Best FTSE Brokers

When searching for FTSE brokers, it's important to find a provider that offers access to a wide range of global indices and cost-effective trading options. Look for brokers with a solid reputation, competitive fees, and a user-friendly FTSE trading platform. Additionally, consider the specific indices you intend to trade and ensure they are available through your chosen broker.

This guide focuses on FTSE brokers and their role in trading indices on the global financial markets. We delve into the risks involved, as well as the reasons why individuals opt for FTSE brokers and trading platforms. Our aim is to provide a comprehensive overview of FTSE brokers, compare different platforms available for FTSE index trading, explore financial instruments related to the FTSE, and offer guidance on what to consider when selecting an FTSE broker. We will cover topics such as verifying financial regulations, assessing the range of major and minor financial indices offered, deposit and withdrawal options on the FTSE broker trading platform, and taking into account trading fees.

Best FTSE Brokers Table of Contents

- FTSE Brokers

- What is FTSE (Financial Times Stock Exchange)?

- FTSE Indices Trading

- FTSE and UK Stock Exchange Markets

- FTSE Stock Exchanges available with FTSE Brokers

- How is the FTSE related to the London Stock Exchange?

- How do FTSE brokers enable trading?

- What is spread betting on the FTSE?

- How can I start trading with an FTSE broker?

- Trading CFDs with an FTSE Broker

- What Are the risks of trading the FTSE?

- What are the trading hours for FTSE brokers?

- What fees are associated with trading?

- What trading tools do FTSE brokers offer?

- Can retail investor accounts lose money rapidly?

- What is negative balance protection?

- What are the best FTSE brokers?

- Do FTSE brokers offer in-house developed trading platforms?

- What do FTSE brokers provide the trading conditions?

- Are there any minimum deposit requirements to start trading?

- Are FTSE brokers suitable for novice traders?

- Do retail investor accounts often lose money?

- What are non-trading fees?

- What are the popular indices other than the FTSE 100?

- What role does risk management play in trading?

- What are the advantages of trading with FTSE brokers?

- FTSE Brokers Verdict

- Best FTSE Brokers List Compared

FTSE Brokers

FTSE brokers play a crucial role in the financial markets, particularly for those interested in trading on the London Stock Exchange. They facilitate the buying and selling of various financial instruments, such as stocks, futures, and CFDs (Contract for Difference), providing retail investor accounts access to the markets using proprietary trading platforms software like MT4, MT5, cTrader and copy trading proprietary trading platform software and trading systems available with FTSE broker firms. In this article, we will address the top questions regarding FTSE brokers to help you better understand their role and how they can assist you in achieving your trading goals.

What is FTSE (Financial Times Stock Exchange)?

FTSE stands for Financial Times Stock Exchange and refers to the index series operated by the London Stock Exchange. It includes various indices representing the performance of different market segments, such as the FTSE 100, which consists of the top 100 companies listed on the London Stock Exchange.

FTSE, which stands for Financial Times Stock Exchange, is a renowned index series operated by the London Stock Exchange (LSE). It is a benchmark for tracking the performance of various market segments and is widely recognized as a barometer of the UK stock market.

The FTSE index series consists of several indices, the most prominent being the FTSE 100. This index comprises the 100 largest companies listed on the London Stock Exchange, representing a significant portion of the UK's market capitalization. It includes companies from diverse sectors such as finance, healthcare, energy, consumer goods, etc.

FTSE Indices Trading

The FTSE indices are market-capitalization-weighted, meaning that companies with higher market values substantially impact the index's overall movement. The indices are calculated in real-time, reflecting the continuous fluctuations in stock prices throughout the trading day.

Being one of the most widely tracked and referenced indices globally, the FTSE 100 plays a crucial role in investment decision-making, portfolio management, and evaluating market trends. It provides investors and market participants with a comprehensive snapshot of the performance of the UK's largest and most liquid companies.

The FTSE indices are also used as the underlying benchmark for various financial products, including exchange-traded funds (ETFs), index funds, and derivatives such as futures and options. These products expose investors to the broader market or specific sectors represented by the FTSE indices.

The FTSE indices are often utilized as indicators of the overall health and stability of the UK economy. Economists, analysts, and policymakers closely monitor movements in the FTSE 100 as they can reflect changes in investor sentiment, market confidence, and economic conditions.

FTSE and UK Stock Exchange Markets

The FTSE is a significant index series that provides valuable insights into the performance of the UK stock market. It serves as a vital tool for investors and market participants, offering a benchmark to gauge the relative performance of companies and sectors within the London Stock Exchange.

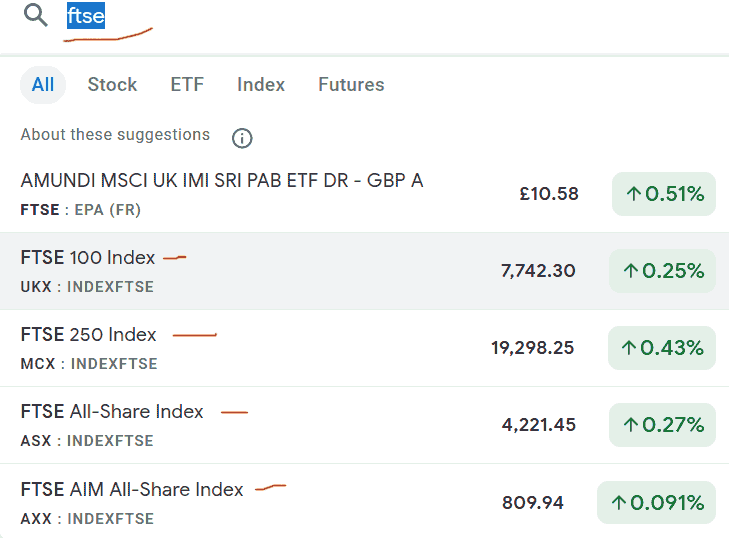

FTSE Stock Exchanges available with FTSE Brokers

This assortment of FTSE stock exchanges showcases the global reach and diversity of the FTSE indices, empowering investors with insights into a wide range of markets and sectors.

The FTSE (Financial Times Stock Exchange) operates numerous notable stock exchanges globally, spanning various regions and markets. Let's explore some of these distinctive FTSE stock exchanges:

-

FTSE 100: This index represents the crème de la crème of the London Stock Exchange (LSE), encompassing the top 100 listed companies in the United Kingdom.

-

FTSE 250: Comprising the subsequent 250 largest companies on the LSE after the FTSE 100, this index offers a broader representation of the UK market.

-

FTSE 350: Combining the FTSE 100 and FTSE 250 indices, the FTSE 350 showcases a comprehensive selection of the largest listed companies on the LSE.

-

FTSE All-Share Index: Encompassing approximately 98% of the market capitalization of all companies listed on the LSE, this index provides a broad view of the UK stock market.

-

FTSE AIM All-Share: Focusing on the Alternative Investment Market (AIM) within the LSE, this index spotlights small and medium-sized companies that offer growth potential.

-

FTSE Bursa Malaysia KLCI: Representing Malaysia's stock market, this index includes the top 30 companies listed on Bursa Malaysia, the nation's primary stock exchange.

-

FTSE/JSE Top 40 Index: This index tracks the performance of the 40 largest companies listed on the Johannesburg Stock Exchange (JSE), showcasing South Africa's vibrant stock market.

-

FTSE China A50: Centered on China's A-share market, this index monitors the performance of the top 50 companies listed on the Shanghai and Shenzhen stock exchanges.

-

FTSE Straits Times Index: Portraying Singapore's stock market, this index captures the performance of the top 30 companies listed on the Singapore Exchange (SGX).

-

FTSE MIB: Illustrating Italy's stock exchange, Borsa Italiana, this index tracks the 40 most liquid and capitalized stocks listed in the country.

-

FTSE CSE Morocco 15 Index: Highlighting Morocco's stock exchange, the Casablanca Stock Exchange, this index includes the 15 most liquid and capitalized companies listed in the country.

-

FTSE SET Index: Showcasing Thailand's stock market, this index monitors the performance of the top 50 companies listed on the Stock Exchange of Thailand (SET).

-

FTSE TWSE Taiwan 50 Index: Centered on Taiwan's stock market, this index represents the top 50 companies listed on the Taiwan Stock Exchange (TWSE).

-

FTSE Nareit All Equity REITs Index: Focusing on the United States, this index tracks the performance of real estate investment trusts (REITs) listed in the country.

-

FTSE/JSE Africa Index Series: Spanning across African stock markets, this includes various indices tailored to specific sectors and market segments.

How is the FTSE related to the London Stock Exchange?

The FTSE (Financial Times Stock Exchange) is closely related to the London Stock Exchange (LSE) as it is a significant index series. The London Stock Exchange is the platform where various financial instruments, such as stocks, bonds, and derivatives, are listed and traded.

FTSE indices, including the popular FTSE 100, are created and managed by FTSE Russell, a London Stock Exchange Group subsidiary. These indices are designed to represent specific segments of the UK stock market, providing investors with benchmarks to measure the performance of different sectors and companies.

The relationship between the FTSE and the London Stock Exchange is twofold. Firstly, the FTSE indices are derived from the stocks listed on the London Stock Exchange. The constituent companies of the FTSE indices are selected based on their market capitalization, liquidity, and other criteria established by FTSE Russell. These companies are representative of the LSE and reflect the overall market movements.

Secondly, the FTSE indices serve as crucial reference points for investors, traders, and market participants who seek to understand the performance of the London Stock Exchange and its listed companies. The FTSE 100, for instance, represents the 100 most prominent and most actively traded companies on the LSE. Movements in the FTSE 100 index are closely watched as they provide insights into the overall direction and sentiment of the London Stock Exchange.

Furthermore, the FTSE indices play a significant role in various investment products and strategies. They are benchmarks for index funds, ETFs, and other financial instruments that aim to replicate the performance of the FTSE indices or specific sectors represented within them. These investment products expose market participants to the London Stock Exchange and its constituent companies without directly owning individual stocks.

The FTSE and the London Stock Exchange share a symbiotic relationship. The London Stock Exchange provides the platform for companies to list and trade their securities, while the FTSE indices derived from the LSE stocks act as important indicators of market performance and serve as benchmarks for investment products. Together, they form a vital ecosystem that supports the functioning and analysis of the UK stock market.

How do FTSE brokers enable trading?

FTSE brokers provide trading platforms that allow retail investors to trade financial instruments, including CFDs, exchange-traded funds (ETFs), and stocks. They offer access to the FTSE 100 and other major indices, allowing investors to take advantage of price movements in these markets.

What is spread betting on the FTSE?

Spread betting is a form of trading that allows investors to speculate on the price movements of various financial instruments like the FTSE trading spread bets. It involves placing bets on whether the price of an asset will rise or fall within a given timeframe. FTSE brokers offer spread betting as one of the trading strategies available on their platforms.

How can I start trading with an FTSE broker?

To start trading with an FTSE broker, you typically need to open an account with an FTSE broker or trading platform that supports FTSE-related financial instruments and is financially regulated in your region. Trading the FTSE involves completing the registration process, verifying your identity, and often making a minimum deposit. Once your account is set up, you can access their trading platform and begin executing trades. Spread betting, the FTSE is a high risk, and traders risk losing money rapidly.

When trading the FTSE (Financial Times Stock Exchange), there are several ways to participate in the market and potentially profit from its movements. Here are some of the primary methods of trading the FTSE:

-

Trading Stocks: One of the most straightforward ways to trade the FTSE is by buying and selling individual stocks of the companies listed on the FTSE indices. By analyzing the performance and prospects of specific companies, traders can take positions based on their expectations of future stock price movements.

-

Exchange-Traded Funds (ETFs): ETFs are investment funds that track the performance of the FTSE indices. By trading ETFs, traders can speculate on the overall movement of the FTSE indices. These funds enable traders to gain exposure to the broader market or specific sectors represented within the FTSE without directly owning individual stocks.

-

Index Futures: Futures contracts based on the FTSE indices provide another avenue for trading. These contracts obligate traders to buy or sell the FTSE index at a predetermined price and date in the future. Index futures allow for leveraged trading, enabling traders to take more prominent positions in the FTSE with less capital.

-

Options: Options provide traders with the right but not the obligation to buy or sell the FTSE index at a predetermined price within a specific timeframe. By trading FTSE options, traders can speculate on the FTSE's direction and volatility, as options offer the potential for significant returns with limited risk.

-

CFDs (Contracts for Difference): CFDs are derivative instruments that allow traders to speculate on the price movements of the FTSE without owning the underlying asset. When trading FTSE CFDs, traders can go long (buy) or short (sell) on the index, profiting from upward and downward price movements.

-

Spread Betting: Spread betting is a popular method of trading the FTSE, particularly in the UK, with a Forex broker. Traders can bet on whether the FTSE index rises or falls within a specific timeframe. Profits or losses are determined by the accuracy of the chance, with potential gains magnified by the extent of the correct prediction.

-

Index Funds: Index funds are mutual funds or exchange-traded funds (ETFs) that aim to replicate the performance of the FTSE indices. By investing in index funds, traders can gain exposure to a diversified portfolio of FTSE-listed stocks, mirroring the index's overall movement.

Trading CFDs with an FTSE Broker

Trading Contracts for Difference (CFDs) with an FTSE broker offers a very high-risk but flexible and accessible way to participate in the FTSE market using high-risk leverage. CFDs allow traders to speculate on the price movements of the FTSE indices without owning the underlying assets, providing opportunities to profit from both rising and falling markets.

It's important to note that trading CFDs with an FTSE broker involves risks, and traders should carefully consider their risk tolerance and objectives before engaging in CFD trading. Understanding market dynamics, conducting a thorough analysis, and implementing effective risk management strategies are vital for successful CFD trading with FTSE brokers.

-

Access to FTSE Indices: FTSE brokers enable traders to access a range of FTSE indices, including the FTSE 100, FTSE 250, and other sector-specific indices. These indices represent various segments of the UK stock market and provide a comprehensive view of market performance. Here's a closer look at trading CFDs with an FTSE broker:

-

Long and Short Positions: With CFD trading, traders can take long (buy) and short (sell) positions on the FTSE indices. The ability to trade in any market direction increases trading opportunities. Traders can profit from price increases by going long or capitalize on price declines by going short.

-

Leverage: FTSE brokers often offer power when trading CFDs. Leverage allows traders to control more prominent positions in the market with a smaller initial investment. However, it's important to remember that while leverage amplifies potential profits, it also increases the risk of losses, so careful risk management is essential.

-

Diverse Range of Financial Instruments: In addition to FTSE indices, CFD trading with an FTSE broker typically includes a wide selection of other tradable instruments. This may consist of stocks, commodities, forex, and global indices, providing traders with a broader range of opportunities and diversification.

-

Trading Flexibility: FTSE brokers provide robust trading platforms that offer a variety of features and tools to enhance the trading experience. Traders can set stop-loss and take-profit orders to manage risk, utilize technical indicators for market analysis, and access real-time price charts for informed decision-making.

-

Trading on Margin: CFD trading involves margin trading, which means traders only need to deposit a percentage of the total trade value as collateral. Allowing for greater exposure to the market with a smaller initial capital outlay. However, it's important to note that trading on margin carries the risk of amplified losses if the market moves against the trader.

-

Risk Management: Managing risk is crucial in CFD trading. FTSE brokers often offer risk management tools such as guaranteed stop-loss orders and negative balance protection to help limit potential losses. Traders should also develop a solid risk management strategy, set appropriate position sizes, and regularly monitor their trades.

-

Quick Execution and Liquidity: Trading CFDs with an FTSE broker usually offers fast execution of trades, allowing traders to take advantage of market opportunities in real time. Additionally, the FTSE market is known for its liquidity, ensuring traders can enter and exit positions without significant slippage.

-

Educational Resources and Support: FTSE brokers often provide educational resources, tutorials, and customer support to assist traders in their journey. These resources can be valuable for traders, particularly those new to CFD trading or looking to enhance their knowledge and skills.

What Are the risks of trading the FTSE?

Trading the FTSE (Financial Times Stock Exchange) carries certain risks that traders should know before engaging in the market. Understanding and managing these risks is crucial for a successful trading experience. Here are some critical risks associated with trading the FTSE:

-

Market Volatility: The FTSE market can be subject to significant price fluctuations and volatility. Various factors, including economic indicators, geopolitical events, and market sentiment, can influence price movements. Rapid price changes can result in gains or losses, and traders must be prepared for potential market volatility.

-

Losses due to Incorrect Analysis: Trading the FTSE requires careful analysis of market trends, company news, and economic data. Traders should conduct thorough research, employ technical and fundamental analysis, and stay updated with relevant news and events to make informed trading decisions. Incorrect analysis or misinterpretation of information can lead to losses.

-

Leveraged Trading: Trading the FTSE involves leveraged positions, allowing traders to control more significant functions with smaller capital investments. While leverage can amplify profits, it also magnifies losses. Traders should exercise caution and use power judiciously, considering the potential risks and ensuring proper risk management strategies are in place.

-

Market Liquidity: The liquidity of the FTSE market can vary, especially during periods of low trading volume or in response to specific market conditions. Limited liquidity may result in wider bid-ask spreads, potential slippage, or difficulty executing trades at desired prices. Traders should know these liquidity risks and adjust their trading strategies accordingly.

-

Systemic Risks: The FTSE market can be affected by systemic risks, including global economic crises, political events, or regulatory changes. Such events can cause sharp market movements and impact the performance of individual stocks or the overall market. Traders must be prepared for unforeseen circumstances and have risk management strategies to mitigate potential losses.

-

Overreliance on Historical Performance: Relying solely on historical performance or past trends of the FTSE may not accurately predict future market movements. Market conditions and investor sentiment can change, leading to deviations from historical patterns. Traders should combine historical analysis with current market indicators and adapt their strategies accordingly.

-

Psychological and Emotional Factors: Trading the FTSE can evoke strong emotions, such as fear, greed, and impatience. Traders should strive to maintain discipline, follow their trading plan, and control their feelings to make objective decisions. Emotional decision-making can lead to irrational trading choices, such as chasing losses or failing to take profits appropriately.

-

Overnight and Weekend Risks: Holding positions overnight or over weekends exposes traders to specific risks. Unexpected news, economic data releases, or geopolitical events during these periods can result in significant price gaps when the market reopens. Traders should consider these risks and implement risk management tools like stop-loss orders to protect against adverse overnight movements.

-

Regulatory and Compliance Risks: Trading the FTSE is subject to regulatory requirements and compliance obligations. Traders must adhere to applicable rules, ensure proper account verification, and comply with anti-money laundering and know-your-customer regulations. Non-compliance can lead to legal consequences and jeopardize trading activities.

What are the trading hours for FTSE brokers?

The trading hours for FTSE brokers may vary depending on their specific market. However, for the London Stock Exchange and the FTSE 100 index, trading usually takes place from Monday to Friday between 8:00 AM and 4:30 PM local time.

What fees are associated with trading?

FTSE brokers charge various fees for their services. These fees can include trading fees, spread costs, non-trading fees (such as withdrawal or overnight expenses), and inactivity fees. It's important to carefully review a broker's fee structure before opening an account to understand the costs involved.

What trading tools do FTSE brokers offer?

FTSE brokers typically provide a range of trading tools to assist investors in their trading activities. These tools can include technical indicators, charting capabilities, economic calendars, and news feeds. Such devices help traders analyze market trends and make informed trading decisions.

Can retail investor accounts lose money rapidly?

Yes, it is possible for retail investor accounts to lose money rapidly when trading financial instruments. Trading CFDs and other complex instruments involve a high level of risk, and if not correctly managed, losses can occur quickly. Traders need to have a sound risk management strategy in place.

What is negative balance protection?

Negative balance protection is a feature some FTSE brokers provide that a trader's account balance cannot go below zero. This protection is crucial in limiting the potential losses that traders may face. In case of significant losses, the broker will automatically close trades or adjust the account balance to prevent the account from falling into a negative balance.

What are the best FTSE brokers?

The choice of the best FTSE broker depends on individual preferences and trading needs. When selecting a broker, factors include trading conditions, tradable instruments, trading platforms, customer support, and regulatory compliance. Some popular FTSE brokers include IC Markets, RoboForex, XTB, AvaTrade, and XM.

Do FTSE brokers offer in-house developed trading platforms?

Yes, many FTSE brokers offer their proprietary trading platforms. These platforms are designed to provide a seamless trading experience with features tailored to the broker's offerings. In-house developed platforms often offer advanced charting tools, customizable interfaces, and real-time market data.

What do FTSE brokers provide the trading conditions?

Trading conditions vary among FTSE brokers. Still, some standard features include tight spreads (the difference between the buying and selling price), competitive trading fees, a wide range of tradable instruments, and access to major indices like the FTSE 100. It's advisable to compare the trading conditions of different brokers before deciding.

Are there any minimum deposit requirements to start trading?

FTSE brokers typically have minimum deposit requirements to open a trading account. This amount can vary significantly depending on the broker and your account type. It's essential to check the minimum deposit requirement beforehand and ensure it aligns with your budget and trading goals.

Are FTSE brokers suitable for novice traders?

FTSE brokers cater to novice traders by providing user-friendly trading platforms, educational resources, and demo accounts. Novice traders should focus on learning and developing their trading style before actively engaging in the markets. Demo accounts allow beginners to practice trading with virtual funds, gaining experience and confidence before risking real money.

Do retail investor accounts often lose money?

While trading can be profitable, it's essential to acknowledge that retail investor accounts can lose money, especially when trading complex instruments like CFDs. Inexperienced traders who lack proper risk management strategies or engage in speculative trading without thorough analysis may experience losses. It's crucial to understand the risks involved and trade responsibly.

What are non-trading fees?

Non-trading fees are charges imposed by FTSE brokers that are not directly related to executing trades. These fees may include withdrawal fees, inactivity fees (for dormant accounts), and overnight fees (for holding positions overnight). Reviewing a broker's fee structure to understand the potential non-trading fees is advisable.

What are the popular indices other than the FTSE 100?

Traders can choose from various indices based on their trading preferences. Besides the FTSE 100, FTSE brokers offer other popular indices for trading. These include the FTSE 250 (representing the following 250 largest companies), the FTSE 350, and international indices like the S&P 500, NASDAQ, and Dow Jones Industrial Average.

What role does risk management play in trading?

Risk management is crucial in trading to protect capital and minimize potential losses. Traders should employ strategies such as setting stop-loss orders, diversifying their portfolio, using appropriate position sizing, and avoiding excessive leverage. Risk management helps maintain a disciplined approach to trading and safeguards against substantial losses.

What are the advantages of trading with FTSE brokers?

Trading with FTSE brokers offers several advantages, including access to major indices, a wide range of tradable instruments, advanced trading platforms, competitive trading conditions, and regulatory oversight. Additionally, FTSE brokers often provide educational resources and customer support to assist traders in their journey.

FTSE Brokers Verdict

FTSE brokers facilitate retail investor accounts' access to the financial markets by providing trading platforms, offering a variety of financial instruments such as CFDs, stocks, and ETFs. They enable traders to participate in the price movements of popular indices like the FTSE 100 and employ different trading strategies. However, it's important to note that trading involves risks, and retail investor accounts can lose money if not approached with proper risk management and knowledge.

Before choosing an FTSE broker, it's essential to compare their trading conditions, including spreads, fees, and available trading tools. Novice traders can benefit from brokers that offer user-friendly platforms, educational resources, and demo accounts to gain experience. Experienced investors may seek advanced features, proprietary trading platforms, and access to various tradable instruments.

Risk management should always be a priority, and traders should develop strategies to mitigate potential losses, including setting stop-loss orders, diversifying portfolios, and avoiding excessive leverage. Traders should also be aware of non-trading fees such as withdrawal fees, inactivity fees, and overnight fees that may affect their trading costs.

By selecting a reputable FTSE broker and practising responsible trading, investors can leverage the opportunities presented by the financial markets and work towards their trading goals. Remember to stay informed, continuously learn about different trading strategies, and adapt to changing market conditions to enhance your chances of success.

Best FTSE Brokers List Compared

| Featured FTSE Broker Trading Platform | Account Features | Trading Features |

|---|---|---|

| Used By: 180,000 Instruments Available: 232 Stocks Available: 2100 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 61 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mirror Trader, ZuluTrade, Web Trader, cTrader, Mac Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 53 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 35 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 10 USD / 10 EUR |

Platforms: MT4, MT5, Mac, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 200,000 Instruments Available: 1000 Stocks Available: 99 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 80 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: Web Trader, MT4, MT5, AvaTradeGo, AvaOptions, Mac, Mobile Apps, ZuluTrade, DupliTrade, MQL5 Negative Balance Protection: Inactivity Fee: No 71% of retail CFD accounts lose moneyVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 10000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 60 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, IRESS, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 250,000 Instruments Available: 4000 Stocks Available: 1696 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 57 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 0 |

Platforms: MT4, Mirror Trader, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Visit |

|

| Used By: 89,000 Instruments Available: 100 Stocks Available: 60 US Stocks: No UK Stocks: No German Stocks: Yes Japanese Stocks: No Indices: Yes Forex Pairs Available: 70 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mac, ZuluTrade, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your moneyVisit |

|

| Used By: 10,000,000 Instruments Available: 1000 Stocks Available: 160 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 55 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 5 |

Platforms: MT4, MT5, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77.74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.Visit |

|

| Used By: 20,000,000 Instruments Available: 2000 Stocks Available: 2042 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 50 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 50 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 76% of retail investor accounts lose money when trading CFDs with this provider.Visit |

|

| Used By: 10,000 Instruments Available: 130 Stocks Available: 60 US Stocks: Yes UK Stocks: Yes German Stocks: No Japanese Stocks: No Indices: Yes Forex Pairs Available: 45 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, Mac, Mirror Trader, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 142,500 Instruments Available: 200 Stocks Available: 52 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 150 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Your capital is at riskVisit |

|

| Used By: 15,000,000 Instruments Available: 10000 Stocks Available: 1731 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 177 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.Visit |

|

| Used By: 10,000 Instruments Available: 148 Stocks Available: 64 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 40 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: $100 |

Platforms: MT4, MT5, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 15000 Stocks Available: 1000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 55 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 300,000 Instruments Available: 100 Stocks Available: 0 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 150 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1000 |

Platforms: MT4, MT5, ZuluTrade, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 10 US Stocks: Yes UK Stocks: No German Stocks: No Japanese Stocks: No Indices: Yes Forex Pairs Available: 40 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes Losses can exceed depositsVisit |

Best FTSE Broker FTSE Broker Reviews

Read our details broker FTSE Broker FTSE Broker reviews, you will find something useful if you are shortlisting a FTSE Broker FTSE Broker and trading platform.

- IC Markets Review (read our in depth reviews)

- Roboforex Review (read our in depth reviews)

- AvaTrade Review (read our in depth reviews)

- FP Markets Review (read our in depth reviews)

- XTB Review (read our in depth reviews)

- Pepperstone Review (read our in depth reviews)

- XM Review (read our in depth reviews)

- eToro Review (read our in depth reviews)

- FXPrimus Review (read our in depth reviews)

- easyMarkets Review (read our in depth reviews)

- Trading 212 Review (read our in depth reviews)

- Admiral Markets Review (read our in depth reviews)

- SpreadEx Review (read our in depth reviews)

- Swissquote Review (read our in depth reviews)

- HYCM Review (read our in depth reviews)

FTSE Broker FTSE Broker Alternatives

Read about and compare FTSE Broker FTSE Broker alternatives. We have indepth side by side comparisons to help you find FTSE Broker FTSE Broker related brokers.

- IC Markets Alternatives

- Roboforex Alternatives

- AvaTrade Alternatives

- FP Markets Alternatives

- XTB Alternatives

- Pepperstone Alternatives

- XM Alternatives

- eToro Alternatives

- FXPrimus Alternatives

- easyMarkets Alternatives

- Trading 212 Alternatives

- Admiral Markets Alternatives

- SpreadEx Alternatives

- Swissquote Alternatives

- HYCM Alternatives

IC Markets

IC Markets

Roboforex

Roboforex

AvaTrade

AvaTrade

FP Markets

FP Markets

XTB

XTB

Pepperstone

Pepperstone

XM

XM

eToro

eToro

FXPrimus

FXPrimus

easyMarkets

easyMarkets

Trading 212

Trading 212

Admiral Markets

Admiral Markets

SpreadEx

SpreadEx

Swissquote

Swissquote

HYCM

HYCM