Best Australian Brokers

When looking for the best Australian brokers, consider trading fees, regulations, customer support, and available assets. Popular options include IC Markets, eToro, and Pepperstone. Researching and comparing features is essential to find the right fit for your trading needs.

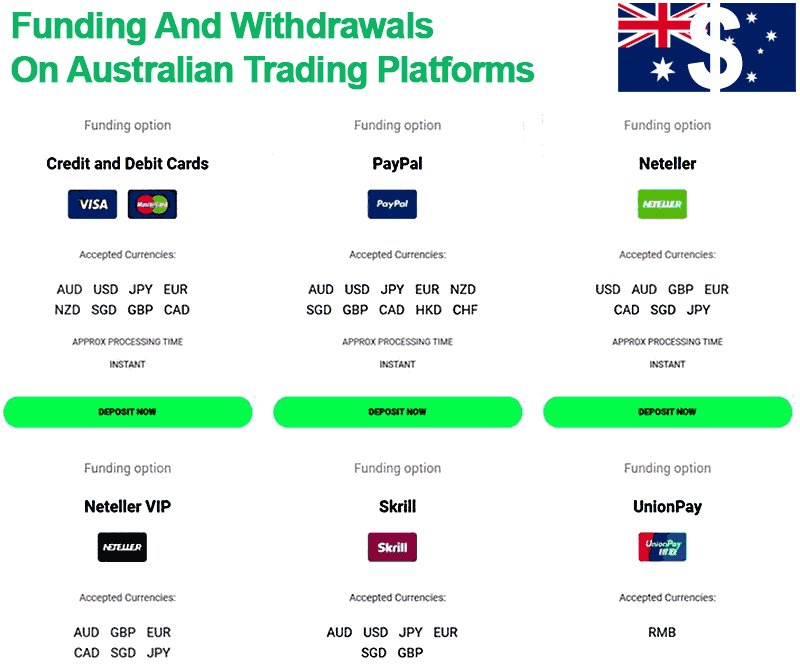

If you're an investor looking for an Australian broker to facilitate your investments, it's important to research and compare brokers to find the one that best suits your needs. Factors to consider when short-listing brokers in Australia include the broker's fees and commissions, available financial instruments for Australians, trading tools, funding and withdrawal methods, and ASIC regulatory compliance. By taking the time to research and compare Australian brokers, you can make informed investment decisions.

This guide is for you if you're an Australian trader looking for information about Australian brokers and trading platforms. Australian brokers provide access to world financial markets, allowing investors to trade various financial instruments, including stocks, bonds, and cryptocurrencies. By diversifying their portfolios, Australian traders can spread their risk and potentially increase their returns.

Trading platforms are often accessible online, making it easier for busy Australian professionals and individuals to manage their investments from anywhere with an internet connection. This convenience allows traders to execute trades quickly and easily.

Before signing up with an Australian broker, it's important to check their ASIC financial regulation to ensure they are properly licensed and regulated. Additionally, comparing Australian brokers and trading platforms is essential to find the one that best suits your needs. Find various available financial instruments, trading tools, funding and withdrawal methods, and real-time market data to help you make more informed investment decisions. Some Australian trading platforms offer access to international markets or exotic assets such as commodities and derivatives, which we explain in this Australian broker's guide.

Best Australian Brokers Table of Contents

- What are the Regulations That Australian Brokers Must Follow?

- What are the Key Features of an Australian Broker?

- Advantages of Trading with an Australian Broker

- Disadvantages of Trading with an Australian Broker

- How do Australian brokers ensure compliance with the relevant laws and regulations?

- What types of trading platforms do Australian brokers offer?

- Trading Platforms Used In Australia

- What types of financial instruments can be traded with Australian brokers?

- Australian And International Stocks And Shares

- Local Australian Stock Exchanges

- International Stock Exchanges

- Trading Stocks and Shares on Margin

- Fractional Shares

- Indices Trading

- Australian Indices

- International Indices Trading

- ETFs Exchange-Traded Funds

- Contracts for Difference (CFDs)

- Forex Trading In Australia

- Bonds

- Options

- Futures

- How can I determine if an Australian broker is legitimate and trustworthy?

- What fees are associated with trading with Australian brokers?

- What is the minimum amount of capital required to open an account with an Australian broker?

- What types of accounts do Australian brokers offer?

- What is the process for opening an account with an Australian broker?

- What are the risks involved in trading with Australian brokers?

- What is customer support like for Australian brokers?

- What is the level of security provided by Australian brokers for client funds and information?

- What is the level of leverage offered by Australian brokers, and how is it calculated?

- Can I trade on margin with an Australian broker?

- Understanding the Differences Between Market Makers and ECN/STP Brokers in Australia

- Trading with an Australian Broker from Overseas

- Tax Treatment for Profits Earned from Trading with Australian Brokers

- Withdrawal Process for Profits

- Educational Resources and Support Provided by Australian Brokers

- Comparing Different Australian Brokers

- Bonuses and Promotions

- Australian Brokers Verdict

- Best Australian Brokers List Compared

Australia has a growing number of traders due to its strong regulatory environment, competitive pricing, and advanced technology. In this spot analysis, we will take a closer look at the brokerage industry and trading platforms in Australia.

An Australian broker is a financial institution or individual facilitating trading in financial markets, such as the forex, stock, and commodities markets. Australian brokers must be regulated by the Australian Securities and Investments Commission (ASIC), which imposes strict regulations on financial services providers operating in Australia.

What are the Regulations That Australian Brokers Must Follow?

Australian brokers must follow regulations set by Australian Securities and Investments Commission (ASIC) designed to protect investors and promote fair and transparent trading practices.

These regulations include capital adequacy requirements and anti-money laundering procedures.

- Client money segregation: Australian brokers must keep client funds separate from their funds in segregated accounts held with reputable banks.

- Capital requirements: Brokers in Australia must hold a minimum level of capital, which acts as a buffer against unexpected losses.

- Risk management: Brokers must have robust risk management systems for their Australian clients, including limits on leverage and margin requirements.

- Capital adequacy: Capital adequacy refers to the amount of capital or funds that a financial institution, such as a bank or brokerage firm, must hold to ensure its financial stability and ability to meet its customer obligations. In Australia, the Australian Prudential Regulation Authority (APRA) regulates capital adequacy and is a key requirement for all financial institutions. APRA sets minimum capital adequacy ratios for financial institutions, which they must maintain to operate safely and soundly.

- Anti-money laundering procedures: Anti-money laundering (AML) procedures in Australia are regulations designed to prevent money laundering activities and the financing of terrorism. These procedures aim to ensure that financial institutions, including brokers and banks, operate with transparency and accountability to prevent their use as a vehicle for illicit activities. The Anti-Money Laundering and Counter-Terrorism Financing Act 2006 (AML/CTF Act) is Australia's primary law governing AML procedures. The Act requires all designated entities, such as banks, brokers, and other financial institutions, to implement and maintain an effective AML/CTF program to mitigate the risk of money laundering and terrorism financing.

What are the Key Features of an Australian Broker?

The key features of an Australian broker include regulation by the ASIC, a wide range of financial instruments for trading, competitive fees, high levels of security for client funds and information, and a commitment to transparency and fair trading practices.

many brokerages operate in Australia, ranging from large international firms to smaller local players. Some of the most well-known brokerages in Australia include IG, CMC Markets, and Pepperstone. One of the key features of the Australian brokerage industry is its strong regulatory environment. The Australian Securities and Investments Commission (ASIC) is the main regulatory body that oversees the financial services industry in Australia, and ASIC must license all brokers operating in Australia. ASIC ensures that strict rules and regulations protect Australian traders and hold brokers to high standards of conduct.

The pricing competitiveness is another important feature of the Australian brokerage industry. Due to the large number of brokerages operating in Australia, there is intense competition to attract clients. As a result, brokers constantly improve their pricing and services to remain competitive.

Advantages of Trading with an Australian Broker

Some of the advantages of trading with an Australian broker include:

- High level of regulation: Australian brokers are highly regulated, which provides traders with peace of mind and protects them against fraudulent activity. Strict regulations and oversight from the Australian Securities and Investments Commission (ASIC)

- Competitive spreads: Australian brokers typically offer competitive spreads, which can help traders maximize their profits.

- Competitive pricing and transparent fee structures.

- Range of financial instruments: Brokers in Australia offer a range of financial instruments, including Forex, CFDs, and cryptocurrencies, providing traders with a range of options.

- Educational resources: Many brokers offer educational resources, including webinars, tutorials, and trading guides, which can help traders improve their skills.

- Access to various financial instruments, including forex, stocks, and commodities.

- Advanced trading platforms and tools.

- High levels of customer service and support.

Disadvantages of Trading with an Australian Broker

Some of the potential disadvantages of trading with an Australian broker include:

- Higher fees: Some Australian brokers charge higher fees and commissions than brokers in other countries.

- Limited leverage: Australian brokers are subject to strict leverage limits, which may be lower than those offered by brokers in other jurisdictions. Restricted leverage for retail traders due to ASIC regulations. ASIC limits leverage to 30:1 to 2:1 in Australia.

- Limited choice of brokers: As a smaller market, there may be fewer Australian brokers to choose from compared to larger markets such as the US and UK. Larger international trading platforms may offer more tradable financial instruments compared to some Australian brokers.

How do Australian brokers ensure compliance with the relevant laws and regulations?

Australian brokers are regulated by the Australian Securities and Investments Commission (ASIC), which ensures that they operate in compliance with the laws and regulations that govern the financial industry in Australia. These regulations cover a range of areas, including client fund protection, transparency of operations, and fair trading practices.

What types of trading platforms do Australian brokers offer?

Australian brokers offer a range of trading platforms, including popular options such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5), cTrader, as well as proprietary trading platforms developed by the Australian broker themselves.

The trading platform is a critical component of any trader's experience, and Australian brokers offer a variety of trading platforms to suit different trading styles and preferences. Some of Australia's most popular trading platforms include MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader.

MT4 is a popular trading platform that offers advanced charting tools, technical analysis, and the ability to create custom indicators and trading robots. MT5 provides similar functionality to MT4 but with additional features such as an economic calendar and a wider range of order types. cTrader is a newer trading platform that is gaining popularity due to its advanced charting tools and user-friendly interface.

One important feature of trading platforms offered by Australian brokers is the ability to trade a wide range of financial instruments. In addition to trading forex, traders can also buy and sell other asset classes such as stocks, indices, commodities, and cryptocurrencies.

Trading Platforms Used In Australia

- MetaTrader 4: The most popular trading platform globally, MT4 is known for its user-friendly interface and advanced charting capabilities.

- MetaTrader 5: A newer version of the MT4 platform, MT5 offers a range of advanced features, including more sophisticated order types and hedging capabilities.

- cTrader: cTrader is a popular electronic trading platform that is designed for use by traders in the foreign exchange (forex) and contracts for difference (CFD) markets. It was developed by Spotware Systems and offers a range of advanced trading tools and features, including customizable charts, technical analysis tools, algorithmic trading capabilities, and a wide range of order types. cTrader is known for its user-friendly interface and fast execution speeds, and is available for use on both desktop and mobile devices.

- Social trading: The last 5 years have seen a huge growth in copy trading or social trading platforms in Australia that allow you to monitor and follow other traders worldwide.

- Proprietary platforms: Some brokers offer trading platforms, which may include advanced charting, trading tools, and custom indicators.

What types of financial instruments can be traded with Australian brokers?

Regarding trading in Australia, various financial instruments are available to investors. These financial instruments can be traded through Australian brokers and platforms, providing investors with diverse options to suit their investment needs.

Australian brokers offer a wide range of financial instruments for trading, including forex, commodities, stocks, indices, and cryptocurrencies.

here are various financial instruments available to trade in Australia through Australian brokers and trading platforms. Each instrument offers its unique benefits and risks.Australian And International Stocks And Shares

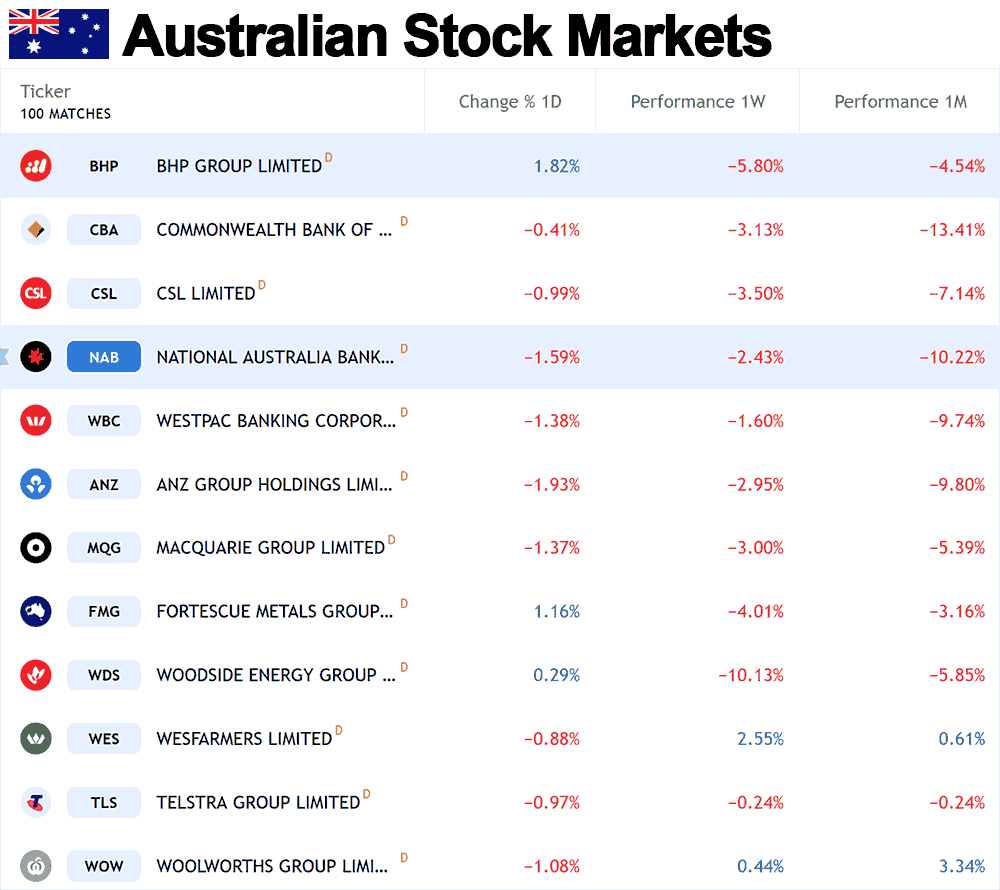

Shares are one of the most common financial instruments traded in Australia. Investors can buy and sell shares in companies listed on the Australian Securities Exchange (ASX), such as BHP, Commonwealth Bank, and Rio Tinto. Shares are often bought and held for the long term, with investors aiming to benefit from the company's growth and receive dividends. Australian investors can access international stock markets, including US, UK, and German stocks and shares.

Local Australian Stock Exchanges

Australia's main local stock exchange is the Australian Securities Exchange (ASX), which lists more than 2,200 companies from various industries. Australian investors can trade stocks and shares on the ASX by opening an account with an Australian broker and trading platform that is a member of the ASX.

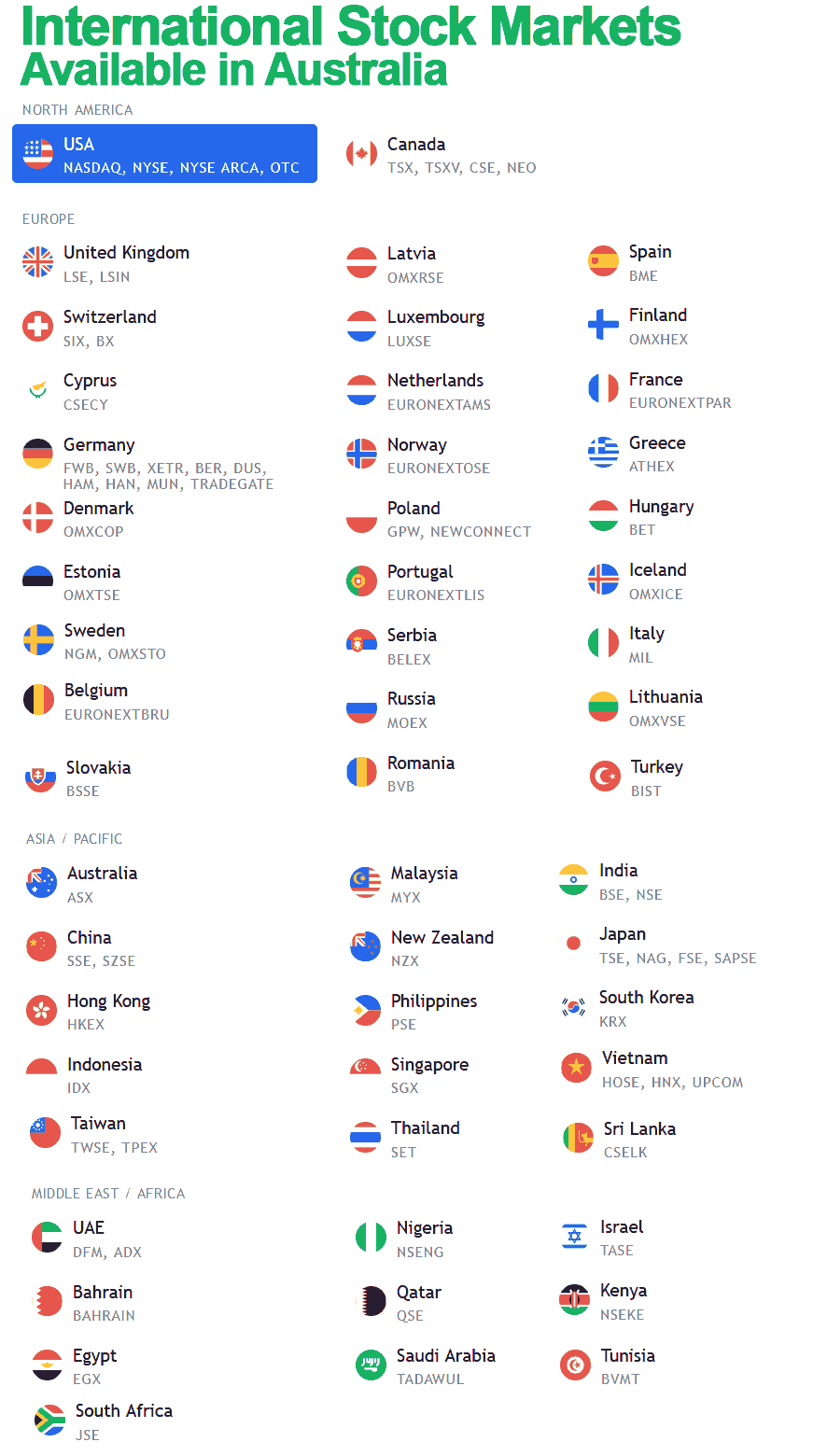

International Stock Exchanges

Australian investors can trade stocks and shares on international exchanges. Several international stock exchanges are accessible to Australian investors, including the New York Stock Exchange (NYSE), NASDAQ, London Stock Exchange (LSE), and Tokyo Stock Exchange (TSE), to name a few.

When trading on international stock exchanges, Australian investors can use the same broker and trading platform they use for local stock exchanges. However, they may be subject to additional fees, such as currency conversion and foreign transaction fees.

Also, Australian investors must be aware of international stock exchanges' different time zones and trading hours. For example, the NYSE operates from 9:30 am to 4:00 pm Eastern Time, which corresponds to 11:30 pm to 6:00 am Australian Eastern Standard Time.

Trading Stocks and Shares on Margin

Australian investors can also trade stocks and shares on margin, which means they borrow funds from their broker to invest in stocks and shares. Margin is high risk. It can increase potential returns for Australian traders but also increases their risk as losses can exceed their initial investment.

Fractional Shares

Fractional shares refer to a portion of a share of stock that is less than one full share. Investors can purchase fraction shares using a brokerage account or trading platform. They allow investors to buy into stocks with a higher price per share than they can afford to purchase with their available funds.

In Australia, fractional shares are becoming increasingly popular due to the convenience and flexibility they offer investors. Investors can buy small company shares with fractional shares, even if the share price is high. Fractional shares make it easier for investors to diversify their portfolios by investing in a range of companies rather than being limited to buying whole shares in just a few companies.

Fractional shares allow investors to take advantage of dollar-cost averaging. Dollar-cost averaging strategies are where investors invest a set amount regularly, no matter the share price. With fractional shares, investors can invest the same amount of money each time, which means they will purchase more shares when the price is low and fewer when the price is high.

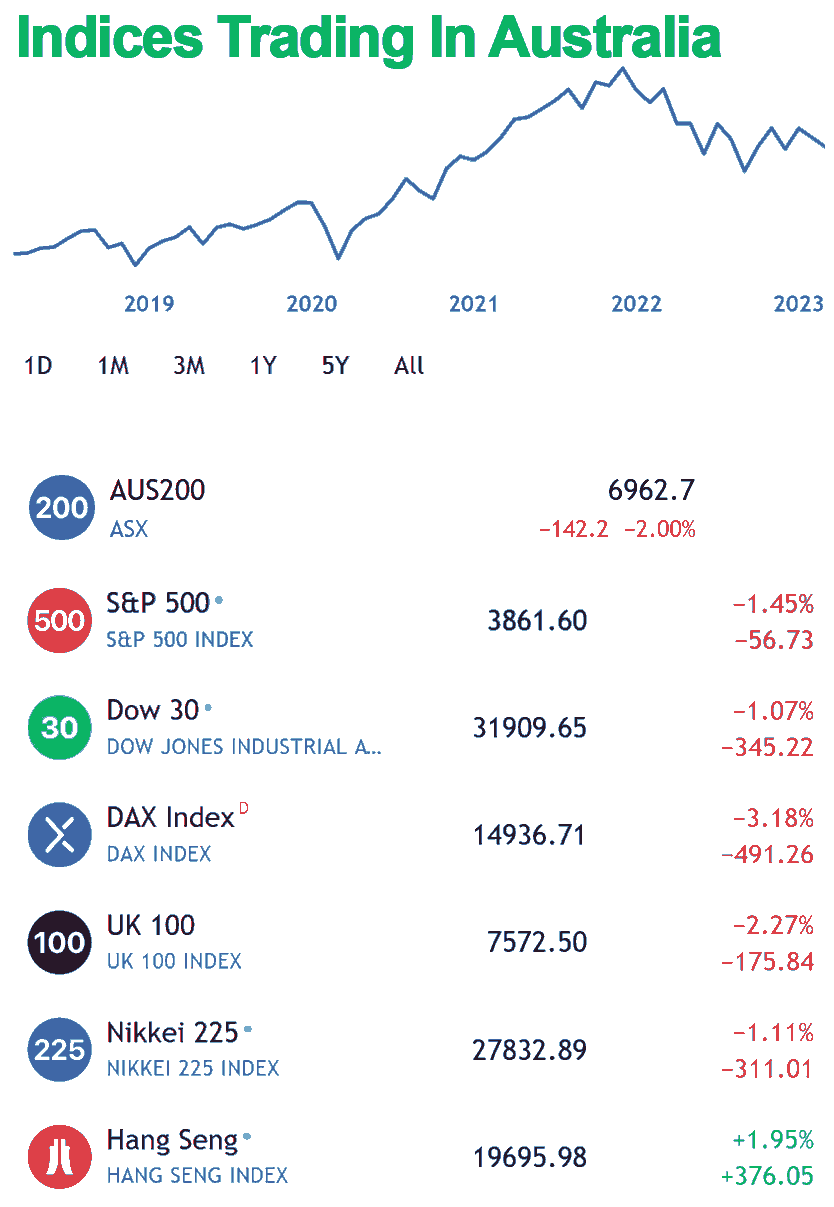

Indices Trading

Indices trading is a popular form of investment in Australia that allows traders to speculate on the performance of a group of stocks rather than just one company. An index is a group of shares from different companies chosen based on specific criteria such as market capitalization, industry sector, or geographic location.

In Australia, the most commonly traded indices are the S&P/ASX 200, which represents the top 200 companies listed on the Australian Securities Exchange (ASX), and the All Ordinaries Index, which tracks the performance of the top 500 companies listed on the ASX.

Trading indices involves speculating on the price movements of the index rather than the individual stocks that make up the index. Traders can either go long (buy) or short (sell) on the index, depending on their market outlook. If a trader believes that the index will go up, they can go long on it, while if they believe it will go down, they can go short.

Trading indices are available through various brokers in Australia and trading platforms that offer access to the ASX and other global exchanges. Some brokers offer CFDs (Contracts for Difference) on indices, which allow traders to speculate on the price movements of the index without actually owning the underlying assets.

*Please note prices of Indices are constantly changing.

Australian Indices

There are several indices available for trading in the Australian market:

- S&P/ASX 200: This index tracks the performance of the top 200 companies listed on the Australian Securities Exchange (ASX).

- S&P/ASX 300: This index tracks the performance of the top 300 companies listed on the ASX.

- All Ordinaries: This index tracks the performance of the top 500 companies listed on the ASX.

International Indices Trading

International indices trading is popular among Australian investors who want to diversify their portfolios and gain exposure to global markets. Trading international indices involve speculating on the performance of a basket of stocks from various countries and regions.

To trade international indices, Australian investors can use the services of Australian brokers who offer access to global markets. These brokers provide trading platforms and tools that allow investors to buy and sell indices contracts using various trading strategies, including leverage and short-selling.

Australian investors need to conduct thorough research and analysis before trading international indices, as market conditions can change rapidly and impact the value of their investment. Understanding the risks associated with leverage trading and ensuring adequate risk management strategies are also important.

Some of the popular international indices that Australian investors can trade include:

- S&P 500 Index: This index tracks the performance of 500 large-cap American companies and is one of the most widely followed indices in the world.

- NASDAQ Composite Index: This index tracks the performance of more than 3,000 technology and growth-oriented companies listed on the NASDAQ stock exchange.

- Dow Jones Industrial Average: This index tracks the performance of 30 large-cap American companies across various sectors.

- FTSE 100 Index: This index tracks the performance of the 100 largest companies listed on the London Stock Exchange by market capitalization.

- Nikkei 225 Index: This index tracks the performance of 225 large-cap Japanese companies listed on the Tokyo Stock Exchange.

- Hang Seng Index: This index tracks the performance of 50 large-cap Hong Kong companies listed on the Hong Kong Stock Exchange.

- DAX Index: This index tracks the performance of the 30 largest and most liquid companies on the Frankfurt Stock Exchange.

ETFs Exchange-Traded Funds

ETFs are traded on the ASX, like shares. ETFs, provide investors with exposure to a diversified portfolio of assets, such as stocks, bonds, and commodities. ETFs can be bought and sold like shares, making them a flexible and accessible investment option for investors looking to diversify their portfolios.

Contracts for Difference (CFDs)

CFDs are derivative instruments that allow investor price movement speculation up or down, with no real ownership of assets. Trading CFDs based only on price. With CFDs, investors can trade various assets with leverage, such as shares, indices, currencies, and commodities. Investors can make larger profits but also risk larger losses. ASIC closely monitors CFD trading in Australia due to the high risk of loss with CFD trading for Australian retail traders.

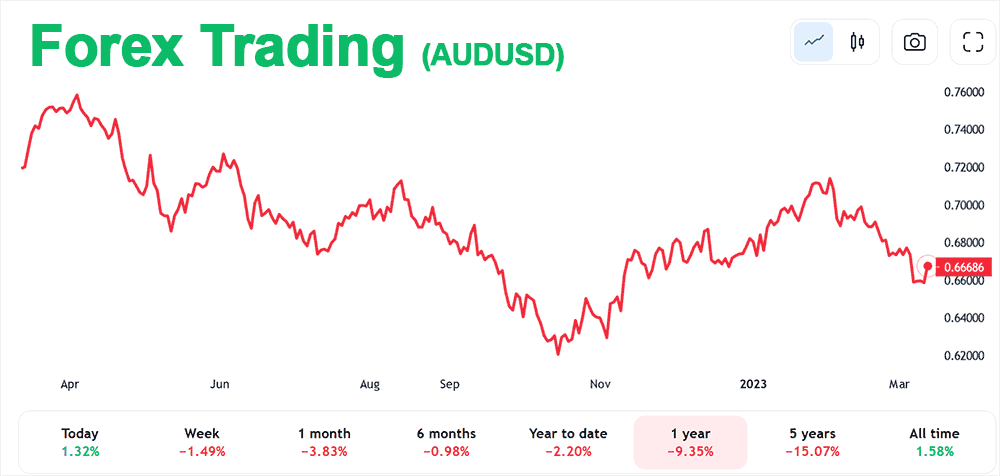

Forex Trading In Australia

Forex, or foreign exchange, involves buying and selling currencies. Investors can trade various currency pairs, such as AUD/USD, EUR/USD, and GBP/USD. Forex is a highly liquid market, providing investors with the potential to profit from fluctuations in exchange rates.

Australia's most traded currency pairs are typically those involving the Australian dollar (AUD). The ranking and order of the most traded currency pairs may vary depending on various factors such as market conditions, economic events, and investor sentiment.

Here are some of the most traded currency pairs in Australia:

- AUD/USD (Australian dollar/US dollar)

- AUD/JPY (Australian dollar/Japanese yen)

- AUD/NZD (Australian dollar/New Zealand dollar)

- AUD/EUR (Australian dollar/Euro)

- AUD/GBP (Australian dollar/British pound)

- AUD/CHF (Australian dollar/Swiss franc)

- AUD/CAD (Australian dollar/Canadian dollar)

*please note that Forex prices are subject to change.

Bonds

Bonds are a type of debt security that companies or governments issue to raise funds. Investors can buy and sell bonds and receive regular interest payments until the bond matures. Bonds are often considered a lower-risk investment than shares and CFDs but offer lower potential returns.

Options

Options are a derivative instrument that gives investors the right, but not the obligation, to buy or sell an underlying asset at a specific price on or before a specific date. Options can be traded on various assets, such as shares and indices, allowing investors to profit from price movements while limiting risk.

Futures

Futures are similar to options in that they are derivative instruments that allow investors to speculate on the price movements of an underlying asset. However, unlike options, futures are binding contracts requiring the investor to buy or sell the underlying asset at a specific price on a specific date. Futures trade on various assets, such as commodities and indices.

How can I determine if an Australian broker is legitimate and trustworthy?

It is important to ensure that any Australian broker you are considering is regulated by ASIC, as this will assure that the broker complies with the relevant laws and regulations. You can also look for information on the broker's reputation and history of customer satisfaction, as well as checking reviews and ratings from other traders.

What fees are associated with trading with Australian brokers?

fees associated with trading with Australian brokers may include spreads, commissions, and other fees such as account maintenance or inactivity fees. It is important to review the broker's fee schedule before opening an account to ensure that you understand the costs involved.

What is the minimum amount of capital required to open an account with an Australian broker?

The minimum amount of capital required to open an account with an Australian broker will vary depending on the broker and the type of account you wish to open. Some brokers may offer accounts with no minimum deposit requirement, while others may require a minimum deposit of several hundred dollars or more.

What types of accounts do Australian brokers offer?

Australian brokers typically offer a range of account types to suit the needs of different traders, including standard accounts, mini accounts, and demo accounts for practice trading.

What is the process for opening an account with an Australian broker?

The process for opening an account with an Australian broker will vary depending on the broker but typically involves submitting an online application form and providing proof of identity and address. Once your account is approved, you can fund your account and start trading.

What are the risks involved in trading with Australian brokers?

Trading with Australian brokers involves market volatility, leverage, and counterparty risks. It is important to be aware of these risks and to manage them through responsible trading practices such as risk management strategies and avoiding excessive leverage.

What is customer support like for Australian brokers?

Australian brokers typically offer customer support through phone, email, and live chat channels. It is important to review the broker's customer support options before opening an account to ensure you can get assistance if needed.

What is the level of security provided by Australian brokers for client funds and information?

Australian brokers must comply with strict client fund protection and information security regulations, including holding client funds in segregated accounts and implementing robust security measures to protect client information.

What is the level of leverage offered by Australian brokers, and how is it calculated?

The level of leverage offered by Australian brokers will vary depending on the broker and the traded financial instrument. Still, ASIC, the financial regulator, limits retail trading leverage at 30:1 to protect Aussie traders. Calculated leverage is a ratio of the size of the position to the amount of margin required to open the position.

- Major currency pairs have a max leverage of 30:1 under ASIC.

- Minor currency pairs, gold, and major stock indices have a max leverage of 20:1 under ASIC.

- Commodity (Non-gold), minor stock index max leverage of 10:1 under ASIC.

- Crypto-assets max leverage of 2:1 under ASIC.

- Other assets have a max leverage of 5:1 under ASIC.

Can I trade on margin with an Australian broker?

Yes, many Australian brokers offer margin trading, which allows traders to open positions with a smaller amount of capital than would be required for the full position size.

Understanding the Differences Between Market Makers and ECN/STP Brokers in Australia

Regarding trading with Australian brokers, it is important to understand the differences between a market maker and an ECN/STP broker. A market maker is a type of broker that sets their bid, asks prices for a particular asset, and can take the other side of a trade. On the other hand, an ECN/STP broker connects traders to a network of liquidity providers, such as banks and other brokers, and offers pricing based on the market.

While market makers often offer tighter spreads and a wider range of assets, they may also have conflicts of interest with their clients as they can benefit from taking the opposite side of a trade. ECN/STP brokers, on the other hand, typically have lower trading costs and may provide more transparent pricing but may have wider spreads and fewer asset offerings.

Trading with an Australian Broker from Overseas

Australian brokers are often able to provide services to traders based overseas, but it is important to check the specific regulations in your country and ensure that the broker is licensed to provide services to clients in your jurisdiction.

Tax Treatment for Profits Earned from Trading with Australian Brokers

The tax treatment for profits earned from trading with Australian brokers depends on the tax laws in your jurisdiction. It is important to consult with a tax professional to ensure you comply with all applicable laws and regulations.

Profits earned from trading with Australian brokers are subject to taxation in Australia. The tax treatment for such profits will depend on various factors, including the individual's residency status, the type of trading account used, and the types of financial instruments traded.

If the individual is a resident of Australia for tax purposes, they will be required to pay tax on their trading profits at their marginal tax rate. The tax rate will vary depending on the individual's income bracket. However, if the individual is a non-resident for tax purposes, they will be subject to withholding tax on their trading profits.

It is important to note that certain financial instruments may have different tax treatments. For example, profits from trading in options or futures may have different tax rules from profits earned from trading in stocks or forex.

Withdrawal Process for Profits

The withdrawal process for profits earned with an Australian broker will vary depending on the broker and the payment method used. Generally, brokers require clients to verify their identity and provide documentation before processing any withdrawal.

The withdrawal process for profits earned with an Australian broker will depend on the broker's policies and procedures. Generally, most brokers allow you to withdraw funds via bank transfer or other payment methods.

Before withdrawing, you may be required to provide some documentation to verify your identities, such as a passport or driver's license. You should also know of any withdrawal fees or charges, such as currency conversion or withdrawal fees.

Educational Resources and Support Provided by Australian Brokers

Many Australian brokers offer a range of educational resources and support to help traders improve their skills and knowledge. These may include webinars, video tutorials, trading guides, and one-on-one coaching sessions.

Most Australian brokers provide a range of educational resources and support for their clients. Aussie broker educational resources include access to trading guides, webinars, market analysis, and educational videos. Some brokers may also offer one-on-one coaching or training sessions.

Besides educational resources, many brokers provide their client's access to trading tools, such as economic calendars, charting software, and news feeds. These tools can help traders make more informed decisions and improve their trading strategies.

Comparing Different Australian Brokers

When comparing different Australian brokers, it is important to consider factors such as regulation, asset offerings, trading costs, customer support, and educational resources. Online reviews and ratings can also be helpful tools in evaluating different brokers.

To choose the best Australian broker for your needs, consider various factors, including the broker's reputation, regulatory compliance, trading platform, fees, customer support, and educational resources.

You can start by researching and comparing different brokers online. Look for reviews and testimonials from other traders, and check whether the broker is licensed and regulated by ASIC.

You should also consider the trading platform the broker offers. Ensure it is user-friendly and has all the features and tools you need to trade effectively. Additionally, you should compare the fees associated with each broker, including spreads, commissions, and deposit and withdrawal fees.

Finally, consider each broker's level of customer support and educational resources. Choose a broker that offers excellent customer service and a range of educational resources to help you improve your trading skills.

Bonuses and Promotions

Many Australian brokers offer bonuses and promotions to attract new clients and retain existing ones. These may include deposit bonuses, no-deposit bonuses, cashback offers, and other incentives.

However, reading any bonus or promotion's terms and conditions is important. Some bonuses may have strict requirements and conditions attached, such as minimum trading volumes or time restrictions.

Some Australian brokers may offer bonuses or promotions to new or existing clients, such as deposit bonuses or cashback rewards. It is important to carefully read the terms and conditions of any bonus or promotion before accepting it.

Australian Brokers Verdict

Australia has a vibrant brokerage industry with a strong regulatory environment and competitive pricing. Australian brokers offer a variety of trading platforms and financial instruments, making it a popular destination for traders worldwide. With its reputation for innovation and technology, the Australian brokerage industry will likely continue attracting traders for years.

Overall, trading with an Australian broker can offer many advantages, including regulatory compliance, access to a range of financial instruments, and educational resources and trading tools. However, it is important to choose a reputable and reliable broker and to understand the risks and costs involved in trading.

Best Australian Brokers List Compared

| Featured Australian Broker Trading Platform | Account Features | Trading Features |

|---|---|---|

| Used By: 180,000 Instruments Available: 232 Stocks Available: 2100 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 61 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mirror Trader, ZuluTrade, Web Trader, cTrader, Mac Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 200,000 Instruments Available: 1000 Stocks Available: 99 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 80 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: Web Trader, MT4, MT5, AvaTradeGo, AvaOptions, Mac, Mobile Apps, ZuluTrade, DupliTrade, MQL5 Negative Balance Protection: Inactivity Fee: No 71% of retail CFD accounts lose moneyVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 10000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 60 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, IRESS, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 50 Stocks Available: 0 US Stocks: No UK Stocks: No German Stocks: No Japanese Stocks: No Indices: No Forex Pairs Available: 65 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Minimum Deposit: 10 |

Platforms: MT4, MT5, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 89,000 Instruments Available: 100 Stocks Available: 60 US Stocks: No UK Stocks: No German Stocks: Yes Japanese Stocks: No Indices: Yes Forex Pairs Available: 70 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mac, ZuluTrade, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your moneyVisit |

|

| Used By: 10,000,000 Instruments Available: 1000 Stocks Available: 160 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 55 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 5 |

Platforms: MT4, MT5, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77.74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.Visit |

|

| Used By: 20,000,000 Instruments Available: 2000 Stocks Available: 2042 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 50 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 50 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 51% of retail investor accounts lose money when trading CFDs with this provider.Visit |

|

| Used By: 142,500 Instruments Available: 200 Stocks Available: 52 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 150 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Your capital is at riskVisit |

|

| Used By: 15,000,000 Instruments Available: 10000 Stocks Available: 1731 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 177 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.Visit |

|

| Used By: 10,000 Instruments Available: 148 Stocks Available: 64 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 40 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: $100 |

Platforms: MT4, MT5, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 15000 Stocks Available: 1000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 55 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 300,000 Instruments Available: 100 Stocks Available: 0 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 150 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1000 |

Platforms: MT4, MT5, ZuluTrade, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 500,000 Instruments Available: 1500 Stocks Available: 1500 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: No Indices: Yes Forex Pairs Available: 40 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 0 |

Platforms: ThinkTrader, MT4, MT5, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71.89% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your moneyVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 10 US Stocks: Yes UK Stocks: No German Stocks: No Japanese Stocks: No Indices: Yes Forex Pairs Available: 40 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 1000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: No Forex Pairs Available: 100 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 0 |

Platforms: MT4, Mac, ZuluTrade, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

Best Australian Broker Australian Broker Reviews

Read our details broker Australian Broker Australian Broker reviews, you will find something useful if you are shortlisting a Australian Broker Australian Broker and trading platform.

- IC Markets Review (read our in depth reviews)

- AvaTrade Review (read our in depth reviews)

- FP Markets Review (read our in depth reviews)

- NordFX Review (read our in depth reviews)

- Pepperstone Review (read our in depth reviews)

- XM Review (read our in depth reviews)

- eToro Review (read our in depth reviews)

- easyMarkets Review (read our in depth reviews)

- Trading 212 Review (read our in depth reviews)

- Admiral Markets Review (read our in depth reviews)

- SpreadEx Review (read our in depth reviews)

- Swissquote Review (read our in depth reviews)

- ThinkMarkets Review (read our in depth reviews)

- HYCM Review (read our in depth reviews)

- Axi Review (read our in depth reviews)

Australian Broker Australian Broker Alternatives

Read about and compare Australian Broker Australian Broker alternatives. We have indepth side by side comparisons to help you find Australian Broker Australian Broker related brokers.

- IC Markets Alternatives

- AvaTrade Alternatives

- FP Markets Alternatives

- NordFX Alternatives

- Pepperstone Alternatives

- XM Alternatives

- eToro Alternatives

- easyMarkets Alternatives

- Trading 212 Alternatives

- Admiral Markets Alternatives

- SpreadEx Alternatives

- Swissquote Alternatives

- ThinkMarkets Alternatives

- HYCM Alternatives

- Axi Alternatives

IC Markets

IC Markets

AvaTrade

AvaTrade

FP Markets

FP Markets

NordFX

NordFX

Pepperstone

Pepperstone

XM

XM

eToro

eToro

easyMarkets

easyMarkets

Trading 212

Trading 212

Admiral Markets

Admiral Markets

SpreadEx

SpreadEx

Swissquote

Swissquote

ThinkMarkets

ThinkMarkets

HYCM

HYCM

Axi

Axi