Best Bulgarian Brokers & Trading Platforms

Best Bulgarian Brokers & Trading Platforms Table of Contents

- Bulgaria Brokers

- What are the central regulatory bodies overseeing brokers in Bulgaria?

- What is the process for obtaining a brokerage license in Bulgaria?

- What are the different types of brokers available in Bulgaria?

- How do I choose a reliable and trustworthy broker in Bulgaria?

- What are the fees and commissions associated with Bulgarian brokers?

- What is the minimum capital requirement for establishing a brokerage firm in Bulgaria?

- Are there any restrictions on foreign investors owning or operating brokerage firms in Bulgaria?

- What are the trading platforms and tools offered by Bulgarian brokers?

- What asset classes are available for trading with Bulgarian brokers?

- How do Bulgarian brokers ensure investor protection?

- What are the leverage and margin requirements for trading with Bulgarian brokers?

- Bulgarian Brokers Verdict

- Best Bulgarian Brokers & Trading Platforms List Compared

Bulgaria Brokers

In the dynamic world of online trading, Bulgaria brokers have emerged as critical facilitators, providing retail investors access to various financial instruments. With robust online platforms, low trading fees, and a focus on investor protection, these brokers have become instrumental in empowering individuals to participate in global markets. Whether it's trade stocks, forex, or even CFDs trading, Bulgaria's best international online brokers provide a diverse range of services that align with the needs of both novice and experienced traders. This guide explores the benefits and considerations when choosing the best online broker in Bulgaria.

What are the central regulatory bodies overseeing brokers in Bulgaria?

Bulgaria's main regulatory body overseeing brokers is the Financial Supervision Commission (FSC). The FSC is crucial in maintaining the financial markets' integrity and ensuring investors' protection. It is an independent institution responsible for regulating and supervising various economic activities, including brokerage firms. The FSC's primary objective is to safeguard the interests of investors, promote transparency, and maintain the stability of the Bulgarian financial system.

What is the process for obtaining a brokerage license in Bulgaria?

Obtaining a brokerage license in Bulgaria involves a thorough and well-defined process. The Financial Supervision Commission (FSC) grants permits to brokerage firms that comply with the requirements. The process typically includes the following steps:

-

Application Submission: The brokerage firm must submit a comprehensive application to the FSC, providing detailed information about the company, its management, ownership structure, business plan, and compliance procedures.

-

Due Diligence: The FSC thoroughly assesses the applicant, including background checks on the company's directors and shareholders. This step ensures that the individuals involved meet the necessary integrity and competence criteria.

Minimum Capital Requirement: The brokerage firm must align with the minimum capital requirement set by the FSC. It ensures the company has sufficient financial resources to operate and handle potential risks.

Compliance and Risk Management: The applicant must demonstrate robust compliance and risk management systems to ensure adherence to regulatory guidelines and safeguard client interests.

License Approval: If the FSC determines that the applicant meets all the requirements, including financial, operational, and legal obligations, a brokerage license will be granted.

Ongoing Compliance: Once licensed, brokerage firms are subject to continuous monitoring and supervision by the FSC to ensure compliance with regulations and maintain the necessary standards of operation.

What are the different types of brokers available in Bulgaria?

In Bulgaria, various brokers are available to cater to different investment needs. Some of the common types of brokers include:

-

Stock Brokers: These brokers specialize in facilitating the buying and selling stocks on the Bulgarian Stock Exchange or other international markets. They provide access to stock trading platforms and offer research and analysis on different stocks.

Forex Brokers: Brokers enable individuals to trade currency pairs in the Forex market. They provide trading platforms, leverage, and access to various currency pairs.

-

CFD Brokers: Contract for Difference (CFD) brokers enable investors to venture into the price fluctuations of financial assets without owning the underlying assets. CFDs can include stocks, commodities, indices, or cryptocurrencies.

-

Online Brokers: Online brokers provide trading services through online platforms, allowing investors to execute trades electronically. They offer convenience, real-time market data, and access to various financial instruments.

Full-Service Brokers: Full-service brokers provide investment advice, portfolio management, and financial planning services. They cater to investors seeking comprehensive support and guidance.

Discount Brokers: Discount brokers offer trading services at lower commission rates than full-service brokers. They provide essential trading capabilities without extensive personalized support.

It's essential to consider individual investment goals, risk tolerance, and trading preferences when choosing a broker in Bulgaria.

How do I choose a reliable and trustworthy broker in Bulgaria?

Choosing a reliable and trustworthy stock broker in Bulgaria is essential to ensure a safe and transparent trading experience. Here are some factors to consider when selecting the best stock broker:

-

Regulation: Verify that the broker is regulated by the Financial Supervision Commission (FSC) in Bulgaria or other reputable regulatory bodies. Regulation ensures adherence to financial standards and the protection of client funds.

-

Reputation and Track Record: Research the brokers reputation and track record in the industry. Look for reviews, testimonials, and any disciplinary actions or complaints against the broker. Choose a broker with a strong reputation and a history of satisfied clients.

Security of Funds: Ensure that the broker offers segregated accounts, which keep client funds separate from the brokers operational funds. It offers extra protection in case of broker insolvency.

Trading Platforms and Tools: Assess the brokers trading platforms and tools. Look for user-friendly interfaces, robust charting capabilities, real-time market data, and access to a wide range of trading instruments.

Customer Support: Evaluate the brokers customer support services. A reliable broker should offer responsive and knowledgeable support via various phone, email, or live chat channels.

Fees and Commissions: Consider the fees and commissions the broker charges. Compare the costs with other brokers in the market to ensure they are competitive and transparent.

Educational Resources: Check if the broker provides educational resources, tutorials, or webinars to help clients improve their trading skills and knowledge.

Deposit and Withdrawal Methods: Review the brokers available deposit and withdrawal methods. Ensure they are convenient, secure, and compatible with your preferences.

By carefully considering these factors, you can make wiser decisions and choose a reliable and trustworthy broker in Bulgaria.

What are the fees and commissions associated with Bulgarian brokers?

The fees and commissions associated with demo trading with Bulgarian brokers can vary depending on the type of broker and the services provided. Here are some standard fees and commissions you may encounter:

-

Trading Fees: Bulgarian brokers may charge trading fees, including commissions or spreads. Commissions are usually a percentage of the trade value, while spreads are the difference between a financial instruments buying and selling prices.

Withdrawal Fees: Some brokers may impose withdrawal fees when you transfer funds from your trading account to your bank account. These costs can vary depending on the withdrawal method chosen.

-

Inactivity Fees: Inactivity fees may be charged if there is no trading activity in your account for a certain period. It is essential to understand the brokers policy on inactivity fees and consider whether it aligns with your trading habits.

Overnight Financing Charges: If you hold positions overnight, some brokers may charge overnight financing fees, also known as swap fees. These fees compensate for the cost of borrowing funds to maintain the position.

-

Deposit and Withdrawal Fees: While some brokers offer free deposits and withdrawals, others charge fees for certain deposit or withdrawal methods. These fees can vary based on the chosen payment provider or bank transfer.

It is crucial to carefully review the fee exchange commission structure provided by the broker before opening an account or trading platform. Compare the fees and commissions across different brokers to ensure they are competitive and aligned with your trading strategy.

What is the minimum capital requirement for establishing a brokerage firm in Bulgaria?

The amount of minimum capital requirement depends on the type of brokerage and the services it intends to offer. The Financial Supervision Commission (FSC) sets the minimum capital requirements to ensure brokerage firms financial stability and operational capacity. While specific minimum deposit requirements may vary, the FSC typically imposes a minimum capital requirement of at least EUR 50,000 for brokerage firms operating in Bulgaria.

It is important to note that this minimum capital requirement may differ for different types of brokers and can be subject to change based on regulatory updates. Aspiring brokerage firms should consult the FSC or seek professional advice to determine the minimum capital requirement for their specific circumstances.

Are there any restrictions on foreign investors owning or operating brokerage firms in Bulgaria?

Bulgaria has no explicit restrictions on foreign investors owning or operating brokerage or deposit money firms. The country welcomes foreign investment and offers an open business market, including brokerage services. Foreign investors are generally allowed to establish and operate brokerage firms in Bulgaria, subject to compliance with applicable laws and regulations.

However, foreign investors must understand the legal and regulatory requirements to operate a Bulgaria brokerage firm. These requirements may include obtaining the necessary licenses from the Financial Supervision Commission (FSC), meeting minimum capital requirements, and complying with anti-money laundering (AML) and know-your-customer (KYC) regulations.

Foreign investors should consult legal and financial professionals to navigate the specific legal and regulatory landscape and ensure compliance with all requirements when establishing or operating a brokerage firm or investment platform in Bulgaria.

What are the trading platforms and tools offered by Bulgarian brokers?

Bulgarian brokers offer a variety of trading and investment platforms and tools to cater to the diverse needs of traders. These platforms and tools enable investors to access the financial markets, execute trades, and monitor portfolios. Some of the commonly offered trading platforms and tools include:

-

Online Trading Platforms: Bulgarian brokers provide user-friendly online trading platforms that allow traders to access markets from anywhere with an internet connection. These platforms offer real-time market data, advanced charting tools, and order execution capabilities.

-

Mobile Trading Apps: Many Bulgarian brokers offer mobile trading apps to align with the growing demand for mobile trading. These apps provide convenient access to trading accounts, real-time market updates, and the ability to execute trades on the go.

-

MetaTrader 4 and MetaTrader 5: The MetaTrader platform is widely used by Bulgarian brokers, offering a comprehensive suite of trading tools and features. MetaTrader 4 (MT4) and MetaTrader 5 (MT5) provide advanced charting, technical analysis tools, automated trading capabilities, and various indicators.

-

Copy Trading and Social Trading: Some Bulgarian brokers offer copy trading and social trading platforms, allowing investors to replicate the trading positions of successful traders or engage in social trading communities. This feature enables beginners to learn from experienced traders and improve their trading performance.

-

Trading Ideas and Research: Bulgarian brokers may provide trading ideas, market analysis, and research reports to help traders make informed investment decisions. These resources can include fundamental analysis, technical analysis, and economic news updates.

It is important to note that the availability of specific trading platforms and tools may vary among brokers. Traders should consider their preferences, trading strategies, and the functionality of the trading apps and platforms when choosing a Bulgarian broker.

What asset classes are available for trading with Bulgarian brokers?

Bulgarian brokers typically offer various asset classes to cater to diverse investment preferences. The available asset classes may include:

-

Stocks: Bulgarian brokers facilitate the trading of stocks, enabling investors to purchase and sell shares of publicly listed businesses on the Bulgarian Stock Exchange or other international stock exchanges. Investors can trade individual stocks or invest in stock market indices.

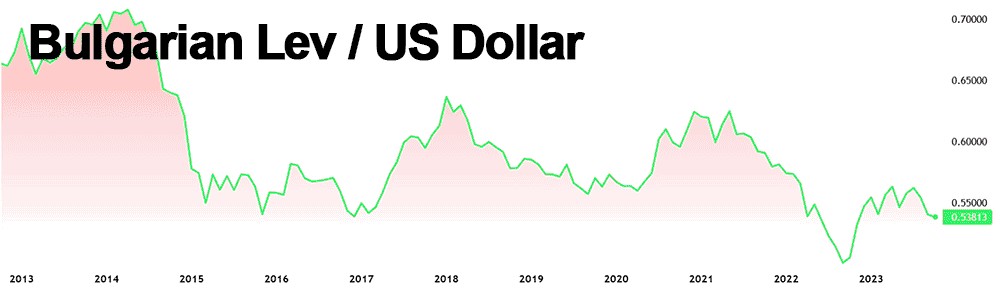

Forex (Foreign Exchange): Forex trading is a popular asset class offered by Bulgarian brokers. Traders can participate in the global currency market, speculating on the price fluctuations of currencies.

Commodities: Bulgarian brokers may provide access to commodity trading, allowing investors to trade commodities such as gold, silver, crude oil, natural gas, agricultural products, and more.

-

Cryptocurrencies: With the growing popularity of cryptocurrencies, many Bulgarian brokers offer trading in digital currencies like Bitcoin, Ethereum, Ripple, and others. It allows investors to take advantage of the volatility and potential profits in the cryptocurrency market.

-

Indices: Bulgarian brokers may offer to trade in stock market indices, such as the Bulgarian Stock Exchange (BSE) Index, or international indices, like the S&P 500, Dow Jones, or FTSE 100. Investors can speculate on the overall performance of the index.

Bonds: Some Bulgarian brokers provide resources to trade bond related financial instruments.

ETFs (Exchange-Traded Funds) and Mutual Funds: Bulgarian brokers may offer trading in ETFs and mutual funds, exposing investors to diversified portfolios of stocks, bonds, or other assets.

The specific availability of asset classes may vary among brokers, and it is advisable to check with the chosen broker to ensure they offer the best stock brokers and desired asset classes for online trading platforms.

How do Bulgarian brokers ensure investor protection?

Investor protection is an important aspect of the regulatory framework in Bulgaria. Bulgarian brokers are subject to regulations and measures aimed at safeguarding the interests of investors. Here are some fundamental mechanisms that ensure investor protection best online brokers:

-

Regulation and Oversight: the Financial Supervision Commission (FSC) regulates and supervises Bulgarian brokers. The FSC is responsible for ensuring the stability and integrity of the financial markets in Bulgaria. The regulatory framework sets standards for transparency, fairness, and the protection of investor rights.

-

Segregation of Client Funds: Bulgarian brokers must separate client funds from operational funds. This segregation of client funds provides an additional layer of protection, as it ensures that the client funds are not used for the brokers operational purposes and can be returned to clients in case of financial difficulties.

-

Investor Compensation Schemes: Bulgarian brokers may participate in investor compensation schemes that aim to protect investors in the event of a brokers insolvency. These schemes provide a certain level of compensation to eligible clients, subject to specific conditions and limits.

-

Disclosure and Transparency: Bulgarian brokers must provide clear and comprehensive information to investors regarding the risks associated with trading and the terms and conditions of their services. It includes disclosing fees, commissions, potential conflicts of interest, and other relevant information that enables investors to make informed decisions.

-

Compliance with Anti-Money Laundering (AML) Regulations: Bulgarian brokers must adhere to severe anti-money laundering regulations and implement robust Know Your Customer (KYC) procedures. These measures help prevent money laundering, terrorist financing, and other illicit activities, further protecting the financial systems integrity.

Investors must choose regulated brokers and conduct due diligence on international online brokers before trading. By selecting reputable brokers, investors can benefit from the protection measures in place and mitigate potential risks.

What are the leverage and margin requirements for trading with Bulgarian brokers?

Leverage and margin requirements dictate the amount of borrowed funds a trader can use for their trading positions. The leverage and margin amount requirements for trading with brokers in Bulgaria are subject to regulatory guidelines. The conditions may vary based on the asset class being traded and the type of retail investor accounts best brokers use. Here are some general points regarding leverage and margin requirements:

-

Forex Trading: The leverage offered for trading with Bulgarian brokers is typically subject to regulatory limitations. The maximum leverage allowed for retail investors is often set at 30:1 or lower, depending on the currency pair being traded. Professional investors who meet specific criteria and qualifications may have access to higher leverage levels.

-

CFD Trading: When trading Contracts for Difference, leverage can vary depending on the asset class. Retail investors are generally subject to leverage restrictions, which can be lower than professional investors. The regulatory authorities typically determine the leverage limits for CFD trading to protect retail investors from excessive risk.

-

Margin Requirements: Margin requirements refer to the percentage of the total trade value traders need to deposit in their trading accounts to open and maintain positions. These requirements serve as collateral to cover potential losses. The margin requirements can vary depending on the asset class, volatility, and regulatory guidelines. Bulgarian brokers typically specify the margin requirements for different instruments in their trading conditions.

It is important to note that leverage can amplify both profits and losses. While it offers the potential for higher returns, it also raises the risk of significant losses. Traders should carefully assess their risk tolerance, understand the impact of leverage on their trading positions, and adhere to responsible risk management strategies.

Bulgarian Brokers Verdict

The landscape of online trading in Bulgaria is shaped by the presence of reputable brokers offering innovative platforms, competitive fees, and a commitment to investor protection. The availability of retail CFD accounts, comprehensive trading platforms, interactive brokers, and the opportunity to trade various financial instruments, for example, stocks, forex, and CFDs, has opened new avenues for Bulgarian traders. However, it is crucial to understand that trading involves risks, and accounts can lose money, especially in high-risk and complex instruments. Therefore, investors should exercise caution, conduct thorough research, and consider factors like regulation, account opening process, zero account amount, and available investor protection schemes when choosing the best broker to embark on their trading journey in Bulgaria.

Best Bulgarian Brokers & Trading Platforms List Compared

| Featured Bulgarian Broker Trading Platform | Account Features | Trading Features |

|---|---|---|

| Used By: 180,000 Instruments Available: 232 Stocks Available: 2100 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 61 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mirror Trader, ZuluTrade, Web Trader, cTrader, Mac Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 53 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 35 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 10 USD / 10 EUR |

Platforms: MT4, MT5, Mac, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 200,000 Instruments Available: 1000 Stocks Available: 99 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 80 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: Web Trader, MT4, MT5, AvaTradeGo, AvaOptions, Mac, Mobile Apps, ZuluTrade, DupliTrade, MQL5 Negative Balance Protection: Inactivity Fee: No 71% of retail CFD accounts lose moneyVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 10000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 60 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, IRESS, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 250,000 Instruments Available: 4000 Stocks Available: 1696 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 57 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 0 |

Platforms: MT4, Mirror Trader, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Visit |

|

| Used By: 89,000 Instruments Available: 100 Stocks Available: 60 US Stocks: No UK Stocks: No German Stocks: Yes Japanese Stocks: No Indices: Yes Forex Pairs Available: 70 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mac, ZuluTrade, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your moneyVisit |

|

| Used By: 10,000,000 Instruments Available: 1000 Stocks Available: 160 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 55 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 5 |

Platforms: MT4, MT5, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77.74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.Visit |

|

| Used By: 20,000,000 Instruments Available: 2000 Stocks Available: 2042 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 50 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 50 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 51% of retail investor accounts lose money when trading CFDs with this provider.Visit |

|

| Used By: 15,000,000 Instruments Available: 10000 Stocks Available: 1731 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 177 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.Visit |

|

| Used By: 10,000 Instruments Available: 15000 Stocks Available: 1000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 55 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 10 US Stocks: Yes UK Stocks: No German Stocks: No Japanese Stocks: No Indices: Yes Forex Pairs Available: 40 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes Losses can exceed depositsVisit |

|

| Used By: 300,000 Instruments Available: 100 Stocks Available: 0 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 150 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1000 |

Platforms: MT4, MT5, ZuluTrade, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 1000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: No Forex Pairs Available: 100 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 0 |

Platforms: MT4, Mac, ZuluTrade, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 4,000,000 Instruments Available: 2200 Stocks Available: 2000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: No Indices: Yes Forex Pairs Available: 67 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your moneyVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 0 US Stocks: No UK Stocks: No German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 45 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

Best Bulgarian Broker Bulgarian Broker Reviews

Read our details broker Bulgarian Broker Bulgarian Broker reviews, you will find something useful if you are shortlisting a Bulgarian Broker Bulgarian Broker and trading platform.

- IC Markets Review (read our in depth reviews)

- Roboforex Review (read our in depth reviews)

- AvaTrade Review (read our in depth reviews)

- FP Markets Review (read our in depth reviews)

- XTB Review (read our in depth reviews)

- Pepperstone Review (read our in depth reviews)

- XM Review (read our in depth reviews)

- eToro Review (read our in depth reviews)

- Trading 212 Review (read our in depth reviews)

- SpreadEx Review (read our in depth reviews)

- HYCM Review (read our in depth reviews)

- Swissquote Review (read our in depth reviews)

- Axi Review (read our in depth reviews)

- Markets.com Review (read our in depth reviews)

- Eightcap Review (read our in depth reviews)

Bulgarian Broker Bulgarian Broker Alternatives

Read about and compare Bulgarian Broker Bulgarian Broker alternatives. We have indepth side by side comparisons to help you find Bulgarian Broker Bulgarian Broker related brokers.

- IC Markets Alternatives

- Roboforex Alternatives

- AvaTrade Alternatives

- FP Markets Alternatives

- XTB Alternatives

- Pepperstone Alternatives

- XM Alternatives

- eToro Alternatives

- Trading 212 Alternatives

- SpreadEx Alternatives

- HYCM Alternatives

- Swissquote Alternatives

- Axi Alternatives

- Markets.com Alternatives

- Eightcap Alternatives

IC Markets

IC Markets

Roboforex

Roboforex

AvaTrade

AvaTrade

FP Markets

FP Markets

XTB

XTB

Pepperstone

Pepperstone

XM

XM

eToro

eToro

Trading 212

Trading 212

SpreadEx

SpreadEx

HYCM

HYCM

Swissquote

Swissquote

Axi

Axi

Markets.com

Markets.com

Eightcap

Eightcap