Best CFD Brokers

CFD trading can be risky, so choosing a reputable broker is essential. Some of the top CFD brokers include IC Markets, eToro, and RoboForex. These brokers offer competitive spreads, a range of markets, and user-friendly platforms. Researching and considering regulations and fees is essential before choosing a CFD broker.

In this CFD brokers guide, we explain what CFD brokers are, the risks, and why people use CFD brokers and trading platforms to trade CFDs on stocks, Forex, crypto, commodities and Indices using leveraged CFD trading. In our CFD brokers guide, we explain and compare CFD brokers and tell you what to look out for when registering with a CFD broker and how to check they are financially regulated and offer a good range of tradable financial instruments, CFD trading tools, funding and withdrawal methods available on your CFD broker trading platform and low CFD trading fees.

Best CFD Brokers Table of Contents

- CFD Brokers

- What is CFD Trading?

- Steps to Start CFD Trading

- Why Use a Broker for CFD Trading

- Is CFD Trading Suitable for Beginners?

- Capital Requirements for CFD Trading

- Features of a Reliable CFD Broker

- Best CFD Brokers in the World

- Regulations for CFD Brokers

- Risks in CFD Trading

- How To Register With A CFD Broker

- Is CFD Trading Legal All Over the World?

- CFD Brokers Verdict

- Best CFD Brokers List Compared

CFD Brokers

What is CFD Trading?

CFD stands for 'Contract for Difference' It is a type of financial derivative that allows CFD traders to invest on the up or down price direction of various financial instruments, such as stocks, currencies, commodities, and indices, using leverage with no ownership of the underlying financial asset. A person trading a CFD enters a contract with their specific CFD broker to trade the difference in the price of the underlying asset from when the CFD contract is opened to when it is closed, using the agreed CFD terms.

CFD trading allows traders to go long (speculating on the price of an asset to increase) or short (speculating on the price of an asset to decrease). Because CFDs offer the ability to use leverage, traders can control large positions with relatively little capital. However, this also means that CFD traders can experience significant losses if the market moves against their position. Using CFD leverage is high-risk and only meant for experienced traders.

CFD trading is generally considered a high-risk investment and is not suitable for all investors. Before engaging in CFD trading, it is important to understand the risks and use proper risk management strategies, like stop loss and limit orders.

Steps to Start CFD Trading

- Research and choose a reputable CFD broker: Look for a broker that is regulated and has a good reputation in the industry.

- Open an account: Once you have chosen a broker, you will need to open an account. Opening an account will typically involve providing personal and financial information and passing any necessary identity verification checks.

- Fund your account: Once your CFD broker account has passed KYC, you will need to fund it with the amount you wish to buy and sell CFDs. Funding a CFD broker account can typically be done via bank transfer, credit/debit card, or e-wallet.

- Choose your markets: CFDs allow you to trade a wide range of markets, including forex, indices, commodities, and shares. Choose the markets you wish to trade and research them to understand their dynamics and risks.

- Download and Install the trading platform: Some brokers will require you to download a trading platform to your computer or mobile device, and you will need to install it and log in to your account to start trading.

- Place your trades: Once you are ready, you can place your trades using the broker's trading platform. It is important to use risk management techniques such as stop-loss orders to limit your potential losses.

Why Use a Broker for CFD Trading

CFD trading involves entering into a contract with a broker to exchange the difference in the price of an asset. CFD traders need to find a broker that offers CFD trading in the assets they are interested in.

Using a broker for CFD trading has several advantages, including:

- Access to a wide range of assets: Brokers often offer a wide range of tradable CFD financial instruments, including stocks, currencies, commodities, and indices.

- Leverage: Most brokers offer leverage, which allows traders to control large positions with relatively little capital.

- Execution of trades: Brokers have the necessary infrastructure and technology to execute trades quickly and efficiently.

- Regulation: Only place live trades with financially regulated CFD brokers in your country. CFD financial regulation provides an additional layer of protection for traders.

Is CFD Trading Suitable for Beginners?

CFD trading can be suitable for beginners, but they need to understand the markets and the risks involved before starting to trade. CFD trading is a high-risk investment and requires a thorough understanding of the markets and proper risk management techniques.

Beginners should start by doing a lot of research, reading books and articles about CFD trading, and educating themselves about the markets they want to trade in. They should also practice trading with a demo account before risking real money.

It is also important for beginners to choose a reputable CFD broker that offers educational resources and customer support. A good broker should provide educational materials such as webinars, video tutorials, and trading guides.

Capital Requirements for CFD Trading

The capital requirements for CFD trading vary depending on the broker and the financial market you are trading CFDs on. However, some general guidelines include:

- Minimum deposit: Most brokers will require a minimum deposit to open an account, typically ranging from $100 to $500.

- Margin requirements: CFDs are traded on margin, meaning that you are required to deposit a small percentage of the total trade value as collateral. Available trading margin can range from 1% to 10%, depending on the market, your country's financial regulation, and the CFD broker.

- Leverage: CFDs offer leverage, meaning that you can trade with a larger amount of capital than you have on deposit. Leverage can range from 1:1 to 1:500, meaning that for every $1 you deposit, you can trade up to $500 in the market.

Features of a Reliable CFD Broker

When choosing a CFD broker, it is important to consider the following features to ensure that the broker is reliable:

- Regulation: A reliable CFD broker should be regulated by a reputable financial authority. Financial regulation provides additional protection for traders and ensures that the broker adheres to strict rules and regulations.

- Security: A reliable CFD broker should have robust security measures in place to protect traders' personal and financial information. CFD broker apps should include SSL encryption for all communications and two-factor authentication for login.

- Trading Platform: A reliable CFD broker should offer a user-friendly and reliable trading platform that allows traders to execute trades quickly and efficiently. The platform should also offer a wide range of trading tools and resources.

- Customer Support: A reliable CFD broker should have a dedicated customer support team that is available 24/7. The support team should be knowledgeable and able to assist traders with any issues or questions they may have.

- Education and Research: A reliable CFD broker should offer educational resources and technical research analysis charting tools and data. CFD broker educational resources include market analysis, economic calendar and webinars.

Best CFD Brokers in the World

There are many CFD brokers worldwide; the best one for you depends on your individual needs and preferences. However, some of the most reputable and well-known CFD brokers include:

IC Markets founded in 1974, IC Markets is a well-established broker that offers a wide range of CFD instruments and a user-friendly trading platform. IC Markets is known for its fast order execution speeds and tight spreads aimed at more experienced traders. IC Markets offers very high CFD trading leverage up to 1:1000 on CFD instruments.

RoboForex founded in 2009, RoboForex is another well-established broker that offers a wide range of tradable CFDs and a user-friendly trading platform. RoboForex offers advanced CFD trading tools and leverages upto 1:2000 on MetaTrader 4 and MetaTrader 5 accounts.

eToro founded in 2007, eToro the largest social trading platform that allows traders to copy the trades of other traders. eToro offers a wide range of assets, including CFD trading and is regulated by the FCA in the UK and the CySEC. eToro has over 27 million registered users. eToro offers x30 leverage for major currency pairs, x20 for non-major currency pairs, x10 for non-major Indices and Commodities, x5 leverage of CFD stock and x2 for CFD cryptocurrency assets.

XTB founded in 2002, XTB is a CFD and Forex broker that offers a wide range of assets and a user-friendly trading platform. The FCA regulates it in the UK and the Polish Financial Supervision Authority (PFSA). UK and EU residents can utilize upto 30:1 CFD leverage. For non-UK and EU residents, CFD leverage can be upto 500:1.

XM founded in 2009, XM is a fast-growing broker that offers a user-friendly trading platform and a wide range of assets including CFD trading. XM offer CFD leverage upto 1000:1.

Regulations for CFD Brokers

CFD trading is regulated by different financial authorities around the world. The specific regulations for CFD brokers vary depending on the country or jurisdiction in which the broker operates. However, some of the key regulations that CFD brokers are typically subject to include:

- Capital Requirements: CFD brokers are typically required to maintain a certain level of capital to ensure that they can meet their financial obligations to their clients. CFD broker capital requirements are to protect the traders in case the broker goes bankrupt.

- Client Funds: CFD brokers are typically required to keep client funds in segregated accounts to ensure that your deposited funds are never mixed with the CFD broker's funds that they use to run their business. Traders' funds are protected if the CFD broker goes bankrupt with segregated accounts.

- Marketing Restrictions: CFD brokers are typically subject to restrictions on how they can market their services. Marketing restrictions are in place to protect traders from being misled by false or misleading advertising. For example, the ESMA (European Securities and Markets Authority) has implemented stricter rules for leverage and margin trading in Europe.

- Reporting: CFD brokers are typically required to submit regular reports to the relevant financial authorities. CFD broker reporting to financial regulators ensures that they comply with all applicable regulations and are financially stable.

Risks in CFD Trading

CFD trading, like any other form of trading, carries a certain level of risk. Some of the main risks associated with CFD trading include:

- Leverage: CFD trading allows traders to use leverage, which means that they can control large positions with relatively little capital. Leverage when CFD trading can amplify potential gains, but it can also amplify potential losses if the market moves against its position. Traders may end up owing more than their initial investment.

- Counterparty Risk: CFD trading involves entering into a contract with a broker. There is a risk that the broker will not be able to fulfil its obligations under the contract, which is known as counterparty risk. It's important to check the broker's financial stability and regulation before opening an account.

- Market Risk: The prices of financial instruments can be affected by a wide range of factors, including economic data, political events, and natural disasters. Traders can lose money if the market moves against their position.

- Stop-Loss Orders: Stop-loss orders are designed to limit potential losses by automatically closing a position when the price reaches a certain level. However, stop-loss orders are not guaranteed and may not execute at the desired price in fast-moving markets.

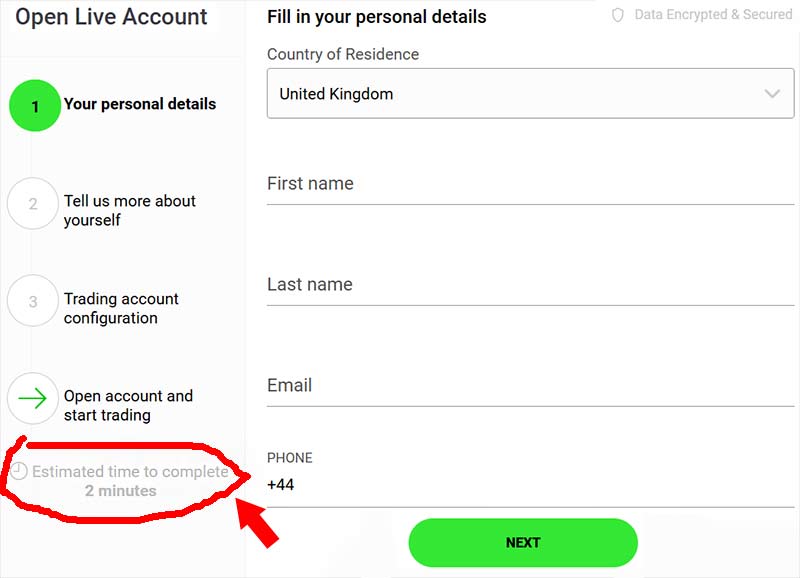

How To Register With A CFD Broker

Before opening a CFD trading account, it is crucial to understand the risks involved when trading high-risk financial instruments like CFDs. To open a CFD trading account, you need to follow these steps:

- Research and compare different CFD brokers.

- Choose a broker and create a live or demo CFD trading account on their website or mobile app.

- Provide personal information to pass regulatory KYC identity verification, like a photo ID and utility bill.

- Fund your CFD trading account through bank transfer, credit card or other payment methods.

- Complete any necessary paperwork, such as a risk disclosure statement to your CFD brokerage.

- Download the CFD trading platform or use the web-based or mobile app version.

- Research CFD financial instruments using technical analysis.

- Buy and sell CFDs once you understand the risks, using stop-loss and limit-order risk management strategies.

Is CFD Trading Legal All Over the World?

The legality of CFD trading varies from country to country. Some countries, such as the United States, do not allow their citizens to trade CFDs at all, while others have more lenient regulations.

In the European Union, CFD trading is legal and regulated by the European Securities and Markets Authority (ESMA). ESMA has implemented strict regulations to protect retail investors and limit the amount of leverage they can offer.

In other countries, such as Australia, CFD trading is legal and regulated by the Australian Securities and Investments Commission (ASIC).

It is important to check the regulations of the country you are in before starting to trade CFDs, as it may be illegal to trade them in your country. If it is illegal, you may face penalties or fines for trading.

CFD Brokers Verdict

CFD trading offers investors the opportunity to trade a wide range of markets with the potential for significant returns. However, it also carries significant risks and requires a thorough understanding of the markets and proper risk management techniques. Choosing a reputable CFD broker is essential in order to ensure that your executed live trades are fair and that your funds are kept safe.

When selecting a CFD broker, be sure to look for one that is regulated, has a good reputation in the industry, and offers a wide range of markets and competitive fees. Additionally, consider factors such as trading platforms, educational resources, and customer support when making your decision.

In summary, CFD trading can be a powerful tool for investors, but it is important to approach it with caution and to choose a reputable broker to ensure that you have the best chance of success.

Best CFD Brokers List Compared

| Featured CFD Broker Trading Platform | Account Features | Trading Features |

|---|---|---|

| Used By: 180,000 Instruments Available: 232 Stocks Available: 2100 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 61 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mirror Trader, ZuluTrade, Web Trader, cTrader, Mac Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 53 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 35 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 10 USD / 10 EUR |

Platforms: MT4, MT5, Mac, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 200,000 Instruments Available: 1000 Stocks Available: 99 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 80 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: Web Trader, MT4, MT5, AvaTradeGo, AvaOptions, Mac, Mobile Apps, ZuluTrade, DupliTrade, MQL5 Negative Balance Protection: Inactivity Fee: No 71% of retail CFD accounts lose moneyVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 10000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 60 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, IRESS, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 50 Stocks Available: 0 US Stocks: No UK Stocks: No German Stocks: No Japanese Stocks: No Indices: No Forex Pairs Available: 65 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Minimum Deposit: 10 |

Platforms: MT4, MT5, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 250,000 Instruments Available: 4000 Stocks Available: 1696 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 57 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 0 |

Platforms: MT4, Mirror Trader, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Visit |

|

| Used By: 89,000 Instruments Available: 100 Stocks Available: 60 US Stocks: No UK Stocks: No German Stocks: Yes Japanese Stocks: No Indices: Yes Forex Pairs Available: 70 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mac, ZuluTrade, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your moneyVisit |

|

| Used By: 10,000,000 Instruments Available: 1000 Stocks Available: 160 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 55 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 5 |

Platforms: MT4, MT5, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77.74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.Visit |

|

| Used By: 20,000,000 Instruments Available: 2000 Stocks Available: 2042 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 50 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 50 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 51% of retail investor accounts lose money when trading CFDs with this provider.Visit |

|

| Used By: 10,000 Instruments Available: 130 Stocks Available: 60 US Stocks: Yes UK Stocks: Yes German Stocks: No Japanese Stocks: No Indices: Yes Forex Pairs Available: 45 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, Mac, Mirror Trader, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 142,500 Instruments Available: 200 Stocks Available: 52 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 150 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Your capital is at riskVisit |

|

| Used By: 15,000,000 Instruments Available: 10000 Stocks Available: 1731 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 177 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.Visit |

|

| Used By: 10,000 Instruments Available: 148 Stocks Available: 64 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 40 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: $100 |

Platforms: MT4, MT5, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 15000 Stocks Available: 1000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 55 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 300,000 Instruments Available: 100 Stocks Available: 0 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 150 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1000 |

Platforms: MT4, MT5, ZuluTrade, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

Best CFD Broker CFD Broker Reviews

Read our details broker CFD Broker CFD Broker reviews, you will find something useful if you are shortlisting a CFD Broker CFD Broker and trading platform.

- IC Markets Review (read our in depth reviews)

- Roboforex Review (read our in depth reviews)

- AvaTrade Review (read our in depth reviews)

- FP Markets Review (read our in depth reviews)

- NordFX Review (read our in depth reviews)

- XTB Review (read our in depth reviews)

- Pepperstone Review (read our in depth reviews)

- XM Review (read our in depth reviews)

- eToro Review (read our in depth reviews)

- FXPrimus Review (read our in depth reviews)

- easyMarkets Review (read our in depth reviews)

- Trading 212 Review (read our in depth reviews)

- Admiral Markets Review (read our in depth reviews)

- SpreadEx Review (read our in depth reviews)

- Swissquote Review (read our in depth reviews)

CFD Broker CFD Broker Alternatives

Read about and compare CFD Broker CFD Broker alternatives. We have indepth side by side comparisons to help you find CFD Broker CFD Broker related brokers.

- IC Markets Alternatives

- Roboforex Alternatives

- AvaTrade Alternatives

- FP Markets Alternatives

- NordFX Alternatives

- XTB Alternatives

- Pepperstone Alternatives

- XM Alternatives

- eToro Alternatives

- FXPrimus Alternatives

- easyMarkets Alternatives

- Trading 212 Alternatives

- Admiral Markets Alternatives

- SpreadEx Alternatives

- Swissquote Alternatives

AvaTrade

AvaTrade

FP Markets

FP Markets

NordFX

NordFX

Pepperstone

Pepperstone

FXPrimus

FXPrimus

easyMarkets

easyMarkets

Trading 212

Trading 212

Admiral Markets

Admiral Markets

SpreadEx

SpreadEx

Swissquote

Swissquote