Best Stock Trading Apps China 2026

China Stock trading apps on mobile devices are a new tool for China traders.

There are a number of different reasons for the growth in mobile phone stock app use in China. The introduction of innovative stock app trading technologies now available to Chinese traders that make it easier then ever to buy and sell stocks and shares on global stock markets. In the last 5 years there has been an increase in the range of mobile stock app trading platforms that can be accessed via mobile phones as mobile internet enabled devices have become wide spread in China, contributing to this mobile enabled stock trading trend.

China does have the local Shanghai Stock Exchange financial market for Chinese stock traders to buy and sell China stocks and shares. Although the Local Shanghai Stock Exchange is there for Chinese stock traders, Chinese traders look to global stock markets to diversify their stock portfolios. Some international stock markets are larger and more stable than the local Shanghai Stock Exchange also.

Best Stock Trading Apps China 2026 Table of Contents

- Best Stock Trading Apps China 2026

- Top China Stock Trading Apps Compared

- Best Stock Trading Apps China List

- IC Markets

- Roboforex

- AvaTrade

- FP Markets

- NordFX

- XTB

- Pepperstone

- XM

- FXPrimus

- easyMarkets

- Trading 212

- SpreadEx

- Admiral Markets

- HYCM

- Swissquote

- Check Your China Stock Trading App Is Regulated

- What Mobile Devices Do China Stock Apps Support?

- Apple IOS Mobile Phone And Tablet Stock Apps China

- Android Mobile Phone And Tablet Stock Apps China

- Windows Phone And Tablet Stock Apps China

- What Are The Most Popular Stock Markets for China Stock App Traders

- Mobile Stock Trading App Tools China

- What Are Stocks and Shares China?

- China Stock Trading Mobile Apps and Desktop Stock Trading Options

- What Can You Trade On China Stock Trading Apps

- China Fractional Shares Trading Apps

- China CFD Stock Trading Apps

- China Penny Stocks Trading Apps

- Trading Global Stock Markets on China Trading Apps

- How To Open A China Trading Account

- China Trading Account Verification

- Fund Your Trading Account China

- Research Stocks And Start Trading China

- How To Place A Stock Trade On A China Trading Platform

- How To Sell A Stock On A China Trading Platform

- China Stock Trading Platform Checklist

- China Stock Trading Apps Ease Of Use

- China Stock trading apps Realtime Financial Market News and Data

- China Stock Trading Charting Tools and Technical Analysis Tools

- China Stock trading apps Educational Resources

- China Stock Trading App Security

- China Stock Trading App Fees And Commissions

- China Commisson Free Stock Trading

- China Stock Broker Fees

- China Stock Trading Apps Membership Fees Monthly / Yearly

- China Stock Trading Apps Withdrawal Fees

- China Stock Trading Apps Currency Conversion Fees

- Free Stock Trading in China

- China Stock Trading Demo Accounts

- Customer Support on China Stock Trading Apps

- Livechat on China Stock Trading Apps

- Email Support on China Stock Trading Apps

- Phone Support on China Stock Trading Apps

- China Stock Trading Strategies On Mobile Devices

- How Often Will You Buy Stocks On Your China Stock Trading App?

- Long or Short Term Stock Investing On China Stock Trading Apps

- Trading Vs Investing On China Stock Trading Apps

- What Moves Stock Prices When Trading in China

- China and Global Earnings Reports

- China and Global Economic Data

- China and Global Market Sentiment

- China and Global Interest Rates

- China Stock Trading Order Types

- China Stock Trading Mobile App Market Orders

- China Stock Trading Mobile App Limit Orders

- China Stock Trading Mobile App Stop Loss Order

- China Stock Trading Mobile App Buy Stop Order

- Types Of China Stocks And Shares

- China Common Stock Trading Apps

- China Preferred Stock Trading Apps

- China Large-cap stocks Trading Apps

- China Mid-cap Stocks Trading Apps

- China Small-cap Stocks Trading Apps

- China Domestic Stock Trading Apps

- China International Stocks Trading Apps

- China Growth Stocks Trading Apps

- China Value Stocks Trading Apps

- China IPO Stocks Trading Apps

- China Dividend Stocks Trading Apps

- China Non-dividend Stocks Trading Apps

- China Income Stocks Trading Apps

- China Cyclical Stocks Trading Apps

- China Non-cyclical Stocks Trading Apps

- China Safe Stocks Trading Apps

- China ESG Stocks Trading Apps

- China Blue Chip Stocks Trading Apps

- China Stock Trading Apps Verdict

- Related Guides

- Best Stock Trading Apps China Reviews

- Best Stock Trading Apps China Alternatives

Top China Stock Trading Apps Compared

Best Stock Trading Apps China List

| Featured Stock Trading App China | Account Features | Trading Features |

|---|---|---|

| Used By: 180,000 Instruments Available: 232 Stocks Available: 2100 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 61 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mirror Trader, ZuluTrade, Web Trader, cTrader, Mac Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsTry Now |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 53 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 35 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 10 USD / 10 EUR |

Platforms: MT4, MT5, Mac, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsTry Now |

|

| Used By: 200,000 Instruments Available: 1000 Stocks Available: 99 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 80 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: Web Trader, MT4, MT5, AvaTradeGo, AvaOptions, Mac, Mobile Apps, ZuluTrade, DupliTrade, MQL5 Negative Balance Protection: Inactivity Fee: No 71% of retail CFD accounts lose moneyTry Now |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 10000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 60 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, IRESS, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsTry Now |

|

| Used By: 10,000 Instruments Available: 50 Stocks Available: 0 US Stocks: No UK Stocks: No German Stocks: No Japanese Stocks: No Indices: No Forex Pairs Available: 65 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Minimum Deposit: 10 |

Platforms: MT4, MT5, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsTry Now |

|

| Used By: 250,000 Instruments Available: 4000 Stocks Available: 1696 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 57 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 0 |

Platforms: MT4, Mirror Trader, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Try Now |

|

| Used By: 89,000 Instruments Available: 100 Stocks Available: 60 US Stocks: No UK Stocks: No German Stocks: Yes Japanese Stocks: No Indices: Yes Forex Pairs Available: 70 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mac, ZuluTrade, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your moneyTry Now |

|

| Used By: 10,000,000 Instruments Available: 1000 Stocks Available: 160 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 55 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 5 |

Platforms: MT4, MT5, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77.74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.Try Now |

|

| Used By: 10,000 Instruments Available: 130 Stocks Available: 60 US Stocks: Yes UK Stocks: Yes German Stocks: No Japanese Stocks: No Indices: Yes Forex Pairs Available: 45 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, Mac, Mirror Trader, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsTry Now |

|

| Used By: 142,500 Instruments Available: 200 Stocks Available: 52 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 150 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Your capital is at riskTry Now |

|

| Used By: 15,000,000 Instruments Available: 10000 Stocks Available: 1731 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 177 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.Try Now |

|

| Used By: 10,000 Instruments Available: 15000 Stocks Available: 1000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 55 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsTry Now |

|

| Used By: 10,000 Instruments Available: 148 Stocks Available: 64 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 40 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: $100 |

Platforms: MT4, MT5, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsTry Now |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 10 US Stocks: Yes UK Stocks: No German Stocks: No Japanese Stocks: No Indices: Yes Forex Pairs Available: 40 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes Losses can exceed depositsTry Now |

|

| Used By: 300,000 Instruments Available: 100 Stocks Available: 0 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 150 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1000 |

Platforms: MT4, MT5, ZuluTrade, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsTry Now |

China stock trading apps are mobile phone and tablet compatible stock trading platforms that allow China stock traders buy and sell stocks on global stock exchanges from anywhere in the world on the move.

China mobile trading stock platforms have grown in popularity due to the increasing usage of Apple and Android smartphones and tablets. China Professional stock traders, who are always on the move, prefer mobile devices as they can stay in touch with stock market opportunities wherever they may be. Stock trading apps for China traders are perfect for this. Many China stock trading platforms and fintech companies are constantly improving their China stock trading mobile platforms, allowing users to use them to buy, sell and research a wide range of stocks and shares for trading purposes.

Check Your China Stock Trading App Is Regulated

Financial regulation is one of the first things you should before depositing any money with a stock trading app that supports China customers.

Financial regulators in China include China Securities Regulatory Commission. When short listing a China stock trading app make sure they have financial regulation from major European financial regulators.

Stock trading app financial regulation is important because it helps to ensure that financial institutions are safe for consumers and investors. For example, if a China stock trading app fails, then people lose their invested money. If a China stock trading app is doing bad things, such as engaging in unethical practices, a financial regulator will step in. Stock apps are not allowed to operate in China the unless they are authorised and regulated by local financial regulators. If a China stock trading app is not regulated, do not trade with them.

What Mobile Devices Do China Stock Apps Support?

Apple IOS Mobile Phone And Tablet Stock Apps China

China IOS stock trading apps are mobile applications that have been developed for the iPhone, iPod Touch and iPad platforms. IOS stock trading apps are built using the native development environment provided by Apple – Xcode. In short, IOS stocks apps is a term used to refer to native IOS applications as opposed to web or hybrid applications that allow China traders to place buy and sell stock orders. Some modern IOS China stock trading apps offer a range of technical analysis and stock market research tools.

Android Mobile Phone And Tablet Stock Apps China

An Android stock trading app is a stock trading software program designed to run on an android device such as a mobile phone or tablet. There are over 3 billion android devices in use around the world including popular Samsung phones and tablets. Many stock trading apps will offer there stock trading platforms with Android support.

Windows Phone And Tablet Stock Apps China

Although not as main stream and popular as Apple and Android, many stock trading mobile applications support Windows Phone devices.

Windows Phone Stock trading apps are applications that run on the Windows Phone platform. These windows phone stock trading apps are aimed at the retail stock trading market.

|

|

|

|

| |

| Name | IC Markets | Roboforex | AvaTrade | FP Markets | NordFX |

| Apple IOS | Yes | Yes | Yes | Yes | Yes |

| Android | Yes | No | Yes | Yes | Yes |

| Windows Phone | Yes | No | No | No | No |

| riskwarning | Try Now Losses can exceed deposits | Try Now Losses can exceed deposits | Try Now 71% of retail CFD accounts lose money | Try Now Losses can exceed deposits | Try Now Losses can exceed deposits |

What Are The Most Popular Stock Markets for China Stock App Traders

The most popular stock markets for China stock app traders are the New York Stock Exchange, NASDAQ, FTSE, Euronext and the Tokyo Stock Exchange. We list all of the most popular stock exchanges for China stock app traders below.

- NYSE

- NASDAQ

- Euronext

- Japan Exchange Group

- Hong Kong Exchanges

- London Stock Exchange

- TMX Group Canada

- Deutsche Boerse

- NASDAQ Nordic And Baltics

- Six Swiss Exchange

- Korea Exchange

- ASX Australian Securities Exchange

- Johannesburg Stock Exchange

- Brasil Bolsa Balcao

- National Stock Exchange Of India

- Shanghai Stock Exchange

Mobile Stock Trading App Tools China

China stock trading apps offer an array of tools for technical and fundamental analysis. Make sure to research all China stock platforms before choosing one. Here are some of the benefits of using a China stock trading platform. It helps you make the most informed decisions. Whether you prefer to trade penny stocks or major stocks, make sure you find the best platform for you. Major stocks tend to move in small increments, but penny stocks can move by double digits but are far more volatile higher risk investments. If you are new to stock trading, it is best to avoid high volatility and select a platform that offers a variety of China stock trading tools and market research. A China stock trading platform should also be user-friendly, and the platform should help you become an expert.

|

|

|

|

| |

| Name | IC Markets | Roboforex | AvaTrade | FP Markets | NordFX |

| Shares Offered | 2100 | 53 | 99 | 10000 | No |

| USA Stocks | Yes | Yes | Yes | Yes | No |

| UK Stocks | Yes | Yes | Yes | Yes | No |

| German Stocks | Yes | Yes | Yes | Yes | No |

| Japanese Stocks | Yes | Yes | Yes | Yes | No |

| riskwarning | Try Now Losses can exceed deposits | Try Now Losses can exceed deposits | Try Now 71% of retail CFD accounts lose money | Try Now Losses can exceed deposits | Try Now Losses can exceed deposits |

What Are Stocks and Shares China?

Firstly, stocks are the smallest unit of stock on the stock market, and their value fluctuates daily. By measuring their value in shares, China investors can determine how much they own of a company. For example, if you bought ten thousand shares of a China company, you own ten percent of all outstanding stock. These are called ordinary or common shares.

Shares are part-ownership rights in a company. A China investor exchanges money for shares in a company, and then receives one vote per share. The China shareholder can also share the company's profits through dividends. The value of shares will fluctuate depending on the success of the company, and it's up to the China shareholder to sell their shares at a higher price. It's important to remember that shares can fluctuate in value.

China Stock Trading Mobile Apps and Desktop Stock Trading Options

Traders should choose a China stock trading mobile app that lets them trade the assets they desire and that allows them to spot profit opportunities in real time. It should also not charge excessive fees for opening and closing positions. When comparing the features of China stock trading mobile apps and desktop stock trading options, consider their minimum deposit, tradable assets, and fees. If you're a beginner, you should stick to a few trusted and recommended options that are listed on the websites of the top brokers.

What Can You Trade On China Stock Trading Apps

Many China stock traders do not have the experience or knowledge to trade on their own, so these China stock platforms are the best option. You can use the services of a China broker to buy and sell shares, but it's important to remember that a broker cannot help you with trading decisions unless they have a license and can demonstrate experience. If you are unsure of how to get started, these China stock trading apps will give you the basics you need to know. There are many to choose from, but check these China stock platforms are all regulated. Each regulated China stock broker will allow you to invest in stocks and options, and they all feature various features that will benefit you in the long run. You can use these tools to learn more about the market, or you can use them to make profitable trades. While a lot of these platforms offer a free demo account, there are some that are more expensive. In addition, some have limitations regarding where you can buy and sell shares.

China Fractional Shares Trading Apps

China Fractional Shares trading apps allow you to purchase fractional amounts of different companies, without paying the full share price. The benefits of using a China fractional share trading platform are numerous, including the flexibility to diversify your portfolio. By setting up your account to buy the exact amount of fractional shares you want, you can purchase a percentage of the company's stock, as many as 50 percent. Once you've set up your account, you can simply input the cash amount that you want to invest.

Most China fractional share trading apps allow you to trade in stocks of all sizes and types. These platforms are the best choice for small investors who don't want to carry a large amount of cash in their brokerage account. With fractional shares, you can invest just a fraction of the total amount of shares, so there is no risk of losing all of your money. You can also track the shares more efficiently, as dealing with hundred-share lots requires a much larger amount of paperwork.

|

|

|

|

| |

| Name | IC Markets | Roboforex | AvaTrade | FP Markets | NordFX |

| Fractional Shares | No | Yes | No | No | No |

| riskwarning | Try Now Losses can exceed deposits | Try Now Losses can exceed deposits | Try Now 71% of retail CFD accounts lose money | Try Now Losses can exceed deposits | Try Now Losses can exceed deposits |

China CFD Stock Trading Apps

There are many different types of China CFD stock trading apps. These include trading on margin, stocks, and options. With CFDs, you can speculate on the direction of price movements in the short term. You can be long or short depending on whether you think prices will rise or fall. Finding a China CFD broker can be a daunting task. There are a variety of different options available, and you need to make sure you find one that meets your personal preferences and trading style. In the China, you should look for a CFD broker that is regulated by the regulation bodies, and any other EU-based regulatory bodies. It is also recommended to go with a stock exchange-listed broker because this shows transparency. The financial records of a CFD broker should be available for public scrutiny.

|

|

|

|

| |

| Name | IC Markets | Roboforex | AvaTrade | FP Markets | NordFX |

| CFD | Yes | Yes | Yes | Yes | Yes |

| riskwarning | Try Now Losses can exceed deposits | Try Now Losses can exceed deposits | Try Now 71% of retail CFD accounts lose money | Try Now Losses can exceed deposits | Try Now Losses can exceed deposits |

Another benefit of trading in blue chip stocks from the China is their stability. These stocks do not experience dramatic day-to-day price changes like other types of stocks do. That's a plus for those who prefer a stable portfolio. These companies also tend to increase their value over time, and are therefore a good place for investors to start. You should also look for a blue chip stocks trading platform that offers a free demo account.

China Penny Stocks Trading Apps

Penny stocks are an excellent but higher risk way to invest in the stock markets from China. Although you can experience big gains and big losses, penny stock investing is not for everyone. You should always consider the financial situation of the company before buying a penny stock. This way, you can take advantage of a volatile market anywhere in the world from your China penny stocks trading platform. Investing in penny stocks is a higher risk way to earn a potentially significant income from your portfolio. However, you should remember that penny stocks have a limited liquidity. Because of this, it can be difficult to sell shares and they can be incredibly painful. If you're a risk-tolerant investor, diversified portfolio, or have plenty of cash, then you may want to give them a try. Otherwise, you should consider how much you're comfortable with taking risk.

|

|

|

|

| |

| Name | IC Markets | Roboforex | AvaTrade | FP Markets | NordFX |

| riskwarning | Try Now Losses can exceed deposits | Try Now Losses can exceed deposits | Try Now 71% of retail CFD accounts lose money | Try Now Losses can exceed deposits | Try Now Losses can exceed deposits |

Trading Global Stock Markets on China Trading Apps

Many people choose China trading apps for the convenience and ease of use. However, there are many factors to consider before choosing a China stock trading platform. Global Stock Markets Indices provide information about the market on a global scale. In other words, these indices are estimates of future values based on the latest financial statements. But these numbers are only estimates and do not represent actual values. In reality, the actual market value of any given stock will be determined by the price to book ratio of the stock. You should understand the importance of these indicators before you begin trading. Global Stock Markets Indices are useful for China stock traders because they provide real-time information on the various markets around the world. The data on these indices can help you decide whether to buy or sell a particular stock at a given time. The prices on the Global Stock Indexes are the best estimates of future rates based on statistical analysis, so it's not always necessary to use them as the only indicator for a given stock.

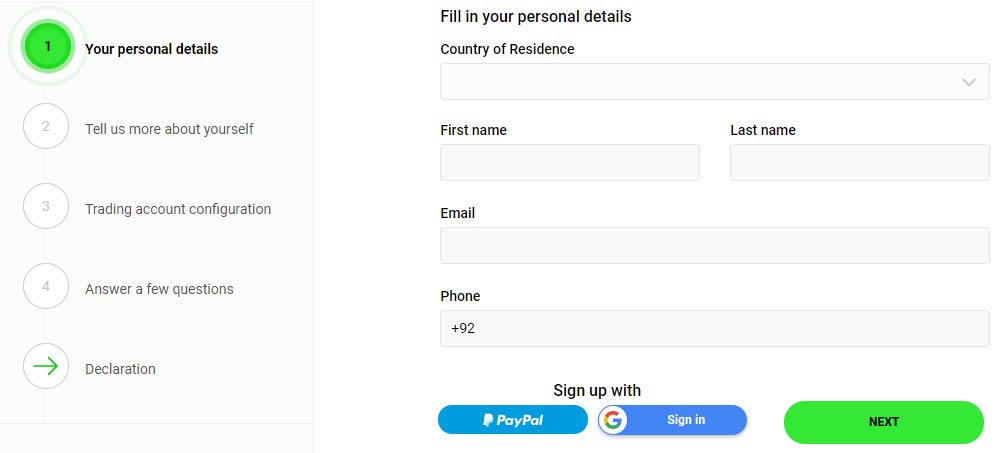

How To Open A China Trading Account

Before you can start trading, you must first open a China stock trading account. This will allow you to trade in the financial market. You can do this in a variety of ways. One of the easiest is to link your bank account. To do this, you'll need your bank routing number and account number. These numbers can be found on your checks or on your China bank's website. When opening an account with a China stock brokerage, you should have the basic information on hand. This includes your social security number, date of birth, and your place of residence in China. You should also be aware of any limitations that your China stock brokerage has, as well as how to open an account. Once you have all the details, you'll be ready to open a China stock investment account

China Trading Account Verification

The first step in enabling a China stock trading account is verifying your identity with the China stock broker. This requires the the China trader to upload documents.

You should also provide a copy of your China identity and proof of address. This should be a copy of a recent utility bill, driver's license, or passport. A proof of address will help the exchange confirm that you are the owner of the China stock trading account. It will prevent fraud and other issues related to your China stock trading account. It is important to provide the correct proof of identity and residency. If you fail to do this, your China stock trading account maybe blocked.

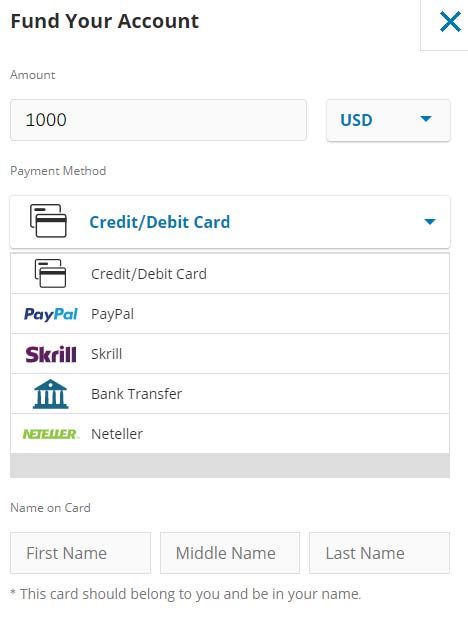

Fund Your Trading Account China

Before buying and selling stocks you will need to fund your chosen China stock trading platform with a payment method. There are many payment methods available to China traders on modern China stock trading apps apart from the funding with a China bank transfer, China traders can also use online payment methods including Paypal, Skill, Neteller and more. Check to see what options are available to you in China. One thing to check is that various payment methods may not be made available to China traders on China stock trading apps. Also the payment providers may add additional fees for example currency conversion fees if your China stock trading accounts base currency is different to your China payment methods base currency.

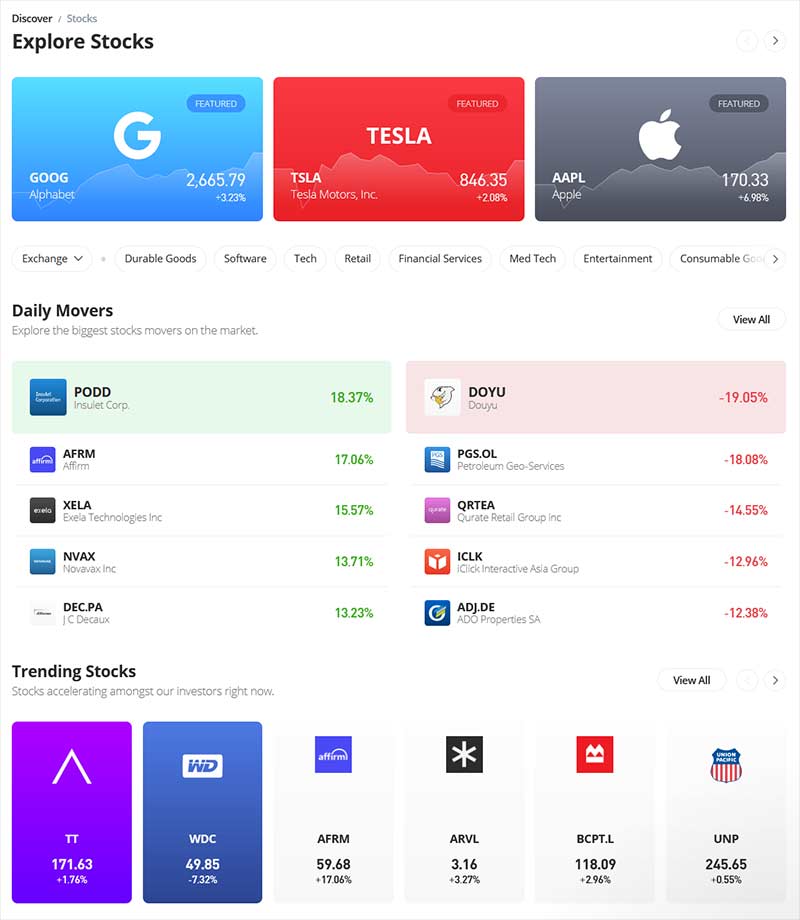

Research Stocks And Start Trading China

You should always research stocks before you start trading in China. You wouldn't buy a new car, house, or toaster without doing research. You can use the tools and resources available on your China stock trading platform to do your research. Once you know what you want, you can start trading and start making money.

A good way to research a stock is to be familiar with its industry. Understanding the industry helps you analyze the company in more detail, as you'll know the nuances and variable inputs. Knowing the product a company sells is important, as it will inform your competitor analysis and future forecast. You can also learn the cost of the product, which is critical for future predictions. Remember that many companies have multiple products and services, which makes it essential to understand how these offerings affect the overall value of the company.

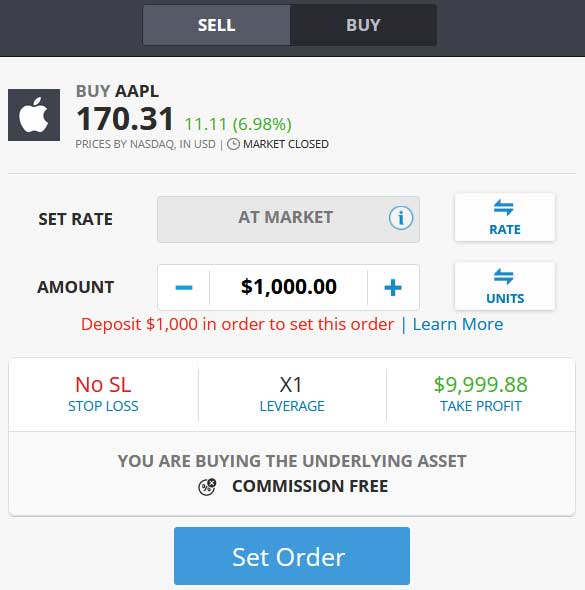

How To Place A Stock Trade On A China Trading Platform

If you live in China, you're probably wondering how to place a stock trade. The first step is to open an account with a China trading platform. Deposit [currency] or your prefered currency, pay for commissions and fees, and start trading. Then, check out the available stocks and choose the broker that best meets your needs. Then, find out how to place a stock trade on a China trading platform. Once you're registered, it's time to choose a China share trading platform. There are a number of options available, and it's a good idea to consider each one's features and tools. There are also different kinds of China stock trading apps, so be sure to take your time to find one that suits your trading style. After all, choosing the right China stock trading platform is essential.

How To Sell A Stock On A China Trading Platform

The process of selling a stock is essentially the same as that of buying it. The price is subject to change from submission to confirmation, so you need to know the current price before you make the sale. Prices are determined by supply and demand, so a high demand will raise the price, while a low one will reduce it. The best China trading platform will allow you to choose from various investment options and have multiple accounts for different levels of risk tolerance. These China stock platforms will provide you with a quote that shows you the price of a stock. These quotes will appear in your account with your chosen trading platform, which is often known as your portfolio. When you want to sell a stock, you must contact your broker and inform them of your decision.

China Stock Trading Platform Checklist

There is a list of features that should be available from every China stock trading platform. It may seem tedious to compare each and every one, but it's worth your time. These features include: a comprehensive help section, advanced options, and conditional orders. A good China stock trading platform should also have advanced technical support and an extensive knowledge base. All of these features are essential to successful stock trading. Choosing the right China stock platform depends on your trading style. If you are an active trader, you will need to add funds into your China stock trading account on a regular basis. On the other hand, if you're a passive trader, you'll leave the busy work to the financial professionals. A good China stock trading platform should be easy to use and intuitively organized.

China Stock Trading Apps Ease Of Use

Ease Of Use is a major factor to consider when selecting a China stock trading platform. The best China trading apps should be easy to use. The ease of use factor is an important consideration when comparing the different options available. Choosing a platform based on ease of usability is a must. You should be able to make decisions quickly and effectively without wasting any time. The ease of use factor is extremely important when comparing China stock trading apps. A user must be able to understand how to operate the software and navigate the trading platform. The software must offer a range of options, including the opportunity to place practical trades, educational tools, market research, and mobile apps. A user should also be able to use the app with a mouse without any trouble.

China Stock trading apps Realtime Financial Market News and Data

A China stock trading platform can be invaluable when it comes to staying on top of market trends and avoiding costly mistakes. The best China stock platforms include real-time market news and data, which will enable you to make better trading decisions. With a China stock trading platform, you can be as informed as possible about what's going on in the financial markets. Unlike traditional stock brokers, online trading apps are the future of investing. These China stock trading apps will provide you with real-time financial market news and data and will help you invest more wisely. You can invest in a variety of companies with these platforms, including stocks, bonds, commodities, and cryptocurrencies. The best options will also allow you to invest without any sales or commission fees.

China Stock Trading Charting Tools and Technical Analysis Tools

Using a China stock trading charting tool to predict a market's movement can help you make more money in the short term. It is important to analyze the position of a stock's price and prepare for a possible move in its favor. Although technical analysis is not based on analyst forecasts, it can be an effective tool. The tools that technical analysts use rely on price patterns and timing. A good China stock charting tool should be easy to use, and support a variety of line studies. This can include the Gann Fan, Speed line, and Raff Regression. It should also support drawing tools, such as rectangles, ellipses, and a variety of other shapes. Having portfolio tracking capabilities is crucial for identifying mistakes and refining your trading strategy. The China trading software should also enable you to back-test your trading system and learn from its community.

China Stock trading apps Educational Resources

If you're new to investing in the stock market, it's important to choose a China stock trading platform with a good amount of educational resources.

Not every platform is the same, so you'll want to check your options carefully and set a few criteria to help you decide which is best for you. China Stock trading apps Education Resources should include videos, educational resources, and other ways to improve your trading skills. You'll want to choose a platform that has the most comprehensive educational resources and provides free market data.

Educational resources can be articles, videos, webinars and more and are ofter freely available on China stock trading apps. It's always a good idea to compare and contrast different China stock platforms, and if you're unsure, try a demo account to see which one best meets your needs.

China Stock Trading App Security

The China Stock Trading Platform is a powerful investment platform for investors. The China stock exchange also features a mobile app, and provides information on market research and trading tools. The platform is user-friendly, which makes it perfect for new traders. Its ease of use is another important consideration. The real-time data feeds from the China Stock Exchange are a key feature. They deliver data in real time, allowing users to exploit it to its fullest potential. In addition to this, the feeds are based on next-generation technology, a flexible platform, and multiple site configuration, so they are reliable and resilient. The China Stock Trading Platform Security is the primary advantage of a China-based broker.

China Stock Trading App Fees And Commissions

When it comes to China stock trading fees and commissions, it is important to know what to expect. There are several factors that you should take into account before choosing a brokerage firm. First, make sure the brokerage offers a range of investment options. In addition, the broker should have mobile stock trading applications and research tools available to China traders. Another important consideration is ease of use, especially if you are new to investing. Another factor to consider is the amount of customer support provided by the broker. You should be able to ask questions at any time. You should also be able to find educational resources on the website for any questions you have. The best China stock brokerages will have a good customer support service and a great educational section. This means that you can learn as much as you need to about investing and how to use the platform.

|

|

|

|

| |

| Name | IC Markets | Roboforex | AvaTrade | FP Markets | NordFX |

| Account Fee | No | No | No | No | No |

| Inactivity Fee | No | No | No | No | No |

| Withdrawal Fee | No | Yes | No | No | No |

| Desposit Fees | Varies | No | No | Yes | No |

| riskwarning | Try Now Losses can exceed deposits | Try Now Losses can exceed deposits | Try Now 71% of retail CFD accounts lose money | Try Now Losses can exceed deposits | Try Now Losses can exceed deposits |

China Commisson Free Stock Trading

With a China commission free stock trading account, China stock traders have no or zero commissions to pay when purchasing stocks. Allowing China stock traders not to be held back buying and selling stocks when the market is moving due to fees from frequent stock position changes. With China zero-commission stock trading apps, you can afford to trade a large number of stocks. You can benefit from the compounding effects of your investment over the long term. And by eliminating trading commissions, you can get started on the path to financial freedom.

If you're a long-term China investor, zero-commission trading may not be for you. There is a danger of being tempted to trade too frequently and risk losing money. In addition to preventing yourself from overtrading, be sure to focus on investing for the long-term and use China commisson free stock trading apps as a tool to increase your profits. The benefits are numerous. The greatest part of commisson free stock trading is that you can trade unlimited numbers of stocks with lower trading fees.

China Stock Broker Fees

The vast majority of China retail investors use execution-only brokers. The top China stockbrokers fall into this category. However, if you need more services, you should consider full-service stockbrokers. As you can see, China stock brokers charge clients in the form of fees. These fees are a necessary part of the overall costs of trading, and it's important to understand them before signing up with a particular broker. In addition to commissions, most of them charge an administrative fee or a currency conversion fee. This fee is usually charged in line with the amount of money you invest and is multiplied against the value of your orders.

China Stock Trading Apps Membership Fees Monthly / Yearly

Most China stock trading apps offer a free trial and monthly or yearly membership. Some platforms have a monthly or yearly membership fee, while others are free for a single account. Some have different fees depending on the type of account that you choose, but most have a range of charges for all types of accounts. Some charge less for regular savings accounts, while others charge a set fee for dividend reinvestment. Some China stock brokers have a set income drawdown feature that can cash out your investment upon a certain amount. In addition to a monthly or yearly membership fee, some platforms also have a per-holding charge.

China Stock Trading Apps Withdrawal Fees

One of the most common questions that investors ask about China stock trading apps is whether they have to pay withdrawal fees. The answer depends on how you plan to withdraw the money. Many China stock platforms have no withdrawal fees, but you should find out how the fees are calculated. Most China stock trading apps charge a fee for adding funds to your account. If you plan to use a debit/credit card to deposit funds, you should look for a platform that offers this option. This will ensure that you can withdraw your funds within a few hours of making your first deposit. However, if you prefer the security of using a credit card, you should check the withdrawal fees, too. Many China stock trading apps also charge transaction fees, which vary from platform to platform. Some charge a flat fee, while others charge a percentage based on the size of the deposit.

China Stock Trading Apps Currency Conversion Fees

A large proportion of China stock trading apps charge currency conversion fees. These fees can significantly reduce your profits, but many traders have found them to be worth it. You can also avoid these charges by shopping around for a better deal. While this may seem like a huge expense, it is well worth it in the long run. While many platforms charge commissions on the foreign currency exchanges, these are far less than the costs involved with using a bank. These fees are essentially a markup of the exchange rate, and are usually considerably lower than the fees charged by a broker. If you're a beginner, a smaller transfer may only be possible online, while larger transfers will need to be handled over the phone.

Free Stock Trading in China

When you have a China stock brokerage account, you can invest in stocks and mutual funds commission-free. However, this method may not be as profitable as investing with an China stock trading account that requires a fee. If you're thinking about experimenting with free stock trading, consider signing up for a demo account. While free stock trading is tempting for new investors, there are some important things to keep in mind before making the switch. One of the most important things to consider before choosing a China stock brokerage is whether the service is worth it. A free trial period can last anywhere from two to six months. This allows you to learn about the China stock platform and what it offers before you open a real account. A China stock trading demo account can also allow you to test drive the China stock trading platform, absorb educational content, and execute trades.

China Stock Trading Demo Accounts

The purpose of a demo account is to help you get familiar with a particular China stock trading platform. However, success on a demo account does not necessarily predict the results you will have with live trading. Therefore, you should never rely on simulated trading results to invest real money. A China stock trading demo account will allow you to learn how to read charts and apply technical indicators. You will be able to identify market trends and identify profitable trends, as well as make mistakes and improve your strategy. Using a China demo account allows you to learn the ins and outs of different China trading apps. You will not be exposed to the emotions of live trading. While you can make the occasional mistake, you may be too scared to risk your own money. You might also become too greedy and hold onto a winning position too long. Using a demo account does not give you the practice you need to control these emotions.

|

|

|

|

| |

| Name | IC Markets | Roboforex | AvaTrade | FP Markets | NordFX |

| Demo Stock trading accounts | Yes | Yes | Yes | Yes | Yes |

| riskwarning | Try Now Losses can exceed deposits | Try Now Losses can exceed deposits | Try Now 71% of retail CFD accounts lose money | Try Now Losses can exceed deposits | Try Now Losses can exceed deposits |

Customer Support on China Stock Trading Apps

A China stock broker should provide its clients with adequate customer support to make sure that they have the information they need to make the best decision. Poor customer service can result in unnecessary losses. The China stock platform should offer multiple language support and the customer service staff should be well-trained to answer questions in any language. Some companies offer chat support as well as email and toll free numbers. In addition, the broker should implement a single system to provide customer assistance and monitor its performance. It should also resolve any shortcomings promptly.

Stock trading is a 24 hour process, so it is essential to have access to a live person who can provide assistance if necessary to China traders. A broker that provides customer support should also be available around the clock. It is important to check how long it takes to get a live person on the phone. Calling the China broker's customer service number is a good way to find out about how fast they respond. Additionally, the China stock trading platform is the investor's portal to the markets. It is essential to select a China trading platform that offers a user-friendly interface that includes the tools necessary for successful trading.

|

|

|

|

| |

| Name | IC Markets | Roboforex | AvaTrade | FP Markets | NordFX |

| Livechat | Yes | Yes | Yes | Yes | Yes |

| Email Support | Yes | Yes | Yes | Yes | Yes |

| Phone Support | Yes | Yes | Yes | Yes | No |

| riskwarning | Try Now Losses can exceed deposits | Try Now Losses can exceed deposits | Try Now 71% of retail CFD accounts lose money | Try Now Losses can exceed deposits | Try Now Losses can exceed deposits |

Livechat on China Stock Trading Apps

The number of China stock trading apps with live chat is limited to a few. Most of these platforms offer support by email, and the only way to get immediate help is to use the live chat feature. However, some platforms only offer email support, which can take days to respond to. If you want instant help from a live chat broker, you should opt for a premium service. There are also some platforms that have telephone support, which can prove to be quite useful for those who are still new to trading.

Email Support on China Stock Trading Apps

You need to check for email support when you use a China stock trading platform. You can usually get help from customer service representatives within 24 hours of emailing them. There are many platforms that offer the option to send an email. However, not all of them are available in all countries. It is a good idea to check for the availability of email support before if you need email support services. This is a good sign for those who are looking to invest from the China.

Phone Support on China Stock Trading Apps

Many China stock trading apps offer phone support, but they may not be as convenient as you'd like. Not all China stock brokers offer telephone support, so check for a phone number before deciding to use a company. The best China brokers have phone support for traders, and most provide a full range of resources. You can find a China stock broker that has the features you need. However, a high-quality service should include telephone support for China stock traders.

China Stock Trading Strategies On Mobile Devices

Choosing the right trading strategy is essential for your success. Before you choose a particular strategy, it's important to determine the end goal that you're seeking. Using a trend-following approach means buying when prices rise and shorting when prices drop. Contrarian investing entails anticipating price declines. You buy during a price fall and sell during a rising one. You can also try to time the market to find a buying opportunity.

While technical analysis and fundamental factors are crucial for trading, these are not the only options you can choose. There are other options available, including trading in currencies. Using a strategy is a great way to reduce your risk and gain profit from forex. It's important to understand which strategy is the best for you, as well as which one will work best for you. And remember that your strategy should never be the only strategy you employ. You need to be disciplined. Using a trading strategy is a smart way to make money in the market. You should determine your end goals before you begin to trade. This will help you avoid risky situations and minimize losses. It's also a great way to deal with emotional reactions. This is why your trading strategy should be based on these factors.

How Often Will You Buy Stocks On Your China Stock Trading App?

China stock trading apps typically offer a range of services, including free or low-cost commission investing. These platforms have excellent tools for managing your money and help you to learn about investing. You can even get your first stock free of charge if you sign up with some China trading apps. However, you'll have to meet certain trading criteria and will have some limitations. These platforms can be a good option if you're looking for a China stock trading platform that has a wide selection of investments. There are a variety of different stock trading apps to choose from. Some are commission-free, while others may charge you. Some have additional restrictions, while others will offer a free trial.

Long or Short Term Stock Investing On China Stock Trading Apps

When it comes to long-term stock investments on China stock trading apps, you should consider the market volatility. While stock prices fluctuate, they tend to rise over the long-term. As a result, you should invest regularly. If you're a beginner, you may want to start small and avoid investing too much at once. If you have the patience and know-how to wait, you'll see exponential profits over the long-term.

Short Term Stock Investments are best suited for those investors who are looking to make a profit in a relatively short amount of time. Those who are interested in investing in short-term stocks should consider the risks of the investment. These investments are considered high-risk due to the possibility of a steep drop in the price, which can leave a person with no money. Therefore, investors should take into consideration the possible loss when considering a short term stock investment.

Trading Vs Investing On China Stock Trading Apps

When deciding between investing and trading on your China stock trading platform, you'll need to take a few things into consideration. For traders, the most important factors to consider include risk tolerance and personal preferences. Long-term investors, on the other hand, should focus on diversification in order to protect against risks and trade over the long term. As such, the choice between investing and trading should be easy, as both have their own advantages.

In addition, China stock traders are more likely to take risks. They often take speculative trades on single stocks that rarely make sense. While trading short term price volatility on a company may seem like a good idea, it is rarely a good idea if you want to build wealth over the long-term. However, investors must remember that they should invest for the long-term, not for short-term gains.

Before investing in stocks, you should establish a China stock trading brokerage account. This will allow you to access the global stock market and trade in stocks from China. To start investing, you need to fund the account with money from your bank account. Your investment amount will depend on your risk tolerance and your investment goals. Moreover, you should know how much you can lose. Keep in mind that there are very few stocks that you can hold for a lifetime. You can also buy and sell stocks when you're tired of them.

What Moves Stock Prices When Trading in China

China stock traders should be interested in what moves stock prices. Stock market movement depends on the underlying fundamentals of a company's stock. When supply exceeds demand, the shares will rise. This cycle is triggered by a variety of factors. The rising global and China housing market may slow the economy, but rising interest rates may stifle the buying activity. That might lead to a dive in stock prices. In contrast, recent tax changes have had a positive impact on the stock market. The movement of stocks is influenced by news stories, shareholder meetings, and inflation. These events have inverse relationships with valuations, so low inflation equals high multiples.

China and Global Earnings Reports

China and global public companies were required to issue annual, semi-annual, and quarterly earnings reports. Although the frequency of the financial reports did not have a significant impact on corporate investment, the change in reporting schedules increased analyst coverage and enhanced analysts' estimates of earnings per share. However, analysts' earnings estimates have been consistently lower for companies reporting annually or semi-annually. This study provides an in-depth analysis of the differences between these two financial reporting schedules.

China and Global Economic Data

To find out what is going on in the China economy, it is important to look at the China and global economic data. The World Economic Situation and Prospects tables provide historical and forecast data. Check this data is available with your shortlisted China stock trading apps. These tables are available in Excel format and include GDP growth, CPI-inflation, unemployment, selected financial indicators, trade and financial flows, and more. The World Economic Situation and Prospects is the definitive source for international trade and development. For comparison, it is one of the most valuable resources for researchers who study international trade and development. This database provides accurate information on international trade, development, and national finances.

China and Global Market Sentiment

The overall attitude of investors toward a given securities or financial market is referred to as market sentiment. When trading China stock traders should always be aware of Global market sentiment.

The EU and the China economy is undergoing a historic realignment. The European Union, is trying to reestablish itself as a standalone economy. As a result, international companies have led the way in vaccine deployment, whereas many other countries including China have followed suit. Global financial markets are volatile due to the COVID outbreak, supply chain issues and rising prices. Despite the uncertainties that have been surrounding the China and world economy, financial markets have seen a huge increase in trading.

China and Global Interest Rates

Interest rates affect financial markets prices. Interest rates are one of the most crucial figures in the economy since they determine the likelihood of people borrowing money. If borrowing is expensive companies on stock markets have higher costs.

The China and the global economy are a key focus for central banks around the world. The goal is to fight inflation and keep the economy from falling into recession. By raising the interest rate, the central bank is attempting to ensure that prices do not go too high, and this is an important step in combating inflation. The Bank of England will have to decide whether the rise in interest rates is temporary or not. The bank will have to monitor energy prices and determine if they will push inflation above the 4% mark. Despite its current economic condition, the China is still recovering from the recent pandemic, and unemployment remains at 3.3% below pre-pandemic levels. The Bank of England's rise in interest rates follows the rise in Norway and South Korea. Rising inflation negatively affects households' purchasing power and income. The central bank generally increases interest rates during lean periods and cuts them in economic booms.

China Stock Trading Order Types

On China stock trading apps, a market order is an instruction to buy or sell shares at the lowest price available in the market. This type of order is a buy and sell and has no price restriction. It is usually used when a particular price is reached. If there is not enough liquidity in the market, a market order is the best option. This type of order is unrestricted by price and is often used when you want to lock in profits or limit your losses. A China market day order is a buy/sell order that is executed in full. If a particular amount of shares is available, the remaining shares are executed and remain outstanding until the end of the day. A stop market day order executes in full when a certain price is exceeded. This type of order is typically used to limit losses and lock in profits for China stock traders. For example, you can buy a certain stock at a specific price but only sell the shares when you have reached that price.

China Stock Trading Mobile App Market Orders

A China Market Order is a simple but reliable method of entering or exiting a trade. It fills almost instantly, which is important for stocks of big market capitalization companies. The market capitalization value of a company is its current share price divided by the number of outstanding shares. This figure is often used by the China investing community to determine which companies are the best to invest in. A Market Order is ideal for those China investors who want to execute a trade immediately and are confident that they will get the fill they need.

China Stock Trading Mobile App Limit Orders

A China Limit Order is an order that will not be executed unless the price meets a predetermined limit. This is particularly important for stock trades, as it will prevent China traders from missing out on profits if the price falls below the specified level. Setting a limit price is an important step in the process. Having the right price for your Limit Order is critical, as a wrong one can lead to an unfilled order. Therefore, it is imperative to understand how to correctly set a limit price for a stock. If you are unsure of the best time to place a Limit Order, you should consult with a financial expert before placing an order. If you are unsure about how to properly set a limit price, contact a professional advisor.

China Stock Trading Mobile App Stop Loss Order

The Stop Loss Order is one of the most basic tools in trading. This tool allows you to exit a stock position at a predetermined price. This allows you to avoid emotional investing and to make rational decisions. In addition to limiting your losses, a stop-loss order protects your profit. This means you won't have to monitor your stocks every day. That's especially helpful when you're on vacation or are in a situation where you can't stay on top of your stock portfolio for a longer period of time. You'll still be able to profit when your stock falls, and you'll be able to stop your losses before your losses get out of hand.

China Stock Trading Mobile App Buy Stop Order

A Buy Stop Order is a type of order placed in global stock markets on China trading apps. It allows China investors to protect their profits from losses when a stock's price moves against their expectations. This order is most commonly used in the capital markets and on Wall Street. A China stock buyer can place a stop order when they expect a particular price to be achieved for a certain quantity of assets. It may also be used as a means of covering a short position. A Buy Stop Order is a buy order that is set above the price at which a short seller intends to enter a stock. This order activates only when the market reaches the price of the short sale. This is a good strategy if the chart doesn't look strong at the current price. If the stock reaches the Buy Stop, the buyer anticipates that the trend will continue, which will allow them to profit.

Types Of China Stocks And Shares

China Common Stock Trading Apps

A security that symbolises ownership in a firm is known as common stock. Ownership of common stock may entitle you to voting and dividend rights.

There are many reasons to use a brokerage account to invest in shares in the China. Those who are in the market for a new broker will want to consider using a company that offers fast execution and a variety of asset classes. Whether you're an experienced trader or just a beginner, you can find a China common stock trading platform online. The choice is up to you - some China stock trading apps offer more advanced features, while others have lower fees. The best option for you is one that has the most features and meets your personal needs. Once you've chosen your platform, be sure to read through the terms and conditions and make a decision based on your preferences.

China Preferred Stock Trading Apps

Preferred stocks are a great way to fund a company. They're a great option for borrowers looking to raise capital. Aside from being flexible in terms of repayment, they're also very secure. There's no risk of default with preferred stocks. Another major advantage of preferred stock is that it offers an alternative form of financing. The benefits of this type of financing are that you won't have to worry about paying off the debt. A preferred stock is a type of equity that allows you to defer the dividends without penalty, which can affect your credit rating. This is a big advantage for China stock investors since deferring the dividends can help the company meet the terms of the financing contract.

China Large-cap stocks Trading Apps

A large-cap stock is one with a market cap of over $10 billion. It is a common misconception that these stocks are only for the wealthy or high-net-worth China individuals. However, this is not the case. China stock traders with a smaller budget can also invest in large-cap companies. In general, large-cap companies are well-established companies with solid financials that consistently turn a profit every quarter. They are also known for distributing a portion of their profits to their shareholders in the form of dividends. As such, these stocks are considered to be steady performers and are therefore a good choice for long-term investors.

Large-cap companies pay high dividends and provide a steady income stream. This is a good way to make a substantial investment. Generally, large-cap companies are market leaders in their industry. They are focused on strategic outcomes. Moreover, they will likely have a long track record. As a result, China stock investors often consider large-caps to be safer investments as they tend to have a proven track record.

China Mid-cap Stocks Trading Apps

The best China mid-cap stocks trading apps are those with a European focus. These firms are a great place to start for people who are new to the stock market. The stock market is a big business and there are hundreds of companies listed on them. The good thing about trading these stocks is that they are considered lower risk than some other types of financial instruments. These companies are on the rise and you will find plenty of opportunities to spruce up your portfolio. Investing in mid-cap stocks using a China trading platform is easily done. You can invest in a broad market index or ETF, which tracks a broad selection of stocks all from your China stock trading platform. There are four indices that track the U.K. market, including the FTSE 100, NASDAQ, and the FTSE 100. The FTSE also has alternative indices for small and mid-caps, ISAs, equity strategies, and Europe.

China Small-cap Stocks Trading Apps

When you start investing in global Small-cap stocks from China, it can be difficult to choose the right China stock trading platform. You should look for a broker that has a wide selection of small-cap shares, or you might end up losing money in the process. A good China stock brokerage should also offer a range of small-cap shares, and you should be aware of any commission fees. It is also crucial to use a trading tool that makes it easy to find small-cap stocks. When it comes to choosing the best China stock trading platform to use, the first thing you need to do is know what you're looking for. The best platforms will allow you to make multiple trades and let you choose the ones that are the most profitable.

China Domestic Stock Trading Apps

There are numerous China domestic stock trading apps. These China stock trading apps offer various account types and investment options. Some China stock trading apps may only support UK or US shares while other China stock brokers might also offer shares of other countries. Several China stock trading apps provide various trading tools, mobile applications, and market research. Another important consideration is the ease of use. Traders should consider the ease of use before choosing a platform. It should also be easy to use for beginners. Online stock trading is also known as share dealing, and is the process of buying and selling shares of publicly-traded companies.

China International Stocks Trading Apps

The risks of international stock trading on China stock trading apps are different from those of domestic stocks. The market volatility can vary and the risk-reward profile of foreign stocks differs. Besides, historical stock performance does not repeat itself. Besides, investing in international stocks involves higher fees and commissions. But if you're a smart investor, you'll have no problem with the process. With the help of China online stock brokerage accounts, you can invest in foreign companies on U.S. exchanges. There are additional costs associated with foreign exchange trading.

When comparing markets, one can easily differentiate developed markets from developing ones. These markets have a developed capital market and a high level of regulation. In addition, they have high per capita income and a higher market capitalization. They also have more liquid markets, which allows for better liquidity. This makes them more attractive for investors, but there are also certain risks associated with these markets. To protect your investment, you should understand the risks of investing in international stock exchanges from the China.

China Growth Stocks Trading Apps

When you are looking to invest in growth stocks from China, you must be aware of a number of factors. Among these factors is the price-to-earnings ratio, which measures how much the current stock price is in relation to the company's current earnings. Companies in the growth stage often have higher P/E ratios than the average because they are still in the early stages of their development. This means that investors may want to stay away from such companies unless they have already become profitable.

When it comes to growth stocks, it's important to remember that the prices of these companies are sensitive to changes in the company's earnings. The price of a growth stock can drop dramatically if the company doesn't continue to grow. Regardless of the risk, investors are willing to pay a high P/E ratio for their investments. So, be aware of these factors and make the right choice for your investments. And don't be afraid to take a risk if you're willing to lose.

China Value Stocks Trading Apps

There are several different types of China value stock trading apps available. You need to decide on your investment goals before choosing a broker. Traders should consider the type of account they're looking for, and the level of technical knowledge that they need. It's also important to know how the platform handles withdrawals and depositing money. A broker can be a great tool for you, but you should make sure that it's suitable for your level of experience. The price of the transaction fees will depend on the type of trading platform. Some platforms charge a fixed fee for each trade, while others charge variable fees based on the amount of money invested. The commissions charged by China value stocks trading apps can be high, but some investors prefer to invest in the long term. However, some investors are comfortable with long-term investments and don't mind paying a small commission to trade with them.

China IPO Stocks Trading Apps

In order to participate in an IPO, you must have a China brokerage account with an China online stock brokerage firm. Once you have your IPO stocks, you can sell them online, over the phone, or through the mail. You can set a price limit and the number of shares that you wish to sell. However, you must note that a profit from shares that you hold for fewer than a year is taxable at ordinary income rates.

Before an China IPO shares trading platform can help you buy the shares of a company, it is important to understand how IPOs operate. Individual Investors were previously excluded from the process. Companies hired investment banks to sell their shares to the public. As a result, they are prone to high volatility and high risk. Besides, IPOs lack financial information, which can be difficult to access. The best way to determine the risk of a particular IPO is to consult the prospectus and research the Underwriters before investing in IPOs from the China.

China Dividend Stocks Trading Apps

When investing in dividend stocks on China stock trading apps, look for companies that will continue to grow profits for years to come. If earnings growth is erratic, that's a sign that a company is in trouble. The next step is to look at the company's competitive advantages. The company should have a competitive advantage that will last for several years. Some of these advantages include high barriers to entry, proprietary technology, and high costs of switching customers.

When a corporation makes a profit or a surplus, it can pay dividends to its shareholders. These dividends can be reinvested back into the business, making the stock a great investment for China traders. It is important to understand how a dividend is paid and why it matters. In addition, dividends are a great way for you to participate in the success of the company you're investing in.

China Non-dividend Stocks Trading Apps

Non dividend stock companies do not pay dividends on their stock and often reinvest the money in the company's expansion and growth. It is speculated the non dividend stock prices rise in value over time.

When it comes to investing in non-dividend stocks, you will want to make sure you choose the right China stock broker. Depending on your investment objectives, you can invest in common and preferred stock. You can choose from China brokerages and exchanges that support these types of transactions. The best China non dividend stock platforms will allow you to trade stocks, ETFs, and mutual funds. Each of these types of investments offer different advantages and disadvantages. Non-Dividend stocks offer an attractive income stream for investors. These stocks are a great place to start your investment journey. They can yield you positive returns, which is a common goal among stock investors. But a high percentage of non-dividend companies have high debt levels. This means they have a high risk of defaulting on their debt obligations. In this case, the dividend stock is the best choice.

China Income Stocks Trading Apps

Income stocks can originate from any business, but REITs, energy industries, utilities, natural resources, and financial institutions are among the most popular.

There are many options available to investors in China. Some are more expensive than others, so it's important to choose one that fits your needs and budget. The majority of share trading apps offer demo accounts for newbies and those with experience. Demo accounts are an important feature for new traders, since they help them test their strategies before committing their funds. Most trading apps accept a wide range of payment methods, and some even accept mobile payments. These features are crucial for investors who are new to trading. You'll want to consider how easy the platform is to use and whether it's easy to follow.

China Cyclical Stocks Trading Apps

When investing in cyclical stocks, it is crucial to understand the business cycle. This will allow you to determine whether cyclical stock investments will benefit you. As with all types of investments, you should also consider the risk factor and investment timeline. Consumer goods and retail stocks are good places to invest in cyclical stocks on China stock trading apps. When the economy is strong, they tend to perform well. In addition, companies such as Procter & Gamble benefited from the surge in sales, which helped keep the company's profits and revenue high. These companies have a large market share in consumer staples, so they should fare well during cyclical periods. China Cyclical stocks are typically traded in line with the economy's highs and lows. Once you become familiar with these trends, timing is easier to do.

China Non-cyclical Stocks Trading Apps

A China non-cyclical stocks Trading Platform can help you buy and sell cyclical shares and other financial instruments. This type of stock is often referred to as a 'non-cyclical' stock. It is a type of investment that is not linked to economic cycles and does not depend on economic growth. These stocks are closely tied to the business cycle and are sensitive to fluctuations in sentiment. They tend to perform well in a healthy economy but suffer during periods of economic contraction or uncertainty. They are often volatile, which makes them an excellent investment option for new investors.

China Safe Stocks Trading Apps

When choosing a stock on a China stock trading platform, always keep in mind the safety of your investment. A stock with a high safety score is considered to be a good investment option. Those with less experience should consider the risks involved. If you're unsure of the risks of investing, a good start is buying defensive stocks. They're generally large companies in sectors with less volatility and higher profitability. There are many reasons to buy safe stocks. First, they're relatively cheap compared to other stocks. Moreover, they are not as volatile as other stocks. Purchasing these companies is a good way to reduce your overall risk. Secondly, they're inherently safe for the China investors. Despite the high risk, they're a great choice for beginner investors. A good example is the company that produces a product and distributes it to the world.

China ESG Stocks Trading Apps

There are many different China ESG stocks trading apps to choose from. Each platform will have its own unique features and benefits, so it's important to consider these factors when deciding on a trading platform. The key is to find one that offers a variety of features for different types of traders. Regardless of what you are looking for in a trading platform, an ESG rating can help you find a product that fits your criteria. Whether you are an investor looking to invest in China ESG stocks or simply to diversify your investment portfolio, you should look into the different types of China ESG stocks trading apps available. These can vary in price, but it's essential to do your homework before choosing the right platform. There are many online brokerages that provide this service.

China Blue Chip Stocks Trading Apps

It is important to know that blue chip stocks are considered safer stock investments. These stocks are generally large and have a high market cap. That means that you have a higher chance of making a good investment on your chosen China blue chip stock trading platform. They are also easy to sell if you're not satisfied with your trade. In addition, these companies are very stable and reliable, so you can rest assured that your money is in good hands. You can use a blue chip stocks trading platform to trade in these stocks.

China Stock Trading Apps Verdict

Thanks to the growth on the internet and computing in China, [citizen] traders can trade the global stock markets using a web browser or mobile app from the comfort of their homes 24 hours a day. We have explained some important aspects of picking a stock broker that accepts China clients. The most important thing is that you understand the risks when trading stocks and you only trade with a China stock trading platform that is very well financial regulated.

Related Guides

- Best Trading Platforms China

- Best Stock Trading Apps China

- Best MT4 Brokers China

- Best MT5 Brokers China

- Trade US Stocks in China

- Best Indices Brokers China

- Best CFD Brokers and CFD Trading Platforms China

- Best Forex Trading Platforms China

- Best Forex Trading Apps China

- Best Penny Stock Brokers China

- Best Islamic Forex Accounts China

- Best Islamic Trading Platforms China

- Best Day Trading Platforms China

- Best API Trading Platforms China

- Best Scalping Trading Platforms China

- Best Investment Platforms China

- Buy Stocks China

- Best Forex Robots China

- Best ECN Trading Platforms China

- How To Short Stocks in China

- Energy Trading Platforms China

- How To Trade The S&P 500 In China

- How To Trade The NYSE From China

- How To Invest in Dow Jones DJIA From China

- How To Invest in Japan Nikkei 225 From China

- How To Invest in the CAC 40 From China

- How To Trade The Euronext From China

- How To Trade The Toronto Stock Exchange TSX From China

- High Leverage CFD Brokers China

Best Stock Trading Apps China Reviews

We also have in depth reviews of each of the best China trading platform reviews listed below.

- IC Markets Review (read our in depth 2026 reviews)

- Roboforex Review (read our in depth 2026 reviews)

- AvaTrade Review (read our in depth 2026 reviews)

- FP Markets Review (read our in depth 2026 reviews)

- NordFX Review (read our in depth 2026 reviews)

- XTB Review (read our in depth 2026 reviews)

- Pepperstone Review (read our in depth 2026 reviews)

- XM Review (read our in depth 2026 reviews)

- FXPrimus Review (read our in depth 2026 reviews)

- easyMarkets Review (read our in depth 2026 reviews)

- Trading 212 Review (read our in depth 2026 reviews)

- SpreadEx Review (read our in depth 2026 reviews)

- Admiral Markets Review (read our in depth 2026 reviews)

- HYCM Review (read our in depth 2026 reviews)

- Swissquote Review (read our in depth 2026 reviews)