Best Dow Jones Index Brokers

When selecting a Dow Jones Index broker or a Dow Jones trading platform, consider factors such as fees, trading platform, research tools, and customer support. IC Markets, eToro, and XTB are some of the top Dow Jones Index trading brokers. Research and compare options to find the best fit for your trading needs.

If you're searching for a broker for Dow Jones Index trading, there are several factors to consider. These include fees, the trading platform, research tools, and customer support. Some of the top brokers for Dow Jones Index trading are IC Markets, eToro, and XTB. Take the time to research and compare your options to find the best fit for your specific trading needs.

Dow Jones Index brokers specialize in allowing traders to engage in speculative buying or selling of the Dow Jones Index stock index and offer a range of financial instruments to enable traders to engage in Dow Jones Index trading. These instruments include Dow Jones Index indices trading, Dow Jones Index CFD trading with leverage, buying and selling individual Dow Jones Index stocks, Dow Jones Index futures contracts, and Dow Jones Index options trading.

Our comprehensive guide to Dow Jones Index brokers provides valuable insights into the trading platforms and financial instruments offered by different brokers. It also outlines the key criteria to consider when selecting Dow Jones Index brokers, including trading tools, funding and withdrawal methods, and trading costs. Whether you're considering a Dow Jones Index brokerage firm or a Dow Jones Index trading platform, our guide can help you make an informed decision.

Best Dow Jones Index Brokers Table of Contents

- What are Dow Jones Index brokers, and how do they differ from other brokers?

- What is the Dow Jones Industrial Average, and how does it affect Dow Jones Index brokers?

- What types of financial products and services do Dow Jones Index brokers offer to investors?

- What trading platforms do Dow Jones Index brokers use to execute client trades?

- What fees and commissions do Dow Jones Index brokers charge for their services?

- Dow Jones Broker Funding And Withdrawal Methods

- Dow Jones Funding Methods

- Dow Jones Withdrawal Methods

- Advantages Of DJIA Indices Brokers

- How do Dow Jones Index brokers handle customer support and resolve client issues or disputes?

- What is the minimum deposit required to open an account with a DJIA broker?

- What are the minimum and maximum trading sizes allowed by Dow Jones Index brokers?

- How do Dow Jones Index brokers ensure the safety and security of their client's funds and personal information?

- What are Dow Jones Index brokers' typical account types and leverage options?

- How do Dow Jones Index brokers compare in terms of spreads and trading costs to other brokers in the market?

- What educational resources and tools do Dow Jones Index brokers offer their clients to help them make informed investment decisions?

- What is the process for opening an account with a DJIA broker, and how long does it typically take?

- What risks are associated with trading with Dow Jones Index brokers, and how can investors mitigate these risks?

- What regulatory body oversees Dow Jones Index brokers and ensures their compliance with laws and regulations?

- What are the restrictions and regulations that Dow Jones Index brokers must adhere to when serving clients in other countries?

- What is the average execution speed for trades with Dow Jones Index brokers?

- What margin requirements are necessary for trading with Dow Jones Index brokers?

- What is the process for withdrawing funds from a DJIA broker account, and what fees or restrictions apply?

- Best Dow Jones Index Brokers List Compared

What are Dow Jones Index brokers, and how do they differ from other brokers?

The expertise of brokers specializing in Dow Jones Index trading lies in dealing with the 30 major public companies listed in the Dow Jones Industrial Average (DJIA), a popular U.S. stock market index. Unlike other brokers, Dow Jones Index brokers are equipped with unique services, research capabilities, and trading tools tailored to the specific requirements of trading DJIA stocks.

What is the Dow Jones Industrial Average, and how does it affect Dow Jones Index brokers?

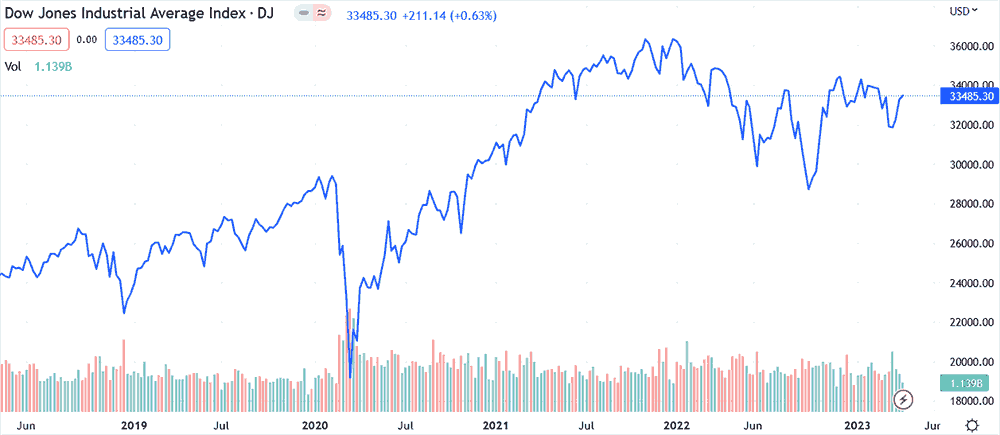

The Dow Jones Industrial Average (DJIA) is a renowned index in the United States that keeps track of 30 major publicly-held companies. Its popularity is not limited to the U.S., as it is also one of the most closely-monitored stock market indices worldwide and is often considered an indicator of the overall well-being of the American economy. The DJIA's performance significantly influences Dow Jones Index brokers' business as their clients tend to trade stocks belonging to the index more frequently.

The Dow Jones Industrial Average (DJIA) is an index that tracks the stock performance of 30 major publicly-traded companies listed on the NASDAQ Stock Market and New York Stock Exchange (NYSE). The DJIA is a highly monitored index worldwide, often considered a measure of the U.S. economy and the stock market's overall health. Dow Jones Index brokers are professionals or companies engaged in trading securities for clients looking to invest in the stock market. The DJIA's performance can significantly impact its business operations, affecting investor sentiments and trading volumes. When the DJIA performs well and shows profits, investors may become more confident and interested in investing, resulting in higher trading volumes and potential commission earnings for brokers.

In contrast, when the DJIA experiences losses and performs poorly, investors may become more cautious and reluctant to invest, leading to lower trading volumes and potentially lower commissions for brokers. The DJIA's performance is just one of the numerous factors influencing Dow Jones Index brokers' performance. These professionals must constantly adapt to the ever-changing market landscape and navigate complexities to help clients attain their investment objectives.

What types of financial products and services do Dow Jones Index brokers offer to investors?

Dow Jones Index brokers typically offer a range of financial products and services, including stock trading, options trading, and futures trading. They may also offer specialized research and analysis tools for trading stocks that are part of the DJIA. Additionally, Dow Jones Index brokers may offer access to margin accounts and other types of leverage to help investors amplify their returns.

Dow Jones Index brokers offer a wide variety of financial products and services to meet the diverse needs of investors and help them achieve their investment goals.

Dow Jones Index brokers offer a wide range of financial products and services to investors interested in investing in the stock market. Some of the most common products and services offered by Dow Jones Index brokers include:

- Stocks: Brokers can help investors buy and sell stocks in the companies that make up the DJIA index or other publicly traded companies.

- Bonds: Brokers can help investors purchase bonds issued by corporations, governments, or other entities.

- Mutual funds: Brokers can offer mutual funds, where many investors speculate on a portfolio of indices, ETFs, commodities, stocks and other assets.

- Exchange-traded funds (ETFs): Brokers can offer ETFs, which are similar to mutual funds but trade on an exchange like a stock.

- Options and futures: Brokers can help investors trade options and futures contracts, which are derivatives that allow investors to bet on the future price movements of underlying assets like stocks, bonds, or commodities.

- Retirement accounts: Brokers can offer retirement accounts like Individual Retirement Accounts (IRAs) or 401(k)s to help investors save for retirement.

- Financial planning services: Brokers can provide financial planning services to help investors set investment goals, create a diversified portfolio, and manage their investments over time.

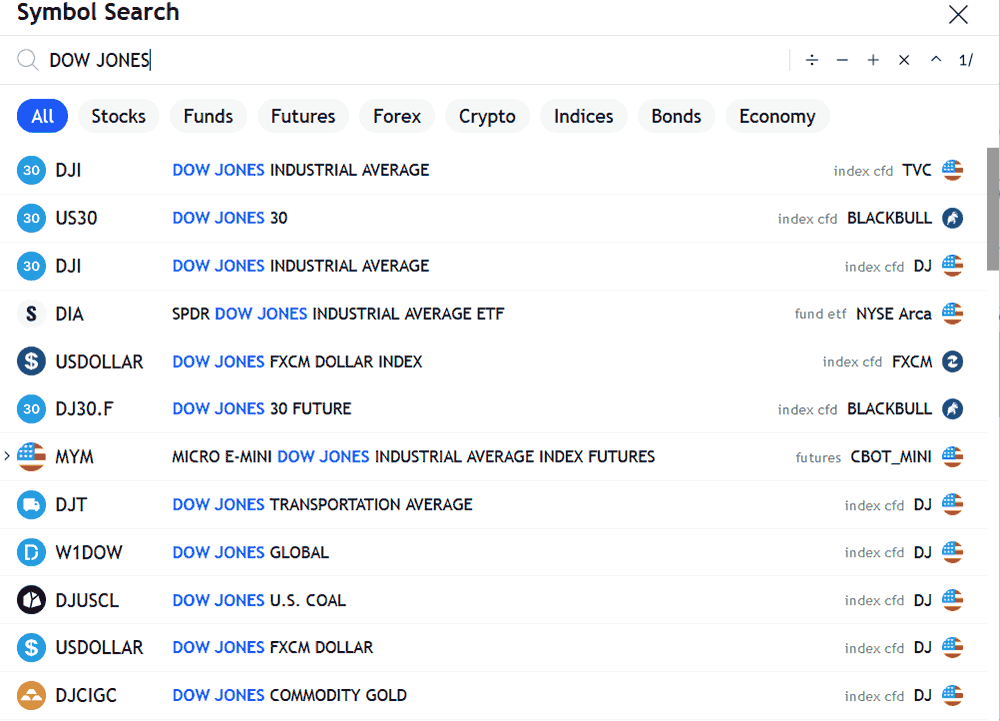

What trading platforms do Dow Jones Index brokers use to execute client trades?

Dow Jones Index brokers may use various trading platforms to execute trades on behalf of their clients. Available DJIA-related financial instrument trading platforms may include proprietary trading platforms developed in-house and popular third-party platforms like MetaTrader 4 and 5, cTrader, or TradingView. The specific trading platform used by a DJIA broker may depend on various factors, including the broker's target market, the types of financial products offered, and the preferences of the broker's clients.

Dow Jones Index brokers use a variety of trading platforms to execute client trades. Some of the most popular trading platforms used by Dow Jones Index brokers include:

- Proprietary platforms: Some brokers offer their proprietary trading platforms, which are developed in-house and tailored to their specific needs and requirements.

- Third-party platforms: Many brokers use third-party trading platforms, such as MetaTrader, ThinkorSwim, or Interactive Brokers, to execute client trades. These platforms offer a range of features and tools that allow traders to analyze market data and execute trades efficiently.

- Mobile trading apps: Many brokers offer mobile trading apps that allow clients to trade on the go from their smartphones or tablets. These apps typically offer similar features and functionality to desktop trading platforms.

- Social trading platforms: Some brokers offer social trading platforms that allow clients to follow and copy the trades of other successful traders. These platforms may also offer features for social interaction and communication between traders.

What fees and commissions do Dow Jones Index brokers charge for their services?

The fees and commissions charged by Dow Jones Index brokers can vary widely depending on several factors, including the broker's target market, the types of financial products offered, and the level of service provided. Common fees and commissions charged by Dow Jones Index brokers may include account maintenance fees, trading fees, and commissions on trades executed on behalf of clients.

The fees and commissions charged by Dow Jones Index brokers may vary depending on various factors, such as the broker's business model, the services provided, and the client's account size and trading volume. It is important for clients to carefully review and understand the fees and commissions charged by their chosen broker before opening an account or executing any trades.

Dow Jones Index brokers charge various fees and commissions depending on the broker and the specific services. Some of the most common fees and commissions charged by Dow Jones Index brokers include:

- Trading commissions: Brokers typically charge a commission for each trade executed on behalf of a client. This commission may be a flat fee or a percentage of the trade value.

- Trading Account fees: Dow Jones Brokers may charge a fixed fee for live trading accounts, which may be monthly or yearly.

- Inactivity fees: Brokers may charge a fee if a client's account is inactive for a certain period.

- Withdrawal fees: Brokers may charge a fee for withdrawing funds from a client's account, which may vary depending on the withdrawal method used.

- Margin interest: Brokers may charge interest on funds borrowed for margin trading.

- Exchange fees: Brokers may pass on exchange fees to clients for executing trades on certain exchanges.

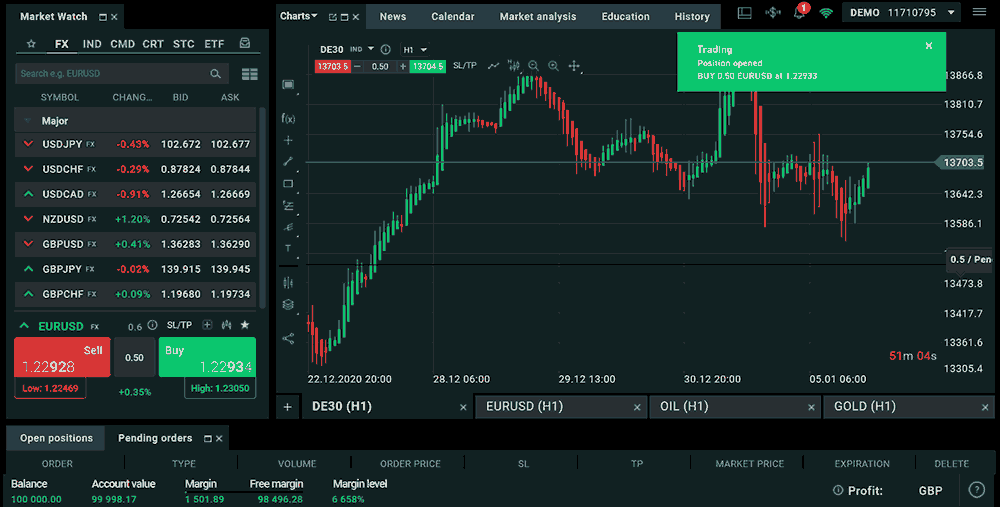

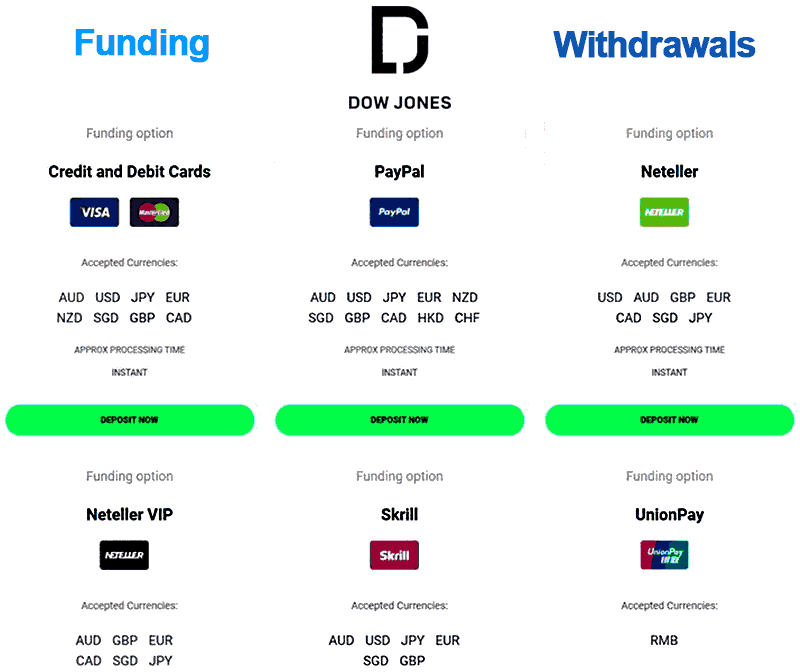

Dow Jones Broker Funding And Withdrawal Methods

Online Dow Jones trading platforms typically offer several deposit and withdrawal methods to enable traders to fund their accounts and withdraw their profits. The methods available may vary depending on the platform and the trader's location.

It's important to note that different trading platforms may offer different funding and withdrawal methods, and some may charge fees for certain methods. Therefore, it's important to check with the specific platform you are using to determine the available options and any associated fees.

Dow Jones Funding Methods

- Credit/Debit Card: This is one of the most popular methods of funding a Dow Jones trading account. Simply provide your card details and the desired amount, and the funds will be transferred instantly.

- Bank Transfer: Bank transfer is another popular method of funding a Dow Jones trading account. You can transfer funds from your bank account to your trading account. This method usually takes a few days to process.

- E-Wallets: E-wallets like PayPal, Neteller, and Skrill are also becoming popular funding methods among Dow Jones Index traders. Most established E-Wallets integrate with Dow Jones trading platforms that are secure, fast, and convenient.

Dow Jones Withdrawal Methods

- Bank Transfer: Bank transfer is one of the most common withdrawal methods used on Dow Jones trading platforms. It usually takes a few days to process, but it is safe and reliable.

- Credit/Debit Card: If you have used a credit or debit card to fund your Dow Jones trading account, you can also withdraw funds to the same card.

- E-Wallets: If you have used an e-wallet to fund your Dow Jones trading account, you can also withdraw funds to the same e-wallet.

Advantages Of DJIA Indices Brokers

DJIA indices brokers offer a range of advantages to clients looking to invest in the stock market. Clients should carefully research and compare brokers to find the best meets their needs and investment goals.

There are many advantages to trading with Dow Jones Index brokers. These brokers offer access to some of the world's largest and most successful companies, which can be a great way to diversify your portfolio and potentially earn significant returns. Additionally, Dow Jones Index brokers typically have strong regulatory oversight and take measures to ensure their clients' funds and personal information safety and security. They also often provide various educational resources and tools to help clients make informed investment decisions.

There are several advantages to using DJIA indices brokers for investment purposes, including:

- Access to diverse investment options: DJIA indices brokers typically offer clients access to a wide range of investment options, including stocks, bonds, ETFs, and mutual funds. Diverse Dow Jones index-related financial instruments allow clients to create a diversified investment portfolio that can help manage risk and maximize returns.

- Expertise and knowledge: DJIA indices brokers typically have a team of financial experts and analysts who can provide valuable insights and advice to clients. Dow Jones educational resources can be particularly helpful for novice investors who may not have the knowledge or experience to make informed investment decisions independently.

- Advanced trading platforms: DJIA indices brokers typically offer advanced trading platforms that allow clients to execute trades quickly and efficiently. These platforms may also provide real-time market data, research reports, and other tools to help clients make informed trading decisions.

- Customer support: DJIA indices brokers typically offer high-quality customer support services to help clients with any questions or issues they may encounter. DJIA brokerage customer support can include online, phone, and other resources to ensure clients have a positive experience using the broker's services.

- Regulatory oversight: DJIA indices brokers are typically subject to regulatory oversight from government agencies such as the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). This oversight helps ensure that brokers comply with industry standards and regulations to protect clients' interests.

How do Dow Jones Index brokers handle customer support and resolve client issues or disputes?

Dow Jones Index brokers typically have dedicated customer support teams to assist clients with issues or disputes. DJIA broker customer support may include providing support via phone, email, or live chat and may involve working with clients to resolve issues related to account access, trade execution, or other areas of concern.

Dow Jones Index brokers typically offer customer support to their clients through various channels, including phone, email, and live chat. Many brokers also offer educational resources, such as webinars and tutorials, to help clients learn more about trading and make informed investment decisions.

If a client has an issue or dispute with their broker, there are several steps they can take to try to resolve the issue. First, contact the broker's customer support team and explain the problem. The broker may be able to provide a solution or resolve the issue.

If the issue cannot be resolved through customer support, the client may need to escalate the issue to a higher level within the broker's organization. Resolving your issue may involve contacting a manager or supervisor within the broker's customer support or compliance team.

If the issue cannot be resolved, the client may need to file a formal complaint with the broker's regulatory authority. In the United States, the regulatory authority for securities brokers is the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). These organizations can investigate client complaints and take disciplinary action against brokers who violate securities laws or regulations.

Dow Jones Index brokers aim to provide high-quality customer support and resolve client issues and disputes as quickly and effectively as possible. Clients should be proactive in communicating with their brokers and seeking a resolution to any issues that arise.

What is the minimum deposit required to open an account with a DJIA broker?

The minimum deposit required to open an account with a DJIA broker may vary depending on the broker and the type of account being opened. However, many Dow Jones Index brokers require a minimum deposit of nothing to several thousand dollars to open an account, depending on the trading features of your DJIA indices trading account.

Some brokers may offer different account types with varying minimum deposit requirements. For example, a broker may offer a basic account with a lower minimum deposit requirement and limited features and a premium account with a higher minimum deposit requirement and more advanced features.

It is important for clients to carefully review the minimum deposit requirements and other account details when considering a DJIA broker. Clients should also consider the broker's fees and commissions, trading platforms, customer support, and other factors when making a decision about which broker to use.

What are the minimum and maximum trading sizes allowed by Dow Jones Index brokers?

The minimum and maximum trading sizes Dow Jones Index brokers allow vary depending on the broker and your account type. Some brokers may allow you to trade as little as one share of a stock, while others may require you to trade in minimum increments of 100 shares or more.

Similarly, the maximum trading size allowed by Dow Jones Index brokers may vary depending on the broker and your account type. Some brokers may allow you to trade up to a certain dollar amount per transaction, while others may have no maximum limit.

It is important to check with your broker to understand the minimum and maximum trading sizes allowed for your account and any associated fees or restrictions.

How do Dow Jones Index brokers ensure the safety and security of their client's funds and personal information?

Dow Jones Index brokers have a legal and ethical obligation to keep their clients' funds and personal information safe and secure. To this end, Dow Jones Index brokers typically employ a range of measures to safeguard their client's interests.

One such measure is to hold client funds in segregated accounts, separate from the DJIA broker's funds. Segregated accounts ensure that client funds are not used for the broker's business expenses or investment activities and can be returned to clients in case of insolvency.

Dow Jones Index brokers may also use encryption technology to protect client data and prevent unauthorized access. Including using Secure Sockets Layer (SSL) encryption for online transactions and account access, as well as firewalls and other security measures to protect against hacking attempts and other cyber threats.

Additionally, Dow Jones Index brokers may be required to comply with anti-money laundering (AML) regulations, which are designed to prevent the use of financial services for illegal activities such as money laundering and terrorist financing. AML processes may involve conducting due diligence on clients to verify their identities and sources of funds, as well as monitoring transactions for suspicious activity.

Dow Jones Index brokers are expected to maintain a high-security standard and compliance with regulatory requirements to ensure the safety and security of their client's funds and personal information. Clients should always conduct due diligence and research a broker's security measures and regulatory compliance before entrusting them with their funds and personal information.

What are Dow Jones Index brokers' typical account types and leverage options?

DJIA broker leverage is limited by financial regulators in your country or region. Dow Jones Index brokers typically offer several account types to cater to the needs of different investors. These may include basic accounts for novice investors with limited trading experience, as well as advanced accounts for more experienced traders with higher risk tolerance.

Many Dow Jones Index brokers also offer leverage options, which allow investors to trade with borrowed funds from the broker. Leverage is a high risk, it can potentially increase the investor's returns, but it also comes with a high chance of loss. Hence, it's essential to understand the risks involved and use leverage responsibly.

How do Dow Jones Index brokers compare in terms of spreads and trading costs to other brokers in the market?

The spreads and trading costs charged by Dow Jones Index brokers can vary depending on the broker and the type of account the investor chooses. It's essential to compare the costs charged by different brokers before choosing one to ensure that you're getting the best value for your money.

Some Dow Jones brokers have lower trading spreads and trading costs but have other hidden fees, so it's important to review the fee schedule carefully and ask questions if necessary.

What educational resources and tools do Dow Jones Index brokers offer their clients to help them make informed investment decisions?

Many Dow Jones Index brokers offer educational resources and tools to help clients make informed investment decisions. These may include webinars, tutorials, e-books, and other educational materials that cover a range of topics, from basic investment principles to advanced trading strategies.

Some brokers may also offer advanced tools such as trading simulators or access to third-party research and analysis tools, which can provide investors with additional insights into the market.

Dow Jones Index brokers typically offer a range of educational resources and tools to help clients make informed investment decisions. Clients should take advantage of these resources and engage in ongoing education to develop their knowledge and skills as investors.

Dow Jones Index brokers typically offer a range of educational resources and tools to help clients make informed investment decisions. Some of these resources may include:

- Research reports: Dow Jones Index brokers may provide clients with access to research reports on various companies, industries, and markets. These reports can provide valuable insights and analysis to help clients make informed investment decisions.

- Market analysis: Brokers may offer daily or weekly market analysis reports to help clients understand market trends and potential investment opportunities.

- Financial news: Many brokers offer access to financial news and analysis from reputable sources to keep clients up-to-date on the latest developments in the financial world.

- Webinars and seminars: Brokers may offer webinars and seminars on a range of investment topics, from basic investing principles to advanced trading strategies.

- Investment tools: Dow Jones Index brokers may offer investment tools such as stock screeners, calculators, and trading simulators to help clients research and test investment strategies.

- Personalized advice: Some brokers offer personalized investment advice from professional financial advisors to help clients develop customized investment plans based on their individual goals and risk tolerance.

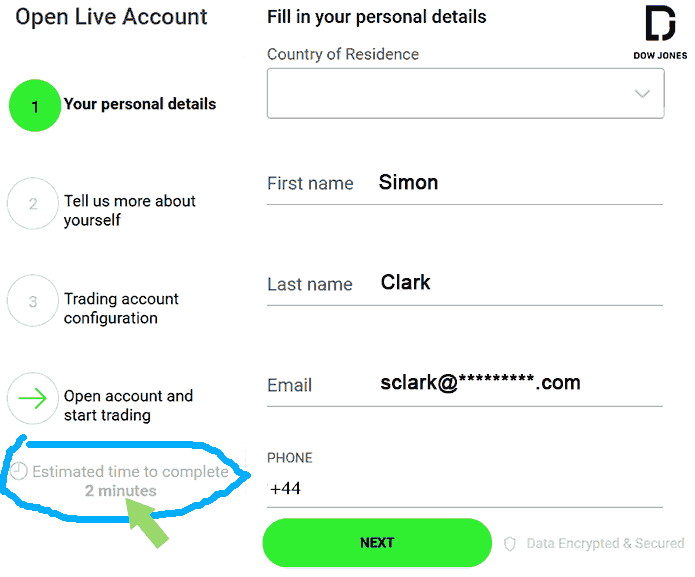

What is the process for opening an account with a DJIA broker, and how long does it typically take?

The time it takes to open an account with a DJIA broker can vary depending on the broker and the type of account you are opening. Some brokers may be able to approve your application and verify your identity within a few days, while others may take longer. Funding your account can also take a few days, depending on your chosen payment method.

Overall, opening an account with a DJIA broker is relatively straightforward and can usually be completed within a week or two.

The process for opening an account with a DJIA broker varies depending on the broker. Generally, it involves filling out an online application and providing personal and financial information. DJIA broker account registration may include your name, address, date of birth, employment status, income, and investment experience.

After submitting your application, you may need to provide additional documentation, such as a copy of your passport or driver's license, to verify your identity. Once your account is approved, you can typically fund your account using a variety of methods, such as bank transfer or credit card.

The time it takes to open an account with a DJIA broker can vary depending on the broker and the information required. Some brokers may be able to approve your account within a few hours, while others may take several days or more.

The process for opening an account with a DJIA broker can vary depending on the broker, but here are the general steps:

- Choose a broker: Research different Dow Jones Index brokers and choose one that meets your needs and preferences.

- Complete an application: Fill out an application with the broker, providing personal and financial information.

- Verify your identity: Dow Jones Index brokers are required to verify the identity of their clients to comply with anti-money laundering regulations. Confirming your identity may involve submitting a government-issued I.D. and other documentation.

- Fund your account: Once your application is approved, you will need to fund your account. Funding your DJIA index live trading account with bank transfers, debit cards, PayPal or other local payment providers.

- Start trading: Once your account is funded, you can start trading with the broker.

What risks are associated with trading with Dow Jones Index brokers, and how can investors mitigate these risks?

As with any investment, risks are associated with trading with Dow Jones Index brokers. One of the main risks is market volatility, which can lead to significant losses if investments are not managed properly. Additionally, trading with leverage can increase the risk of losses and gains.

Another risk associated with trading with Dow Jones Index brokers is the possibility of insolvency or fraud. While reputable brokers take measures to protect their client's funds and personal information, there is always a risk that a broker could go bankrupt or engage in fraudulent behaviour. Investors can mitigate this risk by choosing a broker regulated by a reputable regulatory body, such as the FCA in the United Kingdom and the SEC or FINRA in the United States or BaFin in Germany.

Investors should also know the risks of trading in different markets or asset classes. For example, trading in emerging markets can be risky due to political instability or currency fluctuations. Similarly, investing in derivatives or other complex financial products can be risky if the investor does not fully understand how these products work.

To mitigate these risks, investors should educate themselves on the markets and asset classes they are interested in trading and carefully consider each investment's risks and potential rewards. Additionally, investors should diversify their portfolios to reduce the risk of significant losses due to market volatility or other factors.

- Market risk: Investing in the stock market always involves some degree of market risk. The value of stocks can fluctuate based on various factors, including economic conditions, company performance, and geopolitical events. To mitigate market risk, investors should diversify their portfolios across different asset classes, industries, and geographies.

- Liquidity risk: Some stocks may have lower trading volumes and may be harder to sell quickly. Low trading volume can lead to liquidity risk, where investors may be unable to sell their stocks when they want to. To mitigate liquidity risk, investors should research the trading volumes and liquidity of the stocks they plan to invest in and consider investing in more liquid stocks.

- Broker risk: While Dow Jones Index brokers are regulated by government agencies such as the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA), there is still some risk associated with using a broker. For example, a broker may go bankrupt, which could result in a loss of funds for investors. To mitigate broker risk, investors should research brokers carefully and choose a reputable broker with a strong financial standing.

- Cybersecurity risk: Dow Jones Index brokers may be vulnerable to cyberattacks, which could result in the loss of personal and financial information. To mitigate cybersecurity risk, investors should choose a broker with strong security protocols in place, such as two-factor authentication and encryption, and should regularly monitor their accounts for any suspicious activity.

- Operational risk: Operational risk refers to the risk of losses resulting from inadequate or failed internal processes, systems, or people. Investors should choose a broker with strong internal controls and risk management practices to mitigate operational risk.

What regulatory body oversees Dow Jones Index brokers and ensures their compliance with laws and regulations?

Dow Jones Index brokers are typically regulated by the Financial Conduct Authority in the United Kingdom, the Securities and Exchange Commission (SEC) in the United States or the Federal Financial Supervisory Authority (BaFin) in Germany, as well as other regulatory bodies in the countries in which they operate.

These regulatory bodies oversee the activities of Dow Jones Index brokers and ensure they comply with financial regulations.

What are the restrictions and regulations that Dow Jones Index brokers must adhere to when serving clients in other countries?

When serving clients in other countries, Dow Jones Index brokers must adhere to the regulatory requirements of those countries. Brokers that support trading in the DJIA may register with local regulatory bodies, obtain necessary licenses, and comply with local laws and regulations related to securities trading. Brokers must also comply with international laws related to money laundering and terrorism financing and may be required to perform additional due diligence when serving clients in certain countries.

What is the average execution speed for trades with Dow Jones Index brokers?

The average execution speed for trades placed with Dow Jones Index brokers can vary widely depending on the broker, the traded product, and market conditions. However, most Dow Jones Index brokers offer fast and reliable trade execution, with trades typically executed within seconds. Brokers may use various technologies and strategies to ensure fast execution, including direct market access, algorithmic trading, and low-latency trading infrastructure.

What margin requirements are necessary for trading with Dow Jones Index brokers?

Margin requirements for trading with Dow Jones Index brokers vary widely depending on the broker and the specific product being traded. Generally, brokers require traders to maintain a certain margin level in their accounts to cover potential trade losses. Margin requirements can range from as little as 1% for some indices trade to 50% or more for certain stock trades. Brokers may also offer Dow Jones Industrial Average indices margin trading, which allows traders to borrow funds from the broker to increase their trading power. However, this can also increase the risk of losses.

What is the process for withdrawing funds from a DJIA broker account, and what fees or restrictions apply?

The process for withdrawing funds from a DJIA broker account can vary depending on the broker but generally involves submitting a withdrawal request through the broker's online platform or customer support team. Brokers may require certain documentation to verify the trader's identity and account ownership and may also charge fees for certain types of withdrawals or withdrawals exceeding a certain amount. Some brokers may also impose minimum withdrawal amounts or restrict the frequency of withdrawals.

Once you submit your withdrawal request, it may take some time for the funds to be transferred to your account, depending on the payment method you chose and the broker's processing times. In addition, there may be fees or restrictions associated with withdrawing funds from a DJIA broker account.

Many brokers offer free withdrawals for certain payment methods or a certain number of withdrawals per month. However, there may be fees associated with some payment methods or for exceeding the monthly withdrawal limit. Additionally, some brokers may require a minimum balance to be maintained in the account and may charge a fee if the balance falls below this amount.

Before opening an account with a DJIA broker, it's important to review their withdrawal policies and fees to ensure you understand the costs and restrictions associated with withdrawing funds from your account.

The process for withdrawing funds from a DJIA broker account can vary depending on the broker, but here are the general steps:

- Log in to your account: Go to the broker's website and log in to your account.

- Select withdrawal: Find the section of the website or platform that allows you to make and select a withdrawal request.

- Choose payment method: Choose the payment method you prefer, such as bank transfer, credit card, or other payment methods.

- Enter amount: Enter the amount you wish to withdraw.

- Submit a request: Submit your withdrawal request.

Fees and restrictions may also vary depending on the broker. Some brokers may charge a flat fee or a percentage of the withdrawal amount, while others may offer free withdrawals up to a certain limit. Clients may also need to meet certain requirements or conditions, such as reaching a minimum account balance or completing a certain number of trades, before they can withdraw funds.

Best Dow Jones Index Brokers List Compared

| Featured Dow Jones Index Broker Trading Platform | Account Features | Trading Features |

|---|---|---|

| Used By: 180,000 Instruments Available: 232 Stocks Available: 2100 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 61 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mirror Trader, ZuluTrade, Web Trader, cTrader, Mac Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 53 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 35 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 10 USD / 10 EUR |

Platforms: MT4, MT5, Mac, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 200,000 Instruments Available: 1000 Stocks Available: 99 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 80 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: Web Trader, MT4, MT5, AvaTradeGo, AvaOptions, Mac, Mobile Apps, ZuluTrade, DupliTrade, MQL5 Negative Balance Protection: Inactivity Fee: No 71% of retail CFD accounts lose moneyVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 10000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 60 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, IRESS, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 250,000 Instruments Available: 4000 Stocks Available: 1696 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 57 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 0 |

Platforms: MT4, Mirror Trader, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Visit |

|

| Used By: 89,000 Instruments Available: 100 Stocks Available: 60 US Stocks: No UK Stocks: No German Stocks: Yes Japanese Stocks: No Indices: Yes Forex Pairs Available: 70 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mac, ZuluTrade, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your moneyVisit |

|

| Used By: 10,000,000 Instruments Available: 1000 Stocks Available: 160 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 55 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 5 |

Platforms: MT4, MT5, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77.74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.Visit |

|

| Used By: 20,000,000 Instruments Available: 2000 Stocks Available: 2042 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 50 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 50 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 51% of retail investor accounts lose money when trading CFDs with this provider.Visit |

|

| Used By: 15,000,000 Instruments Available: 10000 Stocks Available: 1731 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 177 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.Visit |

|

| Used By: 10,000 Instruments Available: 15000 Stocks Available: 1000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 55 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 10 US Stocks: Yes UK Stocks: No German Stocks: No Japanese Stocks: No Indices: Yes Forex Pairs Available: 40 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes Losses can exceed depositsVisit |

|

| Used By: 300,000 Instruments Available: 100 Stocks Available: 0 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 150 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1000 |

Platforms: MT4, MT5, ZuluTrade, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 1000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: No Forex Pairs Available: 100 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 0 |

Platforms: MT4, Mac, ZuluTrade, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 4,000,000 Instruments Available: 2200 Stocks Available: 2000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: No Indices: Yes Forex Pairs Available: 67 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your moneyVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 0 US Stocks: No UK Stocks: No German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 45 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

Best Dow Jones Index Broker Dow Jones Index Broker Reviews

Read our details broker Dow Jones Index Broker Dow Jones Index Broker reviews, you will find something useful if you are shortlisting a Dow Jones Index Broker Dow Jones Index Broker and trading platform.

- IC Markets Review (read our in depth reviews)

- Roboforex Review (read our in depth reviews)

- AvaTrade Review (read our in depth reviews)

- FP Markets Review (read our in depth reviews)

- XTB Review (read our in depth reviews)

- Pepperstone Review (read our in depth reviews)

- XM Review (read our in depth reviews)

- eToro Review (read our in depth reviews)

- Trading 212 Review (read our in depth reviews)

- SpreadEx Review (read our in depth reviews)

- HYCM Review (read our in depth reviews)

- Swissquote Review (read our in depth reviews)

- Axi Review (read our in depth reviews)

- Markets.com Review (read our in depth reviews)

- Eightcap Review (read our in depth reviews)

Dow Jones Index Broker Dow Jones Index Broker Alternatives

Read about and compare Dow Jones Index Broker Dow Jones Index Broker alternatives. We have indepth side by side comparisons to help you find Dow Jones Index Broker Dow Jones Index Broker related brokers.

- IC Markets Alternatives

- Roboforex Alternatives

- AvaTrade Alternatives

- FP Markets Alternatives

- XTB Alternatives

- Pepperstone Alternatives

- XM Alternatives

- eToro Alternatives

- Trading 212 Alternatives

- SpreadEx Alternatives

- HYCM Alternatives

- Swissquote Alternatives

- Axi Alternatives

- Markets.com Alternatives

- Eightcap Alternatives

IC Markets

IC Markets

Roboforex

Roboforex

AvaTrade

AvaTrade

FP Markets

FP Markets

XTB

XTB

Pepperstone

Pepperstone

XM

XM

eToro

eToro

Trading 212

Trading 212

SpreadEx

SpreadEx

HYCM

HYCM

Swissquote

Swissquote

Axi

Axi

Markets.com

Markets.com

Eightcap

Eightcap