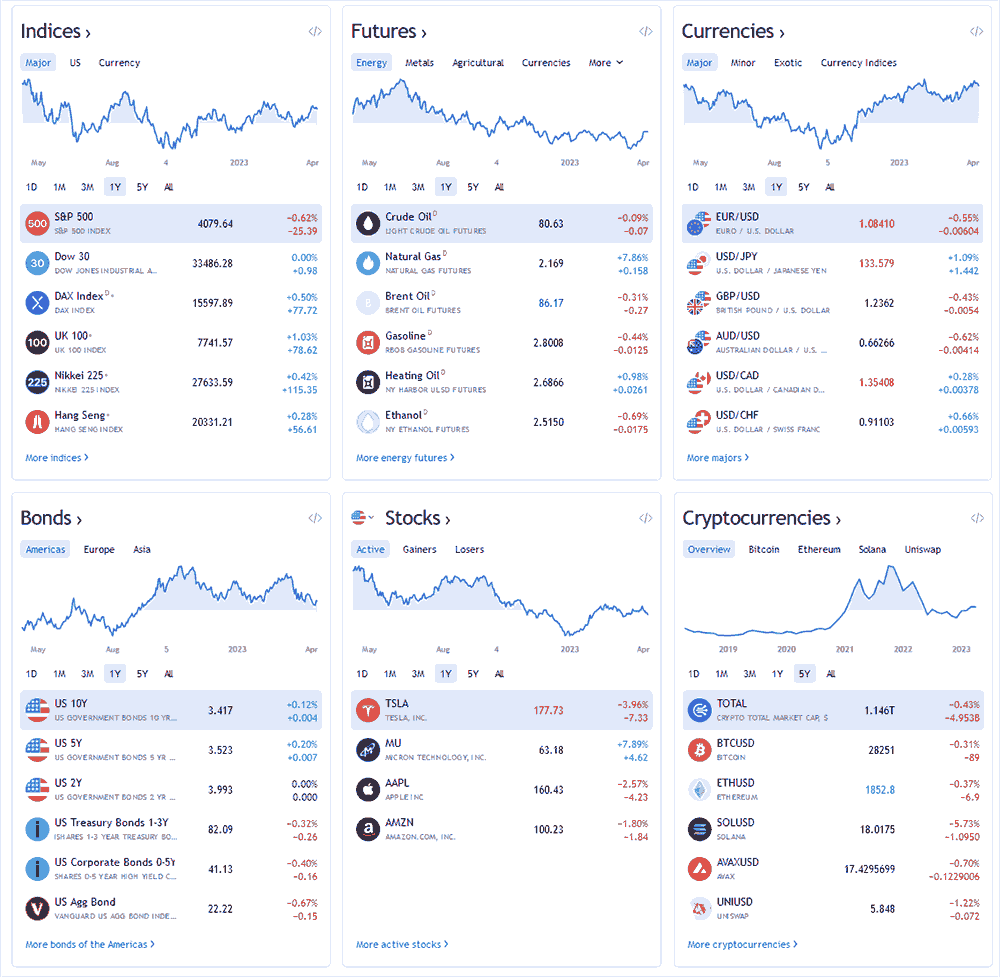

Germany brokers offer various financial products and services, including stocks, bonds, mutual funds, ETFs, options, futures, forex, and commodities. They also provide investment advice, portfolio management, and financial planning services.

Besides these products, German brokers may offer other services to their clients, such as research and analysis, trading signals, and educational resources.

German brokers offer a wide range of financial products and services to investors, including:

- Stocks: German brokers allow clients to invest in shares of companies listed on German and international stock exchanges, including stocks in the USA. Clients can buy and sell stocks from stock exchanges anywhere in the world through the broker's trading platform.

- Bonds: German brokers offer access to a variety of fixed-income securities, including government bonds, corporate bonds, and municipal bonds. Clients can purchase bonds through the broker's trading platform or over-the-counter (OTC).

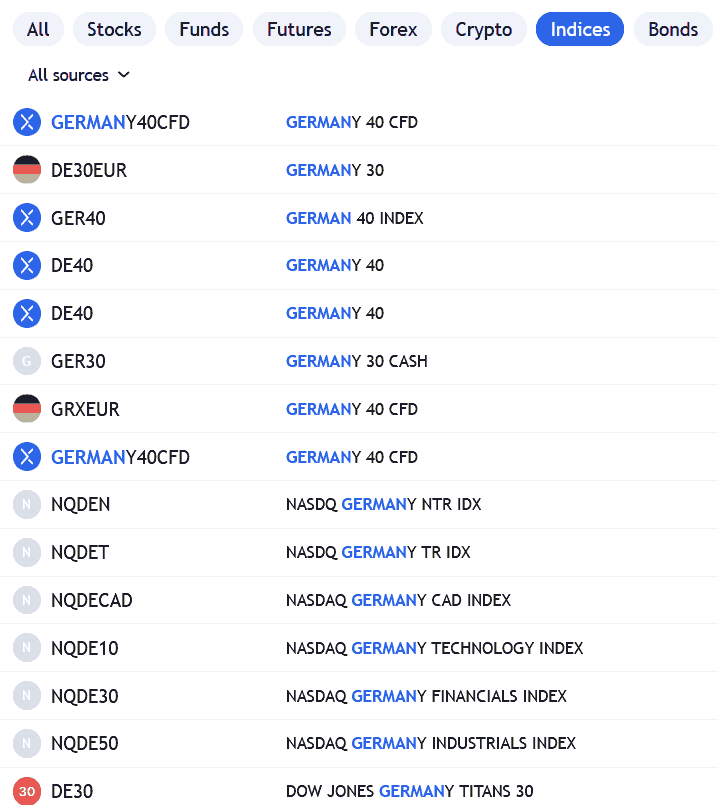

- Indices Trading: Of course the most popular German stock indices like the DAX are available to trade in Germany, but you may also be interested in major US indices like the SP&500 and NASDAQ.

- Forex: Germany brokers provide access to the global foreign exchange market, allowing clients to trade currencies against one another. Clients can trade forex through the broker's trading platform, which may offer advanced charting and analysis tools.

- Commodities: Popular commodities like gold, silver, natural gas and brent oil are all actively available to trade in Germany.

- Contracts for Difference (CFDs): Germany brokers offer CFDs on a variety of underlying assets, including stocks, indices, commodities, and cryptocurrencies. Clients can trade CFDs through the broker's trading platform, which may offer leverage and short-selling capabilities.

- Exchange-traded funds (ETFs): Germany brokers offer access to a variety of ETFs, which are investment funds that trade on stock exchanges like individual stocks. ETFs can provide diversified exposure to a particular market or sector.

- Cryptocurrency: Major cryptocurrency assets are available on German trading platforms, including Bitcoin, Ethereum, XRP, Dogecoin and more.

- Options: Some German brokers offer options trading, which allows clients to purchase the right to buy or sell an underlying asset at a specified price and time. Options can be used for hedging or speculative purposes.

- Managed accounts: Some German brokers offer managed accounts in which a professional money manager makes investment decisions on behalf of the client. Managed accounts may require a higher minimum investment than self-directed accounts.

Advantages Of German Brokers

Trading with German brokers can provide investors access to a well-regulated and financially stable market, advanced trading platforms, diverse product offerings, educational resources, and strong customer support. These advantages can help investors to make informed trading decisions and achieve their investment goals.

German brokers offer various advantages for investors looking to trade in the German financial markets. Here are some of the key advantages of trading with German brokers:

- Regulatory oversight: German brokers are regulated by BaFin, which is one of the most respected financial regulators in the world. BaFin ensures that German brokers comply with all relevant laws and regulations, which helps to protect investors and maintain the integrity of the German financial markets.

- Financial stability: German brokers are typically well-capitalized and have strong financial positions, which helps to reduce the risk of counterparty default. Financial stability can provide investors with greater confidence and security when trading.

- Advanced trading platforms: Many German brokers offer advanced trading platforms with a range of features and tools that can help investors to make informed trading decisions. These platforms may include real-time market data, charting tools, and risk management features.

- Diverse product offerings: German brokers offer a wide range of financial products and services, including stocks, bonds, futures, options, and forex. Diversification allows German investors to diversify their portfolios and exploit market opportunities.

- Education and research: Many German brokers offer educational resources and research tools that can help investors to learn about the markets and make informed trading decisions. These resources may include webinars, tutorials, market analysis, and news updates.

- Customer support: German brokers typically offer high levels of customer support, with dedicated account managers and support teams available to assist investors with any questions or issues they may have.

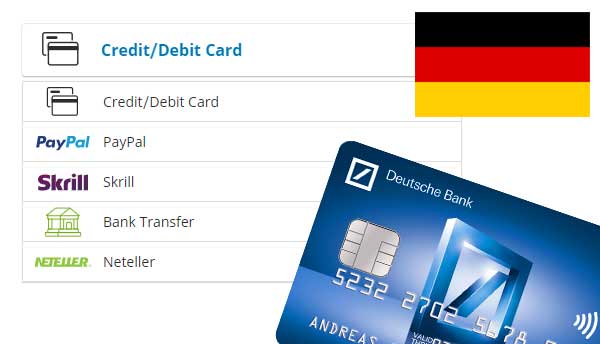

German Broker Deposit And Withdrawal Methods

German trading platforms offer various deposit and withdrawal methods to ensure smooth and convenient transactions for their traders. Traders should review the options provided by their chosen platform, assess the associated fees and processing times, and choose the method that suits their needs.

German Broker Deposit Methods

- Bank Transfers: Bank transfers are a common deposit method on German trading platforms. They allow traders to transfer funds directly from their bank accounts to their trading accounts. This method is reliable and secure but may take several business days to process.

- Credit/Debit Cards: Many German trading platforms also accept credit or debit card payments. This method is quick and easy, and the funds are usually immediately available in the trader's account. However, some platforms may charge a small fee for card transactions.

- Online Wallets: Online wallets have become very popular when used with German trading platforms. Popular ones include PayPal, Skrill, Netteller and even Amazon Pay.

- Sofortüberweisung: Sofortüberweisung is a popular online payment method in Germany. This method allows traders to transfer funds directly from their bank account to their trading account in real time. Sofortüberweisung is secure and reliable, but not all trading platforms support this payment method.

German Broker Withdrawal Methods

- Bank Transfers: Bank transfers are a popular withdrawal method on German trading platforms. Traders can transfer their profits directly from their trading account to their bank account. Bank transfers may take a few business days to process, but they are reliable and secure.

- Credit/Debit Cards: Some platforms also allow traders to withdraw their profits to credit or debit cards. However, the withdrawal amount may be limited, and the fees may be higher than other methods.

- PayPal and other electronic wallets: PayPal is a popular e-wallet payment method among German traders, along with Netteller and Skrill. This method offers fast, secure, and convenient withdrawals on German trading platforms. However, not all German trading platforms support certain payment methods for withdrawals.

How do German brokers differ from other brokers operating in the global market?

German brokers differ from other brokers operating in the global market regarding regulations, fees, and services. Germany brokers must comply with strict regulations set by BaFin, which ensures that they offer safe and reliable services to their clients. Fees charged by German brokers are typically lower than those charged by brokers in other countries. Moreover, German brokers provide personalized services to their clients and offer a range of educational resources to help them make informed investment decisions.

What is the minimum deposit required to open an account with a German broker?

The minimum deposit required to open an account with a German broker varies depending on the broker and the account type. Typically, the minimum deposit ranges from €500 to €5,000, but some brokers in german have no minimum deposit requirements. Minimum trade requirements differ depending on the financial instrument traded.

What fees and commissions do German brokers charge for their services?

German brokers charge various fees and commissions for their services, including account maintenance, trading, and commission fees. The fees charged depend on the broker and the services offered. Generally, German brokers charge lower fees than brokers in other countries.

The fees and commissions charged by German brokers vary depending on the broker and the specific services offered. Here are some of the common fees you may encounter when using a German broker:

- Trading commissions: German brokers typically charge a commission on each trade that you make. This commission can be a fixed amount or a percentage of the trade value.

- Spread: In addition to trading commissions, German brokers may charge a spread, which is the difference between the bid and ask price of a financial instrument. The spread is how the broker makes money on each trade.

- Account fees: Some German brokers may charge fees for maintaining your account, such as an annual or monthly account maintenance fee.

- Withdrawal fees: German brokers may charge a fee for withdrawing funds from your account, especially if you are withdrawing to a foreign bank account.

- Inactivity fees: Some German brokers may charge a fee if you do not make any trades or use your account for a certain period.

- Deposit fees: While not as common, some German brokers may charge a fee for depositing into your account.

It is important to carefully review a German broker's fee schedule and terms and conditions before opening an account to ensure that you understand the costs associated with using the broker's services. Some brokers may offer lower fees or commission rates for larger account balances or frequent traders.

Keep in mind that while lower fees can be attractive, it is also important to consider the quality of the broker's services, such as the range of financial products offered, the trading platform and tools available, and the quality of customer support.

How do German brokers ensure the safety and security of their client's funds and personal information?

German brokers must comply with strict regulations by BaFin to ensure the safety and security of their client's funds and personal information. They must maintain separate accounts for clients' funds and use secure technologies to protect clients' personal information.

German brokers must follow strict regulations and guidelines to ensure the safety and security of their client's funds and personal information. Here are some of the measures that German brokers typically take to protect their clients:

- Regulatory oversight: As mentioned earlier, German brokers are regulated by BaFin and must comply with strict regulations and guidelines to ensure the safety of client funds and personal information. Brokers must also be audited annually to ensure compliance.

- Segregation of client funds: German brokers are required to keep client funds in segregated accounts that are separate from the broker's funds. Client funds will be protected and returned to clients during a broker's insolvency.

- Deposit protection: Many German brokers are members of a deposit protection scheme that provides additional protection to clients in the event of a broker's insolvency. Under these schemes, client funds are protected up to a certain amount, such as €100,000 or €500,000 per client.

- Encryption: German brokers typically use encryption to protect client data and prevent unauthorized access. Including encryption of online transactions, client login credentials, and personal information.

- Two-factor authentication: Some German brokers may require two-factor authentication to access client accounts, which adds an extra layer of security to the login process.

- Anti-money laundering and know-your-customer procedures: German brokers are required to follow strict anti-money laundering and know-your-customer procedures to ensure that clients are legitimate and that funds are not being used for illegal activities.

- Regular monitoring: German brokers typically monitor their systems and accounts for suspicious activity and potential security breaches. They may also provide clients with tools and resources to help them protect their accounts and personal information.

It is important to note that while German brokers take many measures to ensure the safety and security of their clients, there is always a risk of fraud or security breaches. Clients should take precautions to protect their accounts and personal information, such as using strong passwords, avoiding public Wi-Fi networks, and monitoring their accounts regularly for unauthorized activity.

What trading platforms do German brokers use to execute client trades?

Germany brokers use various trading platforms to execute trades on behalf of their clients, including MetaTrader 4 and 5, cTrader, and ProRealTime. These platforms provide clients real-time market data, advanced charting tools, and customizable trading strategies.

It is important to note that different brokers may offer different trading platforms, and the quality and functionality of each platform may vary. Traders should choose a broker that offers a trading platform that meets their needs and preferences.

German brokers typically offer a range of trading platforms for their clients to execute trades. Here are the main trading platforms used by German brokers:

- MetaTrader 4 (MT4): MT4 is one of the most widely used trading platforms in the world and is popular among German brokers. It is known for its advanced charts, and support for automated trading through Expert Advisors (EAs).

- MetaTrader 5 (MT5): MT5 is the successor to MT4 and offers many of the same features, as well as additional tools for market analysis and trading. Some German brokers may offer both MT4 and MT5.

- cTrader: cTrader is a popular trading platform among German brokers, known for its fast execution speeds, advanced charting tools, and support for automated trading.

- NinjaTrader: NinjaTrader is a popular trading platform among professional traders, offering advanced charting capabilities, backtesting, and strategy development tools.

- Web-based platforms: Many German brokers offer web-based trading platforms that can be accessed through a web browser without the need to download and install the software. These platforms are convenient and can be used on any device with internet access.

- Mobile platforms: Most German brokers offer mobile trading platforms that can be accessed through a smartphone or tablet. These platforms are convenient for traders who need to monitor and manage their positions while on the go.

What educational resources and tools do German brokers offer their clients to help them make informed investment decisions?

Germany brokers offer a range of educational resources and tools to help their clients make informed investment decisions. These resources include market analysis, economic calendars, webinars, and educational articles. Brokers may also offer demo accounts for clients to practice trading strategies without risking real money.

Traders should consider the quality and availability of educational resources and tools when choosing a German broker. These resources can be valuable in helping traders develop their skills and make informed trading decisions.

German brokers typically offer a range of educational resources and tools to help their clients make informed investment decisions. Here are some of the most common educational resources and tools offered by German brokers:

- Market analysis: Many German brokers provide daily or weekly market analysis reports, which provide insights into market trends and help traders make informed trading decisions.

- Webinars and seminars: Some German brokers offer webinars and seminars on various trading topics, such as technical analysis, risk management, and trading psychology. These events are usually free for clients to attend.

- Video tutorials: Many German brokers offer video tutorials on their trading platforms and tools, as well as on trading strategies and techniques.

- Trading courses: Some German brokers offer comprehensive trading courses for beginners and advanced traders, covering topics such as trading basics, technical analysis, and risk management. These courses may come at an additional cost.

- Demo accounts: Most German brokers have demo trading accounts, which allow traders to practice trading with virtual funds, no real money is at risk. Demo accounts are a useful educational tool for traders to learn how to use the trading platform and test trading strategies without risking real money.

- Trading tools: German brokers may also offer a range of trading tools to help their clients make informed trading decisions, such as economic calendars, trading calculators, and sentiment indicators.

What are the typical account types and leverage options offered by German brokers?

German brokers offer various account types, including standard, mini, and professional accounts. Leverage options vary depending on the broker and the account type but typically range from 1:30 to 1:500.

How do German brokers handle customer support and resolve client issues or disputes?

German brokers provide customer support via phone, email, and live chat. They also have dedicated customer support teams to help clients resolve issues or disputes. Clients can also file complaints with BaFin if unsatisfied with their broker's services.

What is the average execution speed for trades placed with German brokers?

The average execution speed for trades placed with German brokers varies depending on the broker and the trading platform used. Generally, German brokers offer fast and reliable trade execution, with most trades executed within a few seconds.

What are the margin requirements for trading with German brokers?

The margin requirements for trading with German brokers vary depending on the broker and the financial product being traded. Generally, margin requirements range from 1% to 5% of the total trade value.

How do German brokers compare in terms of spreads and trading costs to other brokers in the market?

German brokers generally offer competitive spreads and trading costs compared to other brokers in the market. However, comparing the fees charged by different brokers before choosing one is important.

What are the restrictions and regulations that German brokers must adhere to when serving clients in other countries?

German brokers must comply with the regulations set by the regulatory bodies in their countries. They must also comply with international regulations, such as MiFID II and AML/CFT.

What risks are associated with trading with German brokers, and how can investors mitigate these risks?

Like all investments, trading with German brokers carries some risks. These risks include market volatility, trading losses, and regulatory changes. Investors can mitigate these risks by diversifying their portfolios, setting realistic investment goals, and conducting thorough research before investing.

Here are some of the most common risks associated with trading with German brokers, as well as some ways investors can mitigate these risks:

- Market risk: The value of investments can fluctuate due to changes in market conditions, which can lead to losses for traders. Investors can mitigate market risk by diversifying their portfolios and using risk management strategies such as stop-loss orders and position sizing.

- Leverage risk: Many German brokers offer leverage. However, leverage can also amplify losses, so investors should be careful when using leverage and only trade with the capital they can afford to lose.

- Counterparty risk: Investors who hold funds with a German broker are exposed to counterparty risk, which is the risk that the broker may not be able to meet its financial obligations to its clients. To mitigate counterparty risk, investors should choose a reputable German broker regulated by BaFin and has a strong financial position.

- Operational risk: Technical failures, system errors, and other operational issues can occur when trading with German brokers, which can lead to losses for traders. Investors can mitigate operational risk by choosing a German broker with a reliable trading platform, robust risk management systems, and strong customer support.

- Regulatory risk: Changes in regulatory requirements or enforcement actions by BaFin can affect the operations and profitability of German brokers, which can impact investors. Investors should stay informed about regulatory developments in the German financial market and choose a broker compliant with all relevant regulations.

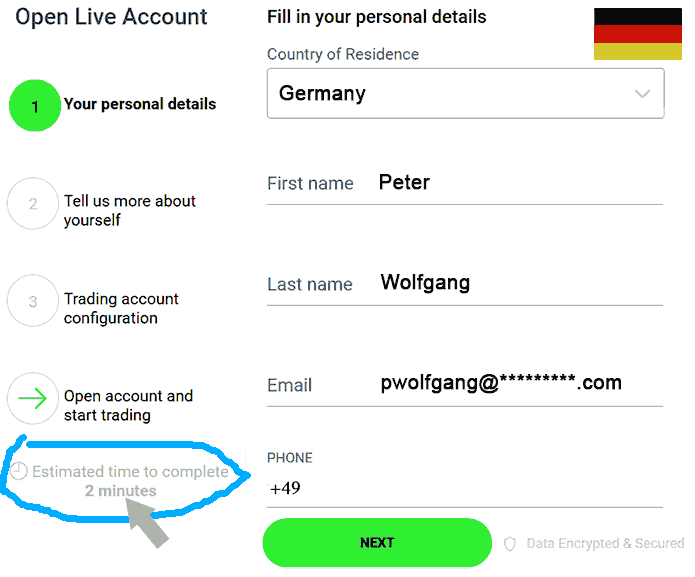

What is the process for opening an account with a German broker, and how long does it typically take?

The process for opening an account with a German broker varies depending on the broker. Generally, clients must fill out an application form and provide proof of identity and address. The process typically takes a few days to a week to complete.

The time it takes to open an account with a German broker can vary depending on the broker's policies and procedures and the completeness and accuracy of the information and documents provided by the applicant. In some cases, opening an account may take only a few hours or days, while others may take several weeks.

It is important to note that opening an account with a German broker may involve additional steps and requirements if you are a non-German resident or citizen. In such cases, you may need to provide additional documentation, such as a residency permit or tax identification number from your home country, and comply with additional regulatory requirements.

The process for opening an account with a German broker may vary depending on the broker and the type of account you are opening. However, here are some general steps that you can expect:

- Choose a broker: Research and compare different German brokers to find one that offers the products, services, and features that meet your trading needs and preferences.

- Complete an application: Once you have selected a German broker, you will need to complete an application form. German broker registration may involve providing personal and financial information, such as your name, address, date of birth, tax identification number, and employment status.

- Submit supporting documents: You will typically need to provide supporting documents to verify your identity and address, such as a passport or national ID card and a recent utility bill or bank statement.

- Agree to terms and conditions: You will need to agree to the broker's terms and conditions, which may include risk disclosures, fee schedules, and other important information.

- Fund your account: Once your account has been approved, you can fund it with the minimum deposit required by the broker. German live trading account funding may vary depending on the type of account and the broker's policies.

- Activate your account: Once your account has been funded, you may need to activate it by logging in to the broker's trading platform and completing any additional steps required by the broker.

What are the minimum and maximum trading sizes allowed by German brokers?

Germanys brokers' minimum and maximum trading sizes vary depending on the broker and the financial product being traded. Generally, the minimum trading size is 0.01 lots, and the maximum trading size is 100 lots.

How do German brokers comply with anti-money laundering and anti-fraud regulations?

German brokers must comply with BaFin's anti-money laundering and anti-fraud regulations. They must conduct thorough customer due diligence, monitor transactions, and report suspicious activities to the authorities.

What is the process for withdrawing funds from a German broker account, and what fees or restrictions apply?

The process for withdrawing funds from a German broker account varies depending on the broker. Generally, clients must request a withdrawal through their account dashboard or by contacting customer support. The broker may require additional documentation, such as proof of bank account ownership. The withdrawal process typically takes a few business days to complete.

German brokers may charge withdrawal fees, such as a fixed fee per transaction or a percentage of the withdrawal amount. Clients should review their broker's fee schedule and withdrawal policies before withdrawing.

German Brokers Verdict

German brokers offer investors a range of financial products and services, including stocks, bonds, forex, and CFDs. These brokers are regulated by BaFin, which ensures that they comply with laws and regulations to protect their clients. German brokers also offer educational resources and tools to help clients make informed investment decisions. However, like all investments, trading with German brokers carries some risks, and investors should conduct thorough research before investing.

Best Germany Brokers & German Trading Platforms List Compared

| Featured German Broker Trading Platform | Account Features | Trading Features |

|---|---|---|

| Used By: 180,000 Instruments Available: 232 Stocks Available: 2100 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 61 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mirror Trader, ZuluTrade, Web Trader, cTrader, Mac Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 53 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 35 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 10 USD / 10 EUR |

Platforms: MT4, MT5, Mac, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 200,000 Instruments Available: 1000 Stocks Available: 99 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 80 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: Web Trader, MT4, MT5, AvaTradeGo, AvaOptions, Mac, Mobile Apps, ZuluTrade, DupliTrade, MQL5 Negative Balance Protection: Inactivity Fee: No 71% of retail CFD accounts lose moneyVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 10000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 60 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, IRESS, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 250,000 Instruments Available: 4000 Stocks Available: 1696 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 57 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 0 |

Platforms: MT4, Mirror Trader, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Visit |

|

| Used By: 89,000 Instruments Available: 100 Stocks Available: 60 US Stocks: No UK Stocks: No German Stocks: Yes Japanese Stocks: No Indices: Yes Forex Pairs Available: 70 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mac, ZuluTrade, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your moneyVisit |

|

| Used By: 10,000,000 Instruments Available: 1000 Stocks Available: 160 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 55 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 5 |

Platforms: MT4, MT5, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77.74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.Visit |

|

| Used By: 20,000,000 Instruments Available: 2000 Stocks Available: 2042 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 50 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 50 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 51% of retail investor accounts lose money when trading CFDs with this provider.Visit |

|

| Used By: 15,000,000 Instruments Available: 10000 Stocks Available: 1731 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 177 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.Visit |

|

| Used By: 10,000 Instruments Available: 15000 Stocks Available: 1000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 55 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 10 US Stocks: Yes UK Stocks: No German Stocks: No Japanese Stocks: No Indices: Yes Forex Pairs Available: 40 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes Losses can exceed depositsVisit |

|

| Used By: 300,000 Instruments Available: 100 Stocks Available: 0 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 150 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1000 |

Platforms: MT4, MT5, ZuluTrade, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 1000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: No Forex Pairs Available: 100 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 0 |

Platforms: MT4, Mac, ZuluTrade, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 4,000,000 Instruments Available: 2200 Stocks Available: 2000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: No Indices: Yes Forex Pairs Available: 67 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your moneyVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 0 US Stocks: No UK Stocks: No German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 45 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

Best German Broker German Broker Reviews

Read our details broker German Broker German Broker reviews, you will find something useful if you are shortlisting a German Broker German Broker and trading platform.

- IC Markets Review (read our in depth reviews)

- Roboforex Review (read our in depth reviews)

- AvaTrade Review (read our in depth reviews)

- FP Markets Review (read our in depth reviews)

- XTB Review (read our in depth reviews)

- Pepperstone Review (read our in depth reviews)

- XM Review (read our in depth reviews)

- eToro Review (read our in depth reviews)

- Trading 212 Review (read our in depth reviews)

- SpreadEx Review (read our in depth reviews)

- HYCM Review (read our in depth reviews)

- Swissquote Review (read our in depth reviews)

- Axi Review (read our in depth reviews)

- Markets.com Review (read our in depth reviews)

- Eightcap Review (read our in depth reviews)

German Broker German Broker Alternatives

Read about and compare German Broker German Broker alternatives. We have indepth side by side comparisons to help you find German Broker German Broker related brokers.

- IC Markets Alternatives

- Roboforex Alternatives

- AvaTrade Alternatives

- FP Markets Alternatives

- XTB Alternatives

- Pepperstone Alternatives

- XM Alternatives

- eToro Alternatives

- Trading 212 Alternatives

- SpreadEx Alternatives

- HYCM Alternatives

- Swissquote Alternatives

- Axi Alternatives

- Markets.com Alternatives

- Eightcap Alternatives

IC Markets

IC Markets

Roboforex

Roboforex

AvaTrade

AvaTrade

FP Markets

FP Markets

XTB

XTB

Pepperstone

Pepperstone

XM

XM

eToro

eToro

Trading 212

Trading 212

SpreadEx

SpreadEx

HYCM

HYCM

Swissquote

Swissquote

Axi

Axi

Markets.com

Markets.com

Eightcap

Eightcap