Best Carry Trade Brokers

Carry trade brokers and specialised financial institutions that facilitate the execution of carry currency trades on popular fiat currencies like the USD and EUR as well as GBP and other currencies, buying at low interest rates and selling at a higher interest. These carry trade brokers play a crucial role in enabling traders to leverage interest rate differentials to generate significant profits elsewhere potentially. In this article, we explore the concept of carry trade brokers, their significance in the Forex carry trade market, and the key factors to consider when selecting the right carry trading broker to execute the trades.

Carry trade brokers are intermediaries between traders and the global currency markets, providing access to various currency pairs and financial instruments. These brokers offer the necessary infrastructure, trading services, the best trading platforms, and tools to enable traders to execute trades effectively. Through carry trade brokers, traders can borrow in low-interest-rate currencies and invest in high-interest-rate currencies, taking advantage of the interest rate differential. This approach allows traders to earn interest income while also seeking capital appreciation.

Best Carry Trade Brokers Table of Contents

- Carry Trade Forex Brokers: Understanding the Basics

- What are carry trade brokers?

- What is Carry Trade?

- What is the best carry trade pair?

- What is the most popular carry trade?

- Does carry trade work?

- Best Forex Brokers For Carry Trade

- Exploring the Best Forex Brokers for Carry Trade Strategies

- Example of a Forex Carry Trading Strategy

- Best trading platform for carry trade

- Carry Trade Pros and Cons

- Carry Trade Pros:

- Carry Trade Cons:

- Carry Trade Brokers Verdict

- Best Carry Trade Brokers List Compared

When choosing carry trade brokers, traders need to consider several factors. One crucial aspect is the availability of competitive interest rates. Since interest rate differentials are the foundation of carry trades, brokers offering attractive rates can significantly impact the strategy's profitability. Traders should also look for brokers that provide transparent and accurate calculations of interest rate differentials and swap rates.

Regulatory compliance is another crucial consideration when selecting carry trade brokers. Working with regulated brokers ensures a certain level of transparency, security, and adherence to industry standards. Regulators such as the FCA (Financial Conduct Authority), the ASIC, and other respected authorities oversee brokers' activities, assuring retail traders.

Moreover, traders should assess the range of tradable instruments offered by carry trade brokers. A diverse selection of currency pairs and financial instruments allows traders to diversify their portfolios and seize opportunities across various markets. Brokers that offer risk management tools like stop-loss orders, trailing stops, and hedging options can also enhance the risk management capabilities of carry trade strategies.

Furthermore, research and education resources provided by carry trade brokers can significantly benefit traders. Access to economic calendars, market analysis, educational materials, and expert insights empower traders with valuable information to make informed trading decisions. These resources keep traders updated with interest rate developments, economic indicators, and other currency market factors.

Carry Trade Forex Brokers: Understanding the Basics

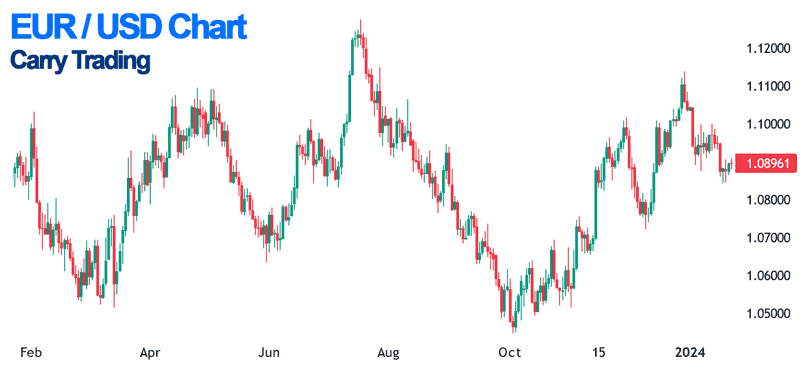

Forex pairs trading offers many strategies, and one approach that has gained significant attention is the carry trade forex pairs. At the heart of this strategy lies the concept of interest rate differentials, and selecting the right carry trade, Forex pairs, and broker is essential for successful implementation.

Competitive swap rates are vital. Swap rates determine the interest income or expense incurred when holding positions overnight. A carry trade trader earns interest income from the favourable interest rate differential, not interest paid, so it's crucial to find a broker that offers competitive and transparent swap rates.

The range of tradable instruments is essential. Carry trade strategies can involve various currency pairs, and having access to a diverse range of tradable instruments allows traders to select the most qualified teams. Brokers offering a wide selection of currency pairs and other financial instruments, such as commodities or indices, provide portfolio diversification and risk management flexibility.

Regulatory compliance, investor protection, and security of online trading platforms are paramount. Trustworthy brokers should be regulated by reputable authorities, ensuring compliance with industry standards and providing client protection. Regulatory oversight enhances transparency and fosters a secure online trading environment.

Moreover, risk management tools play a crucial role. Carry trades come with inherent risks, and having access to tools like stop-loss orders and hedging options helps traders manage and mitigate potential threats effectively.

Educational resources and research materials are invaluable. Forex brokers that provide comprehensive market analysis, economic calendars, educational articles, and webinars can greatly enhance a forex trader's understanding of interest rate dynamics, economic indicators, and market trends. This knowledge equips traders with the necessary insights to make informed decisions.

What are carry trade brokers?

Carry trade is a popular strategy among Forex traders that involves taking advantage of interest rate differentials between currencies. In this article, we delve into the world of carry trading forex trade brokers and discuss how they facilitate this profitable trading forex approach. By understanding the critical aspects of carry trade brokers, traders can make informed decisions and optimise their trading forex strategies for potential gains.

What is Carry Trade?

This section provides an overview of the carry trade and its underlying principles. Carry trading uses borrowed funds to speculate using currency at a low borrowed interest rate to trade high interest rate fiat currencies, profiting from the interest rate differential. Traders engage in carry trade to capitalise on the potential of low-yielding and high-interest currencies for capital appreciation and interest income.

Characteristics of Carry Trade Brokers: Under this heading, we highlight the essential characteristics to consider when selecting carry trade brokers. Interest Rate Differential: Carry trade profitability relies on interest rate differentials. Hence, choosing a carry trading broker that offers competitive rates and transparent calculations for carry trade positions is crucial. b. Range of Tradable Instruments: A diverse range of currency pairs and financial instruments is desirable for carry trade strategies. Brokers with a wide selection of assets allow traders to explore various opportunities and diversify their portfolios. Swap Rates and transparency: Swap rates determine the interest income or expense incurred during carry trades. Transparent and competitive swap rates are essential for maximising profitability. Traders should look for brokers that provide clear information regarding swap rates and their calculation methodology. d. Risk Management Tools: Carry trade involves market risks, including exchange rate fluctuations and geopolitical events. Therefore, it is advantageous to choose brokers that offer risk management tools like stop-loss orders, trailing stops, and hedging options.

Regulatory Considerations: Regulatory oversight is crucial when selecting carry trade brokers. Traders should prioritise brokers' trading services regulated by reputable local financial regulators such as the Financial Conduct Authority (FCA), the ASIC, or the Cyprus Securities and Exchange Commission (CySEC). Regulatory compliance ensures a certain level of transparency, security, and client protection.

Research and Education Resources: To excel in carry trade, traders should consider brokers that provide comprehensive research and education resources. Including economic calendars, market analysis, educational articles, webinars, and seminars. These resources enable traders to stay informed about interest rate developments, economic indicators, and market trends, enhancing their decision-making capabilities.

What is the best carry trade pair?

Determining the 'best' carry trade pair depends on various factors, including interest rate differentials, market conditions, and individual trader preferences. Here are a few currency pairs that have historically been popular choices for carry trade strategies:

AUD/JPY (Australian Dollar/Japanese Yen): The AUD/JPY pair has been favoured by carry traders due to the substantial interest rate differential between the Australian dollar and the Japanese yen. Historically, Australia has offered higher interest rates than Japan, making this pair attractive for earning interest income.

NZD/JPY (New Zealand Dollar/Japanese Yen): Similar to AUD/JPY, the NZD/JPY pair has been favoured for carry trades due to the interest rate differential between New Zealand and Japan. New Zealand has historically offered higher interest rates, making it an appealing choice for carry trade strategies.

USD/TRY (US Dollar/Turkish Lira): The USD/TRY currency pair has become increasingly popular in recent years, primarily because of the substantial interest rate difference between the US dollar and the Turkish lira. Turkey has maintained relatively high-interest rates compared to major currencies, creating an appealing environment for carry trade possibilities involving this pair.

GBP/AUD (British Pound/Australian Dollar): The GBP/AUD pair has been popular among carry traders, primarily due to the interest rate differential and the perceived stability of the British pound and Australian dollar. Traders seek to take advantage of the interest rate differential while potentially benefiting from capital appreciation.

USD/ZAR (US Dollar/South African Rand): The USD/ZAR pair has attracted carry traders due to the substantial interest rate differential between the US dollar and the South African rand. South Africa has historically offered higher interest rates, making this pair appealing for carry trade strategies.

It's important to note that carry trade strategies involve market risks, including exchange rate fluctuations and geopolitical events that can impact currency pairs. Additionally, interest rate differentials can change over time due to shifts in central bank policies and economic conditions. Therefore, thorough analysis, ongoing monitoring, and risk management are crucial when considering carry trade opportunities.

What is the most popular carry trade?

The popularity of trading currencies for carry trade strategies can vary over time, depending on market conditions and investor sentiment. Historically, some currency pairs have been more commonly associated with carry trades due to their interest rate differentials and perceived stability. While the popularity of numerous trading pairs can change, one currency pair that has consistently garnered attention for carry trade strategies is the AUD/JPY (Australian Dollar/Japanese Yen).

The AUD/JPY pair has been a popular choice for carrying trades. Historically, Australia has offered higher interest rates than Japan, providing an attractive low-interest currency and rate differential. Traders borrow in Japanese yen, which typically has low-interest rates, and invest in Australian dollars to earn higher interest income. This high-interest currency and rate differential, combined with the stability and liquidity of the AUD/JPY pair, has made it a preferred choice for carry traders seeking to generate returns through low-interest currency and rate differentials.

However, it's important to note that the popularity of carry trade strategies can shift based on various factors, including changes in interest rate differentials, economic conditions, central bank policies, and market sentiment. Traders should thoroughly analyse, consider current market conditions, and adapt their carry trading strategies accordingly.

As market dynamics evolve, other currency pairs may also gain popularity for carry trade strategies. Therefore, traders must stay informed, monitor interest rate differentials, and evaluate potential opportunities based on risk tolerance and trading objectives. Consulting with financial professionals or experienced traders can provide valuable insights into the most popular carry trade opportunities in the current market environment.

Does carry trade work?

Carry trade can be profitable when implemented effectively and under favourable market conditions. However, it is important to understand that carry trade, like any investment strategy, carries risks and is not guaranteed success in all situations. The effectiveness of carry trade depends on several factors:

Interest Rate Differentials: Carry trade relies on the fiat currency interest rate value difference. Traders by there brokers are lent in a low-interest-rate currency and speculate for profit in a higher interest rate fiat currency like USD. The larger the interest rate differential, the greater the profit potential. However, interest rate differentials can change due to shifts in central bank policies, economic conditions, or other factors, which can impact the profitability of carry trades.

Exchange Rate Stability: Carry trade strategies assume relative stability in exchange rates between the two currencies involved. Sudden and significant fluctuations in exchange rates can erode potential gains or even result in losses. Traders must carefully consider exchange rate risk and employ risk management methods such as stop-loss orders to mitigate potential losses.

Market Conditions: Market sentiment, economic indicators, geopolitical events, and other factors can influence currency markets. Carry trade strategies perform best when market conditions are relatively stable, and interest rate differentials are sustained. However, during periods of increased market volatility or economic uncertainty, carry trades can be exposed to higher levels of risk.

Risk Management: Effective risk management is essential to avoid losing money rapidly. Traders should consider position sizing, set stop-loss orders to limit potential losses and diversify their portfolios to reduce exposure to a single currency pair or market. Risk management practices help protect against adverse market movements and potential losses.

It's important to note that carry trade is a longer-term strategy that aims to generate returns over time. Profits are typically earned through interest income rather than short-term capital appreciation. Traders need patience, discipline, and a thorough understanding of the risks involved in carry trading.

Best Forex Brokers For Carry Trade

Exploring the Best Forex Brokers for Carry Trade Strategies

When engaging in carry trade strategies, choosing the right Forex broker is crucial for maximising the potential profitability of this investment approach. Carry trade involves taking advantage of interest rate differentials between currencies, and selecting a reliable and suitable broker can greatly enhance a forex trader's ability to execute carry trades effectively. In this article, we delve into the world of Forex brokers and highlight some key factors to consider when seeking the best brokers for carry trade strategies.

Competitive Swap Rates: One of the primary considerations for carry trade strategies is the swap rates brokers offer. Swap rates determine the interest income or expense incurred when holding a position overnight. Traders should look for brokerage firms that offer competitive and transparent swap rates to optimise the earnings from carry trades. Additionally, it is important to ensure that the broker's swap rates align with the interest rate differentials of the currency pairs being traded.

Wide Range of Tradable Instruments: Carry trade strategies can involve various currency pairs, and having access to a wide range of tradable instruments is advantageous. The best Forex brokers for carry trade should offer diverse currency pairs, allowing traders to choose the most suitable pairs for their strategies. Additionally, brokers that provide access to other financial instruments like commodities and indices can offer opportunities for portfolio diversification and hedging strategies.

Regulatory Compliance and Security: When selecting a Forex broker for carry trade strategies, it is essential to consider regulatory compliance and security measures. Trusted brokers should be regulated by reputable authorities such as the FCA Financial Conduct Authority (FCA), the ASIC, or the CySEC (Cyprus Securities and Exchange Commission). Regulatory oversight ensures adherence to industry standards, client protection, and transparency in operations.

Risk Management Tools: Carry trades are not without risks, and having access to effective risk management tools is crucial. The best Forex brokers for carry trade should offer risk management features such as stop-loss orders, take-profit orders, and trailing stops. These tools enable traders to set predetermined exit points and protect their positions from adverse market movements. Additionally, brokers that offer hedging options can provide further flexibility in managing risks associated with carry trade strategies.

Quality Research and Educational Resources: To excel in carry trade strategies, traders should consider brokers that provide comprehensive research and educational resources. Access to market analysis, economic calendars, educational articles, webinars, and seminars can enhance a trader's understanding of interest rate dynamics, economic indicators, and market trends. Brokers that prioritise trader education and provide relevant insights contribute to the overall success of carry trade strategies.

Choosing the best Forex broker for Forex carry trades and trade strategies requires careful consideration of various factors. Traders should seek brokers that offer competitive swap rates aligned with interest rate differentials, provide a wide range of tradable instruments, ensure regulatory compliance and security, offer risk management tools, and provide valuable research and educational resources. By selecting a reputable and reliable broker that aligns with their Forex trading platforms and objectives, both Forex carries trade trades, and trade traders can optimise their potential for earning interest income and achieving success in the dynamic Forex market.

Example of a Forex Carry Trading Strategy

Identify the Interest Rate Differential: Carry trade strategies rely on interest rate differentials between two currencies. In this example, let's assume Australia's interest rate is higher than Japan's. As of the current analysis, the Australian interest rate is 2.5%, while the Japanese interest rate is 0.1%. Providing a positive interest rate differential of 2.4% (2.5% - 0.1%).

Long Position: To implement this trading strategy, a carry trader would take a long position in the AUD/JPY currency pair. They would borrow Japanese yen (the funding currency) at a lower interest rate and simultaneously buy Australian dollars (the target currency) to earn a higher interest rate potentially.

Hold the Position: The trader would hold the long AUD/JPY position over an extended period, usually several months or even years, to capitalise on the interest rate differential. During this time, they would earn interest on the Australian dollars held while paying the lower interest rate on the borrowed Japanese yen.

Monitor Economic and Market Conditions: Throughout the carry trade duration, the trader needs to monitor economic indicators, central bank policies, and market conditions. Economic developments and shifts in interest rate expectations can influence the currency pair and impact the profitability of the carry trade. Additionally, changes in exchange rates can also impact the overall returns of the strategy.

Manage Risks: Risk management is crucial in carrying trade strategies. Traders should consider implementing risk management tools, such as setting stop-loss orders to minimise potential losses if the currency pair moves unfavourably. It is also important to diversify the carry trade portfolio and not concentrate all investments in a single currency pair, reducing exposure to any specific market or currency risk.

Unwind the Trade: At a suitable time, the trader may decide to unwind the carry trade by selling the AUD/JPY position and converting the Australian dollars back into the Japanese yen. The timing of the trade exit can depend on various factors, including changes in interest rate differentials, exchange rate movements, or reaching a predetermined profit target.

It's important to note that this move trade example is a simplified representation of a carry trade strategy, and actual trading decisions should be based on thorough analysis, market research, and risk assessment. Carry trade strategies involve risks, including potential losses from adverse foreign exchange, rate movements, and changes in interest rate differentials. Traders should carefully consider their risk tolerance, conduct proper risk management, and adapt their strategy to the prevailing market conditions. Seeking advice from financial professionals or experienced traders can provide further insights and guidance when implementing a carry trade strategy.

Best trading platform for carry trade

Regarding choosing the best trading platform for carry trade, several factors should be considered. Here are some popular trading platforms that are often favoured by carry traders:

MetaTrader 4 (MT4): MT4 is a widely used trading platform known for its user-friendly interface and extensive features. It offers a broad range of technical analysis tools, customisable indicators, and expert advisors (EAs). Many Forex brokers offer MT4 as their primary platform, making it accessible for carry trade strategies.

MetaTrader 5 (MT5): MT5 is the successor to MT4 and provides enhanced features and capabilities. It offers additional asset classes like stocks and futures, making it suitable for traders who want to diversify their carry trade strategies beyond Forex. MT5 also offers advanced order types and a built-in economic calendar for staying updated with important news events.

cTrader: The cTrader software available with most carry trade brokers is used by some professional traders. cTrader has advanced fiat currency charting capabilities to spot carry trading trends and risks. cTrader offers various order types, including market, limits, stops, and trailing stop orders. cTrader also provides access to Level II pricing, allowing traders to see the market depth and liquidity.

It's important to note that the best trading platform for carry trade ultimately depends on individual preferences, trading objectives, and the specific features offered on trading platforms by brokers. Traders should consider factors such as platform reliability, execution speed, available order types, access to relevant markets and currency pairs, and any additional tools or features that may be important for their specific carry trade strategy. It's recommended to explore demo accounts or trial periods offered by various trading platforms by brokers to evaluate the platform's suitability before committing to a specific trading platform for carry trade.

Carry Trade Pros and Cons

Carry trade is a popular strategy that can offer potential benefits but also carries inherent risks. Here are some key facts to consider when engaging in carry trade:

Carry Trade Pros:

Interest Income: Carry trade allows traders to earn interest income by taking advantage of the interest rate differential between two currencies. Traders can generate steady income over time by borrowing a low-interest-rate currency and investing in a high-interest-rate currency.

Diversification: Carry trade strategies provide portfolio diversification opportunities. For example, traders with retail investor accounts can allocate their investments across different currency pairs and take advantage of interest rate differentials in various economies, reducing dependency on a single currency or market.

Potential for Capital Appreciation: Besides interest income, carry trade can benefit from capital appreciation. If the target currency strengthens against the funding currency, traders can gain capital when unwinding the trade, amplifying their overall returns.

Long-Term Profitability: Carry trade strategies are often implemented over longer time horizons, which can align with investors' goals of generating steady returns over time. By capturing interest differentials consistently, carry trade has the potential to deliver sustained profitability.

Carry Trade Cons:

Exchange Rate Volatility: Carry trade strategies are exposed to exchange rate volatility. If the target currency weakens against the funding currency, traders may face potential losses, even if they earn interest income. Exchange rate movements can erode the gains from interest differentials, leading to negative returns.

Market Risks: Carry trade is influenced by economic factors, central bank policies, and market sentiment. Unforeseen events, such as financial crises, political instability, or unexpected interest rate changes, can significantly impact currency values and disrupt the carry trade, leading to losses.

Liquidity Risks: Some higher-yielding currencies may have lower liquidity, which can pose challenges when entering or exiting carry trade positions. Limited liquidity can result in wider bid-ask spreads and increased transaction costs, potentially impacting profitability.

Interest Rate Changes: Interest rates are dynamic and subject to change. Carry trade strategies rely on interest rate differentials, and if interest rates in the target currency decrease or rates in the funding currency rise, trade profitability may diminish.

Leverage Risks: Carry trades often involve leverage, amplifying potential gains and losses. While leverage can increase returns, it also increases risk. Losses can exceed the initial investment if the market moves against the trader.

Carry Trade Brokers Verdict

It's important to note that carry trade strategies require careful analysis, risk management, and staying informed about economic developments and market conditions. Traders should consider their risk tolerance, conduct thorough research, and implement proper risk mitigation strategies to navigate the challenges associated with carry trade and maximise its potential benefits.

Carry trade brokers provide a valuable platform for traders to engage in carry trading and earn profits through interest rate differentials and currency appreciation. However, choosing a reputable broker, exercising risk management strategies, and staying informed about market dynamics is vital. With careful planning, disciplined execution, and a comprehensive understanding of the risks involved, traders can harness the potential of Carry Trade brokers enhance their trading strategies and achieve their financial goals.

Best Carry Trade Brokers List Compared

| Featured Carry Trade Broker Trading Platform | Account Features | Trading Features |

|---|---|---|

| Used By: 180,000 Instruments Available: 232 Stocks Available: 2100 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 61 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mirror Trader, ZuluTrade, Web Trader, cTrader, Mac Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 53 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 35 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 10 USD / 10 EUR |

Platforms: MT4, MT5, Mac, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 200,000 Instruments Available: 1000 Stocks Available: 99 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 80 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: Web Trader, MT4, MT5, AvaTradeGo, AvaOptions, Mac, Mobile Apps, ZuluTrade, DupliTrade, MQL5 Negative Balance Protection: Inactivity Fee: No 71% of retail CFD accounts lose moneyVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 10000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 60 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, IRESS, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 50 Stocks Available: 0 US Stocks: No UK Stocks: No German Stocks: No Japanese Stocks: No Indices: No Forex Pairs Available: 65 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Minimum Deposit: 10 |

Platforms: MT4, MT5, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 250,000 Instruments Available: 4000 Stocks Available: 1696 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 57 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 0 |

Platforms: MT4, Mirror Trader, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Visit |

|

| Used By: 89,000 Instruments Available: 100 Stocks Available: 60 US Stocks: No UK Stocks: No German Stocks: Yes Japanese Stocks: No Indices: Yes Forex Pairs Available: 70 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mac, ZuluTrade, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your moneyVisit |

|

| Used By: 10,000,000 Instruments Available: 1000 Stocks Available: 160 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 55 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 5 |

Platforms: MT4, MT5, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77.74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.Visit |

|

| Used By: 20,000,000 Instruments Available: 2000 Stocks Available: 2042 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 50 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 50 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 51% of retail investor accounts lose money when trading CFDs with this provider.Visit |

|

| Used By: 10,000 Instruments Available: 130 Stocks Available: 60 US Stocks: Yes UK Stocks: Yes German Stocks: No Japanese Stocks: No Indices: Yes Forex Pairs Available: 45 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, Mac, Mirror Trader, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 142,500 Instruments Available: 200 Stocks Available: 52 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 150 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Your capital is at riskVisit |

|

| Used By: 15,000,000 Instruments Available: 10000 Stocks Available: 1731 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 177 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.Visit |

|

| Used By: 10,000 Instruments Available: 148 Stocks Available: 64 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 40 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: $100 |

Platforms: MT4, MT5, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 15000 Stocks Available: 1000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 55 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 10 US Stocks: Yes UK Stocks: No German Stocks: No Japanese Stocks: No Indices: Yes Forex Pairs Available: 40 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes Losses can exceed depositsVisit |

Best Carry Trade Broker Carry Trade Broker Reviews

Read our details broker Carry Trade Broker Carry Trade Broker reviews, you will find something useful if you are shortlisting a Carry Trade Broker Carry Trade Broker and trading platform.

- IC Markets Review (read our in depth reviews)

- Roboforex Review (read our in depth reviews)

- AvaTrade Review (read our in depth reviews)

- FP Markets Review (read our in depth reviews)

- NordFX Review (read our in depth reviews)

- XTB Review (read our in depth reviews)

- Pepperstone Review (read our in depth reviews)

- XM Review (read our in depth reviews)

- eToro Review (read our in depth reviews)

- FXPrimus Review (read our in depth reviews)

- easyMarkets Review (read our in depth reviews)

- Trading 212 Review (read our in depth reviews)

- Admiral Markets Review (read our in depth reviews)

- SpreadEx Review (read our in depth reviews)

- HYCM Review (read our in depth reviews)

Carry Trade Broker Carry Trade Broker Alternatives

Read about and compare Carry Trade Broker Carry Trade Broker alternatives. We have indepth side by side comparisons to help you find Carry Trade Broker Carry Trade Broker related brokers.

- IC Markets Alternatives

- Roboforex Alternatives

- AvaTrade Alternatives

- FP Markets Alternatives

- NordFX Alternatives

- XTB Alternatives

- Pepperstone Alternatives

- XM Alternatives

- eToro Alternatives

- FXPrimus Alternatives

- easyMarkets Alternatives

- Trading 212 Alternatives

- Admiral Markets Alternatives

- SpreadEx Alternatives

- HYCM Alternatives

IC Markets

IC Markets

Roboforex

Roboforex

AvaTrade

AvaTrade

FP Markets

FP Markets

NordFX

NordFX

XTB

XTB

Pepperstone

Pepperstone

XM

XM

eToro

eToro

FXPrimus

FXPrimus

easyMarkets

easyMarkets

Trading 212

Trading 212

Admiral Markets

Admiral Markets

SpreadEx

SpreadEx

HYCM

HYCM