Day trading with Bitcoin

Day trading with Bitcoin can be risky due to its high volatility and lack of regulation. It's essential to have a solid understanding of technical analysis and risk management before getting started. Additionally, using a reputable exchange and keeping a cool head during market fluctuations is recommended.

Our comprehensive guide on Day Trading with Bitcoin explores the most popular Bitcoin brokers in the market, providing key insights on the factors you should consider when selecting a reputable and reliable broker offering a Bitcoin trading platform that meets your trading needs.

We deeply dive into the features, regulations, tradable financial instruments with Bitcoin, available funding and withdrawal methods, customer support, and educational resources different Bitcoin day trading brokers offer. With this information, you can confidently choose a broker that aligns with your Bitcoin trading goals and preferences.

It's essential to note that when researching Day Trading with Bitcoin, selecting a reputable and reliable Bitcoin broker is critical to ensure the security of your funds. Choosing a Bitcoin day trading broker that meets your trading needs and adheres to the necessary regulations allows you to trade Bitcoin with confidence and peace of mind.

Day trading with Bitcoin Table of Contents

- Day Trading with Bitcoin: What You Need to Know

- What is Day Trading with Bitcoin and How Does it Differ from Other Forms of Trading?

- What are the Benefits of Day Trading with Bitcoin Compared to Other Cryptocurrencies or Assets?

- What are the Risks Associated with Day Trading with Bitcoin, and How Can They be Mitigated?

- What are the Most Effective Strategies for Day Trading with Bitcoin?

- How Does the Price of Bitcoin Fluctuate Throughout the Day, and How Can Traders Use This to Their Advantage?

- How Do Traders Determine the Best Time to Buy or Sell Bitcoin During the Day?

- What Tools and Software are Available to Help with Day Trading with Bitcoin, and How Effective are They?

- What Common Mistakes that Day Traders Make When Trading Bitcoin, and How Can They be Avoided?

- How Much Money Do I Need to Start Day Trading with Bitcoin, and What are the Minimum Requirements for Opening a Trading Account?

- What are the Tax Implications of Day Trading with Bitcoin, and How Can Traders Ensure Compliance with Relevant Regulations?

- How Does the Regulatory Environment Affect Day Trading with Bitcoin?

- How Does Trading on Different Exchanges Affect Day Trading with Bitcoin, and What Should Traders Look for When Choosing an Exchange?

- What are the Advantages and Disadvantages of Using Leverage When Day Trading with Bitcoin?

- Bitcoin Leverage Trading Advantages Vs Disadvantages

- How Do Technical Analysis and Charting Tools Help with Day Trading with Bitcoin?

- What are Some of the Key Indicators that Traders Should Look Out for When Day Trading with Bitcoin?

- How Does News and Market Sentiment Affect the Price of Bitcoin During the Day, and How Can Traders Respond to This?

- How Can Traders Manage Risk and Protect Their Investments When Day Trading with Bitcoin?

- What are Some of the Psychological Challenges that Day Traders Face When Trading Bitcoin, and How Can They Overcome Them?

- What are Some of the Best Resources for Learning More About Day Trading with Bitcoin?

- What are Some of the Success Stories and Cautionary Tales of Day Traders Who Have Traded Bitcoin, and What Can We Learn From Them?

- Day trading with Bitcoin List Compared

Day Trading with Bitcoin: What You Need to Know

Day trading with Bitcoin can be highly lucrative but risky. Traders must have a clear understanding of the market and develop a sound trading strategy to be successful. They must also manage their risk effectively and stay disciplined to overcome the psychological challenges of trading. With the right approach, traders can make significant profits and navigate the volatile world of Bitcoin trading.

What is Day Trading with Bitcoin and How Does it Differ from Other Forms of Trading?

Day trading with Bitcoin is a type of short-term trading that involves buying and selling Bitcoin within the same day, intending to profit from the price fluctuations that occur during that time. Day trading with Bitcoin differs from other forms of trading, such as long-term investing or swing trading, in several ways.

One of the main differences is the time horizon. Day trading involves buying and selling Bitcoin within a single day, whereas other forms of trading may involve holding onto an asset for weeks, months, or even years. This short-term focus requires day traders to closely monitor the market and make quick decisions based on market movements.

Another difference is the level of risk involved. Day trading with Bitcoin is generally considered a high-risk, high-reward activity. The price of Bitcoin can fluctuate rapidly, and day traders must be prepared to react quickly to any changes in the market. This level of risk is often greater than other forms of trading, such as long-term investing, where the focus is on achieving steady returns over time.

Besides, day trading with Bitcoin often requires specialized knowledge and skills. Traders must deeply understand the cryptocurrency market and be familiar with technical analysis and charting tools. They must also have a solid trading strategy considering their risk tolerance, financial goals, and market conditions.

Overall, day trading with Bitcoin can be highly profitable but challenging. It requires discipline, knowledge, and a willingness to take on significant risks. However, with the right approach and a solid trading plan, traders can capitalize on Bitcoin's price fluctuations and potentially achieve significant profits in a short time.

What are the Benefits of Day Trading with Bitcoin Compared to Other Cryptocurrencies or Assets?

Overall, day trading with Bitcoin offers several unique benefits, including high volatility, liquidity, global accessibility, a 24/7 market, and low barriers to entry. However, it is important to remember that day trading with Bitcoin also carries significant risks and requires traders to have a solid trading plan and risk management strategy.

Day trading with Bitcoin offers several unique benefits compared to trading other cryptocurrencies or assets. Here are some of the most significant advantages:

- High volatility: Bitcoin is known for its high volatility, meaning that the price can fluctuate rapidly and dramatically in a short amount of time. This volatility can give day traders more opportunities to make profitable trades, as they can buy and sell Bitcoin quickly as the price changes.

- Liquidity: Bitcoin is one of the most widely traded cryptocurrencies, which means that it has high trading volume and liquidity. PayPal broker liquidity makes it easier for day traders to buy and sell Bitcoin quickly and efficiently without worrying about not being able to find a buyer or seller.

- Global accessibility: Bitcoin is a decentralized cryptocurrency that can be traded globally without the need for intermediaries like banks or financial institutions. Modern PayPal trading platforms allow day traders to trade Bitcoin from anywhere in the world, any time of day or night.

- 24/7 market:, Unlike traditional financial markets that operate on specific hours, the Bitcoin market is open 24/7, 365 days a year. With global markets, an open financial market will always allow day traders to trade Bitcoin at any time without being limited by market hours.

- Low barriers to entry: Starting to day trade with Bitcoin requires relatively low barriers to entry compared to other markets. Many exchanges have low minimum deposit requirements, allowing traders to start with small amounts of capital. Additionally, many educational resources are available online to help beginners learn about day trading with Bitcoin.

What are the Risks Associated with Day Trading with Bitcoin, and How Can They be Mitigated?

Day trading with Bitcoin comes with several risks that can be mitigated through risk management strategies, trusted exchanges, and staying up-to-date with regulatory changes. Traders should also be prepared to adapt their strategies as the market and the regulatory landscape evolves.

Day trading with Bitcoin can be highly profitable, but it is also a high-risk activity with several risks. Here are some of the main risks associated with day trading with Bitcoin and how they can be mitigated:

- Volatility risk: Bitcoin's price is highly volatile and can fluctuate significantly within a short period. Market volatility means that traders can make a lot of money quickly but also lose a lot of money just as quickly. To mitigate this risk, traders should use stop-loss orders to limit their losses and have a solid risk management strategy.

- Cybersecurity risk: Bitcoin and other cryptocurrencies are stored in digital wallets that are vulnerable to cyber-attacks. Traders must be vigilant in protecting their wallets and their private keys. They should also use trusted exchanges that have a good reputation for security.

- Liquidity risk: The Bitcoin market is relatively small compared to other financial markets, which means that there may not always be enough buyers or sellers to execute trades. Lack of liquidity can lead to slippage, where trades are executed at a different price than intended. Traders can mitigate this risk by using limit orders instead of market orders.

- Exchange risk: Trading on unregulated or poorly regulated exchanges can pose a significant risk to traders, as these exchanges may engage in fraudulent activities or may not have adequate security measures in place. To mitigate this risk, traders should only use reputable exchanges that are regulated and have a good track record.

- Regulatory risk: Bitcoin and other cryptocurrencies are still largely unregulated in many countries. The regulatory landscape can change quickly and unexpectedly, affecting the value of Bitcoin and the ability of traders to execute trades. When mitigating regulatory risk, traders should stay up-to-date with regulatory changes and be prepared to adapt their trading strategies accordingly.

What are the Most Effective Strategies for Day Trading with Bitcoin?

Several effective strategies for day trading with Bitcoin include technical analysis, fundamental analysis, scalping, swing trading, trend following, and news trading. Traders should choose the strategy that best suits their trading style and risk tolerance and be prepared to adapt their strategy as the market and the regulatory landscape evolves.

Day trading with Bitcoin requires a solid strategy considering the high volatility and other risks associated with the cryptocurrency market. Here are some effective strategies that traders can use to maximize their profits:

- Technical analysis: This involves analyzing past market data and using charts and other technical indicators to identify patterns and trends. Traders can use technical analysis to identify support and resistance levels, which can be used to determine entry and exit points for trades.

- Fundamental analysis: This involves analyzing the underlying factors that affect the value of Bitcoin, such as news events, market sentiment, and regulatory developments. Traders can use fundamental analysis to identify potential market-moving events and adjust their trading strategies accordingly.

- Scalping: This involves making small profits from small price movements in a short period. Traders can use scalping to take advantage of Bitcoin's high volatility, but it requires a high level of skill and discipline.

- Swing trading: This involves holding positions for several days to take advantage of longer-term price movements. Traders can use swing trading to take advantage of market trends and avoid the risks associated with short-term price movements.

- Trend following This involves identifying the direction of the trend and trading in the direction of the trend. Traders can use trend following to take advantage of the momentum of the market and to avoid trading against the trend.

- News trading: This involves taking advantage of news events and other market-moving developments to make profitable trades. Traders can use news trading to take advantage of short-term price movements, but it requires a good understanding of the market and the ability to react quickly to new information.

How Does the Price of Bitcoin Fluctuate Throughout the Day, and How Can Traders Use This to Their Advantage?

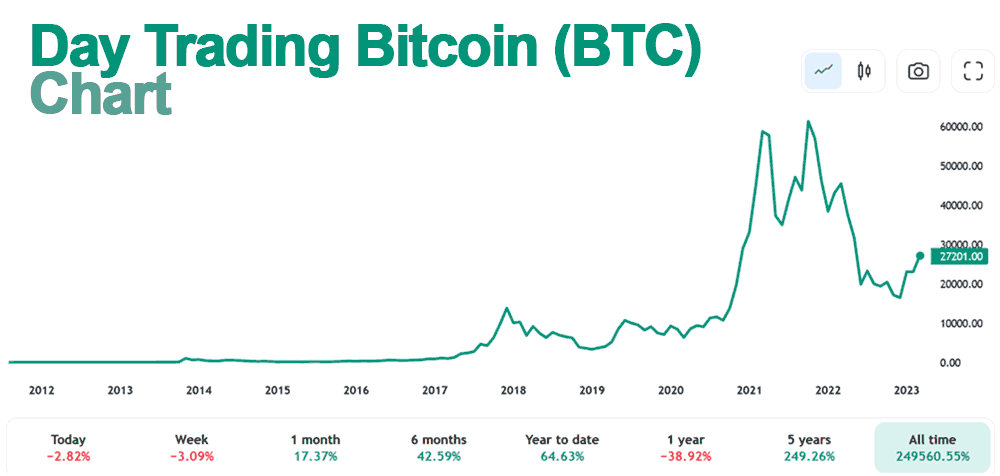

The price of Bitcoin is highly volatile and can fluctuate significantly throughout the day. Bitcoin volatility is due to various factors, including market demand, supply, news events, and regulatory developments.

Bitcoin is traded on a global market, 24 hours a day, seven days a week. The price of Bitcoin can change at any time, and traders need to be prepared to react quickly to market movements.

One-way traders can use the price fluctuations to their advantage is by monitoring the market closely and looking for opportunities to buy or sell Bitcoin at a favourable price. For example, suppose the price of Bitcoin drops significantly due to negative news or market sentiment. In that case, traders may be able to buy Bitcoin at a discounted price and then sell it later at a higher price once the market stabilizes.

Another strategy traders can use identifying key support and resistance levels in the market. Support levels are areas where the price of Bitcoin has historically held up, while resistance levels are areas where the price has struggled to break through. Traders can use these levels to identify their trades' potential entry and exit points.

It's important to note, however, that Bitcoin is a highly volatile asset, and traders should always be prepared for sudden price movements that can occur without warning. Traders should also use risk management strategies, such as stop-loss orders, to limit their losses in case the market moves against them.

The price of Bitcoin can fluctuate significantly throughout the day due to various factors. Traders can use this to their advantage by monitoring the market closely, identifying support and resistance levels, and using risk management strategies to limit losses.

How Do Traders Determine the Best Time to Buy or Sell Bitcoin During the Day?

Determining the best time to buy or sell Bitcoin during the day can be challenging, as the price of Bitcoin fluctuates rapidly and unexpectedly. However, there are several strategies that traders can use to help them make informed decisions.

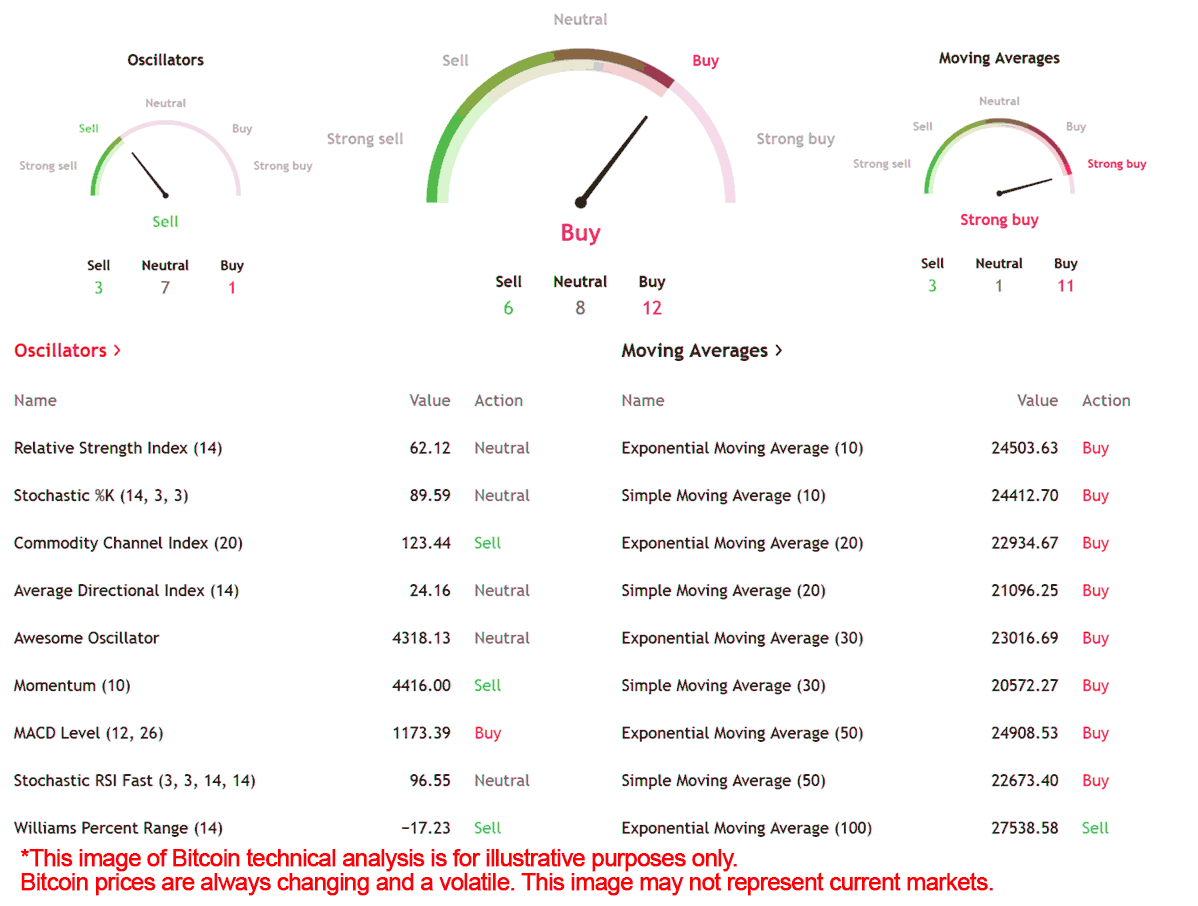

One Bitcoin day trading strategy is to use technical analysis to study live BTC price charts. Bitcoin day traders can use multiple indicators and charts, such as moving averages, MACD, and RSI, to identify potential entry and exit points for their trades. For example, if the price of Bitcoin is trending upwards and the RSI indicator shows that it's oversold, it could be a good time to buy Bitcoin.

Another strategy is to stay informed about the news and events that could impact the price of Bitcoin. Traders should pay attention to announcements from governments, regulatory bodies, and major corporations that could affect the adoption and acceptance of Bitcoin. For example, if a major corporation announces that it's investing in Bitcoin, the price of Bitcoin could increase, and traders may want to consider buying Bitcoin.

Traders can also use fundamental analysis, which involves analyzing the underlying value of Bitcoin based on its adoption rate, network effect, and other factors. Fundamental analysis can help traders make more informed decisions about when to buy or sell Bitcoin.

Traders need to have a clear trading plan and stick to it, even when emotions and market sentiment are high. Traders should also use risk management strategies, such as stop-loss orders, to limit their losses in case the market moves against them.

Traders can determine the best time to buy or sell Bitcoin by using technical analysis, staying informed about the news and events that could impact the price of Bitcoin, and using fundamental analysis to assess the underlying value of Bitcoin. Traders should have a clear trading plan and use risk management strategies to limit losses.

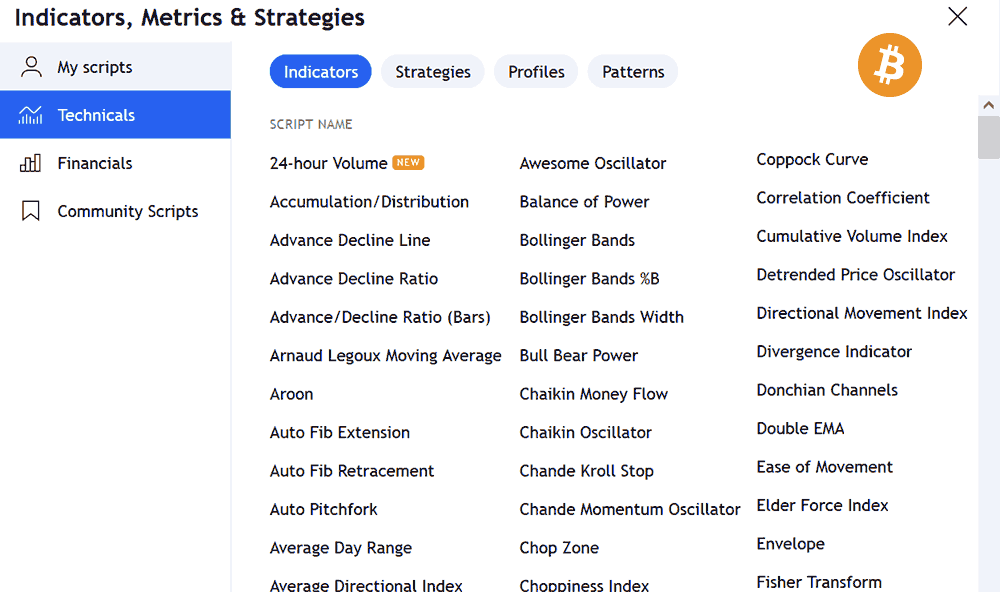

What Tools and Software are Available to Help with Day Trading with Bitcoin, and How Effective are They?

The effectiveness of these tools and software depends on the trader's trading strategy and level of expertise. Some traders may find that using a combination of these tools can help them make better trading decisions, while others may prefer to rely on their analysis and instincts.

It's important for traders to thoroughly research and understand any tools or software they plan to use and the fees and risks associated with each platform or service. Additionally, traders should always use caution and implement proper risk management strategies when trading Bitcoin.

Various tools and software are available to help traders with day trading Bitcoin. Here are some of the most popular ones:

- Trading Platforms: many trading platforms allow traders to buy and sell Bitcoin, including Coinbase, Binance, and Bitstamp. These platforms offer a range of trading tools, such as charts, order books, and technical analysis indicators, to help traders make informed decisions.

- Charting Tools: Charting tools like TradingView provide real-time charts and technical analysis tools that allow traders to track market movements and identify potential trading opportunities.

- News Aggregators: News aggregators like CoinDesk and CryptoSlate provide real-time news updates and analysis on the cryptocurrency markets, helping traders stay informed and make decisions based on market sentiment.

- Trading Bots: Trading bots like 3Commas and HaasOnline can automate trades based on preset rules and indicators. These bots can be useful for traders who want to execute trades quickly and efficiently but require technical knowledge to set up and operate effectively.

- Wallets: Cryptocurrency wallets like Ledger and Trezor provide a secure way for traders to store their Bitcoin and other cryptocurrencies. These wallets can also be used to make trades on some exchanges.

- APIs: APIs like the Coinbase API and Binance API allow traders to access real-time market data and execute trades programmatically. Trading APIs can be useful for Bitcoin traders who want to build their trading bots or integrate trading functionality into other applications.

What Common Mistakes that Day Traders Make When Trading Bitcoin, and How Can They be Avoided?

Day traders should take a disciplined and patient approach to trade Bitcoin and implement proper risk management strategies. Bitcoin traders may have greater profitability and limit some risks when avoiding common BTC day trading mistakes.

Day trading with Bitcoin can be profitable, but it's not without risks. Here are some common mistakes that day traders make when trading Bitcoin and how they can be avoided:

- FOMO (Fear Of Missing Out): One of the most common mistakes that day traders make is entering trades out of FOMO. They may see the price of Bitcoin rising and feel the urge to buy, even if it's not part of their trading plan. Fear of missing out can lead to impulsive decisions and losses. To avoid this, traders must stick to their trading plan and only enter trades meeting their criteria.

- Overtrading: Day traders may be tempted to enter too many trades in a single day, leading to exhaustion and poor decision-making. To avoid this, traders should limit the number of trades they will enter daily and stick to it.

- Lack of Risk Management: Many day traders fail to implement proper risk management strategies, such as setting stop-loss orders or taking profits at predetermined levels. A lack of risk management can lead to large losses if the market moves against them. To avoid this, traders should always use risk management strategies and stick to them.

- Not Conducting Proper Research: Day traders may enter trades without conducting proper research on the market, leading to poor decision-making. To avoid this, traders should always conduct thorough research on the market, including technical analysis, news, and market sentiment.

- Using Excessive Leverage: Day traders may be tempted to use excessive leverage to increase their potential profits, but this can also increase their losses. To avoid this, traders should use leverage cautiously and only when necessary.

- Not Using Proper Trading Tools: Day traders may not use proper trading tools, such as charts or technical indicators, to inform their trading decisions. To avoid this, traders should use various trading tools and indicators to make informed decisions.

How Much Money Do I Need to Start Day Trading with Bitcoin, and What are the Minimum Requirements for Opening a Trading Account?

The money needed to start day trading with Bitcoin varies depending on the trader's goals and risk tolerance. Many exchanges have minimum deposit requirements ranging from $10 to $500.

What are the Tax Implications of Day Trading with Bitcoin, and How Can Traders Ensure Compliance with Relevant Regulations?

Day trading with Bitcoin can have tax implications, and traders should consult a tax professional to ensure compliance with relevant regulations. It is important to keep accurate records of all trades and report all profits and losses on tax returns.

How Does the Regulatory Environment Affect Day Trading with Bitcoin?

The regulatory environment surrounding Bitcoin and other cryptocurrencies is constantly evolving, which can significantly impact day trading activities. In many countries, the legal status of Bitcoin and other digital assets remains uncertain, with regulators grappling with defining how they should be classified and regulated.

One of the main concerns for regulators is the potential for money laundering and other illegal activities through cryptocurrency trading platforms. As a result, many governments have introduced strict Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, which require traders to provide identification and other personal information when opening an account with a trading platform.

Besides KYC and AML regulations, other regulatory measures can impact day traders. For example, in some countries, capital gains taxes may apply to profits made through cryptocurrency trading, which can impact a trader's profitability.

Despite these challenges, the regulatory environment surrounding Bitcoin and other cryptocurrencies are slowly becoming more established. Some countries have introduced clear guidelines for cryptocurrency trading, which can provide a degree of certainty for traders.

Looking ahead, it is likely that we will see further changes in the regulatory landscape as governments seek to strike a balance between protecting investors and promoting innovation in the cryptocurrency industry. For day traders, it will be important to stay up-to-date with the latest regulatory developments and ensure compliance with relevant regulations to avoid penalties and protect their investments.

How Does Trading on Different Exchanges Affect Day Trading with Bitcoin, and What Should Traders Look for When Choosing an Exchange?

When choosing an exchange or trading platform for day trading with Bitcoin, traders should look for an exchange that offers low trading fees, high liquidity, strong security measures, a range of trading tools and features, and a user-friendly interface. By carefully considering these factors, traders can increase their chances of success in the volatile world of Bitcoin day trading.

Trading on different exchanges can significantly impact day trading with Bitcoin. Each exchange has its unique order book, trading fees, and liquidity, which can affect the price and volume of Bitcoin traded on that platform.

Traders should consider several factors when choosing an exchange for day trading Bitcoin. One of the most important factors is the trading fees charged by the exchange. High trading fees can eat into profits, especially for frequent traders.

Another important consideration is the liquidity of the exchange. Higher liquidity means more buyers and sellers on the platform, which can lead to tighter bid-ask spreads and lower slippage. Higher Bitcoin liquidity can make it easier for traders to enter and exit positions at the desired price.

Security is also a crucial factor to consider when choosing an exchange. Traders should look for exchanges with strong security measures to protect against hacking and theft. Bitcoin day trading platforms should include two-factor authentication, cold storage of funds, and regular security audits.

Traders should also consider the range of trading tools and features an exchange offers. Some exchanges offer advanced trading features such as margin, futures, and options trading, which can provide additional opportunities for profit. However, these features also come with additional risk and complexity, so traders should be sure to understand how they work before using them.

In addition, traders should consider the user interface and ease of use of the exchange. A user-friendly interface can make it easier to place trades quickly and efficiently, which is especially important for day traders who need to make quick decisions.

What are the Advantages and Disadvantages of Using Leverage When Day Trading with Bitcoin?

Using leverage when day trading Bitcoin (BTC) can amplify any profits but also greatly increase the risk of financial losses. Traders considering using leverage with a volatile crypto asset like Bitcoin must understand all of the risks involved.

Day trading with Bitcoin can be exciting and potentially profitable for traders. One of the ways to potentially increase returns is through leverage, which allows traders to open larger positions with less capital. However, leverage can also magnify losses, making it a high-risk strategy that requires careful consideration.

One advantage of using leverage when day trading with Bitcoin is the potential to amplify profits. For example, if a trader uses 2x leverage and the price of Bitcoin increases by 5%, the trader's return would be 10%. However, it's important to note that losses can also be magnified, so having a sound risk management strategy is crucial.

Another advantage of using leverage is accessing larger trading volumes that may not be possible with the trader's available capital. Trading Bitcoin with leverage can potentially lead to greater opportunities for profit but equal loss.

On the other hand, one of the main disadvantages of using leverage is the increased risk of loss. If the market moves against the trader, losses can be amplified, resulting in a significant drawdown. Additionally, leverage requires traders to maintain strict risk management practices and discipline to avoid making emotional decisions that could lead to further losses.

When deciding whether to use leverage in day trading with Bitcoin, traders should consider their level of Bitcoin trading risk, and market conditions. It's important to choose a reputable broker that offers transparent and reasonable leverage rates and to ensure that the trading platform provides adequate risk management tools such as stop-loss orders.

Leverage can be a powerful tool for day trading with Bitcoin, but it requires careful consideration and risk management to avoid significant losses. Traders should weigh the potential benefits against the risks before using leverage in their trading strategy.

Bitcoin Leverage Trading Advantages Vs Disadvantages

| Advantages | Disadvantages |

|---|---|

| Potential for high profits | Potential for high losses |

| Access to larger trading positions with less capital | Increased risk due to leverage |

| Ability to hedge against price fluctuations | Margin calls can force liquidation of positions |

| Opportunity to diversify investment portfolio | Limited regulatory oversight and potential for fraud |

| Availability of advanced trading tools and features | Requires advanced knowledge and experience in trading |

How Do Technical Analysis and Charting Tools Help with Day Trading with Bitcoin?

Technical analysis and charting tools can help traders identify patterns and trends in the Bitcoin market, which can inform their trading decisions. These tools can also help traders set clear entry and exit points and implement effective risk management strategies.

Technical analysis and charting tools are essential for day trading with Bitcoin. Technical analysis involves the study of price and volume data to identify trends, patterns, and signals in the market. Charting tools visualize this data and make it easier to spot trends and patterns.

By using technical analysis and charting tools, day traders can make more informed decisions about when to buy and sell Bitcoin. For example, they can identify support and resistance levels, where the price tends to bounce off or breakthrough. This information can help traders make better entry and exit decisions.

technical analysis and charting tools are crucial for day traders to decide when to buy and sell Bitcoin. By using these tools, traders can identify trends, patterns, and potential entry and exit points, giving them an edge in the market.

A variety of technical analysis and charting tools are available to day traders. Some of the most popular include:

- Moving averages: These are lines on the chart that show the average price of Bitcoin over a specific period. Traders use moving averages to identify trends and potential entry and exit points.

- Relative strength index (RSI): This indicator measures the strength of price movements and can help traders identify overbought and oversold conditions.

- Bollinger Bands: These bands are plotted two standard deviations away from a moving average and can help traders identify volatility in the market.

- Fibonacci retracements: These levels are based on the Fibonacci sequence and can help traders identify potential support and resistance levels.

- Candlestick charts: Candlestick charts show price movements and can help Bitcoin traders quickly monitor BTC price patterns and movements on live crypto markets.

What are Some of the Key Indicators that Traders Should Look Out for When Day Trading with Bitcoin?

Regarding day trading with Bitcoin, there are several key indicators that traders should keep an eye on to help them make informed decisions. These indicators are used in technical analysis, which studies market data to identify patterns and trends to help predict future price movements.

Regarding day trading with Bitcoin, there are several key indicators that traders should keep an eye on to help them make informed decisions. These indicators are used in technical analysis, which studies market data to identify patterns and trends to help predict future price movements. Here are some of the key indicators that traders should look out for:

Here are some of the key indicators that Bitcoin traders should look out for:

- Moving Averages: Moving averages are one of the most commonly used indicators in technical analysis. They help traders identify the trend's direction by smoothing out price fluctuations. Traders often use two moving averages, a short-term moving average, and a long-term moving average, to determine when to enter or exit a trade.

- Relative Strength Index (RSI): RSI is indicator measures momentum and of price. It helps traders identify over purchased BTC situations on live financial markets, indicating possible price reversals.

- Bollinger Bands: Bollinger Bands consist of three plotted lines on a price chart. The line in the centre is the a moving average, the top and bottom lines are the moving averages standard deviation. Traders use Bollinger Bands to identify potential entry and exit points based on price volatility.

- Volume: Volume is the total number of shares or contracts traded in a given period. It helps traders to determine the strength of a price movement. Higher trading volumes can indicate a strong trend, while lower volumes can suggest a weak trend.

- MACD: The Moving Average Convergence Divergence is a trend-following momentum indicator used to highlight corelations with moving averages. Traders use MACD to identify potential changes in the trend.

How Does News and Market Sentiment Affect the Price of Bitcoin During the Day, and How Can Traders Respond to This?

News and market sentiment can significantly impact the price of Bitcoin during the day. Traders should stay informed of relevant news or events affecting the market and adjust their trading strategies accordingly.

How Can Traders Manage Risk and Protect Their Investments When Day Trading with Bitcoin?

Day trading with Bitcoin involves a significant amount of risk. Traders must manage their risk effectively to protect their investments. One way to do this is to use stop-loss orders, instructions to sell Bitcoin if the price falls to a certain level. Traders can set stop-loss orders to limit losses if the market moves against them. Another strategy is diversifying their portfolio and not investing all their money in Bitcoin. Traders can also use hedging strategies, such as buying options or futures contracts, to protect themselves from price fluctuations.

What are Some of the Psychological Challenges that Day Traders Face When Trading Bitcoin, and How Can They Overcome Them?

Day traders face various psychological challenges when trading Bitcoin. These include fear, greed, and overconfidence. Fear can cause hesitation on Bitcoin opportunities, while Bitcoin crypto greed may cause uninformed decisions that result in losses. To overcome these challenges, traders should have a clear trading plan and stick to it. They should also have a strategy for managing their emotions, such as taking breaks or using meditation techniques.

What are Some of the Best Resources for Learning More About Day Trading with Bitcoin?

Many resources are available for traders who want to learn more about day trading with Bitcoin. These include online courses, books, forums, and social media groups. Some of the most popular resources include TradingView, CoinDesk, and Investopedia. Traders can also learn from experienced traders by joining communities like Reddit's r/BitcoinMarkets or following Bitcoin traders on Twitter.

What are Some of the Success Stories and Cautionary Tales of Day Traders Who Have Traded Bitcoin, and What Can We Learn From Them?

There have been many success stories and cautionary tales of day traders who have traded Bitcoin. Some traders have made millions of dollars in profits, while others have lost everything. One of the most famous success stories is that of the Winklevoss twins, who invested $11 million in Bitcoin in 2013 and saw their investment grow to over $1 billion. On the other hand, there have been many cautionary tales of traders who lost everything, such as the case of the Mt. Gox exchange, which filed for bankruptcy after losing over 800,000 Bitcoin. Traders can learn from these stories by understanding the risks and rewards of day trading with Bitcoin and developing a solid trading plan considering their risk tolerance and financial goals.

Day trading with Bitcoin List Compared

| Featured Bitcoin Broker Trading Platform | Account Features | Trading Features |

|---|---|---|

| Used By: 180,000 Instruments Available: 232 Stocks Available: 2100 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 61 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mirror Trader, ZuluTrade, Web Trader, cTrader, Mac Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 200,000 Instruments Available: 1000 Stocks Available: 99 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 80 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: Web Trader, MT4, MT5, AvaTradeGo, AvaOptions, Mac, Mobile Apps, ZuluTrade, DupliTrade, MQL5 Negative Balance Protection: Inactivity Fee: No 71% of retail CFD accounts lose moneyVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 10000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 60 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, IRESS, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 250,000 Instruments Available: 4000 Stocks Available: 1696 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 57 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 0 |

Platforms: MT4, Mirror Trader, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Visit |

|

| Used By: 89,000 Instruments Available: 100 Stocks Available: 60 US Stocks: No UK Stocks: No German Stocks: Yes Japanese Stocks: No Indices: Yes Forex Pairs Available: 70 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 200 |

Platforms: MT4, MT5, Mac, ZuluTrade, Web Trader, cTrader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your moneyVisit |

|

| Used By: 20,000,000 Instruments Available: 2000 Stocks Available: 2042 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 50 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 50 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 76% of retail investor accounts lose money when trading CFDs with this provider.Visit |

|

| Used By: 142,500 Instruments Available: 200 Stocks Available: 52 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 150 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Your capital is at riskVisit |

|

| Used By: 15,000,000 Instruments Available: 10000 Stocks Available: 1731 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 177 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.Visit |

|

| Used By: 10,000 Instruments Available: 148 Stocks Available: 64 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 40 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: $100 |

Platforms: MT4, MT5, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 15000 Stocks Available: 1000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: Yes Forex Pairs Available: 55 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 1 |

Platforms: Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 10 US Stocks: Yes UK Stocks: No German Stocks: No Japanese Stocks: No Indices: Yes Forex Pairs Available: 40 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes Losses can exceed depositsVisit |

|

| Used By: 4,000,000 Instruments Available: 2200 Stocks Available: 2000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: No Indices: Yes Forex Pairs Available: 67 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 100 |

Platforms: MT4, MT5, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes 67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your moneyVisit |

|

| Used By: 500,000 Instruments Available: 1500 Stocks Available: 1500 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: No Indices: Yes Forex Pairs Available: 40 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 0 |

Platforms: ThinkTrader, MT4, MT5, Mac, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: Yes CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71.89% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your moneyVisit |

|

| Used By: 10,000 Instruments Available: 100 Stocks Available: 1000 US Stocks: Yes UK Stocks: Yes German Stocks: Yes Japanese Stocks: Yes Indices: No Forex Pairs Available: 100 Major Forex Pairs: Yes Minor Forex Pairs: Yes Exotic Forex Pairs: Yes Minimum Deposit: 0 |

Platforms: MT4, Mac, ZuluTrade, Web Trader, Tablet & Mobile apps Negative Balance Protection: Inactivity Fee: No Losses can exceed depositsVisit |

|

| Used By: 10,000 Instruments Available: 111 Stocks Available: 0 US Stocks: No UK Stocks: Yes German Stocks: No Japanese Stocks: No Indices: Yes Forex Pairs Available: 100 Major Forex Pairs: Yes Minor Forex Pairs: No Exotic Forex Pairs: No Minimum Deposit: 1 |

Platforms: MT4,WEB,desktop Negative Balance Protection: Inactivity Fee: No Your capital is at riskVisit |

Best Bitcoin Broker Bitcoin Broker Reviews

Read our details broker Bitcoin Broker Bitcoin Broker reviews, you will find something useful if you are shortlisting a Bitcoin Broker Bitcoin Broker and trading platform.

- IC Markets Review (read our in depth reviews)

- AvaTrade Review (read our in depth reviews)

- FP Markets Review (read our in depth reviews)

- XTB Review (read our in depth reviews)

- Pepperstone Review (read our in depth reviews)

- eToro Review (read our in depth reviews)

- easyMarkets Review (read our in depth reviews)

- Trading 212 Review (read our in depth reviews)

- Admiral Markets Review (read our in depth reviews)

- SpreadEx Review (read our in depth reviews)

- HYCM Review (read our in depth reviews)

- Markets.com Review (read our in depth reviews)

- ThinkMarkets Review (read our in depth reviews)

- Axi Review (read our in depth reviews)

- ForexMart Review (read our in depth reviews)

Bitcoin Broker Bitcoin Broker Alternatives

Read about and compare Bitcoin Broker Bitcoin Broker alternatives. We have indepth side by side comparisons to help you find Bitcoin Broker Bitcoin Broker related brokers.

- IC Markets Alternatives

- AvaTrade Alternatives

- FP Markets Alternatives

- XTB Alternatives

- Pepperstone Alternatives

- eToro Alternatives

- easyMarkets Alternatives

- Trading 212 Alternatives

- Admiral Markets Alternatives

- SpreadEx Alternatives

- HYCM Alternatives

- Markets.com Alternatives

- ThinkMarkets Alternatives

- Axi Alternatives

- ForexMart Alternatives

IC Markets

IC Markets

AvaTrade

AvaTrade

FP Markets

FP Markets

XTB

XTB

Pepperstone

Pepperstone

eToro

eToro

easyMarkets

easyMarkets

Trading 212

Trading 212

Admiral Markets

Admiral Markets

SpreadEx

SpreadEx

HYCM

HYCM

Markets.com

Markets.com

ThinkMarkets

ThinkMarkets

Axi

Axi

ForexMart

ForexMart