Best Copy Trading Platforms

Copy Trading Platforms: A Comprehensive Guide

Copytrading platforms allow users to copy the trades of experienced traders automatically. Some of the best platforms include eToro, RoboForex, ZuluTrade, and NAGA. These platforms provide a user-friendly interface, a range of markets, and various tools to help users identify top traders to copy.

If you're considering using a copy trading platform, it's essential to choose a reputable and reliable broker that offers a copy trading trading platform that meets your needs. Our guide extensively researched several of the most well-known copy trading platforms available and identified key factors to consider before choosing a copy trading broker.

This copy trading platform comparison guide discusses the features that should be considered when selecting a copy trading platform. These include regulation, tradable financial instruments, funding and withdrawal methods, customer support, and educational resources. It's essential to choose a regulated copy trading platform that provides access to the markets you're interested in, offers convenient funding and withdrawal methods, and has reliable customer support. Additionally, educational resources can help you improve your copy trading skills and make more informed decisions.

By considering these factors, you can select a trustworthy and dependable copy trading broker that is capable of meeting your trading requirements. Use our guide to make an informed decision when selecting your copy trading platform.

Best Copy Trading Platforms Table of Contents

- Copy Trading Platforms

- What Is Copy Trading, And How Does It Work On a Copy Trading Platform?

- What Are The Benefits Of Using a Copy Trading Platform?

- What Are The Risks Associated With Copy Trading, And How Can They Be Mitigated?

- What Are The Fees Associated With Using a Copy Trading Platform?

- What Are The Minimum Deposit Requirements For Using a Copy Trading Platform?

- How Do I Choose a Copy Trading Platform That Is Right For Me?

- Are Copy Trading Platforms Regulated, And If So, By Which Authorities?

- How Do I Select a Trader To Copy, And What Factors Should I Consider?

- How Can I Monitor My Copied Trades On a Copy Trading Platform?

- What Types Of Financial Instruments Can I Trade On a Copy Trading Platform?

- What Is The Minimum Investment Required To Copy a Trader On a Copy Trading Platform?

- What Is The Maximum Investment Allowed On a Copy Trading Platform?

- Can I Customise My Trading Settings When Using a Copy Trading Platform?

- How Does Risk Management Work When Copying Other Traders On a Copy Trading Platform?

- What Are The Differences Between Manual And Automated Copy Trading?

- Manual copy trading

- Automated copy trading

- How Do I Close a Copied Trade On a Copy Trading Platform?

- What Happens If The Trader I'm Copying Makes a Loss?

- How long does it take to start copying a trader on a copy trading platform?

- How does social trading differ from copy trading?

- Can I Access Copy Trading Platforms On My Mobile Device?

- Copy Trading Platforms Verdict

- Best Copy Trading Platforms List Compared

Copy Trading Platforms

What Is Copy Trading, And How Does It Work On a Copy Trading Platform?

Copy trading is a form of trading conducted on trading platforms with a large social network of novice and experienced traders. The process involves selecting a trader to follow and then using a copy trading platform to replicate their trading activity in real time. When the copied trader opens a new trade, the same trade is automatically opened in the investor's account.

The investor can choose to copy all of the trades made by the trader they are following, or they can select specific trades to copy based on certain criteria, such as the size of the trade, the type of asset being traded, or the trader's historical performance.

Copy trading platforms provide investors access to a network of traders to follow and copy. These platforms typically offer a range of features, such as performance statistics, risk management tools, and social interaction between traders and investors.

Copy trading is a popular way for novice traders to learn from experienced traders and gain exposure to the financial markets. However, it is important to understand the risks involved and to carefully select the traders to copy based on their track record, trading strategy, and risk management approach.

What Are The Benefits Of Using a Copy Trading Platform?

Copy trading platforms offer several benefits for investors, including:

- Access to experienced traders: Copy trading platforms provide investors with access to a network of experienced traders who have a proven track record of success in the financial markets. Access to the knowledge base of experienced traders allows novice investors to learn from the strategies and insights of experienced traders.

- Convenience: Copy trading platforms automate the process of copying trades, making it easier for investors to participate in the financial markets without the need for extensive knowledge or experience. Investors can simply select a trader to follow, set their risk parameters, and the platform will automatically replicate the trader's trades in their account.

- Diversification: Copy trading platforms offer investors the ability to diversify their portfolio by following multiple traders who trade different assets or use different strategies. Diversification can help to spread risk and reduce the impact of any single trade on an investor's portfolio.

- Transparency: Copy trading platforms typically provide investors with access to performance statistics and other metrics that allow them to evaluate the track record and risk profile of traders they are considering following. This transparency can help investors make more informed decisions about which traders to follow and how to allocate their capital.

- Flexibility: Copy trading platforms typically offer a range of features and settings that allow investors to customise their copy trading experience. Investors can choose which traders to follow, adjust risk parameters, and set limits on the amount of capital allocated to each trader.

What Are The Risks Associated With Copy Trading, And How Can They Be Mitigated?

While copy trading can offer many benefits, it is important to understand the risks involved. Some of the main risks include:

- Market risk: All investments in the financial markets carry a degree of risk, and copy trading is no exception. Even experienced traders can make losing trades, and investors who copy them may experience losses.

- Risk of following unreliable traders: Some traders may have a good track record initially but may engage in riskier behaviour over time or suffer from significant losses, resulting in the investor also incurring losses.

- Technical risks: Copy trading platforms rely on technology to execute trades automatically. Technical issues like platform downtime or slow execution can result in missed trades or losses.

- Counterparty risk: Investors who copy trades on a copy trading platform are effectively entrusting their capital to the platform provider. There is a risk that the provider may fail to execute trades properly, mismanage funds, or become insolvent.

To mitigate these risks, investors should take the following steps:

- Perform due diligence: Investors should research the traders they plan to copy, evaluate their trading history, and assess their risk management practices.

- Monitor trades closely: Investors should regularly monitor the performance of the traders they are copying and adjust their copy settings or stop copying them altogether if necessary.

- Diversify: Investors should avoid putting all of their capital in one trader or asset class. Copying multiple traders and diversifying across different asset classes can help to spread risk.

- Set stop-loss and take-profit limits: Investors should set stop-loss and take-profit limits to manage their risk and protect their capital.

- Choose a reputable copy trading platform: Investors should choose a copy trading platform that is regulated, has a strong track record, and has a robust risk management framework in place.

What Are The Fees Associated With Using a Copy Trading Platform?

Copy trading platforms typically charge fees to investors for using their services. These fees can vary depending on the platform and the specific features. Some common fees associated with using a copy trading platform include:

- Commission fees: Copy trading platforms may charge commission fees on trades that are copied. These fees are typically a percentage of the trade value and can vary depending on the platform and the asset being traded.

- Spread fees: Copy trading platforms may charge spread fees on trades that are copied. The spread is the difference between an asset's bid and ask price and represents the cost of executing a trade. These fees can vary depending on the platform and the asset being traded.

- Management fees: Some copy trading platforms may charge management fees on investor accounts. These fees are typically a percentage of the account value and are charged to cover the cost of providing the platform and its services.

- Performance fees: Some copy trading platforms may charge performance fees on profits earned by investors. These fees are typically a percentage of the profits earned and are charged to incentivise traders to perform well and attract investors.

It is important for investors to carefully review the fee structure of a copy trading platform before using its services. Investors should be aware of all fees that may be charged and should evaluate whether the benefits of using the platform outweigh the costs.

What Are The Minimum Deposit Requirements For Using a Copy Trading Platform?

The minimum deposit requirements for using a copy trading platform can vary depending on the platform and the specific features being used. Some platforms may require a higher minimum deposit to access certain features or copy certain traders.

Typically, the minimum deposit requirements for using a copy trading platform range from a few hundred to a few thousand dollars. Some platforms may offer lower minimum deposit requirements for beginner traders or investors.

It is important for investors to carefully review the minimum deposit requirements of a copy trading platform before using its services. Investors should ensure that they have sufficient funds to meet the minimum requirements and should evaluate whether the platform offers features and services that are suitable for their investment goals and risk tolerance.

How Do I Choose a Copy Trading Platform That Is Right For Me?

Choosing a copy trading platform can be overwhelming, as many different platforms are available with varying features, fees, and risks. To choose a copy trading platform that is right for you, consider the following factors:

- Regulation: Choose a copy trading platform that is regulated by a reputable financial authority. Regulation can help ensure that the platform operates transparently and follows industry best practices.

- Track record: Look for a copy trading platform that has a strong track record of performance and reliability. Research the platform's history and reputation, and read reviews from other investors to evaluate its trustworthiness.

- Risk management: Choose a copy trading platform that has a robust risk management framework in place. Look for features such as stop-loss limits, diversification options, and risk warnings that can help minimise your loss risk.

- Traders: Evaluate the traders that are available for copying on the platform. Look for traders with a strong track record of performance, risk management practices, and consistency over time.

- Platform features: Consider the features and tools offered by the platform. Look for features such as social trading networks, customisable copy settings, and analytical tools that can help you to make informed investment decisions.

- Fees: Evaluate the fee structure of the platform and compare it to other platforms. Look for a platform that offers competitive fees for the services and features that you plan to use.

Are Copy Trading Platforms Regulated, And If So, By Which Authorities?

Financial authorities typically regulate Copy trading platforms in the jurisdictions in which they operate. The specific regulatory bodies and requirements will vary depending on the country or region in which the platform is based.

For example, in the United States, copy trading platforms are regulated by the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). In the European Union, copy trading platforms are subject to the regulations of the European Securities and Markets Authority (ESMA), as well as local regulatory bodies such as the Financial Conduct Authority (FCA) in the UK, the Autoriti des marches financiers (AMF) in France, and the Bundesanstalt f|r Finanzdienstleistungsaufsicht (BaFin) in Germany.

Regulatory bodies typically require copy trading platforms to adhere to certain transparency, risk management, and investor protection standards. Regulatory requirements include requirements for the disclosure of performance data, managing risk for copied trades, and providing educational resources for investors.

investors need to verify that a copy trading platform is properly regulated before using it to trade. Financial regulation can help ensure that the platform meets certain standards and that investors are protected in case of any issues or disputes.

Ultimately, the copy trading platform right for you will depend on your investment goals, risk tolerance, and preferences. It is important to do your research, compare different platforms, and carefully evaluate the risks and benefits before choosing a platform to use.

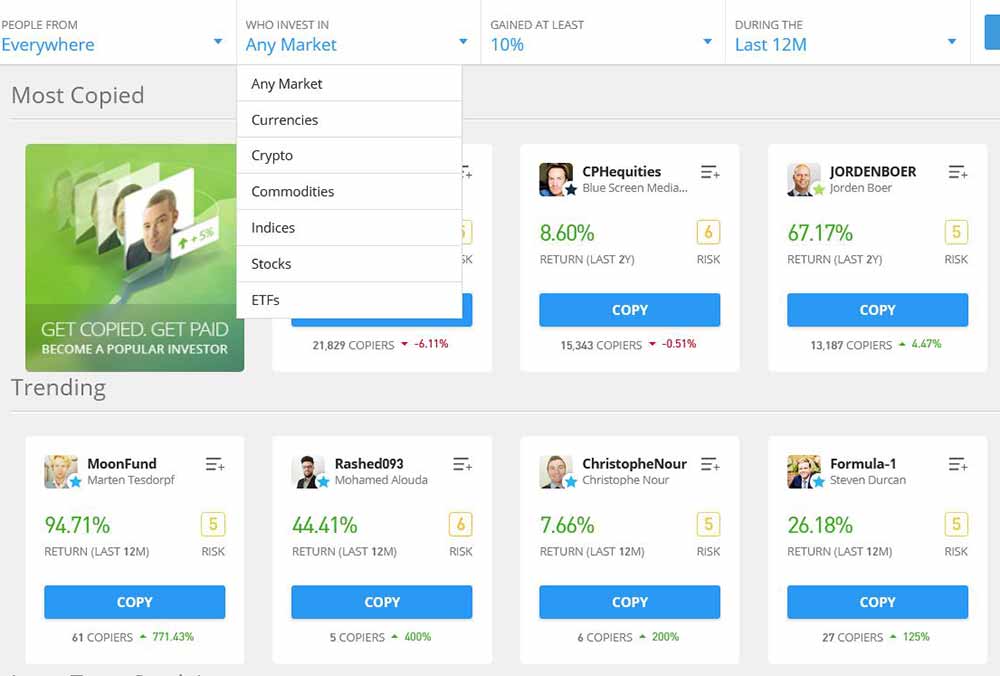

How Do I Select a Trader To Copy, And What Factors Should I Consider?

Selecting a trader to copy on a copy trading platform can be challenging, as many traders are available with varying levels of experience and performance. To select a trader to copy, consider the following factors:

- Performance: Evaluate the trader's performance over time. Look for traders with a consistent track record of profitable trades and low drawdowns. Avoid traders with a high risk of loss or a history of inconsistent performance.

- Risk management: Evaluate the trader's risk management practices. Look for traders who use stop-loss limits, diversification strategies, and other risk management tools to minimise the risk of loss. Avoid traders who take on excessive risk or use risky trading strategies.

- Trading style: Consider the trader's trading style and whether it is compatible with your investment goals and risk tolerance. Look for traders who use a style that matches your investment strategy and has a similar risk tolerance.

- Communication: Evaluate the trader's communication skills and responsiveness. Look for traders willing to communicate with their followers, answer questions, and provide updates on their trades.

- Experience: Consider the trader's experience and qualifications. Look for traders with a track record of success in the markets and a deep understanding of the assets they trade.

- Market knowledge: Evaluate the trader's market knowledge and analytical skills. Look for traders who deeply understand market fundamentals, technical analysis, and other key factors that can affect the price of the assets they trade.

Ultimately, the trader you select to copy will depend on your individual investment goals, risk tolerance, and preferences. Researching and evaluating the risks and benefits of copying a particular trader is important, and carefully monitoring their performance over time is important.

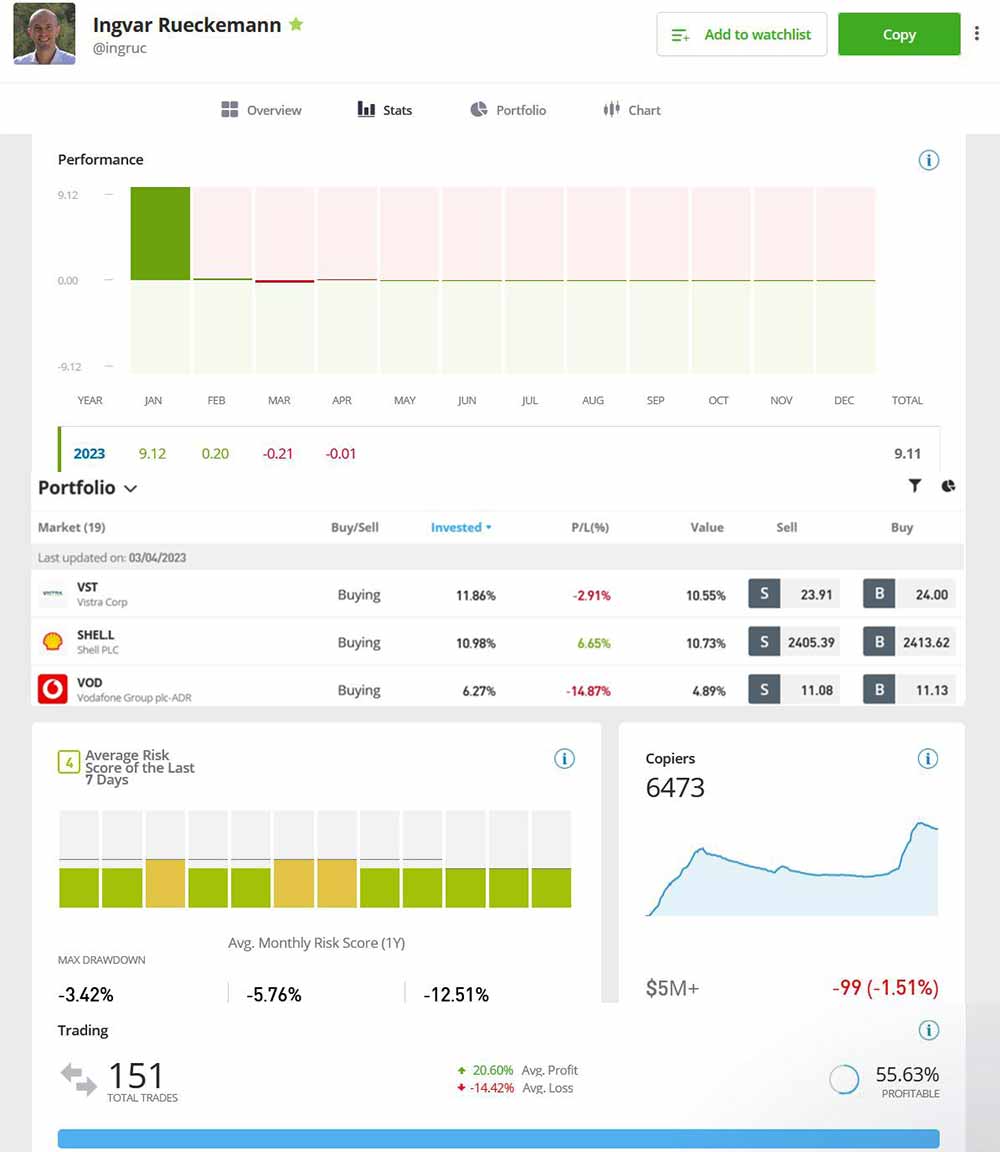

How Can I Monitor My Copied Trades On a Copy Trading Platform?

Once you have selected a trader to copy on a copy trading platform, monitoring your copied trades is important to ensure that they perform as expected and make any necessary adjustments to your investment strategy. Here are some ways to monitor your copied trades:

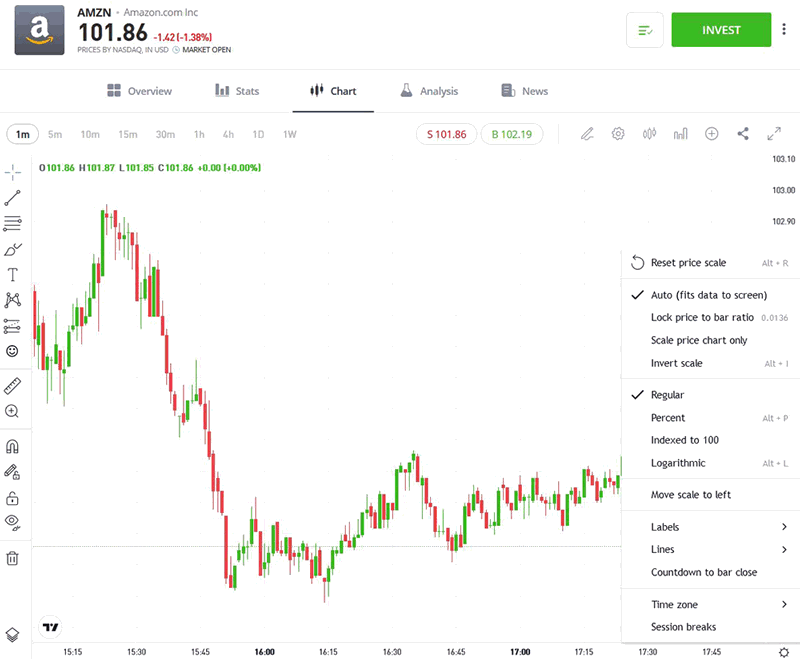

- Dashboard: Most copy trading platforms provide a dashboard or interface that allows you to monitor your copied trades in real time. This dashboard may show you information such as your open trades, profit and loss, and overall portfolio performance.

- Notifications: Some copy trading platforms provide email or mobile notifications that alert you to changes in your copied trades, such as when a trade is opened or closed or when a stop-loss order is triggered.

- Trade history: Most copy trading platforms provide a detailed trade history that shows all of your past trades, including the date, time, and price of each trade. Viewing a trade history can help you evaluate your performance and identify any areas for improvement.

- Performance analysis: Many copy trading platforms provide tools and analytics that allow you to analyse your portfolio performance, such as charts, graphs, and performance metrics. Use these tools to evaluate your performance over time and identify trends or patterns that may indicate areas for improvement.

- Trader updates: Many copy trading platforms allow you to communicate directly with the trader you are copying. Use this feature to ask questions, get updates on the trader's strategy and performance, and make any necessary adjustments to your investment strategy.

Overall, monitoring your copied trades is essential to ensure you meet your investment goals and manage your risk effectively. Use the tools and features your copy trading platform provides to stay informed and make informed investment decisions.

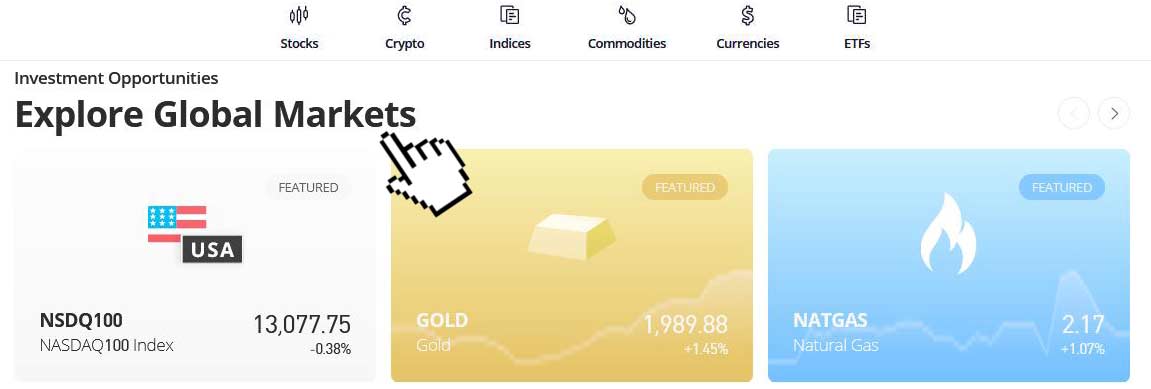

What Types Of Financial Instruments Can I Trade On a Copy Trading Platform?

The types of financial instruments that can be traded on a copy trading platform may vary depending on the platform itself. However, in general, copy trading platforms allow users to copy traders who trade a range of financial instruments, such as:

- Stocks: These represent ownership in a publicly traded company and are one of the most popular instruments traded on copy trading platforms.

- Forex: This is the largest financial market in the world where traders buy and sell different currencies.

- Commodities: This refers to raw materials or primary agricultural products such as gold, silver, oil, or coffee.

- Indices: This is a statistical measure of the performance of a group of stocks that represent a particular sector or market.

- Cryptocurrencies: These are digital assets that use cryptography for security and are traded on various exchanges.

- ETFs: These are investment funds that track a specific index, commodity, or sector and trade like a stock on an exchange.

It's important to note that not all copy trading platforms offer access to all financial instruments. Some may specialise in a particular type of instrument or market, while others may offer a wider range of instruments. Before choosing a copy trading platform, it's important to research the instruments available and ensure that they align with your investment goals and risk tolerance.

What Is The Minimum Investment Required To Copy a Trader On a Copy Trading Platform?

The minimum investment required to copy a trader on a copy trading platform may vary depending on the platform and the trader being copied. Some platforms may have a minimum deposit requirement, while others may not have any specific minimum investment. However, it's important to note that the money invested may also depend on the trader being copied and their minimum investment requirements.

Some traders may have a minimum investment amount set for their strategy, meaning users who wish to copy that trader would need to invest at least that amount. Some traders may also require a certain amount of equity to start copying their trades.

Researching the copy trading platform and the traders available is important to determine the minimum investment required. It's also important to consider your financial situation and risk tolerance when deciding how much to invest in copying a trader. It's recommended to start with a smaller amount and gradually increase the investment as you become more familiar with the platform and the trader's strategy.

What Is The Maximum Investment Allowed On a Copy Trading Platform?

The maximum investment allowed on a copy trading platform may vary depending on the platform and the trader being copied. Some platforms may have a maximum investment limit, while others may not have any specific maximum investment restrictions.

However, it's important to note that the amount of money invested may also depend on the trader being copied and their maximum investment restrictions. Some traders may limit the amount of money that can be invested in their strategy, either to maintain control over their trading or to avoid excessive risk.

Researching the copy trading platform and the traders available is important to determine the maximum investment allowed. It's also important to consider your financial situation and risk tolerance when deciding how much to invest in copying a trader. It's recommended to start with a smaller amount and gradually increase the investment as you become more familiar with the platform and the trader's strategy.

Additionally, it's important to note that some copy trading platforms may have different account types that offer higher investment limits or additional features, such as dedicated account managers or lower fees. These account types may require a higher minimum deposit or trading volume. It's important to research the available account types and their requirements to determine if they are suitable for your investment goals and risk tolerance.

Can I Customise My Trading Settings When Using a Copy Trading Platform?

Yes, many copy trading platforms allow users to customise their trading settings to better suit their investment goals and risk tolerance.

Some of the common trading settings that can be customised on a copy trading platform include:

- Investment amount: Users can choose how much money to invest in each copied trade, either as a fixed amount or as a percentage of their total account balance.

- Stop-loss and take-profit levels: Users can set automatic stop-loss and take-profit levels for each copied trade to limit potential losses or lock in profits.

- Trading hours: Users can set specific trading hours or days when they want their account to automatically copy trades from the selected trader.

- Risk management: Some platforms offer risk management tools, such as margin calls or other risk warnings, to help users better manage their risk exposure.

- Traded instruments: Users can choose which financial instruments to trade, such as stocks, currencies, commodities, or indices.

It's important to carefully review and adjust these settings to align with your investment goals and risk tolerance. Customising your trading settings can help you optimise your copy trading strategy and better manage your risk exposure.

How Does Risk Management Work When Copying Other Traders On a Copy Trading Platform?

Risk management is an important aspect of copy trading, as copying other traders can involve significant risks. Many copy trading platforms offer risk management tools that users can use to better manage their risk exposure.

Some of the common risk management tools available on copy trading platforms include:

- Stop-loss orders: A stop-loss order in copy trading is a crucial tool that helps traders limit potential losses by automatically closing their positions when the asset's price reaches a predetermined level. This feature ensures that traders avoid significant losses by preventing them from holding onto an asset as its value declines. By utilizing stop-loss orders, traders can adhere to their trading strategies and plans, which is essential for long-term success in copy trading. In summary, the use of stop-loss orders is a vital component of risk management in copy trading, and it's a common practice among traders who seek to minimize their risks while maximizing their profits.

- Take-profit orders: A take-profit order is a trade order that automatically closes a position when the price of an asset reaches a predetermined level, helping to lock in profits.

- Margin calls: A margin call is a notification from the platform to the user that their account balance has fallen below a certain level, which can help users avoid potential losses by requiring them to deposit additional funds to maintain their open trades.

- Risk warnings: Some platforms provide users with risk warnings, which can help users better understand the potential risks associated with copying certain traders or strategies.

In addition to these tools, users can also customise their trading settings, such as investment amount and trading hours, to better manage their risk exposure.

It's important to carefully review the risk management tools available on the copy trading platform and use them with your risk management strategies. It's also important to regularly monitor your copied trades and adjust your risk management settings to ensure that your overall risk exposure is within your acceptable limits.

What Are The Differences Between Manual And Automated Copy Trading?

Copy trading can be done either manually or through automated systems, and each approach has advantages and disadvantages.

Manual copy trading

In manual copy trading, users select and copy trades from other traders on the platform. This approach gives users greater control over their trading activities, as they can choose which trades to copy and adjust their settings as needed. Additionally, manual copy trading can be more suitable for users who have a greater understanding of the markets and who prefer to be more involved in the trading process.

Automated copy trading

In automated copy trading, users rely on algorithms and software to automatically copy trades from other traders on the platform. This approach can be more efficient and less time-consuming, as the platform handles the trade execution and management. Additionally, automated copy trading can be more suitable for less experienced users in the markets, as the algorithms and software can help remove emotion and bias from trading decisions.

However, it's important to note that automated copy trading may also come with some risks, such as technical glitches or software malfunctions. Additionally, automated systems may not always be able to adapt to changing market conditions, and they may not always reflect the most up-to-date market information.

Ultimately, the choice between manual and automated copy trading depends on a user's preferences and needs. Some users may prefer a more hands-on approach to trading, while others may prefer to rely on automated systems to execute trades for them.

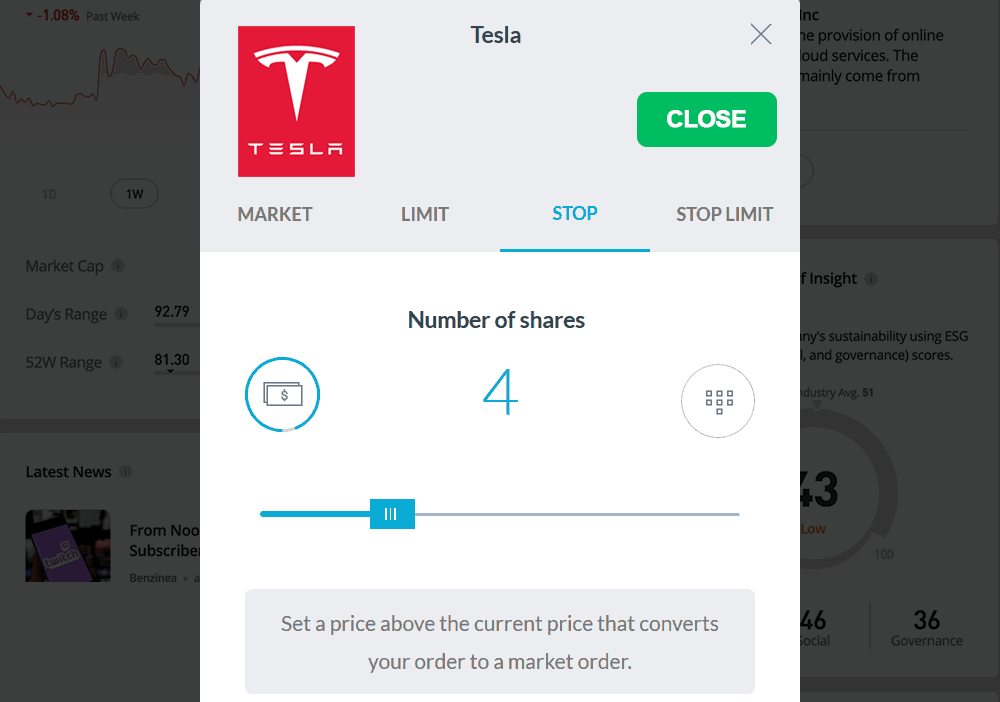

How Do I Close a Copied Trade On a Copy Trading Platform?

The process for closing a copied trade on a copy trading platform may vary slightly depending on the platform you are using. However, in general, the following steps can be followed:

- Log in to your copy trading account.

- Locate the trade that you wish to close.

- Select the trade, and then choose the 'Close' or 'Close Trade' option.

- You may be prompted to confirm your decision to close the trade. If so, follow the prompts to confirm the closure.

- Once the trade has been closed, you should see the updated details reflected in your account balance and trade history.

It's important to note that closing a trade may result in a profit or a loss, depending on the market conditions and the performance of the copied trader. Additionally, some copy trading platforms may charge fees or commissions for closing trades, so review the platform's fee schedule and policies before executing any trades.

If you have questions or concerns about closing trade on a copy trading platform, consult the platform's help centre or customer support resources for guidance.

What Happens If The Trader I'm Copying Makes a Loss?

If the trader you are copying makes a loss, your account balance will also be affected. The extent of the impact on your account balance will depend on the size of the position you copied and the percentage of your account balance that the position represents. In general, the following things may happen:

- If the loss is small, it may only have a minor impact on your account balance.

- If the loss is larger, it could potentially wipe out a significant portion of your account balance.

- If the loss is very large, it could potentially result in a margin call, requiring you to deposit additional funds to cover the loss or risk automatically closing your positions.

It's important to note that copying a trader on a copy trading platform always involves a certain level of risk, and it's possible to lose money even if you are copying a successful trader. To help mitigate these risks, it's important to carefully choose the traders you copy, set appropriate risk management measures, and closely monitor your account and open positions.

If you have any concerns or questions about the potential impact of a loss by a trader you are copying, consult the copy trading platform's help centre or customer support resources for guidance.

How long does it take to start copying a trader on a copy trading platform?

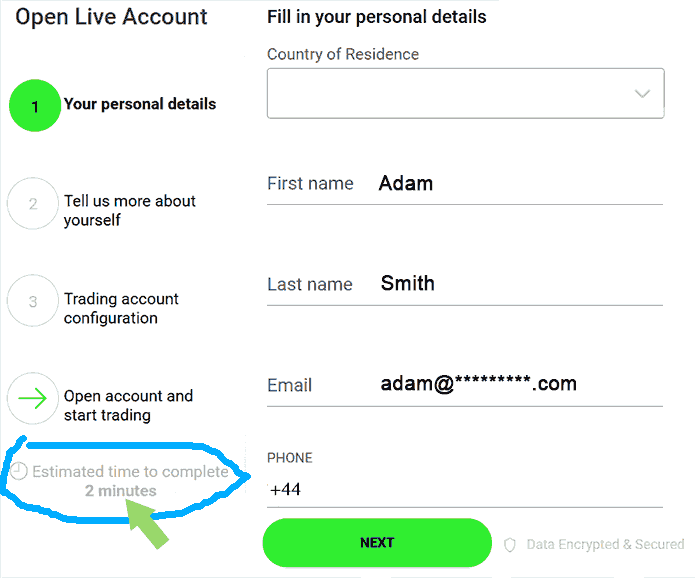

The time it takes to start copying a trader on a copy trading platform will depend on several factors, including the specific platform you are using and the requirements for verifying your account.

In general, setting up an account and copying a trader can take anywhere from a few minutes to a few days. Here are some of the factors that can impact the time it takes:

- Account verification: Many copy trading platforms require users to complete a verification process before they can start trading. Copy trading account verification may involve submitting identification documents, such as a passport or driver's license, and proof of address, such as a utility bill. Depending on the platform, this process can take a few minutes to several days.

- Funding your account: Once your account is verified, you'll need to fund it with the required minimum deposit before you can start copying traders. The time it takes to complete this step will depend on the payment method you choose, the platform's processing times, and the payment provider.

- Choosing a trader: Before you can start copying a trader, you'll need to select one from the list of available traders on the platform. Choosing a trader to copy may involve reviewing their trading history, performance, and other metrics to help you make an informed decision.

- Setting up your copying preferences: Once you've chosen a trader to copy, you'll need to set up your copying preferences, such as the amount you want to invest and the risk management settings you want to use. Setting a copy trade can typically be done in just a few clicks.

Overall, while the exact time it takes to start copying a trader will vary depending on the platform and your circumstances, most users can expect to start copying a trader within a few days of signing up for a copy trading platform.

How does social trading differ from copy trading?

Social trading and copy trading are two related concepts in online trading, but there are some key differences between the two.

Social trading involves sharing information and trading ideas between traders within a social network or community. Traders can interact with each other, share their strategies and insights, and collaborate to improve their trading results. In social trading, traders may or may not copy the trades of other traders.

Copy trading, on the other hand, involves copying the trades of other traders automatically. With copy trading, traders can choose a successful trader to copy, and their trades will be automatically replicated in their trading account. The copied trades are executed based on predetermined settings, such as the investment amount per trade and the stop loss and take profit levels.

In essence, social trading is more about sharing information and ideas, while copy trading is more about replicating successful trades.

Can I Access Copy Trading Platforms On My Mobile Device?

Many copy trading platforms offer mobile applications allowing users to access their accounts and perform copy trading on their mobile devices. These apps are often available for iOS and Android devices and can be downloaded from the respective app stores.

Using a mobile app can allow users to monitor their copied trades and adjust their settings on the go without needing to be at a computer. However, it is important to ensure that the app is secure and that users access it over a secure internet connection to protect their personal and financial information.

Copy Trading Platforms Verdict

Copy trading platforms can be a useful tool for individuals looking to enter the world of trading and investing. They allow users to automatically copy the trades of experienced traders without deeply understanding the financial markets or spending significant amounts of time researching and analysing investment opportunities.

While copy trading can offer a range of benefits, such as the potential for higher returns and the ability to diversify an investment portfolio, it is important to remember that risks are also involved. Users should carefully consider the traders they choose to copy, monitor their performance regularly, and implement appropriate risk management strategies to minimise their exposure to potential losses.

Before using a copy trading platform, users should also take the time to research and compare different options to find a platform that meets their needs, is secure and reliable, and offers competitive pricing and fees.

Overall, copy trading can be useful for individuals looking to gain exposure to the financial markets and potentially grow their wealth. However, as with any investment, it is important to approach it cautiously, do thorough research, and implement appropriate risk management strategies.

Best Copy Trading Platforms List Compared

| Featured Copy Trading Platform Trading Platform | Account Features | Trading Features |

|---|---|---|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 53 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 35 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 10 USD / 10 EUR |

Platforms: MT4, MT5, Mac, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 200,000 Instruments Available: 1000 Stocks Available: 99 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 80 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: Web Trader, MT4, MT5, AvaTradeGo, AvaOptions, Mac, Mobile Apps, ZuluTrade, DupliTrade, MQL5 Negative Balance Protection: Inactivity Fee: No 71% of retail CFD accounts lose moneyVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 10000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 60 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, IRESS, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 50 Stocks Available: 0 US Stocks: No UK Stocks: No German Stocks: No Japanese Stocks: No Indices: No Forex Pairs Available: 65 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Minimum Deposit: 10 |

Platforms: MT4, MT5, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 89,000 Instruments Available: 100 Stocks Available: 60 US Stocks: No UK Stocks: No German Stocks: Yes Japanese Stocks: No Indices: Yes Forex Pairs Available: 70 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mac, ZuluTrade, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your moneyVisit |

|

| Used By: 20,000,000 Instruments Available: 2000 Stocks Available: 2042 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 50 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 50 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 51% of retail investor accounts lose money when trading CFDs with this provider.Visit |

|

| Used By: 10,000 Instruments Available: 130 Stocks Available: 60 US Stocks: Yes UK Stocks: Yes German Stocks: No Japanese Stocks: No Indices: Yes Forex Pairs Available: 45 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, Mac, Mirror Trader, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 148 Stocks Available: 64 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 40 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: $100 |

Platforms: MT4, MT5, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 10 US Stocks: Yes UK Stocks: No German Stocks: No Japanese Stocks: No Indices: Yes Forex Pairs Available: 40 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes Losses can exceed depositsVisit |

|

| Used By: 500,000 Instruments Available: 1500 Stocks Available: 1500 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: No Indices: Yes Forex Pairs Available: 40 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 0 |

Platforms: ThinkTrader, MT4, MT5, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71.89% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your moneyVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 0 US Stocks: No UK Stocks: No German Stocks: Yes Japanese Stocks: No Indices: Yes Forex Pairs Available: 50 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 300 |

Platforms: MT4, Mirror Trader, Web Trader, NinjaTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 142 Stocks Available: 100 US Stocks: No UK Stocks: Yes German Stocks: No Japanese Stocks: No Indices: Yes Forex Pairs Available: Major Forex Pairs: Yes Minor Forex Pairs: No Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: Desktop,Android,iPhone,Mac Negative Balance Protection: Inactivity Fee: Your capital is at riskVisit |

|

| Used By: 10,000 Instruments Available: 143 Stocks Available: 0 US Stocks: No UK Stocks: Yes German Stocks: No Japanese Stocks: No Indices: Yes Forex Pairs Available: Major Forex Pairs: Yes Minor Forex Pairs: No Exotic Forex Pairs: No Minimum Deposit: 1 |

Platforms: Metatrader 4 - desktop, iOS and Android versions available. Negative Balance Protection: Inactivity Fee: Your capital is at riskVisit |

|

| Used By: 30,000 Instruments Available: 50 Stocks Available: 0 US Stocks: No UK Stocks: No German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: Major Forex Pairs: Yes Minor Forex Pairs: Exotic Forex Pairs: Minimum Deposit: 100 |

Platforms: MT4, MT5, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 140 Stocks Available: 0 US Stocks: No UK Stocks: NO German Stocks: NO Japanese Stocks: No Indices: NO Forex Pairs Available: Major Forex Pairs: Yes Minor Forex Pairs: No Exotic Forex Pairs: No Minimum Deposit: 1 |

Platforms: MetaTrader 4,MetaTrader 5,cTrader Negative Balance Protection: Inactivity Fee: Your capital is at riskVisit |

Best Copy Trading Platform Copy Trading Platform Reviews

Read our details broker Copy Trading Platform Copy Trading Platform reviews, you will find something useful if you are shortlisting a Copy Trading Platform Copy Trading Platform and trading platform.

- Roboforex Review (read our in depth reviews)

- AvaTrade Review (read our in depth reviews)

- FP Markets Review (read our in depth reviews)

- NordFX Review (read our in depth reviews)

- Pepperstone Review (read our in depth reviews)

- eToro Review (read our in depth reviews)

- FXPrimus Review (read our in depth reviews)

- Admiral Markets Review (read our in depth reviews)

- HYCM Review (read our in depth reviews)

- ThinkMarkets Review (read our in depth reviews)

- FXCM Review (read our in depth reviews)

- ICM Capital Review (read our in depth reviews)

- IFC Markets Review (read our in depth reviews)

- OctaFX Review (read our in depth reviews)

- Huobi Review (read our in depth reviews)

Copy Trading Platform Copy Trading Platform Alternatives

Read about and compare Copy Trading Platform Copy Trading Platform alternatives. We have indepth side by side comparisons to help you find Copy Trading Platform Copy Trading Platform related brokers.

- Roboforex Alternatives

- AvaTrade Alternatives

- FP Markets Alternatives

- NordFX Alternatives

- Pepperstone Alternatives

- eToro Alternatives

- FXPrimus Alternatives

- Admiral Markets Alternatives

- HYCM Alternatives

- ThinkMarkets Alternatives

- FXCM Alternatives

- ICM Capital Alternatives

- IFC Markets Alternatives

- OctaFX Alternatives

- Huobi Alternatives

Roboforex

Roboforex

AvaTrade

AvaTrade

FP Markets

FP Markets

NordFX

NordFX

Pepperstone

Pepperstone

eToro

eToro

FXPrimus

FXPrimus

Admiral Markets

Admiral Markets

HYCM

HYCM

ThinkMarkets

ThinkMarkets

FXCM

FXCM

ICM Capital

ICM Capital

IFC Markets

IFC Markets

OctaFX

OctaFX

Huobi

Huobi