Best ASX Brokers

Choosing the best ASX broker depends on your investment goals and preferences. Some popular options include IC Markets, XTB and RoboForex. Research and compare the fees, services, and reputation of different brokers to find the best fit for you.

When selecting a broker for ASX, it is important to consider factors such as reputation, level of regulation, and the range of minor and major currency pairs provided. ASX trading has gained immense popularity in recent years, attracting many individuals interested in generating extra income. A broker acts as an intermediary between traders and the ASX stock market. It is crucial to ensure that the chosen broker has the necessary licensing and regulations to protect investors from fraudulent practices when performing ASX trading. However, it is important to remember that trading in volatile stock markets carries high potential loss, and not all brokers support ASX trades.

Best ASX Brokers Table of Contents

- Best ASX Brokers for 2026

- ASX Brokers: Your Comprehensive Guide to Trading and Investing

- What is an ASX broker?

- How do ASX brokers operate?

- What services do ASX brokers provide?

- What are the benefits of using an ASX broker?

- How do I choose an ASX broker?

- What fees do ASX brokers charge?

- What is the difference between full-service and discount ASX brokers?

- What are the risks associated with using an ASX broker?

- How do I open an account with an ASX broker?

- What documents do I need to provide to open an account with an ASX broker?

- What types of investments can I make through an ASX broker?

- How can I place an order with an ASX broker?

- How quickly will my trades be executed by an ASX broker?

- Can I trade international stocks through an ASX broker?

- What research and analysis tools are available through ASX brokers?

- How can I monitor my portfolio through an ASX broker?

- How is the withdrawal process from an ASX broker account?

- How can I contact my ASX broker with questions or concerns?

- What are the qualifications and credentials of ASX brokers?

- How can I stay up-to-date with the latest developments in the ASX broker industry?

- How do I trade on ASX from Other Countries?

- Can you buy at ASX without a broker?

- The best share trading platform for ASX stocks

- What is the cheapest way to buy stocks in Australia?

- Do any Australian stockbrokers offer forex trading?

- Best ASX Brokers List Compared

Best ASX Brokers for 2026

ASX Brokers: Your Comprehensive Guide to Trading and Investing

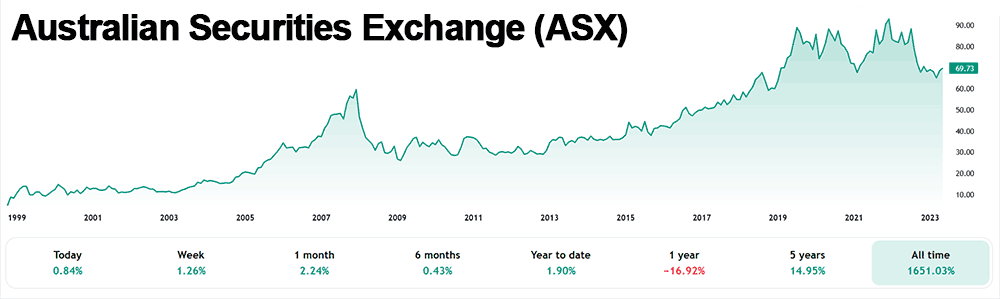

Trading and investing in the Australian Securities Exchange (ASX), an Australian stock exchange, can be an exciting and profitable venture for active and casual traders. Choosing the right ASX broker is crucial to successfully trading Australian stocks. This article will cover everything you need to know about ASX brokers, from the services they provide to the fees they charge and how to choose the best one for your needs on a reasonable basis.

What is an ASX broker?

An ASX broker is a licensed professional or firm offering an online booking service that allows active traders to buy and sell shares on the Australian Securities Exchange. They facilitate transactions between buyers and sellers by executing orders on their client's behalf. Online brokers have become increasingly popular in recent years, providing a convenient and cost-effective way to trade Australian stocks.

How do ASX brokers operate?

ASX brokers operate by providing a trading platform for investors to access the Australian Securities Exchange. The trading platform lets you view share prices, research, and place buy and sell orders. Most online brokers offer a range of trading tools and educational resources to help you make informed investment decisions. ASX brokers make money by charging a brokerage fee for each trade executed on their platform.

What services do ASX brokers provide?

ASX brokers provide various services to help investors trade stocks on the Australian Securities Exchange. These services include:

- Access to a trading platform for buying and selling shares

- Research tools and analysis to help make informed investment decisions

- Portfolio monitoring and performance tracking

- Customer support for any questions or concerns

- Educational resources to improve your trading skills

What are the benefits of using an ASX broker?

There are several benefits to using an ASX broker for trading Australian stocks, including:

- Convenience: Online brokers allow you to trade from the comfort of your own home or office

- Cost savings: Online trading platforms often have lower fees than traditional full-service brokers

- Access to research tools and analysis: ASX brokers provide a wealth of resources to help you make informed investment decisions

- Portfolio monitoring: Easily track your portfolio performance and make adjustments as needed

- Customer support: ASX brokers offer assistance for any questions or concerns you may have

How do I choose an ASX broker?

Choosing the right ASX broker for your investment needs is essential. Consider the following factors when selecting an ASX broker:

- Fees: Compare brokerage fees, inactivity fees, and other charges between different brokers

- Trading platform: Ensure the trading platform is user-friendly and provides the tools and resources you need

- Customer support: Choose a broker that offers prompt and helpful support when needed

- Research tools and educational resources: Look for a broker that offers a range of research tools and educational resources to help you make informed investment decisions

- Reputation: Research the broker's reputation and reviews from other investors

- Investment options: Ensure the broker offers access to the types of investments you are interested in, such as Australian stocks, global markets, or managed funds

What fees do ASX brokers charge?

ASX brokers charge various fees, including brokerage, inactivity, and other ongoing fees. Brokerage fees are charged for each buy-and-sell transaction and can vary between brokers. Some brokers charge inactivity fees if your trading account is inactive for a certain period. Comparing inactivity fees between brokers is essential to ensure you get the best deal for your trading needs.

What is the difference between full-service and discount ASX brokers?

Full-service ASX brokers offer various services, including personalized advice, research, and portfolio management. They typically charge higher fees than discount brokers. On the other hand, Discount ASX brokers provide a more streamlined service with lower costs. They offer an online trading platform for executing trades but may not provide personalized advice or extensive research tools. The best choice for you depends on your investment goals and preferences.

What are the risks associated with using an ASX broker?

Using an ASX broker can provide many benefits, but risks are also associated with trading Australian stocks. These risks include the stock market and volatility, leading to fluctuating share prices and potential losses. Additionally, there is always the risk that a broker may not be reputable or could go out of business. It's essential to choose a well-established broker with a strong reputation and research the risks associated with specific investments before trading. Casual and day traders should research before investing (placing trades) in any financial product, including ASX share performance.

How do I open an account with an ASX broker?

Opening an account with an ASX broker is generally straightforward. Most brokers offer an online application process, requiring you to provide personal information, including your name, address, and tax file number. You may also need to provide proof of identity, such as a driver's license or passport, and complete a risk assessment questionnaire. ASX trades can be conducted with a standard account with conditional orders.

What documents do I need to provide to open an account with an ASX broker?

To open an account with an ASX broker, you will need to provide several documents, including:

- Proof of identity (e.g., driver's license, passport, or birth certificate)

- Proof of address (e.g., utility bill or bank statement)

- Tax file number

- Some brokers may require additional documentation, such as employment or financial information.

What types of investments can I make through an ASX broker?

ASX brokers offer access to various investment products, including Australian stocks, managed funds, and other financial products. Some brokers also provide access to global markets, allowing you to trade international stocks and participate in foreign exchange (forex) trading.

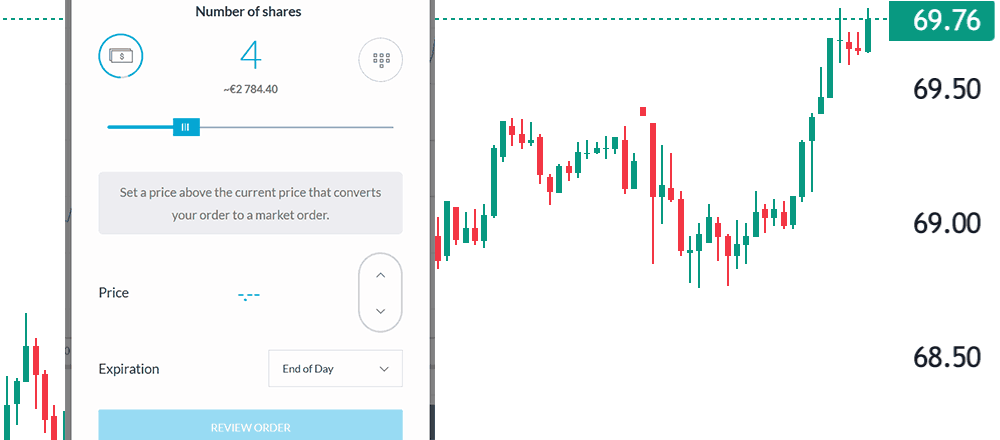

How can I place an order with an ASX broker?

Placing an order with an ASX broker typically involves using their online trading platform. You can enter the trade details, such as the stock you want to buy or sell, the number of shares, and the type of order (e.g., market or limit order). Once you have submitted the order to an online broker, the broker will execute the trade on your behalf on the Australian Securities Exchange.

How quickly will my trades be executed by an ASX broker?

The speed at which an ASX broker executes your trades depends on various factors, including the fair liquidity price of the stock, the type of order, and the trading platform's efficiency. Market orders are generally executed more quickly than limit orders, as they are filled at the best available price. Most online brokers offer near-instant execution for market orders during the trading day.

Can I trade international stocks through an ASX broker?

Some ASX brokers offer access to international and global markets, allowing you to trade value and diversify your portfolio beyond Australian stocks. Trading international stocks may involve additional fees and risks, such as currency fluctuations and geopolitical factors. Researching these risks and understanding the fees associated with trading international stocks before investing is essential.

What research and analysis tools are available through ASX brokers?

ASX brokers provide various research tools and analyses to help you make informed investment decisions. These tools may include:

- Company information and financial statements

- Technical analysis and charting tools

- Analyst ratings and recommendations

- Market news and updates

- Educational resources and tutorials

How can I monitor my portfolio through an ASX broker?

ASX brokers typically offer portfolio monitoring tools as part of their online trading platform. These tools allow you to track the performance of your investments, view your brokerage account and balance, and access detailed reports on your trading activity. Monitoring your portfolio can help you adjust to align with your investment goals.

How is the withdrawal process from an ASX broker account?

Withdrawing funds from an ASX broker account usually involves submitting a withdrawal request through the online trading account or platform. The broker may require additional documentation to verify your identity before processing the withdrawal. The funds typically take several business days to be transferred to your bank account. Make sure Australian investors take into account any Australian taxation office compliance

How can I contact my ASX broker with questions or concerns?

Most ASX brokers offer various channels for customer support, including email, phone, and live chat. It's essential to choose a broker that provides prompt and helpful support to address any questions or concerns you may have practice trading with.

What are the qualifications and credentials of ASX brokers?

ASX brokers must meet specific regulatory requirements and hold the appropriate licenses to operate in Australia. The Australian Securities and Investments Commission (ASIC) regulates ASX brokers and ensures they comply with industry standards and best practices. Verifying that your chosen broker is licensed and regulated by ASIC before opening an account is essential.

How can I stay up-to-date with the latest developments in the ASX broker industry?

Staying informed about the latest developments in the ASX broker industry can help you make better investment decisions and take advantage of new opportunities. You can stay up-to-date by:

- Subscribing to industry newsletters and blogs

- Following ASX broker news on financial news websites

- Joining online forums and communities related to ASX trading

- Attending industry events and conferences

How do I trade on ASX from Other Countries?

International investors can trade on the ASX by opening an account with an ASX broker that offers access to global markets. Some international brokers, such as Interactive Brokers, provide access to the Australian Securities Exchange for clients in various countries. It's essential to research and compares brokers that offer access to the ASX and understand any additional fees or requirements associated with trading from outside Australia.

Can you buy at ASX without a broker?

It is generally impossible to trade directly on the ASX without a broker. Brokers act as intermediaries between investors and the exchange, executing trades on their behalf. To buy and sell shares on the ASX, you must open an account with a licensed broker.

The best share trading platform for ASX stocks

The best share trading platform for ASX stocks depends on your needs and preferences. When choosing the best trading platform, factors include fees, trading tools, research capabilities, and customer support. Some popular share trading platforms for trading ASX stocks include CommSec, nabtrade, and Bell Direct. It's essential to compare different platforms and choose the one that best aligns with your investment goals, style, and preferences. Be aware of any minimum fee requirements for varying asset class financial instruments, especially on small trades on ASX brokers and other platforms.

What is the cheapest way to buy stocks in Australia?

The cheapest way to buy stocks in Australia typically involves using a discount broker with low fees. These brokers offer lower-cost trading services by providing streamlined online platforms without personalized advice or extensive research tools. It's essential to compare fees between different brokers and consider other factors, such as trading tools and customer support, to find the best fit full-service broker with low costs that matches your needs for checking ASX share price when you trade shares.

Do any Australian stockbrokers offer forex trading?

Some Australian stockbrokers offer forex trading in addition to trading Australian stocks. Forex trading involves buying and selling currencies on the foreign exchange market. Brokers that offer forex trading provide access to a range of currency pairs and may offer additional tools and resources for forex traders. Researching and comparing brokers offering forex and the best ASX share trading platforms is essential to find the best fit for your trading needs.

Best ASX Brokers List Compared

| Featured ASX Broker Trading Platform | Account Features | Trading Features |

|---|---|---|

| Used By: 180,000 Instruments Available: 232 Stocks Available: 2100 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 61 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mirror Trader, ZuluTrade, Web Trader, cTrader, Mac Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 53 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 35 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 10 USD / 10 EUR |

Platforms: MT4, MT5, Mac, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 200,000 Instruments Available: 1000 Stocks Available: 99 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 80 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: Web Trader, MT4, MT5, AvaTradeGo, AvaOptions, Mac, Mobile Apps, ZuluTrade, DupliTrade, MQL5 Negative Balance Protection: Inactivity Fee: No 71% of retail CFD accounts lose moneyVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 10000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 60 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, IRESS, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 250,000 Instruments Available: 4000 Stocks Available: 1696 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 57 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 0 |

Platforms: MT4, Mirror Trader, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Visit |

|

| Used By: 89,000 Instruments Available: 100 Stocks Available: 60 US Stocks: No UK Stocks: No German Stocks: Yes Japanese Stocks: No Indices: Yes Forex Pairs Available: 70 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mac, ZuluTrade, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your moneyVisit |

|

| Used By: 10,000,000 Instruments Available: 1000 Stocks Available: 160 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 55 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 5 |

Platforms: MT4, MT5, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77.74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.Visit |

|

| Used By: 20,000,000 Instruments Available: 2000 Stocks Available: 2042 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 50 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 50 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 51% of retail investor accounts lose money when trading CFDs with this provider.Visit |

|

| Used By: 15,000,000 Instruments Available: 10000 Stocks Available: 1731 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 177 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.Visit |

|

| Used By: 10,000 Instruments Available: 15000 Stocks Available: 1000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 55 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 10 US Stocks: Yes UK Stocks: No German Stocks: No Japanese Stocks: No Indices: Yes Forex Pairs Available: 40 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes Losses can exceed depositsVisit |

|

| Used By: 300,000 Instruments Available: 100 Stocks Available: 0 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 150 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1000 |

Platforms: MT4, MT5, ZuluTrade, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 1000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: No Forex Pairs Available: 100 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 0 |

Platforms: MT4, Mac, ZuluTrade, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 4,000,000 Instruments Available: 2200 Stocks Available: 2000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: No Indices: Yes Forex Pairs Available: 67 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your moneyVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 0 US Stocks: No UK Stocks: No German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 45 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

Best ASX Broker ASX Broker Reviews

Read our details broker ASX Broker ASX Broker reviews, you will find something useful if you are shortlisting a ASX Broker ASX Broker and trading platform.

- IC Markets Review (read our in depth reviews)

- Roboforex Review (read our in depth reviews)

- AvaTrade Review (read our in depth reviews)

- FP Markets Review (read our in depth reviews)

- XTB Review (read our in depth reviews)

- Pepperstone Review (read our in depth reviews)

- XM Review (read our in depth reviews)

- eToro Review (read our in depth reviews)

- Trading 212 Review (read our in depth reviews)

- SpreadEx Review (read our in depth reviews)

- HYCM Review (read our in depth reviews)

- Swissquote Review (read our in depth reviews)

- Axi Review (read our in depth reviews)

- Markets.com Review (read our in depth reviews)

- Eightcap Review (read our in depth reviews)

ASX Broker ASX Broker Alternatives

Read about and compare ASX Broker ASX Broker alternatives. We have indepth side by side comparisons to help you find ASX Broker ASX Broker related brokers.

- IC Markets Alternatives

- Roboforex Alternatives

- AvaTrade Alternatives

- FP Markets Alternatives

- XTB Alternatives

- Pepperstone Alternatives

- XM Alternatives

- eToro Alternatives

- Trading 212 Alternatives

- SpreadEx Alternatives

- HYCM Alternatives

- Swissquote Alternatives

- Axi Alternatives

- Markets.com Alternatives

- Eightcap Alternatives

IC Markets

IC Markets

Roboforex

Roboforex

AvaTrade

AvaTrade

FP Markets

FP Markets

XTB

XTB

Pepperstone

Pepperstone

XM

XM

eToro

eToro

Trading 212

Trading 212

SpreadEx

SpreadEx

HYCM

HYCM

Swissquote

Swissquote

Axi

Axi

Markets.com

Markets.com

Eightcap

Eightcap