Best Forex Broker Malaysia

Choosing a Forex broker in Malaysia can be a daunting task. Factors such as Malaysian customer support, Securities Commission Malaysia regulation, trading platform, fees are essential. Some of the top forex brokers in Malaysia include eToro, IC Markets and XM. Doing your research and comparing different brokers before making a decision is recommended.

As a forex trader in Malaysia, there are several factors to consider when choosing a forex broker in Malaysia. Key factors that Malaysian traders should look for in a Malaysian forex broker include regulatory compliance which should include the Securities Commission Malaysia (SC), competitive spreads and commissions, payment methods that allow deposits and withdrawals in multiple currencies including the Malaysian Ringgit (MYR), and a good range of trading platforms and educational resources. Malaysian traders should choose a forex broker that is reliable, trustworthy, and provides a good trading environment with competitive trading conditions, low fees, and excellent customer support.

Best Forex Broker Malaysia Table of Contents

- How do Forex Brokers in Malaysia Differ from Other Countries?

- How do I Compare Different Forex Brokers in Malaysia to Find the Best One for Me?

- What trading platforms are offered by forex brokers in Malaysia?

- Is mobile trading available with forex brokers in Malaysia?

- What does a Malaysian Forex broker trading platform look like?

- What are the Regulations Governing Forex Brokers in Malaysia?

- What is the Minimum Deposit Requirement for Forex Brokers in Malaysia?

- How Can I Check if a Forex Broker in Malaysia is Licensed?

- What are the Trading Instruments Offered by Forex Brokers in Malaysia?

- What are the Account Types Available for Trading with Forex Brokers in Malaysia?

- What is the Maximum Leverage Offered by Forex Brokers in Malaysia?

- What are the fees and commissions charged by forex brokers in Malaysia?

- What are the deposit and withdrawal fees for forex brokers in Malaysia?

- How do forex brokers in Malaysia ensure the safety of funds?

- What is Bank Negara Malaysia's official forex warning list?

- What are the deposit and withdrawal options available with forex brokers in Malaysia?

- How can I deposit and withdraw funds from my forex broker account in Malaysia?

- How long does it take for deposits and withdrawals to be processed by forex brokers in Malaysia?

- How long does it take for deposits and withdrawals to be processed by forex brokers in Malaysia?

- How do I sign up with a Forex broker in Malaysia?

- What are the most popular forex currency pairs for Malaysian traders?

- What is the difference between a market maker and ECN forex brokers in Malaysia?

- Forex brokers in Malaysia

- Best Forex Broker Malaysia List Compared

As one of the major financial centres in Southeast Asia, Malaysia has a vibrant forex market, with many local and international forex brokers competing for Malaysian forex traders' business. In this Malaysian forex broker guide, we'll take a closer look at the forex broker landscape in Malaysia, including the key players, their strengths and weaknesses, and how they compare to one another.

Forex brokers in Malaysia offer a variety of account types to suit different traders' needs and preferences, including demo accounts, micro accounts, standard accounts, and VIP or premium accounts. It's essential to choose a broker that offers account types that align with your trading style and experience level.

A Forex broker in Malaysia is a financial institution providing individuals or organisations with a platform to trade foreign currencies. Forex brokers act as intermediaries between the traders and the market, allowing traders to buy or sell currencies easily. They offer various services, including trading platforms, educational resources, analysis tools, customer support, and more, to help traders make informed decisions and maximise profits. Forex brokers in Malaysia are regulated by the Securities Commission of Malaysia and must comply with strict regulations to ensure the safety and security of their client's funds.

How do Forex Brokers in Malaysia Differ from Other Countries?

Forex brokers in Malaysia are regulated by the Securities Commission of Malaysia, which enforces strict guidelines to ensure transparency and fairness in forex trading. These guidelines include minimum capital requirements, client fund segregation, and reporting obligations to the regulatory authority. The Securities Commission of Malaysia also monitors the conduct of forex brokers to prevent fraudulent activities.

How do I Compare Different Forex Brokers in Malaysia to Find the Best One for Me?

Choosing the right forex broker in Malaysia is crucial for Malaysians trading live forex markets.

When comparing forex brokers in Malaysia, some factors to consider include:

- Regulation and Safety of Funds: Working with a regulated forex broker in Malaysia ensures the safety of funds, as the broker is required to adhere to strict regulatory standards and guidelines. Regulation helps protect Malaysian forex traders from fraudulent practices and ensures that their deposits and withdrawals are processed efficiently and securely.

- Trading Platforms: The trading platform offered by a forex broker plays a critical role in the success of forex trading. A reliable and user-friendly platform helps traders to execute trades effectively and quickly and access real-time market data and analysis.

- Trading Instruments: The trading instruments offered by a forex broker are essential, as they provide traders with a range of options to diversify their portfolio and manage risk. A forex broker that offers a variety of forex pairs, commodities, indices, and cryptocurrencies will provide traders with more opportunities to profit.

- Account Types: Forex brokers in Malaysia typically offer different account types, each with varying features and requirements. Choosing the right account type that aligns with your trading goals and risk tolerance is critical to successful trading.

- Leverage: High leverage ratios can amplify profits, but they can also amplify losses. It is crucial to choose a forex broker in Malaysia that offers reasonable leverage ratios that suit your trading style and risk tolerance.

- Trading Fees and Commissions: Trading fees and commissions can eat into profits quickly. It is important to choose a forex broker in Malaysia that offers competitive trading fees and commissions while also providing transparent pricing and no hidden charges.

- Deposit and Withdrawal Options: A forex broker that offers a wide range of deposit and withdrawal options makes it easier for traders to fund and withdraw from their trading account. The availability of local payment methods can also make the process more convenient for Malaysian traders.

- Malaysian Customer Support: Access to reliable and responsive customer support is essential when trading forex. A forex broker in Malaysia that offers various customer support channels, including live chat, email, and phone support, can help traders resolve any issues that arise quickly and efficiently.

- Malaysian Educational Resources: Forex trading is a complex and dynamic market that requires continuous learning and improvement. A forex broker in Malaysia that provides comprehensive educational resources, including webinars, seminars, trading guides, and market analysis, can help traders to develop their knowledge and skills and make better trading decisions.

By comparing these factors, you can find the forex broker that best suits your trading needs and preferences.

What trading platforms are offered by forex brokers in Malaysia?

Forex brokers in Malaysia offer a range of trading platforms to suit different trading styles and preferences. Some popular platforms include MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and proprietary platforms developed by the broker.

MT4 and MT5 are widely regarded as the industry standard trading platforms and offer a range of features, including advanced charting tools, technical indicators, and automated trading. cTrader is a popular alternative that offers advanced charting capabilities and access to multiple liquidity providers.

We list Malaysia's main trading platforms for forex trading available below. Each trading platform will have its unique features and benefits. Malaysian forex traders must research and compare the options to find the platform that best suits their trading style and needs.

- MetaTrader 4 (MT4): MT4 is one of the most widely used trading platforms in Malaysia and around the world. It is a user-friendly platform that offers advanced charting capabilities, customisable indicators, and automated trading options through Expert Advisors (EA). It also has a mobile application for trading on the go.

- MetaTrader 5 (MT5): MT5 is the successor to MT4 and offers many of the same features but with more advanced capabilities. It has a more modern interface, improved charting tools, and the ability to trade more asset classes, such as stocks and futures.

- cTrader: cTrader is a powerful platform that offers advanced charting, technical analysis tools, and algorithmic trading options. It has a user-friendly interface and is customisable to meet the needs of individual traders. cTrader is also available on mobile devices.

- WebTrader: WebTrader is a browser-based platform that allows traders to access their accounts and trade from any device with internet access. It offers basic charting capabilities and real-time market data.

- NinjaTrader: NinjaTrader is a platform that is popular among professional traders and offers advanced charting, technical analysis tools, and algorithmic trading options. It has a user-friendly interface and supports multiple asset classes, including futures, forex, and stocks.

- TradingView: TradingView is a popular platform for technical analysis and charting. It offers real-time market data and customisable charts with various indicators and drawing tools. TradingView also has a social community where traders can share their ideas and analysis.

- MultiCharts: MultiCharts is a platform that offers advanced charting capabilities, technical analysis tools, and automated trading options. It supports multiple asset classes and has a user-friendly interface that is customisable to meet the needs of individual traders.

Is mobile trading available with forex brokers in Malaysia?

Many forex brokers in Malaysia offer mobile trading apps for iOS and Android devices, although the apps may be in English, not Malay.

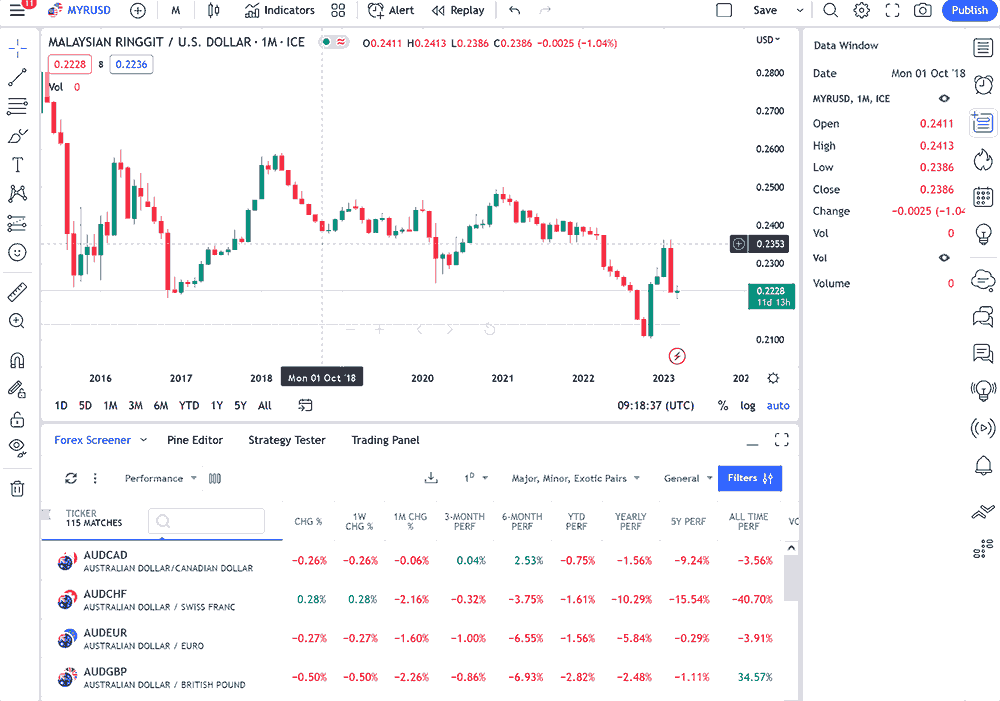

What does a Malaysian Forex broker trading platform look like?

Forex broker trading platforms offer advanced charting tools, market data and risk management tools. The UI and features of various trading platforms may various, but generally charting tools are used by Malaysian traders to research Forex pairs.

*Live Forex prices may differ to prices shown.

What are the Regulations Governing Forex Brokers in Malaysia?

Forex brokers in Malaysia are regulated by the Securities Commission of Malaysia under the Capital Markets and Services Act 2007. The regulations protect traders from fraudulent activities and promote transparency and fairness in forex trading.

What is the Minimum Deposit Requirement for Forex Brokers in Malaysia?

The minimum deposit requirement for forex brokers in Malaysia varies depending on the broker. Some brokers may require a minimum deposit of as little as $1, while others may require a minimum deposit of several thousand dollars.

How Can I Check if a Forex Broker in Malaysia is Licensed?

You can check if a forex broker in Malaysia is licensed by checking with the Securities Commission of Malaysia. The regulatory authority maintains a list of licensed forex brokers on its website.

What are the Trading Instruments Offered by Forex Brokers in Malaysia?

Forex brokers in Malaysia offer a variety of trading instruments, including major currency pairs, minor currency pairs, and exotic currency pairs. Some brokers offer other financial instruments, such as stocks, indices, and commodities.

What are the Account Types Available for Trading with Forex Brokers in Malaysia?

The account types offered by forex brokers in Malaysia may vary, but they typically include standard accounts, mini accounts, and Islamic accounts.

What is the Maximum Leverage Offered by Forex Brokers in Malaysia?

The maximum leverage offered by forex brokers in Malaysia varies depending on the broker. Some brokers offer up to 1:1000, while others offer lower leverage.

What are the fees and commissions charged by forex brokers in Malaysia?

Forex brokers in Malaysia typically charge fees and commissions on each trade. The exact fees and commissions vary between brokers and can depend on factors such as your account type and the trading instruments you use. Some common fees and commissions that you may encounter include:

- Spread: This is the difference between the bid and ask price and is how most forex brokers make money. The spread can vary depending on the trading instrument and market conditions.

- Commission: Some forex brokers charge a commission on top of the spread, especially for ECN accounts.

- Swap fees: If you hold a position overnight, you may be charged a swap fee, which is essentially the cost of borrowing or lending the currency overnight.

- Inactivity fees: Some brokers may charge a fee if your account is inactive for a certain period.

What are the deposit and withdrawal fees for forex brokers in Malaysia?

Deposit and withdrawal fees vary between forex brokers in Malaysia. Some brokers may not charge any fees for deposits or withdrawals, while others may charge a percentage of the transaction amount or a flat fee. Additionally, some brokers may have minimum and maximum deposit and withdrawal amounts.

How do forex brokers in Malaysia ensure the safety of funds?

Forex brokers in Malaysia must adhere to strict regulations set by the Securities Commission of Malaysia (SC). They must keep client funds separate from their operating funds in segregated bank accounts. Segregated accounts ensure that client funds are protected during the broker's insolvency. Forex brokers in Malaysia must also submit regular financial reports to the SC to ensure that they maintain the required financial stability level.

Additionally, many forex brokers in Malaysia use encryption technology to protect client data and transactions. Encryption ensures that all client information and financial transactions are secure.

Forex brokers in Malaysia are regulated by the Securities Commission Malaysia (SC) and must adhere to strict guidelines to ensure the safety of their client's funds. These guidelines may include:

- Segregating client funds from company funds.

- Partnering with reputable banks for deposit and withdrawal transactions.

- Providing negative balance protection prevents clients from losing more than their account balance.

- Insurance coverage for clients' funds if the broker becomes insolvent.

What is Bank Negara Malaysia's official forex warning list?

Bank Negara Malaysia (BNM) is the central bank of Malaysia, and it maintains a list of companies that are not authorized to provide foreign exchange services in Malaysia. This list is known as the BNM's Official Forex Warning List.

The BNM's Official Forex Warning List can be found on the bank's website and is publicly available. Consumers are advised to refer to the list before engaging in any foreign exchange transactions with companies or individuals to ensure that they are dealing with authorized and legitimate entities.

The list includes companies identified by BNM as operating illegally or fraudulently in the forex market, updated regularly. The list aims to protect Malaysian consumers from scams or fraudulent forex schemes.

What are the deposit and withdrawal options available with forex brokers in Malaysia?

Forex brokers in Malaysia offer various deposit and withdrawal options to cater to the needs of different traders. Some of the common options include bank wire transfers, credit/debit cards, and e-wallets such as Neteller, Skrill, and PayPal.

It is important to note that some brokers may charge fees for deposits and withdrawals, and processing times may vary depending on the chosen method. Traders should check with their broker for more information on the available deposit and withdrawal options.

Forex brokers in Malaysia offer various deposit and withdrawal options to make it easy for clients to fund and withdraw from their trading accounts.

Note that not all forex brokers in Malaysia may offer all of these payment methods. It is important to check with your chosen broker to see which payment methods they accept.

Some common deposit and withdrawal options available on forex trading accounts in Malaysia include:

- Credit/debit cards (Visa, Mastercard, American Express).

- Online banking (Maybank2u, CIMB Clicks, Hong Leong Connect, etc.).

- E-wallets (Neteller, Skrill, GrabPay, Boost, Touch' n Go eWallet, etc.).

- Bank transfers (local and international).

- Prepaid cards (Visa, Mastercard).

- Mobile payments (Samsung Pay, Apple Pay).

How can I deposit and withdraw funds from my forex broker account in Malaysia?

The process of depositing and withdrawing funds from a forex broker account in Malaysia varies depending on the chosen broker and the selected payment method. Generally, traders can deposit funds by logging into their accounts and selecting the deposit option. They will then be prompted to choose their preferred payment method and enter the necessary details.

Withdrawing funds typically involves a similar process, where traders must select the withdrawal option and choose their preferred payment method. Some brokers may require additional documentation or verification before processing a withdrawal.

How long does it take for deposits and withdrawals to be processed by forex brokers in Malaysia?

The processing times for deposits and withdrawals vary depending on the chosen broker and payment method. Bank wire transfers may take several business days, while e-wallets such as Neteller and Skrill offer faster processing times.

Traders should check with their broker for more information on the processing times for deposits and withdrawals.

How long does it take for deposits and withdrawals to be processed by forex brokers in Malaysia?

The time it takes for deposits and withdrawals to be processed by forex brokers in Malaysia can vary depending on the payment method and the broker's internal processing time. Some payment methods, such as credit/debit cards and e-wallets, may be processed almost instantly, while bank wire transfers may take several business days to process.

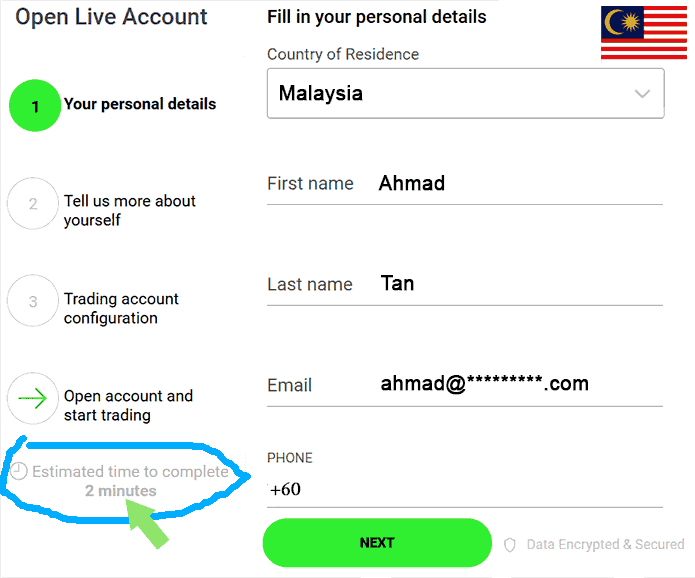

How do I sign up with a Forex broker in Malaysia?

Specific steps and requirements may vary depending on the Malaysian Forex broker and your account type. Read and understand the broker's guidelines and policies before signing up and depositing funds.

- Research and compare: Look for forex brokers in Malaysia and compare their offerings, such as trading platforms, trading instruments, account types, maximum leverage, trading fees and commissions, deposit and withdrawal options, customer support, and educational resources.

- Choose a broker: After comparing the brokers, choose the one that best fits your trading needs and preferences.

- Open an account: Go to the broker's website and click on 'Open Account' or 'Register' to start the account opening process.

- Fill out the application form: Provide your personal and contact details, such as name, address, phone number, and email address.

- Provide verification documents: Depending on the broker's requirements, you may need to provide identification documents, such as a passport or national ID, and proof of address, such as utility bills or bank statements.

- Agree to terms and conditions: Read and agree to the broker's terms and conditions, including risk disclosures, fees, and privacy policy.

- Fund your account: Once your account is approved, fund it with the minimum deposit required by the broker. You can use various payment methods, such as bank transfers, credit/debit cards, e-wallets, or online banking.

- Download and install the trading platform: After funding your account, download and install the trading platform offered by the broker.

- Start trading: Log in to your trading account on the platform and start trading with the trading instruments and tools offered by the broker. Remember your trading strategy and risk management rules to minimise losses and maximise profits.

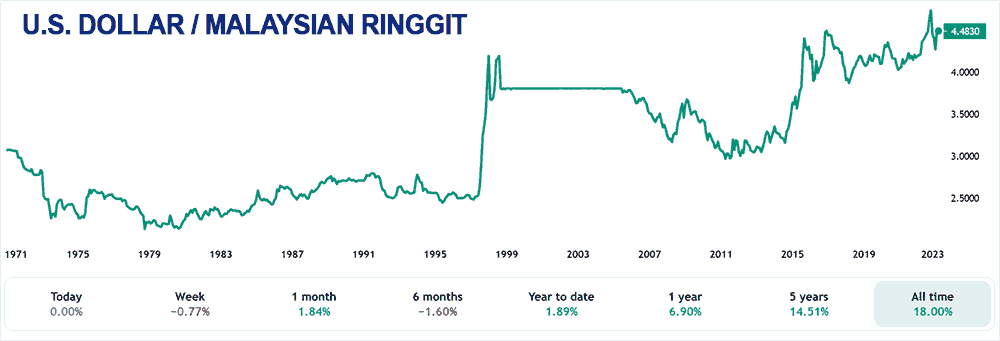

What are the most popular forex currency pairs for Malaysian traders?

Different Forex brokers may offer different currency pairs, so choosing a broker that offers the currency pairs you're interested in trading and risk profile is important. Additionally, traders may focus on specific currency pairs based on their trading strategies or market analysis.

The most popular Forex currency pairs for Malaysian traders may vary depending on individual preferences, but generally, some of the most commonly traded currency pairs include:

- US Dollar / Malaysian Ringgit (USD/MYR)

- EURO / US Dollar (EUR/USD)

- Great British Pound / US Dollar (GBP/USD)

- Australian Dollar / US Dollar (AUD/USD)

- US Dollar / Japanese Yen (USD/JPY)

- US Dollar / Canadian Dollar (USD/CAD)

- US Dollar / Swiss Franc (USD/CHF)

- New Zealand Dollar / US Dollar (NZD/USD)

What is the difference between a market maker and ECN forex brokers in Malaysia?

Market makers and ECN (Electronic Communication Network) brokers are two types of forex brokers available in Malaysia. The main difference between the two is in the way they execute trades.

Market makers act as the counterparty to their clients' trades, meaning they take the opposite position of their clients. If a client wants to buy a currency pair, the market maker will sell it to them. Market makers earn money through the spread, which is the difference between a currency pair's buy and sell prices.

ECN brokers, on the other hand, act as a marketplace, matching buyers and sellers together. They do not take the opposite position of their clients' trades and instead earn money through commissions on trades. ECN brokers provide traders with direct access to the interbank market, which can offer tighter spreads and faster trade execution.

When choosing between a market maker and an ECN broker in Malaysia, it is important to consider your trading style and preferences. Market makers may be better suited for less experienced traders or who prefer fixed spreads. At the same time, ECN brokers may be better for more experienced traders who value transparency and faster execution.

Forex brokers in Malaysia

Choosing the right forex broker in Malaysia is crucial for success in the forex market. When selecting a forex broker, it is important to consider factors such as regulations, fees, trading platforms, customer support, and educational resources. You can find the best one for your trading needs and preferences by researching and carefully comparing different brokers.

Best Forex Broker Malaysia List Compared

| Featured Forex Broker Trading Platform | Account Features | Trading Features |

|---|---|---|

| Used By: 180,000 Instruments Available: 232 Stocks Available: 2100 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 61 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mirror Trader, ZuluTrade, Web Trader, cTrader, Mac Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 53 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 35 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 10 USD / 10 EUR |

Platforms: MT4, MT5, Mac, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 200,000 Instruments Available: 1000 Stocks Available: 99 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 80 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: Web Trader, MT4, MT5, AvaTradeGo, AvaOptions, Mac, Mobile Apps, ZuluTrade, DupliTrade, MQL5 Negative Balance Protection: Inactivity Fee: No 71% of retail CFD accounts lose moneyVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 10000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 60 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, IRESS, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 50 Stocks Available: 0 US Stocks: No UK Stocks: No German Stocks: No Japanese Stocks: No Indices: No Forex Pairs Available: 65 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Minimum Deposit: 10 |

Platforms: MT4, MT5, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 250,000 Instruments Available: 4000 Stocks Available: 1696 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 57 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 0 |

Platforms: MT4, Mirror Trader, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Visit |

|

| Used By: 89,000 Instruments Available: 100 Stocks Available: 60 US Stocks: No UK Stocks: No German Stocks: Yes Japanese Stocks: No Indices: Yes Forex Pairs Available: 70 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mac, ZuluTrade, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your moneyVisit |

|

| Used By: 10,000,000 Instruments Available: 1000 Stocks Available: 160 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 55 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 5 |

Platforms: MT4, MT5, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77.74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.Visit |

|

| Used By: 20,000,000 Instruments Available: 2000 Stocks Available: 2042 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 50 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 50 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 76% of retail investor accounts lose money when trading CFDs with this provider.Visit |

|

| Used By: 10,000 Instruments Available: 130 Stocks Available: 60 US Stocks: Yes UK Stocks: Yes German Stocks: No Japanese Stocks: No Indices: Yes Forex Pairs Available: 45 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, Mac, Mirror Trader, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 142,500 Instruments Available: 200 Stocks Available: 52 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 150 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Your capital is at riskVisit |

|

| Used By: 15,000,000 Instruments Available: 10000 Stocks Available: 1731 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 177 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.Visit |

|

| Used By: 10,000 Instruments Available: 15000 Stocks Available: 1000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 55 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 148 Stocks Available: 64 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 40 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: $100 |

Platforms: MT4, MT5, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 4,000,000 Instruments Available: 2200 Stocks Available: 2000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: No Indices: Yes Forex Pairs Available: 67 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your moneyVisit |

Best Forex Broker Forex Broker Reviews

Read our details broker Forex Broker Forex Broker reviews, you will find something useful if you are shortlisting a Forex Broker Forex Broker and trading platform.

- IC Markets Review (read our in depth reviews)

- Roboforex Review (read our in depth reviews)

- AvaTrade Review (read our in depth reviews)

- FP Markets Review (read our in depth reviews)

- NordFX Review (read our in depth reviews)

- XTB Review (read our in depth reviews)

- Pepperstone Review (read our in depth reviews)

- XM Review (read our in depth reviews)

- eToro Review (read our in depth reviews)

- FXPrimus Review (read our in depth reviews)

- easyMarkets Review (read our in depth reviews)

- Trading 212 Review (read our in depth reviews)

- SpreadEx Review (read our in depth reviews)

- Admiral Markets Review (read our in depth reviews)

- Markets.com Review (read our in depth reviews)

Forex Broker Forex Broker Alternatives

Read about and compare Forex Broker Forex Broker alternatives. We have indepth side by side comparisons to help you find Forex Broker Forex Broker related brokers.

- IC Markets Alternatives

- Roboforex Alternatives

- AvaTrade Alternatives

- FP Markets Alternatives

- NordFX Alternatives

- XTB Alternatives

- Pepperstone Alternatives

- XM Alternatives

- eToro Alternatives

- FXPrimus Alternatives

- easyMarkets Alternatives

- Trading 212 Alternatives

- SpreadEx Alternatives

- Admiral Markets Alternatives

- Markets.com Alternatives

IC Markets

IC Markets

Roboforex

Roboforex

AvaTrade

AvaTrade

FP Markets

FP Markets

NordFX

NordFX

XTB

XTB

Pepperstone

Pepperstone

XM

XM

eToro

eToro

FXPrimus

FXPrimus

easyMarkets

easyMarkets

Trading 212

Trading 212

SpreadEx

SpreadEx

Admiral Markets

Admiral Markets

Markets.com

Markets.com