Best Cryptocurrency Brokers

The best cryptocurrency brokers offer various services, including trading platforms, security features, and low fees. Researching and comparing different brokers before choosing one is essential to ensure they align with your investment goals and risk tolerance. Look for regulated brokers with solid reputations and user-friendly interfaces.

Our all-inclusive Cryptocurrency broker guide encompasses a variety of subjects, comprising an in-depth comparison of Cryptocurrency trading platforms and crypto financial tools. Moreover, we provide valuable insights to help you narrow your choices while selecting the best Cryptocurrency broker for your needs.

Apart from evaluating the functionalities of Cryptocurrency trading tools and funding and withdrawal options provided by Cryptocurrency brokers, we also examine the expenses associated with using a Cryptocurrency brokerage firm or crypto trading platform. Our guide offers a comprehensive and illuminating summary of the factors investors should contemplate when picking Cryptocurrency brokers.

Best Cryptocurrency Brokers Table of Contents

- Cryptocurrency Brokers: Everything You Need to Know

- What is a Cryptocurrency Broker?

- How do Cryptocurrency Brokers differ from Cryptocurrency Exchanges?

- What are the most popular cryptocurrencies?

- What are the Advantages of Using a Cryptocurrency Broker?

- What are the Risks Associated with Using a Cryptocurrency Broker?

- What are the limits of cryptocurrency brokers?

- How do I Choose a Reputable Cryptocurrency Broker?

- What is the Process for Opening an Account with a Cryptocurrency Broker?

- What Types of Cryptocurrencies can I Trade with a Cryptocurrency Broker?

- What are the Fees and Commissions Charged by Cryptocurrency Brokers?

- What Types of Trading Platforms do Cryptocurrency Brokers Offer?

- What are the funding options for my cryptocurrency broker account?

- Are there any restrictions on trading with cryptocurrency brokers?

- How do cryptocurrency brokers handle customer support?

- What is the process for withdrawing funds from a cryptocurrency broker account?

- Do cryptocurrency brokers offer demo accounts for practice trading?

- What are the tax implications of trading with a cryptocurrency broker?

- What regulatory bodies oversee cryptocurrency brokers?

- Are cryptocurrency brokers insured against financial losses?

- What is the level of transparency provided by cryptocurrency brokers regarding their financial health?

- Can I transfer my account from one cryptocurrency broker to another?

- What are the most common strategies for trading cryptocurrencies with a broker?

- What regulatory bodies oversee cryptocurrency brokers?

- Are cryptocurrency brokers insured against financial losses?

- What is the level of transparency provided by cryptocurrency brokers regarding their financial health?

- Can I transfer my account from one cryptocurrency broker to another?

- What are the most common strategies for trading cryptocurrencies with a broker?

- What are the best resources for staying informed about changes or regulation updates that may affect my trading with a cryptocurrency broker?

- Cryptocurrency brokers verdict

- Best Cryptocurrency Brokers List Compared

Cryptocurrency Brokers: Everything You Need to Know

Cryptocurrencies have become increasingly popular in recent years, with many people seeking to invest in digital assets such as Bitcoin, Ethereum, and Litecoin. Cryptocurrency brokers offer a way for individuals to buy and sell cryptocurrencies easily and quickly. This article will answer some of the most frequently asked questions about cryptocurrency brokers.

What is a Cryptocurrency Broker?

A cryptocurrency broker is a company that enables individuals to buy and sell cryptocurrencies through their platform. The broker is an intermediary between the buyer and seller and charges a fee or commission for their services.

How do Cryptocurrency Brokers differ from Cryptocurrency Exchanges?

Cryptocurrency brokers differ from cryptocurrency exchanges in that they do not allow users to trade cryptocurrencies directly with each other. Instead, brokers act as a middleman, buying and selling cryptocurrencies for their clients. On the other hand, cryptocurrency exchanges facilitate direct trades between buyers and sellers.

What are the most popular cryptocurrencies?

Determining the top 20 cryptocurrencies by popularity can be subjective and may depend on market capitalization, trading volume, media coverage, and community support.

We list some of the most popular cryptocurrencies available on cryptocurrency broker trading platforms below:

- Bitcoin (BTC): The world's first cryptocurrency that operates on a decentralized, peer-to-peer network without a central bank or administrator. BTC is known for its limited supply cap of 21 million coins and its high volatility.

- Ethereum (ETH): The second-largest cryptocurrency by market cap, ETH is a decentralized software platform that enables developers to build and deploy smart contracts and decentralized applications (DApps).

- Cardano (ADA): An open-source, decentralized blockchain platform that aims to provide a more secure and sustainable infrastructure for DApps and smart contracts.

- Binance Coin (BNB): The native token of the Binance exchange, BNB, is used to pay trading fees and other fees on the platform, as well as for accessing certain features and services.

- XRP (XRP): The native digital asset of the XRP ledger, XRP is designed to facilitate fast, cross-border payments and reduce the cost of settlement fees.

- Dogecoin (DOGE): A meme-inspired cryptocurrency that gained popularity in 2021 due to its endorsement by celebrities such as Elon Musk. DOGE has no practical use case but has a strong community following.

- Polkadot (DOT): An open-source, sharded blockchain platform that enables the interoperability of multiple chains and networks, allowing for greater scalability and faster transaction speeds.

- Solana (SOL): A high-performance, open-source blockchain platform that uses a unique consensus mechanism called Proof of History (PoH) to achieve fast transaction speeds and low fees.

- Chainlink (LINK): A decentralized oracle network that provides secure and reliable data feeds to smart contracts and DApps, enabling them to access external data sources and execute real-world actions.

- Tether (USDT): A stablecoin pegged to the US dollar, USDT is designed to maintain a stable value and is commonly used as a means of transferring value between different exchanges and wallets.

- Bitcoin Cash (BCH): A hard fork of Bitcoin that aims to provide faster transaction speeds and lower fees by increasing the block size limit.

- Litecoin (LTC): A peer-to-peer cryptocurrency that is similar to Bitcoin but with faster transaction confirmation times and a different mining algorithm.

- Polygon (MATIC): A Layer 2 scaling solution for Ethereum that aims to improve transaction speeds and reduce fees by using sidechains and Plasma technology.

- Stellar (XLM): A decentralized payment network that facilitates cross-border transactions and enables low-cost, fast settlement times.

- VeChain (VET): A blockchain platform that uses RFID technology to track and verify supply chain data, providing greater transparency and efficiency for businesses.

- Uniswap (UNI): A decentralized exchange (DEX) that operates on the Ethereum blockchain, enabling users to trade cryptocurrencies without the need for a centralized intermediary.

- Cosmos (ATOM): A decentralized network of independent blockchains that can communicate with each other through a shared consensus mechanism, enabling greater interoperability and scalability.

- Theta Token (THETA): A decentralized video delivery network that enables users to share and stream high-quality video content without relying on centralized platforms.

- Stellar (XLM): Stellar is a decentralized platform that allows the transfer of digital currencies, including its native asset XLM. The platform aims to make financial transactions more efficient and affordable.

- VeChain (VET): VeChain is a blockchain platform that aims to improve supply chain management and business processes. Its native token, VET, facilitates transactions and access services on the VeChain network.

- Uniswap (UNI): Uniswap is a decentralized exchange (DEX) that allows users to trade cryptocurrencies directly from their wallets. UNI is the platform's native token, which governs the protocol and provides liquidity.

- Cosmos (ATOM): Cosmos is a decentralized network of independent blockchains that can interact with each other through the Cosmos Hub. ATOM is the native token of the Cosmos network and is used to pay transaction fees and governance.

- Theta Token (THETA): Theta is a decentralized video streaming platform that uses blockchain technology. THETA is the native token of the Theta network and is used to reward content creators and viewers for participating in the platform.

- Internet Computer (ICP): Internet Computer is a decentralized computing platform that aims to provide a scalable and efficient alternative to traditional cloud computing services. ICP is the native token of the Internet Computer network and is used to pay for transaction fees and governance.

- Filecoin (FIL): Filecoin is a decentralized storage platform that allows users to rent out their unused storage space to store and retrieve data. FIL is the native token of the Filecoin network and is used to pay for storage and retrieval services.

- Avalanche (AVAX): Avalanche is a decentralized platform that allows the creation and exchange of digital assets and applications. AVAX is the native token of the Avalanche network and is used to pay transaction fees and governance.

- Terra (LUNA): Terra is a blockchain platform that aims to create a stablecoin ecosystem. LUNA is the native token of the Terra network and is used to stabilize the value of the platform's stablecoins and provide liquidity.

- Algorand (ALGO): Algorand is a decentralized platform that aims to provide a scalable and secure infrastructure for the development of decentralized applications. ALGO is the native token of the Algorand network and is used to pay transaction fees and governance.

- Theta Token (THETA): Theta Token is the native cryptocurrency of the Theta network, a decentralized video delivery platform that aims to provide high-quality video streaming with reduced costs by using blockchain technology. Theta Token can reward users who share idle computing and bandwidth resources to enhance the video delivery network.

- Internet Computer (ICP): Internet Computer is a decentralized network that aims to provide a platform for building and deploying decentralized applications. The native cryptocurrency of the Internet Computer network is ICP, which can be used to pay for transactions and other network activities. Internet Computer aims to provide a more scalable and efficient platform for building decentralized applications.

- Filecoin (FIL): Filecoin is a decentralized storage network that allows users to store and retrieve data securely and efficiently. The native cryptocurrency of the Filecoin network is FIL, which is used to pay for storage and retrieval services on the network. Filecoin aims to provide a decentralized and efficient alternative to traditional cloud storage services.

What are the Advantages of Using a Cryptocurrency Broker?

- Quick and convenient: Cryptocurrency brokers are a way to buy and sell cryptocurrencies

- Easy to use: Cryptocurrency brokers typically offer user-friendly platforms that allow traders to buy and sell digital assets quickly and easily.

- Variety of cryptocurrencies: Cryptocurrency brokers offer a wide range of cryptocurrencies, including the most popular ones like Bitcoin, Ethereum, and Litecoin, as well as lesser-known ones.

- Low barriers to entry: Unlike traditional financial markets, cryptocurrency brokers have low minimum deposit requirements, making them accessible to a wider range of traders.

- 24/7 market: Cryptocurrency markets are open 24/7, allowing traders to buy and sell digital assets at any time of the day or night.

- Fast transactions: Cryptocurrency transactions are typically processed quickly, allowing traders to take advantage of price movements in the market.

- Advanced trading tools: Some brokers offer advanced trading features and tools

What are the Risks Associated with Using a Cryptocurrency Broker?

- Volatility: Cryptocurrencies are highly volatile and can experience large price swings in a short period. Traders should be prepared to handle the high risk associated with trading cryptocurrencies. The volatility of cryptocurrencies can result in significant losses

- Security concerns: Cryptocurrencies are stored in digital wallets, and if these wallets are compromised, traders can lose their entire investment. Therefore, traders must be careful when choosing a cryptocurrency broker and ensure adequate security measures. Like all digital platforms, cryptocurrency brokers are vulnerable to hacks and cyber attacks. While reputable brokers will take steps to protect their client's funds, there is always a risk of theft or loss.

- Lack of regulation: Cryptocurrencies are largely unregulated, which means that traders may not have the same level of protection as they do in traditional financial markets. Therefore, choosing a reputable cryptocurrency broker operating in a regulated jurisdiction is essential. Cryptocurrency brokers are not regulated in the same way as traditional financial institutions.

- Limited deposit options: Cryptocurrency brokers typically offer limited deposit options, with most only accepting payments in cryptocurrencies or through bank transfers.

- Crypto scams: Unless you use a reputable cryptocurrency broker, there is a potential for fraud and scams.

What are the limits of cryptocurrency brokers?

while cryptocurrency brokers offer a convenient way for investors to trade cryptocurrencies, they have limitations. It is important for investors to carefully consider these limitations and their own investment goals before using a cryptocurrency broker.

As with any investment, there are limits to what cryptocurrency brokers can offer. Here are some of the main limitations of cryptocurrency brokers:

- Limited Cryptocurrency Offerings: Not all cryptocurrency brokers offer access to the same range of cryptocurrencies. Some may only offer the most popular ones, like Bitcoin, Ethereum, and Litecoin, while others offer a wider range of altcoins. Investors looking to trade less common cryptocurrencies may need to look beyond cryptocurrency brokers.

- Regulatory Limitations: Cryptocurrency brokers are subject to the regulations of the countries in which they operate. Their offer may have limitations, and investors may not have access to certain cryptocurrencies or trading features depending on their location.

- Limited Leverage: While some cryptocurrency brokers do offer leverage trading, the leverage ratios may be lower than what is available in traditional financial markets.

- Liquidity Issues: Some smaller cryptocurrency brokers may struggle to maintain the same levels of liquidity as larger exchanges. Low liquidity can result in wider spreads and less favorable trading conditions.

How do I Choose a Reputable Cryptocurrency Broker?

- Research different brokers and read reviews from other users

- Check the broker's regulatory status and licensing

- Look for brokers with a history of reliable service and good customer support

- Choose a broker with a secure platform and a good reputation for security measures

What is the Process for Opening an Account with a Cryptocurrency Broker?

The process for opening an account with a cryptocurrency broker varies depending on the broker. However, it typically involves creating an account, verifying your identity, and depositing funds into your account.

What Types of Cryptocurrencies can I Trade with a Cryptocurrency Broker?

The cryptocurrencies available for trading with a broker will vary depending on the broker. However, most brokers offer a wide range of popular cryptocurrencies such as Bitcoin, Ethereum, and Litecoin.

What are the Fees and Commissions Charged by Cryptocurrency Brokers?

The fees and commissions charged by cryptocurrency brokers vary depending on the broker. Some brokers charge a flat fee per trade, while others charge a percentage of the transaction amount. Understanding a broker's fee structure before opening an account is important.

What Types of Trading Platforms do Cryptocurrency Brokers Offer?

Cryptocurrency brokers offer various types of trading platforms to their clients. These platforms differ in functionality, user interface, and trading tools. The type of trading platform offered by a cryptocurrency broker depends on the broker's target audience, the level of trading experience of the clients, and the broker's business model. Traders should choose a trading platform that suits their trading needs and preferences. Here are some of the most common types of trading platforms that cryptocurrency brokers offer:

- Web-based platforms: These platforms are accessed through a web browser and do not require any installation. They offer basic trading functionalities such as price charts, order management, and account management.

- Mobile trading apps: Cryptocurrency brokers offer mobile trading apps for Android and iOS devices. These apps offer the same functionalities as web-based platforms but are optimized for mobile devices.

- Desktop trading platforms: These platforms are downloaded and installed on a computer. They offer advanced trading functionalities such as automated trading, backtesting, and customized trading strategies.

- Social trading platforms: These platforms allow traders to follow and copy the trades of other traders. They offer a social network-like experience and are popular among novice traders.

- Algorithmic trading platforms: These platforms allow traders to automate their trading strategies using computer programs. They offer advanced programming tools and support for popular programming languages such as Python and Java.

- API trading platforms: These platforms allow traders to connect their trading accounts with third-party trading software or applications. They offer advanced trading functionalities such as real-time market data, order management, and portfolio management.

What are the funding options for my cryptocurrency broker account?

Cryptocurrency brokers typically offer their clients a range of funding options, including bank transfers, credit/debit cards, and e-wallets like PayPal or Skrill. Some brokers may also accept other cryptocurrencies as a form of payment. It's important to check with the broker to see what specific funding options are available and whether fees or minimum deposit requirements are associated with each method.

Are there any restrictions on trading with cryptocurrency brokers?

This can depend on the specific broker and the country they operate. Some brokers may restrict who can open an account, while others may restrict the types of trades that can be made. It's important to research the broker's policies and regulations before opening an account.

How do cryptocurrency brokers handle customer support?

Good cryptocurrency brokers typically have various customer support options, including phone, email, and live chat. Some may also offer a knowledge base or FAQ section on their website. It's important to check what support options are available and how responsive the broker is to customer inquiries.

What is the process for withdrawing funds from a cryptocurrency broker account?

The withdrawal process from a cryptocurrency broker account can vary depending on the broker and the funding method used. Typically, withdrawals are made through the same method used to fund the account. It's important to check with the broker for their specific withdrawal policies and any fees that may be associated with the process.

Do cryptocurrency brokers offer demo accounts for practice trading?

Many cryptocurrency brokers offer demo accounts for practice trading. These free accounts allow traders to simulate real trades using virtual funds. Demo accounts can be useful for new traders who want to test different strategies before committing real money to the market.

What are the tax implications of trading with a cryptocurrency broker?

Tax implications can vary depending on the country in which the trader resides. In many countries, profits made from cryptocurrency trading are subject to capital gains taxes. Traders need to consult with a tax professional or financial advisor to understand the specific tax implications in their jurisdiction.

What regulatory bodies oversee cryptocurrency brokers?

Regulatory bodies overseeing cryptocurrency brokers can vary depending on the country in which the broker operates. The Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA) oversee cryptocurrency brokers in the United States. The Financial Conduct Authority (FCA) regulates cryptocurrency brokers in the United Kingdom.

Are cryptocurrency brokers insured against financial losses?

This can depend on the European broker and the country they operate. Some brokers may offer insurance against financial losses, while others may not. It's important to research the broker's policies and regulations before opening an account.

What is the level of transparency provided by cryptocurrency brokers regarding their financial health?

The level of transparency provided by cryptocurrency brokers regarding their financial health can vary. Some brokers may publish financial statements or audits on their websites, while others may not. It's important to research the broker's policies and regulations before opening an account.

Can I transfer my account from one cryptocurrency broker to another?

It is usually possible to transfer an account from one cryptocurrency broker to another. The process for doing so can vary depending on the brokers involved. Still, it typically involves filling out a transfer request form and providing documentation to verify identity and account ownership.

What are the most common strategies for trading cryptocurrencies with a broker?

The most common strategies for trading cryptocurrencies with a broker include technical analysis, fundamental analysis, and algorithmic trading. Technical analysis involves analyzing charts and price patterns to identify trading opportunities. Fundamental analysis involves analyzing the underlying fundamentals of a cryptocurrency, such as its technology and adoption rate. Algorithmic crypto trading involves using computer programs. It is essential to note that each trading strategy has pros and cons, and traders should choose the one that suits their trading style and risk tolerance. Practicing risk management and having a well-defined trading plan to minimize losses and maximize profits is also crucial.

There are various strategies for trading cryptocurrencies with a broker, and the most common ones are:

- HODLing: This is a long-term investment strategy where the trader buys and holds cryptocurrencies for an extended period, believing that their value will appreciate over time. This strategy requires patience and a strong belief in the cryptocurrency's future potential.

- Swing Trading: This strategy involves taking advantage of short-term price fluctuations in the cryptocurrency market by buying low and selling high. Swing traders typically hold their positions for a few days to a few weeks.

- Day Trading: This strategy involves buying and selling cryptocurrencies within a single trading day to profit from short-term price movements. Day traders use technical analysis and market news to make quick trading decisions.

- Scalping: This is a high-frequency trading strategy where the trader takes advantage of small price movements in the market. Scalpers typically hold their positions for a few seconds to a few minutes.

- Position Trading: This is a long-term trading strategy where the trader takes advantage of the major price movements in the market. Position traders typically hold their positions for weeks or months.

- Automated Trading: This strategy uses computer programs to automate trading decisions. Traders can use pre-built trading bots or create their own using programming languages such as Python and Java.

What regulatory bodies oversee cryptocurrency brokers?

Cryptocurrency brokers are subject to regulatory oversight in many countries, but the specific agencies vary by location. For example, cryptocurrency brokers in the United States must register with the Financial Crimes Enforcement Network (FinCEN) as a money services business (MSB) and may also be subject to state-level regulations. In Europe, cryptocurrency brokers may be overseen by the European Securities and Markets Authority (ESMA) or national regulatory bodies such as the Financial Conduct Authority (FCA) in the UK or BaFin in Germany. Researching the regulatory requirements in your jurisdiction before choosing a cryptocurrency broker is important.

Are cryptocurrency brokers insured against financial losses?

Some cryptocurrency brokers offer insurance against financial losses due to hacking or other security breaches, but this is not a standard feature across the industry. It is important to check with your broker to see if they offer insurance or protection against losses.

What is the level of transparency provided by cryptocurrency brokers regarding their financial health?

The level of transparency regarding financial health varies among cryptocurrency brokers. Some brokers may provide clients with regular audits and financial statements, while others may not provide information beyond what is legally required. Researching a broker's financial health and transparency is important before trading with them.

Can I transfer my account from one cryptocurrency broker to another?

It is typically possible to transfer your account from one cryptocurrency broker to another. However, the specific process for doing so may vary depending on the brokers involved. Checking with both brokers for the steps required to transfer your account is important.

What are the most common strategies for trading cryptocurrencies with a broker?

There are many different strategies for trading cryptocurrencies with a broker, and the best strategy for you will depend on your individual goals and risk tolerance. Some common strategies include day trading, swing trading, and long-term investing. It is important to research and understand the risks associated with each strategy before deciding which approach to take.

What are the best resources for staying informed about changes or regulation updates that may affect my trading with a cryptocurrency broker?

There are many resources available for staying informed about changes or updates to cryptocurrency regulations, including industry news sites, regulatory agency websites, and social media accounts of industry leaders and experts. Staying up-to-date on regulatory changes is important to ensure compliance and protect your investments.

Cryptocurrency brokers verdict

cryptocurrency brokers offer a convenient and accessible way to trade cryptocurrencies, but it is important to understand the risks and do thorough research before choosing a broker. You can choose a reputable broker that meets your individual needs and goals by considering factors such as regulatory oversight, fees, and trading platforms.

Best Cryptocurrency Brokers List Compared

| Featured Cryptocurrency Broker Trading Platform | Account Features | Trading Features |

|---|---|---|

| Used By: 180,000 Instruments Available: 232 Stocks Available: 2100 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 61 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mirror Trader, ZuluTrade, Web Trader, cTrader, Mac Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 53 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 35 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 10 USD / 10 EUR |

Platforms: MT4, MT5, Mac, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 200,000 Instruments Available: 1000 Stocks Available: 99 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 80 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: Web Trader, MT4, MT5, AvaTradeGo, AvaOptions, Mac, Mobile Apps, ZuluTrade, DupliTrade, MQL5 Negative Balance Protection: Inactivity Fee: No 71% of retail CFD accounts lose moneyVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 10000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 60 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, IRESS, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 250,000 Instruments Available: 4000 Stocks Available: 1696 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 57 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 0 |

Platforms: MT4, Mirror Trader, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Visit |

|

| Used By: 89,000 Instruments Available: 100 Stocks Available: 60 US Stocks: No UK Stocks: No German Stocks: Yes Japanese Stocks: No Indices: Yes Forex Pairs Available: 70 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mac, ZuluTrade, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your moneyVisit |

|

| Used By: 10,000,000 Instruments Available: 1000 Stocks Available: 160 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 55 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 5 |

Platforms: MT4, MT5, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77.74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.Visit |

|

| Used By: 20,000,000 Instruments Available: 2000 Stocks Available: 2042 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 50 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 50 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 51% of retail investor accounts lose money when trading CFDs with this provider.Visit |

|

| Used By: 15,000,000 Instruments Available: 10000 Stocks Available: 1731 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 177 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.Visit |

|

| Used By: 10,000 Instruments Available: 15000 Stocks Available: 1000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 55 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 10 US Stocks: Yes UK Stocks: No German Stocks: No Japanese Stocks: No Indices: Yes Forex Pairs Available: 40 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes Losses can exceed depositsVisit |

|

| Used By: 300,000 Instruments Available: 100 Stocks Available: 0 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 150 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1000 |

Platforms: MT4, MT5, ZuluTrade, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 1000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: No Forex Pairs Available: 100 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 0 |

Platforms: MT4, Mac, ZuluTrade, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 4,000,000 Instruments Available: 2200 Stocks Available: 2000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: No Indices: Yes Forex Pairs Available: 67 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your moneyVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 0 US Stocks: No UK Stocks: No German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 45 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

Best Cryptocurrency Broker Cryptocurrency Broker Reviews

Read our details broker Cryptocurrency Broker Cryptocurrency Broker reviews, you will find something useful if you are shortlisting a Cryptocurrency Broker Cryptocurrency Broker and trading platform.

- IC Markets Review (read our in depth reviews)

- Roboforex Review (read our in depth reviews)

- AvaTrade Review (read our in depth reviews)

- FP Markets Review (read our in depth reviews)

- XTB Review (read our in depth reviews)

- Pepperstone Review (read our in depth reviews)

- XM Review (read our in depth reviews)

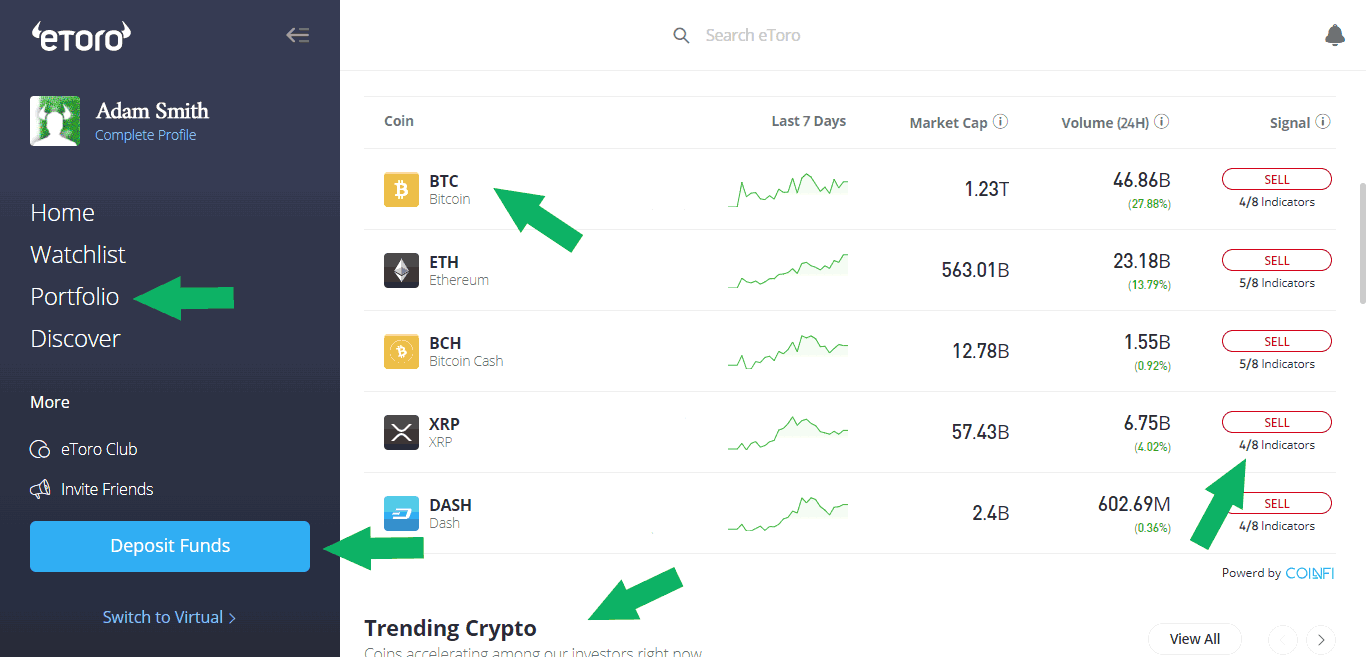

- eToro Review (read our in depth reviews)

- Trading 212 Review (read our in depth reviews)

- SpreadEx Review (read our in depth reviews)

- HYCM Review (read our in depth reviews)

- Swissquote Review (read our in depth reviews)

- Axi Review (read our in depth reviews)

- Markets.com Review (read our in depth reviews)

- Eightcap Review (read our in depth reviews)

Cryptocurrency Broker Cryptocurrency Broker Alternatives

Read about and compare Cryptocurrency Broker Cryptocurrency Broker alternatives. We have indepth side by side comparisons to help you find Cryptocurrency Broker Cryptocurrency Broker related brokers.

- IC Markets Alternatives

- Roboforex Alternatives

- AvaTrade Alternatives

- FP Markets Alternatives

- XTB Alternatives

- Pepperstone Alternatives

- XM Alternatives

- eToro Alternatives

- Trading 212 Alternatives

- SpreadEx Alternatives

- HYCM Alternatives

- Swissquote Alternatives

- Axi Alternatives

- Markets.com Alternatives

- Eightcap Alternatives

IC Markets

IC Markets

Roboforex

Roboforex

AvaTrade

AvaTrade

FP Markets

FP Markets

XTB

XTB

Pepperstone

Pepperstone

XM

XM

eToro

eToro

Trading 212

Trading 212

SpreadEx

SpreadEx

HYCM

HYCM

Swissquote

Swissquote

Axi

Axi

Markets.com

Markets.com

Eightcap

Eightcap